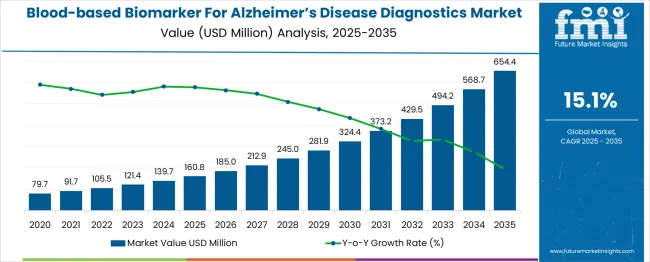

The global blood-based biomarker for Alzheimer's disease diagnostics market is projected to grow from USD 160.8 million in 2025 to approximately USD 654.4 million by 2035, recording an absolute increase of USD 493.6 million over the forecast period. This translates into a total growth of 307.0%, with the market forecast to expand at a compound annual growth rate (CAGR) of 15% between 2025 and 2035. The market size is expected to grow by nearly 4.07X during the same period, supported by increasing prevalence of Alzheimer's disease globally, rising demand for early diagnosis and accessible testing, and growing adoption of blood-based biomarkers as alternatives to invasive cerebrospinal fluid testing and expensive brain imaging.

Between 2025 and 2030, the blood-based biomarker for Alzheimer's disease diagnostics market is projected to expand from USD 160.8 million to USD 324 million, resulting in a value increase of USD 163.2 million, which represents 33.1% of the total forecast growth for the decade. This phase of growth will be shaped by increasing clinical validation of blood-based biomarkers, growing regulatory approvals for blood tests, and rising adoption in primary care settings for early Alzheimer's detection. Diagnostic companies are expanding their blood-based biomarker portfolios to address the growing demand for accessible and cost-effective Alzheimer's diagnostic solutions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 160.8 million |

| Forecast Value in (2035F) | USD 654.4 million |

| Forecast CAGR (2025 to 2035) | 15% |

From 2030 to 2035, the market is forecast to grow from USD 324 million to USD 654.4 million, adding another USD 330.4 million, which constitutes 66.9% of the ten-year expansion. This period is expected to be characterized by expansion of combination biomarker panels, integration with artificial intelligence for enhanced diagnostic accuracy, and development of point-of-care testing platforms for immediate results. The growing adoption of precision medicine approaches and personalized treatment strategies will drive demand for blood-based biomarkers with enhanced predictive capabilities and prognostic value.

Between 2020 and 2025, the blood-based biomarker for Alzheimer's disease diagnostics market experienced significant acceleration, driven by breakthrough research demonstrating the clinical utility of plasma biomarkers and growing recognition of the limitations of traditional diagnostic approaches. The market developed as researchers and clinicians recognized the potential for blood tests to revolutionize Alzheimer's diagnosis by providing accessible, cost-effective, and minimally invasive testing alternatives. FDA approvals and clinical guideline updates began emphasizing the clinical validity of blood-based biomarkers for Alzheimer's disease assessment.

Market expansion is being supported by the increasing global prevalence of Alzheimer's disease and the corresponding demand for early diagnostic tools that can identify patients before significant cognitive decline occurs. Modern healthcare systems are increasingly focused on early intervention approaches that can slow disease progression and improve patient outcomes through timely diagnosis and treatment initiation. Blood-based biomarkers' proven ability to detect Alzheimer's pathology years before clinical symptoms appear makes them essential tools for precision medicine and preventive neurology approaches.

The growing focus on accessible and cost-effective diagnostic solutions is driving demand for blood-based biomarkers that can overcome the barriers associated with traditional diagnostic methods including invasive lumbar punctures and expensive neuroimaging procedures. Healthcare provider preference for diagnostic tools that can be implemented in routine clinical practice is creating opportunities for blood-based testing platforms that integrate with existing laboratory workflows. The rising influence of aging population demographics and healthcare cost containment pressures is also contributing to increased adoption of blood-based diagnostic alternatives that can reduce healthcare utilization while improving diagnostic accuracy.

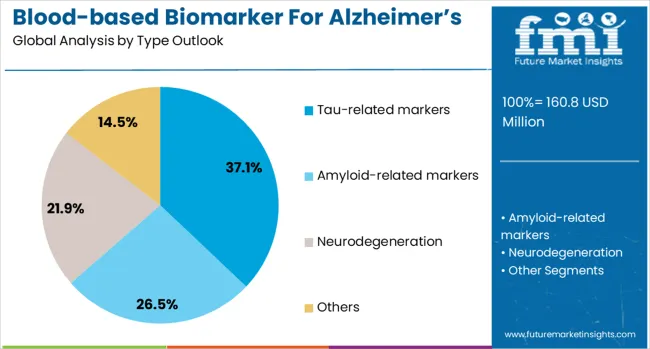

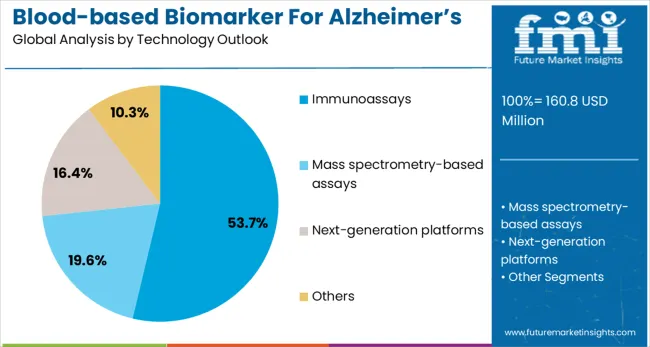

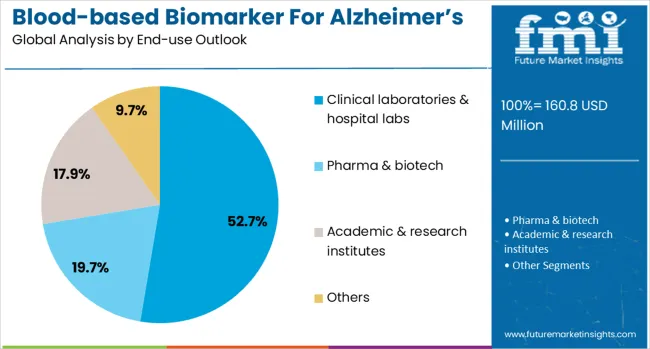

The market is segmented by type, technology, end-use, and region. By type, the market is divided into tau-related markers, amyloid-related markers, neurodegeneration markers, and others. Based on technology, the market is categorized into immunoassays, mass spectrometry-based assays, next-generation platforms, and others. In terms of end-use, the market is segmented into clinical laboratories & hospital labs, pharma & biotech companies, academic & research institutes, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The tau-related markers segment is projected to account for 37% of the blood-based biomarker for Alzheimer's disease diagnostics market in 2025, reaffirming its position as the leading biomarker category. Healthcare providers and researchers increasingly recognize tau-related markers for their strong correlation with neurodegeneration and their predictive value for cognitive decline and disease progression. Tau markers' proven effectiveness in detecting neurofibrillary tangle pathology and monitoring disease progression directly addresses clinical needs for accurate staging and prognosis in Alzheimer's disease management.

This biomarker type forms the foundation of blood-based Alzheimer's diagnostics, as it represents one of the core pathological hallmarks of the disease with established clinical utility for diagnosis and monitoring. Research investments in tau biomarker development and ongoing clinical validation studies continue to strengthen adoption of tau-based testing. With clinicians prioritizing biomarkers that can predict disease progression and guide treatment decisions, tau-related markers align with both diagnostic requirements and therapeutic monitoring needs, making them the central component of comprehensive Alzheimer's biomarker panels.

Immunoassays are projected to represent 54% of blood-based Alzheimer's biomarker testing demand in 2025, underscoring their critical role as the primary detection technology for blood-based biomarkers. Clinical laboratories prefer immunoassay platforms for their established workflows, automated capabilities, and ability to deliver quantitative results with high throughput and reproducibility. Positioned as essential technology for routine biomarker testing, immunoassays offer both analytical reliability benefits and operational efficiency advantages for clinical laboratories.

The segment is supported by continuous advancement in ultra-sensitive immunoassay technologies and growing availability of automated platforms that can detect biomarkers at the low concentrations present in blood samples. Immunoassay platforms enable standardized testing protocols and quality control procedures necessary for clinical implementation. As blood-based biomarker testing becomes more routine and widespread, immunoassays will continue to dominate the technology landscape while supporting scalable and reliable biomarker detection across diverse clinical settings.

The clinical laboratories & hospital labs end-use segment is forecasted to contribute 53% of the blood-based biomarker for Alzheimer's disease diagnostics market in 2025, reflecting the primary role of clinical laboratory services in diagnostic testing and patient care. Hospital laboratories and commercial diagnostic labs increasingly integrate blood-based biomarker testing into routine laboratory menus while providing comprehensive diagnostic services for neurological disorders. This aligns with healthcare delivery models that emphasize centralized laboratory testing and standardized diagnostic protocols.

The segment benefits from established laboratory infrastructure and growing recognition of blood-based biomarkers as clinically useful diagnostic tools that can be implemented using existing laboratory capabilities and workflows. With proven analytical expertise and quality assurance programs, clinical laboratories serve as the primary setting for blood-based biomarker testing, making them a critical foundation for market adoption and clinical implementation of Alzheimer's diagnostic biomarkers.

The blood-based biomarker for Alzheimer's disease diagnostics market is advancing rapidly due to increasing disease prevalence and growing demand for early diagnostic capabilities that can enable timely intervention and treatment planning. The market faces challenges, including regulatory complexity for biomarker validation, standardization requirements across different platforms, and reimbursement uncertainties for novel diagnostic tests. Innovation in ultra-sensitive detection technologies and combination biomarker panels continue to influence product development and market expansion patterns.

The growing focus on early Alzheimer's detection and intervention is enabling blood-based biomarkers to support precision medicine approaches that can identify at-risk individuals before significant cognitive decline. Early detection capabilities allow for timely therapeutic intervention and lifestyle modifications that may slow disease progression. Healthcare providers are increasingly recognizing the clinical utility of blood-based biomarkers for risk stratification and personalized treatment planning.

Modern diagnostic companies are incorporating artificial intelligence and machine learning algorithms to improve biomarker interpretation and develop sophisticated diagnostic models that combine multiple biomarkers with clinical and demographic data. These technologies enhance diagnostic accuracy while providing predictive analytics that can assess disease risk and progression likelihood. Advanced AI integration also enables personalized risk assessment and treatment recommendation systems that support clinical decision-making.

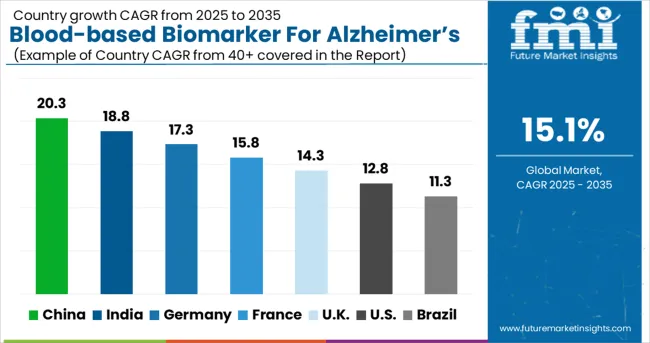

| Country | CAGR (2025-2035) |

|---|---|

| China | 20.3% |

| India | 18.8% |

| Germany | 17.3% |

| France | 15.8% |

| UK | 14.3% |

| USA | 12.8% |

| Brazil | 11.3% |

The blood-based biomarker for Alzheimer's disease diagnostics market is experiencing exceptional growth globally, with China leading at a 20.3% CAGR through 2035, driven by a rapidly aging population, increasing Alzheimer's disease prevalence, and growing healthcare infrastructure supporting advanced diagnostic capabilities. India follows closely at 18.8%, supported by expanding healthcare access, rising awareness about dementia, and increasing adoption of advanced diagnostic technologies. Germany shows strong growth at 17.3%, emphasizing neurological healthcare excellence and precision medicine. France records 15.8%, focusing on neurodegenerative disease research and healthcare innovation. The UK shows 14.3% growth, prioritizing NHS integration and neurological care advancement.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

The blood-based biomarker market for Alzheimer's disease diagnostics in China is projected to grow at a CAGR of 20.3% from 2025 to 2035. Rapid expansion of diagnostic capability in tertiary hospitals and increasing deployment of centralized laboratory networks are driving adoption of blood-based assays. Large-scale screening pilots are being introduced in urban medical centers to enable earlier identification of at-risk cohorts, and payer coverage for confirmatory testing is being negotiated with provincial health authorities. Local biotechnology firms are moving to commercialize immunoassays and mass-spectrometry based proteomic panels, while contract manufacturing organizations are scaling up reagent production. Research collaborations between medical universities and hospitals are being used to validate population-specific cutoffs and to enhance clinical utility in mixed-pathology cases. Regulatory pathways are being streamlined through conditional approvals for companion diagnostics, which are helping to speed clinical deployment.

The blood-based biomarker market for Alzheimer’s disease diagnostics in India is expected to expand at a CAGR of 18.8% from 2025 to 2035. Growth in specialized neurology centers and an expanding network of diagnostic laboratories is increasing demand for affordable blood-based biomarker tests. Public health initiatives focused on noncommunicable diseases have led to pilot screening programs targeting older adults in metropolitan and large tier-2 cities, which have raised awareness among primary care physicians. Local diagnostics companies are being encouraged to develop cost-optimized assays using established antibody platforms to lower per-test price points for broader market penetration. Clinical validation studies are being undertaken in diverse genetic and environmental cohorts to ensure assay performance across subpopulations. Procurement policies are being shaped by state-level health authorities with a focus on coverage decisions for confirmatory testing pathways.

The blood-based biomarker market for Alzheimer’s disease diagnostics in Germany is projected to grow at a CAGR of 17.3% from 2025 to 2035. A highly structured healthcare reimbursement environment and broad access to specialty neurology services are encouraging early adoption of blood-based biomarkers for diagnostic triage. Academic medical centers are leading large multicenter validation studies that compare plasma biomarkers with established CSF and PET standards, allowing evidence-based recommendations to be incorporated into clinical guidelines. Diagnostic laboratories with accredited quality systems are being positioned to provide centralized testing services serving regional memory centers. Partnerships between German molecular diagnostics firms and larger international suppliers are being used to localize assays and to ensure compliance with EU in vitro diagnostic regulations. Health technology assessment bodies are being engaged to evaluate cost-effectiveness for targeted patient subgroups, which is guiding payer decisions for routine testing.

The blood-based biomarker market for Alzheimer’s disease diagnostics in France is forecast to register a CAGR of 15.8% from 2025 to 2035. National dementia strategies and coordinated memory clinic networks are supporting uptake of blood-based assays as an initial screening tool to prioritize patients for advanced testing. Regional hospital systems are integrating laboratory-developed tests into existing dementia pathways to shorten diagnostic timelines. Public research institutes are launching large-scale cohorts to validate the predictive performance of plasma-based markers in early cognitive decline. French biotech firms are entering licensing deals to adapt international assay kits for domestic use under local regulatory requirements. Health authorities are evaluating reimbursement options for plasma assays to reduce reliance on costlier CSF and imaging modalities. Training initiatives are targeting primary care physicians to promote early referral to memory clinics, and regional diagnostic hubs are emerging to consolidate testing volumes.

The blood-based biomarker market for Alzheimer’s disease diagnostics in the UK is projected to grow at a CAGR of 14.3% from 2025 to 2035. Memory assessment services within the National Health Service are beginning to pilot blood-based screening tools to accelerate triage before neuroimaging. Clinical commissioning groups are exploring inclusion of biomarker testing within local dementia pathways to reduce diagnostic waiting times. Universities and NHS trusts are collaborating to generate real-world evidence on assay performance across ethnically diverse populations. Private diagnostic labs are investing in automated high-throughput platforms to process rising test volumes. Regulatory agencies are offering fast-track evaluations for diagnostic devices addressing high-burden conditions, which is encouraging new market entrants. Patient advocacy organizations are campaigning for biomarker integration into standard diagnostic guidelines to enable earlier therapeutic intervention.

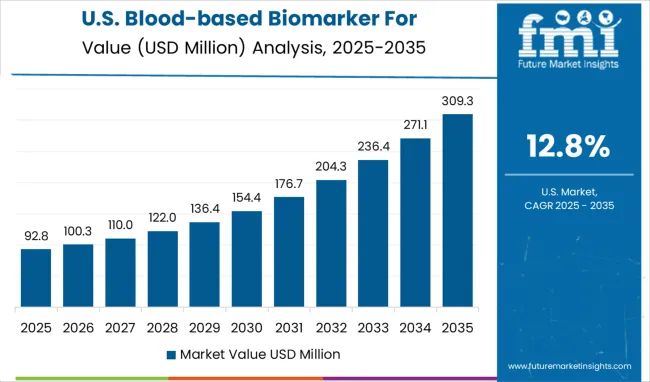

The blood-based biomarker market for Alzheimer’s disease diagnostics in the USA is expected to expand at a CAGR of 12.8% from 2025 to 2035. Major academic medical centers are adopting plasma biomarker panels to triage patients before PET or lumbar puncture. National payer networks are assessing coverage for blood-based tests as part of value-based care models in neurology. Large commercial labs are integrating Alzheimer’s biomarker assays into existing chronic disease testing menus to increase accessibility. Federal research funding is supporting multi-ethnic cohort studies to establish normative ranges for plasma markers. Industry consortia are working with regulatory agencies to define analytical performance criteria and clinical validity benchmarks. Direct-to-consumer diagnostic firms are exploring physician-supervised models for at-home blood collection linked to centralized lab analysis, aiming to tap into growing consumer interest in cognitive health screening.

The blood-based biomarker market for Alzheimer’s disease diagnostics in Brazil is projected to register a CAGR of 11.3% from 2025 to 2035. Public hospitals in metropolitan areas are introducing pilot screening programs for older adults as part of geriatric care modernization plans. Diagnostic service providers are partnering with universities to establish local assay validation labs. Government health agencies are allocating grants for early-detection programs aimed at reducing diagnostic delays in under-resourced regions. Private laboratories are importing plasma biomarker kits under expedited regulatory pathways to address growing demand from neurologists. Training initiatives are being launched to build a workforce skilled in neurodegenerative diagnostics, with emphasis on standardized pre-analytical handling. Awareness campaigns by patient groups are encouraging early evaluation of cognitive decline, increasing the number of individuals presenting for diagnostic workups at memory clinics.

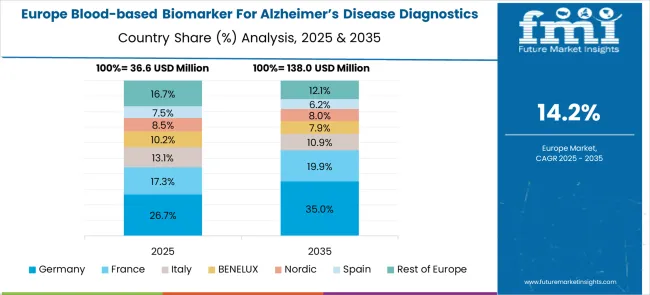

The blood-based biomarker for Alzheimer's disease diagnostics market in Europe demonstrates advanced development across major economies, with Germany showing a strong presence through its aging population demographics and focus on neurological healthcare excellence, supported by healthcare providers leveraging clinical expertise to implement comprehensive blood-based biomarker testing programs that emphasize early diagnosis and patient care integration across neurology and geriatric medicine specialties.

France represents a significant market driven by its healthcare system excellence and sophisticated understanding of neurodegenerative disease management, with healthcare providers focusing on advanced blood-based biomarker approaches that combine French medical expertise with cutting-edge diagnostic technologies for enhanced Alzheimer's detection and patient care in hospital and clinical laboratory settings.

The UK exhibits considerable growth through its focus on National Health Service integration and neurological research excellence, with strong adoption of blood-based biomarker testing across NHS laboratories, memory clinics, and specialized neurology services. Germany and France show expanding interest in precision medicine applications, particularly in early intervention and personalized treatment approaches for Alzheimer's disease. BENELUX countries contribute through their focus on healthcare innovation and advanced diagnostic technology adoption, while Eastern Europe and Nordic regions display growing potential driven by increasing healthcare investment and expanding neurological care capabilities.

The blood-based biomarker for Alzheimer's disease diagnostics market is characterized by competition among established diagnostic companies, specialized neurological testing providers, and emerging biomarker technology developers. Companies are investing in biomarker research and development, as well as clinical validation studies, regulatory compliance, and comprehensive clinical support services, to deliver accurate, reliable, and clinically useful blood-based diagnostic solutions. Innovation in ultra-sensitive detection technologies, combination biomarker panels, and AI-assisted interpretation are central to strengthening market position and clinical adoption.

F. Hoffmann-La Roche Ltd leads the market through comprehensive neurological diagnostic solutions with a focus on biomarker research and precision medicine applications. Quanterix provides specialized ultra-sensitive detection platforms with a focus on neurodegenerative disease biomarkers and advanced analytical capabilities. Fujirebio delivers established immunoassay technologies and biomarker testing solutions with a focus on neurological applications. C2N Diagnostics specializes in blood-based biomarkers for Alzheimer's disease with a focus on clinical utility and accessibility.

Labcorp and Quest Diagnostics Incorporated provide comprehensive laboratory services, including blood-based biomarker testing, with a focus on clinical laboratory implementation and healthcare provider access. Siemens Healthineers offers diagnostic instrumentation and testing solutions for neurological biomarkers. Lilly USA LLC offers a pharmaceutical industry perspective and expertise in biomarker development. Abbott and ALZpath provide specialized diagnostic technologies and testing platforms for detecting Alzheimer's disease biomarkers and their clinical applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 160.8 million |

| Type | Tau-related markers, Amyloid-related markers, Neurodegeneration markers, Others |

| Technology | Immunoassays, Mass spectrometry-based assays, Next-generation platforms, Others. |

| End-use | Clinical laboratories & hospital labs, Pharma & biotech companies, Academic & research institutes, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | F. Hoffmann-La Roche Ltd, Quanterix, Fujirebio, C2N Diagnostics, Labcorp, Quest Diagnostics Incorporated, Siemens Healthineers, Lilly USA LLC, Abbott, and ALZpath |

| Additional Attributes | Dollar sales by biomarker type and end-use category, regional demand trends, competitive landscape, buyer preferences for tau versus amyloid markers, integration with clinical care pathways, innovations in ultra-sensitive detection technology, AI-assisted interpretation, and point-of-care platform development |

The global blood-based biomarker for alzheimer’s disease diagnostics market is estimated to be valued at USD 160.8 million in 2025.

The market size for the blood-based biomarker for alzheimer’s disease diagnostics market is projected to reach USD 654.4 million by 2035.

The blood-based biomarker for alzheimer’s disease diagnostics market is expected to grow at a 15.1% CAGR between 2025 and 2035.

The key product types in blood-based biomarker for alzheimer’s disease diagnostics market are tau-related markers, amyloid-related markers, neurodegeneration and others.

In terms of technology outlook, immunoassays segment to command 53.7% share in the blood-based biomarker for alzheimer’s disease diagnostics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Key Players & Market Share in the Blood-Based Biomarker Industry

Biomarker-based Immunoassays Market Size and Share Forecast Outlook 2025 to 2035

Global Biomarker Discovery Outsourcing Service Market Analysis – Size, Share & Forecast 2024-2034

EPO Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

ST2 Biomarker Market

Dual Biomarker Assays Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

PD-L1 Biomarker Testing Market Report – Demand, Trends & Forecast 2025–2035

Brain Biomarker Market Trends and Forecast 2025 to 2035

Market Share Breakdown of PD-L1 Biomarker Testing Manufacturers

Renal Biomarker Market Report – Trends & Forecast 2024-2034

Vitamin Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Biomarker Diagnostic Test Kits Market Analysis – Trends & Forecast 2025 to 2035

Multiplex Biomarker Imaging Market Forecast and Outlook 2025 to 2035

Molecular Biomarkers For Cancer Detection Market Size and Share Forecast Outlook 2025 to 2035

Prognostic Biomarkers Market

Neurological Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Predisposition Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Asthma and COPD Biomarkers Market

Multiplex Sepsis Biomarker Panels Market Size and Share Forecast Outlook 2025 to 2035

Global Advanced At-home Biomarker Testing Market Analysis – Size, Share & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA