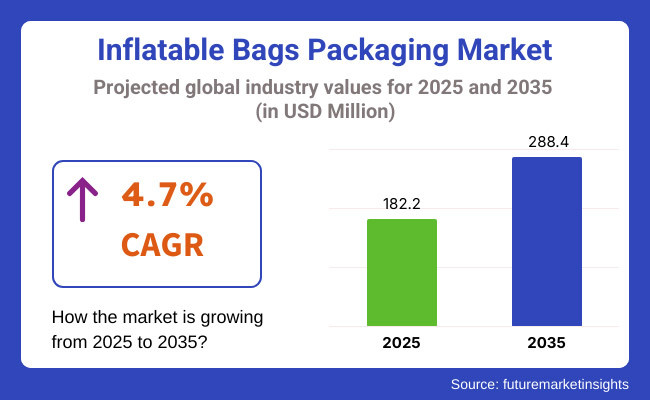

The inflatable bags packaging market is projected to grow from USD 182.2 million in 2025 to USD 288.4 million by 2035, registering a CAGR of 4.7% during the forecast period. Sales in 2024 reached USD 174.0 million, reflecting a steady demand in the sector.

This growth has been attributed to the increasing need for lightweight, cost-effective, and protective packaging solutions across various industries, including e-commerce, electronics, food & beverage, pharmaceuticals, and industrial goods. The rise in online shopping and global trade has necessitated efficient packaging methods that ensure product safety during transit, thereby boosting the demand for inflatable bags packaging. Additionally, the emphasis on sustainable and recyclable packaging solutions has further propelled market growth, as consumers and businesses alike prioritize environmentally friendly options.

In February 2025, With AIRfiber, Storopack now offers another innovative solution that perfectly complements its air cushion portfolio. Storopack is the only protective packaging specialist on the market that offers air pillows mostly made of paper in combination with a water-soluble inner coating.

Because they are 100% recyclable and made from partially renewable raw materials, Storopack’s AIRfiber is ideal for companies that value both high-quality protective packaging and sustainability. “Effective product design is a key driver of the circular economy. Storopack incorporates eco-design principles to enhance the sustainability of its packaging solutions. Our strategy focuses on reducing excess packaging and minimizing the unnecessary use of resources,” explains Vicentina Pereira, Product Manager AIR & Loose Fill at Storopack.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 182.2 Million |

| Projected Market Size in 2035 | USD 288.4 Million |

| CAGR (2025 to 2035) | 4.7% |

Advancements in film design have led to improved energy efficiency and reduced material waste, enhancing overall sustainability. Integration of smart features, such as tamper-evident seals and real-time tracking, has been implemented to ensure product safety and quality.

These innovations have not only reduced the environmental footprint of packaging processes but have also opened new avenues for application in various industries. Looking ahead, the inflatable bags packaging market is poised for continued growth, driven by the ongoing expansion of the e-commerce sector and the increasing emphasis on sustainable packaging solutions.

The market's trajectory suggests a steady rise in demand for innovative, eco-friendly inflatable bags that cater to both consumer preferences and regulatory requirements. Companies investing in research and development to create durable, cost-effective, and environmentally friendly inflatable packaging are expected to gain a competitive edge.

The integration of advanced materials and ergonomic designs will likely play a crucial role in shaping the future of the inflatable bags packaging market. Furthermore, strategic partnerships and acquisitions highlight the industry's focus on expanding capabilities and meeting evolving market demands.

The market is segmented based on material type, product type, end use, and region. By material type, the market includes polyethylene (PE), polyamide (PA), polyethylene terephthalate (PET), biodegradable films, and recyclable multi-layer films. In terms of product type, the market is categorized into air column bags, bubble wrap inflatable bags, air pillow bags, inflatable mailers, and custom molded inflatable cushions.

By end use, the market comprises food & beverage, cosmetics & personal care, pharmaceuticals, electricals & electronics, e-commerce, and other consumer goods. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

Air pillow bags have been projected to account for 34.5% of the inflatable bags packaging market in 2025, owing to their lightweight structure and efficiency in protecting diverse product categories. Compact air chambers have been utilized to provide flexible padding without increasing dimensional weight. Ease of inflation and disposal has been ensured with minimal packaging equipment.

Storage space has been reduced due to their flat, pre-inflation form. These bags have been favored for fragile goods, books, cosmetics, and electronics, particularly in e-commerce shipping. Rapid inflation with automatic systems has been adopted by high-throughput facilities. A reduction in damaged returns has been observed due to consistent shock absorption. Tamper-resistance and clean aesthetics have further improved consumer confidence in packaging.

Cost-effectiveness has been realized by retailers using these bags to minimize filler materials like foam or paper. Supply chains have integrated on-demand inflation stations to streamline operations. Material usage has been optimized, offering more protection with less plastic volume.

Recycling efforts have been supported by the shift to mono-material and biodegradable air pillows. Customization of air pillow shapes and branding has been increasingly offered by manufacturers. Barcode-printed surfaces and product protection codes have been used to improve traceability. Branding has been preserved even in secondary packaging through co-branded cushioning materials. As logistics and unboxing trends continue to evolve, air pillow bags have been positioned as a sustainable and scalable solution.

The e-commerce industry has been estimated to account for 42.1% of the inflatable bags packaging market in 2025 due to rapid online retail growth and demand for protective secondary packaging. Fragile and high-value items have been safeguarded through inflatable formats that prevent shifting and surface damage.

Compact, inflatable materials have reduced dimensional shipping costs for retailers. Air pillows and inflatable mailers have enabled cost-efficient order fulfillment at scale. Product return rates have been lowered by e-commerce sellers using inflatable packaging that retains product integrity. Tamper-evidence and cushioning performance have addressed buyer expectations for quality delivery. Fulfillment centers have adopted automatic inflation lines to handle high volumes with minimal operator input. Compact pre-inflation storage has made them ideal for micro-fulfillment hubs.

Consumer packaging experiences have been enhanced by inflatable formats that arrive intact and easy to dispose of. Positive unboxing reviews have helped build brand equity in digital marketplaces. Plastic use reduction targets have been supported through recyclable and biodegradable inflatable film alternatives.

Custom printing and QR code integration have allowed enhanced marketing opportunities. Retailers have continued to adopt smart packaging initiatives through digitally trackable inflatable bags. Cross-border e-commerce logistics have relied on inflatable packaging to ensure low damage rates during transit. Temperature-sensitive and sensitive electronics items have also benefited from air-cushioned protection. As consumer behavior shifts toward home delivery, inflatable packaging demand from the e-commerce sector is expected to sustain its momentum.

The growing demand for increasingly light and sustainable protective packaging across a host of industries driving transformation from e-commerce to electronics, food, and pharmaceuticals has made USA the inflating bags packaging king. The demand for superior cushioning, impact resistance, and space-saving designs gave birth to inflatable air column bags, bubble wrap packaging, and air pillow systems improving product safety while in transit.

Stringent regulations promoting eco-friendly alternatives towards packaging solutions have boosted manufacturers in developing biodegradable, recyclable, and reusable inflatable bags. Further, rapid technological advancements have resulted in the development of systems featuring self-sealing air chambers, smart air-inflation mechanisms, and even tamper-evident designs.

Thus, the market is driven forward thanks to emerging trends in online shopping, fragile product shipment, and optimization of supply chain networks. The accelerating thrust toward sustainable packaging materials has also advanced research into plant-based and compostable air-filled packaging alternatives.

Moreover, companies have begun to experiment with innovative, first-of-their-kind manufacturing methods - such as 3D-printed inflatable packaging-that widen scope for optimal customization and efficiency. The new dimension of inflating bags will be added with AI-driven inflation control systems that optimize air distribution and lead to improved durability in inflatable bags.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.4% |

The United Kingdom inflatable bags packaging market is evolving, as businesses look for cost-effective-for-shipping, lightweight, and protective solutions for fragile goods. An increasing number of companies are adopting air packaging materials, including bubble wraps, air cushions, and inflatable pouches, to enhance product safety.

The government policies promoting reduced plastic waste, recyclability, and minimizing carbon footprints encourage companies to consider bio-based, compostable blow-up bags, and few other alternatives that generate minimum waste. Meanwhile, the development of biodegradable air packaging, vacuum-sealed protective bags, and air-column cushioning systems is rapidly making these options attractive for logistics, e-commerce, and retail implementations.

High-performance inflatable bags are also gaining traction in the UK as demand grows for compact, storable, and reusable packaging. Moreover, AI-enabled customization for packaging is promoting speedy creation of optimized, product-centric inflatable packaging.

Companies are also investing in hybrid packaging designs that merge inflatable cushions with recyclable rigid components for greater safety. Besides, advancements in moisture-resistant and anti-static inflatable bags are really responding to the interests of the electronics and pharmaceutical sectors.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.9% |

Japan's inflatable bag packaging market has been growing tremendously owing to a rise in demand for space-efficient, highly protective, and environment-friendly packaging solutions. The country's advanced packaging industry is spearheading the development of very thin, high-strength, and precision engineered inflatable packaging material for application in the electronics, medical devices, and fragile consumer goods.

In line with this, Japanese manufacturers are also looking into the biodegradability of air cushions, multi-layered recyclable films, and zero-wasteary inflatable packaging designs as they keep up focus on sustainability. The integration of anti-theft high-speed inflation and RFID tracking systems to deliver cost-effective packaging processes has increased efficiency. As also the increase in demand for high-performance, lightweight, and resealable inflatable bag packaging for food and pharmaceutical products market growth, its prevalence impacts on Japanese waters.

There are innovations, too, which are now being developed concerning anti-static inflatable packaging, especially with the increasing market demand for semiconductors and precision electronics applications. Further, companies are involved in developing fire resistance inflatable bags, especially when it comes to shipping in higher risk environments.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.7% |

South Korean demand for inflatable bags packaging in sustainable options is rising at a high speed owing to durability and protection against impact from the electronics, e-commerce, and logistics segments. The industrial growth of the country, along with technological innovations in flexible packaging solutions, has led to the development of novel air column bags, biodegradable air pillows, and smart cushioning materials.

The government is taking initiatives to reduce plastic packaging and the promotion of sustainable materials and high recyclability solutions, thus fast-tracking the transformation. Furthermore, AI-based air-fill optimization, vacuum-sealed inflatable bags, and adaptive intelligent cushioning systems have been introduced by the companies in enhancing product safety and reducing wastage from packaging.

The market is accelerated further by employing lightweight, highly strong, and moisture-resistant inflatable bags for shipping fragile electronics and precision instruments. Additionally, the South Korean manufacturers are exploring self-healing inflatable materials, with abilities to automatically heal from minor punctures, thereby enhancing durability of the goods.

Research into temperature-sensitive inflatable packaging is being carried out in response to the increasing need for thermal insulation in pharmaceutical and food logistics. In addition, the recent advancement in the ultra-thin multi-layered inflatable films has the potential to minimize material usage while still offering good build protection.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

Investments into advanced air cushioning technologies, lightweight materials, and sustainable innovations in packaging have increased in the inflatable bags packaging market. In addition to these, the companies also focus on packaging lines automation, intelligent inflation control systems, and customizable air cushions for greater efficiency and waste reduction.

Strategic collaboration between packaging manufacturers, logistics service providers, and e-commerce giants has further spurred the adoption of inflatable packaging solutions worldwide. Continuing also is a growing emphasis on recyclable materials and emphasis on biodegradable air pillows, which is shaping the future of the market.

The overall market size for the Inflatable Bags Packaging Market was USD 182.2 Million in 2025.

The Inflatable Bags Packaging Market is expected to reach USD 288.4 Million in 2035.

The market will be driven by the increasing demand from e-commerce, electronics, and logistics industries. Advancements in biodegradable materials, automation, and AI-driven inflation technologies will further boost market growth.

Key challenges include concerns over plastic waste, high initial setup costs for inflatable packaging lines, and resistance from traditional packaging users. However, innovations in sustainable air cushioning and AI-driven packaging solutions are addressing these concerns.

North America and Europe are expected to dominate due to strong e-commerce growth, stringent sustainability regulations, and technological advancements. Asia-Pacific is also witnessing strong growth due to increasing online retail and logistics expansion.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Inflatable Tent Market Size and Share Forecast Outlook 2025 to 2035

Inflatable Pouches Market

Inflatable Pet Collars Market

Inflatable Void Fill System Market

Inflatable Packaging Market Forecast and Outlook 2025 to 2035

Foldable Inflatable Boats Market Size and Share Forecast Outlook 2025 to 2035

Portable & Inflatable Swimming Pool Market Trends - Growth & Demand to 2025 to 2035

Automotive Inflatable Seat Belt Market

Polybags Market Size and Share Forecast Outlook 2025 to 2035

Net Bags Market

VCI Bags Market

Sandbags Market

Leno Bags Market Size and Share Forecast Outlook 2025 to 2035

Silo bags Market Size and Share Forecast Outlook 2025 to 2035

Food Bags Market Share, Size, and Trend Analysis for 2025 to 2035

Competitive Breakdown of Silo Bag Manufacturers

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Jumbo Bags Market Size and Share Forecast Outlook 2025 to 2035

Blood Bags Market Size and Share Forecast Outlook 2025 to 2035

Craft Bags Market Growth, Trends, Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA