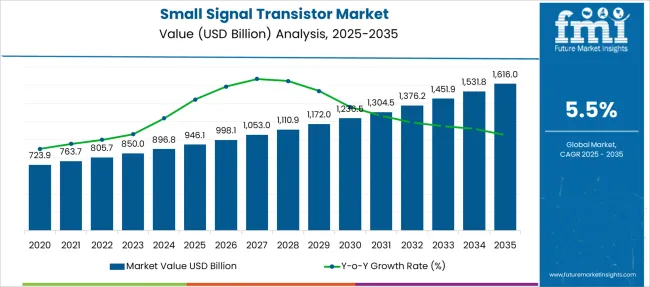

The Small Signal Transistor Market is estimated to be valued at USD 946.1 billion in 2025 and is projected to reach USD 1616.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Small Signal Transistor Market Estimated Value in (2025 E) | USD 946.1 billion |

| Small Signal Transistor Market Forecast Value in (2035 F) | USD 1616.0 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The proliferation of smart gadgets and the Internet of Things has intensified the need for efficient signal amplification components. Advances in semiconductor manufacturing have improved the performance and reliability of small signal transistors while reducing costs. Growing consumer adoption of smartphones, wearable devices, and home automation systems has fueled market growth by increasing the volume of electronics requiring these transistors.

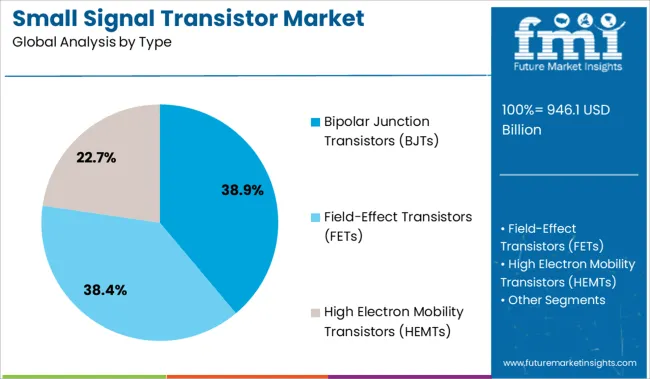

Industry efforts to develop energy-efficient and miniaturized components have further supported the trend. With continuous innovation in portable and connected electronics, the market outlook remains positive. Segmental growth is expected to be driven by Bipolar Junction Transistors (BJTs) due to their robustness and consumer electronics as the leading industry vertical.

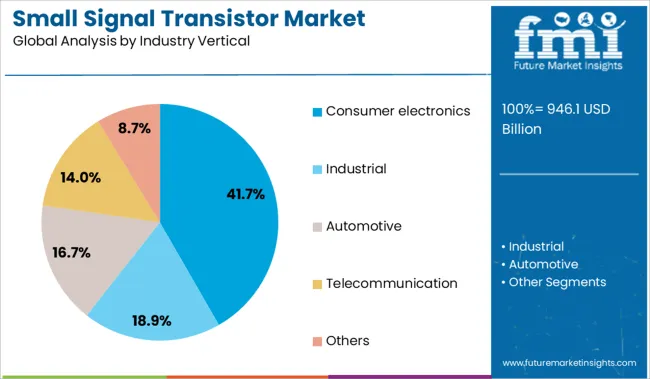

The small signal transistor market is segmented by type and industry vertical, and geographic regions. The small signal transistor market is divided by type into Bipolar Junction Transistors (BJTs), Field-Effect Transistors (FETs), and High Electron Mobility Transistors (HEMTs). The small signal transistor market is classified by industry vertical into Consumer Electronics, Industrial, Automotive, Telecommunication, and Others. Regionally, the small signal transistor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Bipolar Junction Transistors segment is projected to hold 38.9% of the market revenue in 2025, remaining the dominant type in the small signal transistor market. This segment’s growth is supported by BJTs’ ability to provide reliable amplification and switching performance across a wide frequency range.

Their relatively simple design and cost-effectiveness have made them a preferred choice in various analog circuit applications. BJTs continue to be favored in designs where linearity and gain are critical.

Their widespread use in audio devices, radio frequency circuits, and power management modules has reinforced their market position. As electronic devices demand consistent and stable performance, the Bipolar Junction Transistor segment is expected to sustain its leading role.

The Consumer Electronics segment is projected to contribute 41.7% of the small signal transistor market revenue in 2025, establishing itself as the largest industry vertical. Growth in this segment has been fueled by the expanding market for smartphones, laptops, tablets, and wearable devices, all of which rely heavily on small signal transistors for signal processing and amplification.

Consumer preference for compact, high-performance, and energy-efficient electronics has driven demand for advanced transistor components. Additionally, increasing investments in next-generation communication technologies and smart home devices have broadened application opportunities.

The segment benefits from rapid product innovation cycles and growing consumer spending on electronic devices. As connectivity and digitalization intensify, the Consumer Electronics vertical is expected to remain a primary driver of market expansion.

Demand for small signal transistors is accelerating across consumer electronics, automotive modules, and IoT devices. Sales of low-noise, high-gain bipolar and FET transistors are surging as miniaturization and power efficiency reshape design architecture. Surface-mount variants are leading volume growth across high-frequency and switching applications.

Demand for small signal transistors in surface-mount packaging jumped 18% YoY in 2025, as PCB designers across Asia and North America transitioned to miniaturized modules. Smartphones and wearables adopted ultra-compact SOT-23 and SOT-323 transistors to optimize board real estate. Telecom OEMs upgraded RF front-ends with low-leakage, fast-switching NPN transistors that delivered 27% lower power dissipation. Automotive Tier 1 suppliers integrated high-voltage small signal transistors into ADAS sensor interfaces, citing improved EMI resilience and thermal control. Production lines in Malaysia and Vietnam ramped up output of dual-pack transistors, enabling cost-per-unit reductions of 12% across consumer electronics contracts.

Sales of low-noise small signal transistors increased 22% in 2025, driven by demand from audio preamplifier circuits, sensor buffers, and analog front-end designs. Industrial automation OEMs adopted ultra-low noise FETs for precision position control and feedback loops. Signal conditioning systems in aerospace and medical instrumentation integrated transistors with <1nV/√Hz noise levels, improving system SNR by 31%. Audio interface designers in Europe shifted to low hFE drift transistors to maintain tonal clarity in compact speaker systems. Fast rise-time devices supporting 1–10MHz switching also gained market share in point-of-load converters and low-latency logic circuits.

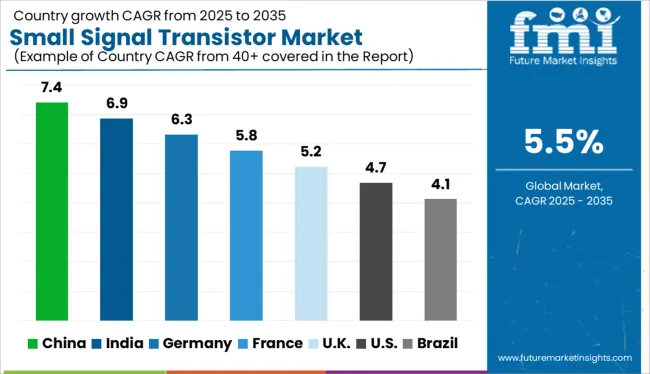

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

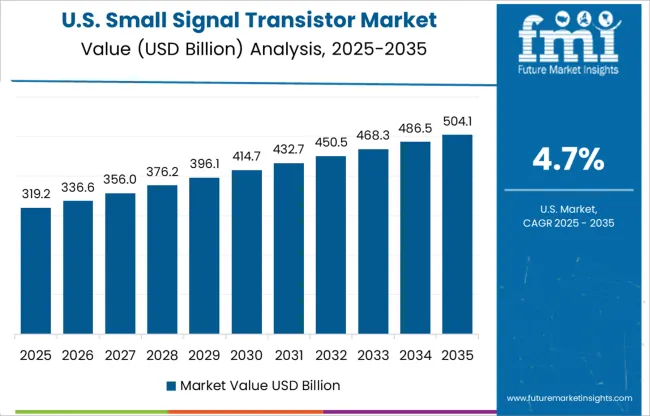

| USA | 4.7% |

| Brazil | 4.1% |

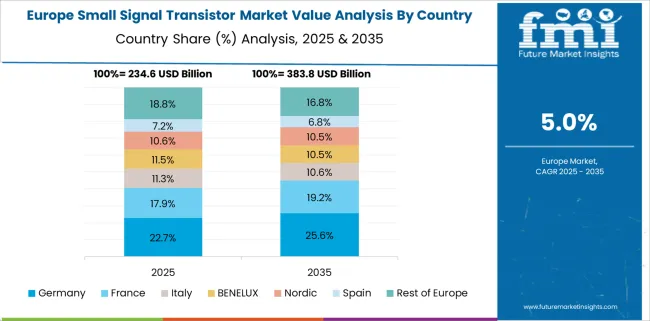

The global market is projected to grow at a CAGR of 5.5% between 2025 and 2035. China is expanding fastest at 7.4%, led by the surge in consumer electronics manufacturing and investments in semiconductor localization. India follows with a 6.9% CAGR, as domestic electronics assembly and demand for low-power devices gain momentum. Among OECD members, Germany is progressing at 6.3%, supported by strong industrial electronics demand and auto-sector digitization. The UK is near the global average at 5.2%, while the USA lags slightly at 4.7%, due to outsourcing trends and mature local production. The BRICS bloc continues to outpace growth across most developed markets, while ASEAN economies are expected to see steady expansion driven by electronics exports. This variation in CAGR reflects diverging strategies in manufacturing, design innovation, and supply chain resilience across key regions. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is forecast to lead the global small signal transistor market with a CAGR of 7.4% from 2025 to 2035, supported by its stronghold in semiconductor manufacturing and rising demand from the consumer electronics and automotive sectors. During 2020-2024, growth was primarily driven by discrete component usage in mobile and TV production. The next decade is expected to see a sharp rise in the integration of small signal transistors into electric vehicle control units, smart appliances, and 5G infrastructure. Local fabs are boosting investments in bipolar junction transistor (BJT) and MOSFET production lines to meet internal consumption and export demand.

India’s small signal transistor market is expected to grow at a CAGR of 6.9% during 2025-2035, driven by increasing localization in electronics manufacturing and the rise of IoT-based consumer devices. Between 2020 and 2024, imports dominated the supply chain for transistors in smartphones and televisions. Now, Make-in-India initiatives and semiconductor policy incentives are encouraging domestic foundries to establish small signal transistor production capabilities. Demand is rising from PCB designers and embedded system developers who are prioritizing compact, low-power components for wireless communication modules and wearables.

Germany is projected to see its small signal transistor market grow at a CAGR of 6.3% between 2025 and 2035, supported by the country’s robust automotive electronics industry and push for industrial automation. From 2020 to 2024, transistors were used mainly in control boards and infotainment systems. Looking ahead, demand is rising for high-reliability small signal transistors in ADAS (Advanced Driver Assistance Systems), EV chargers, and smart industrial controllers. German Tier 1 suppliers are collaborating with global semiconductor firms to localize high-speed switching transistor supply chains.

The small signal transistor market in the United Kingdom is poised to grow at a CAGR of 5.2% through 2035, supported by expanding defense electronics projects and upgrades in telecom infrastructure. Between 2020 and 2024, growth was steady across medical devices and low-volume industrial equipment. Going forward, domestic demand is strengthening for transistors with higher thermal stability and switching speeds to support applications in radar systems, communication modules, and edge AI devices. The UK government’s backing of compound semiconductor clusters is also improving access to advanced discrete components.

The small signal transistor market in the United States is projected to expand at a CAGR of 4.7% during the forecast period, influenced by renewed interest in domestic semiconductor security and growth in medical and aerospace electronics. During 2020-2024, imports filled most of the demand for discrete transistors in consumer and industrial products. In the next phase, reshoring initiatives and CHIPS Act incentives are encouraging domestic fabs to scale up small signal transistor production. Applications in ventilators, drones, and test equipment are shaping procurement patterns for high-efficiency transistor variants.

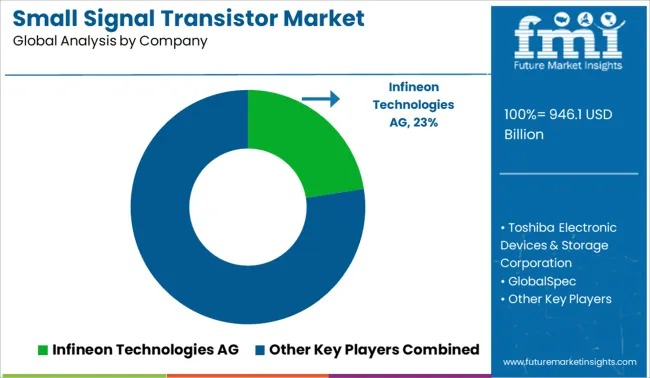

Demand for small signal transistors in 2025 continues to rise with growing applications in signal amplification, switching circuits, and compact embedded systems. Infineon Technologies leads the global landscape with a significant market share, driven by robust performance in automotive and industrial signal processing. STMicroelectronics and NXP Semiconductors are reinforcing their positions through advanced bipolar junction and field-effect transistor offerings for high-frequency modules. Sales of small signal transistors from Toshiba focus on low-noise, energy-efficient components across sensor and RF circuits. Microchip Technologies and GlobalSpec cater to niche demands in consumer electronics and microcontroller-integrated switching. Cadence Design Systems supports innovation through design simulation platforms that enhance transistor integration across IoT and communication hardware ecosystems.

Recent Small Signal Transistor Industry News In November 2024, Infineon introduced the CoolGaN™ 650 V G5, showcased at electronica Munich. This advanced GaN product enhances power density and switching efficiency, underscoring the company’s commitment to cutting-edge transistor innovation.

| Item | Value |

|---|---|

| Quantitative Units | USD 946.1 Billion |

| Type | Bipolar Junction Transistors (BJTs), Field-Effect Transistors (FETs), and High Electron Mobility Transistors (HEMTs) |

| Industry Vertical | Consumer electronics, Industrial, Automotive, Telecommunication, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Infineon Technologies AG, Toshiba Electronic Devices & Storage Corporation, GlobalSpec, Cadence Design Systems, Inc., STMicroelectronics, Microchip Technologies Inc., and NXP Semiconductors N.V |

| Additional Attributes | Dollar sales by transistor type and circuit application, demand dynamics across consumer electronics and industrial automation, regional trends in miniaturized component integration, innovation in low-noise and high-frequency switching technologies, environmental impact of semiconductor fabrication and material sourcing, and emerging use cases in wearable devices and IoT sensor nodes. |

The global small signal transistor market is estimated to be valued at USD 946.1 billion in 2025.

The market size for the small signal transistor market is projected to reach USD 1,616.0 billion by 2035.

The small signal transistor market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in small signal transistor market are bipolar junction transistors (bjts), field-effect transistors (fets) and high electron mobility transistors (hemts).

In terms of industry vertical, consumer electronics segment to command 41.7% share in the small signal transistor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Small Molecule Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Small Form Factor (SFF) Connectors Market Size and Share Forecast Outlook 2025 to 2035

Small Satellite Market Size and Share Forecast Outlook 2025 to 2035

Small Marine Engine Market Forecast Outlook 2025 to 2035

Small Gas Engine Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule CDMO Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule CMO/CDMO Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Metabolic Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Running Wheel System Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule-Drug Conjugates Market Size and Share Forecast Outlook 2025 to 2035

Small Caliber Ammunition Market Size and Share Forecast Outlook 2025 to 2035

Small Boats Market Size and Share Forecast Outlook 2025 to 2035

Small Capacity Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Imaging (In Vivo) Market Size and Share Forecast Outlook 2025 to 2035

Small Cell Lung Cancer (SCLC) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule Innovator CDMO Market Size and Share Forecast Outlook 2025 to 2035

Small Cell Network Market Size and Share Forecast Outlook 2025 to 2035

Small Wind Turbine Market Size and Share Forecast Outlook 2025 to 2035

Small Off-Road Engines Market Size and Share Forecast Outlook 2025 to 2035

Small Continuous Fryer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA