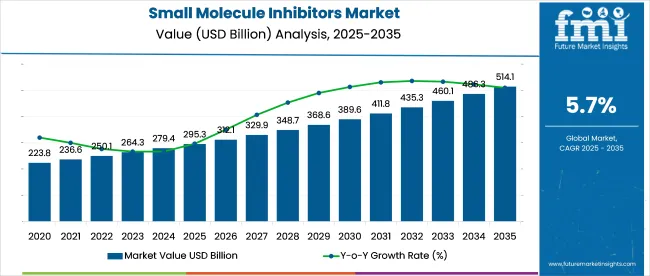

In 2025, the small molecule inhibitors market is anticipated to be valued at USD 295.3 billion, with estimates indicating growth to USD 514.1 billion by 2035 at a CAGR of 5.7%.

Quick Stats of the Small Molecule Inhibitors Market

Between 2020 and 2024, the industry expanded from USD 220.6 billion to USD 278.4 billion,with an average YoY growth of 6%. Initial momentum was driven by kinase inhibitors in NSCLC and leukemia, along with increased use of apoptosis modulators. Oral bioavailability and targeted precision made these therapies favorable over biologics. By 2024, adoption had widened across adjuvant settings and autoimmune indications in high-income industries.

In February 2025, Novartis announced the acquisition of Anthos Therapeutics in a transaction valued up to USD 3.1 billion. This strategic move aims to bolster Novartis' cardiovascular portfolio through the integration of Anthos’ factor‑XI inhibitors, designed to reduce stroke risk without increasing bleeding events. The acquisition reflects Novartis’ continued investment in next-generation small-molecule assets with multi-indication potential.

The small molecule inhibitors market holds a measurable share across multiple life sciences sectors. In the USD 1.5 trillion global pharmaceutical industry, small molecule inhibitors contribute approximately 5-7% of annual sales, primarily in targeted therapeutics. Within the USD 250 billion oncology therapeutics segment, they represent 35-40%, led by kinase and PARP inhibitors.

Roughly 40-45% of the USD 120 billion targeted therapy market stems from small molecules, reflecting their ability to modulate intracellular pathways. In the USD 80 billion precision therapeutics segment, they account for 45-50%, often complementing biologics in personalized medicine. Across the USD 700 billion chronic disease therapeutics space, 8-10% is tied for autoimmune, cardiovascular, and metabolic disorder management.

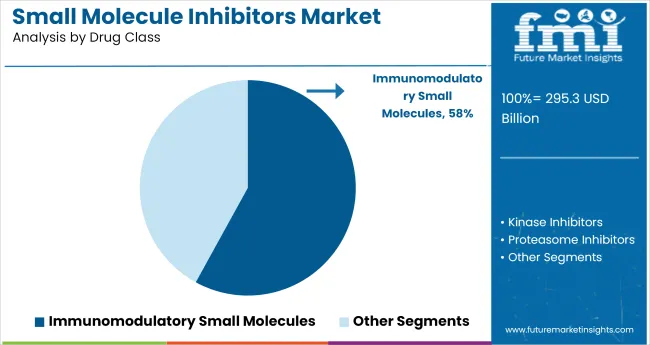

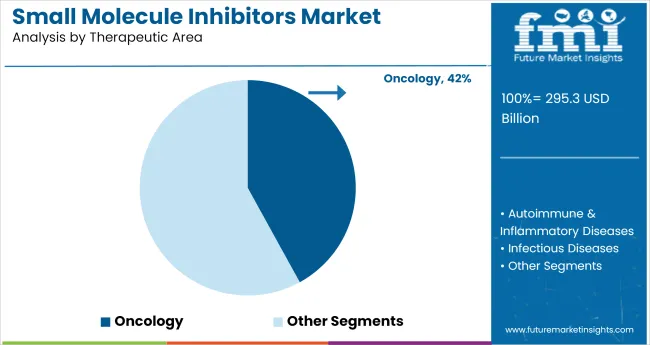

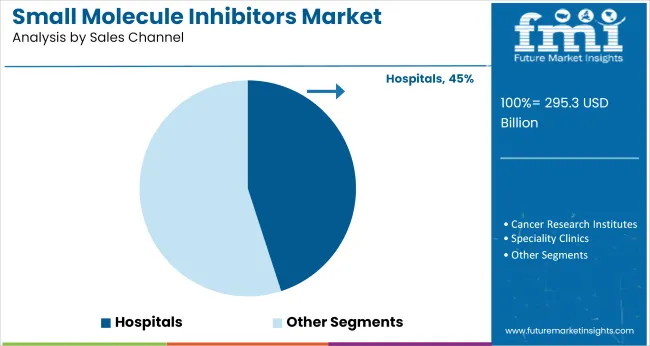

The industry is segmented by molecule class into immunomodulatory agents, kinase-targeting compounds, proteasome blockers, and enzyme inhibition therapies. Therapeutic areas include oncology, autoimmune conditions, inflammatory disorders, infectious diseases, and cardiometabolic applications. Distribution channels include hospital-based systems, specialty treatment centers, and regulated pharmacy networks.

Regional segmentation covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific.

A 58% revenue share in 2025 is projected to be held by immunomodulatory small molecules. These compounds are being favored due to their mechanism-level targeting across inflammatory pathways and hematologic dysregulation. Between 2020 and 2024, JAK and BTK inhibitors were positioned as frontline therapies in autoimmune relapses and lymphoproliferative cancers. This shift was not driven by general prescription trends but by rapid clinical adoption tied to regulatory momentum and trial-supported efficacy.

The category’s dominance is being reinforced by sustained demand for orally active immune modulators, particularly those enabling long-term management protocols. Unlike broader immunotherapy platforms, small molecule-based immunoregulators are offering precision with lower patient monitoring burden.

In 2025, oncology is forecasted to account for 42% of total therapeutic demand for small molecule inhibitors. This share is being maintained not through legacy usage but through active trial pipelines and molecularly guided treatment algorithms. From 2020 to 2024, BRAF, EGFR, ALK, and PARP inhibitors were given multiple first-line approvals across solid and hematologic tumors, leading to rapid protocol-level incorporation.

The dominance of oncology in the industry shows the clinical reliability of kinase and cell-cycle disruptors, especially when paired with immunotherapy. Small-molecule regimens are being used to sensitize tumors before checkpoint blockade, solidifying their role beyond monotherapy.

Hospitals are projected to represent 45% of all small molecule inhibitor sales by 2025. This trend is being led by protocol-based dosing, diagnostic-tethered prescription flows, and the consolidation of first-cycle drug management into tertiary care environments. Between 2020 and 2024, the inpatient share was expanded due to oral transitions from high-risk intravenous therapies, along with the adoption of treatment algorithms tied to molecular diagnostics.

Hospital networks are not merely acting as distribution nodes-they are serving as initiation hubs where biomarker testing, specialist consultation, and dosing oversight are centralized. In high-risk cancer and immune-driven admissions, small molecule agents are being used as first-line pharmacologic assets.

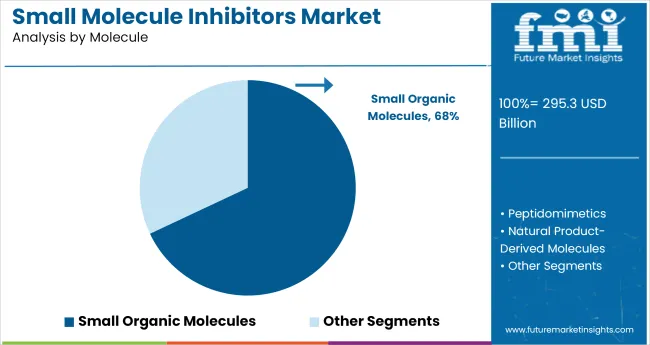

In 2025, small organic molecules are projected to account for 68% of total sales. This share is being sustained by their proven success in targeting intracellular proteins, offering oral availability, and enabling cost-efficient manufacturing. From 2020 to 2024, a significant number of kinase inhibitors, GPCR modulators, and enzyme blockers were developed using small organic scaffolds, contributing to their dominance in oncology, immunology, and infectious disease pipelines.

The continued preference for small organic molecules reflects their pharmacokinetic advantages and compatibility with structure-based drug design. Their modularity supports rapid analog generation, making them the preferred starting point for high-throughput screening and IND filing strategies.

The industry is expanding rapidly due to advancements in drug discovery and growing demand for targeted therapies. Adoption is increasing in oncology, particularly in North America and the EU. However, high development costs, drug resistance, and regulatory delays pose significant challenges to industry growth.

Volume Growth Linked to Small Molecule Inhibitors Industry Expansion

The industry is experiencing considerable growth, propelled by innovations in drug discovery technologies and increasing demand for precision treatments. In North America, the use of these inhibitors in oncology grew by 25% in the past year, particularly in therapies targeting cancer cells.

The EU has seen 72% of newly developed oncology drugs incorporating small molecule inhibitors, contributing to a 15% reduction in hospitalization costs due to enhanced patient responses. Additionally, 43% of hospitals in Asia-Pacific have started using these inhibitors as the initial treatment for cancer, demonstrating rising adoption across the region.

Challenges Linked to Small Molecule Inhibitors Development and Approval

Despite the ongoing growth in the market, significant obstacles remain. The cost of development remains a critical challenge, with R&D and clinical trial expenses consistently exceeding USD 2.6 billion per drug. Resistance mechanisms in cancer therapies are affecting the long-term efficacy of small molecule inhibitors, with resistance seen in 35% of cancer patients receiving treatment. Regulatory delays continue to hamper progress, with 18% of new small molecule inhibitor applications encountering approval holdups in the EU and U.S. due to complicated and varying standards.

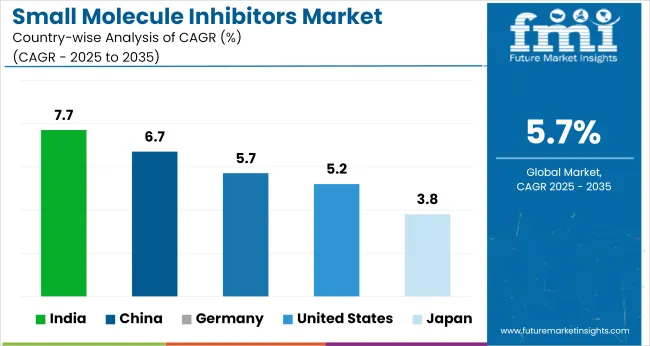

The global small molecule inhibitors market is projected to grow at 5.7% CAGR from 2025 to 2035. Among the 40+ countries analyzed, India leads with 7.7%, followed by China at 6.7%. Both BRICS nations are benefitting from expanded API manufacturing zones, fast-tracked clinical trial approvals, and increasing participation in global oncology supply chains. Domestic companies are investing in kinase inhibitor portfolios targeting breast and lung cancer segments.

Germany, an OECD country, matches the global average at 5.7%, driven by steady institutional demand and reimbursement-backed launches. The United States follows at 5.2%, with market entry slowed by pricing scrutiny and extended HTA cycles. Japan posts the lowest growth at 3.8%, constrained by longer regulatory timelines and stricter formulary restrictions. Diverging growth rates reflect policy regimes, patent cliffs, and the pace of clinical adoption across OECD and BRICS blocs.

| Countries | CAGR (2025-2035) |

|---|---|

| United States | 5.2% |

| Germany | 5.7% |

| China | 6.7% |

| Japan | 3.8% |

| India | 7.7% |

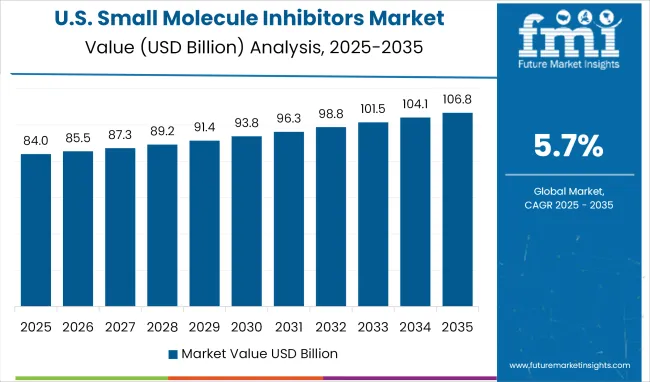

A CAGR of 5.2% has been projected for 2025;2035, compared to 3.9% during 2020;2024. During the historical phase, small molecule inhibitors were primarily prescribed in oncology, with limited uptake in primary care settings. The forecast period is expected to reflect broader therapeutic integration, as these inhibitors are increasingly preferred over biologics in autoimmune and metabolic disorders. Patient accessibility has improved due to oral formats and home-care protocols. Formulary inclusion under Medicare accelerated wider coverage, prompting higher outpatient demand.

Germany posted a projected CAGR of 5.7% for 2025;2035, improving from 4.3% in the 2020;2024 phase. Small molecule inhibitors were initially limited to oncology-based settings. By 2025, a therapeutic expansion into dermatology, neurology, and rheumatology contributed to broader adoption. National reimbursement plans and faster CE approvals allowed physicians to prioritize these inhibitors in outpatient protocols. Public-private partnerships fostered domestic production of generics, while EU-wide procurement frameworks enhanced regional distribution.

The China market is projected to expand at a CAGR of 6.7% during 2025;2035, compared to 5.6% between 2020 and 2024. Initial demand for these inhibitors was focused on high-cost, imported oncology treatments. A significant shift has occurred with the rise of domestic players and fast-tracked NMPA approvals. Small molecule inhibitors are now widely used across gastroenterology, hematology, and infectious diseases. Government tenders and bulk purchase mechanisms have made pricing more competitive across provincial hospitals.

Japan recorded a projected CAGR of 3.8% from 2025 to 2035, up from 3.1% during 2020;2024. Limited early-stage growth was linked to brand-dominated prescribing and slow PMDA approvals. Recent policy changes enabled greater clinical use of small molecule inhibitors beyond oncology, particularly in respiratory and dermatological conditions. Improved pharmacist training and expanded point-of-care dispensing have also supported wider usage. Japanese companies have begun accelerating post-market studies to extend therapeutic labels.

A CAGR of 7.7% has been forecasted for 2025;2035, improving from 5.9% during 2020;2024. In the earlier period, small molecule inhibitors were restricted to high-end oncology hospitals in metro cities. By 2025, rapid expansion of domestic API production in Gujarat and Telangana, along with digital prescription platforms, boosted rural and semi-urban access. Government programs now promote inhibitors for respiratory, inflammatory, and cardiovascular indications, particularly through public hospitals and D2C channels.

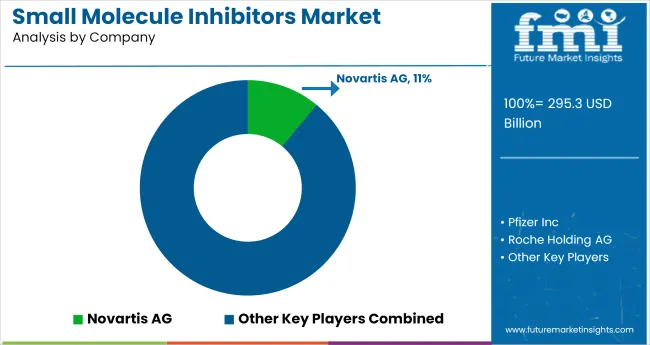

Leading Company ; Novartis AG; Industry Share ; 11%

The small molecule inhibitors market features a fragmented but intensifying competitive environment, segmented into dominant pharmaceutical innovators, oncology-focused developers, and targeted therapy specialists. Novartis, Pfizer, and Roche lead the category with blockbuster molecules in cancer, inflammation, and cardiovascular pathways. These players leverage proprietary R&D engines, biologics-small molecule hybrids, and multi-indication regulatory strategies to maintain dominance.

Key players like AstraZeneca, Merck & Co., and Bristol-Myers Squibb are doubling down on kinase and PARP inhibitor pipelines, with parallel expansion into companion diagnostics and biosimilars to hedge revenue dependencies. Meanwhile, firms such as Janssen, AbbVie, and Eli Lilly are scaling oral therapeutic portfolios targeting hematological and autoimmune indications.

Emerging participants, including Gilead Sciences, Takeda, and Amgen, are pivoting toward allosteric inhibitors, synthetic lethality, and precision drug delivery technologies. Most companies are advancing three strategic priorities: improving oral bioavailability and selectivity, integrating digital biomarkers for dose modulation, and co-developing synergistic combination regimens to elevate treatment outcomes and lifecycle value.

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 295.3 billion |

| Projected Industry Size (2035) | USD 514.1 billion |

| CAGR (2025 to 2035) | 5.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million doses for volume |

| Drug Classes Analyzed (Segment 1)/p> | Kinase Inhibitors, Proteasome Inhibitors, PARP Inhibitors, BCL-2 Inhibitors, BTK Inhibitors, CDK Inhibitors, Immunomodulatory Small Molecules, CGRP Inhibitors, Others |

| Therapeutic Areas Analyzed (Segment 2) | Oncology, Autoimmune and Inflammatory Diseases, Infectious Diseases, Neurology, Cardiovascular and Metabolic Disorders, Rare Diseases, Pain Management |

| Sales Channels Analyzed (Segment 3) | Hospitals, Cancer Research Institutes, Specialty Clinics, Retail Pharmacy Chains, Specialty Pharmacies, Mail Order Pharmacies |

| Molecules Analyzed (Segment 4) | Small Organic Molecules, Peptidomimetics, Natural Product-Derived Molecules |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Novartis AG, Pfizer Inc, Roche Holding AG, Bristol-Myers Squibb, AstraZeneca plc, Merck & Co., Inc., Janssen Pharmaceuticals, AbbVie Inc., Takeda Pharmaceutical Co, Gilead Sciences, Inc., Eli Lilly and Company, Amgen Inc. |

| Additional Attributes | Dollar sales by molecule and therapeutic area, oncology market leadership, emerging peptidomimetic therapies, expansion of immunomodulatory inhibitor use, shift toward outpatient and specialty pharmacy distribution |

The industry includes kinase inhibitors, proteasome inhibitors, PARP inhibitors, BCL-2 inhibitors, BTK inhibitors, CDK inhibitors, immunomodulatory small molecules, CGRP inhibitors, and others.

The industry covers oncology, autoimmune and inflammatory diseases, infectious diseases, neurology, cardiovascular and metabolic disorders, rare diseases, and pain management.

These products are distributed through hospitals, cancer research institutes, specialty clinics, retail pharmacy chains, specialty pharmacies, and mail order pharmacies.

The segmentation includes small organic molecules, peptidomimetics, and natural product-derived molecules.

The industry is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific.

The industry is projected to reach USD 514.1 billion by 2035.

The industry is expected to grow at a CAGR of 5.7% from 2025 to 2035.

Immunomodulatory small molecules are expected to dominate with a 58% share in 2025.

The industry is estimated to reach USD 295.3 billion in 2025.

India is expected to be the key growth region with a projected CAGR of 7.7% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Small Form Factor (SFF) Connectors Market Size and Share Forecast Outlook 2025 to 2035

Small Satellite Market Size and Share Forecast Outlook 2025 to 2035

Small Marine Engine Market Forecast Outlook 2025 to 2035

Small Gas Engine Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Metabolic Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Running Wheel System Market Size and Share Forecast Outlook 2025 to 2035

Small Caliber Ammunition Market Size and Share Forecast Outlook 2025 to 2035

Small Boats Market Size and Share Forecast Outlook 2025 to 2035

Small Capacity Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Imaging (In Vivo) Market Size and Share Forecast Outlook 2025 to 2035

Small Cell Lung Cancer (SCLC) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Small Cell Network Market Size and Share Forecast Outlook 2025 to 2035

Small Wind Turbine Market Size and Share Forecast Outlook 2025 to 2035

Small Off-Road Engines Market Size and Share Forecast Outlook 2025 to 2035

Small Continuous Fryer Market Size and Share Forecast Outlook 2025 to 2035

Small Signal Transistor Market Size and Share Forecast Outlook 2025 to 2035

Small Bowel Enteroscopes Market Size and Share Forecast Outlook 2025 to 2035

Small Paint Pail Market Size and Share Forecast Outlook 2025 to 2035

Small Bore Connectors Market Analysis - Size, Growth, and Forecast 2025 to 2035

Small Space Furniture Market Trends – Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA