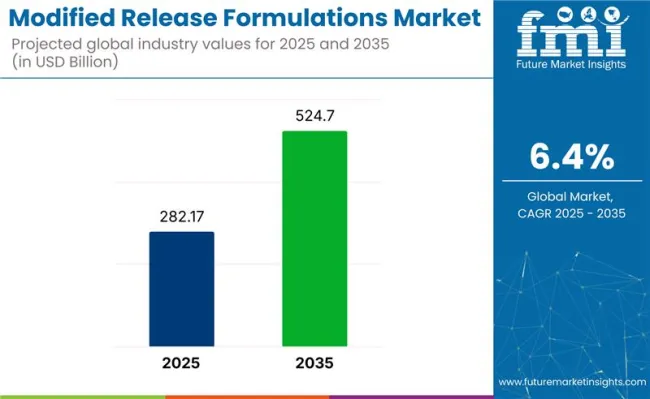

The global modified release formulations market is set for continued expansion between 2025 and 2035, with its size projected to rise from USD 282.1 billion to approximately USD 524.7 billion, representing a CAGR of 6.4%.

Growth is driven by increasing demand for more effective, patient-friendly drug delivery systems that optimize pharmacokinetic profiles, reduce side effects, and enhance compliance-particularly for chronic and long-term therapies.

The modified release formulations market represents a significant segment within the broader pharmaceutical industry. While specific percentage share estimates vary, it is generally recognized that modified release formulations contribute a substantial portion to the drug delivery systems market, where it holds around 30-40% of the share. In the broader pharmaceutical industry, this sector accounts for approximately 10-15%, driven by increasing demand for controlled and targeted drug delivery methods.

The generic drugs industry also relies heavily on modified release formulations, with a growing adoption in generic drug production to extend product lifecycle. In the biopharmaceuticals and contract manufacturing organization markets, the share is smaller but steadily increasing, given the increasing emphasis on specialized delivery methods in biologics and outsourced production.

Regulatory bodies such as the USA FDA and EMA have expanded guidance on in vitro-in vivo correlation (IVIVC) models and bioequivalence protocols, particularly for modified-release products. These frameworks are enabling drug developers to reduce R&D risks and accelerate time-to-market by allowing clinical study waivers based on predictive models.

Simultaneously, there is a rise in investments in polymer science and nanotechnology to enhance formulation stability and precision in drug release. Leading pharmaceutical companies are forming strategic partnerships with CDMOs to scale production and develop customized release profiles across therapeutic areas, supporting innovation in advanced drug delivery systems.

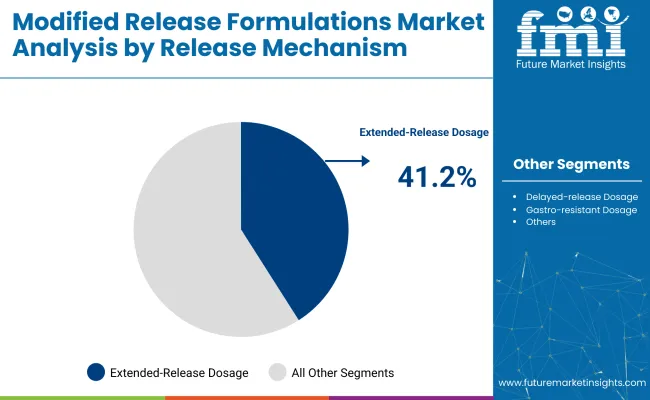

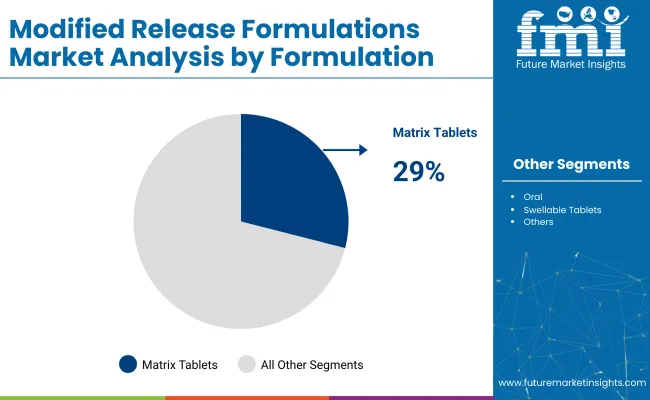

Extended-release dosage forms, matrix tablets, and pharmaceutical & biopharmaceutical companies are expected to dominate the modified release formulations industry by 2025, driven by innovation in drug delivery and patient compliance strategies.

Extended-release dosage forms are projected to lead the release mechanism segment with a 41.2% share in 2025.

Matrix tablets are expected to dominate the formulation segment with a 29.0% share in 2025, due to their effectiveness in delivering controlled-release drugs.

Pharmaceutical and biopharmaceutical companies are projected to lead the end-user segment with a 34.2% share in 2025, driven by the demand for lifecycle management of existing drugs and enhanced delivery platforms for new chemical entities (NCEs).

Advanced delivery systems and regulatory support are fueling modified release formulation growth. Smart polymers, controlled release technologies, and streamlined approvals are enhancing patient adherence, targeting chronic illnesses, and extending drug lifecycle value.

Technology Advancements Enabling Extended and Targeted Delivery

Regulatory & Market Pressures Favoring Patient-Centric Dosage Forms

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.5% |

| Germany | 4.2% |

| China | 8.1% |

| Japan | 3.9% |

| India | 10.7% |

India is expected to experience the highest growth rate in the Modified Release Formulations market, with a projected CAGR of 10.7%. This growth is driven by the expanding healthcare infrastructure, increasing healthcare access, and rising demand for advanced pharmaceutical solutions. China follows with an 8.1% CAGR, fueled by the increasing adoption of modern pharmaceutical technologies and the growth of the pharmaceutical sector.

In contrast, developed economies such as the United States (6.5%), Germany (4.2%), and Japan (3.9%) are expanding at steady but moderate rates. The United States remains a dominant player due to its advanced pharmaceutical industry and high demand for modified release medications. Germany focuses on innovation in drug delivery technologies, while Japan, with its aging population, continues to see steady demand for pharmaceutical advancements.

This report covers the in-depth analysis of 40+ Countries; Five top performing OECD countries highlighted below.

The United States holds a formidable position in the global modified release formulations industry with a projected CAGR of 6.5% between 2025 and 2035.

Modified release formulations industry in Germany is forecast to grow steadily at 4.2% CAGR over the 2025 to 2035 period. Known for its precision in pharmaceutical engineering and stringent regulatory oversight, Germany fosters the development of high-quality modified release drugs particularly within the cardiovascular and central nervous system segments.

China commands notable attention with a projected CAGR of 8.1% in the modified release formulations market between 2025 and 2035. This strong growth is propelled by the country’s expanding middle class, higher chronic disease burden, and upgraded national healthcare standards.

Modified release formulations market in Japan grows at a moderate pace of 3.9% CAGR, shaped by its aging population and highly tech-enabled pharmaceutical landscape.

India emerges as the fastest-growing industry in modified release formulations with a strong CAGR of 10.7% from 2025 to 2035.

The modified release formulations industry is moderately consolidated, with a blend of dominant, key, and emerging players shaping its landscape. Dominant players such as Catalent, Recipharm, and Quotient Sciences lead the industry through proprietary drug delivery technologies, strong regulatory support, and strategic alliances with major pharmaceutical companies. Key players like Adragos Pharma, BioDuro, and Adare Pharma Solutions specialize in tailored release mechanisms, lifecycle management, and therapeutic diversification.

The emerging players including Zocalo Pharmaceutical, Societal CDMO, Syngene International, and Mayne Pharma are gaining traction by offering agile, cost-effective solutions for modified-release generics, specialty drugs, and mid-sized pharma clients.

Recent Modified Release Formulations Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 282.1 billion |

| Projected Market Size (2035) | USD 524.7 billion |

| CAGR (2025 to 2035) | 6.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Release Mechanisms Analyzed (Segment 1) | Delayed-release Dosage, Gastro-resistant Dosage, Gastro-retention Dosage, Extended-release Dosage, Targeted-release Dosage, Pulsatile-release Dosage, Biphasic-release Dosage, Others |

| Formulations Analyzed (Segment 2) | Oral, Swellable Tablets, Enteric-coated Tablets, Matrix Tablets, Coated Tablets, Bilayer Tablets/Multi-Particulate Systems, Others |

| Therapeutic Areas Analyzed (Segment 3) | Chronic Pain, Gastroenterology, Cardiovascular, Diabetes, Others |

| End Users Analyzed (Segment 4) | Pharmaceutical & Biopharmaceutical Companies, Innovator Pharma Companies, Specialty Pharma Companies, Generics Manufacturers, Biopharma Companies, CDMOs, Academic & Research Institutes |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Saudi Arabia, UAE, South Africa |

| Key Players influencing the Modified Release Formulations Market | Catalent , Inc , Recipharm AB, Quotient Sciences, Adragos Pharma, BioDuro , Zocalo Pharmaceutical Ltd, Societal CDMO, Adare Pharma Solutions, Syngene International Limited, Mayne Pharma Group |

| Additional Attributes | Dollar sales, share by release platform and end user, extended-release industry dominance in chronic care, growing adoption in diabetes and cardiovascular drugs, CDMO innovation for multiparticulate systems, regulatory pathways for MR generics and branded drugs |

Delayed-release Dosage, Gastro-resistant Dosage, Gastro-retention Dosage, Extended-release Dosage, Targeted-release Dosage, Pulsatile-release Dosage, Biphasic-release Dosage, and Others.

Oral, Swellable Tablets, Enteric-coated Tablets, Matrix Tablets, Coated Tablets, Bilayer Tablets/Multi-Particulate Systems, and Others.

Chronic Pain, Gastroenterology, Cardiovascular, Diabetes, and Others.

Pharmaceutical & Biopharmaceutical Companies, Innovator Pharma Companies, Specialty Pharma Companies, Generics Manufacturers, Biopharma Companies, CDMOs, and Academic & Research Institutes.

North America, Latin America, Europe, Asia-Pacific, and Middle East & Africa.

The market is projected to reach USD 282.1 billion in 2025.

It is expected to grow to USD 524.7 billion by 2035.

The industry is anticipated to expand at a CAGR of 6.4% during the forecast period.

Extended-release dosage forms are dominant with a 41.2% share in 2025.

Catalent, Inc. is the industry leader with an 11% global market share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Modified Milk Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Modified Atmosphere Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Modified Bitumen Market Size and Share Forecast Outlook 2025 to 2035

Modified Soya Flour Market Size and Share Forecast Outlook 2025 to 2035

Modified Flour Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Modified Starch Market Analysis - Size, Share, and Forecast 2024 to 2034

Modified lecithin Market

DNA-Modified Plant Extracts Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Organo-Modified Bentonite Market Growth - Trends & Forecast 2025 to 2035

Polymer Modified Bitumen Market Forecast and Outlook 2025 to 2035

Polyether Modified Polysiloxane Market Analysis – Share, Size, and Forecast 2025 to 2035

Competitive Overview of Active and Modified Atmospheric Packaging Companies

Active & Modified Atmospheric Packaging Market Trends & Forecast 2024-2034

Genetically Modified Food Market Analysis by Type, Trait, and Region through 2035

Release Tapes Market Size and Share Forecast Outlook 2025 to 2035

Release Agent Market – Trends & Forecast 2025 to 2035

Release Liner Recycling Market

PET Release Liner Market

Heat Release Tester Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Smart-Release Moisture-Boosting Technology Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA