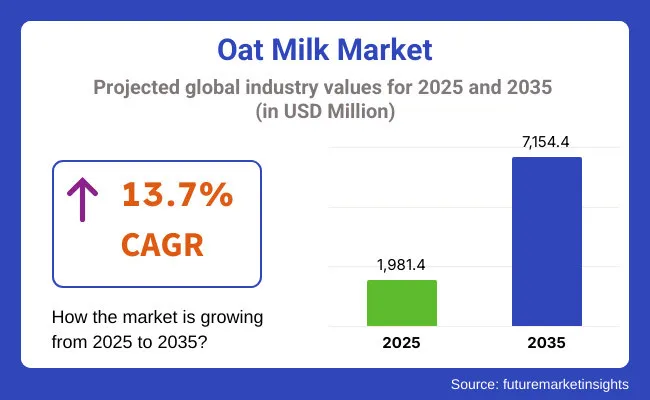

The global oat milk market is experiencing robust growth, reflecting a broader shift in consumer preferences toward plant-based and sustainable food options. The oat milk market is valued at USD 1,981.4 million in 2025. Projections suggest that the market will continue on an upward trajectory, reaching a forecasted value of USD 7,154.4 million by the end of 2035. This growth corresponds to a CAGR of 13.7% over the 2025 to 2035 period, positioning oat milk as one of the most dynamic segments within the broader dairy alternatives industry.

The rising popularity of oat milk can largely be attributed to increased consumer awareness about health and sustainability. Many consumers are actively seeking alternatives to traditional dairy products due to concerns over lactose intolerance, cholesterol intake, and the environmental impact of animal agriculture. Oat milk, being naturally free of lactose, cholesterol, and soy, provides a convenient and nutritious solution that aligns with these changing dietary preferences.

Additionally, its creamy texture and ability to replicate the mouthfeel of cow's milk have made it a preferred choice not only for drinking but also for cooking and beverage applications. The ease with which oat milk can be fortified with vitamins, minerals, and proteins further enhances its appeal among health-conscious consumers.

Oat milk holds a growing share across its parent markets. Within the global plant-based milk market, it accounts for approximately 20-25%, ranking second after almond milk. In the broader dairy alternatives market, oat milk represents around 10-12% of total value, which includes plant-based yogurt, cheese, and creamers.

As part of the plant-based food and beverage market, its share is about 5-7%, reflecting its niche but fast-growing position. In the health and wellness food sector, oat milk contributes roughly 2-3%, as it aligns with clean-label and lactose-free trends. Within the functional beverages market, fortified oat milks make up about 1-2% due to growing demand for products with added fiber, vitamins, or minerals. Overall, oat milk’s market presence continues to expand globally.

The USA is expected to be the fastest-growing market for oat milk, with a projected CAGR of 16.5%. The regular/full‑fat segment is projected to hold a dominant share of the global oat milk market, capturing 71.3%. The shelf-stable format is projected to dominate the global oat milk market, capturing 61.3% of the market share. India and China are also expected to experience notable growth, with projected CAGRs of 13.7% and 12.2%, respectively.

Relative representation of difference of performance on basis of CAGR in half year period between base year (2024) and current year (2025) of oat milk market globally. Research entails comparison of extreme performance and makes assumptions based on generation of revenues and thus presents an image of trend in growth for one year to stakeholders. Half year as H1 Jan to June. Half year as H2 Jul to Dec.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 13.2% |

| H2 (2024 to 2034) | 13.4% |

| H1 (2025 to 2035) | 13.5% |

| H2 (2025 to 2035) | 13.7% |

In the first half (2025 to 2035, H1) of the decade, the company is expanding at 13.5% CAGR, and in the second half (H2) of the decade, it will be relatively higher at 13.8%. In the subsequent decade, H1 2025-H2 2035, the CAGR is 13.5% CAGR in H1 and relatively higher in H2 at 13.8%. The company increased by 30 BPS in H1, and the company increased another 20 BPS in H2.

Oat milk market will continue to grow based on product innovation milestone strength and repeat consumer health and sustainability need. Fortification and nutrition priority will be given topmost preference for it to be in a position to be able to catch up with consumers' and regulation requirement needs.

The regular/full-fat segment leads the oat milk market due to its rich, creamy texture and versatility, especially favored in coffee applications. Natural oat milk dominates the flavor category, valued for its simplicity, health benefits, and adaptability across uses. Meanwhile, the shelf-stable format is preferred for its long shelf life, cost efficiency, and accessibility in regions with limited cold storage infrastructure.

The regular/full‑fat segment is projected to hold a dominant share of the global oat milk market, capturing 71.3% in2025.

The natural (unflavored) segment is projected to dominate the global oat milk market, holding approximately 58.3% of the market share in 2025. This preference is driven by consumer demand for simplicity, minimal ingredients, and versatility in various culinary applications.

The shelf-stable format is projected to dominate the global oat milk market, capturing 61.3% of the market share. This preference is driven by its extended shelf life, ambient storage capabilities, and lower distribution costs, making it ideal for large-scale retail, e-commerce, and foodservice operations.

World Market Dominating Master Brand Leaders - They are conquering the global oat milk market with deep distribution, innovation in products, and strong brand building. They spend a tremendous amount on advertising, research, and expansion activities. Oatly (Sweden), Worldwide oat milk market leader Oatly, with its operations in North America, Europe, and Asia, has a footprint on the globe.

Its drive towards sustainability, clean label, and innovation on oat milk-based dairy such as barista-use oat milk and oat milk-based ice cream leads the charge. Califia Farms (USA), its premium plant-based drinks strongly placed Califia Farms among the vegan and wellness-oriented consumer base.

Regional Players Building Market Share - These players have some presence in some markets and building their presence through retail relationships, environmental efforts, and product innovation. Danone (France), Danone with Alpro and Silk brands has heavily invested in the oat milk business. It has enormous distribution channels and a positive image in the European and North American dairy alternative market.

Minor Figures (UK), a specialty coffee brand oat milk manufacturer, Minor Figures produces barista-grade oat milk. Minor Figures goes that extra mile to sustainability and carbon-neutral production for eco-conscious buyers and specialty coffee shops.

Niche Brands and Emerging Innovators - The tier consists of small and emerging brands marketed organic, local, or premium oat milk products to meet niche consumers' needs. Elmhurst 1925 (USA), the relatively new plant-based oat milk competitor, Elmhurst 1925 retains oats' natural nutrition through its proprietary HydroRelease process.

A clean-label oat milk specialist, Elmhurst 1925 does not use gums and emulsifiers. Rude Health (UK), Rude Health is a natural oat milk specialist brand with a low-process strategy that will appeal to health-conscious consumers who would prefer to utilize raw, unprocessed ingredients in their milk alternative.

Between 2025 and 2035, the oat milk market is expected to grow at varying rates across key countries. The USA leads with the highest CAGR of 16.5%, reflecting strong consumer demand and widespread adoption of plant-based alternatives. India follows closely with a robust 13.7% growth rate, driven by increasing health awareness and expanding urban populations.

China and Japan show moderate growth at 12.2% and 11.4%, respectively, fueled by rising interest in dairy alternatives and wellness trends. Germany has the slowest growth among these countries, at 10.0%, indicating a more mature market with steady but slower expansion.

| Countries | CAGR 2025 to 2035 |

|---|---|

| USA | 16.5% |

| Germany | 10.0% |

| China | 12.2% |

| Japan | 11.4% |

| India | 13.7% |

The oat milk market in the USA is growing as more customers choose dairy products that are plant based. As the demand for lactose-free, vegan, and eco-friendly milk alternatives rises, oat milk is thriving at coffee chains, grocery retail, and foodservice.

Moreover, organic and fortified oat milk formulations are also gaining prominence among health-conscious consumers who prefer high-fiber and low-fat dairy alternatives.

Germany’s oat milk sector is growing steadily, buoyed by stringent EU regulations on the production of organic food and sustainability. There growing demand for clean-label, minimally processed, and fortified oat milk in the retail and café, as well as the on-the-go beverage markets.

Due to consumers becoming more concerned with their impact on the environment, German producers are turning to carbon-neutral production methods and regenerative oat farming.

Rising rates of lactose intolerance and demand for functional plant-based beverages are driving China's oat milk market. Urban consumers demand nutrient-dense, digestive-friendly beverages, and oat milk is increasingly featured in ready-to-drink (RTD) formats and fortified formulations.

Government initiatives for plant-based alternatives and sustainable agriculture also have local manufacturers ramping up investment in high-protein and calcium-enriched variants of oat milk.

Japan’s oat milk market resides in an extensive focus on premium-quality dairy alternatives and functional health beverages. Mildly sweet, barista-style, and high-fiber oat milk varieties favored by Japanese consumers in tea, coffee, and health-conscious diets.

In addition, Japanese innovation in enzymatic processing and food science is resulting in oat milk formulations that deliver better texture and nutritional bioavailability.

The oat milk market in India is growing due to increasing awareness of health, rising levels of lactose intolerance and increasing urbanization. There is a growing appetite for functional oat milk fortified with fiber, protein and Ayurvedic adaptogens.

As plant-based food startups and e-commerce grocery platforms proliferate, oat milk is more widely available to vegan, fitness-fixated, and sustainably minded customers.

The oat milk market is moderately consolidated, with key players such as Oatly Group AB, Nestlé SA, Lam Soon, Alpro, Califia Farms, and PureHarvest leading the competitive landscape. These companies dominate through strong branding, wide distribution networks, and continuous product innovation tailored to both retail and foodservice channels.

For instance, Oatly Group AB has established itself as a market leader with its barista-style oat milk offerings widely used in cafés and restaurants. Nestlé SA leverages its global distribution strength and R&D to introduce fortified and flavored oat milk under its various health-focused brands. Alpro, a pioneer in plant-based dairy alternatives, offers a diverse oat milk portfolio with organic and sugar-free options. Califia Farms is known for its stylish packaging and premium oat milk lines designed for both home and café use.

Meanwhile, PureHarvest and Chobani are expanding their presence with clean-label and nutritionally enhanced oat milk products to attract health-conscious consumers. Companies like F&N Life, Donene SA, Urban Platter, Earth’s Own, and Sanitarium are also carving out significant regional niches by focusing on sustainability, organic ingredients, and local sourcing.

The market is categorized into regular/full-fat and reduced-fat products, catering to different consumer preferences.

The product offerings include natural, flavored, fruit, chocolate, vanilla, and other varieties, providing a range of taste options.

These products are available in shelf-stable and refrigerated formats to suit varying storage and consumption needs.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global oat milk industry is projected to reach USD 1,981.4 million in 2025.

Key players include Oatly Group AB; Nestle SA; Lam Soon; Alpro; Califia Farms; PureHarvest; Chobani; F&N Life; Donene SA.

North America is expected to dominate due to strong demand for plant-based dairy alternatives in retail and foodservice.

The industry is forecasted to grow at a CAGR of 13.7% from 2025 to 2035.

Key drivers include rising demand for plant-based dairy, increasing use in coffee and foodservice, growing awareness of lactose-free alternatives, and advancements in oat milk fortification and sustainability.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Goat Milk Products Market Size and Share Forecast Outlook 2025 to 2035

Oat-based Snacks Market Size and Share Forecast Outlook 2025 to 2035

Oat Proteins Market Size and Share Forecast Outlook 2025 to 2035

Oats Market Analysis - Size, Share, and Forecast 2025 to 2035

Oat Beta-Glucan Market Analysis - Size, Share, and Forecast 2025 to 2035

Oat Drink Market Analysis - Size, Share & Forecast 2025 to 2035

Oat-based Beverage Market Analysis by Source, Product Type, Speciality and Distribution channel Through 2035

Oatmeal market Analysis by Nature, Type and Sales Channel Through 2025 to 2035

Oat Protein Market Trends - Plant-Based Nutrition & Industry Demand 2024 to 2034

Coated Label Market Size and Share Forecast Outlook 2025 to 2035

Coated Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Boat Trailers Market Size and Share Forecast Outlook 2025 to 2035

Boat Wiring Harness Market Size and Share Forecast Outlook 2025 to 2035

Coating Pretreatment Market Size and Share Forecast Outlook 2025 to 2035

Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Boat Steering Wheels Market Size and Share Forecast Outlook 2025 to 2035

Coating Auxiliaries Market Size and Share Forecast Outlook 2025 to 2035

Goat Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Boat Trolling Motor Market Size and Share Forecast Outlook 2025 to 2035

coated-paper-packaging-box-market-market-value-analysis

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA