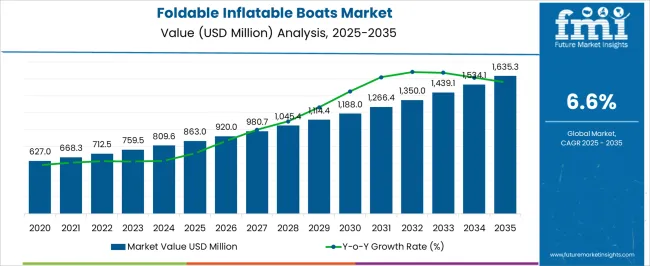

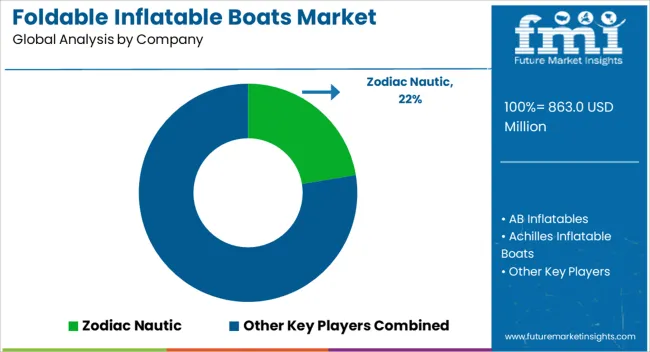

The foldable inflatable boats market is forecast to grow from USD 863.0 million in 2025 to USD 1,635.3 million by 2035, advancing at a CAGR of 6.6%. This expansion generates an absolute dollar opportunity of USD 772.3 million over the period, with the market almost doubling in size and achieving a multiplication factor of 1.9x. Demand is shaped by rising interest in recreational boating, fishing, and water sports, coupled with the affordability, portability, and ease of storage that foldable inflatable boats provide compared to traditional rigid boats.

The absolute dollar opportunity of USD 772.3 million reflects the incremental value created across the decade. From 2025 to 2028, opportunity generation is moderate, supported by steady demand in North America and Europe where recreational boating is well established. Between 2029 and 2032, opportunity creation accelerates, particularly in Asia Pacific and Latin America, where increasing disposable incomes and growing tourism drive adoption. By 2033 to 2035, opportunity generation stabilizes as penetration deepens, with innovations in materials, durability, and eco-friendly designs adding incremental value. The absolute dollar opportunity underscores how steady replacement demand, coupled with new adoption in emerging regions, will sustain consistent revenue creation across the global foldable inflatable boats market through 2035.

| Metric | Value |

|---|---|

| Foldable Inflatable Boats Market Estimated Value in (2025 E) | USD 863.0 million |

| Foldable Inflatable Boats Market Forecast Value in (2035 F) | USD 1635.3 million |

| Forecast CAGR (2025 to 2035) | 6.6% |

\The foldable inflatable boats market is primarily driven by the recreational boating sector, which holds around 41% of the market share, as consumers seek lightweight and portable options for water sports and leisure. The rescue and emergency services segment contributes about 27%, where foldable inflatables are valued for rapid deployment in flood relief and search-and-rescue operations. Military and defense applications represent close to 15%, using these boats for transport and tactical missions. The tourism and hospitality sector accounts for roughly 10%, integrating inflatable boats into adventure packages and resort activities. The remaining 7% comes from fishing and small-scale marine operations, which require cost-effective, easy-to-store watercraft.

The market is evolving with improvements in materials, durability, and multifunctional designs. Advanced polymers and reinforced fabrics are being used to enhance strength, puncture resistance, and longevity. Modular assembly and compact folding systems are making boats easier to transport and store. Electric outboard compatibility is expanding eco-friendly propulsion options. Customizable accessories, including detachable seating, storage modules, and sunshades, are gaining popularity. Manufacturers are focusing on lightweight yet robust frames for improved performance in diverse water conditions. Growing interest in outdoor recreation, marine tourism, and rapid-response rescue equipment continues to support global market expansion.

The Foldable Inflatable Boats market is experiencing steady growth driven by increasing recreational and commercial water-based activities, along with rising demand for portable, versatile, and durable watercraft solutions. Current market conditions are influenced by advancements in materials technology, improved manufacturing processes, and enhanced safety features that increase product reliability and user confidence.

The ability to offer lightweight and foldable designs has expanded the accessibility of these boats across urban and coastal regions, enabling easier transportation, storage, and deployment. Investments in tourism, adventure sports, and water-based recreational infrastructure are supporting market expansion, while environmentally conscious materials and innovative design features are aligning with consumer preferences for sustainable products.

Future growth is anticipated to be shaped by rising disposable incomes, increasing participation in outdoor water sports, and growing adoption in both personal and commercial segments, creating opportunities for differentiated product offerings with enhanced durability, modularity, and portability.

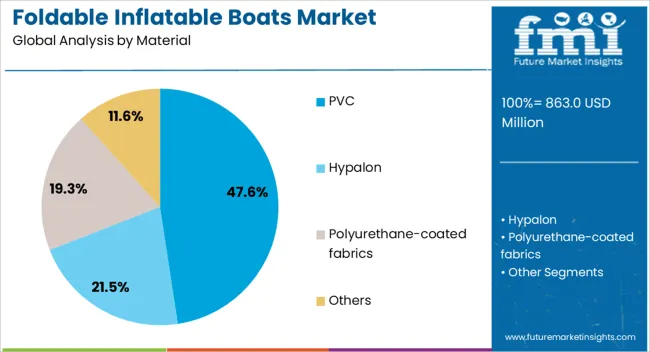

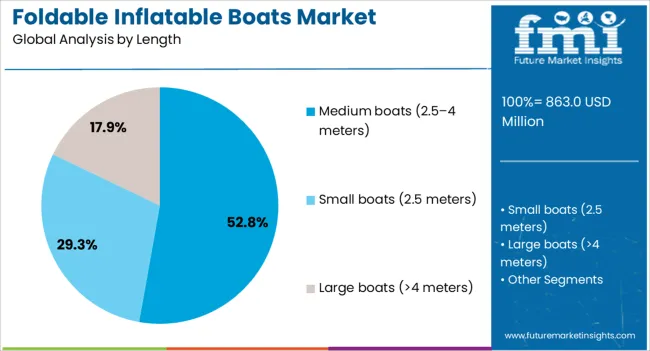

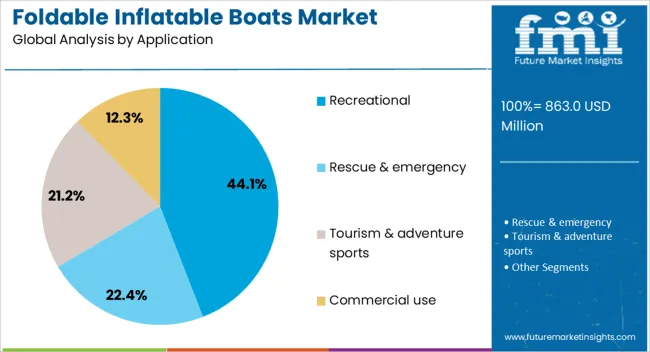

The foldable inflatable boats market is segmented by material, length, application, end user, and geographic regions. By material, foldable inflatable boats market is divided into PVC, Hypalon, Polyurethane-coated fabrics, and Others. In terms of length, foldable inflatable boats market is classified into Medium boats (2.5–4 meters), Small boats (2.5 meters), and Large boats (>4 meters). Based on application, foldable inflatable boats market is segmented into Recreational, Rescue & emergency, Tourism & adventure sports, and Commercial use. By end user, foldable inflatable boats market is segmented into Individual users, Commercial operators, and Government & NGO agencies. Regionally, the foldable inflatable boats industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The PVC material segment is projected to hold 47.6% of the Foldable Inflatable Boats market revenue share in 2025, making it the leading material type. This leadership is attributed to PVC’s high durability, resistance to abrasion, and ability to withstand exposure to sunlight and saltwater environments, which makes it particularly suitable for recreational boating applications.

Adoption has been supported by the ease of manufacturing foldable designs with PVC, allowing for lightweight and compact storage without compromising structural integrity. The material’s flexibility enables rapid deployment and folding, which enhances portability for users with limited storage space.

Furthermore, PVC offers cost-effective production compared to alternative materials while providing sufficient puncture resistance and longevity, supporting both individual and commercial buyer preferences The continued focus on enhancing coating technologies and seam sealing has further reinforced PVC’s suitability, making it the preferred choice for foldable inflatable boats that require a balance of durability, portability, and affordability.

Medium boats with lengths of 2.5–4 meters are expected to account for 52.8% of the total market revenue in 2025, emerging as the most prominent length category. This segment has been favored due to its versatility, offering sufficient capacity for multiple passengers while remaining compact enough for ease of transport and storage.

Adoption has been encouraged by recreational and commercial operators who require a balance between stability, maneuverability, and portability. Medium-sized boats can be deployed across lakes, rivers, and coastal areas with relative ease, supporting a wide range of activities from leisure boating to small-scale water-based transport.

The foldable design further enhances their appeal, enabling users to store the boat in vehicles or small storage spaces without specialized equipment Growing interest in family-oriented water sports, adventure tourism, and small-scale commercial operations has strengthened the demand for medium-length inflatable boats, ensuring this category remains a leading contributor to market growth in both personal and professional segments.

The recreational application segment is anticipated to capture 44.1% of the Foldable Inflatable Boats market revenue in 2025, positioning it as the largest application area. This prominence is being driven by increasing participation in leisure activities such as fishing, camping, adventure sports, and water-based tourism, where portable and foldable boats provide convenience and accessibility.

Recreational users benefit from lightweight designs, ease of handling, and rapid setup, which enhance the overall experience without requiring significant storage space or transportation infrastructure. The segment’s growth is also supported by rising disposable incomes, expansion of recreational water facilities, and growing awareness of outdoor fitness and adventure lifestyles.

Manufacturers are increasingly focusing on integrating durable materials, user-friendly designs, and enhanced safety features tailored to recreational usage, further increasing adoption rates As the trend of experiential outdoor activities continues to grow, recreational applications are expected to remain a key driver of the foldable inflatable boats market, reinforcing innovation and demand across global regions.

The foldable inflatable boats market reached approximately USD 620 million in 2024, driven by growing demand for portable watercraft across leisure, rescue, and commercial segments. North America leads with 35% share, followed by Europe at 30% and Asia Pacific at 25%; the remainder is RoW. Recreational buyers account for roughly 50% of unit sales, rescue and safety operators 20%, commercial uses (fishing, eco-tours) 15%, and government/military applications 15%. Popular hull materials include PVC (58%), Hypalon (28%), and TPU (14%). Typical retail prices range from USD 400–1,800 for consumer models and USD 2,500–8,000 for professional rapid-deploy units. Portability, fast setup, and low transport cost underpin market uptake globally.

Key growth drivers include demand for compact, transportable boats for weekend recreation, growing organized water-sport activities, and procurement by emergency services for fast, short-notice deployment. Recreational fleet expansion—kayak-style and inflatable RIBs—accounts for about 50% of demand; rental fleets for tourism contribute another 12%. Rescue teams and municipal authorities increased procurement by an estimated 18% in 2024, seeking lightweight craft that deploy in under 10 minutes. Advances in drop-stitch flooring and reinforced transoms improved load capacity by 12–18%, enabling larger outboard motors and higher payloads. Lower trailering costs and rising interest in micro-adventures spur consumer purchases, while manufacturers scale modular designs to reduce SKU complexity and improve margins across regions.

Product innovation centers on faster deployment, lighter composite frames, and integrated electronics. Foldable aluminum or composite floors now collapse into compact packs, reducing packed volume by 40–60%. Battery-compatible electric outboards have gained traction, representing 14% of new unit pairings in 2024, useful for low-noise rental fleets and marina-restricted zones. Materials shift toward TPU laminates for UV and abrasion resistance, increasing service life by an estimated 20% versus standard PVC. Subscription and rental-as-a-service models for portable boats grew 22% year-on-year in select coastal markets, enabling trial adoption. Digital ordering, modular accessory kits, and standardized folding mechanisms are enhancing user experience and lowering first-time buyer friction.

Opportunities lie in municipal procurement for flood response, growth of rental platforms, and electrified marina services. Emergency services worldwide are tendering rapid-deploy fleets; targeted supply to these buyers could increase professional revenue by up to 30% in niche suppliers’ portfolios. Tourism operators in coastal and lake destinations are expanding rental fleets—urban waterfronts and island-hopping routes offer scalable recurring revenue. Integration with lightweight electric propulsion and portable solar charging units creates bundled solutions that address operational range limits and appeal to eco-conscious operators. Cross-selling modular accessories—seat systems, boarding ladders, and tow-bars—can lift average order value by 18–25% for both consumer and commercial channels.

Constraints include material and component cost volatility, certification hurdles for commercial/rescue craft, and consumer concerns on durability. High-grade fabrics such as Hypalon and TPU carry a 20–35% premium over basic PVC, compressing margins for mid-tier manufacturers. Regulatory certification for rescue or passenger-carrying use requires additional testing and approvals, adding USD 15,000–60,000 in upfront compliance costs per model in many jurisdictions. Repairability perceptions and limited local service networks depress resale values in some regions, slowing repeat purchases. Finally, competition from compact rigid hull tenders and low-cost export models exerts downward pressure on pricing, particularly in price-sensitive South and Southeast Asian markets.

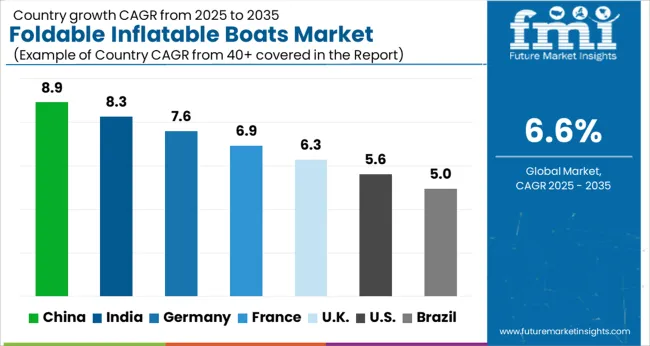

| Country | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

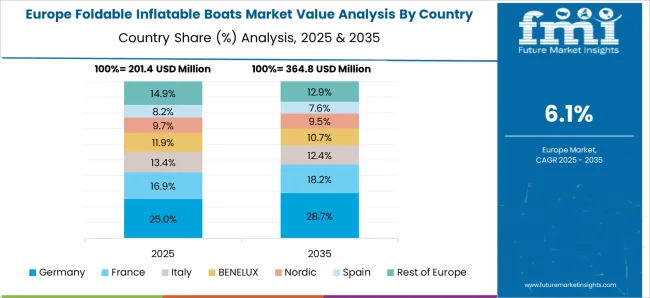

The foldable inflatable boats market is projected to grow at a global CAGR of 6.6% through 2035, supported by rising demand in recreational boating, water sports, and defense applications. China leads at 8.9%, a 1.35× multiple over the global benchmark, driven by BRICS-focused expansion in leisure marine manufacturing, coastal tourism, and naval applications. India follows at 8.3%, a 1.26× multiple of the global rate, reflecting increasing uptake in recreational boating, inland waterways, and defense procurement. Germany records 7.6%, a 1.15× multiple of the benchmark, shaped by OECD-driven innovation in lightweight materials, premium inflatable boat design, and safety compliance standards. The United Kingdom posts 6.3%, 0.95× the global rate, with demand centered on marine tourism, personal leisure use, and niche rescue applications. The United States stands at 5.6%, 0.85× the benchmark, with steady adoption in coastal recreation, defense, and professional rescue operations. BRICS economies drive most of the market’s volume growth, OECD countries emphasize product innovation and safety, while ASEAN nations contribute through expanding marine tourism and small craft usage.

The foldable inflatable boats market in China is projected to expand at a CAGR of 8.9%, supported by recreational boating, water sports, and expanding marine tourism. Domestic producers such as Qingdao Allheart Marine and Seahawk Boats supply cost-effective models targeting both local and export demand. Government investments in coastal infrastructure and leisure facilities add further momentum. The fishing sector also contributes, as compact foldable boats are preferred in small-scale operations due to portability. Technological development emphasizes lighter hull materials, improved air chambers, and reinforced safety designs, strengthening the appeal of inflatable boats in both inland and coastal waters.

The foldable inflatable boats market in India is forecast to grow at a CAGR of 8.3%, driven by defense procurement, coastal surveillance, and increasing adoption in tourism hubs such as Goa and Kerala. Indian suppliers, along with international brands, provide military-grade inflatable boats alongside consumer-grade recreational models. Rising interest in water adventure sports and expanding beach tourism strengthen market penetration. Lightweight foldable boats are also utilized for rescue operations in flood-prone areas, boosting government and NGO-related demand. Material upgrades with puncture resistance and improved storage portability support higher acceptance.

The foldable inflatable boats market in Germany is expected to advance at a CAGR of 7.6%, supported by recreational boating, sport fishing, and increasing use in inland waterways. German manufacturers emphasize quality, safety certifications, and durability, catering to both domestic demand and exports across Europe. Recreational water sports remain the strongest driver, while fishing enthusiasts also contribute to steady sales. Lightweight, compact models designed for easy transport in cars are gaining traction among younger consumers. Technical improvements focus on drop-stitch technology, UV-resistant materials, and enhanced air chamber segmentation for added safety.

The foldable inflatable boats market in the United Kingdom is projected to grow at a CAGR of 6.3%, supported by leisure boating, coastal tourism, and sport fishing along popular water routes. Domestic demand is also influenced by rising participation in marine adventure sports and an increase in caravan and camping enthusiasts seeking portable watercraft. Suppliers focus on user-friendly assembly, compact storage, and reinforced designs suitable for varied sea conditions. Online sales and specialty marine retailers contribute to greater accessibility, while technological upgrades in high-pressure inflatable floors improve overall stability.

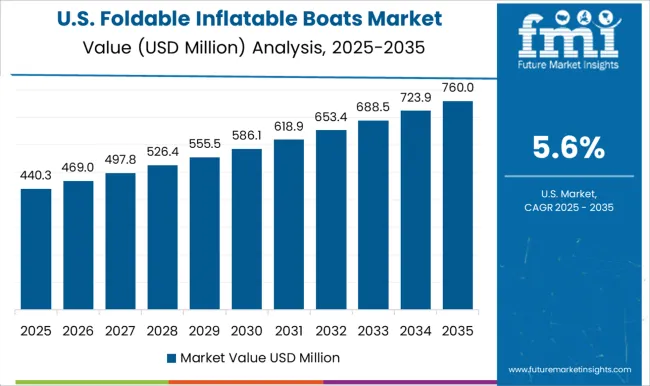

The foldable inflatable boats market in the United States is projected to grow at a CAGR of 5.6%, influenced by recreational boating, fishing, and emergency services. USA manufacturers such as Zodiac Nautic and Sea Eagle Boats provide a range of consumer and professional-grade inflatable boats. Growth in coastal leisure activities, camping trips, and fishing supports sustained demand. The market also benefits from use in rescue operations and by state authorities for quick deployment in flood-prone regions. Design improvements emphasize enhanced buoyancy, reinforced seams, and quick inflation systems to attract recreational users.

Competition in the foldable inflatable boats market is being shaped by advancements in lightweight materials, compact storage solutions, and ease of transport, as manufacturers focus on serving recreational, rescue, and professional applications. Zodiac Nautic and AB Inflatables are being positioned with premium-grade inflatable boats designed for performance, durability, and portability, catering to marine enthusiasts and professional users alike. Achilles Inflatable Boats and BRIS are being applied with reinforced fabrics and foldable frames that provide stability and resilience in challenging waters. Highfield Boats is being utilized with aluminum hull integrations, combining rigidity with inflatable versatility. Intex Recreation Corp. and Sea Eagle Boats are being developed for the leisure segment, offering affordable and easy-to-assemble foldable inflatables for families and casual users. Sevylor is being supplied with accessible recreational models, while Walker Bay is being extended with innovative modular boat systems that emphasize portability and multifunctional use. Strategies in this market are being directed toward improving air retention, puncture resistance, and user-friendly assembly mechanisms. Research and development are being allocated to high-pressure drop-stitch fabrics, advanced valve systems, and compact folding technologies that maximize storage convenience while maintaining performance. Product brochures are being structured with details on weight capacity, hull design, material composition, and transport features, ensuring alignment with consumer expectations for reliability and versatility. Safety features such as multiple air chambers, non-slip flooring, and reinforced seams are being highlighted to guide selection for recreational, professional, or emergency applications. Each brochure is being organized to showcase specifications, durability factors, and customization options, ensuring procurement teams, distributors, and end users can evaluate solutions that combine portability, resilience, and ease of handling.

| Item | Value |

|---|---|

| Quantitative Units | USD 863.0 Million |

| Material | PVC, Hypalon, Polyurethane-coated fabrics, and Others |

| Length | Medium boats (2.5–4 meters), Small boats (2.5 meters), and Large boats (>4 meters) |

| Application | Recreational, Rescue & emergency, Tourism & adventure sports, and Commercial use |

| End User | Individual users, Commercial operators, and Government & NGO agencies |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Zodiac Nautic, AB Inflatables, Achilles Inflatable Boats, BRIS, Highfield Boats, Intex Recreation Corp., Sea Eagle Boats, Sevylor, and Walker Bay |

| Additional Attributes | Dollar sales by boat type and end use, demand dynamics across recreation, rescue, and military applications, regional trends in water sports and coastal activities, innovation in lightweight materials, portability, and durability, environmental impact of PVC and fabric disposal, and emerging use cases in eco-tourism, expeditions, and tactical operations. |

The global foldable inflatable boats market is estimated to be valued at USD 863.0 million in 2025.

The market size for the foldable inflatable boats market is projected to reach USD 1,635.3 million by 2035.

The foldable inflatable boats market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in foldable inflatable boats market are pvc, hypalon, polyurethane-coated fabrics and others.

In terms of length, medium boats (2.5–4 meters) segment to command 52.8% share in the foldable inflatable boats market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foldable/Compressible Beverage Carton Market Size and Share Forecast Outlook 2025 to 2035

Foldable Display Market Size and Share Forecast Outlook 2025 to 2035

Foldable And Collapsible Pallets Market Size and Share Forecast Outlook 2025 to 2035

Foldable Phone Market Analysis by Product Type, Display Technology, Sales Channel, End-User and Region from 2025 to 2035

Foldable Steel Containers Market Insights & Growth 2025 to 2035

Key Companies & Market Share in Foldable Mailer Box Sector

Examining Market Share Trends in Foldable Plastic Pallet Boxes

Foldable Mailer Box Market Analysis – Trends & Demand 2025 to 2035

Foldable Plastic Pallet Boxes Market Trends & Forecast through 2035

Foldable Container Market Trends & Forecast 2024-2034

Foldable Bottles Market

ESD Foldable Container Market Size and Share Forecast Outlook 2025 to 2035

Non-woven Foldable Container Market Analysis - Size, Share, and Forecast Outlook 2025-2035

Inflatable U Shaped Travel Pillow Market Size and Share Forecast Outlook 2025 to 2035

Inflatable Tent Market Size and Share Forecast Outlook 2025 to 2035

Inflatable Packaging Market Forecast and Outlook 2025 to 2035

Inflatable Bags Packaging Market Size, Share & Forecast 2025 to 2035

Inflatable Pouches Market

Inflatable Pet Collars Market

Inflatable Void Fill System Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA