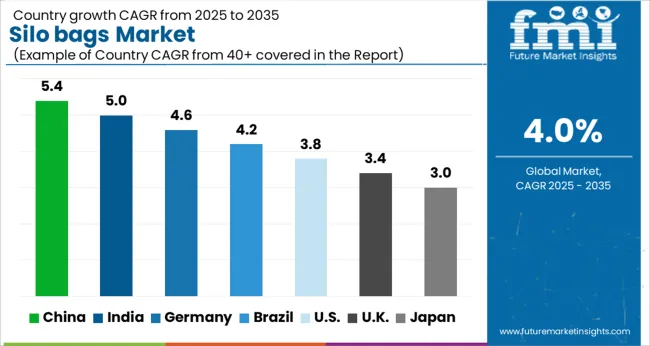

The Silo bags Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| Silo bags Market Estimated Value in (2025 E) | USD 1.9 billion |

| Silo bags Market Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The Silo Bags market is experiencing steady growth, driven by increasing demand for efficient grain and feed storage solutions across agricultural and commercial sectors. Rising adoption of modern storage techniques to reduce post-harvest losses and maintain product quality is shaping the current market scenario.

The market is being influenced by factors such as growing mechanization in agriculture, expansion of feed and grain production, and the need for cost-effective storage systems that minimize spoilage and contamination. Flexible, durable, and easily deployable storage solutions are being preferred by farmers and enterprises seeking scalable alternatives to conventional silos.

Advancements in polymer technology, which enhance the durability and UV resistance of silo bags, are supporting their widespread adoption As global agricultural production continues to increase and supply chain efficiency becomes more critical, the Silo Bags market is expected to sustain growth, offering opportunities for innovative materials, enhanced storage capacities, and multi-layered designs that ensure long-term preservation and operational efficiency.

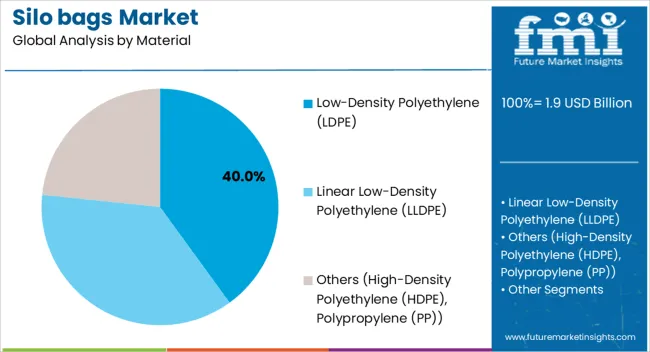

The Low-Density Polyethylene (LDPE) material segment is projected to hold 40.00% of the Silo Bags market revenue share in 2025, emerging as the leading material type. This prominence is being attributed to LDPE’s high flexibility, resistance to tearing, and cost-effectiveness, making it suitable for diverse storage conditions. The material’s capability to provide moisture and UV protection ensures stored grains and feed maintain quality over extended periods.

Adoption has been supported by the ease of manufacturing LDPE bags in varying sizes and thicknesses, which allows customization according to storage requirements. Additionally, LDPE’s compatibility with multi-layer construction enhances its performance under environmental stress and reduces the risk of spoilage.

The segment’s growth has been reinforced by increasing awareness among agricultural producers regarding long-term storage efficiency and the economic benefits of using durable polymer-based solutions As farmers and commercial operators continue to seek reliable and adaptable storage options, the LDPE material segment is expected to maintain its leading position in the market.

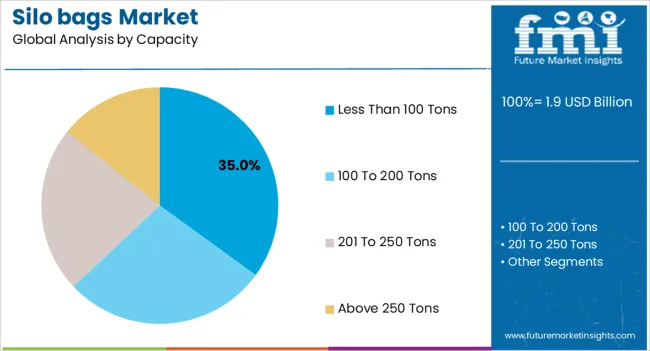

The Less Than 100 Tons capacity segment is expected to capture 35.00% of the Silo Bags market revenue in 2025, making it the largest capacity category. This segment has been favored due to its suitability for small- and medium-sized farms, where storage needs are moderate and operational flexibility is essential. Smaller capacity bags allow for easier handling, transport, and deployment, which reduces labor and logistical costs.

The adoption of these bags has been further driven by the need to maintain product quality during short-term storage while minimizing post-harvest losses. Additionally, the ability to store incremental quantities of feed or grain enables better inventory management and risk mitigation against spoilage or pest infestation.

The segment’s leadership is also supported by rising awareness of efficient storage solutions among small-scale commercial operators and cooperatives As agricultural practices continue to modernize, the demand for flexible, easy-to-use, and cost-efficient storage solutions is expected to sustain growth in this capacity segment.

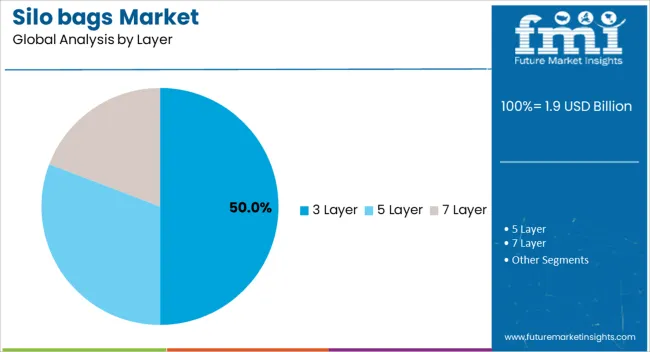

The 3 Layer silo bag segment is projected to hold 50.00% of the market revenue share in 2025, emerging as the leading layer configuration. Growth in this segment has been driven by the superior protective qualities offered by multi-layered construction, which enhances resistance to punctures, UV degradation, and environmental stress.

Three-layer bags provide improved barrier performance, reducing moisture ingress and preserving the quality of stored grains and feed for longer durations. Adoption has been further encouraged by the ease of stacking and handling these bags, as well as the ability to integrate advanced polymer blends in different layers to optimize strength and durability.

The segment’s prominence is reinforced by the increasing demand from commercial and large-scale agricultural operators seeking long-term storage solutions with minimal spoilage As awareness regarding preservation efficiency and the benefits of multi-layered design continues to grow, the 3 Layer silo bags are expected to maintain leadership, offering reliable, high-performance storage solutions across diverse operational contexts.

The silo bags market registered a CAGR of 5.1% during the historical period from 2020 to 2025. It reached a market value of USD 1.9.0 million in 2025 from USD 1.6 million in 2020.

Silo bags might offer a cost-effective and flexible grain storage solution. Farmers are drawn to these bags as they eliminate the need for expensive permanent silos, reducing capital investment and operational costs.

Silo bags can also be easily set up in various locations. They might enable farmers to store grains closer to the fields, optimizing logistics, and minimizing transportation expenses.

Scalability of silo bags is another appealing aspect for farmers. These bags come in various sizes and capacities, providing flexibility to store different quantities of grains based on individual harvest volumes. Farmers can easily adjust their storage needs, making silo bags a practical choice for handling varying yields from season to season.

Temporary nature of silo bags might address the need for short-term storage solutions during peak harvest periods. Farmers often face challenges in managing large volumes of freshly harvested grains.

Silo bags provide a convenient and efficient way to store the surplus until it can be transported or sold at a later date. This is set to help prevent post-harvest losses and enable farmers to capitalize on favorable market conditions.

Another crucial factor contributing to the rising demand for silo bags is their portability. Unlike traditional silos, which are fixed structures, silo bags can be easily moved to different locations on the farm. This mobility would allow farmers to store grains closer to the fields, reducing the time and cost of transportation.

Ability to relocate the bags based on changing weather conditions or logistical requirements might provide a practical advantage. It is expected to be mainly beneficial in regions with unpredictable climates.

Automated filling and emptying systems are influencing the silo bags industry share in a number of ways.

Silo bags are a popular option for storing fertilizer as they are durable, easy to transport, and relatively inexpensive. Additionally, they can be used to store fertilizer in a variety of climates, making them a versatile option for farmers and other businesses.

Use of fertilizer is increasing in various parts of the world, as farmers look to improve crop yields. Silo bags are a convenient and cost-effective way to store fertilizer. They are becoming increasingly popular among farmers and fertilizer distributors.

Growing demand for fertilizer has been a positive force for the market for silo bags. As demand for fertilizer continues to expand, the global silo bags industry is expected to elevate.

| Country | United States |

|---|---|

| Market Share (2025) | 79.2% |

| Market Share (2035) | 75.4% |

| BPS Analysis | -300 |

| Country | Canada |

|---|---|

| Market Share (2025) | 20.8% |

| Market Share (2035) | 24.6% |

| BPS Analysis | 50 |

| Country | Brazil |

|---|---|

| Market Share (2025) | 38.2% |

| Market Share (2035) | 34.8% |

| BPS Analysis | -530 |

| Country | China |

|---|---|

| Market Share (2025) | 47.2% |

| Market Share (2035) | 45.4% |

| BPS Analysis | 110 |

| Country | Germany |

|---|---|

| Market Share (2025) | 22.5% |

| Market Share (2035) | 20.4% |

| BPS Analysis | -70 |

| Country | France |

|---|---|

| Market Share (2025) | 16.3% |

| Market Share (2035) | 15.9% |

| BPS Analysis | -40 |

| Country | United Kingdom |

|---|---|

| Market Share (2025) | 18.6% |

| Market Share (2035) | 17.5% |

| BPS Analysis | -60 |

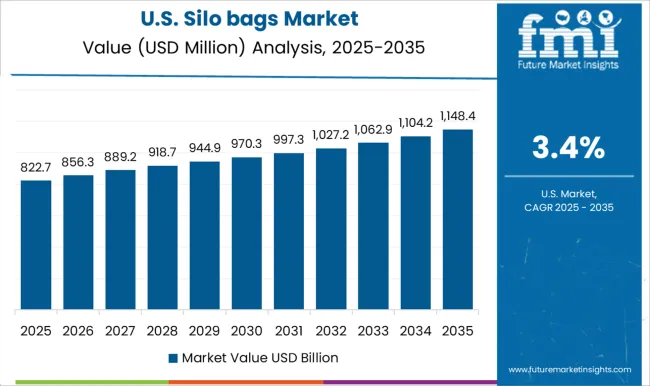

Silo Bags for Grain Storage to Witness High Demand amid Adoption of New Farming Methods in the United States

The United States silo bags market is anticipated to offer an incremental opportunity of USD 167.8 million in the evaluation period. The country’s agricultural sector might have seen a rise in the adoption of temporary grain storage solutions such as silo bags.

It is due to their cost-effectiveness and flexibility. This trend could create a growing demand for silo bags vendors in the country.

Government policies or incentives aimed at promoting modern agricultural practices and improving food security might have encouraged the use of efficient and sustainable grain storage methods such as silo bags. These policies can create a favorable environment for silo bags vendors.

With an increasing focus on sustainable agricultural practices and eco-friendly solutions, demand for environmentally friendly silo bags could have been on the rise in the United States. It is expected to present lucrative opportunities for vendors offering such products.

The United States is a significant exporter of agricultural products. Use of silo bags for temporary storage could have helped farmers and exporters manage surpluses more efficiently.

They can help in ensuring the quality and quantity of grains during transportation and storage. This, in turn, might have increased the demand for silo bags from vendors catering to export-focused clients.

Grain Storage Bags to Become Popular in China with Need to Prevent Post-harvest Losses

China silo bags industry is estimated to provide an incremental opportunity of USD 2.9 million by 2035. China's agricultural sector is substantial, and it plays a crucial role in feeding its vast population and supporting its economy. With increasing agricultural production and need to store larger quantities of grains, there has been a rising demand for efficient storage solutions such as silo bags.

In a few parts of China, there might be limited access to traditional storage infrastructure such as permanent silos. Silo bags might provide a practical and accessible alternative for temporary grain storage, especially in areas where constructing permanent structures is not feasible or cost-effective.

China has a massive population, and as it continues to surge, demand for food products also increases. To ensure food security and minimize post-harvest losses, farmers and grain producers have been seeking reliable and temporary storage solutions such as silo bags.

China is also a key exporter of agricultural products. Silo bags enable efficient storage and handling of grains during transportation and export. They might help in ensuring the quality of produce and meeting international market demands.

LLDPE Silo Bags for Grain & Forage Storage to Gain Momentum Worldwide

The linear low-density polyethylene (LLDPE) segment is expected to surge with a CAGR of 6.8% in the forecast period. It is likely to create an incremental opportunity of USD 164 million in the same time frame.

LLDPE is known for its excellent strength and durability, making it ideal for withstanding the rigors of outdoor storage. It also helps in protecting grains from external factors such as moisture, pests, and UV radiation. Robust nature of LLDPE ensures that the silo bags can effectively preserve the quality of stored grains over extended periods.

LLDPE has a high level of flexibility, allowing the silo bags to conform to the shape of the stored grain. This flexibility helps minimize air gaps within the bag, reducing the risk of spoilage and maintaining an optimal storage environment. LLDPE's puncture resistance might also prevent damage to these bags during handling and transportation, ensuring integrity of the stored grains.

LLDPE is a relatively cost-effective material, making silo bags made of LLDPE a more affordable storage option compared to permanent storage structures. This cost-effectiveness might appeal to farmers and grain producers looking for economical solutions for temporary grain storage.

Three-layer Silo Bag Storage to Find Extensive Usage across the Globe

The 3 layer segment is expected to hold around 48.6% of the silo bags market share in 2035. Three-layer silo bags might have a slightly higher upfront cost compared to single-layer or two-layer bags.

Their enhanced protection and extended shelf life can result in long-term cost savings. Reduced spoilage and minimal losses due to improved storage conditions can outweigh the initial investment.

Three-layer silo bags are versatile and suitable for a wide range of crops & storage conditions. Whether storing grains, seeds, or other agricultural products, the multilayer design offers flexibility in adapting to different storage needs and requirements.

Three-layer construction provides an extra layer of protection for the stored grains. Each layer serves a specific purpose. The outer layer offers UV protection, the middle layer provides strength & puncture resistance, and the inner layer safeguards the grains from moisture. This multilayer design would help ensure superior protection against spoilage and quality degradation during storage.

Silo bag manufacturers might focus on producing bags with high-quality materials and improved durability to ensure the safe storage of grains over extended periods. Offering a range of bag sizes and capacities allows manufacturers to cater to the diverse needs of farmers and grain producers.

Implementing UV protection and specialized coatings on the bags can increase their longevity and protect the stored grains from external factors. Manufacturers might invest in research & development to improve bag design, materials, and production processes, making the bags more efficient and user-friendly.

In response to growing environmental concerns, a few manufacturers might have focused on developing biodegradable silo bags or those made from eco-friendly materials. Integration of technology such as sensors and monitoring systems into these bags might enable real-time monitoring of grain conditions and reduce the risk of spoilage.

For instance,

| Attributes | Details |

|---|---|

| Estimated Market Size (2025) | USD 1.9 billion |

| Projected Market Valuation (2035) | USD 2.9 billion |

| Value-based CAGR (2025 to 2035) | 4.0% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD million) |

| Segments Covered | Material, Capacity, Layer, Application, Region |

| Key Regions Covered | North America; Latin America; East Asia; South Asia & Pacific; Western Europe; Eastern Europe; Central Asia; Russia & Belarus; Balkan & Baltic Countries; Middle East & Africa |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, Italy, France, United Kingdom, Spain, Russia, GCC Countries, China, India, Australia |

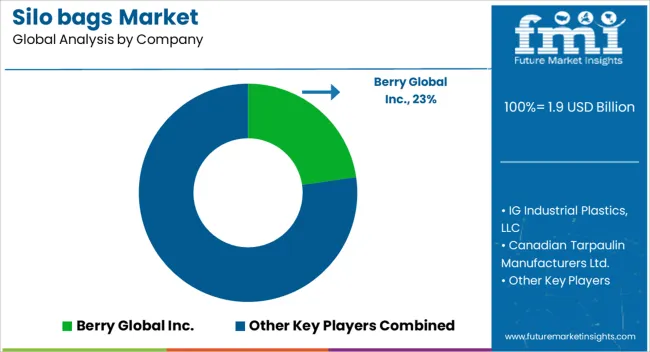

| Key Companies Profiled | Berry Global Inc.; IG Industrial Plastics, LLC; Canadian Tarpaulin Manufacturers Ltd.; Poly-Ag Corp.; Pacifil Brasil; Agroflex; Planet Plastic LLC; ARGSELMASH; Up North Plastics, Inc.; Seed & Forage Bags Australia Pty Ltd.; Polypropylene Products and Polypropylene Bags; Shanghai HiTeC Plastics Co., Ltd.; Shandong Longxing Plastic Film Technology Corp. Ltd.; Rishi FIBC Solutions Pvt. Ltd; IPESA USA LLC; RKW Group; PLASTAR; GEM Silage Products; Blue lake Plastics, LLC |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

The global silo bags market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the silo bags market is projected to reach USD 2.9 billion by 2035.

The silo bags market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in silo bags market are low-density polyethylene (ldpe), linear low-density polyethylene (lldpe) and others (high-density polyethylene (hdpe), polypropylene (pp)).

In terms of capacity, less than 100 tons segment to command 35.0% share in the silo bags market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Breakdown of Silo Bag Manufacturers

North America Silo Bags Market Size and Share Forecast Outlook 2025 to 2035

Silos Market Size and Share Forecast Outlook 2025 to 2035

Flexible Silos Market

Polydimethylsiloxane Market Forecast and Outlook 2025 to 2035

Polyether Modified Polysiloxane Market Analysis – Share, Size, and Forecast 2025 to 2035

Polybags Market Size and Share Forecast Outlook 2025 to 2035

Net Bags Market

VCI Bags Market

Sandbags Market

Leno Bags Market Size and Share Forecast Outlook 2025 to 2035

Food Bags Market Share, Size, and Trend Analysis for 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Jumbo Bags Market Size and Share Forecast Outlook 2025 to 2035

Blood Bags Market Size and Share Forecast Outlook 2025 to 2035

Craft Bags Market Growth, Trends, Forecast 2025 to 2035

Market Share Breakdown of Craft Bags Manufacturers

Competitive Breakdown of Paper Bags Providers

Market Share Analysis of Jumbo Bags & Key Players

Grout Bags Market Demand & Construction Industry Trends 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA