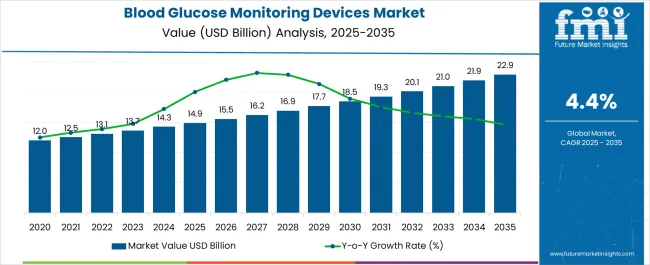

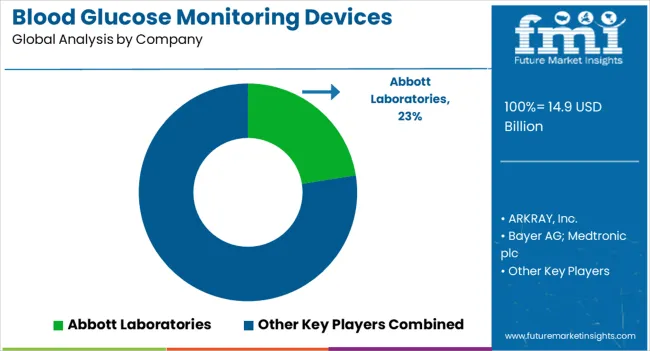

The Blood Glucose Monitoring Devices Market is estimated to be valued at USD 14.9 billion in 2025 and is projected to reach USD 22.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

| Metric | Value |

|---|---|

| Blood Glucose Monitoring Devices Market Estimated Value in (2025 E) | USD 14.9 billion |

| Blood Glucose Monitoring Devices Market Forecast Value in (2035 F) | USD 22.9 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The blood glucose monitoring devices market is expanding steadily as the prevalence of diabetes continues to rise globally. Growth is being driven by increasing awareness of diabetes management, expanding patient education programs, and improvements in device technology that support accuracy and convenience.

The current scenario reflects strong adoption of both self-monitoring and continuous monitoring systems, supported by healthcare initiatives encouraging regular blood glucose tracking. Regulatory approvals and reimbursement frameworks are enhancing access, while the entry of advanced digital health platforms is fostering integration with mobile and cloud-based ecosystems.

The future outlook is defined by innovation in minimally invasive and non-invasive modalities, alongside the growing demand for portable devices that offer real-time insights and patient autonomy Growth rationale is supported by the necessity of ongoing monitoring in chronic disease management, rising healthcare expenditures, and the ability of manufacturers to deliver compact, user-friendly, and connected devices, which collectively position the market for sustained expansion and broader adoption across both developed and emerging regions.

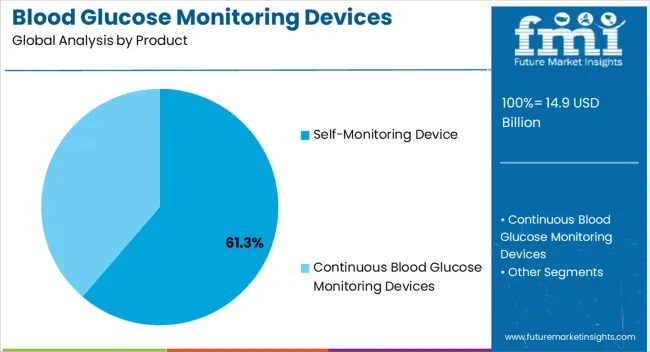

The self-monitoring device segment, accounting for 61.30% of the product category, has maintained its lead due to its affordability, accessibility, and ease of use. Adoption has been driven by its ability to provide quick results that support daily diabetes management. The segment benefits from widespread distribution through pharmacies and retail channels, ensuring availability for both urban and rural populations.

Technological improvements in test strips, lancets, and compact meters have enhanced accuracy and user confidence. Cost-effectiveness compared to continuous monitoring systems has reinforced market preference, particularly in developing economies where affordability plays a critical role.

Integration with digital platforms and mobile applications has further improved patient compliance and engagement These advantages have solidified the position of self-monitoring devices as the dominant product type in the blood glucose monitoring devices market.

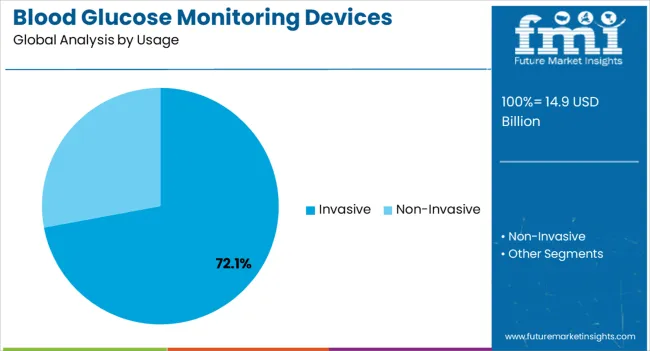

The invasive segment, representing 72.10% of the usage category, continues to dominate due to its long-standing presence and clinical reliability. Its market share has been sustained by consistent demand for conventional testing methods, which remain widely prescribed by healthcare providers.

Invasive devices are supported by established reimbursement systems and regulatory approvals, ensuring continued trust among patients and clinicians. Technological refinements have minimized discomfort and improved ease of sampling, enhancing patient adherence to testing protocols.

Cost advantages compared to emerging non-invasive alternatives have reinforced adoption across a broad patient base While innovation in non-invasive technologies is progressing, invasive devices are expected to remain the primary choice in the near term due to their proven accuracy, affordability, and widespread clinical acceptance.

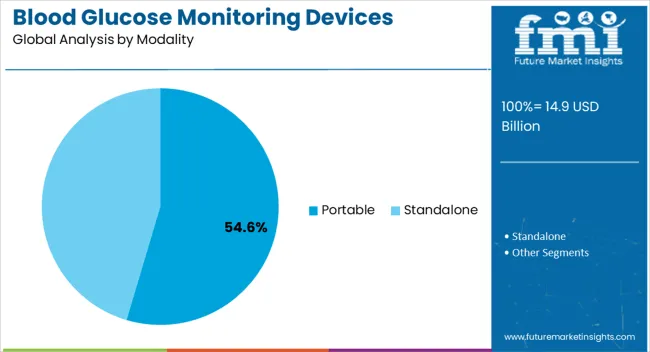

The portable segment, holding 54.60% of the modality category, has been leading the market due to rising demand for compact and user-friendly devices that support on-the-go monitoring. Its growth is supported by increasing lifestyle-related diabetes cases and the need for continuous monitoring outside clinical settings.

Advances in portability, combined with Bluetooth connectivity and integration with health apps, have strengthened user engagement and compliance. Distribution through retail, hospital, and e-commerce channels has expanded access, driving adoption across diverse demographics.

Cost competitiveness compared to wearable continuous monitors has made portable devices a practical solution for daily glucose management Ongoing innovation in miniaturization, accuracy, and connectivity is expected to sustain the segment’s dominance, ensuring portable devices remain a cornerstone of the blood glucose monitoring devices market.

| CAGR from 2020 to 2025 | 5.0% |

|---|---|

| CAGR from 2025 to 2035 | 4.9% |

| Countries | 2035 Value CAGR in Global Market |

|---|---|

| United States | 3.9% |

| United Kingdom | 3.8% |

| China | 4.8% |

| Germany | 4.1% |

| Attributes | Details |

|---|---|

| By Product Type | Self-Monitoring Devices |

| Market Share in 2025 | 71.4% |

| Attributes | Details |

|---|---|

| By Distribution Channel | Retail Pharmacy |

| Market Share in 2025 | 38.2% |

To meet consumer demand and expand their customer base, major players are concentrating on new product launches, regulatory approvals, acquisitions, improvements in current products & technologies, and other methods to increase their business portfolio & fortify their presence.

Recent developments

Similarly, recent developments related to companies manufacturing blood glucose monitoring device products have been tracked by the team at Future Market Insights, which are available in the full report.

The global blood glucose monitoring devices market is estimated to be valued at USD 14.9 billion in 2025.

The market size for the blood glucose monitoring devices market is projected to reach USD 22.9 billion by 2035.

The blood glucose monitoring devices market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in blood glucose monitoring devices market are self-monitoring device and continuous blood glucose monitoring devices.

In terms of usage, invasive segment to command 72.1% share in the blood glucose monitoring devices market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Non-Invasive Blood Glucose Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Blood Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Blood Sugar Tester Market Size and Share Forecast Outlook 2025 to 2035

Blood Flow Restriction Bands Market Size and Share Forecast Outlook 2025 to 2035

Blood-based Biomarker For Alzheimer's Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Blood Bank Reagent Market Size and Share Forecast Outlook 2025 to 2035

Blood Pressure Transducers Market Size and Share Forecast Outlook 2025 to 2035

Blood Culture Test Market Size and Share Forecast Outlook 2025 to 2035

Blood Bag Tube Sealer Market Size and Share Forecast Outlook 2025 to 2035

Blood Bags Market Size and Share Forecast Outlook 2025 to 2035

Blood Temperature Indicator Market Size, Share & Forecast 2025 to 2035

Blood Testing Equipment Market Growth - Trends & Forecast 2025 to 2035

Blood Coagulation Analyzers Market Growth – Trends & Forecast 2025 to 2035

The Blood Fluid Warming System Market is segmented by product type, application, and end user from 2025 to 2035

Blood Cancer Treatment Market Growth – Trends & Forecast 2025 to 2035

Blood Volume Analyzer Market – Demand, Growth & Forecast 2025 to 2035

Blood Pressure Monitor Market Analysis by Product, Indication, End User and Region: Forecast for 2025 to 2035

Key Players & Market Share in the Blood-Based Biomarker Industry

Competitive Landscape of Blood Temperature Indicator Providers

Blood Meal Market Analysis – Applications, Demand & Growth

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA