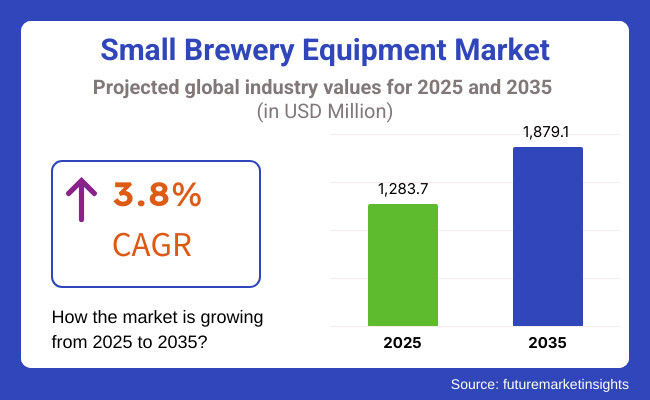

The small brewery equipment market is anticipated to be valued at USD 1,283.7 million in 2025. It is expected to grow at a CAGR of 3.8% during the forecast period and reach a value of USD 1,879.1 million in 2035.

Small brewery equipment is small-scaled machinery and systems for brewing, fermenting, and packaging within craft and microbreweries. Microbreweries, brewpubs, and independent craft breweries have turned them into quite essential equipment for turning out unique high-quality beers in demand as a consequence of the increasing popularity of artisanal and locally brewed beverages.

The small brewery equipment market includes brewing systems designed for craft and microbreweries to produce beer on a smaller scale. Market growth is driven by rising consumer demand for craft beer, increasing microbrewery establishments, technological advancements in brewing automation, and a growing preference for unique, locally brewed beverages worldwide.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Gradual growth as a result of expanding craft beer culture and growing number of microbreweries. | Faster-than-ever technological growth and automation will further spur the market. |

| Semi-automated brewing practices with traditional equipment. | Artificial intelligence-driven brewing operations, IoT-integrated monitoring, and automated quality monitoring. |

| Transition towards energy-efficient equipment and water recycling systems. | Universal uptake of carbon-free brewing systems, renewable energy-fueled configurations, and zero-waste brewing techniques. |

| Manual control systems with stainless steel tanks and simple temperature control. | Self-regulating temperature control-enabled intelligent brewing tanks, sophisticated filtration equipment, and ingredient dosing enabled by automation. |

| Increased demand for individualized brewing installations to support one-of-a-kind craft beer products. | Greater emphasis on sustainable brewing, with demand for organic inputs and AI-powered recipe development. |

| Increased sales through online platforms and direct-to-manufacturer purchases. | Artificial intelligence-based supply chain optimization, predictive maintenance, and blockchain-based ingredient traceability. |

| Strict license requirements and food safety and alcohol compliance. | More efficient regulatory systems favoring small brewers with incentives for sustainability efforts. |

| High upfront capital costs, complicated licensing processes, and low scalability. | Overcoming the cost of automation, data security in AI-based brewing, and keeping up with changing consumer trends. |

Automated and Smart Brewing Systems

Consumers are embracing small brewery equipment that integrates automation and smart technology for precision brewing. Craft brewers now prefer systems with AI-driven fermentation monitoring, remote-controlled temperature adjustments, and automated ingredient dosing to ensure consistency in flavor and quality.

These innovations reduce manual effort, allowing small-scale brewers to experiment with new recipes while maintaining efficiency. As demand for craft beer grows, people expect brewing equipment that combines convenience with high-tech customization.

Sustainable and Waste-Reducing Brewing Solutions

Consumers are prioritizing eco-friendly brewery equipment that minimizes waste and optimizes resource use. Manufacturers are developing systems that recycle water, repurpose spent grains for animal feed or baking, and use energy-efficient heating methods.

Small breweries now seek solutions that align with sustainability goals while maintaining cost-effectiveness. With increasing awareness of environmental impact, people demand brewing equipment that supports green brewing practices without compromising production quality.

The fermentation tanks segment plays a crucial role in small brewery operations, ensuring consistent beer quality and controlled fermentation. These tanks are designed to maintain ideal temperatures and pressure, allowing brewers to achieve precise flavor profiles. Stainless steel tanks are widely preferred for their durability, hygiene, and resistance to contamination.

Modern fermentation tanks come equipped with advanced monitoring systems, enabling brewers to track pH levels, temperature, and yeast activity. The demand for customized tank sizes is rising, allowing small breweries to scale production efficiently. As craft brewing gains popularity, investments in high-quality fermentation tanks continue to grow.

As per FMI research, the residential segment in the small brewery equipment market is expanding due to the growing trend of home brewing. Enthusiasts seek compact, user-friendly brewing systems to create custom craft beers at home. Small-scale equipment, including mini fermentation tanks and brewing kits, allows users to experiment with unique flavors and ingredients.

Homebrewing has gained popularity due to online tutorials, brewing communities, and DIY culture. Manufacturers are developing affordable and efficient brewing systems tailored for residential users. With increasing interest in personalized brewing experiences, the demand for small-scale residential brewing equipment continues to rise.

The microbreweries segment drives demand for small brewery equipment, as independent brewers focus on crafting high-quality, small-batch beers. Equipment such as fermentation tanks, kettles, and filtration systems helps microbreweries maintain flavor consistency and production efficiency. These breweries cater to local markets and niche audiences, emphasizing unique brewing techniques.

The rise of brewpubs and taprooms has fueled investments in versatile and scalable brewing systems. Microbreweries require efficient and space-saving equipment to optimize limited production areas. With consumers increasingly seeking artisanal and locally brewed beers, microbreweries are continuously upgrading their brewing infrastructure to meet market demand.

UK A Flourishing Industry with Expanding Opportunities in Brewing

The UK is experiencing significant growth, driven by the increasing number of microbreweries and the rising popularity of craft beer. The UK's rich brewing heritage and consumer demand for unique, high-quality brews have led to a surge in small-scale breweries. This trend is further supported by favorable government policies and initiatives that encourage local brewing enterprises.

Manufacturers in the UK are focusing on producing advanced brewing equipment tailored to the needs of small breweries. Innovations in brewing technology, such as energy-efficient systems and automation, are enabling brewers to enhance production efficiency and maintain consistent quality. The market is also benefiting from the growing trend of home brewing, with enthusiasts seeking professional-grade equipment to replicate commercial brewing processes.

The USA Dominant Region with Credibility in Brewing Industry

The USA continues to lead the market, bolstered by a robust craft beer culture and a substantial number of small brewers. As of 2025, the USA is home to approximately 6,000 small breweries, a testament to the nation's thriving craft beer industry. This proliferation is driven by consumer demand for diverse and premium beer flavors, prompting an increase in microbreweries and brewpubs across the country.

American manufacturers are renowned for producing high-quality brewing equipment, contributing to the market's dominance. The emphasis on innovation has led to the development of advanced brewing systems that cater to the specific needs of small-scale brewers.

Features such as automation, compact designs, and energy efficiency are becoming standard, enabling brewers to optimize production and reduce operational costs. The reputation of USA equipment manufacturers continues to attract new entrants to the market, further solidifying the country's leading position.

China’s Rapid Expansion Amidst Growing Craft Beer Culture

China is undergoing rapid growth, fueled by the burgeoning craft beer scene and a rising number of microbreweries. Chinese consumers are increasingly exploring diverse beer flavors, moving away from traditional mass-produced options. This shift in consumer preference has led to a surge in demand for small brewing equipment, as entrepreneurs establish new breweries to cater to this evolving taste.

Local equipment manufacturers are capitalizing on this trend by offering cost-effective and technologically advanced brewing solutions. The focus is on developing equipment that meets international standards while being accessible to small and medium-sized enterprises. Government support in the form of favorable policies and subsidies is also playing a crucial role in nurturing the craft beer industry, thereby boosting the small brewing equipment market.

India is Emerging Opportunities in a Nascent Industry

India is in its early stages but shows promising potential due to the growing interest in craft beer among urban consumers. The increasing number of brewpubs and microbreweries in metropolitan areas reflects a shift towards premium and diverse beer offerings. This trend is creating a demand for specialized brewing equipment tailored to small-scale operations.

Indian manufacturers and international players are recognizing this opportunity, leading to collaborations and the introduction of advanced brewing technologies in the market. Challenges such as high import duties and regulatory hurdles are being addressed through policy reforms and local production initiatives. As the craft beer culture gains momentum, the small brewing equipment market in India is poised for substantial growth between 2025 and 2035.

Germany Balancing Heritage and Modernization in Brewing Equipment

Germany, with its deep-rooted beer culture and adherence to quality, presents a mature yet evolving market for small brewing equipment. The country's Reinheitsgebot (Beer Purity Law) has long dictated brewing practices, emphasizing traditional methods. However, there is a growing trend of craft breweries experimenting within these guidelines to offer unique flavors, leading to a demand for specialized brewing equipment.

German equipment manufacturers are renowned for their precision engineering and quality. The market is characterized by a blend of tradition and innovation, with brewers seeking equipment that allows for experimentation while maintaining compliance with established brewing standards.

The export of German-made brewing equipment is also significant, as international brewers look to incorporate German engineering into their operations. Between 2025 and 2035, the German small brewing equipment market is expected to maintain steady growth, driven by both domestic demand and international partnerships.

The small brewery equipment industry is fragmented, with numerous manufacturers competing on customization, automation, and cost-efficiency.

Leading suppliers design advanced brewing systems with precision controls and modular configurations. Their ability to provide high-quality fermenters, kettles, and filtration units ensures strong demand from craft breweries and microbreweries, reinforcing their presence in both local and international brewing markets.

These manufacturers invest in research to enhance energy efficiency, brewing consistency, and space optimization. By integrating automation and digital monitoring systems, they differentiate their products. While established brands cater to large-scale craft brewers, smaller firms focus on affordable, customizable solutions that appeal to independent brewers and startup businesses.

Pricing and distribution strategies vary widely, with global players leveraging economies of scale, while niche manufacturers emphasize personalized service and flexible equipment designs. Established companies secure contracts with major breweries, while smaller firms rely on direct sales and local distributors to reach emerging brewers.

The competitive landscape remains diverse, with continuous innovation in compact and energy-efficient brewing systems. Top-tier firms expand through technological advancements and turnkey solutions, while new entrants introduce budget-friendly alternatives. This balance between established industry leaders and independent suppliers keeps the market dynamic, offering opportunities for both premium and cost-conscious brewery equipment buyers.

The small brewery equipment market is experiencing significant growth, driven by the rising popularity of craft beer and the increasing number of microbreweries worldwide. Manufacturers are focusing on developing compact, efficient, and cost-effective brewing systems tailored to small-scale operations. This trend is particularly prominent in regions with a burgeoning craft beer culture.

Technological advancements, such as automation and IoT integration, are transforming small brewery operations. Automated brewing equipment enhances consistency, reduces manual labor, and improves overall efficiency, making it an attractive investment for small breweries aiming to scale their production while maintaining quality.

Sustainability is becoming a key focus, with breweries adopting eco-friendly equipment to minimize environmental impact. Energy-efficient brewing systems and waste-reduction technologies are gaining traction, aligning with the global shift towards sustainable manufacturing practices. This approach not only appeals to environmentally conscious consumers but also helps in reducing operational costs.

The competitive landscape is marked by collaborations between equipment manufacturers and breweries to develop customized solutions. Tailored equipment designs that meet specific brewing requirements provide a competitive edge, fostering innovation and enhancing product offerings in the market. This collaborative approach ensures that the unique needs of small breweries are met effectively.

Recent Development

In October 2024, Sussex-based Hepworth Brewery is the first in the UK to trial Futraheat’s innovative heat pump, which recycles waste vapor into 130°C steam. This groundbreaking technology can cut carbon emissions by up to 90%, reinforcing the brewery’s commitment to sustainability and energy-efficient brewing practices.

The market is segmented by equipment type into fermentation tanks, bright beer tanks, brewhouses, and kettles.

Based on the application, the market is segmented into residential, commercial, and industrial.

The market are categories based on end-user, including microbreweries and nanobreweries.

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

The small brewery equipment market is expected to be valued at USD 1,283.7 million in 2025 and reach USD 1,879.1 million by 2035, growing at a CAGR of 3.8%.

The future prospects of small brewery equipment sales are promising, driven by rising craft beer demand, automation, and sustainability trends.

Key manufacturers in the small brewery equipment market include Krones, Criveller, Ss Brewtech, GEA, Newlands System, and DME Brewing Solutions.

North America, Europe, and China are expected to generate lucrative opportunities due to the growing craft beer culture and technological advancements.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Number) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by By Equipment, 2018 to 2033

Table 4: Global Market Volume (Number) Forecast by By Equipment, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by By End Users, 2018 to 2033

Table 6: Global Market Volume (Number) Forecast by By End Users, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by By Application, 2018 to 2033

Table 8: Global Market Volume (Number) Forecast by By Application, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by By Distribution Channel, 2018 to 2033

Table 10: Global Market Volume (Number) Forecast by By Distribution Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Number) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by By Equipment, 2018 to 2033

Table 14: North America Market Volume (Number) Forecast by By Equipment, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by By End Users, 2018 to 2033

Table 16: North America Market Volume (Number) Forecast by By End Users, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by By Application, 2018 to 2033

Table 18: North America Market Volume (Number) Forecast by By Application, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by By Distribution Channel, 2018 to 2033

Table 20: North America Market Volume (Number) Forecast by By Distribution Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Number) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by By Equipment, 2018 to 2033

Table 24: Latin America Market Volume (Number) Forecast by By Equipment, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by By End Users, 2018 to 2033

Table 26: Latin America Market Volume (Number) Forecast by By End Users, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by By Application, 2018 to 2033

Table 28: Latin America Market Volume (Number) Forecast by By Application, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by By Distribution Channel, 2018 to 2033

Table 30: Latin America Market Volume (Number) Forecast by By Distribution Channel, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Number) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by By Equipment, 2018 to 2033

Table 34: Europe Market Volume (Number) Forecast by By Equipment, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by By End Users, 2018 to 2033

Table 36: Europe Market Volume (Number) Forecast by By End Users, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by By Application, 2018 to 2033

Table 38: Europe Market Volume (Number) Forecast by By Application, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by By Distribution Channel, 2018 to 2033

Table 40: Europe Market Volume (Number) Forecast by By Distribution Channel, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: East Asia Market Volume (Number) Forecast by Country, 2018 to 2033

Table 43: East Asia Market Value (US$ Million) Forecast by By Equipment, 2018 to 2033

Table 44: East Asia Market Volume (Number) Forecast by By Equipment, 2018 to 2033

Table 45: East Asia Market Value (US$ Million) Forecast by By End Users, 2018 to 2033

Table 46: East Asia Market Volume (Number) Forecast by By End Users, 2018 to 2033

Table 47: East Asia Market Value (US$ Million) Forecast by By Application, 2018 to 2033

Table 48: East Asia Market Volume (Number) Forecast by By Application, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by By Distribution Channel, 2018 to 2033

Table 50: East Asia Market Volume (Number) Forecast by By Distribution Channel, 2018 to 2033

Table 51: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia Market Volume (Number) Forecast by Country, 2018 to 2033

Table 53: South Asia Market Value (US$ Million) Forecast by By Equipment, 2018 to 2033

Table 54: South Asia Market Volume (Number) Forecast by By Equipment, 2018 to 2033

Table 55: South Asia Market Value (US$ Million) Forecast by By End Users, 2018 to 2033

Table 56: South Asia Market Volume (Number) Forecast by By End Users, 2018 to 2033

Table 57: South Asia Market Value (US$ Million) Forecast by By Application, 2018 to 2033

Table 58: South Asia Market Volume (Number) Forecast by By Application, 2018 to 2033

Table 59: South Asia Market Value (US$ Million) Forecast by By Distribution Channel, 2018 to 2033

Table 60: South Asia Market Volume (Number) Forecast by By Distribution Channel, 2018 to 2033

Figure 1: Global Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 2: Global Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Value (US$ Million) by End-User, 2023 to 2033

Figure 4: Global Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Value (US$ Million) Analysis by Region, 2018-2033

Figure 6: Global Volume (MT) Analysis by Region, 2018-2033

Figure 7: Global Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Value (US$ Million) Analysis by Equipment Type, 2018-2033

Figure 10: Global Volume (MT) Analysis by Equipment Type, 2018-2033

Figure 11: Global Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 12: Global Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 13: Global Value (US$ Million) Analysis by Application, 2018-2033

Figure 14: Global Volume (MT) Analysis by Application, 2018-2033

Figure 15: Global Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Value (US$ Million) Analysis by End-User, 2018-2033

Figure 18: Global Volume (MT) Analysis by End-User, 2018-2033

Figure 19: Global Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 20: Global Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 21: Global Attractiveness by Equipment Type, 2023 to 2033

Figure 22: Global Attractiveness by Application, 2023 to 2033

Figure 23: Global Attractiveness by End-User, 2023 to 2033

Figure 24: Global Attractiveness by Region, 2023 to 2033

Figure 25: North America Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 26: North America Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Value (US$ Million) by End-User, 2023 to 2033

Figure 28: North America Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Value (US$ Million) Analysis by Country, 2018-2033

Figure 30: North America Volume (MT) Analysis by Country, 2018-2033

Figure 31: North America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Value (US$ Million) Analysis by Equipment Type, 2018-2033

Figure 34: North America Volume (MT) Analysis by Equipment Type, 2018-2033

Figure 35: North America Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 36: North America Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 37: North America Value (US$ Million) Analysis by Application, 2018-2033

Figure 38: North America Volume (MT) Analysis by Application, 2018-2033

Figure 39: North America Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Value (US$ Million) Analysis by End-User, 2018-2033

Figure 42: North America Volume (MT) Analysis by End-User, 2018-2033

Figure 43: North America Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 44: North America Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 45: North America Attractiveness by Equipment Type, 2023 to 2033

Figure 46: North America Attractiveness by Application, 2023 to 2033

Figure 47: North America Attractiveness by End-User, 2023 to 2033

Figure 48: North America Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 50: Latin America Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Value (US$ Million) by End-User, 2023 to 2033

Figure 52: Latin America Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Value (US$ Million) Analysis by Country, 2018-2033

Figure 54: Latin America Volume (MT) Analysis by Country, 2018-2033

Figure 55: Latin America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Value (US$ Million) Analysis by Equipment Type, 2018-2033

Figure 58: Latin America Volume (MT) Analysis by Equipment Type, 2018-2033

Figure 59: Latin America Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 60: Latin America Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 61: Latin America Value (US$ Million) Analysis by Application, 2018-2033

Figure 62: Latin America Volume (MT) Analysis by Application, 2018-2033

Figure 63: Latin America Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Value (US$ Million) Analysis by End-User, 2018-2033

Figure 66: Latin America Volume (MT) Analysis by End-User, 2018-2033

Figure 67: Latin America Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 68: Latin America Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 69: Latin America Attractiveness by Equipment Type, 2023 to 2033

Figure 70: Latin America Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Attractiveness by End-User, 2023 to 2033

Figure 72: Latin America Attractiveness by Country, 2023 to 2033

Figure 73: Europe Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 74: Europe Value (US$ Million) by Application, 2023 to 2033

Figure 75: Europe Value (US$ Million) by End-User, 2023 to 2033

Figure 76: Europe Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Value (US$ Million) Analysis by Country, 2018-2033

Figure 78: Europe Volume (MT) Analysis by Country, 2018-2033

Figure 79: Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Value (US$ Million) Analysis by Equipment Type, 2018-2033

Figure 82: Europe Volume (MT) Analysis by Equipment Type, 2018-2033

Figure 83: Europe Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 84: Europe Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 85: Europe Value (US$ Million) Analysis by Application, 2018-2033

Figure 86: Europe Volume (MT) Analysis by Application, 2018-2033

Figure 87: Europe Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Europe Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Europe Value (US$ Million) Analysis by End-User, 2018-2033

Figure 90: Europe Volume (MT) Analysis by End-User, 2018-2033

Figure 91: Europe Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 92: Europe Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 93: Europe Attractiveness by Equipment Type, 2023 to 2033

Figure 94: Europe Attractiveness by Application, 2023 to 2033

Figure 95: Europe Attractiveness by End-User, 2023 to 2033

Figure 96: Europe Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 98: East Asia Value (US$ Million) by Application, 2023 to 2033

Figure 99: East Asia Value (US$ Million) by End-User, 2023 to 2033

Figure 100: East Asia Value (US$ Million) by Country, 2023 to 2033

Figure 101: East Asia Value (US$ Million) Analysis by Country, 2018-2033

Figure 102: East Asia Volume (MT) Analysis by Country, 2018-2033

Figure 103: East Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Value (US$ Million) Analysis by Equipment Type, 2018-2033

Figure 106: East Asia Volume (MT) Analysis by Equipment Type, 2018-2033

Figure 107: East Asia Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 108: East Asia Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 109: East Asia Value (US$ Million) Analysis by Application, 2018-2033

Figure 110: East Asia Volume (MT) Analysis by Application, 2018-2033

Figure 111: East Asia Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: East Asia Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: East Asia Value (US$ Million) Analysis by End-User, 2018-2033

Figure 114: East Asia Volume (MT) Analysis by End-User, 2018-2033

Figure 115: East Asia Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 116: East Asia Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 117: East Asia Attractiveness by Equipment Type, 2023 to 2033

Figure 118: East Asia Attractiveness by Application, 2023 to 2033

Figure 119: East Asia Attractiveness by End-User, 2023 to 2033

Figure 120: East Asia Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 122: South Asia Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia Value (US$ Million) by End-User, 2023 to 2033

Figure 124: South Asia Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia Value (US$ Million) Analysis by Country, 2018-2033

Figure 126: South Asia Volume (MT) Analysis by Country, 2018-2033

Figure 127: South Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Value (US$ Million) Analysis by Equipment Type, 2018-2033

Figure 130: South Asia Volume (MT) Analysis by Equipment Type, 2018-2033

Figure 131: South Asia Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 132: South Asia Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 133: South Asia Value (US$ Million) Analysis by Application, 2018-2033

Figure 134: South Asia Volume (MT) Analysis by Application, 2018-2033

Figure 135: South Asia Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia Value (US$ Million) Analysis by End-User, 2018-2033

Figure 138: South Asia Volume (MT) Analysis by End-User, 2018-2033

Figure 139: South Asia Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 140: South Asia Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 141: South Asia Attractiveness by Equipment Type, 2023 to 2033

Figure 142: South Asia Attractiveness by Application, 2023 to 2033

Figure 143: South Asia Attractiveness by End-User, 2023 to 2033

Figure 144: South Asia Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 146: Oceania Value (US$ Million) by Application, 2023 to 2033

Figure 147: Oceania Value (US$ Million) by End-User, 2023 to 2033

Figure 148: Oceania Value (US$ Million) by Country, 2023 to 2033

Figure 149: Oceania Value (US$ Million) Analysis by Country, 2018-2033

Figure 150: Oceania Volume (MT) Analysis by Country, 2018-2033

Figure 151: Oceania Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Value (US$ Million) Analysis by Equipment Type, 2018-2033

Figure 154: Oceania Volume (MT) Analysis by Equipment Type, 2018-2033

Figure 155: Oceania Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 156: Oceania Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 157: Oceania Value (US$ Million) Analysis by Application, 2018-2033

Figure 158: Oceania Volume (MT) Analysis by Application, 2018-2033

Figure 159: Oceania Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: Oceania Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: Oceania Value (US$ Million) Analysis by End-User, 2018-2033

Figure 162: Oceania Volume (MT) Analysis by End-User, 2018-2033

Figure 163: Oceania Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 164: Oceania Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 165: Oceania Attractiveness by Equipment Type, 2023 to 2033

Figure 166: Oceania Attractiveness by Application, 2023 to 2033

Figure 167: Oceania Attractiveness by End-User, 2023 to 2033

Figure 168: Oceania Attractiveness by Country, 2023 to 2033

Figure 169: MEA Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 170: MEA Value (US$ Million) by Application, 2023 to 2033

Figure 171: MEA Value (US$ Million) by End-User, 2023 to 2033

Figure 172: MEA Value (US$ Million) by Country, 2023 to 2033

Figure 173: MEA Value (US$ Million) Analysis by Country, 2018-2033

Figure 174: MEA Volume (MT) Analysis by Country, 2018-2033

Figure 175: MEA Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: MEA Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: MEA Value (US$ Million) Analysis by Equipment Type, 2018-2033

Figure 178: MEA Volume (MT) Analysis by Equipment Type, 2018-2033

Figure 179: MEA Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 180: MEA Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 181: MEA Value (US$ Million) Analysis by Application, 2018-2033

Figure 182: MEA Volume (MT) Analysis by Application, 2018-2033

Figure 183: MEA Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: MEA Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: MEA Value (US$ Million) Analysis by End-User, 2018-2033

Figure 186: MEA Volume (MT) Analysis by End-User, 2018-2033

Figure 187: MEA Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 188: MEA Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 189: MEA Attractiveness by Equipment Type, 2023 to 2033

Figure 190: MEA Attractiveness by Application, 2023 to 2033

Figure 191: MEA Attractiveness by End-User, 2023 to 2033

Figure 192: MEA Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Small Satellite Market Size and Share Forecast Outlook 2025 to 2035

Small Marine Engine Market Forecast Outlook 2025 to 2035

Small Gas Engine Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule CDMO Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule CMO/CDMO Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Metabolic Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Running Wheel System Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule-Drug Conjugates Market Size and Share Forecast Outlook 2025 to 2035

Small Caliber Ammunition Market Size and Share Forecast Outlook 2025 to 2035

Small Boats Market Size and Share Forecast Outlook 2025 to 2035

Small Capacity Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Imaging (In Vivo) Market Size and Share Forecast Outlook 2025 to 2035

Small Cell Lung Cancer (SCLC) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule Innovator CDMO Market Size and Share Forecast Outlook 2025 to 2035

Small Cell Network Market Size and Share Forecast Outlook 2025 to 2035

Small Wind Turbine Market Size and Share Forecast Outlook 2025 to 2035

Small Off-Road Engines Market Size and Share Forecast Outlook 2025 to 2035

Small Continuous Fryer Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule Inhibitors Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Small Signal Transistor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA