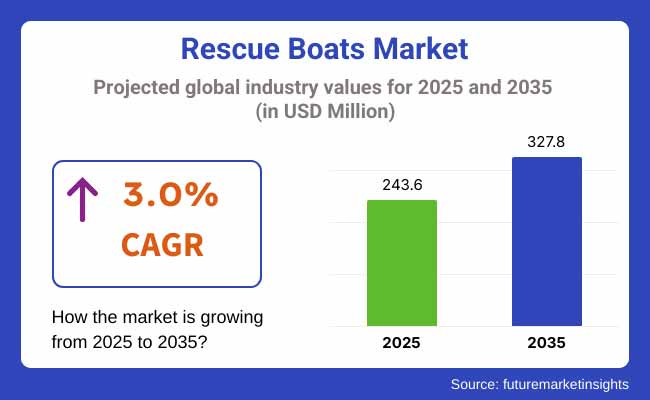

The rescue boats market is projected to reach USD 243.6 million in 2025. By 2035, a valuation of USD 327.8 million is expected. A CAGR of 3.0% will be maintained during this period. The United States is likely to hold the largest share of the market. The Asia Pacific region is anticipated to grow the fastest between 2025 and 2035.

Continuous innovation is being observed across product types. Regulatory emphasis has been placed on safety across the marine and offshore sectors. Expansion of maritime trade and offshore oil and gas activity has pushed demand. Enhanced naval capabilities have been prioritized by governments. Technological advancements have been made in hull design and propulsion. Cost concerns and high maintenance have limited market penetration in some developing economies. Challenges have been posed by fluctuating raw material costs.

Trends include the adoption of hybrid rescue boats and the integration of autonomous navigation systems. Investments have been made in upgrading fleets and meeting international safety standards. Lightweight composite materials are being favored for durability. Cross-sector demand is being supported by risk preparedness initiatives. Partnerships are being forged with regional distributors for broader access.

Between 2025 and 2035, steady growth is expected to continue. Expansion into emerging economies will be witnessed. Increased maritime safety regulations are likely to drive replacement cycles. Demand from offshore wind and energy sectors will remain consistent. Product efficiency and fuel economy will be prioritized.

Greater attention is anticipated on sustainability and emission reduction. Enhanced communication and remote monitoring systems will be embedded. Digital integration in rescue operations will be improved. Market expansion will be enabled by flexible product customization. Focus will be placed on training and preparedness infrastructure. Strategic investments will be directed toward R&D. Market opportunities are expected across civilian and military domains. Favorable government policies may accelerate market growth.

The rescue boats market has been segmented and analyzed across several key dimensions to offer a comprehensive investment outlook. By product type, the segments include fast boats and normal speed boats. Based on application, the market has been assessed across ships, coast guard service, offshore installation, and others (including inland waterways, harbor rescue operations, and port authority services). Regional analysis covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, the Middle East, and Africa.

The rescue boats market, segmented by product type, includes fast boats and normal speed boats. Fast boats are expected to witness the highest growth between 2025 and 2035 at a CAGR of 4.2%. Their adoption is being driven by increasing demand from naval defense operations, rapid-response coastal surveillance, and offshore energy platforms where speed is mission-critical. These boats offer high maneuverability and faster deployment during emergency situations, making them ideal for time-sensitive maritime operations.

In contrast, normal speedboats are projected to witness comparatively muted growth. These vessels are generally used in low-intensity applications and often lack the power-to-weight ratio required for high-risk missions. With growing emphasis on operational efficiency and mission success rates, fast boats are being prioritized in procurement and modernization initiatives. Additionally, the use of lightweight materials and advancements in propulsion technologies are further accelerating their integration across both government and commercial fleets.

| Category | CAGR (2025 to 2035) |

|---|---|

| Fast Boats | 4.2% |

Application-wise, the rescue boats market is segmented into ships, coast guard service, offshore installation, and others (including inland waterways, harbor rescue operations, and port authority services). Among these, the Coast Guard service is expected to emerge as the fastest-growing segment at a CAGR of 4.6% from 2025 to 2035.

The segment is being propelled by rising investments in maritime security, increased patrol frequency, and modernization of aging fleets in coastal nations. Rapid response needs and national defense mandates are fueling demand for high-performance rescue vessels tailored for law enforcement and search operations.

Offshore installations will continue to present stable growth due to consistent demand from the oil & gas and renewable energy sectors. However, growth will be moderated by economic cyclicality in energy markets. The ships segment is expected to witness slower expansion, largely tied to limited fleet replacement cycles and reliance on existing onboard emergency craft. The ‘others’ segment remains niche, with growth driven by localized demand spikes.

| Category | CAGR (2025 to 2035) |

|---|---|

| Coast Guard Service | 4.6% |

Challenge: High Operational and Maintenance Costs

Development and maintenance of efficient rescue boats are costly, especially for defense and offshore industries. Maintenance, conformity verification, and regular inspection charges are economic liabilities on fleet owners and encourage others to postpone the upgrading of fleets. Safety and certification regulations include stringent testing, further raising the cost of development.

Opportunity: Integration of Smart and Autonomous Technologies

Technological advances in GPS tracking, AI-based navigation, and remotely controlled rescue boats are the greatest opportunities for the market. Autonomously controlled rescue boats are being developed to assist life-saving operations with higher accuracy, reducing the risk to human life. Also, advances in hybrid propulsion systems allow rescue boats to be cost-effective and fuel-efficient with green rescue boats as a future opportunity.

The USA rescue boat industry has been spurred by rigorous marine safety regulations, increasing coastal defence spending, and the increased occurrence of hurricanes and floods. FEMA and the USA Coast Guard have doubled their rescue boat fleets and have deployed high-speed reinforced-hull boats to enable instant emergency response.

Off-shore energy sector, particularly in the Gulf of Mexico, has been driving long-term demand for rescue boats with advanced navigation and distress tracking. AI-powered rescue boats are also becoming more popular with high speed, as defence agencies spend in autonomous surface rescue craft for naval fleets.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.2% |

The UK market for rescue boats is showing sustained growth with more expenditure on maritime security, off-shore wind farms being constructed off-shore, and the government striving to advance search and rescue. The Royal National Lifeboat Institution (RNLI) has led the charge to overhaul rescue fleets by using green cost-saving vessels.

Regulatory shifts by the Maritime and Coastguard Agency (MCA) are promoting hybrid-electric rescue boats, reducing carbon emissions and improving effectiveness. In addition, increased risk accompanying greater weather patterns has prompted the government to invest further in specialty disaster-response vessels.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.8% |

Stricter maritime legislation and sustainability goals spur the European Union rescue boat industry. Germany, the Netherlands, and France are leading future investments in electric and hybrid rescue boats. The EU climate-neutrality initiative has spurred innovation as it pertains to hydrogen fuel rescue boats, and coastal and off-shore areas are among the top beneficiaries.

Offshore wind energy sector, expanding rapidly along the North Sea, is one of the leading demand drivers. Maritime agencies are also equipping advanced digital surveillance and distress-response systems, improving rescue efficiency and response time on European seas.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.0% |

Japan's rescue boat market is mostly demand-based for disaster relief since the country is highly vulnerable to earthquake and tsunami catastrophe. Budgets by the government for self-righting tsunami-resistant rescue boats have registered a notable increase. Furthermore, the infusion of AI-driven navigation and real-time monitoring of environmental information into rescue boats is augmenting efficiency.

The country's boat-building industry has also been active creating solar-powered, high-speed rescue boats to achieve sustainability goals. Advances in technology in materials, including ultra-lightweight alloys, are conserving fuel while propelling boats faster and withstanding rough seas more effectively.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.9% |

The South Korean rescue boat market is growing due to having a highly industrialized shipbuilding industry combined with increased government spending in maritime security. South Korea's Coast Guard is replacing their old fleet of rescue boats with new, modern, AI-equipped rescue boats that are specifically designed for severe weather conditions.

The world's interest in green ship technology has witnessed development in hybrid-electric power systems that reduce fuel consumption while providing high-speed capabilities. Aside from this, the South Korean shipbuilding and offshore energy industries are also investing in next-generation sensor technology rescue boats for next-generation search-and-rescue missions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.1% |

Rescue boat industry is a competitive and dynamic industry with regional and international players dominating the market growth. The major players concentrate on technology innovation, ruggedness, and regulatory compliance to address increased safety and performance in sea rescues.

The market has experienced players with strong R&D capabilities and new entrants with low-cost as well as innovative design capabilities. The company deals with numerous markets such as coast guards, navy, offshore business, and commercial shipping in a bid to provide a huge variety of products.

Palfinger Marine (14-18%)

Palfinger Marine is the leader in the rescue boats segment with a vast product portfolio of high-speed rescue boats, lifeboats, and davit systems. It is the master of light-weight boats with excellent maneuverability and the latest tracking technology. Its boats are used extensively by coast guards, naval vessels, and merchant fleets. Palfinger Marine's safety innovation and compliance with SOLAS and IMO regulations make it the most sought-after supplier for marine rescue operations globally.

Zodiac Milpro (10-15%)

Zodiac Milpro is a top brand in rescue boats, or it is also famous for rigid inflatable boats (RIBs) deployed by the military and rescue agencies during distress operations. Zodiac Milpro is employing hybrid and electric power to balance environmental impact at the expense of tolerable performance at high speeds. Zodiac Milpro is engaged in partnership agreements with defense teams and emergency units in order to provide difficult-to-attain operational conditions.

Survitec Group (9-13%)

Survitec Group produces various kinds of rescue boats, including self-righting lifeboats and FRCs. With a collaboration with marine societies as a business, the company gains the capacity to offer bespoke solutions especially designed for severe sea conditions. Technology in the form of real-time monitoring is utilized by the company for other areas of safe operation procedures. Survitec offers maintenance and training schemes in order to ensure highest rescue efficiency.

Viking Life-Saving Equipment (7-12%)

Viking Life-Saving Equipment develops innovative, effective life-saving equipment including enclosed lifeboats and quick-deployment rescue vessels. Viking targets high integration of intelligent technologies, i.e., remote diagnostics and predictive maintenance are feasible. Viking's large international distribution network covering the world gives commercial shipping and offshore customers worldwide maximum availability of Viking's product range.

Fassmer (5-9%)

Fassmer produces heavy-duty rescue boats for hostile weather. Fassmer, being fireproof material and heavy-duty construction, is ahead of the curve. Fassmer boats have extensive application in the offshore oil and gas industries and Arctic rescue due to their added stability and anticorrosion features. Fassmer maintains its production vertically integrated to become price competitive and of quality.

Other Key Players (40-50% Combined)

A significant number of other companies are highly interested in the rescue boat industry, while they also make contributions in terms of technologies, regulatory requirements, and low-cost production. These include:

The industry is slated to reach USD 243.6 million in 2025.

The industry is predicted to reach a size of USD 327.8 million by 2035.

Key companies include Fassmer GmbH & Co. KG, Palfinger AG, Norsafe AS, Viking Life-Saving Equipment, and Survitec Group Ltd.

The USA is slated for the fastest growth through 2035 at a CAGR of 3.2%.

Fast boats are widely used due to their rapid deployment and high maneuverability.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rescue Hoist System Market Growth - Trends & Forecast 2025 to 2035

Airboats Market

Mine Rescue Vehicle Market

Rope Rescue Harness Market

Crew boats (Standby Crew Vessels) Market

Small Boats Market Size and Share Forecast Outlook 2025 to 2035

Rowing Boats Market

Search and Rescue Equipment (SAR) Market Size and Share Forecast Outlook 2025 to 2035

Foldable Inflatable Boats Market Size and Share Forecast Outlook 2025 to 2035

Emergency Response and Rescue Vessels Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA