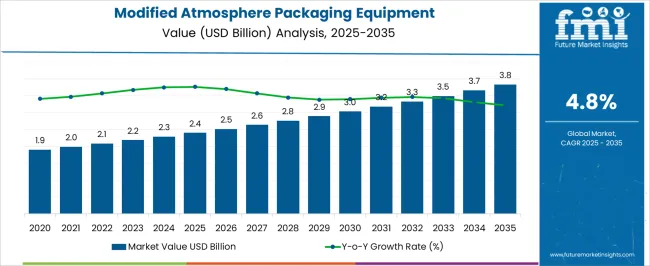

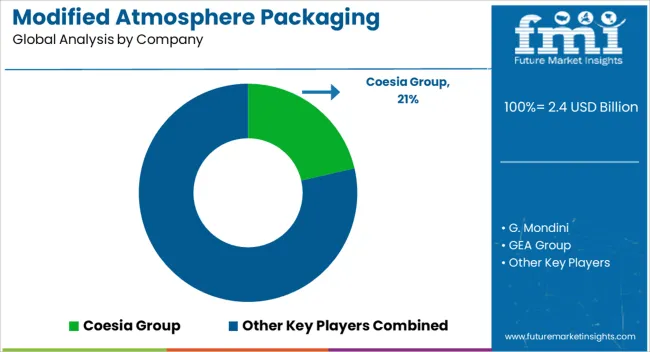

The Modified Atmosphere Packaging Equipment Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 3.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Modified Atmosphere Packaging Equipment Market Estimated Value in (2025E) | USD 2.4 billion |

| Modified Atmosphere Packaging Equipment Market Forecast Value in (2035F) | USD 3.8 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

With increasing consumer demand for minimally processed yet long-lasting fresh food products, manufacturers are turning to advanced packaging technologies that preserve taste, texture, and nutritional value without synthetic additives. Regulatory pressure around food labeling accuracy, spoilage prevention, and sustainability is also driving the adoption of modern MAP equipment. Technological advancements in precision gas flushing, integration with smart sensors, and automation are enhancing production efficiency and consistency.

The market outlook remains optimistic as more companies invest in equipment that enables cleaner labels, waste reduction, and extended distribution capabilities across perishable product categories such as fresh produce, meats, and bakery items.

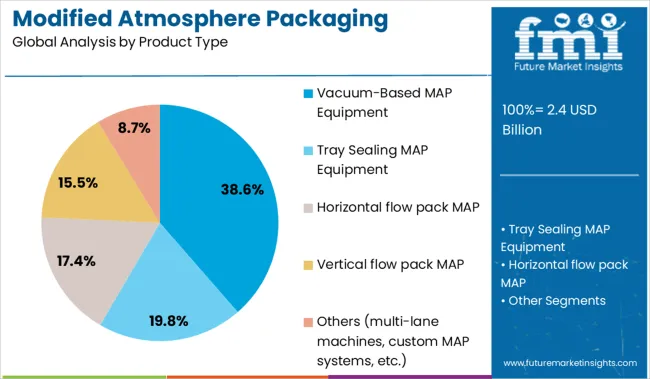

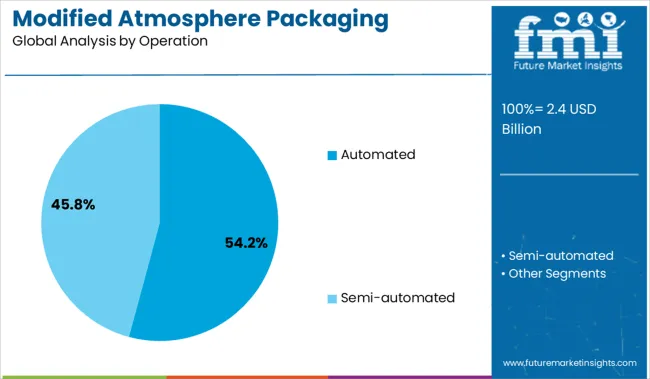

The market is segmented by Product Type, Operation, Packaging Type, End Use Application, Distribution Channel, and region. By Product Type, the market is divided into Vacuum-Based MAP Equipment, Tray Sealing MAP Equipment, Horizontal flow pack MAP, Vertical flow pack MAP, and Others (multi-lane machines, custom MAP systems, etc.). In terms of Operation, the market is classified into Automated and Semi-automated.

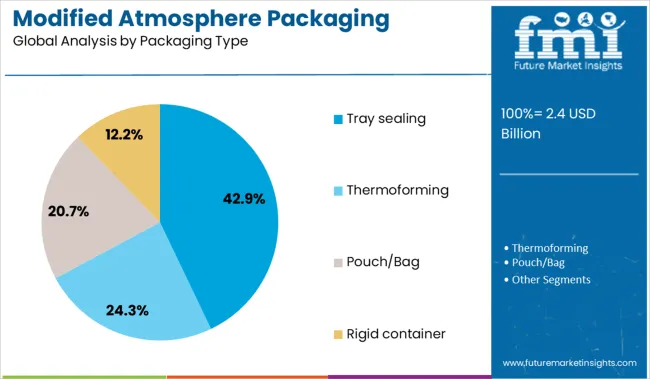

Based on Packaging Type, the market is segmented into Tray sealing, Thermoforming, Pouch/Bag, and Rigid container. By End Use Application, the market is divided into Meat, poultry, and seafood, Bakery & confectionery, Fresh produce (fruits and vegetables), Dairy products, Ready-to-Eat (RTE) meals, and Others. By Distribution Channel, the market is segmented into Direct and Indirect. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The vacuum based MAP equipment segment is projected to represent 38.60% of market revenue by 2025 within the product type category. This segment’s growth is being supported by its superior ability to remove residual oxygen from packaging, effectively slowing microbial activity and oxidation in perishable food products.

The technology is highly suited for high risk products such as meat, seafood, and dairy where safety and appearance are critical to consumer acceptance. Its operational simplicity, energy efficiency, and compatibility with a wide range of film materials are further enhancing market penetration.

Manufacturers have favored vacuum based systems for their reliability and proven performance in extending shelf life and improving product presentation across retail channels.

Automated MAP equipment is anticipated to contribute 54.20% of total market revenue by 2025 under the operation category, marking it as the leading segment. The preference for automation stems from its ability to reduce labor costs, ensure consistent packaging quality, and increase production speed.

Automation supports hygienic operation, minimizes human error, and enables seamless integration with conveyor and inspection systems, which are essential for modern food processing facilities. Moreover, automated systems facilitate compliance with stringent food safety standards and traceability requirements.

As producers aim to meet rising demand while maintaining efficiency and safety, the shift toward automated MAP solutions continues to gain traction across the industry.

Tray sealing is expected to account for 42.90% of the market by 2025 within the packaging type category, making it the dominant format. This method provides secure containment of food products while maintaining visual appeal and freshness.

Tray sealing is especially effective for fresh cut fruits, vegetables, ready to eat meals, and protein products due to its excellent sealing integrity and compatibility with modified atmosphere conditions. The format supports efficient portioning and branding while allowing for convenient stacking and storage.

With increasing demand for convenience foods and premium fresh offerings, tray sealing has established itself as the most preferred packaging type in the MAP equipment landscape.

The MAP equipment market reached a valuation of approximately USD 2.2 billion in 2024 and is projected to approach USD 3.5 billion by 2034. Equipment sales are driven by demand across processed meat, dairy, fresh produce, and ready-to-eat food segments. Food applications account for nearly 60% of equipment installations, with pharmaceuticals and electronics forming the remainder. Asia-Pacific leads in unit deployments, followed by North America and Western Europe. Market expansion is tied to packaging line automation and extended cold-chain coverage, especially in tier-2 cities. Machine formats include tray sealers, thermoformers, and inline gas flushing systems with integrated leak detectio

MAP adoption is scaling across food processing hubs due to the need for longer product shelf life, reduced food returns, and lower distribution losses. Retailers have reported a 14–18% increase in shelf turnover for vacuum-sealed meat and pre-cut produce, while spoilage claims have declined by 9–11% on average. Manufacturers are switching to high-throughput tray sealers with programmable gas injection, where oxygen levels are dropped below 1% and replaced with gas blends tailored to the product. CO₂ levels between 25–45% are now standard for perishables. In production lines where MAP is fully integrated with cold storage, net waste from unsold packs has declined by up to 30%, creating clear incentives for plant-level investment.

Initial acquisition costs remain a barrier, with tray sealers and inline gas mixers priced between USD 80,000 and USD 450,000 per unit. For smaller processors, return on investment exceeds 36 months. Inconsistent power supply and lack of skilled technicians in emerging regions disrupt sensor calibration and compromise seal integrity. Field data shows that 31–43% of operators in smaller plants fail to meet gas accuracy tolerances within ±2%, leading to higher oxygen ingress and shortened shelf life. Cold chain infrastructure often lags, with last-mile distribution unable to maintain target temperatures, rendering MAP less effective. Regulatory misalignment across trade zones delays machine approvals, adding another layer of complexity to procurement cycles.

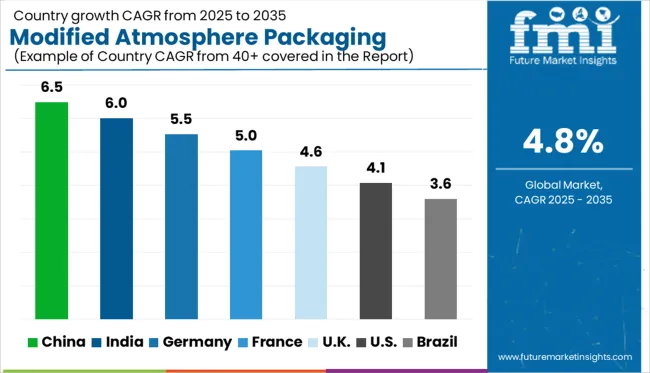

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

The global modified atmosphere packaging (MAP) equipment market is projected to grow at a CAGR of 4.8% from 2025 to 2035. China (BRICS) leads with a CAGR of 6.5%, exceeding the global average by 1.7 percentage points, driven by rising demand for extended shelf-life packaging in food exports. India (BRICS) follows at 6.0% (+1.2 pp), reflecting growth in processed food manufacturing and retail packaging innovation. Among OECD nations, Germany posts 5.5% (+0.7 pp), backed by automation investments and compliance with EU packaging standards. France reports 5.0% (+0.2 pp), in line with sustainability goals and food safety regulations. The UK records 4.6%, just 0.2 pp below the global average, indicating modest uptake amid cost considerations and regulatory adjustments post-Brexit. The report features insights from 40+ countries, with the top five shown below.

China reports a 6.5% growth rate in the modified atmosphere packaging equipment market, above the global average of 4.8%. Equipment adoption is driven by large-scale production shifts in chilled meats, dairy exports, and convenience meals. Equipment suppliers are expanding integration with nitrogen and CO₂ flow regulators for automated line calibration. MAP units are being installed in medium-tier processing facilities across second-tier cities. Regulatory adjustments in food shelf-life labeling have led to machine upgrades with precision gas ratio controls. Growth is expected to be supported by regional consolidation of cold chain networks across provincial trading zones.

India records a 6.0% growth rate in MAP equipment, outpacing the global average of 4.8%. Demand is tied to cold storage development in poultry, processed grains, and regional snack categories. Equipment deployment has expanded across Tier 2 and Tier 3 cities with rising capacity in automated food handling units. Domestic manufacturers are offering low-power MAP units tailored to small-volume operators. Food safety boards have revised packaging mandates on modified gas levels in export-bound SKUs. Growth is expected in perishable goods supply chains serving rail-linked freight corridors.

Germany reports a 5.5% growth rate in MAP equipment, above the global average of 4.8%. Expansion is seen in prepared meals, deli meat packaging, and premium bakery formats. Engineering focus is placed on sensor-integrated gas mix verification and automated tray sealing. Equipment buyers are replacing legacy platforms with modular components linked to clean-room protocols. Technical audits have identified packaging loss reduction through improved inert gas distribution. Market growth aligns with tighter safety compliance targets for retailers and large-scale food distributors.

France shows a 5.0% growth rate in modified atmosphere packaging equipment, above the global rate of 4.8%. Deployment is centered around ready-to-eat salads, processed cheese, and gourmet seafood packaging units. System upgrades are focused on replacing rotary platforms with inline sealers fitted for tray depth adjustment. MAP use has increased in regional cooperatives that specialize in short-shelf-life artisan products. Gas supply firms have collaborated with equipment vendors on optimizing gas mix storage for small operators. Trade bodies have recorded better compliance scores in factory assessments tied to packaging safety.

United Kingdom reports a 4.6% growth rate in modified atmosphere packaging equipment, just under the global average of 4.8%. Growth is linked to automation in poultry and seafood processing units operating near key export docks. Equipment vendors are reengineering gas sensor feedback loops to meet audit frequency requirements. Packaging standards introduced by regional wholesalers have led to MAP upgrades in frozen meal and pre-cooked entrée lines. Platform suppliers have started offering retrofits for older chamber machines in small-volume facilities. Food processors are adopting mobile MAP tools for testing package integrity on distribution lines.

Coesia Group holds a significant share of the modified atmosphere packaging (MAP) equipment market, offering high-speed systems tailored for food and pharmaceutical products. G. Mondini and MULTIVAC Group provide tray sealing and vacuum solutions compatible with varied product types and gas mixtures. GEA Group and Ilapak develop packaging lines aimed at extending shelf life for perishables, while Henkelman and Webomatic focus on vacuum technology suited for medium-volume operations. ULMA Packaging, Ishida, and Reepack contribute through modular machines adaptable to changing production needs. Proseal and ORICS Industries supply custom sealing systems used across the protein and produce sectors. High machinery cost, integration complexity, and strict packaging safety standards limit access for small-scale manufacturers without specialized engineering capabilities.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 Billion |

| Product Type | Vacuum-Based MAP Equipment, Tray Sealing MAP Equipment, Horizontal flow pack MAP, Vertical flow pack MAP, and Others (multi-lane machines, custom MAP systems, etc.) |

| Operation | Automated and Semi-automated |

| Packaging Type | Tray sealing, Thermoforming, Pouch/Bag, and Rigid container |

| End Use Application | Meat, poultry, and seafood, Bakery & confectionery, Fresh produce (fruits and vegetables), Dairy products, Ready-to-Eat (RTE) meals, and Others |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Coesia Group, G. Mondini, GEA Group, Henkelman, Ilapak, Ishida, MULTIVAC Group, ORICS Industries, PFM Group, Proseal, Reepack, Robert Reiser, Ross Industries, ULMA Packaging, and Webomatic |

| Additional Attributes | Dollar sales by equipment type and packaging format, growing demand in fresh produce and meat processing, stable usage in bakery and dairy segments, advancements in gas flushing systems and seal integrity technologies enhance shelf life extension and food safety compliance |

The global modified atmosphere packaging equipment market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the modified atmosphere packaging equipment market is projected to reach USD 3.8 billion by 2035.

The modified atmosphere packaging equipment market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in modified atmosphere packaging equipment market are vacuum-based map equipment, tray sealing map equipment, horizontal flow pack map, vertical flow pack map and others (multi-lane machines, custom map systems, etc.).

In terms of operation, automated segment to command 54.2% share in the modified atmosphere packaging equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Modified Milk Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Modified Bitumen Market Size and Share Forecast Outlook 2025 to 2035

Modified Soya Flour Market Size and Share Forecast Outlook 2025 to 2035

Modified Flour Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Modified Release Formulations Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Modified Starch Market Analysis - Size, Share, and Forecast 2024 to 2034

Modified lecithin Market

DNA-Modified Plant Extracts Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Organo-Modified Bentonite Market Growth - Trends & Forecast 2025 to 2035

Polymer Modified Bitumen Market Forecast and Outlook 2025 to 2035

Polyether Modified Polysiloxane Market Analysis – Share, Size, and Forecast 2025 to 2035

Competitive Overview of Active and Modified Atmospheric Packaging Companies

Active & Modified Atmospheric Packaging Market Trends & Forecast 2024-2034

Genetically Modified Food Market Analysis by Type, Trait, and Region through 2035

Atmosphere Roller Furnace Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA