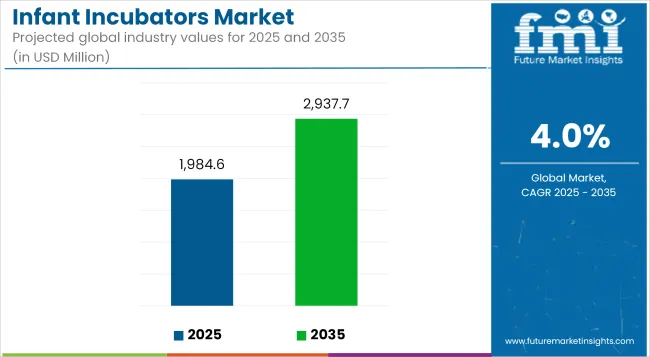

The global Infant Incubators Market is estimated to be valued at USD 1,984.6 million in 2025 and is projected to reach USD 2,937.7 million by 2035, registering a compound annual growth rate of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1,984.6 Million |

| Projected Market Size in 2035 | USD 2,937.7 Million |

| CAGR (2025 to 2035) | 4.0% |

The infant incubators market is advancing due to rising preterm birth rates, greater neonatal care investments, and increasing awareness in both developed and emerging economies. Key growth enablers include technological innovation particularly AI, IoT, and smart monitoring enhancing precision and care quality.

The shift toward portable and energy-efficient incubators is expanding access in underserved regions. However, high device costs and a shortage of trained staff limit widespread adoption, especially in low-resource settings. Despite these challenges, the market outlook remains strong, supported by public-private partnerships, improved healthcare infrastructure and policy-level focus on neonatal health. Future growth depends on scalable, affordable solutions that ensure accessibility and equity across global healthcare ecosystems.

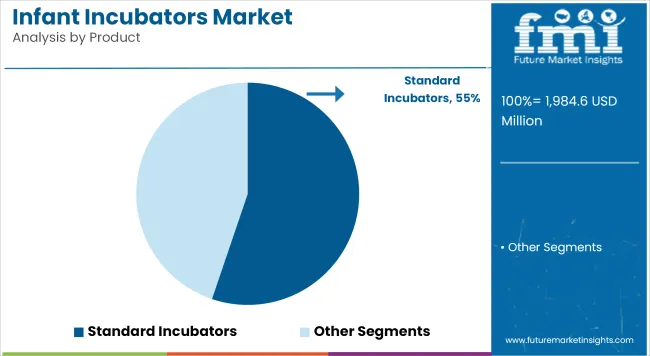

The dominance of standard incubators accounting for 55.2% of the market in 2025 has been attributed to their universal adoption across neonatal intensive care units (NICUs). Their clinical reliability and versatility in managing a wide range of neonatal complications have been highly favored by healthcare professionals. In particular, closed-box and double-wall configurations have been integrated into standard care protocols due to their effectiveness in maintaining thermal stability and minimizing external contamination.

Standard incubators have also been supported by established procurement frameworks in both public and private hospitals, where budget-friendly options and reliable supplier relationships have fostered high-volume acquisition. Additionally, their compatibility with various neonatal monitoring systems has contributed to increased preference across developed and emerging economies.

Regulatory compliance and consistent performance outcomes in multi-center trials have further reinforced trust in their deployment. As neonatal care guidelines continue to emphasize stability and infection control, the standard incubator segment is expected to maintain its leadership role.

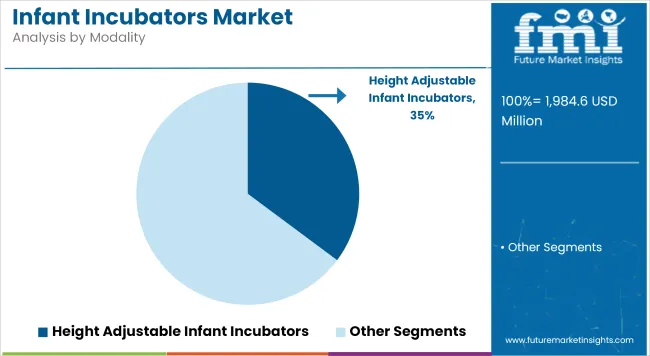

In 2025, height adjustable infant incubators holding a 35.2% revenue share has grown primarily due to improved ergonomic design and clinical workflow efficiency. These incubators have been preferred for their ability to reduce physical strain on healthcare professionals, particularly during frequent interventions and prolonged neonatal handling.

Their use has been associated with better staff compliance and reduced musculoskeletal stress, especially in high-acuity NICU environments. The enhanced mobility and adjustment features have also supported integration in diverse settings, including emergency rooms, specialized pediatric wards, and mobile NICU units.

Moreover, the adaptability of these incubators to different healthcare settings has enabled their deployment in both high- and mid-resource hospitals. Hospitals have increasingly prioritized ergonomic safety for clinical staff, and height-adjustable solutions have aligned with occupational safety mandates.

Patient monitor integrated incubators dominate the market with 60.2% revenue share in 2025. This dominance is driven by rising demand for continuous physiological assessment of neonates. These incubators have enabled real-time monitoring of vital signs such as heart rate, oxygen saturation, and respiratory patterns parameters that are critical for timely clinical interventions.

Patient monitors have been embedded to reduce the latency of response in emergency situations and to enable closed-loop neonatal care systems. This integration has also been supported by regulatory agencies and hospital accreditation bodies, which increasingly mandate high-resolution patient surveillance in neonatal care. The deployment of such incubators has been linked with improved neonatal outcomes, particularly in premature infants or those requiring ventilatory support.

High Costs and Limited Access in Low-Income Regions

The infant incubators market's challenges include high equipment, maintenance costs, and lesser neonatal facilities in low-resource & rural populations. Most services in developing economies have unreliable electricity, qualified health workers and no funds to pay for advanced incubator technology that affects infant death rates. Stricter regulatory control and long processes for medical equipment manufacturers acts as a hindrance for the growth hurdle in industry.

Growth in Smart, Portable, and AI-Enabled Incubator Technology

Increasing interest in neonatal care developments, survival rates of preterm neonates, and AI-connected health services are driving demand for smart incubators with features like live monitoring and connectivity to remote networks. Emerging low-cost, portable, solar-powered, and AI-based incubators are widening access to neonatal care in low-resource contexts. In addition, government grants, non-profit healthcare programs, and smart hospital penetrations are fueling market expansion.

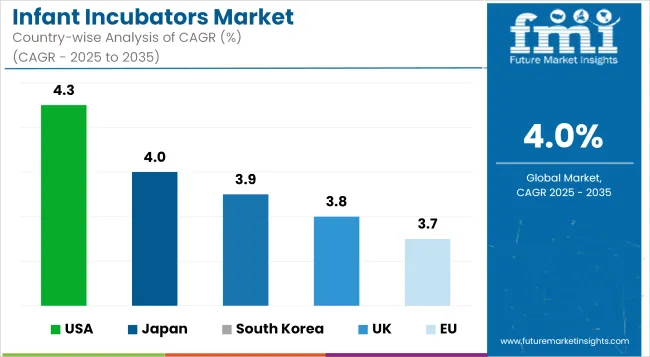

The United States infant incubators market is consistently growing due to innovative engineering in neonatal care, increasing preterm birth rates, and increasing investment in pediatric healthcare infrastructure. Market growth is driven by an increase in the demand for advanced incubators, such as with temperature control, humidity control, and built-in monitoring systems.

Presence of large medical device manufacturers and strong government support for neonatal health are also aiding the growth of the market. Moreover, increasing use of mobile and transport incubators for emergency neonatal care is further propelling market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.3% |

The UK infant incubators market is spurred by the rising emphasis on enhancing neonatal care services along with the increasing prevalence of premature births. NHS: Ministry of Health in the UK is building neonatal units with advanced incubators to increase infant survival.

In addition, the market is driven by technological innovation in incubator technology, such as the introduction of AI-based monitoring and non-invasive respiratory treatment. Increasing demand for home-use neonatal care products is also shaping the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.8% |

The Europe infant incubators market is expanding at a slow pace, owing to rising expenditures on healthcare, advances in neonatal intensive care units (NICUS), and growing awareness about neonatal health.

Germany, France, and Italy are leading markets in the region, registering good adoption with high-performance incubators with smart temperature control and oxygen therapy integration. In addition, EU medical device regulations around safety and quality are driving innovation in new-born baby care equipment.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 3.7% |

The Japanese market for infant incubators is expanding on account of the country's advanced health care system and the importance to them of neonatal care. The increasing use of artificial intelligence-based monitoring, wireless technology, and automation in incubators is further driving the market.

Moreover, the rising elderly population in the country, coupled with the government's focus towards the provision of improved maternal & child health care services, is anticipated to drive market growth. Even now, Japan's effort to establish highly accurate medical instrument technology is affecting the next-gen neonatal incubators.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.0% |

South Korea Infant Incubators Market is witnessing steady growth and is expected to progress further due to increased investments in the infrastructure of neonatal healthcare and a rising demand for technologically advanced incubators. Growing number of cases of adherence to infant mortality and improving NICU facilities in the country are driving the market growth

Government programs that encourage maternal and child well-being and increasing studies related to neonatal treatment also contribute to the market growth. In addition, mobile and portable incubators for emergency transport are also aiding the expansion of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.9% |

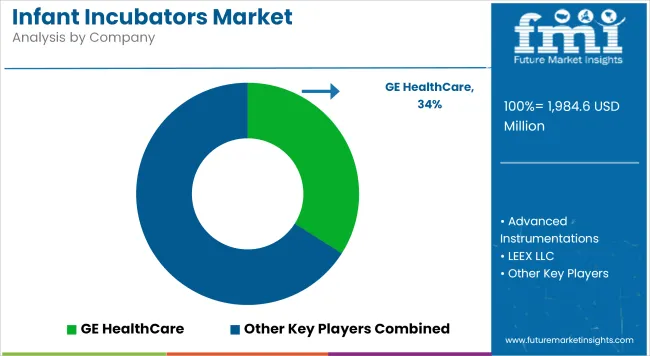

The infant incubators market is witnessing growing competition, fueled by rapid innovation and rising demand for advanced neonatal care solutions. Companies are focusing on integrating features like smart monitoring, remote access, and AI-based alert systems to enhance clinical outcomes and differentiate their offerings.

With a clear shift toward compact, energy-efficient and modular designs that cater to diverse healthcare environments, from high-end NICUs to rural clinics. Players are also prioritizing regulatory approvals and clinical trials to fast-track product launches in developed markets.

Strategic collaborations with hospitals and public health agencies are further strengthening market presence. Additionally, bundled service contracts and flexible pricing models are being adopted to secure long-term institutional partnerships and improve retention in an increasingly price-sensitive landscape.

Key Development:

The overall market size for infant incubators market was USD 1,984.6 million in 2025.

The infant incubators market is expected to reach USD 2,937.7 million in 2035.

Increasing preterm birth rates, advancements in neonatal care technology, and rising investments in healthcare infrastructure will drive market growth.

The top 5 countries which drives the development of infant incubators market are USA, European Union, Japan, South Korea and UK.

Pediatric & neonatal intensive care units (NICUs) expected to grow to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Infant Incubators & Warmers Market Size and Share Forecast Outlook 2025 to 2035

Infant Positioning Aids Market Size and Share Forecast Outlook 2025 to 2035

Infant Nutrition Hydrolysate Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Infant Formula DHA Algae Oil Market Size and Share Forecast Outlook 2025 to 2035

Infant Fever Stickers Market Size and Share Forecast Outlook 2025 to 2035

Infant Nutritional Premix Market Size and Share Forecast Outlook 2025 to 2035

Infant Formula Industry Analysis in United States Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Infant Formula Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Infant Formula Ingredients Market Analysis - Size, Share & Forecast 2025 to 2035

Infant Care Equipment Market Growth - Trends & Forecast 2025 to 2035

A2 Infant Formula Market Analysis By Form Type, By Age Group, By Distribution Channel and By Region - Forecast from 2025 to 2035

Probiotic Infant Formula Market – Growth & Infant Nutrition Trends

Malignant Infantile Osteopetrosis Market

Lactose-free Infant Formula Market

Noise-muffling Infant Hat Market

Carbon Dioxide Incubators Market Insights - Growth & Trends 2024 to 2034

Pharmaceutical Incubators Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA