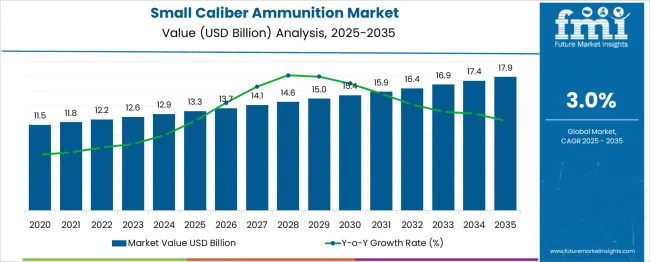

The global small caliber ammunition market is estimated to grow from USD 13.3 billion in 2025 to approximately USD 17.9 billion by 2035, recording an absolute increase of USD 4.6 billion over the forecast period. This translates into a total growth of 34.6 percent, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.0 percent between 2025 and 2035. The overall market size is expected to grow by nearly 1.3X during the same period, supported by rising defense expenditures and increasing demand for law enforcement training programs across various countries.

Between 2025 and 2030, the small caliber ammunition market is projected to expand from USD 13.3 billion to USD 15.25 billion, resulting in a value increase of USD 1.93 billion, which represents 42.1% of the total forecast growth for the decade. This phase of growth will be shaped by rising defense modernization programs in developing countries, increasing law enforcement training requirements, and growing civilian shooting sports participation. Manufacturers are expanding their production capabilities to address the growing complexity of modern ammunition requirements across military and civilian markets.

From 2030 to 2035, the market is forecast to grow from USD 15.25 billion to USD 17.9 billion, adding another USD 2.65 billion, which constitutes 57.9% of the overall ten-year expansion. This period is expected to be characterized by widespread adoption of advanced ammunition technologies, integration of smart projectile systems, and development of specialized rounds for emerging applications. The growing emphasis on precision marksmanship and counter-terrorism operations will drive demand for more sophisticated small caliber ammunition with enhanced ballistic performance.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 13.3 billion |

| Forecast Value in (2035F) | USD 17.9 billion |

| Forecast CAGR (2025 to 2035) | 3.0% |

Market expansion is being supported by the rapid increase in defense spending worldwide and the corresponding need for advanced ammunition solutions in military and law enforcement operations. Modern military applications rely on precision small caliber ammunition to ensure operational effectiveness, mission success, and personnel safety. The growing complexity of security threats and increasing emphasis on specialized tactical operations are driving demand for high-performance ammunition from certified manufacturers with appropriate quality standards and technical expertise.

The expanding civilian shooting sports market and rising hunting activities are creating significant demand for specialized ammunition that provides accuracy and reliability. Government regulations establishing ammunition quality standards are establishing new requirements for manufacturing processes that require advanced production capabilities and specialized technical knowledge.

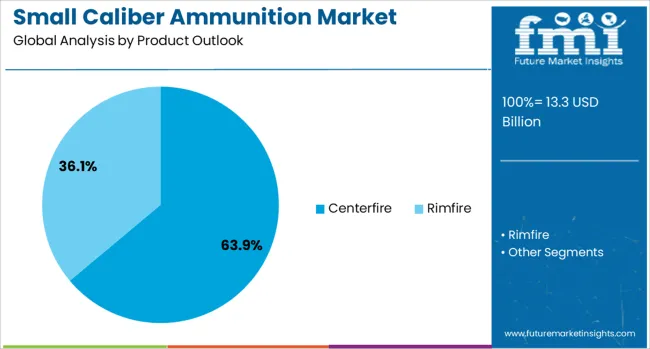

The market is segmented by product outlook, caliber, and region. By product outlook, the market is divided into centerfire and rimfire ammunition. Based on caliber, the market is categorized into 5.56mm, 7.62mm, 9mm, and others. Regionally, the market is divided into China, India, Germany, France, United Kingdom, United States, and Brazil.

Centerfire ammunition is projected to account for 63.9% of the small caliber ammunition market in 2025. This leading share is supported by the widespread adoption of centerfire cartridges in military, law enforcement, and civilian applications due to their superior reliability and performance characteristics. Centerfire ammunition provides consistent ignition and higher pressures, making it the preferred choice for tactical and hunting applications. The segment benefits from established manufacturing processes and comprehensive supply chain networks serving military and commercial markets.

5.56 mm caliber ammunition is expected to represent 45.9% of the caliber segment in 2025. This dominant share reflects the widespread adoption of 5.56mm NATO standard ammunition in military forces worldwide and its popularity in civilian shooting sports. Modern 5.56mm ammunition delivers excellent ballistic performance while maintaining manageable recoil characteristics. The segment benefits from standardized specifications across NATO countries and extensive production capabilities from multiple manufacturers.

The small caliber ammunition market is advancing steadily due to increasing defense expenditures and growing recognition of ammunition quality importance. However, the market faces challenges including strict regulatory requirements, environmental concerns regarding lead content, and varying export restrictions across different countries. Standardization efforts and certification programs continue to influence product quality and market development patterns.

The growing deployment of specialized ammunition featuring advanced projectile designs is enabling superior ballistic performance and target effectiveness. Enhanced bullet designs including hollow points, polymer tips, and bonded cores provide improved accuracy and terminal performance. These advanced projectiles are particularly valuable for law enforcement and hunting applications where precise shot placement and effective energy transfer are critical.

Modern ammunition manufacturers are incorporating lead-free projectiles and non-toxic primers that reduce environmental impact while maintaining ballistic performance. Integration of copper and composite materials enables comprehensive environmental compliance and comprehensive safety documentation. Advanced formulations also support shooting in restricted areas where lead-based ammunition is prohibited.

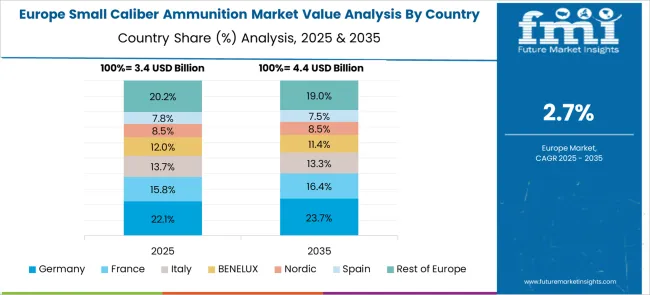

The small caliber ammunition market in Europe is projected to grow steadily across major countries, with Germany leading the regional market development. The United Kingdom maintains strong demand for small caliber ammunition, supported by established defense forces and active shooting sports communities. France demonstrates consistent growth in ammunition consumption, driven by military modernization programs and law enforcement training requirements.

Germany is expected to maintain its leadership position in European small caliber ammunition consumption, supported by its advanced defense manufacturing infrastructure and established export markets. The country benefits from comprehensive research and development capabilities and established supply chain networks serving both domestic and international customers.

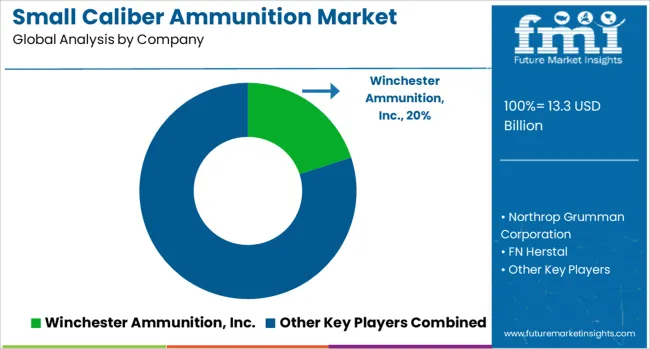

The small caliber ammunition market is defined by competition among defense contractors, ammunition manufacturers, and specialty munitions companies. Companies are investing in advanced manufacturing technologies, quality control systems, comprehensive testing facilities, and technical expertise to deliver high-performance, reliable, and cost-effective ammunition solutions. Strategic partnerships, technological innovation, and regulatory compliance are central to strengthening product portfolios and market presence.

Winchester Ammunition Inc., United States-based, offers comprehensive small caliber ammunition products with focus on civilian and law enforcement markets. Northrop Grumman Corporation, United States, provides advanced ammunition solutions integrated with defense systems capabilities. FN Herstal, Belgium, delivers military-grade ammunition with emphasis on NATO standardization and quality excellence. Hornady Manufacturing Company Inc., United States, focuses on precision ammunition for hunting and competitive shooting applications. General Dynamics Corporation, United States, emphasizes military ammunition solutions and defense contract capabilities. Nosler Inc., United States, provides specialized hunting ammunition with premium performance characteristics. Rheinmetall Defense, Germany, offers comprehensive military ammunition systems and technical expertise. Remington Arms Company LLC, United States, Vista Outdoor Operations LLC, United States, Sierra Bullets, United States, Australian Munitions, Australia, Nammo AS, Norway, Poongsan Corporation, South Korea, ST Engineering, Singapore, and DSG Technology AS, Norway, offer specialized ammunition expertise, standardized manufacturing processes, and reliable supply capabilities across global and regional defense markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.9 billion |

| Product | Centerfire and rimfire ammunition |

| Caliber | 5.56mm, 7.62mm, 9mm, and others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Winchester Ammunition Inc., Northrop Grumman Corporation, FN Herstal, Hornady Manufacturing Company Inc., General Dynamics Corporation, Nosler Inc., Rheinmetall Defense, Remington Arms Company LLC, Vista Outdoor Operations LLC, Sierra Bullets, Australian Munitions, Nammo AS, Poongsan Corporation, ST Engineering, DSG Technology AS |

| Additional Attributes | Dollar sales by product and caliber, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established defense contractors and specialty manufacturers, production capabilities for military versus civilian applications, integration with advanced manufacturing technologies and quality control systems, innovations in projectile design and ballistic performance optimization, and adoption of environmentally friendly formulations with lead-free components and non-toxic primers for enhanced safety and environmental compliance. |

The global small caliber ammunition market is estimated to be valued at USD 13.3 billion in 2025.

The market size for the small caliber ammunition market is projected to reach USD 17.9 billion by 2035.

The small caliber ammunition market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in small caliber ammunition market are centerfire and rimfire.

In terms of caliber outlook, the 5.56 mm segment is expected to command a 45.9% share in the small caliber ammunition market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Small Molecule Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Small Form Factor (SFF) Connectors Market Size and Share Forecast Outlook 2025 to 2035

Small Satellite Market Size and Share Forecast Outlook 2025 to 2035

Small Marine Engine Market Forecast Outlook 2025 to 2035

Small Gas Engine Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule CDMO Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule CMO/CDMO Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Metabolic Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Running Wheel System Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule-Drug Conjugates Market Size and Share Forecast Outlook 2025 to 2035

Small Boats Market Size and Share Forecast Outlook 2025 to 2035

Small Capacity Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Imaging (In Vivo) Market Size and Share Forecast Outlook 2025 to 2035

Small Cell Lung Cancer (SCLC) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule Innovator CDMO Market Size and Share Forecast Outlook 2025 to 2035

Small Cell Network Market Size and Share Forecast Outlook 2025 to 2035

Small Wind Turbine Market Size and Share Forecast Outlook 2025 to 2035

Small Off-Road Engines Market Size and Share Forecast Outlook 2025 to 2035

Small Continuous Fryer Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule Inhibitors Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA