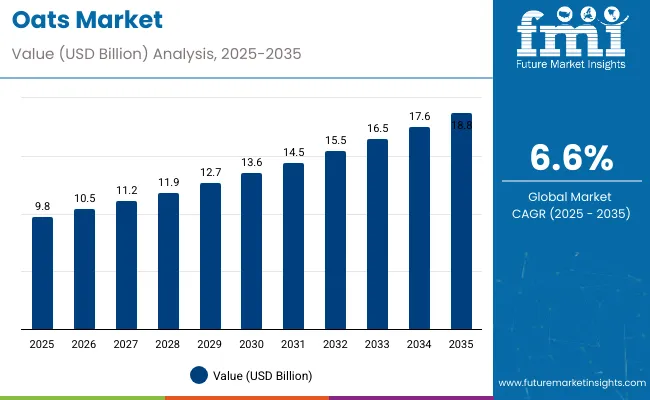

The global oats market is expected to demonstrate steady growth, with its valuation projected to increase from approximately USD 9.8 billion in 2025 to about USD 18.8 billion by 2035. This corresponds to CAGR of 6.6% during the forecast period. The expanding demand for oats is driven by growing consumer awareness of their nutritional benefits, rising adoption of health-conscious diets, and increasing applications across food and beverage sectors.

Oats are widely recognized for their rich dietary fiber content, particularly beta-glucan, which contributes to cardiovascular health by lowering cholesterol levels. Their versatility and health benefits have made them a staple in breakfast cereals, snack foods, bakery products, and dairy alternatives. Additionally, the growing trend toward plant-based and gluten-free diets has further propelled oats as a preferred ingredient among health-conscious consumers.

The food and beverage industry remains the primary consumer of oats, with applications ranging from oatmeal and granola to oat milk and flour. The introduction of innovative oat-based products, including protein bars and functional beverages, is expanding market reach and consumer appeal. The natural and clean-label attributes of oats also align well with consumer preferences for minimally processed foods.

| Attributes | Description |

|---|---|

| Estimated Size, 2025 | USD 9.8 billion |

| Projected Size, 2035 | USD 18.8 billion |

| Value-based CAGR (2025 to 2035) | 6.6% |

Geographically, North America and Europe are leading markets due to established health and wellness trends, high per capita consumption, and advanced food processing industries. However, the Asia Pacific region is anticipated to witness the fastest growth, driven by increasing health awareness, rising disposable incomes, and expanding urbanization in countries such as China, India, and Japan.

Sustainability and responsible sourcing are becoming important factors influencing market growth. Oats are considered a sustainable crop due to their relatively low water and pesticide requirements, making them attractive to environmentally conscious consumers and manufacturers. Efforts to promote sustainable farming practices and reduce carbon footprints in the oats supply chain are gaining momentum. Innovation in processing technologies and product development continues to enhance the functional and sensory properties of oat-based products. This includes advances in oat protein extraction and formulation, contributing to broader applications in nutrition and wellness products.

In March 2024, Bob's Red Mill launched a new Cinnamon Swirl Coffee Cake Mix as part of its Signature Blends Baking Mixes line. This product is designed to compete with Krusteaz's popular coffee cake mix, offering a convenient and flavorful option for home bakers. The mix requires only oil, water, and eggs to prepare, and features a cinnamon swirl throughout the cake and a crunchy cinnamon streusel topping. It is currently available at Whole Foods and on Amazon, providing consumers with an easy way to enjoy a fresh coffee cake at home

Finland is among the highest oat consumers. Consumption has continued to rise, reaching 12 kg in 2024, reflecting the broadening range of oat foods available in the market.

In Canada, oatmeal and rolled oats availability per person reached 1.6 kg in 2024, more than double the level of the previous year.

In the United States, nationally representative diet recalls show how much oatmeal people actually eat on a given day. About 6 percent of the population reported eating cooked oatmeal, with an average portion of roughly 238 g among consumers. That translates to a population average of about 0.9 kg of dry oats per person per year from hot oatmeal alone. Other oat foods such as cold cereals and snack bars would add to this baseline, but detailed oats-only totals are not routinely published.

For broader coverage, international food balance data provide country-level quantities for oats in kilograms per capita per year across more than 180 countries, with time series available from 2010 to 2022. These data are commonly used to compare per capita availability of specific commodities across countries and over time.

Together these figures highlight large cross-country differences: double-digit kilograms per capita in oat-centric contexts like Finland, around 1–2 kg in Canada, and much lower averages inferred for the United States when considering oatmeal alone.

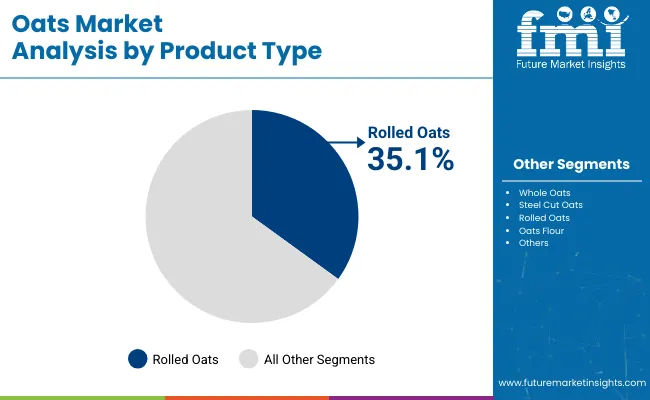

The rolled oats segment is projected to hold a significant 35.1% market share in 2025, driven by its enduring popularity among consumers and widespread availability in both grocery stores and online retail channels. Rolled oats are a familiar and trusted product, favored for their convenience and versatility in meal preparation.

Their high beta-glucan content is linked to heart health benefits, particularly in reducing cholesterol levels, making them attractive to health-conscious consumers focused on cardiovascular wellness. The segment benefits from continuous innovation and quality improvements by leading brands, which support consumer confidence and loyalty. Rolled oats’ ability to be incorporated into a variety of food products, from breakfast cereals to snacks and baked goods, further solidifies their dominant position.

As consumer awareness of dietary health continues to rise, rolled oats remain a staple in both traditional and modern diets. The segment’s robust performance reflects not only its nutritional value but also its adaptability and consistent market demand, ensuring sustained growth throughout the forecast period.

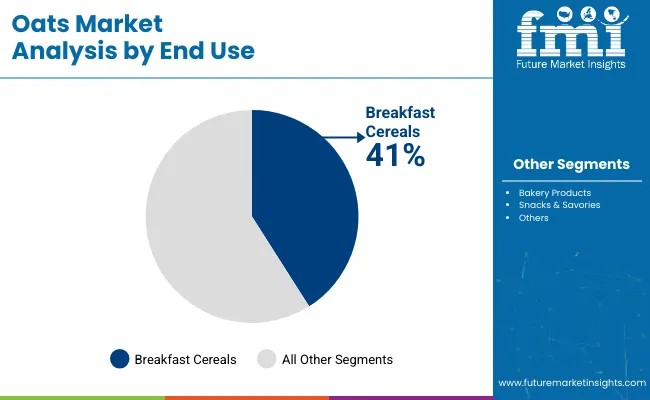

Breakfast cereals account for the largest share of the oats market, contributing around 41% in 2025. The dominance of this segment is driven by the widespread perception of oats as a healthy, high-fiber ingredient that supports heart health and weight management.

Global consumption of ready-to-eat and instant cereals has risen, particularly among urban households seeking convenient and nutritious breakfast options. Manufacturers are increasingly incorporating oats into both traditional cereal formats and innovative granola, muesli, and flavored blends.

With rising demand for clean-label and functional foods, the breakfast cereals segment is expected to remain the cornerstone of oat consumption worldwide.

Manufacturers of the pet nutrition industry satisfy increasing customer demand for high-quality, health-focused pet food by using oats in the pet nutrition industry. Pet owners are constantly seeking high-quality and nutritious food for their pets.

Oats have many nutritional benefits that help to pets' health attracting manufacturers to use oats in pet food. The trend toward personalized pet food products, where customers can choose the right product and flavor for their pet. These are the Significant factors driving the market growth.

The oats industry is strategically shifting toward product customization in response to customer demand for personalized nutritional experiences. Innovative producers are allowing customers to customize their oat-based products by adding distinct flavors, ingredients, and healthy boosters to their mixes.

By catering to individual tastes and dietary requirements, this tailored strategy increases customer interaction and promotes brand loyalty. Executing this personalized product approach requires strong data analytics and direct consumer feedback systems, which will guarantee a smooth and customer-focused customization process.

Benefiting from their calming and nourishing qualities, oats are becoming increasingly popular in the beauty and personal care sectors. Oat-based skincare products, such as scrubs, masks, and lotions, are popular among consumers looking for natural and plant-based components.

Working with producers of beauty products, funding studies that confirm oats' beneficial effects on dermatology, and launching targeted marketing campaigns that emphasize the all-natural and holistic qualities of oat-based beauty products are necessary to keep up with this trend.

To improve the market positioning of these oat-infused products, alliances with beauty and wellness merchants and certifications for sustainable and organic sourcing should be formed.

| Attributes | Details |

|---|---|

| Oats Market CAGR (2020 to 2024) | 6.3% |

The global Oats market increased at a CAGR of 6.3% from 2020 to 2024. For the next ten years (2025 to 2035), projections are that expenditure on Industry will rise at 6.6% CAGR.

Consumer awareness about healthy eating habits, wellness, and health is increasing. Oats are a good source of fiber and beta-glucan content, they are rich in antioxidants, vitamins, and minerals. Oats can give various health benefits with regular consumption, they can reduce cholesterol, and blud sugar levels, and improve insulin sensitivity.

Manufacturers are investing in innovation and the development of products. Product innovation and the health benefits of Oats are the prominent factors driving the market growth.

Oat-based snacks and quick breakfast alternatives are growing in popularity due to burgeoning consumer demand for ready-to-eat, convenient meals. The convenience food industry is experiencing growth due to the increasing demand for oat-based granola bars, cereals, and on-the-go snacks among busy consumers.

Consumers' awareness of celiac illness and gluten sensitivity and demand for gluten-free products are increased. Being gluten-free, oats are good choices for consumers. This is why more companies are making gluten-free oat products, and the market for these products is growing.

Selling products online and directly to customers is increasing. These help oat sellers to reach more people. Online shopping is important because it allows companies to interact with customers directly and learn important information, and market insights which is good for future direction.

There is an increasing trend where consumers want healthy and organic products. Clear nutrition information is significantly influencing consumer choices and attitudes, leading to an increase in the demand for oats. As people become more aware of the nutritional advantages of oats, this awareness is greatly aiding the growth of the oat market.

| Attributes | Details |

|---|---|

| Trends |

|

| Opportunities |

|

| Challenges |

|

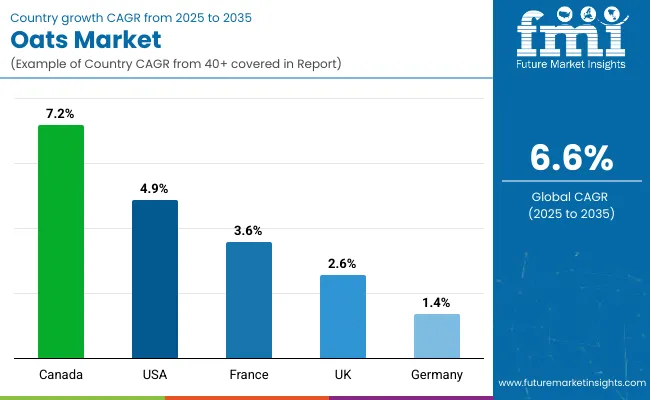

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 4.9% |

| Germany | 1.4% |

| United Kingdom | 2.6% |

| Canada | 7.2% |

| France | 3.6% |

The demand for oats in the United States is predicted to surge at a 4.9% CAGR through 2035. A transition in retail channels toward wellness marketing drives industry development in the United States. Retailers are marketing oats as the foundation of a balanced and wholesome lifestyle by implementing holistic wellness branding methods.

This trend generates a favorable feedback loop that fosters market expansion by appealing to consumers' desires for holistic well-being. The growth is motivated by real-time data analytics providing sophisticated insight into customer preferences.

Market leaders use cutting-edge analytics techniques to obtain practical insights into changing customer preferences and habits. This data-driven methodology ensures flexibility in satisfying changing market demands by influencing focused product development and marketing tactics.

The sales of oats in Germany are projected to rise at a 1.4% CAGR through 2035. A focus on sustainable sourcing methods serves as the foundation for the expansion in Germany.

Leading companies in the industry are incorporating Environmental, Social, and Governance (ESG) concepts into their supply chains in a deliberate manner to conform to the firm demands of German customers for goods that are responsibly produced and have little or no environmental impact.

Companies in the market are deliberately modifying the range of products they sell to suit different German regions' tastes. Local oat varieties draw inspiration from regional culinary customs, let businesses connect with particular customer preferences, and foster market expansion by providing individualized and culturally appropriate products.

The oats market growth in the United Kingdom is estimated at a 2.6% CAGR through 2035. Strategic partnerships with online meal kit providers help to expand the market. Embracing the convenience trend and the growth of e-commerce, oat manufacturers are incorporating their offerings into meal kit services. Companies use this synergistic method to expand their market reach and profit from evolving customer buying habits.

Oat companies that comply with renewable agriculture principles encourage market development. By adopting sustainable agricultural practices that prioritize biodiversity and soil health, firms improve their environmental credentials and satisfy the growing demand from British consumers for brands that uphold ecological responsibility.

The demand for oats in Canada is projected to surge at a 7.2% CAGR through 2035. The key drivers are:

The oats sales in France are anticipated to rise at a 3.6% CAGR through 2035. The key factors are:

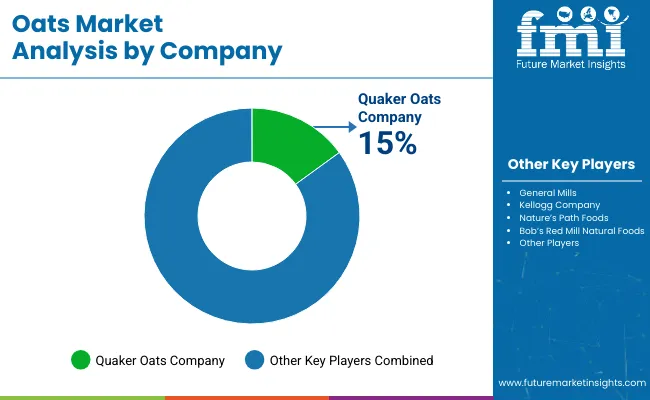

The oat market is characterized by a competitive environment in which well-known companies with vast distribution networks, such as Quaker, General Mills, and Kellogg, dominate. Agile startups prioritize innovation while emphasizing specialized oat, gluten-free, and organic products.

Strategic alliances, sustainability initiatives, and diversification into snacks and drinks are shaping competition. The interaction between market leaders and quick starters illustrates a dynamic market that adapts to changing customer trends and tastes.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 9.8 billion |

| Projected Market Size (2035) | USD 18.8 billion |

| CAGR (2025 to 2035) | 6.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and kilotons for volume |

| Product Types Analyzed (Segment 1) | Oat Groats, Whole Oats, Steel Cut Oats, Rolled Oats, Oats Flour |

| End Uses Analyzed (Segment 2) | Breakfast Cereals, Bakery Products, Snacks & Savories, Others |

| Distribution Channels Analyzed (Segment 3) | Hypermarkets/Supermarkets, Convenience Stores, Online Retail, Others |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Oats Market | Quaker Oats Company, General Mills, Kellogg Company, Nature's Path Foods, Bob's Red Mill Natural Foods, Post Holdings, Weetabix Limited, Grain Millers, Inc., The Jordans & Ryvita Company, Nature's Best Ltd. |

| Additional Attributes | Dollar sales by product type (groats, rolled, flour), Conventional vs organic oats trends, Growth of oat-based breakfast cereals and on-the-go snacks, Regional dietary trends favoring high-fiber grains, Expansion of e-commerce in grain-based health products |

| Customization and Pricing | Customization and Pricing Available on Request |

The oats market is valued at USD 9.8 billion in 2025.

The oats market size is estimated to increase at a 6.6% CAGR through 2035.

The oats market is anticipated to be worth USD 18.8 billion by 2035.

Rolled oats witnesses high demand in the industry.

The oats market in Canada is predicted to rise at a 7.2% CAGR through 2035.

Table 1: Global Market Value (US$ Billion) and Forecast by Region, 2019 to 2023

Table 2: Global Market Value (US$ Billion) and Forecast by Region, 2024 to 2034

Table 3: Global Market Volume (MT) and Forecast by Region, 2019 to 2023

Table 4: Global Market Volume (MT) and Forecast by Region, 2024 to 2034

Table 5: Global Market Value (US$ Billion) and Forecast by Product Type, 2019 to 2023

Table 6: Global Market Value (US$ Billion) and Forecast by Product Type, 2024 to 2034

Table 7: Global Market Volume (MT) and Forecast by Product Type, 2019 to 2023

Table 8: Global Market Volume (MT) and Forecast by Product Type, 2024 to 2034

Table 9: Global Market Value (US$ Billion) and Forecast by End Use, 2019 to 2023

Table 10: Global Market Value (US$ Billion) and Forecast by End Use, 2024 to 2034

Table 11: Global Market Volume (MT) and Forecast by End Use, 2019 to 2023

Table 12: Global Market Volume (MT) and Forecast by End Use, 2024 to 2034

Table 13: Global Market Value (US$ Billion) and Forecast by Application, 2019 to 2023

Table 14: Global Market Value (US$ Billion) and Forecast by Application, 2024 to 2034

Table 15: Global Market Volume (MT) and Forecast by Application, 2019 to 2023

Table 16: North America Market Value (US$ Billion) and Forecast by Country, 2024 to 2034

Table 17: North America Market Volume (MT) and Forecast by Country, 2019 to 2023

Table 18: North America Market Volume (MT) and Forecast by Country, 2024 to 2034

Table 19: North America Market Value (US$ Billion) and Forecast by Product Type, 2019 to 2023

Table 20: North America Market Value (US$ Billion) and Forecast by Product Type, 2024 to 2034

Table 21: North America Market Volume (MT) and Forecast by Product Type, 2019 to 2023

Table 22: North America Market Volume (MT) and Forecast by Product Type, 2024 to 2034

Table 23: North America Market Value (US$ Billion) and Forecast by End Use, 2019 to 2023

Table 24: North America Market Value (US$ Billion) and Forecast by End Use, 2024 to 2034

Table 25: North America Market Volume (MT) and Forecast by End Use, 2019 to 2023

Table 26: North America Market Volume (MT) and Forecast by End Use, 2024 to 2034

Table 27: North America Market Value (US$ Billion) and Forecast by Application, 2019 to 2023

Table 28: North America Market Value (US$ Billion) and Forecast by Application, 2024 to 2034

Table 29: North America Market Volume (MT) and Forecast by Application, 2019 to 2023

Table 30: North America Market Volume (MT) and Forecast by Application, 2024 to 2034

Table 31: Latin America Market Value (US$ Billion) and Forecast by Country, 2024 to 2034

Table 32: Latin America Market Volume (MT) and Forecast by Country, 2019 to 2023

Table 33: Latin America Market Volume (MT) and Forecast by Country, 2024 to 2034

Table 34: Latin America Market Value (US$ Billion) and Forecast by Product Type, 2019 to 2023

Table 35: Latin America Market Value (US$ Billion) and Forecast by Product Type, 2024 to 2034

Table 36: Latin America Market Volume (MT) and Forecast by Product Type, 2019 to 2023

Table 37: Latin America Market Volume (MT) and Forecast by Product Type, 2024 to 2034

Table 38: Latin America Market Value (US$ Billion) and Forecast by End Use, 2019 to 2023

Table 39: Latin America Market Value (US$ Billion) and Forecast by End Use, 2024 to 2034

Table 40: Latin America Market Volume (MT) and Forecast by End Use, 2019 to 2023

Table 41: Latin America Market Volume (MT) and Forecast by End Use, 2024 to 2034

Table 42: Latin America Market Value (US$ Billion) and Forecast by Application, 2019 to 2023

Table 43: Latin America Market Value (US$ Billion) and Forecast by Application, 2024 to 2034

Table 44: Latin America Market Volume (MT) and Forecast by Application, 2019 to 2023

Table 45: Latin America Market Volume (MT) and Forecast by Application, 2024 to 2034

Table 46: Europe Market Value (US$ Billion) and Forecast by Country, 2024 to 2034

Table 47: Europe Market Volume (MT) and Forecast by Country, 2019 to 2023

Table 48: Europe Market Volume (MT) and Forecast by Country, 2024 to 2034

Table 49: Europe Market Value (US$ Billion) and Forecast by Product Type, 2019 to 2023

Table 50: Europe Market Value (US$ Billion) and Forecast by Product Type, 2024 to 2034

Table 51: Europe Market Volume (MT) and Forecast by Product Type, 2019 to 2023

Table 52: Europe Market Volume (MT) and Forecast by Product Type, 2024 to 2034

Table 53: Europe Market Value (US$ Billion) and Forecast by End Use, 2019 to 2023

Table 54: Europe Market Value (US$ Billion) and Forecast by End Use, 2024 to 2034

Table 55: Europe Market Volume (MT) and Forecast by End Use, 2019 to 2023

Table 56: Europe Market Volume (MT) and Forecast by End Use, 2024 to 2034

Table 57: Europe Market Value (US$ Billion) and Forecast by Application, 2019 to 2023

Table 58: Europe Market Value (US$ Billion) and Forecast by Application, 2024 to 2034

Table 59: Europe Market Volume (MT) and Forecast by Application, 2019 to 2023

Table 60: Europe Market Volume (MT) and Forecast by Application, 2024 to 2034

Table 61: East Asia Market Value (US$ Billion) and Forecast by Country, 2024 to 2034

Table 62: East Asia Market Volume (MT) and Forecast by Country, 2019 to 2023

Table 63: East Asia Market Volume (MT) and Forecast by Country, 2024 to 2034

Table 64: East Asia Market Value (US$ Billion) and Forecast by Product Type, 2019 to 2023

Table 65: East Asia Market Value (US$ Billion) and Forecast by Product Type, 2024 to 2034

Table 66: East Asia Market Volume (MT) and Forecast by Product Type, 2019 to 2023

Table 67: East Asia Market Volume (MT) and Forecast by Product Type, 2024 to 2034

Table 68: East Asia Market Value (US$ Billion) and Forecast by End Use, 2019 to 2023

Table 69: East Asia Market Value (US$ Billion) and Forecast by End Use, 2024 to 2034

Table 70: East Asia Market Volume (MT) and Forecast by End Use, 2019 to 2023

Table 71: East Asia Market Volume (MT) and Forecast by End Use, 2024 to 2034

Table 72: East Asia Market Value (US$ Billion) and Forecast by Application, 2019 to 2023

Table 73: East Asia Market Value (US$ Billion) and Forecast by Application, 2024 to 2034

Table 74: East Asia Market Volume (MT) and Forecast by Application, 2019 to 2023

Table 75: East Asia Market Volume (MT) and Forecast by Application, 2024 to 2034

Table 76: South Asia Market Value (US$ Billion) and Forecast by Country, 2024 to 2034

Table 77: South Asia Market Volume (MT) and Forecast by Country, 2019 to 2023

Table 78: South Asia Market Volume (MT) and Forecast by Country, 2024 to 2034

Table 79: South Asia Market Value (US$ Billion) and Forecast by Product Type, 2019 to 2023

Table 80: South Asia Market Value (US$ Billion) and Forecast by Product Type, 2024 to 2034

Table 81: South Asia Market Volume (MT) and Forecast by Product Type, 2019 to 2023

Table 82: South Asia Market Volume (MT) and Forecast by Product Type, 2024 to 2034

Table 83: South Asia Market Value (US$ Billion) and Forecast by End Use, 2019 to 2023

Table 84: South Asia Market Value (US$ Billion) and Forecast by End Use, 2024 to 2034

Table 85: South Asia Market Volume (MT) and Forecast by End Use, 2019 to 2023

Table 86: South Asia Market Volume (MT) and Forecast by End Use, 2024 to 2034

Table 87: South Asia Market Value (US$ Billion) and Forecast by Application, 2019 to 2023

Table 88: South Asia Market Value (US$ Billion) and Forecast by Application, 2024 to 2034

Table 89: South Asia Market Volume (MT) and Forecast by Application, 2019 to 2023

Table 90: South Asia Market Volume (MT) and Forecast by Application, 2024 to 2034

Table 91: Oceania Market Value (US$ Billion) and Forecast by Country, 2024 to 2034

Table 92: Oceania Market Volume (MT) and Forecast by Country, 2019 to 2023

Table 93: Oceania Market Volume (MT) and Forecast by Country, 2024 to 2034

Table 94: Oceania Market Value (US$ Billion) and Forecast by Product Type, 2019 to 2023

Table 95: Oceania Market Value (US$ Billion) and Forecast by Product Type, 2024 to 2034

Table 96: Oceania Market Volume (MT) and Forecast by Product Type, 2019 to 2023

Table 97: Oceania Market Volume (MT) and Forecast by Product Type, 2024 to 2034

Table 98: Oceania Market Value (US$ Billion) and Forecast by End Use, 2019 to 2023

Table 99: Oceania Market Value (US$ Billion) and Forecast by End Use, 2024 to 2034

Table 100: Oceania Market Volume (MT) and Forecast by End Use, 2019 to 2023

Table 101: Oceania Market Volume (MT) and Forecast by End Use, 2024 to 2034

Table 102: Oceania Market Value (US$ Billion) and Forecast by Application, 2019 to 2023

Table 103: Oceania Market Value (US$ Billion) and Forecast by Application, 2024 to 2034

Table 104: Oceania Market Volume (MT) and Forecast by Application, 2019 to 2023

Table 105: Oceania Market Volume (MT) and Forecast by Application, 2024 to 2034

Table 106: MEA Market Value (US$ Billion) and Forecast by Country, 2024 to 2034

Table 107: MEA Market Volume (MT) and Forecast by Country, 2019 to 2023

Table 108: MEA Market Volume (MT) and Forecast by Country, 2024 to 2034

Table 109: MEA Market Value (US$ Billion) and Forecast by Product Type, 2019 to 2023

Table 110: MEA Market Value (US$ Billion) and Forecast by Product Type, 2024 to 2034

Table 111: MEA Market Volume (MT) and Forecast by Product Type, 2019 to 2023

Table 112: MEA Market Volume (MT) and Forecast by Product Type, 2024 to 2034

Table 113: MEA Market Value (US$ Billion) and Forecast by End Use, 2019 to 2023

Table 114: MEA Market Value (US$ Billion) and Forecast by End Use, 2024 to 2034

Table 115: MEA Market Volume (MT) and Forecast by End Use, 2019 to 2023

Table 116: MEA Market Volume (MT) and Forecast by End Use, 2024 to 2034

Table 117: MEA Market Value (US$ Billion) and Forecast by Application, 2019 to 2023

Table 118: MEA Market Value (US$ Billion) and Forecast by Application, 2024 to 2034

Table 119: MEA Market Volume (MT) and Forecast by Application, 2019 to 2023

Table 120: MEA Market Volume (MT) and Forecast by Application, 2024 to 2034

Figure 1: Global Market Value (US$ Billion) and Volume (MT) Forecast, 2024 to 2034

Figure 2: Global Market Absolute $ Opportunity (US$ Billion), 2024 to 2034

Figure 3: Global Market Value (US$ Billion) and Customer Orientation by Region, 2024 & 2034

Figure 4: Global Market Y-o-Y Growth Rate by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Billion) and Customer Orientation by Product Type, 2024 & 2034

Figure 6: Global Market Y-o-Y Growth Rate by Product Type, 2024 to 2034

Figure 7: Global Market Value (US$ Billion) and Customer Orientation by End Use, 2024 & 2034

Figure 8: Global Market Y-o-Y Growth Rate by End Use, 2024 to 2034

Figure 9: Global Market Value (US$ Billion) and Customer Orientation by Application, 2024 & 2034

Figure 10: Global Market Y-o-Y Growth Rate by Application, 2024 to 2034

Figure 17: Global Market Attractiveness Analysis by Region, 2024 to 2034

Figure 18: Global Market Attractiveness Analysis by Product Type, 2024 to 2034

Figure 19: Global Market Attractiveness Analysis by Nature, 2024 to 2034

Figure 21: Global Market Attractiveness Analysis by End Use, 2024 to 2034

Figure 22: Global Market Attractiveness Analysis by Application, 2024 to 2034

Figure 24: North America Market Value (US$ Billion) and Volume (MT) Forecast, 2024 to 2034

Figure 25: North America Market Absolute $ Opportunity (US$ Billion), 2024 to 2034

Figure 26: North America Market Value (US$ Billion) and Customer Orientation by Country,2024 & 2034

Figure 27: North America Market Y-o-Y Growth Rate by Country, 2024 to 2034

Figure 28: North America Market Value (US$ Billion) and Customer Orientation by Product Type,2024 & 2034

Figure 29: North America Market Y-o-Y Growth Rate by Product Type, 2024 to 2034

Figure 30: North America Market Value (US$ Billion) and Customer Orientation by End Use,2024 & 2034

Figure 31: North America Market Y-o-Y Growth Rate by Nature, 2024 to 2034

Figure 32: North America Market Value (US$ Billion) and Customer Orientation by End Use, 2024 & 2034

Figure 33: North America Market Y-o-Y Growth Rate by Application, 2024 to 2034

Figure 34: North America Market Value (US$ Billion) and Customer Orientation by Application,2024 & 2034

Figure 38: North America Market Attractiveness Analysis by Country, 2024 to 2034

Figure 39: North America Market Attractiveness Analysis by Product Type, 2024 to 2034

Figure 40: North America Market Attractiveness Analysis by End Use, 2024 to 2034

Figure 41: North America Market Attractiveness Analysis by Application, 2024 to 2034

Figure 46: Latin America Market Value (US$ Billion) and Volume (MT) Forecast, 2024 to 2034

Figure 47: Latin America Market Absolute $ Opportunity (US$ Billion), 2024 to 2034

Figure 48: Latin America Market Value (US$ Billion) and Customer Orientation by Country,2024 & 2034

Figure 49: Latin America Market Y-o-Y Growth Rate by Country, 2024 to 2034

Figure 50: Latin America Market Value (US$ Billion) and Customer Orientation by Product Type,2024 & 2034

Figure 51: Latin America Market Y-o-Y Growth Rate by Product Type, 2024 to 2034

Figure 52: Latin America Market Value (US$ Billion) and Customer Orientation by End Use,2024 & 2034

Figure 53: Latin America Market Y-o-Y Growth Rate by Nature, 2024 to 2034

Figure 54: Latin America Market Value (US$ Billion) and Customer Orientation by End Use, 2024 & 2034

Figure 55: Latin America Market Y-o-Y Growth Rate by Application, 2024 to 2034

Figure 56: Latin America Market Value (US$ Billion) and Customer Orientation by Application,2024 & 2034

Figure 57: Latin America Market Attractiveness Analysis by Country, 2024 to 2034

Figure 58: Latin America Market Attractiveness Analysis by Product Type, 2024 to 2034

Figure 59: Latin America Market Attractiveness Analysis by End Use, 2024 to 2034

Figure 60: Latin America Market Attractiveness Analysis by Application, 2024 to 2034

Figure 61: Europe Market Value (US$ Billion) and Volume (MT) Forecast, 2024 to 2034

Figure 62: Europe Market Absolute $ Opportunity (US$ Billion), 2024 to 2034

Figure 63: Europe Market Value (US$ Billion) and Customer Orientation by Country,2024 & 2034

Figure 64: Europe Market Y-o-Y Growth Rate by Country, 2024 to 2034

Figure 65: Europe Market Value (US$ Billion) and Customer Orientation by Product Type,2024 & 2034

Figure 66: Europe Market Y-o-Y Growth Rate by Product Type, 2024 to 2034

Figure 67: Europe Market Value (US$ Billion) and Customer Orientation by End Use,2024 & 2034

Figure 68: Europe Market Y-o-Y Growth Rate by Nature, 2024 to 2034

Figure 69: Europe Market Value (US$ Billion) and Customer Orientation by End Use, 2024 & 2034

Figure 70: Europe Market Y-o-Y Growth Rate by Application, 2024 to 2034

Figure 71: Europe Market Value (US$ Billion) and Customer Orientation by Application,2024 & 2034

Figure 72: Europe Market Attractiveness Analysis by Country, 2024 to 2034

Figure 73: Europe Market Attractiveness Analysis by Product Type, 2024 to 2034

Figure 74: Europe Market Attractiveness Analysis by End Use, 2024 to 2034

Figure 75: Europe Market Attractiveness Analysis by Application, 2024 to 2034

Figure 76: East Asia Market Value (US$ Billion) and Volume (MT) Forecast, 2024 to 2034

Figure 77: East Asia Market Absolute $ Opportunity (US$ Billion), 2024 to 2034

Figure 78: East Asia Market Value (US$ Billion) and Customer Orientation by Country,2024 & 2034

Figure 79: East Asia Market Y-o-Y Growth Rate by Country, 2024 to 2034

Figure 80: East Asia Market Value (US$ Billion) and Customer Orientation by Product Type,2024 & 2034

Figure 81: East Asia Market Y-o-Y Growth Rate by Product Type, 2024 to 2034

Figure 82: East Asia Market Value (US$ Billion) and Customer Orientation by End Use,2024 & 2034

Figure 83: East Asia Market Y-o-Y Growth Rate by Nature, 2024 to 2034

Figure 84: East Asia Market Value (US$ Billion) and Customer Orientation by End Use, 2024 & 2034

Figure 85: East Asia Market Y-o-Y Growth Rate by Application, 2024 to 2034

Figure 86: East Asia Market Value (US$ Billion) and Customer Orientation by Application,2024 & 2034

Figure 87: East Asia Market Attractiveness Analysis by Country, 2024 to 2034

Figure 88: East Asia Market Attractiveness Analysis by Product Type, 2024 to 2034

Figure 89: East Asia Market Attractiveness Analysis by End Use, 2024 to 2034

Figure 90: East Asia Market Attractiveness Analysis by Application, 2024 to 2034

Figure 91: South Asia Market Value (US$ Billion) and Volume (MT) Forecast, 2024 to 2034

Figure 92: South Asia Market Absolute $ Opportunity (US$ Billion), 2024 to 2034

Figure 93: South Asia Market Value (US$ Billion) and Customer Orientation by Country,2024 & 2034

Figure 94: South Asia Market Y-o-Y Growth Rate by Country, 2024 to 2034

Figure 95: South Asia Market Value (US$ Billion) and Customer Orientation by Product Type,2024 & 2034

Figure 96: South Asia Market Y-o-Y Growth Rate by Product Type, 2024 to 2034

Figure 97: South Asia Market Value (US$ Billion) and Customer Orientation by End Use,2024 & 2034

Figure 98: South Asia Market Y-o-Y Growth Rate by Nature, 2024 to 2034

Figure 99: South Asia Market Value (US$ Billion) and Customer Orientation by End Use, 2024 & 2034

Figure 100: South Asia Market Y-o-Y Growth Rate by Application, 2024 to 2034

Figure 101: South Asia Market Value (US$ Billion) and Customer Orientation by Application,2024 & 2034

Figure 102: South Asia Market Attractiveness Analysis by Country, 2024 to 2034

Figure 103: South Asia Market Attractiveness Analysis by Product Type, 2024 to 2034

Figure 104: South Asia Market Attractiveness Analysis by End Use, 2024 to 2034

Figure 105: South Asia Market Attractiveness Analysis by Application, 2024 to 2034

Figure 106: Oceania Market Value (US$ Billion) and Volume (MT) Forecast, 2024 to 2034

Figure 107: Oceania Market Absolute $ Opportunity (US$ Billion), 2024 to 2034

Figure 108: Oceania Market Value (US$ Billion) and Customer Orientation by Country,2024 & 2034

Figure 109: Oceania Market Y-o-Y Growth Rate by Country, 2024 to 2034

Figure 110: Oceania Market Value (US$ Billion) and Customer Orientation by Product Type,2024 & 2034

Figure 111: Oceania Market Y-o-Y Growth Rate by Product Type, 2024 to 2034

Figure 112: Oceania Market Value (US$ Billion) and Customer Orientation by End Use,2024 & 2034

Figure 113: Oceania Market Y-o-Y Growth Rate by Nature, 2024 to 2034

Figure 114: Oceania Market Value (US$ Billion) and Customer Orientation by End Use, 2024 & 2034

Figure 115: Oceania Market Y-o-Y Growth Rate by Application, 2024 to 2034

Figure 116: Oceania Market Value (US$ Billion) and Customer Orientation by Application,2024 & 2034

Figure 117: Oceania Market Attractiveness Analysis by Country, 2024 to 2034

Figure 118: Oceania Market Attractiveness Analysis by Product Type, 2024 to 2034

Figure 119: Oceania Market Attractiveness Analysis by End Use, 2024 to 2034

Figure 120: Oceania Market Attractiveness Analysis by Application, 2024 to 2034

Figure 121: MEA Market Value (US$ Billion) and Volume (MT) Forecast, 2024 to 2034

Figure 122: MEA Market Absolute $ Opportunity (US$ Billion), 2024 to 2034

Figure 123: MEA Market Value (US$ Billion) and Customer Orientation by Country,2024 & 2034

Figure 124: MEA Market Y-o-Y Growth Rate by Country, 2024 to 2034

Figure 125: MEA Market Value (US$ Billion) and Customer Orientation by Product Type,2024 & 2034

Figure 126: MEA Market Y-o-Y Growth Rate by Product Type, 2024 to 2034

Figure 127: MEA Market Value (US$ Billion) and Customer Orientation by End Use,2024 & 2034

Figure 128: MEA Market Y-o-Y Growth Rate by Nature, 2024 to 2034

Figure 129: MEA Market Value (US$ Billion) and Customer Orientation by End Use, 2024 & 2034

Figure 130: MEA Market Y-o-Y Growth Rate by Application, 2024 to 2034

Figure 131: MEA Market Value (US$ Billion) and Customer Orientation by Application,2024 & 2034

Figure 132: MEA Market Attractiveness Analysis by Country, 2024 to 2034

Figure 133: MEA Market Attractiveness Analysis by Product Type, 2024 to 2034

Figure 134: MEA Market Attractiveness Analysis by End Use, 2024 to 2034

Figure 135: MEA Market Attractiveness Analysis by Application, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airboats Market

Crew boats (Standby Crew Vessels) Market

Small Boats Market Size and Share Forecast Outlook 2025 to 2035

Level Floats Market Size and Share Forecast Outlook 2025 to 2035

Organic Oats Market Size and Share Forecast Outlook 2025 to 2035

Rescue Boats Market Analysis - Size, Share, and Forecast 2025 to 2035

Rowing Boats Market

Gluten-Free Oats Market Insights – Clean Eating & Industry Growth 2025 to 2035

Disposable Lab Coats Market by Material Type, End-Use, Demographic, Price Range, Distribution Channel and Region 2025 to 2035

Foldable Inflatable Boats Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA