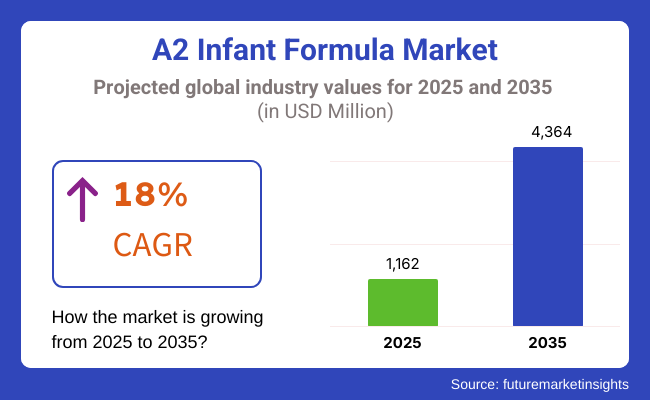

The A2 infant formula market size for 2025 is estimated at approximately USD 1,162 million and is projected to exceed USD 4,364 million by 2035, showcasing long-term upward potential at 18% CAGR.

This growth is being driven by increasing awareness of the potential health benefits of A2 infant formula. This formula is a very popular option amongst parents when looking for a formula due to its potential to diminish colic, gas, and digestive discomfort. Another factor driving the demand for infant nutrition is the continued trends toward premiumization and more consumers seeking organic, non-GMO, and clean-label baby products. What consumers will read and see on social media, impacted by scientific research, healthcare recommendations, and social media awareness, also affects consumer preferences.

The demand for A2 infant formula has witnessed rapid expansion, owing to an increasing awareness among consumers and a growing inclination towards specialized nutrition for infants. In contrast to traditional formulas, A2 infant formula is derived from cow’s milk that contains only the A2 type of beta-casein protein, which is thought to be easier for infants to digest and less likely to cause discomfort. As parents are becoming increasingly aware of the digestive health of their children, the demand for A2-based alternatives is only likely to increase.

Countries like China and the USA are seeing growing demand driven by changing dietary preferences. With increasing awareness of the benefits of A2 protein, manufacturers are adapting and innovating to meet the needs of this growing market segment. Product innovations and ongoing studies into the benefits of A2 protein create promising opportunities for the A2 infant formula market. Manufacturing and investment have considerable opportunities to take advantage of this emerging trend as the demand goes up further.

Innovation is essential in market expansion, and in turn, leading market players make research and development investments to increase the quality of goods and address changing customer demands. The A2 Milk Company, a leading brand in the sector, has extended its infant formula offerings with scientifically confirmed formulations that contribute to optimal infant nutrition, for instance. The company believes that a2 Platinum® Premium Infant Formula will become a No. 1 infant formula brand through adverse consumers in Germany.

Similarly, companies launch premium A2 milk in Asia sourced from select farms, targeting high-end consumers in the region. Such innovations are already influencing the competitive landscape and further consolidating the market’s growth potential.

As product innovations continue and more studies on A2 protein benefits develop, the A2 infant formula market is ready for massive growth. With the demand on the way up, there are many opportunities for manufacturers and investors to benefit from this changing trend.

Clean-label and organic formulations remain buzzwords, driving demand in the market. This impacts various end-use segments. In healthcare and pediatric nutrition, A2 infant formula is increasingly being used at hospitals and pediatric clinics as an alternative to infants with issues with digestion, cow’s milk sensitivity, or mild lactose intolerance. Here, the main purchasing factors are clinically proven benefits, regulatory compliance, and digestibility.

Retail and e-commerce channels play an active role in this end-user segment. These segments curate organic, certified non-GMO, and premium-quality formulas fortified with probiotics, natural DHA, and a comprehensive set of vitamins and folic acid. Brand trust and packaging transparency also influence consumer choice. A2 infant formula is required to adhere to safety and nutritional standards while being easily prepared in bulk in daycare and childcare centers, where consistency in quality and allergen-free formulations are also at the top of mind.

A growing trend for pharmaceutical and functional nutrition companies is to develop a wider medical nutrition approach and utilize A2 infant formula at the same time, especially for developing food options, pre-or post-biotics for infants with digestive concerns. Here, research-supported formulations, medical recommendations, and ingredient purity matter. The increase in awareness of organics and specialty nutrition brands has driven demand for A2 formulas from grass-fed cows without artificial additives and preservatives. This group understands ingredient sourcing, ethical farming practices, and sustainability.

The A2 infant formula market surged from 2020 to 2024 as parents looked for easily digestible options. The Asia Pacific region dominated sales, as e-commerce is making such products far more accessible. Mainstream dairy brands release A2-derived formulas, and regulations guarantee product safety and quality.

From 2025 to 2035, the market will focus on scientific research, AI-driven personalization, and sustainability. Tighter regulations and market demands for functional ingredients can lead to innovations. Increasing awareness of the physical benefits of A2 protein, an expanding emerging market, and a range of premium organic formula offerings are pegged to accelerate market growth.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 (Projections) |

|---|---|

| Rising demand for A2 protein-based infant formula due to digestive benefits. | Increased research on gut health and immune-boosting formulations. |

| Parents preferred A2 milk formula over traditional options to reduce lactose intolerance issues. | Greater consumer awareness will drive demand in emerging markets. |

| Asia-Pacific led the market, with strong demand from China and Australia. | North America and Europe will see higher adoption due to health trends. |

| E-commerce and direct-to-consumer sales expanded product accessibility. | Subscription-based and AI-driven personalized nutrition services will grow. |

| Regulations focused on ingredient safety, organic certification, and nutritional standards. | Stricter quality control and sustainability mandates will shape production. |

| Large dairy companies introduced A2-based infant formulas to meet demand. | Market consolidation as major brands acquire smaller, specialized producers. |

| Marketing emphasized digestive health, natural ingredients, and organic certification. | AI-driven recommendations and targeted advertising will influence purchasing decisions. |

| Premiumization trend led to the rise of organic and fortified A2 infant formulas. | Functional ingredients like probiotics and DHA will be widely integrated. |

| Concerns over allergies and digestion issues fueled demand. | Scientific advancements will further validate the benefits of A2 protein. |

| Sustainable sourcing and eco-friendly packaging gained importance. | Carbon-neutral production and biodegradable packaging will become industry standards. |

Factors such as growing consumption demand for digestion-friendly, natural alternatives are driving the market growth of A2 infant formula. However, high R&D costs and stringent regulatory compliance obligations imply financial risks. Besides this, companies need to invest in efficient production and meat processing while ensuring that they meet evolving food safety requirements.

Supply chain issues like raw materials shortages, dairy fluctuations, and transport restrictions can hinder production. Investing in localized manufacturing and diversified supplier networks will also help reduce dependence on external sources.

Technological progress, as well as rapidly changing consumer preferences, may affect market stability. Changes in regulation, with stricter infant nutrition guidelines and sustainability demands, compound the existing risk. With regard to their supply chains, transparency, traceability, and adherence to global food safety regulations will be absolutely critical for keeping consumer trust intact.

Infant (milk) is anticipated to hold the largest market share in 2025. Infant milk, which is designed for babies to take in the first six months of life, is particularly valuable owing to its digestive qualities and the fact that it closely mimics natural breast milk. Concerns regarding digestive discomfort and lactose intolerance in infants are increasingly prompting parents to choose formulas based on A2 protein.

Increase in awareness regarding beta-casein protein A2, which increases absorption of nutrients and reduces colic symptoms, is the driving factor boosting the growth of the segment. Manufacturers are also tooling research and development to improve formula composition to help infants achieve optimal health and development outcomes.

Moreover, drake birth rates among emerging economies, wherein the levels of disposable income have also been rising, have increased the demand for premium, easily digestible infant nutrition, thus complementing the dominance of the segment of infant milk.

In 2025, supermarkets and hypermarkets will be the key distribution channel for A2 infant formula. These retail chains carry thousands of brands of infant formula for parents to pick and choose from. Supermarkets offer the allures of one-stop shopping-plus sales events and bulk purchases-making them the go-to destination for shoppers. Moreover, the increasing variety of organic and specialty baby products available in supermarket aisles has also contributed to growth in this market.

To assist parents in making informed choices about more specialized infant nutrition, retailers are prioritizing premium placement and in-store consultative services. With more people starting to understand the benefits of the A2 formula, we grabbed the attention of the major supermarket chains that are working with our manufacturers to develop exclusive in-house brands.

Retail infrastructure is a huge part of the success and continued investment in this area coupled with the growing preference for brick-and-mortar shopping means supermarkets will remain a key distribution channel in A2 infant formula.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.5% |

| UK | 7.1% |

| France | 6.8% |

| Germany | 7.2% |

| Italy | 6.7% |

| South Korea | 7.6% |

| Japan | 7.4% |

| China | 8.2% |

| Australia | 6.9% |

| New Zealand | 6.5% |

The growing incidence of lactose intolerance and digestive disorders among infants is the key factor driving the growth of the A2 infant formula market in the nation. Parents are moving to A2-based formulas because they are said to be easier to digest than other formulas and also cause less bloating. The A2 Milk Company and Nestlé are among the companies adding A2 products, and smaller brands are cropping up to fill the demand.

The demand for organic and clean-label products are boosting the market growth, as parents prefer formulas that are minimally processed and of high-quality. Government policies promoting A2 premium infant nutrition and advancements in dairy at the processing level are also propelling the growth of the industry.

The growing acceptance of A2 infant formula in Western regions is primarily due to the increasing demand for organic and natural foods, such as infant formula, among consumers to prevent health issues associated with infant formula. Incumbent baby formula brands are extending their product offerings to A2, and new entrants are taking advantage of the increased focus on premium infant nutrition.

Furthermore, government policies encourage high quality, safety, and nutrition of infant formula, which drives the market. A2 formulations, which are marketed as being easier to digest than the common A1 type, also benefit from a growing population of lactose-sensitive infants, and the increasing trend for gut-friendly formulas through e-commerce platforms has widened the scope of their reach across the country.

The industry is anticipated to develop from 2025 to 2035 at a CAGR of 6.8%. The growth of this market can be attributed to a rising end-user preference towards premium, organic, and easy-to-digest formula solutions. France's well-established dairy sector is already investing in A2 milk, which presents opportunities for local and international brands to enter the market. With rising concerns about allergies in infants and the digestiveness of milk, parents are turning to the perceived gentler method for digestion - A2-based alternatives.

Danone A2 formulas for institutional purposes are among the products being rolled out in response to changing consumer preferences. In addition, the French place a high value on their food, especially on high-quality and natural products, which is well-suited for the A2 infant formula growth, and, therefore, France is expected to be a promising market in the upcoming years.

The industry is projected to register a CAGR of 7.2% from 2025 to 2035. The adoption of A2 infant formula is supported by the country's extremely high focus on high-quality organic and functional food products. A significant factor propelling the market growth is the growing inclination towards natural or minimally processed products for infant nutrition among health-conscious parents.

Germany's stringent food safety standards mean that only the best formulas are available to consumers, a lucrative market for domestic and international brands alike. Many parents are opting for A2 formulations over regular counterparts due to the increasing incidents of lactose intolerance in infants. This trend is further supplemented by the rise of online retail platforms dedicated to organic baby products, making A2 infant formula even more accessible and popular in Germany.

Given that parents look for awareness regarding gut health and the importance of easy-to-digest infant formula, demand for A2-based alternatives is skyrocketing. The growth of the market can be primarily attributed to the increasing demand for premium baby products along with lactose-free options that aid in improved digestion.

Italian dairy producers are investing in A2 milk production to meet this increase in demand. Moreover, the rising popularity of e-commerce platforms for baby nutrition will further enable consumer access to the A2 formulas. In Italy, the market is driven by the fact that dairy is produced domestically for the most part, coupled with a growing demand for organic and high-quality infant nutrition products.

The industry is anticipated to garner a CAGR of 7.6% during the forecast years of 2025 to 2035. Given the openness to scientifically substantiated solutions around infant nutrition, South Korean parents have shown high adoption of A2-based formulas. The increased focus on gut and digestive health trends has complemented the benefits associated with A2 milk, which is seen as a better alternative to traditional formulas. Leading dairy and infant formula players are responding to this demand with premium A2-based offerings.

Moreover, the dominating factors, such as K-health trends focused on natural substances and functional nutrition, are further fuelling the market growth. Moreover, with South Korea being at the forefront of technology in dairy processing and product innovation, the country has better avenues for selling more quality A2 infant formula.

The industry is expected to grow at a CAGR of 7.4% between 2025 and 2035. This demand for A2 formulas has been coupled with the country's strong emphasis on premium formulas for infants and sophisticated dairy processing technologies. Japan's declining birth rate is driving its infant formula market increasingly towards premium and specialized: the growing sophistication of parents is driving growth in Japan's infant formula contribution, away from baby milk powder and towards premium and specialist products.

Japan is a country where parents tend to opt for formulas that come with functional benefits that claim to improve digestion and reduce allergic reactions, which is one of the reasons for the popularity of A2 milk.

Some of the major dairy companies are carrying out research and development activities to improve the effectiveness of the A2-based formulas. Another contributing factor to the market's growth in Japan is the presence of an affluent and well-educated consumer segment that is highly selective about quality and health-conscious options.

The industry is estimated to grow the fastest at a CAGR of 8.2%. Store-based methods to categorize products and sales through Maternity or baby shops; however, increasing disposable incomes and urbanization coupled with a strong preference for premium makeup baby nutrition has been fueling the demand for A2-based formulas. The policy shift to encourage larger families has also resulted in parents spending more on premium infant nutrition, contributing to market growth.

A2 product lines are wildly expanding as both international brands and Chinese manufacturers respond to growing consumer demand. The rise of A2 formula industry is also driven by increasing government support for better quality infant nutrition products, as well as strict quality regulations. In addition, A2 formulas are becoming more and more accessible to parents across China due to the popularity of e-commerce platforms.

With Australia as one of the world's largest producers of A2 milk, strong domestic production is matched by global demand - particularly from China. It is great to see that market growth is driven by high dairy standard in the country accompanied with demand for organic and clean-label formulas.

Australian companies such as The A2 Milk Company are going global, banking on Australia's good name when it comes to quality dairy food. Growing consumer awareness about digestive health benefits and the trend to consume natural ingredients are the driving factors for this growth. The growing use of e-commerce platforms and cooperation with global retailers further increases the availability of A2 infant formulas made in Australia in global markets.

The industry is expected to grow at a CAGR of 6.5% during the forecast period. Its strong dairy industry and reputation for quality milk production make it a leader in the A2 space. New Zealand is a leading exporter of A2-based formulas, especially to China and Southeast Asia, where demand for premium infant nutrition is growing. To stand out from the competition, local dairy companies invest in sustainable farming practices and organic A2 milk production.

Focus on high-quality, traceable dairy product lines is part of global trends in infant nutrition. Furthermore, the stringent regulations regarding dairy practices set by New Zealand government authorities contribute to the booming of this market as it produces safe and high-quality A2 infant formula to meet the requirements in both domestic and international markets.

The A2 infant formula category is highly competitive, with multinational dairy companies, specialty infant nutrition companies, and small organic companies competing for market share. Competition is largely over scientific discovery, approvals, brand equity, and strong distribution networks.

Barriers like high production costs, regulatory requirements and supply chain challenges leave space for competitive advantage to companies with advanced R&D, proprietary formulations and premium positioning to survive the rest.

The stakes get higher as the leaders spend heavily on clinical trials, marketing campaigns, and global footprints to realize diverse products. DTC models and digital marketing strategies are also playing an increasingly important role in getting companies in front of health-conscious parents.

Premium pricing may turn a few consumers off, but they are a small minority, and the cravings for gut-friendly and organic nutrition continue to fuel demand. Only one has added to the competition in the space, trends around alternative proteins, sustainability and personalized nutrition solutions.

A2 Infant Formula Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| The a2 Milk Company | 25-30% |

| Nestlé S.A. | 15-20% |

| Danone S.A. | 12-17% |

| Abbott Laboratories | 8-12% |

| Reckitt Benckiser Group | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| The a2 Milk Company | Pioneer of A2-only infant formula, widely trusted for its digestion-friendly milk-based nutrition. |

| Nestlé S.A. | Offers premium A2 infant formula under its NAN brand, focusing on gut health benefits. |

| Danone S.A. | Produces A2-based formulas with a focus on premium organic options and nutritional innovation. |

| Abbott Laboratories | Introduced A2 formulas within its Similac range, targeting lactose-sensitive infants. |

| Reckitt Benckiser Group | Features A2 protein formulas in its Enfamil product line, emphasizing digestive comfort. |

Key Company Insights

The a2 Milk Company (25-30%)

As the pioneer of A2-only dairy, this company dominates the A2 infant formula segment with strong brand recognition and premium product positioning.

Nestlé S.A. (15-20%)

Nestlé’s NAN A2 range is growing rapidly, backed by extensive R&D and global distribution networks.

Danone S.A. (12-17%)

A major player in specialized nutrition, Danone’s A2 offerings emphasize organic and high-quality ingredients.

Abbott Laboratories (8-12%)

Abbott’s Similac A2 formula provides an alternative for infants with digestive sensitivities, supported by clinical research.

Reckitt Benckiser Group (5-9%)

A growing competitor, leveraging its expertise in infant nutrition with A2 protein-based Enfamil products.

Other Key Players (20-30% Combined)

The industry includes supermarkets & hypermarkets, pharmacies & drugstores, e-commerce, and specialty stores.

In terms of application, the industry is divided into general infant nutrition (0-6 months), follow-on formula (6-12 months), and toddler formula (12+ months).

By type, the industry covers organic A2 formula and conventional A2 formula.

The industry spans North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa (MEA).

The industry is expected to generate USD 1,162 million in revenue by 2025.

The industry is projected to exceed USD 4,364 million by 2035, growing at a CAGR of 18%.

Key players include The A2 Milk Company, Nestlé S.A., Danone S.A., Abbott Laboratories, Reckitt Benckiser Group, Bellamy’s Organic, Bubs Australia, Yili Group, Feihe International Inc., and Mengniu Dairy.

North America and Asia Pacific present lucrative opportunities due to increasing consumer awareness, rising lactose intolerance concerns, and growing demand for premium infant nutrition products.

Infant formula (0–6 months) and follow-on formula (6–12 months) dominate the industry due to their importance in early-stage infant nutrition and digestion benefits.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Age Group, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Age Group, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 7: Global Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 9: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by Age Group, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Age Group, 2018 to 2033

Table 13: North America Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 15: North America Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ million) Forecast by Age Group, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Age Group, 2018 to 2033

Table 21: Latin America Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 23: Latin America Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 25: Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ million) Forecast by Age Group, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Age Group, 2018 to 2033

Table 29: Europe Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 31: Europe Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 33: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 34: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: East Asia Market Value (US$ million) Forecast by Age Group, 2018 to 2033

Table 36: East Asia Market Volume (MT) Forecast by Age Group, 2018 to 2033

Table 37: East Asia Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 38: East Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 39: East Asia Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 40: East Asia Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 41: South Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 42: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia Market Value (US$ million) Forecast by Age Group, 2018 to 2033

Table 44: South Asia Market Volume (MT) Forecast by Age Group, 2018 to 2033

Table 45: South Asia Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 46: South Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 47: South Asia Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 48: South Asia Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 49: Oceania Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 50: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Oceania Market Value (US$ million) Forecast by Age Group, 2018 to 2033

Table 52: Oceania Market Volume (MT) Forecast by Age Group, 2018 to 2033

Table 53: Oceania Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 54: Oceania Market Volume (MT) Forecast by Form, 2018 to 2033

Table 55: Oceania Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 56: Oceania Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 57: MEA Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 58: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 59: MEA Market Value (US$ million) Forecast by Age Group, 2018 to 2033

Table 60: MEA Market Volume (MT) Forecast by Age Group, 2018 to 2033

Table 61: MEA Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 62: MEA Market Volume (MT) Forecast by Form, 2018 to 2033

Table 63: MEA Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 64: MEA Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Age Group, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Form, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ million) Analysis by Age Group, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Age Group, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 13: Global Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 17: Global Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Age Group, 2023 to 2033

Figure 22: Global Market Attractiveness by Form, 2023 to 2033

Figure 23: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ million) by Age Group, 2023 to 2033

Figure 26: North America Market Value (US$ million) by Form, 2023 to 2033

Figure 27: North America Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 28: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ million) Analysis by Age Group, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Age Group, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 37: North America Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 41: North America Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Age Group, 2023 to 2033

Figure 46: North America Market Attractiveness by Form, 2023 to 2033

Figure 47: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ million) by Age Group, 2023 to 2033

Figure 50: Latin America Market Value (US$ million) by Form, 2023 to 2033

Figure 51: Latin America Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ million) Analysis by Age Group, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Age Group, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 61: Latin America Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 65: Latin America Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Age Group, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ million) by Age Group, 2023 to 2033

Figure 74: Europe Market Value (US$ million) by Form, 2023 to 2033

Figure 75: Europe Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 76: Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ million) Analysis by Age Group, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Age Group, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 85: Europe Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 89: Europe Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 93: Europe Market Attractiveness by Age Group, 2023 to 2033

Figure 94: Europe Market Attractiveness by Form, 2023 to 2033

Figure 95: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ million) by Age Group, 2023 to 2033

Figure 98: East Asia Market Value (US$ million) by Form, 2023 to 2033

Figure 99: East Asia Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 100: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ million) Analysis by Age Group, 2018 to 2033

Figure 106: East Asia Market Volume (MT) Analysis by Age Group, 2018 to 2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 109: East Asia Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 110: East Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 113: East Asia Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 114: East Asia Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Age Group, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ million) by Age Group, 2023 to 2033

Figure 122: South Asia Market Value (US$ million) by Form, 2023 to 2033

Figure 123: South Asia Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 124: South Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ million) Analysis by Age Group, 2018 to 2033

Figure 130: South Asia Market Volume (MT) Analysis by Age Group, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 133: South Asia Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 134: South Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 137: South Asia Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 138: South Asia Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Age Group, 2023 to 2033

Figure 142: South Asia Market Attractiveness by Form, 2023 to 2033

Figure 143: South Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ million) by Age Group, 2023 to 2033

Figure 146: Oceania Market Value (US$ million) by Form, 2023 to 2033

Figure 147: Oceania Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 148: Oceania Market Value (US$ million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ million) Analysis by Age Group, 2018 to 2033

Figure 154: Oceania Market Volume (MT) Analysis by Age Group, 2018 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 157: Oceania Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 158: Oceania Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 161: Oceania Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 162: Oceania Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Age Group, 2023 to 2033

Figure 166: Oceania Market Attractiveness by Form, 2023 to 2033

Figure 167: Oceania Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: MEA Market Value (US$ million) by Age Group, 2023 to 2033

Figure 170: MEA Market Value (US$ million) by Form, 2023 to 2033

Figure 171: MEA Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 172: MEA Market Value (US$ million) by Country, 2023 to 2033

Figure 173: MEA Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 174: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: MEA Market Value (US$ million) Analysis by Age Group, 2018 to 2033

Figure 178: MEA Market Volume (MT) Analysis by Age Group, 2018 to 2033

Figure 179: MEA Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 180: MEA Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 181: MEA Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 182: MEA Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 183: MEA Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 184: MEA Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 185: MEA Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 186: MEA Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 187: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 188: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 189: MEA Market Attractiveness by Age Group, 2023 to 2033

Figure 190: MEA Market Attractiveness by Form, 2023 to 2033

Figure 191: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 192: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

A2P Messaging Market Size and Share Forecast Outlook 2025 to 2035

A2 Ice Cream Market Size and Share Forecast Outlook 2025 to 2035

A2 Lactose-Free Milk Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

A2 Milk Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

A2 Yogurt Market Trends – Growth, Demand & Innovations

A2P & P2A Messaging – AI-Driven Communication & Security

Enterprise A2P SMS Market Size and Share Forecast Outlook 2025 to 2035

Infant Positioning Aids Market Size and Share Forecast Outlook 2025 to 2035

Infant Incubators & Warmers Market Size and Share Forecast Outlook 2025 to 2035

Infant Nutrition Hydrolysate Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Infant Fever Stickers Market Size and Share Forecast Outlook 2025 to 2035

Infant Nutritional Premix Market Size and Share Forecast Outlook 2025 to 2035

Infant Incubators Market Analysis - Trends & Forecast 2025 to 2035

Infant Care Equipment Market Growth - Trends & Forecast 2025 to 2035

Infant Formula DHA Algae Oil Market Size and Share Forecast Outlook 2025 to 2035

Infant Formula Industry Analysis in United States Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Infant Formula Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Infant Formula Ingredients Market Analysis - Size, Share & Forecast 2025 to 2035

Malignant Infantile Osteopetrosis Market

Probiotic Infant Formula Market – Growth & Infant Nutrition Trends

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA