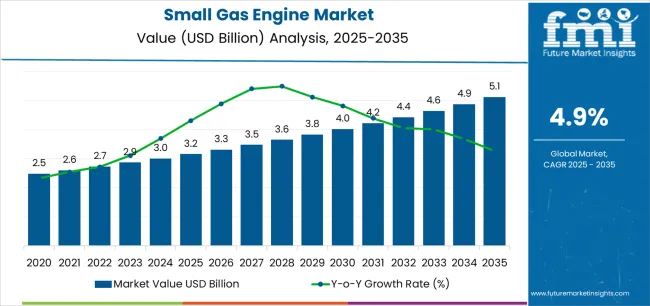

The Small Gas Engine Market is estimated to be valued at USD 3.2 billion in 2025 and is projected to reach USD 5.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

The small gas engine market is experiencing consistent growth driven by increasing use in residential, commercial, and industrial outdoor equipment. Demand has been supported by rising landscaping activities, growing adoption of small construction machinery, and expanding urban green spaces. Manufacturers are focusing on improving engine efficiency, reducing emissions, and enhancing durability to comply with environmental regulations and customer expectations.

The market is also benefiting from the introduction of compact, fuel-efficient engines that deliver high performance with lower maintenance requirements. Future expansion is expected to be influenced by rising infrastructure development, increasing mechanization in agriculture and landscaping, and continuous technological advancements in combustion and ignition systems.

Growth rationale is centered on the widespread applicability of small gas engines across diverse equipment categories, the reliability of gasoline as a power source, and the ongoing modernization of outdoor power tools These factors collectively are expected to strengthen market presence and ensure stable revenue growth across major regional markets.

| Metric | Value |

|---|---|

| Small Gas Engine Market Estimated Value in (2025 E) | USD 3.2 billion |

| Small Gas Engine Market Forecast Value in (2035 F) | USD 5.1 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

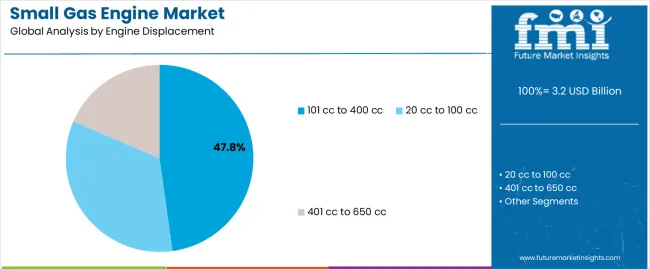

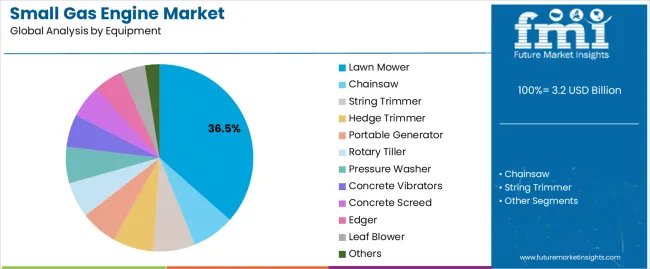

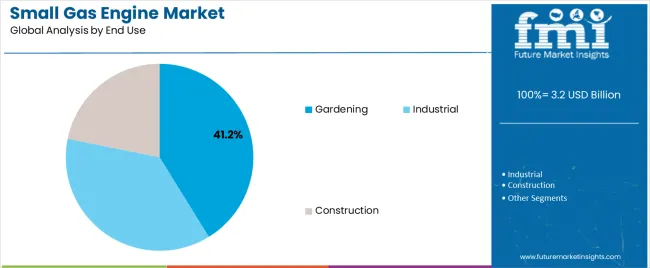

The market is segmented by Engine Displacement, Equipment, and End Use and region. By Engine Displacement, the market is divided into 101 cc to 400 cc, 20 cc to 100 cc, and 401 cc to 650 cc. In terms of Equipment, the market is classified into Lawn Mower, Chainsaw, String Trimmer, Hedge Trimmer, Portable Generator, Rotary Tiller, Pressure Washer, Concrete Vibrators, Concrete Screed, Edger, Leaf Blower, and Others. Based on End Use, the market is segmented into Gardening, Industrial, and Construction. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 101 cc to 400 cc segment, accounting for 47.80% of the engine displacement category, has remained dominant due to its extensive use in medium-duty power equipment requiring balanced efficiency and performance. This range offers optimal torque and fuel economy, making it suitable for applications such as lawn mowers, tillers, and pressure washers.

Demand has been supported by advancements in lightweight engine design and improved fuel injection systems that enhance reliability and reduce emissions. Market share is further reinforced by consistent replacement demand and integration into newly developed multi-utility outdoor machines.

Manufacturers are leveraging technological innovations to extend product life cycles and reduce operational noise, enhancing appeal for both residential and professional users This displacement category is expected to maintain its leadership through continued demand from gardening, landscaping, and light construction applications.

The lawn mower segment, holding 36.50% of the equipment category, has LED the market owing to increasing residential landscaping activities and expanding commercial maintenance services. Its market dominance is supported by continuous innovation in design, fuel efficiency, and operational convenience.

The use of small gas engines in both walk-behind and ride-on mowers has enabled manufacturers to meet varying end-user needs across urban and suburban environments. Growing adoption of advanced self-propelled and high-torque models has reinforced sales momentum.

Demand stability is also attributed to the replacement cycle in mature markets and expanding penetration in developing regions with rising household ownership of gardens and lawns Continued technological integration, such as improved ignition systems and lower emissions, is expected to sustain the lawn mower segment’s leading position within the equipment category.

The gardening segment, representing 41.20% of the end-use category, has been the leading contributor due to rising demand for mechanized tools that improve productivity and efficiency in residential and small-scale horticultural activities. Increasing consumer preference for convenient and time-saving gardening solutions has stimulated the use of small gas engines in trimmers, blowers, and cultivators.

The segment’s growth is reinforced by the trend toward home-based landscaping and outdoor beautification projects, which continue to expand in both developed and emerging markets. Consistent product innovations focused on compact design, low vibration, and easy maintenance have enhanced user adoption.

Furthermore, the availability of multi-functional gardening equipment powered by small gas engines is driving repeat purchases and market retention Sustained investment in domestic gardening and outdoor leisure activities is expected to ensure the continued dominance of this segment throughout the forecast period.

The growth of the construction industry, particularly in emerging economies, drives the demand for construction equipment powered by small gas engines, such as concrete mixers, pumps, and compactors.

The scope for small gas engine rose at a 6.9% CAGR between 2020 and 2025. The global market is anticipated to grow at a moderate CAGR of 5.2% over the forecast period 2025 to 2035.

The market experienced steady growth during the historical period, driven by factors such as increasing demand for outdoor power equipment, expansion of the landscaping and gardening services industry, technological advancements improving engine efficiency and emissions control, and the rising popularity of portable generators for residential and commercial use.

The market had also witnessed trends such as the integration of smart technologies into small gas powered equipment, a shift towards environmentally friendly engines to comply with emissions regulations, and expansion into emerging markets with growing infrastructure development and urbanization.

Forecast projections for the small gas engine market during the forecast period are anticipate continued growth fueled by several factors, including sustained demand for outdoor power equipment driven by landscaping services, urbanization, and infrastructure development.

Technological advancements are likely to play a significant role, with manufacturers focusing on developing cleaner, more fuel efficient engines and integrating smart features for improved performance and maintenance.

The market is also expected to witness increasing competition from electric powered alternatives, prompting small gas engine manufacturers to innovate and differentiate their products to maintain market share.

The growing demand for outdoor power equipment such as lawnmowers, trimmers, chainsaws, and generators, which rely on small gas engines, is a significant driver of market growth.

Increasingly stringent emissions regulations, particularly in regions like Europe and North America, pose a challenge for small gas engine manufacturers. Compliance with emission standards requires investments in research and development to develop cleaner and more efficient engine technologies, which can increase production costs.

The below table showcases revenues in terms of the top 5 leading countries, spearheaded by Japan, and the United Kingdom. The countries are expected to lead the market through 2035.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 5.5% |

| The United Kingdom | 6.5% |

| China | 5.9% |

| Japan | 6.9% |

| Korea | 3.2% |

The small gas engine market in the United States expected to expand at a CAGR of 5.5% through 2035. The country has a large market for outdoor power equipment such as lawn mowers, trimmers, chainsaws, and leaf blowers, all of which rely on small gas engines. The demand for these products is driven by residential and commercial landscaping needs, as well as maintenance of parks, golf courses, and other outdoor spaces.

The high homeownership rate in the United States contributes to the demand for small gas powered equipment for lawn care and maintenance. Homeowners often invest in lawn mowers, trimmers, and other tools powered by small gas engines to maintain their properties.

The small gas engine market in the United Kingdom is anticipated to expand at a CAGR of 6.5% through 2035. There is a significant demand for landscaping and gardening services in the United Kingdom.

Small gas powered equipment such as lawn mowers, trimmers, and leaf blowers are essential tools for maintaining gardens, parks, and outdoor spaces, driving demand for small gas engines.

The construction industry in the United Kingdom, both residential and commercial sectors, drives demand for small gas powered equipment used in construction activities. Tools such as portable generators, concrete mixers, and pressure washers are commonly powered by small gas engines and are essential for construction projects.

Small gas engine trends in China are taking a turn for the better. A 5.9% CAGR is forecast for the country from 2025 to 2035. The agricultural sector in China is undergoing mechanization, with farmers increasingly adopting small gas powered equipment such as tillers, sprayers, and pumps. Small gas engines play a crucial role in modernizing agricultural practices and improving productivity.

China experiences frequent power outages, especially in rural areas, due to infrastructure limitations and weather related events. Portable generators powered by small gas engines provide backup power during emergencies, contributing to market growth.

The small gas engine market in Japan is poised to expand at a CAGR of 6.9% through 2035. Japanese manufacturers are known for their innovation and focus on technological advancements.

Continuous improvements in engine design, fuel efficiency, and emission reduction contribute to the appeal of small gas engines in the Japanese market. Consumers are increasingly inclined towards eco friendly and energy efficient products, which drive the adoption of advanced small gas engines.

The Japanese government implements regulations and incentives to promote energy efficiency, reduce emissions, and encourage the adoption of environmentally friendly technologies. Compliance with these regulations drives innovation in small gas engine technology and encourages manufacturers to develop cleaner and more efficient engines, thereby boosting market growth.

The small gas engine market in Korea is anticipated to expand at a CAGR of 3.2% through 2035. The tourism industry in Korea continues to grow, attracting domestic and international visitors to its diverse attractions and natural landscapes.

Small gas engines power equipment used in the tourism sector, including recreational vehicles, tour boats, and outdoor event equipment, contributing to market growth.

Infrastructure development projects in rural areas, including road construction, irrigation systems, and rural electrification, drive demand for small gas powered equipment. Portable generators, water pumps, and compactors are essential tools for these projects, stimulating market growth in rural regions.

The below table highlights how 20 cc to 100 cc segment is projected to lead the market in terms of engine displacement, and is expected to account for a CAGR of 5.0% through 2035. Based on equipment, the lawn mower segment is expected to account for a CAGR of 4.7% through 2035.

| Category | CAGR through 2035 |

|---|---|

| 20 cc to 100 cc | 5.0% |

| Lawn Mower | 4.7% |

Based on engine displacement, the 20 cc to 100 cc segment is expected to continue dominating the small gas engine market. The 20 cc to 100 cc engine segment is commonly used in various outdoor power equipment such as lawn mowers, trimmers, chainsaws, and small generators. The demand for small gas engines within this displacement range increases, as homeowners, landscapers, and commercial users seek efficient and reliable equipment for lawn care and landscaping tasks.

There is a corresponding rise in the demand for small gas engines to power equipment used in maintaining lawns, gardens, and green spaces, with an increasing focus on landscaping and gardening activities for residential and commercial properties.

In terms of equipment, the lawn mower segment is expected to continue dominating the small gas engine market, attributed to several key factors. There is a growing demand for lawn mowers and related equipment, as homeowners, landscaping companies, and commercial property owners prioritize lawn maintenance and landscaping. Lawn mowers powered by small gas engines are widely used for cutting grass in residential yards, parks, golf courses, and commercial landscapes.

Gas powered lawn mowers offer several advantages over electric and manual mowers, including greater power, longer run times, and the ability to handle larger lawns and thicker grass. Many users prefer gas powered mowers for their performance and convenience, especially in areas without easy access to electrical outlets or for properties with extensive grass areas.

The competitive landscape of the small gas engine market is dynamic and diverse, characterized by a mix of established players, emerging companies, and regional manufacturers.

Company Portfolio

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 3.0 billion |

| Projected Market Valuation in 2035 | USD 5.0 billion |

| Value-based CAGR 2025 to 2035 | 5.2% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Engine Displacement, Equipment, End Use, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, France, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

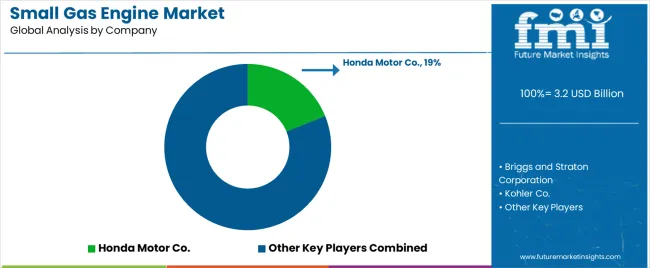

| Key Companies Profiled | Briggs and Straton Corporation; Honda Motor Co.; Kohler Co.; Kawasaki Heavy Industries; Fuji Heavy Industries; Yamaha Motor Co.; Kubota Corporation; Liquid Combustion Technology LLC.; Champion Power Equipment; Fuzhou Launtop M&E Co. Ltd.; Maruyama Mfg. Co. Inc.; Lifan Power |

The global small gas engine market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the small gas engine market is projected to reach USD 5.1 billion by 2035.

The small gas engine market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in small gas engine market are 101 cc to 400 cc, 20 cc to 100 cc and 401 cc to 650 cc.

In terms of equipment, lawn mower segment to command 36.5% share in the small gas engine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Small Molecule CDMO Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule CMO/CDMO Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Metabolic Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Running Wheel System Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule-Drug Conjugates Market Size and Share Forecast Outlook 2025 to 2035

Small Caliber Ammunition Market Size and Share Forecast Outlook 2025 to 2035

Small Boats Market Size and Share Forecast Outlook 2025 to 2035

Small Capacity Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Imaging (In Vivo) Market Size and Share Forecast Outlook 2025 to 2035

Small Cell Lung Cancer (SCLC) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule Innovator CDMO Market Size and Share Forecast Outlook 2025 to 2035

Small Cell Network Market Size and Share Forecast Outlook 2025 to 2035

Small Wind Turbine Market Size and Share Forecast Outlook 2025 to 2035

Small Satellite Market by Ticketing Infrastructure, by Orbit Type, by Application & Region Forecast till 2035

Small Continuous Fryer Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule Inhibitors Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Small Signal Transistor Market Size and Share Forecast Outlook 2025 to 2035

Small Bowel Enteroscopes Market Size and Share Forecast Outlook 2025 to 2035

Small Paint Pail Market Size and Share Forecast Outlook 2025 to 2035

Small Bore Connectors Market Analysis - Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA