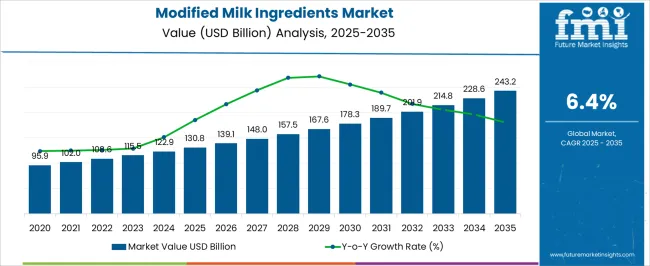

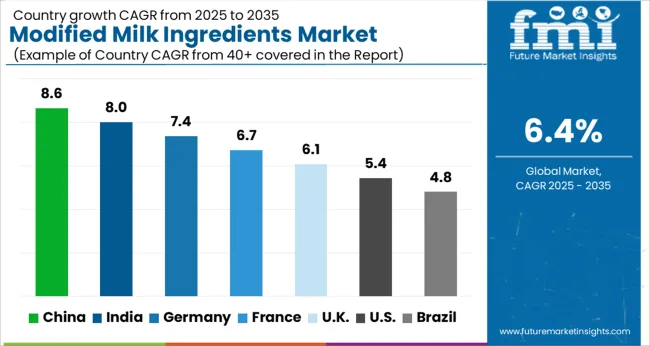

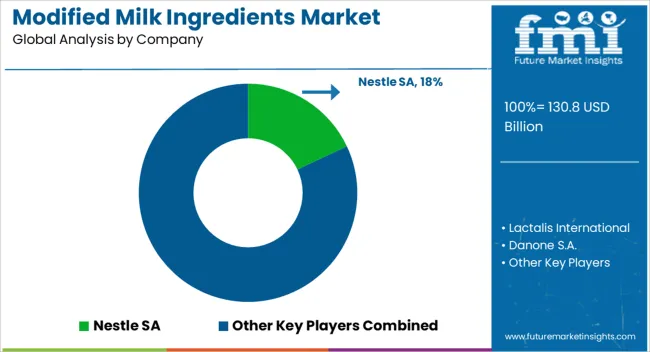

The Modified Milk Ingredients Market is estimated to be valued at USD 130.8 billion in 2025 and is projected to reach USD 243.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

| Metric | Value |

|---|---|

| Modified Milk Ingredients Market Estimated Value in (2025 E) | USD 130.8 billion |

| Modified Milk Ingredients Market Forecast Value in (2035 F) | USD 243.2 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The modified milk ingredients market is expanding steadily, fueled by rising demand for high-performance dairy derivatives in processed foods, infant nutrition, and functional beverage sectors. Regulatory clarity around labeling standards and country-of-origin declarations is improving product transparency, fostering greater consumer confidence in ingredient sourcing.

Dairy processors are increasingly investing in specialized extraction, drying, and filtration technologies to isolate milk components tailored to precise industrial applications. Food manufacturers are leveraging these ingredients to enhance texture, extend shelf life, and improve nutritional density across a wide range of products.

Additionally, the market is being supported by trade agreements that streamline cross-border movement of modified milk ingredients, especially in regions with robust dairy surpluses. As global health trends push for clean-label and protein-rich formulations, sustained innovation in dairy fractionation and value-added processing is expected to open new avenues for growth.

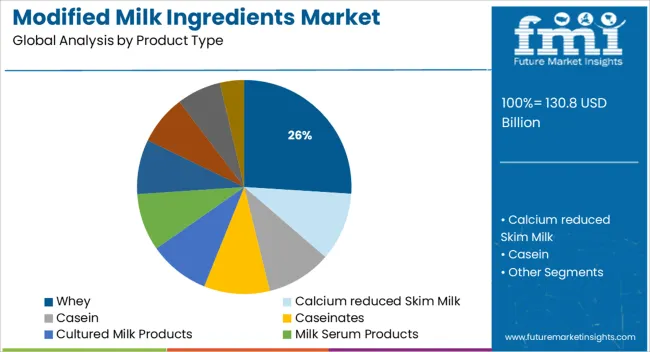

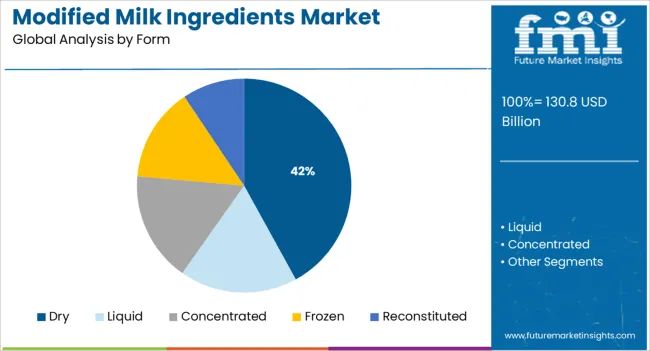

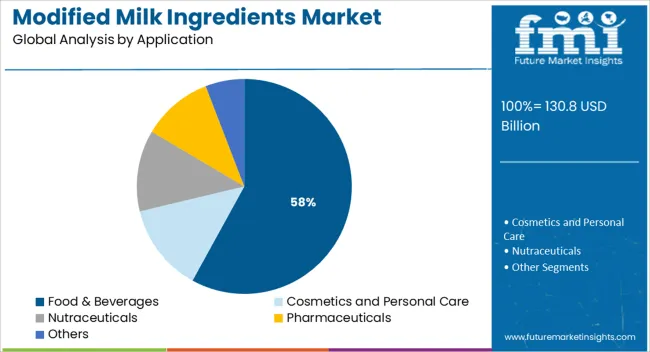

The market is segmented by Product Type, Form, Application, and Distribution Channel and region. By Product Type, the market is divided into Whey, Calcium reduced Skim Milk, Casein, Caseinates, Cultured Milk Products, Milk Serum Products, Ultra-filtered Milk, Whey Butter, Whey Cream, and Others. In terms of Form, the market is classified into Dry, Liquid, Concentrated, Frozen, and Reconstituted. Based on Application, the market is segmented into Food & Beverages, Cosmetics and Personal Care, Nutraceuticals, Pharmaceuticals, and Others. By Distribution Channel, the market is divided into B2B and B2C. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Whey is projected to hold 26.0% of the total revenue in the modified milk ingredients market by 2025, making it the leading product type. Its dominance is being supported by the broad nutritional profile and functional versatility it offers in both food and nutritional applications.

High protein content, ease of digestibility, and bioactive compound presence have positioned whey as a preferred base for sports nutrition, infant formulas, and bakery products. Whey’s compatibility with advanced processing technologies like ultrafiltration and microfiltration has allowed producers to create differentiated isolates and concentrates with minimal fat and lactose content.

Furthermore, the ingredient’s ability to support clean-label formulations and its status as a sustainable co-product of cheese production have reinforced its value proposition in an environmentally conscious marketplace.

The dry form segment is expected to contribute 42.0% of the modified milk ingredients market revenue in 2025, establishing it as the leading format. This segment’s growth has been reinforced by logistical advantages such as extended shelf life, reduced storage costs, and ease of transportation.

Dry formulations also enable more consistent incorporation in large-scale food production due to improved dosing accuracy and longer usability. The growing adoption of powdered formats in R&D labs and food manufacturing facilities has led to wider acceptance of dry ingredients across infant nutrition, bakery, and ready-to-drink applications.

Additionally, improvements in spray drying and agglomeration technologies have enhanced solubility and dispersibility, making dry ingredients more adaptable in both hot and cold formulations.

The food & beverages sector is expected to account for 58.0% of the total modified milk ingredients market revenue by 2025, positioning it as the dominant application segment. This leadership is being driven by increasing utilization of milk derivatives in enhancing nutritional profiles, emulsification, and water-binding capacity in processed food items.

The growing demand for protein-rich snacks, fortified beverages, and dairy-alternative formulations has accelerated the use of functional milk-based inputs. Product reformulation trends aimed at reducing sugar and fat content without compromising taste or mouthfeel have also contributed to increased inclusion of modified milk ingredients.

Moreover, rising consumption of packaged foods in urban markets and health-conscious preferences among consumers continue to fuel consistent uptake across the global food and beverage industry.

Developments in flavour:

High consumer demand for modified milk ingredients with minimal ingredients and a clean flavour has created a clean label niche in the dairy industry. The modified milk ingredients market has recently seen several technological advancements to improve dairy products' feel and flavour.

One such flavouring option is Dairy by Nature, created by Synergy Flavors Inc of the USA to meet the requirements of dairy and plant-based products. The product promises to be able to cover up unpleasant flavours in plant-based alternatives and restore the full-fat dairy's smoothness without compromising on taste.

Synergy claims to have developed technically layered components for taste and better functioning by fusing flavour science with cutting-edge dairy fermentation knowledge. Synergy has created cutting-edge solutions that improve quality, mouthfeel, and flavour retention instead of common flavourings that add a single top note, like caramelized butter or condensed milk solids.

It can be used for anything from fresh and cultured dairy products to nutritional, bread, beverage, confection items, and even savoury uses like dips and cheese. The 'Dairy by Nature' technology is a major step forward for the dairy and dairy-alternative industries since it allows for a more authentic, all-natural dairy experience.

Artificial dairy:

All around the world, cow's milk is a key ingredient in various products. Seventy per cent of Canada's sold milk is used in industrial processes. Most consumers (52%) choose dairy milk solids, whereas 48% prefer plant-based milk (IPSOS).

Plant-based milk alternatives have seen their share of innovation in the market over the years, with soy, pea, oat, almond, and rice milk solids stealing the spotlight. What if, however, researchers succeeded in cultivating a lactose-free, vegan, cow's-milk substitute that did not require the use of cows?

Genetically modified microflora that can generate whey and casein, the proteins found in cow's milk, has been produced by Perfect Day Inc., a firm based in California. The company asserts that lab-grown dairy has the same nutritional value as regular dairy protein. Many customers may wish to cut back on dairy products but still appreciate the flavour of cow's milk. Therefore this innovation could have a major impact on the modified milk ingredients market.

The evolving taste of the general public is the primary factor propelling the modified milk ingredients market. Modified milk ingredients are mostly used to alter the flavour of dairy products, including cheese, butter, and cream. Other than that, enzyme-modified dairy products provide flavour to the foods.

Enzyme-modified dairy products are expanding in popularity because of the industry's increasing experimentation with flavours and textures. The modified milk ingredients market is an integral part of the expanding food and beverage sector driven by innovation.

Modified dairy products are also relevant to the rising popularity of flavoured beverages. One of the most common flavourings in beverages is a dairy flavour. The enzyme process alters the flavour and texture of the dairy ingredients. Beverage companies now have a better chance to sell drinks with various flavours.

Regarding market share and projected growth rate, developed regions such as North America and Europe lead the pack in the global modified milk ingredients market. Market players can anticipate growth in these regions due to the rising demand for infant foods containing modified milk ingredients and sports nutrition products made with these ingredients.

Owing to rising milk solids production and increased exports of modified milk ingredients to Southeast Asian countries, Oceania is the third fastest-growing area in the world. Foreign direct investments in low-cost manufacturing facilities have led to new modified milk ingredient market players in the Latin American region.

In 2024, the modified milk ingredients market was dominated by Asia-Pacific, while the Middle East and Africa were projected to develop at the quickest CAGR during the forecast period. Dairy products are a major export for India. India produces 22 percent of the world's milk, according to the Food and Agriculture Organization (FAO). One of the main forces for the expansion of the modified milk ingredients market is the existence of a thriving dairy industry.

Several reasons are contributing to the expansion of the modified milk ingredients market in Asia and the Pacific. One of the most important is the rising demand for functional foods and drinks and protein supplements due to the increased attention paid to health.

To meet the needs of its customers and expand its customer base, companies in the modified milk ingredients market are constantly releasing new varieties of ingredients. In addition, businesses are concentrating on penetrating untapped markets by establishing a wider distribution system.

The future of the modified milk ingredients market is anticipated to be shaped by the key developments of new firms.

Some key players in modified milk ingredients are Nestle SA, Lactalis International, Danone S.A., Fonterra Co-operative Group, FrieslandCampina, Arla Foods, Dean Foods, Yili Group, and China Mengniu Dairy Co., Ltd.

| Report Attribute | Details |

|---|---|

| Growth Rate | 6.4% |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Product Type, Form, Application, Sales Channel, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC Countries, South Africa |

| Key Companies Profiled | Nestle SA, Lactalis International, Danone, S.A., Fonterra Co-operative Group, FrieslandCampina, Arla Foods, Dean, Foods, Yili Group, China Mengniu Dairy Co., Ltd |

| Customization | Available Upon Request |

The global modified milk ingredients market is estimated to be valued at USD 130.8 billion in 2025.

The market size for the modified milk ingredients market is projected to reach USD 243.2 billion by 2035.

The modified milk ingredients market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in modified milk ingredients market are whey, calcium reduced skim milk, casein, caseinates, cultured milk products, milk serum products, ultra-filtered milk, whey butter, whey cream and others.

In terms of form, dry segment to command 42.0% share in the modified milk ingredients market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Modified Atmosphere Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Modified Bitumen Market Size and Share Forecast Outlook 2025 to 2035

Modified Soya Flour Market Size and Share Forecast Outlook 2025 to 2035

Modified Flour Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Modified Release Formulations Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Modified Starch Market Analysis - Size, Share, and Forecast 2024 to 2034

Modified lecithin Market

DNA-Modified Plant Extracts Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Organo-Modified Bentonite Market Growth - Trends & Forecast 2025 to 2035

Polymer Modified Bitumen Market Forecast and Outlook 2025 to 2035

Polyether Modified Polysiloxane Market Analysis – Share, Size, and Forecast 2025 to 2035

Competitive Overview of Active and Modified Atmospheric Packaging Companies

Active & Modified Atmospheric Packaging Market Trends & Forecast 2024-2034

Genetically Modified Food Market Analysis by Type, Trait, and Region through 2035

Milk Carton Market Size and Share Forecast Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

Milking Robots Market Size and Share Forecast Outlook 2025 to 2035

Milk Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Clarifier Market Size and Share Forecast Outlook 2025 to 2035

Milk Homogenizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA