The infant formula ingredients market demonstrates reasonable expansion predictions from 2025 through 2035 because of rising worldwide birth numbers as well as increasing parental understanding about infant nutrition and escalating preferences for premium, nutritionally balanced baby formula products.

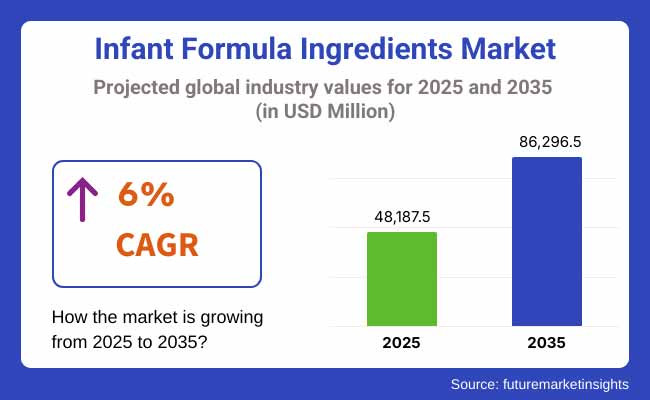

The ingredients used in these formulas carry out a vital function to duplicate breast milk nutrition thus enabling proper infant growth. The Infant Formula Ingredients industry will grow at a compound annual rate of 6% from 2025 to 2035 resulting in a market value increase from USD 48,187.5 million to USD 86,296.5 million.

The market grows because mother's employment rates increase while formula composition advances and emerging economies embrace infant formula. The application of human milk oligosaccharides (HMOs) together with omega-3 fatty acids and plant-based proteins develops better nutrition throughout different product lines in formula development.

The market faces obstacles from complex regulations as well as the sensitive nature of product prices and increasing support for breastfeeding among various groups. Factories employ visible packaging and advanced nutritional research alongside beneficial microbe ingredients as a means to help digestive health while supporting overall immunity.

The infant formula ingredients market functions through ingredient type divisions and formula stage segments while primarily serving infant food producers together with paediatric nutrition supply providers. The market contains key ingredients which include proteins and carbohydrates together with fats and oils along with vitamins and minerals while specialty components contain probiotics and human milk oligosaccharides.

Whey protein and casein proteins lead the nutritional content as essential amino acids necessary for infant growth. Fats & oils together with specialty ingredients serve to support developmental growth of the brain and provide energy source while improving digestive health and immune response.

Stage 1 formula for babies under six months old controls the maximum market share because new-borns need complete nutritional content. Asia-Pacific leads the market growth in Stage 2 and 3 infant formula sales at ages six to twelve months and above twelve months. The manufacturing industry focuses on producing products with clean labels that contain no allergies and organic contents to address shifting parent requirements.

The North America infant formula ingredients market maintains strong performance because customers understand infant nutrition needs well thus driving organic formula and premium ingredients adoption. The United States along with Canada engage in substantial research and development activities which result in market expansion dedicated to immune-boosting components and plant-based formula ingredients.

This market thrives because the region has vigorous oversight from regulators as well as strong health-focused attitudes among consumers who increasingly look for formula with clean labels and without allergens. European manufacturers emphasize the development of formula products containing probiotics and omega-3s and HMOs to maintain product safety and nutritional value in Germany France and the United Kingdom.

The infant formula ingredients market grows at its fastest rate within the Asia-Pacific region due to quick urban development together with rising family wealth and massive total number of infants. China, India, Japan, and Australia witness high demand for stage-wise formulas with premium ingredients.

Market expansion receives motivation from multiple government programs that advocate child nutrition and from domestic manufacturing initiatives in the region. The infant formula ingredients market in the Asia-Pacific region expands due to changing consumer tastes that favour premium science-based nutritional choices but cost factors still play a significant role.

Challenge: Regulatory Scrutiny and Product Safety Standards

The infant formula ingredients market is witnessing stringent and regulatory scrutiny affecting the quality and safety standards and hence this acts as a deterrent for the market. A key requirement is that the ingredients used in the infant formulas, such as proteins, fats, carbohydrates, vitamins, and minerals, are similar in composition to that of the human breast milk, while also adhering to strict global food safety regulations.

Agencies including FDA, EFSA, and Codex Alimentary require detailed approval paths, quality certifications, and compliance assessments that ultimately lengthen development paths and raise the cost for manufacturers. Allergen risks, ingredient authenticity and product contamination are also forces for producers to maintain strong traceability and quality assurance systems through their supply chains.

Opportunity: Innovation in Human Milk Mimicry and Organic Formulations

The increasing need for science-backed, premium products addressing infant nutrition opens a highly attractive opportunity for ingredient innovation. Manufacturers are designing bioactive ingredients including human milk oligosaccharides (HMOs), lactoferrin, nucleotides and prebiotics aiming to closely replicate all of the immune and digestive benefits of breast milk. At the same time, growing consumer preferences for clean-label, organic, non-GMO, and plant-based infant formulas drive adoption of vegetarian forms of DHA, organic lactose, and hydrolysed plant proteins.

Protein properties can be modified for enhanced digestibility and bioavailability with new technological advances such as enzymatic processing, fermentation, and lipid structuring, paving the way for next-generation infant formulas to target specific nutrition needs for children requiring hypoallergenic and lactose-free formulas.

In 2020 and 2024, steady growth in the infant formula market helped to accommodate increasing demand for premium and specialty formulas, such as products designed for the specialized medic- al needs of a cow milk allergy, pre-term infant, and digestive comfort.

Manufacturers began to concentrate on improving the nutritional constituents and digestibility of densified products whereby the incorporation of probiotics, omega-3 fatty acids and antibiotic-free organic lactose became prevalent. But product development and availability in some markets were hindered by supply chain disruptions, regulatory delays and global ingredient shortages.

While the market will shift toward personalized and functional infant nutrition between 2025 and 2035, it will be firmly anchored by advances in biotechnology, microbiome science, and AI exposure-based formulation platforms. Ingredient innovation will include customizing formulas for individual health profiles, while sustainable sourcing of dairy and vegetable inputs will be increasingly pursued.

Alternatives emerging from precision fermentation, lab-grown proteins and human milk cell cultivation will usher in the next generation of ingredient solutions, improving how closely formula can mimic breast milk and minimizing the industry's dependence on traditional animal-based sources.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Tight global regulation on ingredient safety and nutritional compliance. |

| Technological Advancements | Use of probiotics, DHA, and lactose derivatives in standard formulas. |

| Sustainability Trends | Evolving toward organic ingredients and transparent supply chains |

| Market Competition | Dominated by established dairy-based formula providers. |

| Industry Adoption | Common in standard formulas and allergen-reduced variants. |

| Consumer Preferences | Demand for clean-label and organic-certified infant nutrition. |

| Market Growth Drivers | Growth fuelled by urbanization, rising birth rates in emerging economies, and premium trends. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Standardization of human milk-based bioactive and AI-aided formulation approvals. |

| Technological Advancements | Introduction of precision-fermented HMOs, lab-cultured lactoferrin, and AI-optimized blends. |

| Sustainability Trends | Plant-based, carbon-neutral, and humane ingredient sourcing goes mainstream |

| Market Competition | Entry of biotech firms and plant-based innovators targeting functional infant nutrition. |

| Industry Adoption | Expanded use in microbiome-specific, immune-boosting, and growth-optimized formulations. |

| Consumer Preferences | Preference for customized, bioactive-rich, and breast milk-equivalent formulations. |

| Market Growth Drivers | Expansion driven by biotech breakthroughs, sustainability demands, and personalized infant health solutions. |

The USA infant formula ingredients market is flourishing, owing to rising demand for premium-quality nutritionally balanced baby food and increasing number of working mothers choosing formula-based feeding. Interest in organic, non-GMO, and DHA-rich formulations that replicate the nutritional profile of breast milk is driving the market.

Consumer awareness is higher than ever about functional ingredients, such as probiotics, nucleotides and milk fat globule membrane (MFGM), and regulatory support from the FDA, along with the involvement of key industry players, has accelerated the development of customized blends. The expansion of e-commerce, along with consumer education, has improved access to specialty formulas for infants with dietary sensitivities or allergies.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.2% |

Increased global focus on early childhood nutrition alongside the demand for clean-label products are some of the factors positively impacting the UK infant formula ingredients market. As infant gut health and inherently associated immunity gain awareness; infant formula manufacturing companies are focusing on formulations that include prebiotic & probiotic enrichment as well as vitamins & minerals fortification.

The post-pandemic consumer focus on health-conscious parenting becomes even more combined with stronger regulatory scrutiny through the eyes of the Food Standards Agency (FSA) enables innovation in all aspects of plant proteins and organic carbohydrate blends. The UK also makes a positive contribution to the European supply chain through imports and exports of high-grade infant nutrition ingredients.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.9% |

The market for infant formula ingredients in the European Union is growing strongly, supported by strict EU regulations related to product safety and nutritional quality as well as increasing consumer preference for clean, organic, and sustainable sources of ingredients. Germany, France and the Netherlands are large producers and exporters of ingredients for dairy-based and specialty formula.

There's a growing need for advanced protein sources, oligosaccharides, and lactose derivatives throughout the region. And innovation in bioactive compounds and allergen-friendly formulations is generating opportunities for ingredient manufacturers. The infant health research being supported by the EU is also providing value to R&D to fortify next-gen infant formula.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.1% |

Japan already has an infant formula ingredients market fuelled by an ageing population accompanied by falling birth rates and by premium and highly specialized infant nutrition. Japanese consumers are focused on quality, traceability, and functional health benefits and manufacturers are responding with advanced bioactive compounds, lactoferrin-enriched formulas, and immune-boosting additives.

Additionally, the nation’s tech skills in dairy processing and infant health science is elevating the development of fermented formula ingredients as well as plant-based alternatives. Japan's regulatory landscape, governed by the Ministry of Health, Labour and Welfare, mandates stringent adherence and quality assurance, bolstering confidence among consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.0% |

The South Korea baby formula ingredients market is booming due to increasing parent accessibility to higher-value convenience and raising disposable income, which is boosting higher-value consumer spending on customized infant nutrition segments. Parents are increasingly opting for premium formulations fortified with omega-3s, human milk oligosaccharides (HMOs), and digestive enzymes to meet diverse infant health needs.

Moreover, stringent governance and a focus on food safety are driving ingredient suppliers to be adaptable to more transparent, traceable, and allergen-free ingredients. The demand for next-generation formula ingredients in immunity and cognitive development is now being supported by South Korea's innovation in functional food ingredient and biotechnology-derived nutrients.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.0% |

As priorities in global infant nutrition evolve away from breastmilk and towards digestive health, immune support and nutrient-rich alternatives, the infant formula ingredients market is growing at an accelerated pace. Among all ingredient types used in formula production, fats & oils and prebiotics are leading the segments, accounting for the largest share of value attributed due to their indispensable role in infant growth, cognitive development, and gastrointestinal function.

As infant formula manufacturers move towards increasingly complex products, one solution is for manufacturers to increasingly create blends of ingredients that are bioavailable, clinically tested, and functional, to try to replicate the components of human milk.

The increasing popularity of advanced ingredients in nutrition products such as structured lipids, DHA-enriched oils, and oligosaccharide-based prebiotics that ensure gut microbiota balance, immune system support and brain development of the child has led to preference for advanced nutrition in early stages of the growing problem.

As demand for premium infant nutrition continues to grow in emerging markets, companies are investing in sustainable sourcing, traceability technologies, and hypoallergenic ingredient formulations that can match a range of infant needs and parental expectations.

As a result of the social health needs associated with feeding and how to make it available through food related small and medium enterprises. Fats & oils leading the market demand in between macronutrients required for brain development and providing the required energy.

Fats & oils are a crucial element of infant formula providing as much as 50% of caloric value. These macros are also the major source of fuel, but they’re also important for proper brain development, nervous system maturation and absorption of fat-soluble vitamins. Manufacturers of infant formula utilize vegetable oils, structured triglycerides, and long-chain polyunsaturated fatty acids (LCPUFAs) DHA (docosahexaenoic acid) and ARA (arachidonic acid) to aim for a similar lipid profile to that found in breast milk.

Blends typically include oils, from palm, coconut, soy, sunflower and canola that are adjusted for digestibility, fatty acid profiles and oxidative stabilization. The recent innovation has particularly concentrated on custom triglyceride constructs that, in some cases, can facilitate fat absorption while reducing intestinal anxiety, including that experienced by preterm or low-birth-weight neonates.

Fats & oils will always be one of the key ingredient categories included in any formula composition, and with the evolution of our science around early nutrition and its impact on later life cognitive outcomes, it can only become an even more critical choice in formula.

While certain oils especially palm oil are facing regulatory scrutiny, manufacturers are getting creative with sustainable alternatives, like algal oil for DHA and high-oleic sunflower oil, both of which provide clean-label, plant-based and non-GMO options. Continued demand for tailored fat compositions for the processing of infant formula has been extending with the inclusion of structured lipid blends that are age-group specific and growth stage specific.

With increasing numbers of parents looking for high-performance infant formula that supports brain health, vision health and fat metabolism, the demand for DHA-rich, sustainably sourced and easily digested fats and oils continues to grow.

Most Premium and Specialty formulas include these ingredients to improve nutrient bioavailability, especially in infants with digestive sensitivities or rapid developmental requirements. Plant-based interests are on the rise, but oil innovation is key in formulations aimed at vegan parents, lactose-free diets and environmentally conscious consumers.

They serve as one of the beneficial prebiotic functional ingredients in infant formula that support gut microbiome development, mineral and iron absorption, and immune modulation. These non-digestible carbohydrates fructooligosaccharides (FOS) and galactooligosaccharides (GOS) serve as prebiotics, nourishing beneficial gut probiotics and replicating the microbiota benefits of breastmilk.

The additions of prebiotics to infant formulas also improve stool consistency, colic, and promote bifid bacteria and lactobacilli growth to aid in early life immune maturation. Supported by increasing scientific evidence relating gut health with immunity, cognitive development and allergy prevention, prebiotics have emerged as an important functional ingredient in both our traditional and specialty infant formula products.

Top manufacturers are also working on prebiotic mixes containing a number of oligosaccharides to improve diversity in the gut microbiome. Some formulations are symbiotic blends that combine prebiotics with probiotics or postbiotics, synergistically improving overall gut flora stability and digestive efficiency. Also, the cost-effective manufacturing of prebiotics small molecule products for large scales of production in infant formula applications is being propelled by state-of-the-art advancements in plant-based extraction, fermentation technologies, and molecular stability.

With growing emphasis on early gut microbiome development and targeted gut microbiome modulation of infant gut microbiota, particularly in formula-fed infant’s prebiotics have become a first-class ticket available in many premium and functional infant nutrition products.

Its role in supporting natural defences, reducing the risk of infection, and improving the use of nutrients makes them well suited to infants with impaired immunity or digestive problems. With clean-label preferences taking centre stage alongside clinical validation in the consumer journey, prebiotics are projected to unlock sustained growth in all age-based formula applications.

The largest application segment of the market is infant formula developed for the 0>6 months age group. The early stage is characterized by the most intense growth in physical and neurological aspects, therefore issues with the nutritional composition that play a healthy role in breast milk need to be replicated in the closest possible way.

In such a competitive segment, ingredient selection is particularly important, as these products must replicate the formula more closely than ever, including protein composition, fatty acid profile, and micronutrient density.

Infant formulas designed for this group focus on the balance between whey and casein proteins, inclusion of DHA and ARA fatty acids, lactose as the predominant carbohydrate source, and bioavailable mineral formulations. Furthermore, goods in this group combine prebiotics and nucleotides to assist the growth of the immune system and gastrointestinal system.

For some in this category, such as non-lactating mothers, mothers who had adopted babies, or medical conditions that prevent nursing, formula may be the only form of nutrition available to newborns.

As such, all components added to 0-6-month formulas must adhere to stringent regulatory standards for food safety, sterility, and digestibility in the sensitive segment. OEMs are investing in clinical trials, nutrition modelling and biochemical resource development initiatives to assure product safety and efficacy for newborns.

The infant formula ingredients industry is evolving rapidly, with such essential components as fats & oils and prebiotics playing key roles in the pursuit of safe, digestible, and nutritionally complete substitutes for breast milk. Particularly for formula products aimed at the 0 to 6-month demographic, these ingredients are essential to establishing gut health, brain development, and immunity.

Given evolving regulatory standards, rising consumer demands for functional nutrition, sustainability, and ingredient transparency, manufacturers are all set for innovation with clean-label, scientifically credentialed, and globally compliant infant nutrition solutions.

The infant formula ingredients represents an extensive landscape, with a myriad of players thriving in the space owing to the growing global demand for safe, nutritionally complete and easy-to-digest formula products for infants. That's because these ingredients are key to mirroring the composition of breast milk, particularly with regard to its proteins, fats, carbohydrates, vitamins, minerals and functional additives.

Leading players have focused on clinical validation, clean-label formulations, and advanced processing technologies to enhance digestibility, immune support and cognitive development. It services millennial consumers, offering formula manufacturers the premium and mass-market solutions as global dairy ingredient suppliers, specialty nutrition related companies and food science innovators.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Friesland Campina Ingredients | 18-22% |

| Fonterra Co-operative Group | 15-19% |

| Arla Foods Ingredients Group P/S | 12-16% |

| BASF SE | 8-12% |

| Kerry Group plc | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Friesland Campina Ingredients | Produces human milk oligosaccharides (HMOs), whey proteins, and lipid blends, optimized for digestibility and cognitive development. |

| Fonterra Co-operative Group | Offers whey protein isolates, lactose, and milk fat globule membrane (MFGM), catering to premium infant formula manufacturers. |

| Arla Foods Ingredients Group P/S | Specializes in lactose, alpha-lactalbumin, and mineral blends, focusing on gut health and immune system development. |

| BASF SE | Develops functional lipids such as DHA and ARA, along with vitamins and micronutrients essential for early-stage infant nutrition. |

| Kerry Group plc | Provides probiotic cultures, plant-based proteins, and flavour-masking technologies, enhancing digestive support and palatability. |

Key Company Insights

Friesland Campina Ingredients

Friesland Campina leads in functional infant formula ingredients, producing HMOs, prebiotics, and protein blends that closely mimic the benefits of breast milk.

Fonterra Co-operative Group

Fonterra supplies premium dairy-derived ingredients, including bioactive proteins and MFGM, tailored for immune health and neurodevelopment in infants.

Arla Foods Ingredients Group P/S

Arla Foods Ingredients focuses on high-purity alpha-lactalbumin and mineral systems, designed to improve digestion and support infant gut microbiota.

BASF SE

BASF delivers high-quality functional lipids (DHA/ARA) and vitamin complexes, ensuring balanced growth and immune system fortification in infant formula products.

Kerry Group plc

Kerry Group specializes in probiotic and enzymatic solutions, supporting digestive comfort, nutrient absorption, and enhanced flavour profiles in infant formulas.

Other Key Players (30-40% Combined)

Several other companies contribute to the infant formula ingredients market, focusing on clinical-grade formulations, sustainable sourcing, and nutritional innovations:

The overall market size for the infant formula ingredients market was USD 48,187.5 million in 2025.

The infant formula ingredients market is expected to reach USD 86,296.5 million in 2035.

The increasing demand for high-nutrition alternatives to breast milk, rising awareness of infant health, and growing inclusion of functional ingredients in infant formulas fuel the infant formula ingredients market during the forecast period.

The top 5 countries driving the development of the infant formula ingredients market are the USA, UK, European Union, Japan, and South Korea.

Fats & oils and prebiotics lead market growth to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Ingredient Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Ingredient Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Source, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Ingredient Type, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Ingredient Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Ingredient Type, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Ingredient Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Ingredient Type, 2018 to 2033

Table 34: Western Europe Market Volume (MT) Forecast by Ingredient Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 36: Western Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Western Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 40: Western Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Ingredient Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (MT) Forecast by Ingredient Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 46: Eastern Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Eastern Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 50: Eastern Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Ingredient Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (MT) Forecast by Ingredient Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (MT) Forecast by Source, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (MT) Forecast by Form, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Ingredient Type, 2018 to 2033

Table 64: East Asia Market Volume (MT) Forecast by Ingredient Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 66: East Asia Market Volume (MT) Forecast by Source, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 68: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 70: East Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Ingredient Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (MT) Forecast by Ingredient Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 76: Middle East and Africa Market Volume (MT) Forecast by Source, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 78: Middle East and Africa Market Volume (MT) Forecast by Application, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 80: Middle East and Africa Market Volume (MT) Forecast by Form, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Ingredient Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 26: Global Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Source, 2023 to 2033

Figure 28: Global Market Attractiveness by Application, 2023 to 2033

Figure 29: Global Market Attractiveness by Form, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Ingredient Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 56: North America Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Source, 2023 to 2033

Figure 58: North America Market Attractiveness by Application, 2023 to 2033

Figure 59: North America Market Attractiveness by Form, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Ingredient Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 101: Western Europe Market Volume (MT) Analysis by Ingredient Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 105: Western Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 109: Western Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 113: Western Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Source, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Form, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (MT) Analysis by Ingredient Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 135: Eastern Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Eastern Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 143: Eastern Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Source, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Form, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Form, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (MT) Analysis by Ingredient Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Source, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Form, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 191: East Asia Market Volume (MT) Analysis by Ingredient Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 195: East Asia Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 199: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 203: East Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Source, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Source, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Form, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (MT) Analysis by Ingredient Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Source, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Form, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Infant Positioning Aids Market Size and Share Forecast Outlook 2025 to 2035

Infant Incubators & Warmers Market Size and Share Forecast Outlook 2025 to 2035

Infant Fever Stickers Market Size and Share Forecast Outlook 2025 to 2035

Infant Nutritional Premix Market Size and Share Forecast Outlook 2025 to 2035

Infant Incubators Market Analysis - Trends & Forecast 2025 to 2035

Infant Care Equipment Market Growth - Trends & Forecast 2025 to 2035

Infant Nutrition Hydrolysate Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Infant Formula DHA Algae Oil Market Size and Share Forecast Outlook 2025 to 2035

Infant Formula Industry Analysis in United States Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Infant Formula Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

A2 Infant Formula Market Analysis By Form Type, By Age Group, By Distribution Channel and By Region - Forecast from 2025 to 2035

Malignant Infantile Osteopetrosis Market

Probiotic Infant Formula Market – Growth & Infant Nutrition Trends

Lactose-free Infant Formula Market

Noise-muffling Infant Hat Market

Formulation Development Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Preformulation intermediates Market Size and Share Forecast Outlook 2025 to 2035

AI-Formulated Custom Serums Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drug Formulation Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Aseptic Formulation Processing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA