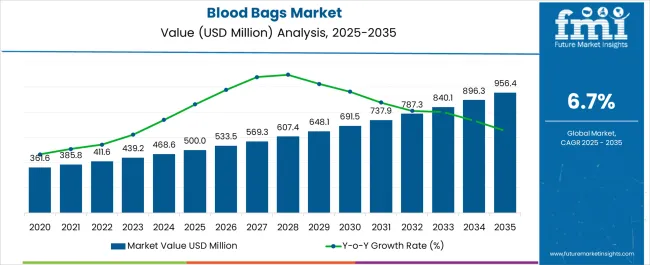

The blood bags market is estimated to be valued at USD 500.0 million in 2025 and is projected to reach USD 956.4 million by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

The market experiences robust expansion driven by escalating blood transfusion demands, expanding blood banking infrastructure, and advancing blood storage technologies that extend shelf life while maintaining cellular viability throughout collection, processing, and storage operations. Healthcare systems implement sophisticated blood collection protocols that require specialized bag configurations for whole blood collection, component separation, and targeted therapeutic applications including plasma exchange, platelet concentrate preparation, and red blood cell storage. The technology's evolution toward integrated systems enables automated blood processing that reduces contamination risks while improving efficiency in blood center operations.

Blood collection organizations demonstrate increasing adoption of multi-bag systems that enable component separation during single donation procedures, maximizing therapeutic value from individual donor contributions while reducing processing complexity and storage requirements. Quality assurance protocols demand blood bags manufactured with precise plasticizer formulations that prevent hemolysis and maintain blood component integrity during extended storage periods under controlled temperature conditions. Blood bank operations require consistent bag performance across varying environmental conditions and handling procedures that occur throughout collection, transportation, and storage phases of blood management operations.

Supply chain dynamics reflect stringent regulatory requirements for blood bag manufacturing that demand compliance with medical device standards, biocompatibility testing, and sterility validation protocols necessary for direct blood contact applications. Raw material specifications emphasize medical-grade plastics, anticoagulant formulations, and sterilization-compatible materials that maintain performance characteristics after gamma irradiation or ethylene oxide treatment. Manufacturing facilities operate under strict quality control systems that ensure batch consistency and traceability essential for medical device regulations governing blood collection products.

Hospital blood bank operations create demand for blood bags optimized for specific storage applications including refrigerated whole blood storage, frozen plasma preservation, and platelet concentrate preparation requiring temperature-controlled environments and specialized additive solutions. Laboratory managers specify bag configurations that accommodate automated processing equipment while maintaining compatibility with existing blood bank infrastructure and processing protocols. Inventory management systems track blood product expiration dates and storage conditions that directly impact patient safety and blood bank efficiency metrics.

Emergency medical services represent growing market segments requiring portable blood collection systems and field-deployable storage solutions for trauma response and disaster relief operations where traditional blood banking infrastructure remains unavailable. Military medical applications demand blood bags qualified for extreme environmental conditions including temperature variations, altitude exposure, and transportation stresses that exceed civilian medical requirements. Mobile blood collection units utilize specialized bag configurations that accommodate vehicle-mounted processing equipment while maintaining sterile collection environments.

| Metric | Value |

|---|---|

| Blood Bags Market Estimated Value in (2025 E) | USD 500.0 million |

| Blood Bags Market Forecast Value in (2035 F) | USD 956.4 million |

| Forecast CAGR (2025 to 2035) | 6.7% |

The blood bags market is experiencing consistent growth driven by increasing demand for safe blood collection, storage, and transfusion practices across healthcare systems. Rising incidences of trauma cases, surgeries, and chronic diseases requiring regular blood transfusion are supporting the use of advanced blood storage solutions.

Governments and healthcare organizations are emphasizing stringent safety protocols, sterile collection methods, and efficient storage capacity, which are contributing to the widespread adoption of standardized blood bags. Technological improvements in materials and labeling have enhanced product safety and traceability.

Furthermore, the growing network of blood donation drives and awareness programs is reinforcing demand for high quality blood collection and storage products. The overall market outlook remains positive as hospitals and blood banks continue to invest in reliable transfusion infrastructure and improved blood management systems.

The single blood bag product type is expected to hold 47.60% of market revenue by 2025, making it the most prominent product type segment. Its dominance is attributed to cost effectiveness, ease of use, and wide availability across both developed and developing healthcare systems.

Single blood bags are preferred in routine transfusion and collection processes where separation of components is not required. Their adoption has been reinforced by high frequency blood donation programs and increased usage in general hospital settings.

Their affordability and operational efficiency continue to strengthen their position as the leading product type in the blood bags market.

The less than 250 ml capacity segment is projected to account for 42.90% of market revenue by 2025, positioning it as the leading capacity type. This growth is supported by rising demand for pediatric transfusions, neonatal care, and cases requiring precise low volume collection.

Hospitals and specialized care centers frequently adopt this size due to safety and accuracy in dosing. The segment is also reinforced by ongoing pediatric health programs and blood donation initiatives targeted toward younger populations.

The ability to support small volume collection without compromising on sterility or storage stability has positioned this capacity as a preferred option across healthcare facilities.

The global blood bags market registered a CAGR of 6.4% during the historic period with a market value of USD 500 million in 2025. This growth can be attributed to several factors, including the increasing demand for blood and blood products, the rise in the number of blood donations, and the growing prevalence of chronic diseases such as cancer and haemophilia.

Blood components like red blood cells (RBCs), white blood cells (WBCs), and blood platelets are transported and stored in blood bags. The blood bags must be used to store both the blood and its constituent parts. The blood is extremely sensitive to changes in temperature, light, and air, blood bags are required to retain blood and its constituent parts.

For the collection, storage, and transportation of blood and its constituent parts, blood bags have taken the position of glass bottles. The blood bags are designed in a way that makes it simple to separate the various components of the blood that has been collected. Accidents are happening more frequently, which is driving up demand for blood bags.

In addition, technological advancements in the manufacturing of blood bags, such as the use of PVC-free materials and improved sterilization techniques, are also contributing to the blood bags market growth.

The market is also facing challenges such as the high cost of blood bags and stringent regulations for their manufacturing and distribution. The COVID-19 pandemic had a moderate impact on the market, with disruptions in the supply chain and reduced blood donations in some regions. Overall, the blood bags market is expected to continue to grow, driven by increasing demand and advancements in technology.

The rising awareness about blood donation is a significant driver for the growth of the blood bags market. As more people become aware of the importance of blood donation, there is an increase in the number of blood donations.

This leads to a higher demand for blood bags. Blood bags are essential for the collection, storage, and transportation of blood and blood components. With more people donating blood, there is a need for an adequate supply of blood bags to ensure that the collected blood is safe and can be used for transfusion when needed.

Moreover, the increasing awareness of the need for safe and high-quality blood transport is driving the demand for blood bags that are manufactured to high standards and quality. This, in turn, is leading to the adoption of advanced blood bag technologies that improve the safety, reliability, and durability of blood bags.

Blood bags are used in a wide range of healthcare applications, including blood transfusions, blood component therapy, and blood collection for testing and analysis. As the healthcare sector expands, the demand for these applications also increases, driving the need for more blood bags.

In addition, the growth of the healthcare sector is also leading to advancements in blood bag technologies, such as the use of PVC-free materials and improved sterilization techniques. These advancements are improving the safety and quality of blood bags, leading to better patient outcomes and driving the demand for more advanced blood bag technologies.

Overall, the growing healthcare sector is a significant driver for the blood bags market, as it increases the demand for blood bags and supports the adoption of advanced blood bag technologies.

The triple blood bags is expected to experience the consistent demand in the market during the forecast period. The same segment is projected to grow 1.7 times the current market value during the forecast period.

These bags are used for collection, preservation, and transfusion of Packed Red Blood Cells (PRBC) Platelets (PLT) and Plasma (FFP). The surge in need for separating blood into three components fuel the demand for triple blood bags.

The leading end user in the blood bags market is the hospitals segment followed by blood banks segment. Hospitals and blood banks are the primary facilities where blood bags are used for blood collection, storage, and transfusion.

Hospitals use blood bags for a wide range of medical procedures, including surgeries, trauma cases, and critical care treatments, where blood transfusions may be necessary. Blood banks collect and store blood and blood components for use in emergencies and medical treatments.

The growing demand for blood bags in hospitals and blood banks is driven by the increasing prevalence of chronic diseases, growing aging population, rising number of surgeries, and trauma cases.

The COVID-19 pandemic has also increased the demand for blood bags in hospitals as many patients required blood transfusions during their treatment. Both the segment collectively are estimated to hold nearly 61% of the market value share by the end of 2025.

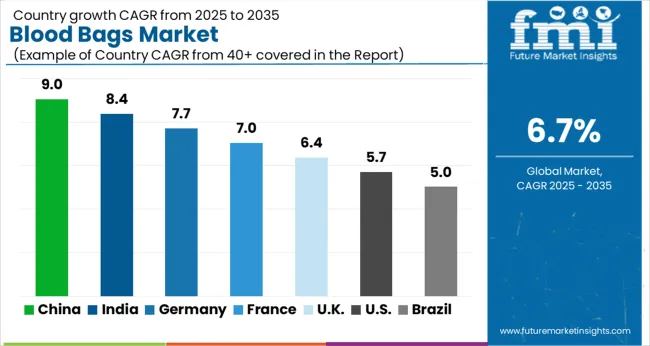

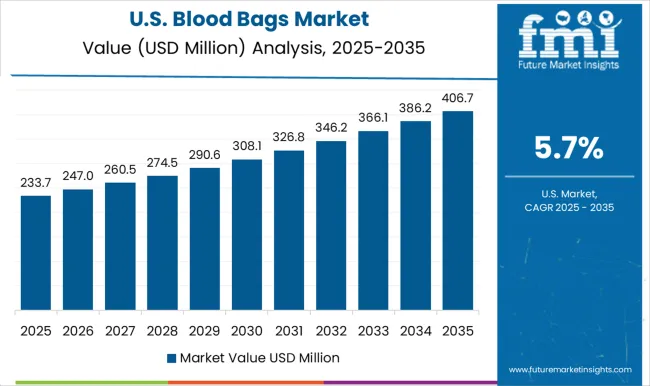

| Countries | USA |

|---|---|

| Market Share (2025) | 28.3% |

| Market Share (2035) | 25.7% |

| BPS Analysis | -300 |

| Countries | China |

|---|---|

| Market Share (2025) | 9.2% |

| Market Share (2035) | 11.0% |

| BPS Analysis | +220 |

| Countries | Germany |

|---|---|

| Market Share (2025) | 6.7% |

| Market Share (2035) | 5.2% |

| BPS Analysis | -100 |

| Countries | UNITED KINGDOM |

|---|---|

| Market Share (2025) | 5.3% |

| Market Share (2035) | 5.7% |

| BPS Analysis | +30 |

| Countries | Canada |

|---|---|

| Market Share (2025) | 4.4% |

| Market Share (2035) | 6.1% |

| BPS Analysis | +140 |

The USA is projected to hold around 84% of the market value share by the end of 2025. The USA has advanced medical infrastructure, technological innovations in blood collection and storage, strong regulatory standards. Also, the presence of major pharmaceutical companies that invest heavily in the development of blood-related products.

The USA has a large population and a robust healthcare system that demands a high volume of blood and blood-related products. According to the American National Red Cross, in February 2024, approximately 29,000 units of red blood cells were required daily and that nearly 21 million blood components were transfused in the USA This factor fuel the demand for blood bags.

India's road traffic accidents have been surging in recent years, leading to an increase in demand for blood in the country. This is because many of the accident victims require blood transfusions as a part of their treatment, and the demand for blood bags increases accordingly.

According to Government of India ministry of road transport and highways transport, during the year 2024, a total number of 4,12,432 road accidents have been reported in the country, claiming 1,53,972 lives and causing injuries to 3,84,448 persons.

People suffer non-fatal injuries, and many of them develop disabilities as a result. As a result, the growth of the blood bags market is closely tied to the incidence of road traffic accidents in India. India blood bags market is anticipated to register a CAGR of XX% during 2025 to 2035.

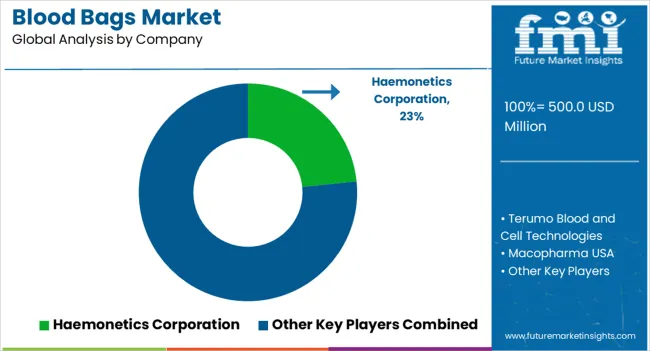

The blood bags market is driven by medical device manufacturers and healthcare solution providers focused on safe, sterile, and efficient blood collection, storage, and transfusion systems. Haemonetics Corporation and Terumo Blood and Cell Technologies lead the market with advanced blood collection and component separation systems designed for high precision and donor safety. Their products integrate closed-system technologies that minimize contamination risks and improve handling efficiency in hospitals and blood banks.

Macopharma and Fresenius Kabi India Pvt. Ltd. offer a wide range of single, double, triple, and quadruple blood bag systems equipped with anticoagulant solutions for optimized storage and plasma separation. Both companies emphasize compliance with international safety standards and innovations that extend shelf life and enhance traceability. Qingdao Sinoland International Trade Co. Ltd. supports the market with cost-effective, export-grade blood bag systems catering to emerging economies and healthcare procurement programs.

Genesis BPS and BL Lifesciences specialize in closed blood collection systems and customized medical disposables for laboratory and clinical use. Polymedicure Limited and B. Braun Melsungen AG manufacture high-quality medical-grade polymer bags ensuring consistent sterilization and durability. HLL Lifecare Limited plays a significant role in public healthcare supply, offering affordable blood collection solutions across developing regions.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 6.7% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million, Volume in Units and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Product Type, Capacity, End User, Region |

| Regions Covered | North America; Latin America; East Asia; South Asia & Pacific; Western Europe; Eastern Europe; Central Asia; Russia & Belarus; Balkan Countries; Baltic Countries; Middle East & Africa |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Germany, UNITED KINGDOM, France, Italy, Spain, Russia, China, Japan, India, GCC countries, Australia & New Zealand |

| Key Companies Profiled | Haemonetics Corporation, Terumo Blood and Cell Technologies, Macopharma, Fresenius Kabi India Pvt. Ltd., Qingdao Sinoland International Trade Co. Ltd., Genesis BPS, BL Lifesciences, Polymedicure Limited, B. Braun Melsungen AG, and HLL Lifecare Limited. |

| Customization & Pricing | Available upon Request |

The global blood bags market is estimated to be valued at USD 500.0 million in 2025.

The market size for the blood bags market is projected to reach USD 956.4 million by 2035.

The blood bags market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in blood bags market are single blood bag, double blood bag, triple blood bag, quadruple blood bag and penta blood bag.

In terms of capacity, less than 250 ml segment to command 42.9% share in the blood bags market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Blood Bags Market

Blood Compatible Nanocoating Market Size and Share Forecast Outlook 2025 to 2035

Blood Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Blood Sugar Tester Market Size and Share Forecast Outlook 2025 to 2035

Blood Flow Restriction Bands Market Size and Share Forecast Outlook 2025 to 2035

Blood-based Biomarker For Alzheimer's Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Blood Bank Reagent Market Size and Share Forecast Outlook 2025 to 2035

Blood Clot Retrieval Devices Market Size and Share Forecast Outlook 2025 to 2035

Blood Glucose Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Blood Pressure Transducers Market Size and Share Forecast Outlook 2025 to 2035

Blood Culture Test Market Size and Share Forecast Outlook 2025 to 2035

Blood Bag Tube Sealer Market Size and Share Forecast Outlook 2025 to 2035

Blood Warmer Devices Market Size and Share Forecast Outlook 2025 to 2035

Blood Temperature Indicator Market Size, Share & Forecast 2025 to 2035

Blood Testing Equipment Market Growth - Trends & Forecast 2025 to 2035

Blood Coagulation Analyzers Market Growth – Trends & Forecast 2025 to 2035

The Blood Fluid Warming System Market is segmented by product type, application, and end user from 2025 to 2035

Blood Cancer Treatment Market Growth – Trends & Forecast 2025 to 2035

Blood Volume Analyzer Market – Demand, Growth & Forecast 2025 to 2035

Blood Collection Devices Market Insights – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA