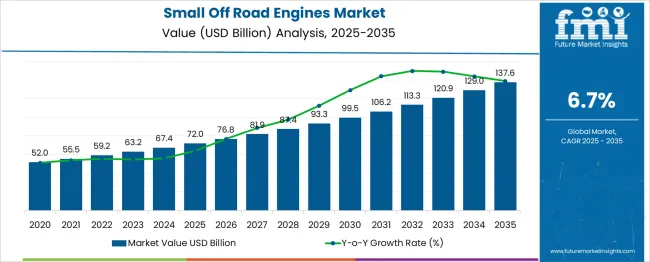

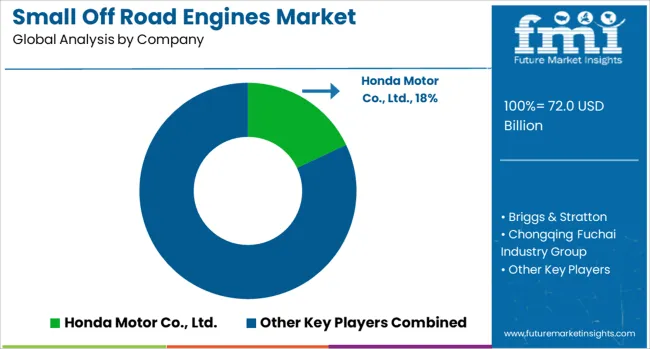

The Small Off-Road Engines Market is estimated to be valued at USD 72.0 billion in 2025 and is projected to reach USD 137.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period. It represents a key segment within the broader Global Off-Road Engine and Power Equipment parent market, which includes industrial engines, agricultural engines, construction machinery engines, and recreational vehicle engines. Within this ecosystem, SORE accounts for roughly 25-30% of the total off-road engine market, reflecting its importance in landscaping equipment, compact construction machinery, generators, and recreational off-road vehicles.

The parent market is segmented by engine technology and fuel type. Conventional gasoline engines dominate SORE with approximately 55-60% market share, favored for cost-effectiveness, availability, and ease of maintenance. Diesel engines hold around 20-25%, primarily in commercial and industrial compact machinery due to torque and durability advantages.

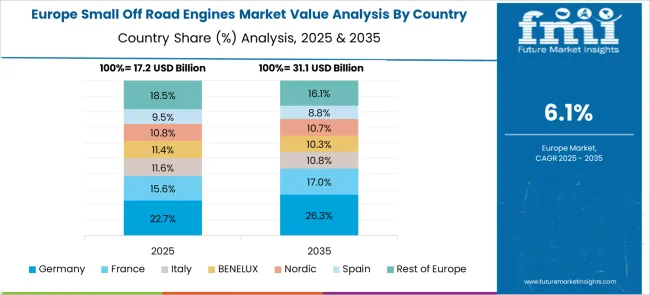

Emerging electric and hybrid engines, analogous to “Electric Hydraulic” and “EPS” in voltage regulation, capture roughly 15–20%, growing steadily as emission regulations, electrification initiatives, and urban noise restrictions drive adoption. Geographically, Asia-Pacific leads with ~40% share due to high demand in agriculture, landscaping, and small construction sectors, followed by North America (~30%) and Europe (~20%), while the rest of the world contributes ~10%. SORE’s growth outpaces the broader parent market, reflecting modernization and electrification trends in small off-road equipment.

| Metric | Value |

|---|---|

| Small Off-Road Engines Market Estimated Value in (2025 E) | USD 72.0 billion |

| Small Off-Road Engines Market Forecast Value in (2035 F) | USD 137.6 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The small off road engines market is progressing steadily as demand grows from applications such as lawn and garden equipment, utility vehicles, and construction machinery. The market is being shaped by a focus on fuel efficiency, compliance with emission regulations, and consumer preference for reliable and low-maintenance engines.

Advancements in engine design and materials are enabling manufacturers to deliver higher performance within compact form factors while reducing operational costs and environmental impact. Future growth is expected to benefit from the rising adoption of power equipment in residential and commercial landscaping, as well as infrastructure development activities that require portable machinery.

The integration of cleaner combustion technologies and improved durability features is paving the way for increased adoption and competitive differentiation.

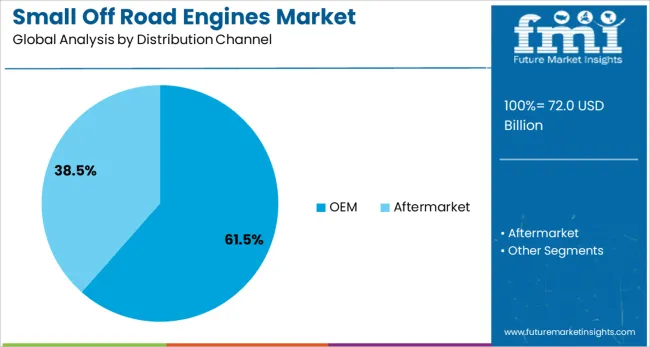

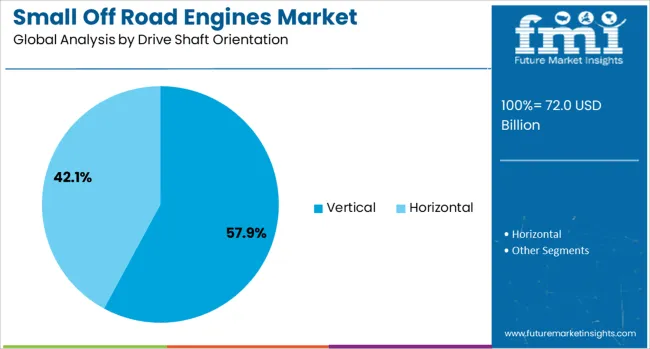

The small off-road engines market is segmented by engine displacement, no. of cylinders, drive shaft orientation, end use, distribution channel, and geographic regions. By engine displacement, the small off-road engines market is divided into three categories: 100-500cc, up to 100cc, and 500cc to 800cc. In terms of the number of cylinders, the small off-road engines market is classified into Single, Double, and Multi. Based on the drive shaft orientation, the small off-road engines market is segmented into Vertical and Horizontal. By end use, the small off-road engines market is segmented into Agriculture, Domestic, Gardening/ Landscaping, Residential, Commercial, Industrial, Automotive, and Construction. By distribution channel, the small off-road engines market is segmented into OEM and Aftermarket. Regionally, the small off-road engines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by engine displacement, the 100 to 500cc segment is expected to account for 46.8% of the market revenue in 2025, positioning it as the leading segment. This dominance is being driven by the versatility of engines within this range, which makes them suitable for a wide variety of small off-road equipment.

Their compact size, combined with sufficient power output, has made them a preferred choice for both residential and light commercial applications. Manufacturers have optimized engines in this displacement range to meet stricter emissions standards without compromising on performance or durability.

The balance between cost effectiveness, fuel efficiency, and ease of maintenance has further strengthened the appeal of this segment, ensuring its continued leadership across diverse end-use scenarios.

Segmenting by number of cylinders shows that the single cylinder segment is projected to hold 64.3% of the market revenue in 2025, maintaining its top position. This leadership is being supported by the simplicity and reliability of single cylinder configurations, which are particularly suited to the intermittent and moderate-duty cycles typical of small off road applications.

Their lightweight design, lower production costs, and reduced maintenance requirements have contributed to widespread adoption across consumer and professional equipment. Continuous improvements in vibration damping, fuel economy, and thermal management have enhanced the performance of single cylinder engines, making them an optimal choice where compactness and affordability are prioritized.

The enduring preference for this configuration in portable and entry-level machines has secured its prominence within the market.

When segmented by drive shaft orientation, the vertical shaft segment is anticipated to capture 57.9% of the market revenue in 2025, establishing itself as the leading orientation. This segment’s dominance is being reinforced by its suitability for lawn mowers and other turf care equipment, which represent a significant share of small off road engine applications.

The vertical orientation allows for efficient integration into chassis designs commonly used in mowing and cutting equipment, providing better weight distribution and mechanical efficiency. Manufacturers have refined vertical shaft engines to deliver improved durability, ease of service, and compliance with emission standards, further driving their adoption.

The alignment of this configuration with the functional requirements of the largest demand segments has solidified its leadership in the overall market.

The small off-road engines market is growing steadily due to rising demand for compact, high-performance engines in recreational and utility vehicles. These engines power ATVs, lawn equipment, golf carts, and construction machinery, emphasizing reliability and fuel efficiency. Asia-Pacific leads due to increasing recreational activities and agricultural mechanization, while North America and Europe focus on emission-compliant and high-durability engines. Product development emphasizes lightweight designs, fuel economy, and lower noise levels. Expansion in rental services, landscaping, and outdoor recreation supports sustained market growth.

Small off-road engines are extensively used in ATVs, dirt bikes, snowmobiles, and golf carts, catering to both recreational and utility applications. The rise in outdoor leisure activities, adventure sports, and landscaping services is boosting engine demand. Compact and lightweight designs allow easier maneuverability and maintenance, making them ideal for diverse terrains. In agriculture and construction, small off-road engines power equipment like mini tractors and pumps, supporting efficiency and productivity. Manufacturers are focusing on engines that balance power output with fuel efficiency, enabling longer operation hours while minimizing operating costs. This versatility in applications continues to drive adoption globally.

Regulatory requirements for emissions and fuel consumption are shaping small off-road engine designs. Manufacturers are investing in low-emission technologies, including four-stroke engines, catalytic converters, and optimized combustion systems. Fuel-efficient engines help reduce operating costs for end-users while meeting environmental standards in developed markets. Lightweight materials, improved cooling, and advanced ignition systems enhance overall engine performance. Compliance with regional emission norms, such as EPA in North America and Stage V in Europe, is crucial for market acceptance. The growing importance of environmental regulations is influencing product development, with demand for cleaner and more efficient engines rising steadily across all applications.

Asia-Pacific dominates due to rapid mechanization in agriculture, landscaping, and construction sectors, along with increasing recreational vehicle use. North America emphasizes durable and emission-compliant engines for recreational vehicles and professional landscaping equipment. Europe prioritizes environmentally friendly engines due to stringent regulations and growing adoption of eco-conscious outdoor machinery. Regional trends in outdoor recreation, agricultural modernization, and small-scale construction projects directly influence the types of engines in demand. Market expansion is also supported by increased rental services for recreational vehicles and equipment, creating recurring demand for reliable small off-road engines.

Engine manufacturers are forming collaborations with vehicle OEMs, distributors, and service providers to expand market reach and improve product offerings. Partnerships enable co-development of engines with higher efficiency, durability, and emission compliance. Collaborations also facilitate faster adoption of engines in new vehicle models and applications, ensuring reliable supply chains for end-users. Companies work with dealers and service networks to provide after-sales support, improving customer trust. By leveraging strategic partnerships, manufacturers can expand regional presence, accelerate product innovation, and maintain competitiveness in a market characterized by diverse applications and performance expectations.

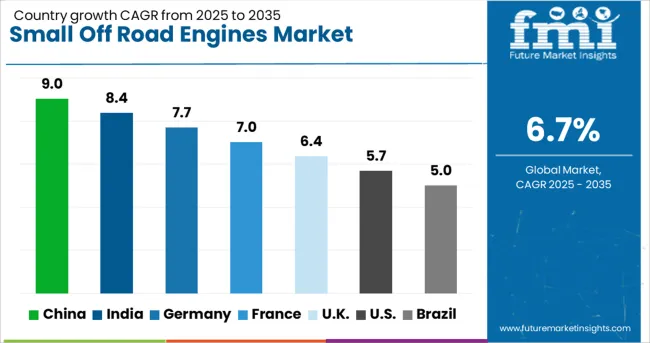

| Country | CAGR |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| France | 7.0% |

| UK | 6.4% |

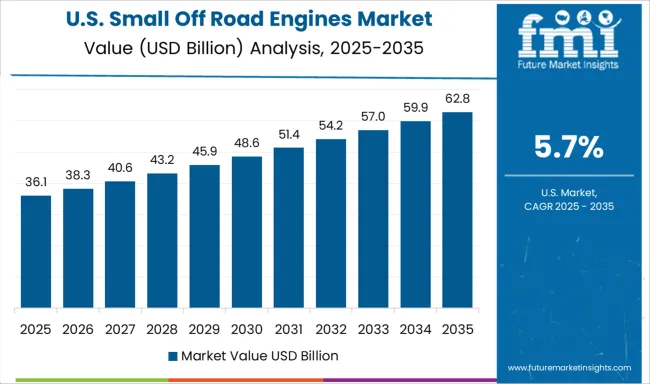

| USA | 5.7% |

| Brazil | 5.0% |

The small off-road engines market is projected to grow at a CAGR of 6.7%, reflecting steady demand from agricultural, construction, and recreational vehicle sectors. China leads with a growth rate of 9.0%, supported by a large production base and widespread adoption in farming and industrial equipment. India follows at 8.4%, driven by mechanization in agriculture and increasing demand for compact construction machinery. Germany, growing at 7.7%, leverages advanced engineering capabilities to produce high-performance engines for European markets. The UK., with 6.4% growth, focuses on reliable supply chains and quality engines for local and export markets, while the USA, at 5.7%, maintains consistent demand through replacement engines and off-road vehicle applications. This report includes insights on 40+ countries; the top countries are shown here for reference. Market expansion is driven by rising mechanization and equipment modernization.

China leads the small off road engines market with 9.0% growth, driven by strong demand from construction, agriculture, and landscaping machinery. Compared to India, China benefits from a large industrial base and government support for rural mechanization. Manufacturers invest heavily in research and development to improve engine fuel efficiency, durability, and emission compliance. Technological advancements focus on compact, high-performance engines suitable for various applications. Urbanization and infrastructure development increase machinery usage, further boosting demand. Local production and export opportunities strengthen China’s position in the global market. Continuous adoption of cleaner technologies and improved engine components supports sustained growth. Rising mechanization in agriculture and industrial sectors ensures long-term demand. Overall, China maintains a leading role due to innovation, scale, and supportive government policies.

India’s market grows at 8.4%, fueled by agriculture mechanization, industrial, and construction machinery. Compared to Germany, India emphasizes cost-effective and versatile engines for rural and urban applications. Government initiatives promoting agricultural mechanization and small-scale industry expansion encourage engine adoption. Local manufacturers focus on improving fuel efficiency, reducing emissions, and extending engine lifespan. Increasing infrastructure projects, landscaping, and irrigation requirements support steady growth. Export potential to neighboring countries further boosts the market. Technological upgrades ensure competitive production quality, while aftermarket support maintains engine longevity. Rising industrialization and urban development amplify engine utilization. The market benefits from affordable solutions combined with performance-focused designs. As mechanization continues, India is projected to experience consistent growth in small off road engines.

Germany grows at 7.7%, driven by industrial, agricultural, and landscaping machinery needs. Compared to the UK, Germany emphasizes high-quality engines meeting strict emission and performance standards. Manufacturers focus on precision engineering, durability, noise reduction, and environmental compliance. Adoption of hybrid and electric small engines influences market trends. Export opportunities across Europe strengthen German market presence. Investments in research and development improve fuel economy and engine reliability. Industrial and construction sectors maintain steady consumption of small off road engines. Sustainability initiatives and regulatory compliance also drive market growth. Germany maintains steady progress due to technological advancements, quality emphasis, and environmentally conscious production.

The UK market grows at 6.4%, driven by demand from industrial, agricultural, and landscaping machinery. Compared to the US, the UK emphasizes compact, efficient engines with emission control and noise reduction. Manufacturers invest in R&D to improve reliability, fuel efficiency, and lifespan. Demand is supported by landscaping, irrigation, and construction machinery usage. Aftermarket services and replacement parts further support growth. Technological improvements allow engines to meet environmental regulations and consumer expectations. Ongoing infrastructure projects and mechanization trends ensure consistent market expansion. The UK market demonstrates steady growth due to technological development, sectoral demand, and regulatory compliance.

The US market grows at 5.7%, driven by construction, agriculture, and landscaping machinery requirements. Compared to China, the US emphasizes emission compliance, fuel efficiency, and engine durability. Local manufacturers focus on performance, maintenance reduction, and lifespan improvement. Hybrid and electric small engine alternatives meet environmental standards and consumer expectations. Demand from commercial landscaping, irrigation, and recreational equipment supports market growth. Aftermarket and replacement demand also contribute to steady expansion. Technological advancements continue to enhance engine efficiency and performance. Overall, the US small off road engines market shows consistent moderate growth due to innovation, sectoral demand, and sustainable engine development.

The small off-road engines market presents significant barriers to entry due to capital-intensive manufacturing requirements, stringent emission compliance, and complex engineering for fuel efficiency, reliability, and low-noise operation. Regulatory approvals and international certifications, such as EPA, CARB, and EU Stage V standards, create hurdles for new entrants. Intellectual property protection and established OEM partnerships further consolidate market positions of dominant players like Honda, Briggs & Stratton, and Kawasaki, limiting immediate competitive inroads.

Regional expansion strategies are concentrated on emerging markets in Asia-Pacific, Latin America, and Eastern Europe, where demand for affordable, fuel-efficient engines is growing in agriculture, construction, and landscaping segments. Greenfield plants, localized assembly, and partnerships with regional equipment manufacturers are leveraged to enhance market penetration and reduce logistical overhead. In developed markets, growth relies on premium, emission-compliant engines, hybrid solutions, and aftermarket service networks.

Market challenges include volatility in raw material costs, particularly steel and aluminum, increasing pressure to meet global emission norms, and the rising adoption of electric alternatives for compact outdoor equipment. Competitive players are navigating these dynamics by investing in R&D for low-emission fuels, modular engine architectures, and hybrid or electric powertrains. Companies that balance performance, compliance, and cost-effectiveness while addressing regional demand variations are positioned to secure sustainable market growth.

| Item | Value |

|---|---|

| Quantitative Units | USD 72.0 Billion |

| Engine Displacement | 100-500cc, Upto 100cc, and 500cc to 800cc |

| No. of Cylinders | Single, Double, and Multi |

| Drive Shaft Orientation | Vertical and Horizontal |

| End Use | Agriculture, Domestic, Gardening/ Landscaping, Residential, Commercial, Industrial, Automotive, and Construction |

| Distribution Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honda Motor Co., Ltd., Briggs & Stratton, Chongqing Fuchai Industry Group, Chongqing Zongshen Power Machinery Co., Ltd., Greaves Cotton Ltd., Kawasaki Heavy Industries, Ltd., Kohler Co., Kubota Corporation, Lifan Industry (Group) Co., Ltd., Liquid Combustion Technology, LLC, Loncin Motor Co., Ltd., Mitsubishi Heavy Industries Engine & Turbocharger, Ltd., Motorenfabrik Hatz GmbH & Co. KG, Yamaha Motor Co., Ltd., and Yanmar Co., Ltd. |

| Additional Attributes | Dollar sales in the Small Off Road Engines Market vary by engine type including gasoline and diesel, application across agriculture, construction, and recreational vehicles, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising mechanization in agriculture, increasing construction activities, and demand for recreational off-road vehicles. |

The global small off-road engines market is estimated to be valued at USD 72.0 billion in 2025.

The market size for the small off-road engines market is projected to reach USD 137.6 billion by 2035.

The small off-road engines market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in small off-road engines market are 100-500cc, upto 100cc and 500cc to 800cc.

In terms of no. of cylinders, single segment to command 64.3% share in the small off-road engines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Emission Control Catalyst for Small Engines Market - Size, Share, and Forecast 2025 to 2035

Small Molecule Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Small Form Factor (SFF) Connectors Market Size and Share Forecast Outlook 2025 to 2035

Small Satellite Market Size and Share Forecast Outlook 2025 to 2035

Small Marine Engine Market Forecast Outlook 2025 to 2035

Small Gas Engine Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule CDMO Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule CMO/CDMO Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Metabolic Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Running Wheel System Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule-Drug Conjugates Market Size and Share Forecast Outlook 2025 to 2035

Small Caliber Ammunition Market Size and Share Forecast Outlook 2025 to 2035

Small Boats Market Size and Share Forecast Outlook 2025 to 2035

Small Capacity Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Imaging (In Vivo) Market Size and Share Forecast Outlook 2025 to 2035

Small Cell Lung Cancer (SCLC) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule Innovator CDMO Market Size and Share Forecast Outlook 2025 to 2035

Small Cell Network Market Size and Share Forecast Outlook 2025 to 2035

Small Wind Turbine Market Size and Share Forecast Outlook 2025 to 2035

Small Continuous Fryer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA