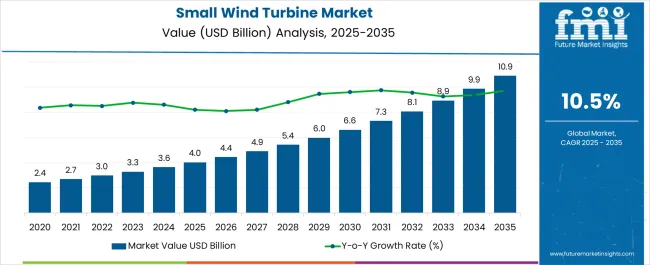

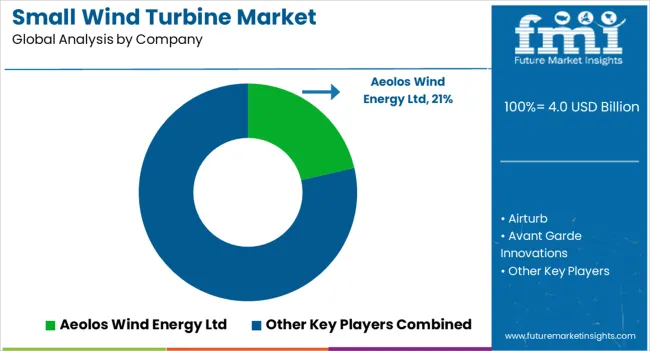

The Small Wind Turbine Market is estimated to be valued at USD 4.0 billion in 2025 and is projected to reach USD 10.9 billion by 2035, registering a compound annual growth rate (CAGR) of 10.5% over the forecast period. The market maturity curve illustrates a progression through early adoption, scaling, and consolidation phases, aligned with technological advancements, policy support, and increasing deployment of distributed renewable energy systems. During the early adoption phase leading up to 2025, market penetration remained selective, with investments concentrated in pilot projects and off-grid applications.

The market value of USD 4.0 billion reflected limited commercial deployment, with high installation costs and variability in small-scale turbine efficiency constraining broader uptake. From 2025 to 2030, the market enters the scaling phase, growing to approximately USD 6.6 billion by 2030. Expansion during this period is driven by reductions in capital expenditure, improvements in turbine design and reliability, and supportive regulatory frameworks incentivizing decentralized renewable energy generation. Early movers and established turbine manufacturers increased production capacity, while new entrants leveraged modular designs and integrated digital monitoring to accelerate adoption. The consolidation phase, spanning 2030 to 2035, sees the market reaching USD 10.9 billion. In this phase, industry players are expected to optimize operational efficiency, standardize product offerings, and strengthen distribution networks.

Mature adoption across residential, commercial, and community energy projects reduces barriers to entry, while incremental innovations in turbine materials and control systems sustain market growth. The adoption lifecycle reflects a transition from niche deployment to mainstream integration, positioning small wind turbines as a viable component of decentralized energy solutions.

| Metric | Value |

|---|---|

| Small Wind Turbine Market Estimated Value in (2025 E) | USD 4.0 billion |

| Small Wind Turbine Market Forecast Value in (2035 F) | USD 10.9 billion |

| Forecast CAGR (2025 to 2035) | 10.5% |

The small wind turbine market is gaining momentum due to increasing demand for decentralized clean energy solutions, rural electrification initiatives, and heightened awareness of carbon neutrality goals. Small wind systems are being adopted in residential, agricultural, and commercial settings where grid connectivity is limited or cost-prohibitive.

Technological advancements in turbine efficiency, lightweight materials, and intelligent control systems have improved energy output and system reliability, driving wider adoption. Supportive government incentives, feed-in tariffs, and net metering policies are further encouraging investment in small-scale wind systems.

As energy resilience and sustainability become critical focus areas for both developed and developing regions, the market is positioned for steady expansion, with emphasis on hybrid systems, modular designs, and rooftop integrations that align with modern energy needs.

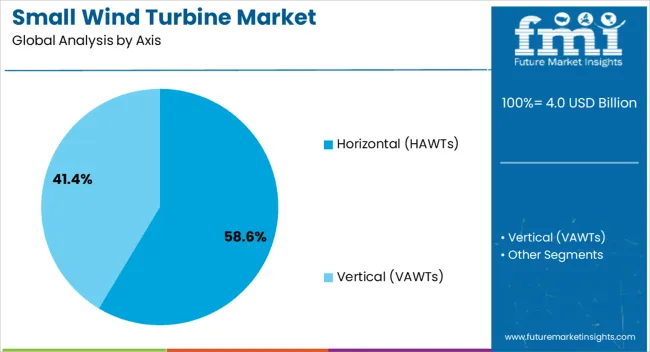

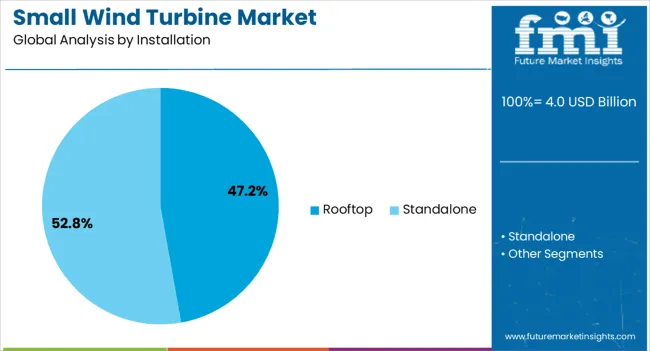

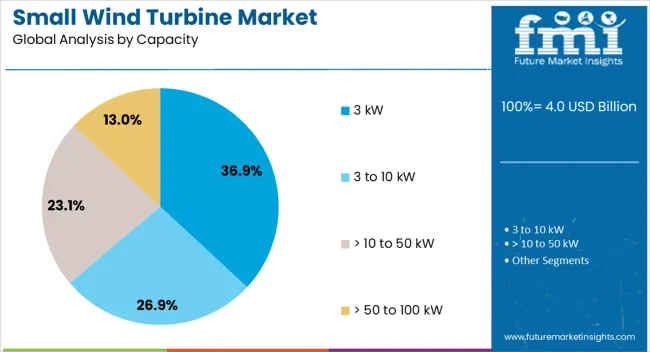

The small wind turbine market is segmented by axis, installation, capacity, application, and geographic regions. By axis, the small wind turbine market is divided into Horizontal (HAWTs) and Vertical (VAWTs). In terms of installation, the small wind turbine market is classified into Rooftop and Standalone. Based on capacity, the small wind turbine market is segmented into 3 kW, 3 to 10 kW, > 10 to 50 kW, and > 50 to 100 kW.

By application, the small wind turbine market is segmented into Residential and Commercial. Regionally, the small wind turbine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The horizontal axis wind turbine segment is projected to contribute 58.60% of total market revenue by 2025 under the axis category, making it the most dominant. This position is supported by its high energy conversion efficiency, proven design architecture, and compatibility with varying wind conditions.

These turbines have been favored for their ability to operate at higher speeds and generate consistent output, especially in open and semi-urban environments. Their longstanding use in the wind energy sector has contributed to manufacturing scale, cost efficiency, and technological refinement.

As performance optimization remains a key driver in small wind applications, horizontal-axis systems continue to lead in deployment due to their superior aerodynamics and energy yield.

The rooftop installation segment is expected to hold 47.20% of the overall market revenue by 2025, establishing it as the leading installation type. The growth of this segment is being driven by space optimization in urban and suburban settings, growing interest in building-integrated renewables, and the rising cost of electricity in residential areas.

Rooftop turbines provide an accessible way for homeowners and small businesses to reduce dependency on conventional energy sources. With improvements in noise control, vibration reduction, and lightweight rotor materials, these systems have become more suitable for installation on buildings and small structures.

The convenience and reduced infrastructure requirements have propelled rooftop systems into mainstream adoption, making them the preferred installation choice in the small wind turbine market.

The 3 kW capacity segment is anticipated to represent 36.90% of total market revenue by 2025 within the capacity category, making it the largest shareholder. This capacity range is particularly well-suited for individual homes, small farms, and remote facilities requiring moderate power generation.

It strikes a balance between affordability, output, and system scalability. Users in this segment benefit from reduced energy bills and greater control over energy production without incurring the complexity or cost associated with larger turbines.

The 3 kW systems are often easier to install, require minimal maintenance, and qualify for residential renewable energy incentives in various regions. These advantages have collectively established the 3 kW capacity segment as the most widely adopted across small wind turbine applications.

The market has expanded due to the increasing adoption of distributed renewable energy solutions for residential, commercial, and remote applications. Small-scale turbines provide localized electricity generation, reduce dependence on centralized power grids, and complement solar or hybrid energy systems. Advancements in turbine design, higher energy conversion efficiency, and integration with smart energy management systems have driven growth. Environmental awareness, government incentives, and off-grid electrification projects have reinforced adoption. Technological innovations and modular designs have made small wind turbines more accessible, efficient, and reliable for diverse energy applications worldwide.

Technological advancements have significantly strengthened the market by improving energy capture, efficiency, and durability. Blade aerodynamics, low-resistance materials, and high-performance generators have increased energy output in low- to medium-wind-speed areas. Lightweight composite materials and corrosion-resistant coatings have enhanced turbine lifespan and reduced maintenance requirements in challenging environments. Smart controllers and sensors have been integrated to optimize performance, regulate speed, and prevent mechanical damage during high-wind conditions. Additionally, innovations in vertical-axis and horizontal-axis turbine designs have expanded suitability for urban, rural, and industrial installations. Combined with predictive maintenance and remote monitoring capabilities, these technological improvements have increased operational efficiency, reduced downtime, and enhanced the attractiveness of small wind turbines for off-grid and hybrid energy applications globally.

Government policies and renewable energy initiatives have played a crucial role in driving the small wind turbine market. Incentive programs, subsidies, tax credits, and feed-in tariffs have encouraged adoption for residential, commercial, and community-based energy projects. Regulatory frameworks promoting distributed generation, carbon emission reduction, and renewable energy targets have reinforced deployment in urban, rural, and island locations. Off-grid electrification programs have accelerated small wind turbine integration in remote regions with limited grid access. Certification standards and installation guidelines have ensured safety, reliability, and compliance, further increasing market confidence. Policy-driven support, combined with growing public awareness of clean energy and environmental benefits, has positioned small wind turbines as viable alternatives for sustainable electricity generation globally.

Cost-effectiveness and reliability have been significant drivers in the adoption of small wind turbines. Modular designs, scalable installation options, and lower manufacturing costs have enabled wider deployment for residential, commercial, and hybrid energy systems. Operational reliability has been enhanced through improved materials, optimized gearboxes, and aerodynamic blades that withstand variable wind speeds and environmental conditions. Maintenance schedules have been simplified with remote monitoring, predictive diagnostics, and durable components, reducing downtime and total lifecycle costs. The ability to generate consistent power while minimizing operational and maintenance expenditures has attracted adoption in off-grid installations, small-scale commercial facilities, and residential energy systems. These cost and reliability advantages have reinforced small wind turbines as practical and sustainable energy solutions worldwide.

The integration of small wind turbines with hybrid energy systems and smart grids has reinforced market growth. Turbines are increasingly combined with solar panels, energy storage units, and microgrid systems to provide reliable, continuous electricity generation. Smart energy management platforms allow real-time monitoring of generation, storage, and consumption, optimizing energy utilization and reducing wastage. Integration with IoT-enabled control systems facilitates predictive maintenance, fault detection, and efficient load balancing. Community microgrids and off-grid installations have benefited from such hybrid solutions, ensuring uninterrupted power supply and energy resilience. The convergence of small wind turbines with hybrid and smart energy systems has expanded their utility, making them key contributors to decentralized, renewable, and sustainable energy strategies globally.

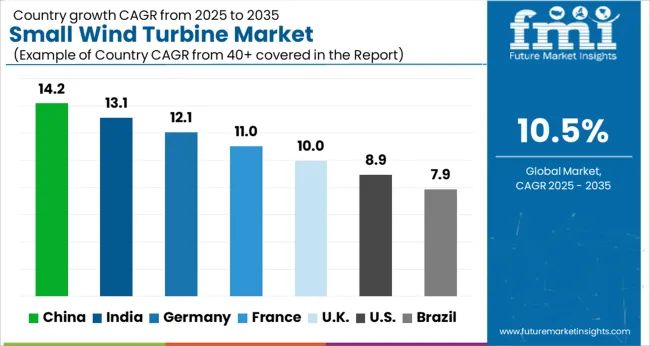

The market is projected to grow at a CAGR of 10.5% between 2025 and 2035, fueled by increasing adoption of decentralized renewable energy systems, government incentives, and technological advancements in turbine efficiency. China leads with a 14.2% CAGR, driven by large-scale deployment and integration into rural and industrial energy networks. India follows at 13.1%, supported by policy-backed renewable energy expansion and off-grid applications. Germany, at 12.1%, benefits from advanced engineering and community-based renewable projects. The UK, growing at 10.0%, focuses on distributed energy solutions and sustainable infrastructure initiatives. The USA, at 8.9%, experiences steady demand from residential and commercial installations. This report covers 40+ countries, with the top markets highlighted here for reference.

The industry in China is anticipated to expand at a CAGR of 14.2% from 2025 to 2035, driven by government initiatives supporting decentralized renewable energy and rural electrification programs. Manufacturers are investing in high-efficiency turbine designs and advanced materials to improve performance. Rising adoption in off-grid and industrial applications is accelerating demand, while integration with smart microgrids is enhancing operational efficiency. Export potential is increasing as Chinese manufacturers compete globally, and research in noise reduction and turbine durability is improving long-term reliability.

India is forecast to grow at a CAGR of 13.1% during 2025 to 2035, supported by renewable energy policies promoting decentralized generation and rural electrification. Technological improvements and cost-effective turbine manufacturing are encouraging adoption across remote communities and agricultural sites. Private sector investment and pilot programs for hybrid energy systems are boosting market penetration. Government incentives and state-level renewable programs are accelerating infrastructure development, while collaborative projects with international manufacturers are enhancing technological transfer.

Germany is projected to expand at a CAGR of 12.1% between 2025 and 2035, driven by residential and commercial adoption of small-scale renewable energy solutions. Regulatory incentives and feed-in tariffs are supporting local installations, while manufacturers are focusing on high-performance and low-noise turbine designs. The use of advanced composites and modular systems is increasing efficiency and adaptability. Energy cooperatives and community-based projects are further promoting decentralized wind energy, enhancing market demand.

The United Kingdom is forecast to grow at a CAGR of 10.0% from 2025 to 2035, supported by government-backed renewable energy programs and increasing private adoption. Focus on energy independence in rural areas and eco-friendly technologies is driving the uptake of small turbines. Manufacturers are investing in robust designs suitable for varied climates, while research on turbine efficiency and durability is enhancing product offerings. Collaborative ventures with European firms are facilitating technological upgrades and market expansion.

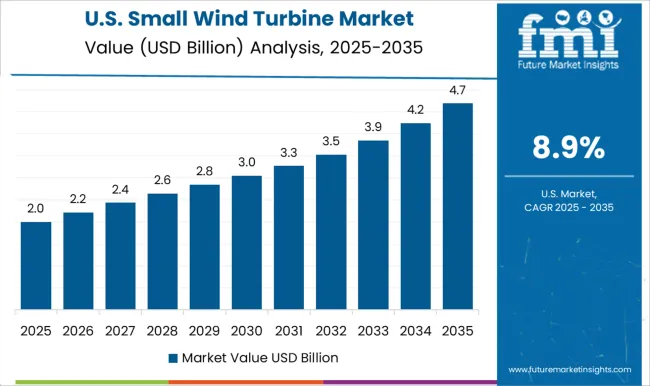

The United States market is expected to grow at a CAGR of 8.9% during 2025 to 2035, driven by off-grid renewable projects and increasing interest in decentralized energy systems. Private and municipal investments in small-scale wind generation are expanding, especially in remote and semi-urban areas. Technological developments in turbine design, noise reduction, and energy storage integration are enhancing performance. Policy support through incentives and tax credits is further enabling market adoption across industrial, residential, and agricultural sectors.

Vestas and Bergey Windpower dominate with proven turbine technologies, extensive after-sales service networks, and global deployment experience. Aeolos Wind Energy Ltd. and Northern Power Systems focus on high-efficiency models optimized for variable wind conditions, catering to off-grid and decentralized power needs. Avant Garde Innovations, City Windmills, and Ryse Energy emphasize design flexibility and modular turbine systems, allowing integration in urban or semi-urban environments. Plugin India, SDWE, and Senwei Energy target emerging markets with cost-effective solutions, supporting local energy independence initiatives.

TESUP, TUGE, Unitron Energy, and Wind Energy Solutions specialize in customized installations for farms, small businesses, and community projects, integrating smart monitoring and hybrid system compatibility. Market players actively pursue product development and partnerships to enhance turbine performance, reduce maintenance requirements, and expand service networks. Entry barriers remain moderate due to technology complexity, certification standards, and grid integration requirements, encouraging established manufacturers to leverage brand reputation and operational expertise while new entrants explore innovative designs and niche deployments to gain a foothold.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.0 Billion |

| Axis | Horizontal (HAWTs) and Vertical (VAWTs) |

| Installation | Rooftop and Standalone |

| Capacity | 3 kW, 3 to 10 kW, > 10 to 50 kW, and > 50 to 100 kW |

| Application | Residential and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aeolos Wind Energy Ltd.; Airturb; Avant Garde Innovations; Bergey Windpower; City Windmills; SD Wind Energy Ltd.; Ryse Energy; TESUP; TUGE Energia; Unitron Energy Systems Pvt. Ltd.; Eocycle Technologies; Bornay Aerogeneradores; Fortis Wind Energy; Wind Energy Solutions (WES); Kestrel Renewable Energy |

| Additional Attributes | Dollar sales by turbine type and application segment, demand dynamics across residential, commercial, and off-grid installations, regional trends in deployment across North America, Europe, and Asia-Pacific, innovation in vertical and horizontal axis designs, high-efficiency blades, and hybrid energy integration, environmental impact of manufacturing, land use, and noise emissions, and emerging use cases in microgrid systems, rural electrification, and distributed renewable energy solutions. |

The global small wind turbine market is estimated to be valued at USD 4.0 billion in 2025.

The market size for the small wind turbine market is projected to reach USD 10.9 billion by 2035.

The small wind turbine market is expected to grow at a 10.5% CAGR between 2025 and 2035.

The key product types in small wind turbine market are horizontal (hawts) and vertical (vawts).

In terms of installation, rooftop segment to command 47.2% share in the small wind turbine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Small Gas Engine Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule CDMO Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule CMO/CDMO Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Metabolic Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Running Wheel System Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule-Drug Conjugates Market Size and Share Forecast Outlook 2025 to 2035

Small Caliber Ammunition Market Size and Share Forecast Outlook 2025 to 2035

Small Boats Market Size and Share Forecast Outlook 2025 to 2035

Small Capacity Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Imaging (In Vivo) Market Size and Share Forecast Outlook 2025 to 2035

Small Cell Lung Cancer (SCLC) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule Innovator CDMO Market Size and Share Forecast Outlook 2025 to 2035

Small Cell Network Market Size and Share Forecast Outlook 2025 to 2035

Small Satellite Market by Ticketing Infrastructure, by Orbit Type, by Application & Region Forecast till 2035

Small Off-Road Engines Market Size and Share Forecast Outlook 2025 to 2035

Small Continuous Fryer Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule Inhibitors Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Small Signal Transistor Market Size and Share Forecast Outlook 2025 to 2035

Small Bowel Enteroscopes Market Size and Share Forecast Outlook 2025 to 2035

Small Paint Pail Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA