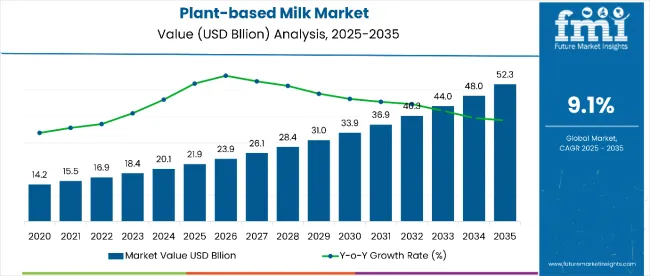

Global demand for plant-based milk is projected to climb from USD 21.9 billion in 2025 to USD 52.3 billion by 2035, a 9.1% CAGR. Growth is anchored in shifting dietary norms, heightened lactose intolerance diagnoses, and climate-conscious purchasing. A 2024 critical review in Journal of Cleaner Production found plant milks use 79% less land and emit 67% less CO₂-eq than dairy, reinforcing their environmental appeal as per ScienceDirect.

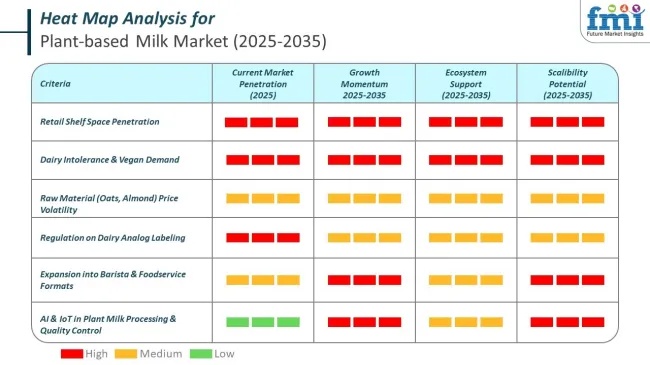

Recent Oxford work highlights impact trade-offs-almond’s high water draw, oat’s processing intensity-pushing brands to publish farm-level life-cycle data and diversify raw-material portfolios as per The Times. Product innovation keeps momentum high. R&D pipelines now favour protein-fortified pea, faba-bean, and precision-fermented oat bases that close amino-acid gaps while delivering “barista” functionality for foodservice. Fortification with calcium, vitamin D, and B-complex micronutrients is standard, addressing nutritional parity concerns raised in a 2025 International Journal of Food Sciences meta-analysis.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025E) | USD 21.9 Billion |

| Projected Industry Value (2035F) | USD 52.3 billion |

| Value-based CAGR (2025 to 2035) | 9.1% |

Shelf-stable, aseptically packed SKUs are also rising, propelled by e-commerce growth and lower cold-chain costs. Leading co-packers report a double-digit uptick in requests for recyclable multilayer cartons and mono-PP pouches as regulations tighten on extended-producer responsibility. Regional dynamics vary. North America remains value leader thanks to mature retail penetration and aggressive dairy-alternatives positioning by Danone, Califia Farms, and SunOpta.

Europe benefits from stringent animal-welfare and carbon targets, yet the strongest volume lifts are forecast in Asia-Pacific, where China’s Generation Z consumers-and India’s lactose-intolerant majority-push adoption toward double-digit CAGR territory. Multinationals have reacted: Nestlé enlarged its Tianjin plant for pea-and-oat beverages in 2024, while Tata Consumer Products launched millet-based milks aimed at Indian breakfast occasions.

Industry sentiment reflects durable stickiness. Commenting on quarterly results, Oatly CEO Toni Petersson said, “Plant-based is very sticky. This is not about demand-it’s about how fast you can recruit new consumers.” As per Just Food. His assessment mirrors wider investor confidence-capital inflows into alt-dairy start-ups topped USD 600 million in 2024, fuelling capacity expansions and sensory-enhancement research.

With environmental credentials, continuous formulation advances, and supportive regulation converging, plant-based milk is set to entrench itself as a mainstream dairy alternative, more than doubling in value and reshaping global beverage shelves through 2035.

The plant-based milk market reflects significant variation in per-capita consumption. Sweden and the Netherlands show the highest volumes per household, mostly through oat and almond blends. In South Korea, intake has expanded across urban foodservice locations. USA consumers regularly purchase single-serve packs, with per-person usage strongest in Los Angeles, Austin, and Seattle. In India, household consumption remains focused on soy- and rice-based variants offered through regional co-ops and e-commerce.

The plant-based milk market uses dual-mode cold chain and ambient storage. Ready-to-drink formats require refrigerated transport. UHT variants are moved through shelf-stable systems. In France and Malaysia, supermarket chains operate regional chillers. Middle-income regions rely on ambient warehousing tied to institutional sales.

Soy milk holds the dominant position with 38.0% of the market share in the product type category within the plant-based milk market. This leadership is driven by soy milk's exceptional nutritional profile, including protein content comparable to dairy milk and fortified vitamins and minerals that strengthen consumer preference.

Soy milk's well-established presence, backed by decades of market familiarity and consumer trust, continues to fuel its prominence in both developed and emerging markets globally.

The segment's dominance is reinforced by soy milk's allergen-free nature and widespread consumer acceptance, particularly among individuals with lactose intolerance or dairy and nut allergies. The versatility of soy milk in both culinary and beverage applications enhances its appeal, while retail chains worldwide consistently stock diverse soy-based products, facilitating broad market accessibility.

Major players such as Silk, So Good, and Alpro continue significant investment in expanding soy milk product lines and distribution networks, further supporting its leading market position through regulatory endorsements from health organizations highlighting soy milk's benefits.

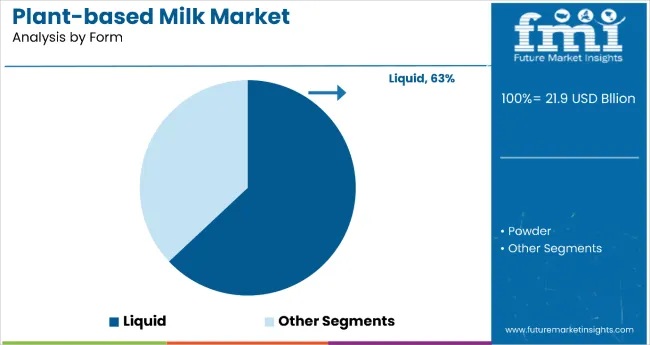

Liquid plant-based milk dominates the market with 63.0% of the market share in the form category. This dominance is attributed primarily to convenience, widespread consumer acceptance, and ease of integration into daily diets.

Liquid plant-based milk, unlike powdered forms, requires no preparation, making it immediately suitable for consumption or direct addition to beverages, cereals, and culinary applications.

The segment's dominance is reinforced by consumers' increasing preference for ready-to-use, convenient nutritional solutions compatible with busy lifestyles. Liquid products benefit from better availability and visibility in retail outlets, supermarkets, and convenience stores, making them more accessible to everyday consumers.

Major brands such as Silk, Oatly, and Alpro focus predominantly on liquid offerings, contributing to their extensive market penetration. Enhanced packaging solutions, including tetra packs and recyclable bottles, further support growth by improving shelf life and sustainability, ensuring the liquid form maintains consumer loyalty throughout the forecast period.

Demand for Vegan Diet is Driving the Market Growth

Consumers are increasingly concerned about sustainability and reducing their intake of animal-based foods moral and health-related reasons. Customers in the modern era are aware of meat alternatives and believe they are secure. advantageous to the ecosystem. Plant-based milk products are expected to grow as a result of this awareness.

Additionally, consumers are becoming more health conscious favoring dairy substitutes and traveling. Plant-based options have become increasingly important in the food industry due to changes in dietary patterns. Consequently customers. Consumers are shifting their purchasing habits away from milk and manufacturers of plant-based products are starting to follow suit.

Lactose Intolerance is Driving the Market Growth

Due to the growing prevalence of lactose intolerance consumers are looking for dairy milk substitutes. Moreover,the global populations growing prevalence of digestive disorders is opening the door for a number of milk products replacements Almond milk coconut milk and oat milk are excellent substitutes for animal milk because of these differences as well. include fiber protein vitamins and other nutrients. In response to the increasing demand for lactose-free milk producers are offering a variety of plant-based milk types. Plant-based milk product sales are expected to be driven by beverages.

During the period 2020 to 2024, the sales grew at a CAGR of 8.6%, and it is predicted to continue to grow at a CAGR of 9.1% during the forecast period of 2025 to 2035.

Some of the factors propelling the global market for plant-based milk are consumers growing health consciousness and the continued popularity of plant-based and non-dairy beverages. Due to increased calorie concerns lactose intolerance and the high prevalence of hypercholesterolemia among consumers plant-based milk is also seen as the ideal milk substitute for dairy beverages. Plant-based milk is a growing market within the functional beverage category.

Additionally, consumers are choosing cow milk substitutes due to the increased popularity of vegan diets. In an effort to draw consumers food and beverage producers are also developing fresh and inventive products using plant-based ingredients. East Asia is the region with the highest demand for plant-based milk followed by Europe. Because both areas have established production facilities and a well-organized logistics and supply chain system demand is anticipated to increase in both.

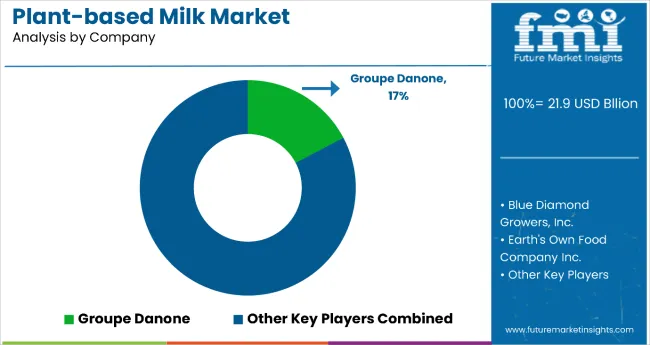

Tier 1 companies comprises industry leaders acquiring a 70% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base. They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 20%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies comprises mostly of small-scale businesses serving niche economies and serving at the local presence having a market share of 10%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope. As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

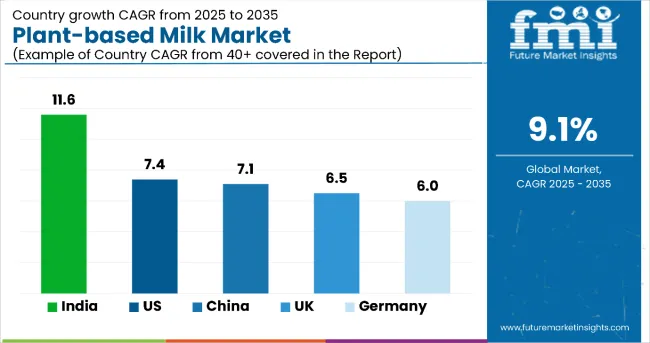

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, Germany and India come under the exhibit of high consumption, recording CAGRs of 7.4%, 6.0% and 11.6%, respectively, through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| United States | 7.4% |

| Germany | 6.0% |

| India | 11.6% |

According to studies from 2025 to 2035 the USA market for plant-based milk held a 28% share. As health consciousness grows there has been a notable increase in demand for plant-based milk substitutes in the United States. The United States Agriculture Departments predictions that govern consumer dietary preferences are inferred from the United States Trends in Eating and Nutrition Declarations.

A widespread focus on healthy eating habits and growing lactose intolerance are the main causes of the significant demand for plant-based milk. The main non-dairy drinks are made from hemp oats coconut soy and almonds. Because of the increased demand all plant-based milk alternatives are widely available. The market for plant-based milk is expanding which benefits the food and beverage industry in the US due to rising health consciousness and demand for lactose-free options.

From 2025 to 2035 the Indian market for plant-based milk will account for 11.6% of the global market. People in India are becoming more conscious of their health preferences which is driving up demand for these products. Adoption of plant-based beverages increased as a result of improved products on the market and an increase in disposable income.

Since more homes are promoting healthy feeding practices there is a growing demand in India for vegan milk free of artificial flavoring and stabilizers. In addition to being healthier than traditional dairy milk plant-based beverages have a high nutritional content that includes important vitamins and minerals.

As millennials in Germany grow more conscious of environmental and health issues the market for plant-based milk is growing. The plant-based milk market has a lot of potential with options ranging from coconut and oat milk to soy and almond milk. As more people become vegans or search for healthier options without compromising flavor many plant-based beverages have become commonplace fixtures in contemporary homes.

Globally the market for plant-based milk is fragmented with major vendors gaining a sizeable portion of the market. To remain stable in the market the major plant-based milk suppliers regularly employ a variety of growth techniques.

The major vegan milk suppliers use a variety of growth strategies such as product launches innovations mergers and acquisitions alliances and research and development to stay afloat in the very competitive market. The main producers of plant-based milk are concentrating on research and development in order to offer cost-effective and effective solutions for various industries.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 21.9 billion |

| Projected Market Size (2035) | USD 52.3 billion |

| CAGR (2025 to 2035) | 9.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion; Million liters for volume |

| Product Types Analyzed (Segment 1) | Soy Milk, Almond Milk, Oat Milk, Coconut Milk, Rice Milk, Others |

| Form Analyzed (Segment 2) | Liquid, Powder |

| Distribution Channels Analyzed (Segment 3) | Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Others |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, South Africa |

| Key Players Influencing the Plant-Based Milk Market | Danone S.A.; The Hain Celestial Group, Inc.; Blue Diamond Growers; Califia Farms, LLC; Ripple Foods; Oatly AB; Elmhurst Milked Direct, LLC; SunOpta Inc.; Earth’s Own Food Company Inc.; Nestlé S.A. |

| Additional Attributes | Market segmentation by product type, form, and distribution channel; analysis of consumer preferences for plant-based alternatives; regulatory landscape overview; impact of technological advancements on market growth; regional market trends and growth opportunities |

| Customization and Pricing | Customization and Pricing Available on Request |

By form, methods industry has been categorized into powder and liquid

By product type, industry has been categorized into Almond Milk, Soy Milk, Oat Milk, Coconut Milk, Rice Milk and Cashew Milk

Industry analysis has been carried out in key countries of North America; Europe, Middle East, Africa, ASEAN, South Asia, Asia, New Zealand and Australia

The market is expected to grow at a CAGR of 9.1% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 52.4 billion.

Demand for vegan food is increasing demand for Powder Induction and Dispersion Systems.

North America is expected to dominate the global consumption.

Some of the key players in manufacturing include Alpina Foods, Döhler GmbH, Elden Foods Inc. and more.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Milk Froth Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Milk Carton Market Size and Share Forecast Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

Milking Robots Market Size and Share Forecast Outlook 2025 to 2035

Milk Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Clarifier Market Size and Share Forecast Outlook 2025 to 2035

Milk Homogenizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Milk Pasteurization Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Sterilizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Protein Market - Size, Share, and Forecast 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Milk Mineral Concentrate Market Trends-Demand, Innovations & Forecast 2025 to 2035

Milk Thistle Market Analysis by Form, Distribution Channel and Region through 2035

Milk Powder Market Analysis by Type, Distribution Channel, Region and Other Applications Through 2035

Milk Tank Cooling System Market Growth – Trends & Forecast 2025 to 2035

Milk Alternatives Market – Growth, Demand & Dairy-Free Trends

Milk Protein Hydrolysate Market Growth - Infant Nutrition & Functional Use 2024 to 2034

Milking Equipment Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA