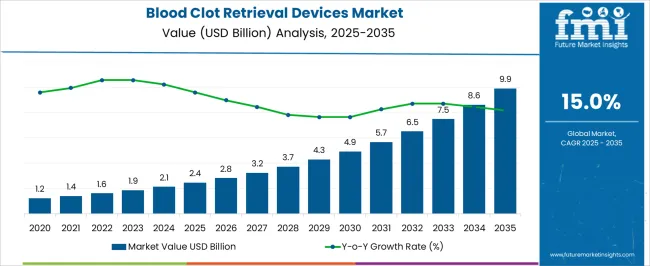

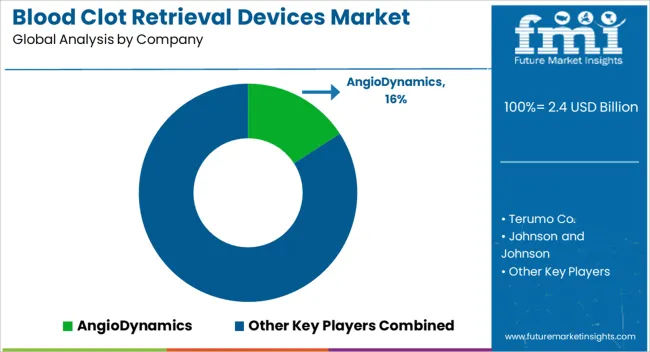

The Blood Clot Retrieval Devices Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 9.9 billion by 2035, registering a compound annual growth rate (CAGR) of 15.0% over the forecast period.

| Metric | Value |

|---|---|

| Blood Clot Retrieval Devices Market Estimated Value in (2025 E) | USD 2.4 billion |

| Blood Clot Retrieval Devices Market Forecast Value in (2035 F) | USD 9.9 billion |

| Forecast CAGR (2025 to 2035) | 15.0% |

The blood clot retrieval devices market is experiencing significant growth, driven by the increasing prevalence of ischemic stroke and the urgent need for effective interventional therapies. Rising awareness about stroke symptoms and timely treatment, coupled with advancements in minimally invasive neurovascular procedures, is expanding adoption of mechanical thrombectomy solutions. Continuous innovation in device design, materials, and navigation technology is enhancing procedural success rates and patient safety.

Hospitals and specialized stroke centers are investing heavily in advanced intervention equipment to improve outcomes and reduce long-term disability. Regulatory support and reimbursement policies in developed and emerging markets are encouraging wider adoption of blood clot retrieval devices. Increasing research and clinical trials validating the efficacy of stent retrievers and aspiration systems are strengthening market confidence.

As the global burden of stroke rises due to aging populations, sedentary lifestyles, and comorbid conditions, demand for devices capable of rapid and precise clot removal is expected to grow substantially The market is poised for continued expansion, with manufacturers focusing on improved device performance, ease of use, and compatibility with neuroimaging guidance systems.

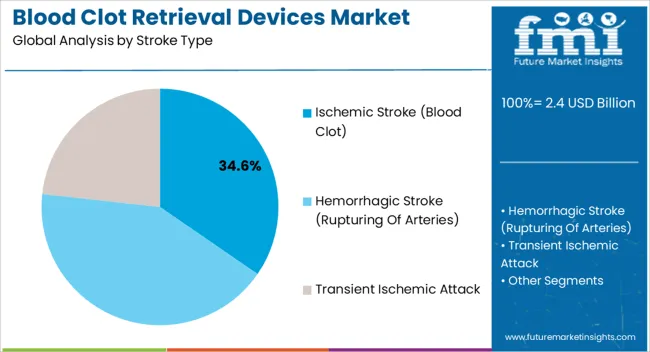

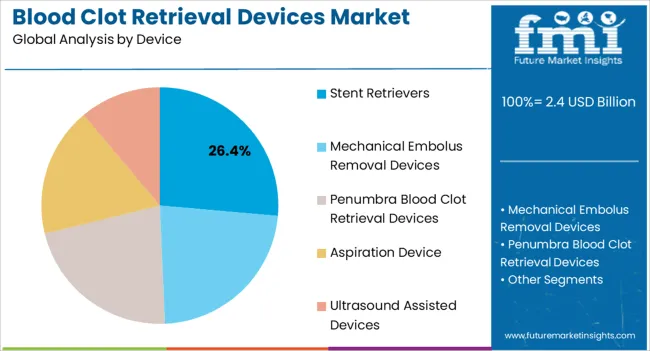

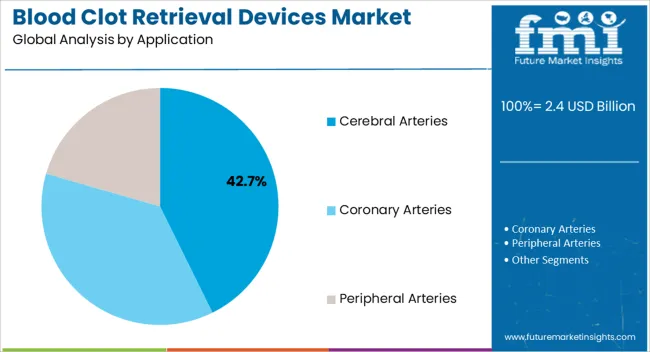

The blood clot retrieval devices market is segmented by stroke type, device, application, end user, and geographic regions. By stroke type, blood clot retrieval devices market is divided into Ischemic Stroke (Blood Clot), Hemorrhagic Stroke (Rupturing Of Arteries), and Transient Ischemic Attack. In terms of device, blood clot retrieval devices market is classified into Stent Retrievers, Mechanical Embolus Removal Devices, Penumbra Blood Clot Retrieval Devices, Aspiration Device, and Ultrasound Assisted Devices. Based on application, blood clot retrieval devices market is segmented into Cerebral Arteries, Coronary Arteries, and Peripheral Arteries. By end user, blood clot retrieval devices market is segmented into Hospitals, Diagnostic Centers, Clinics, and Ambulatory Surgical Centers. Regionally, the blood clot retrieval devices industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ischemic stroke device segment is projected to hold 34.6% of the blood clot retrieval devices market revenue share in 2025, making it the leading stroke type segment. Its leadership is being driven by the high incidence of ischemic strokes globally and the need for urgent mechanical clot removal to restore cerebral blood flow. Devices targeting ischemic stroke are optimized for navigating tortuous vasculature and minimizing procedure time, directly impacting patient outcomes and survival rates.

The segment’s growth is also supported by increasing hospital adoption of evidence-based interventional protocols and the availability of skilled neurointerventionalists. Technological advancements in device flexibility, trackability, and clot engagement mechanisms have improved success rates and reduced complications.

Hospitals and stroke centers are prioritizing investment in devices with proven efficacy for ischemic stroke, creating sustained demand As clinical awareness and early stroke diagnosis continue to improve, the segment is expected to maintain its dominant position, driven by the combination of clinical necessity and continuous device innovation.

The stent retrievers device segment is expected to account for 26.4% of the blood clot retrieval devices market revenue share in 2025, positioning it as the leading device type. This dominance is being supported by their proven efficacy in mechanical thrombectomy procedures, enabling high rates of successful clot removal and vessel recanalization. Stent retrievers are designed to engage and extract thrombi efficiently, reducing the risk of distal embolization and improving patient recovery outcomes.

Their ability to navigate complex cerebral artery anatomy and compatibility with advanced neuroimaging guidance systems has facilitated adoption across specialized stroke centers. Continuous improvements in stent design, material composition, and delivery systems are enhancing performance and procedural safety.

Clinical studies and guidelines recommending stent retrievers as first-line intervention for eligible ischemic stroke patients are further reinforcing demand As awareness of mechanical thrombectomy benefits grows and procedural volumes increase globally, stent retrievers are expected to maintain their leadership position in the market.

The cerebral arteries application segment is anticipated to capture 42.7% of the blood clot retrieval devices market revenue share in 2025, making it the leading application segment. This dominance is being driven by the critical need to restore blood flow in major cerebral vessels during acute ischemic stroke, where timely intervention is essential to minimize neuronal damage. Blood clot retrieval devices are optimized for use in cerebral arteries due to their precision, flexibility, and ability to navigate intricate vascular pathways safely.

The segment’s growth is further reinforced by expanding adoption in high-volume stroke centers and increased procedural success rates reported in clinical studies. Compatibility with both stent retrievers and aspiration systems allows comprehensive treatment across a range of patient anatomies and thrombus characteristics.

Growing emphasis on reducing stroke-related mortality and long-term disability, combined with improved imaging and catheterization technologies, is promoting the use of these devices in cerebral artery interventions As early diagnosis and interventional capabilities expand globally, this segment is expected to continue leading the market.

The danger of paralysis or brain damage is reduced by the use of blood clot retrieval devices. This surgical procedure aids in removing the patient's blood clots from the brain. Patients with blood clots in the brain undergo an invasive surgery that involves arteries going to the brain. Blood clot retrieval devices are used to treat two main types of strokes, ischemic and hemorrhagic, both of which are brought on by impaired blood flow to the brain.

Thrombectomy devices, commonly referred to as blood clot retrieval devices are useful in eliminating blood clots by broadening the arteries. When blood clots form in the brain, retrieval devices for blood clots can be very effective in the removal process.

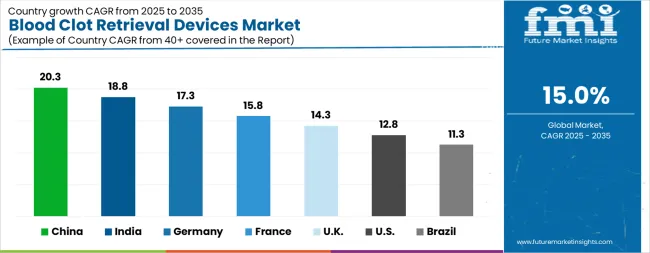

| Country | CAGR |

|---|---|

| China | 20.3% |

| India | 18.8% |

| Germany | 17.3% |

| France | 15.8% |

| UK | 14.3% |

| USA | 12.8% |

| Brazil | 11.3% |

The Blood Clot Retrieval Devices Market is expected to register a CAGR of 15.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 20.3%, followed by India at 18.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 11.3%, yet still underscores a broadly positive trajectory for the global Blood Clot Retrieval Devices Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 17.3%. The USA Blood Clot Retrieval Devices Market is estimated to be valued at USD 884.9 million in 2025 and is anticipated to reach a valuation of USD 2.9 billion by 2035. Sales are projected to rise at a CAGR of 12.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 130.7 million and USD 77.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 Billion |

| Stroke Type | Ischemic Stroke (Blood Clot), Hemorrhagic Stroke (Rupturing Of Arteries), and Transient Ischemic Attack |

| Device | Stent Retrievers, Mechanical Embolus Removal Devices, Penumbra Blood Clot Retrieval Devices, Aspiration Device, and Ultrasound Assisted Devices |

| Application | Cerebral Arteries, Coronary Arteries, and Peripheral Arteries |

| End User | Hospitals, Diagnostic Centers, Clinics, and Ambulatory Surgical Centers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AngioDynamics, Terumo Co., Johnson and Johnson, ECKOS Co., Bayer HealthCare LLC, Boston Scientific Co., Argon Medical Devices, Medtronic Plc, Teleflex Incorporated, and Penumbra |

The global blood clot retrieval devices market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the blood clot retrieval devices market is projected to reach USD 9.9 billion by 2035.

The blood clot retrieval devices market is expected to grow at a 15.0% CAGR between 2025 and 2035.

The key product types in blood clot retrieval devices market are ischemic stroke (blood clot), hemorrhagic stroke (rupturing of arteries) and transient ischemic attack.

In terms of device, stent retrievers segment to command 26.4% share in the blood clot retrieval devices market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blood Warmer Devices Market Size and Share Forecast Outlook 2025 to 2035

Blood Collection Devices Market Insights – Trends & Forecast 2025 to 2035

Home Blood Testing Devices Market Insights - Trends, Growth & Forecast 2025 to 2035

Blood Glucose Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Assessing Vacuum Blood Collection Devices Market Share & Industry Trends

Pet Blood Pressure Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Point Of Care Blood Testing Devices Market Size and Share Forecast Outlook 2025 to 2035

Non-Invasive Blood Glucose Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Blood Compatible Nanocoating Market Size and Share Forecast Outlook 2025 to 2035

Blood Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Blood Sugar Tester Market Size and Share Forecast Outlook 2025 to 2035

Blood Flow Restriction Bands Market Size and Share Forecast Outlook 2025 to 2035

Blood-based Biomarker For Alzheimer's Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Blood Bank Reagent Market Size and Share Forecast Outlook 2025 to 2035

Cloth Drying Machine Market Size and Share Forecast Outlook 2025 to 2035

Clothing Fibers Market Size and Share Forecast Outlook 2025 to 2035

Blood Pressure Transducers Market Size and Share Forecast Outlook 2025 to 2035

Blood Culture Test Market Size and Share Forecast Outlook 2025 to 2035

Blood Bag Tube Sealer Market Size and Share Forecast Outlook 2025 to 2035

Blood Bags Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA