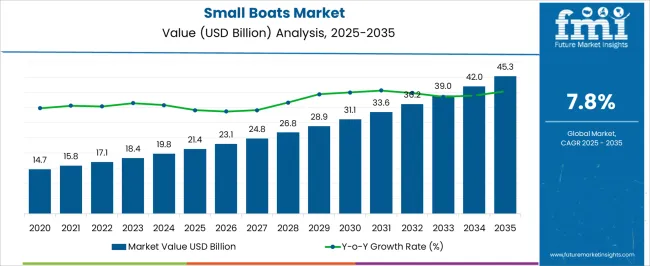

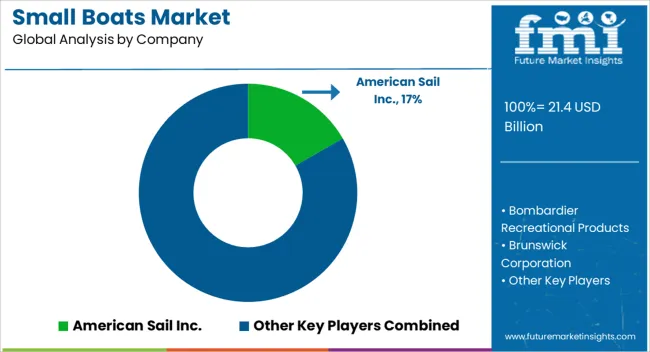

The small boats market is estimated to be valued at USD 21.4 billion in 2025 and is projected to reach USD 45.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.8% over the forecast period.

Year-on-year growth analysis indicates a steady expansion, with values rising from USD 23.1 billion in 2026 to USD 42.0 billion in 2034 before reaching the forecasted value. This growth trajectory highlights the increasing demand for recreational, commercial, and utility boats, which is being driven by rising interest in leisure activities, coastal transportation, and small-scale maritime operations. The YoY increments suggest that manufacturers are responding to evolving consumer preferences and regional boating regulations, ensuring that vessel production and distribution are aligned with market needs. The steady growth pattern also reflects the market’s resilience in adapting to fluctuating economic conditions while maintaining a consistent demand base. The small boats market stood at USD 21.4 billion in 2025 and is expected to advance to USD 45.3 billion by 2035, maintaining a CAGR of 7.8%.

Year-on-year comparisons demonstrate a predictable upward trend, with annual values moving from USD 24.8 billion in 2027 to USD 39.0 billion in 2033. The market expansion is being reinforced by growing adoption of fuel-efficient, compact, and multi-purpose boats that cater to recreational enthusiasts, fishing operators, and small commercial fleets. From my perspective, the steady YoY growth underlines the importance of design flexibility, safety standards, and regional distribution strategies in sustaining market momentum. The trend also indicates that stakeholders who focus on meeting consumer expectations and regulatory compliance are likely to capture significant opportunities over the forecast period.

| Metric | Value |

|---|---|

| Small Boats Market Estimated Value in (2025 E) | USD 21.4 billion |

| Small Boats Market Forecast Value in (2035 F) | USD 45.3 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The small boats market has been increasingly positioned as a key segment within several larger parent industries, each reflecting measurable adoption and strategic relevance. Within the recreational boating market, small boats account for approximately 8.9%, driven by growing consumer interest in leisure, fishing, and short-distance travel activities that require compact, versatile watercraft. In the marine transportation market, the share is estimated at 6.7%, as small boats are utilized for local passenger transport, cargo movement, and auxiliary vessel operations in harbors and coastal areas.

The water sports equipment market records a penetration of around 5.8%, reflecting demand for small boats in activities such as rowing, kayaking, and competitive sports where maneuverability and performance are critical. Within the personal watercraft market, small boats hold roughly 4.9% share, due to their integration into lifestyle-focused and recreational segments that prioritize ease of use, storage, and affordability. In the boat manufacturing and repair market, the small boats segment contributes approximately 5.5%, driven by demand for maintenance, customization, and replacement of smaller vessels in private and commercial fleets.

Collectively, these parent sectors indicate that the small boats market represents about 32% across these industries, highlighting its importance in shaping manufacturing, operational, and consumer engagement strategies. Market adoption has been influenced by preferences for versatility, safety, and cost-effective solutions, prompting manufacturers and service providers to focus on quality, durability, and accessibility. Its presence has been actively reshaping competitive strategies, establishing small boats as indispensable for both recreational and functional maritime applications while reinforcing the growth potential of parent markets.

The small boats market is witnessing steady expansion, supported by increasing recreational water activities, rising interest in personal leisure assets, and demand for specialized utility vessels. Current market dynamics are influenced by growing disposable incomes, greater access to coastal and inland waterways, and the integration of advanced propulsion and navigation technologies in compact vessels.

The sector benefits from robust participation in marine tourism, competitive sports, and fishing, while commercial and government applications contribute to stable demand in non-recreational categories. The market outlook remains positive as customization trends, enhanced safety features, and environmentally compliant designs gain traction.

Additionally, the adoption of lightweight materials and efficient hull designs is improving fuel efficiency and overall performance, aligning with evolving regulatory and consumer expectations. Long-term growth is expected to be underpinned by replacement cycles, fleet modernization initiatives, and expansion in emerging markets with improving maritime infrastructure, positioning the small boats segment as a resilient and versatile segment of the global marine industry.

The small boats market is segmented by type, application, and geographic regions. By type, small boats market is divided into personal watercraft, pontoon, deck boat, inflatable boat, runabout, bowrider, and others. In terms of application, small boats market is classified into utility, sports, recreation, and military. Regionally, the small boats industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The personal watercraft segment accounts for approximately 28.4% of the small boats market, reflecting its strong position in the recreational boating sector. This share is driven by the increasing popularity of compact, maneuverable vessels for individual and small-group leisure use in coastal, lake, and river settings. The segment’s growth is further supported by advancements in engine performance, safety enhancements, and ergonomic design improvements, which have broadened its appeal among both experienced and novice operators.

Seasonal tourism demand, rental operations, and private ownership collectively sustain the segment’s volume, while marketing strategies targeting younger demographics have expanded the customer base. The personal watercraft category has also benefited from a shift toward multi-functional models that combine recreational agility with limited utility applications.

Regulatory compliance in emission and noise reduction has strengthened its adoption in environmentally conscious markets. With rising participation in water sports and expanding distribution networks, the segment is poised to maintain a competitive share within the forecast period.

The utility segment holds approximately 33.1% of the small boats market, underscoring its critical role in functional and operational maritime applications. Demand for utility boats is largely driven by their versatility in supporting fishing, transportation, emergency response, and general-purpose tasks in both commercial and governmental sectors. The segment’s prominence is reinforced by its adaptability to varying operational environments, from shallow inland waters to nearshore maritime zones, aided by robust hull construction and efficient propulsion systems.

Growth in maritime security operations, search-and-rescue missions, and industrial support services has further enhanced the segment’s relevance. In addition, the expansion of aquaculture, port maintenance activities, and offshore service requirements has stimulated consistent demand for utility vessels.

Manufacturers have focused on durability, low-maintenance materials, and modular configurations to meet diverse operational needs. Given its broad functional scope and dependable demand from essential services, the utility segment is expected to retain a strong market position, providing stable growth prospects in the coming years.

The small boats market has been shaped by rising demand for recreational boating, fishing, and water transport solutions. Adoption has been driven by increasing leisure activities, tourism, and coastal or inland waterway transport. Opportunities are emerging in electric and hybrid small boats, modular designs, and customized vessels for premium experiences. Trends are being observed in lightweight materials, multi-functional designs, and connected boating solutions, while challenges persist in high production costs, maintenance requirements, and stringent regulatory standards. Overall, market growth is expected to remain positive with expanding consumer interest and commercial adoption.

The demand for small boats has been strongly influenced by their extensive use in recreational boating, fishing, and coastal transport services. Recreational enthusiasts, fishing communities, and tourism operators have been observed increasingly relying on small boats for leisure, adventure, and transport purposes. In opinion, this demand has been reinforced by the growing popularity of boating experiences, guided tours, and private leisure activities in coastal, river, and lake regions. Manufacturers are focusing on delivering vessels with comfort, performance, and durability to meet evolving consumer expectations. Small boats are also being adopted for water sports, angling, and personal travel, creating diverse application opportunities. The demand trajectory is further shaped by seasonal and regional preferences, where small boats serve as both functional transport and recreational assets. Overall, reliance on small boats is being viewed as essential for facilitating enjoyable, safe, and efficient water-based experiences.

Opportunities in the small boats market have been largely defined by the increasing adoption of electric, hybrid, and customizable boat designs catering to leisure and premium segments. Manufacturers have been observed developing energy-efficient propulsion systems, modular hulls, and configurable interiors to enhance user experience and expand application possibilities. In opinion, emerging markets present significant opportunities as disposable incomes rise, and boating culture gains popularity in coastal and inland regions. Specialty boats, including luxury, fishing, and adventure-focused vessels, are being designed to meet specific consumer needs. Opportunities have also been identified in retrofitting and upgrading existing fleets with modern propulsion or safety systems. Collaborations between boat builders and component suppliers are facilitating tailored solutions, creating added value for end-users. Overall, these opportunities are expected to drive product differentiation, expand market reach, and strengthen adoption in both recreational and commercial boating sectors.

The small boats market has been shaped by trends in lightweight construction, multi-functional layouts, and connected boating features. Manufacturers have been increasingly using materials such as fiberglass, aluminum, and composites to reduce vessel weight while maintaining durability and performance. In opinion, trends in multi-functional designs, including modular seating, convertible decks, and integrated storage, are redefining consumer expectations for versatility and convenience. Connected boating solutions, including GPS navigation, remote monitoring, and onboard safety systems, are gaining traction among recreational and commercial operators. These trends are also influencing the adoption of small boats in tourism, rental, and guided adventure services. Overall, these developments are expected to shape product innovation strategies, enhance competitive positioning, and increase adoption by offering functional, user-friendly, and technologically aligned boating solutions.

The small boats market has faced ongoing challenges related to high manufacturing costs, maintenance requirements, and complex regulatory frameworks. Crafting vessels with quality materials, reliable propulsion systems, and safety features requires significant capital investment, which can limit adoption in price-sensitive segments. In opinion, adherence to safety standards, certification processes, and regional maritime regulations has occasionally slowed market expansion, particularly for manufacturers aiming to operate across multiple jurisdictions. Maintenance demands, including engine servicing, hull upkeep, and seasonal preparation, further affect user experience and cost efficiency. Supply chain dependencies for specialized components, electronics, and marine-grade materials have also constrained production scalability in some cases. Addressing these challenges requires strategic sourcing, compliance management, and customer support services. Overcoming these barriers is critical for ensuring reliability, safety, and long-term growth in the small boats market.

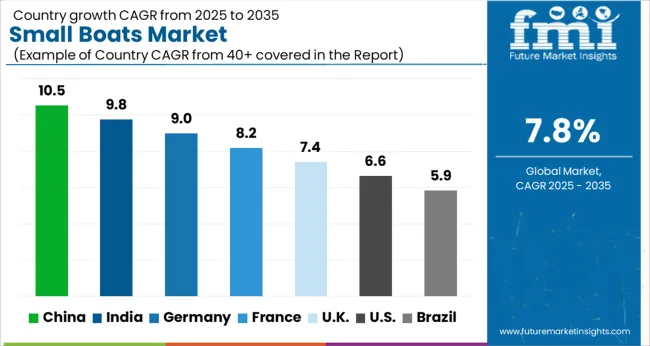

| Country | CAGR |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9.0% |

| France | 8.2% |

| UK | 7.4% |

| USA | 6.6% |

| Brazil | 5.9% |

The global small boats market is projected to grow at a CAGR of 7.8% from 2025 to 2035. China leads with 10.5% growth, followed by India at 9.8%, and Germany at 9%. The United Kingdom records 7.4%, while the United States shows 6.6% growth. Expansion is being driven by rising recreational boating, water sports activities, and commercial applications such as fishing and tourism. Emerging markets like China and India witness higher growth due to increasing disposable income, coastal tourism development, and recreational infrastructure expansion, while developed markets focus on premium boats, advanced materials, and innovative designs for leisure, sports, and utility purposes. This report includes insights on 40+ countries; the top markets are shown here for reference.

The small boats market in China is growing at a CAGR of 10.5%, supported by rising demand for recreational boating, fishing, and tourism activities. Manufacturers are adopting lightweight, durable materials and advanced designs to meet consumer preferences. Growth is reinforced by coastal infrastructure development, marina expansions, and government support for water-based tourism. Adoption is further driven by increasing disposable income and the growing popularity of leisure water sports among urban populations, which encourages higher sales of small recreational and utility boats.

The small boats market in India is advancing at a CAGR of 9.8%, fueled by growth in water-based tourism, fishing, and recreational activities. Indian manufacturers are focusing on lightweight, high-performance small boats for leisure and commercial purposes. Growth is reinforced by government initiatives promoting coastal and inland waterway tourism, increasing disposable income, and expansion of boating clubs and marinas. Adoption is further driven by rising interest in water sports and adventure activities among urban and semi-urban populations.

The small boats market in Germany is projected to grow at a CAGR of 9%, supported by demand for leisure boating, water sports, and small-scale commercial applications. German manufacturers are focusing on high-quality, durable, and efficient small boats to meet safety and performance standards. Market expansion is reinforced by the presence of established boating clubs, marina facilities, and government regulations promoting safe water navigation. Adoption is particularly strong in recreational and tourism sectors, where consumers value innovative designs, fuel efficiency, and premium features.

The small boats market in the United Kingdom is expanding at a CAGR of 7.4%, fueled by recreational boating, tourism, and water sports activities. UK manufacturers are integrating lightweight materials, safety features, and performance enhancements in small boats. Growth is supported by marina infrastructure development, boating clubs, and an increasing consumer preference for leisure watercraft. Adoption is further reinforced by seasonal tourism demand and government initiatives promoting safe boating practices.

The small boats market in the United States is growing at a CAGR of 6.6%, driven by demand from recreational boating, water sports, and commercial fishing sectors. USA manufacturers are focusing on innovative designs, lightweight materials, and safety features to meet consumer expectations. Growth is reinforced by strong boating culture, marina expansions, and increasing disposable income. While growth is moderate compared to emerging markets, adoption remains steady across leisure, tourism, and utility applications, particularly in coastal and inland waterway regions.

The small boats market is being driven by a mix of global recreational brands, marine specialists, and motorized watercraft innovators. Brunswick Corporation, Malibu Boats, and MasterCraft Boat Holdings are being positioned as leaders through high-performance hull designs, premium build quality, and brand heritage. Their strategy is being executed with a focus on innovation in materials, safety features, and tailored models for leisure, sports, and fishing applications. American Sail Inc., Chaparral Boats, and Regal Boats are being directed toward mid-range and customizable offerings, combining craftsmanship with operational reliability. Honda Motor, Kawasaki Motors, and Polaris are being recognized for engine integration, performance efficiency, and reliability, supplying power units to both OEMs and aftermarket enthusiasts.

Scout Boats, Taiga Motors, and Tracker Marine Group are being noted for niche specialization, electric propulsion options, and compact designs optimized for coastal and inland waters. Competition is being defined by hull performance, engine reliability, and feature integration, while market leadership is reinforced by customer experience, after-sales support, and innovative leisure solutions. Product brochures are being designed as precise, persuasive instruments that communicate performance, design, and utility. Brunswick, Malibu, and MasterCraft brochures are structured with hull diagrams, engine specifications, and lifestyle imagery to showcase versatility and premium quality.

American Sail, Chaparral, and Regal brochures emphasize customization options, safety certifications, and operational ease. Honda, Kawasaki, and Polaris brochures highlight engine power, fuel efficiency, and integration compatibility. Scout, Taiga, and Tracker brochures focus on electric propulsion, compact dimensions, and maneuverability for niche markets. Each brochure is crafted as a standalone reference, combining visuals, concise specifications, and application highlights. They ensure small boat offerings are presented with clarity, credibility, and immediate appeal to recreational users, fleet operators, and marine enthusiasts.

| Item | Value |

|---|---|

| Quantitative Units | USD 21.4 billion |

| Type | Personal watercraft, Pontoon, Deck boat, Inflatable boat, Runabout, Bowrider, and Others |

| Application | Utility, Sports, Recreation, and Military |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | American Sail Inc., Bombardier Recreational Products, Brunswick Corporation, Chaparral Boats, Honda Motor Co., Ltd., Kawasaki Motors Corp., USA, Malibu Boats, MasterCraft Boat Holdings, Inc., Polaris Inc., Regal Boats, Scout Boats, Taiga Motors, and Tracker Marine Group |

| Additional Attributes | Dollar sales by boat type (inflatable, fishing, recreational, patrol) and material (fiberglass, aluminum, wood, composite) are key metrics. Trends include rising demand for leisure and sports boating, growth in tourism and marine activities, and increasing adoption of lightweight and durable materials. Regional adoption, consumer preferences, and technological advancements are driving market growth. |

The global small boats market is estimated to be valued at USD 21.4 billion in 2025.

The market size for the small boats market is projected to reach USD 45.3 billion by 2035.

The small boats market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in small boats market are personal watercraft, pontoon, deck boat, inflatable boat, runabout, bowrider and others.

In terms of application, utility segment to command 33.1% share in the small boats market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Small Molecule Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Small Form Factor (SFF) Connectors Market Size and Share Forecast Outlook 2025 to 2035

Small Satellite Market Size and Share Forecast Outlook 2025 to 2035

Small Marine Engine Market Forecast Outlook 2025 to 2035

Small Gas Engine Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule CDMO Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule CMO/CDMO Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Metabolic Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Running Wheel System Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule-Drug Conjugates Market Size and Share Forecast Outlook 2025 to 2035

Small Caliber Ammunition Market Size and Share Forecast Outlook 2025 to 2035

Small Capacity Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Imaging (In Vivo) Market Size and Share Forecast Outlook 2025 to 2035

Small Cell Lung Cancer (SCLC) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule Innovator CDMO Market Size and Share Forecast Outlook 2025 to 2035

Small Cell Network Market Size and Share Forecast Outlook 2025 to 2035

Small Wind Turbine Market Size and Share Forecast Outlook 2025 to 2035

Small Off-Road Engines Market Size and Share Forecast Outlook 2025 to 2035

Small Continuous Fryer Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule Inhibitors Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA