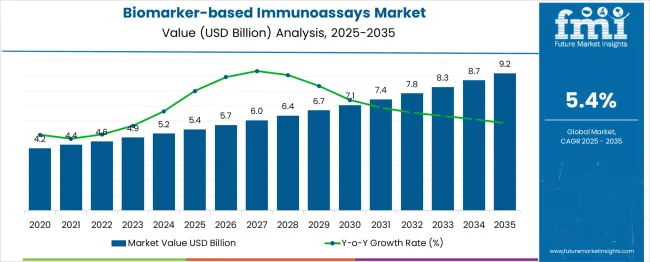

The biomarker-based immunoassays market is valued at USD 5.4 billion in 2025 and is expected to grow to USD 9.2 billion by 2035, registering a CAGR of 5%. From 2021 to 2025, the market expands from USD 4.2 billion to USD 5.4 billion, with annual increments through USD 4.4 billion, 4.6 billion, 4.9 billion, and 5.2 billion. This growth is driven by the increasing adoption of immunoassays in diagnostics, particularly in oncology, infectious diseases, and cardiovascular applications. The rise in biomarker research, along with advancements in test sensitivity and specificity, supports steady market growth during this period.

Between 2026 and 2030, the market continues to expand, moving from USD 5.4 billion to USD 7.4 billion, passing through USD 5.7 billion, 6.0 billion, 6.4 billion, and 6.7 billion. This phase is characterized by broader clinical adoption, especially in personalized medicine and companion diagnostics, as healthcare providers aim for more precise and efficient patient care. The value increase reflects both the growing volume of immunoassay tests and higher per-test prices due to technological advancements. By 2035, the market reaches USD 9.2 billion, with additional growth driven by the expanding global healthcare infrastructure and the increasing prevalence of chronic diseases requiring early and accurate diagnostics.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 5.4 billion |

| Forecast Value in (2035F) | USD 9.2 billion |

| Forecast CAGR (2025 to 2035) | 5% |

Seasonal fluctuations play a significant role in shaping the demand dynamics of markets like biomarker-based immunoassays, where predictable peaks and dips in demand are closely tied to factors such as disease outbreaks and changing healthcare needs. Peak demand for diagnostic testing typically occurs during colder months, particularly in late fall and winter, when seasonal illnesses like the flu, respiratory infections, and other viral outbreaks become more prevalent. These periods witness a significant increase in the need for immunoassays as healthcare providers focus on diagnosing and monitoring these diseases.

On the other hand, dips in demand are generally observed during the warmer months, especially between spring and early summer, when disease rates tend to be lower. During these off-peak periods, the need for diagnostic testing diminishes, and there is often a reduction in the volume of immunoassay tests conducted. Periods with no significant health concerns or disease outbreaks result in a predictable drop in demand.

Market expansion is being supported by the increasing prevalence of chronic diseases and the corresponding demand for accurate diagnostic and prognostic tools that can guide treatment decisions and monitor therapeutic responses. Modern healthcare systems are increasingly focused on personalized medicine approaches that require reliable biomarker detection to select appropriate therapies and optimize patient outcomes. Biomarker-based immunoassays' proven ability to detect and quantify disease-related proteins and other biomarkers makes them essential tools for precision diagnostics and therapeutic monitoring.

The growing emphasis on companion diagnostics and precision oncology is driving demand for biomarker immunoassays that can identify patients most likely to respond to specific therapies. Healthcare providers' preference for diagnostic solutions that combine analytical accuracy with clinical utility is creating opportunities for innovative biomarker assay implementations. The rising influence of regulatory requirements for biomarker validation and the growing pharmaceutical industry investment in biomarker-guided drug development are also contributing to increased adoption of standardized and validated immunoassay platforms.

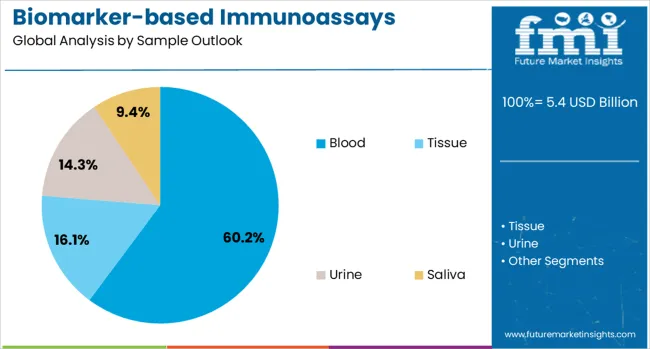

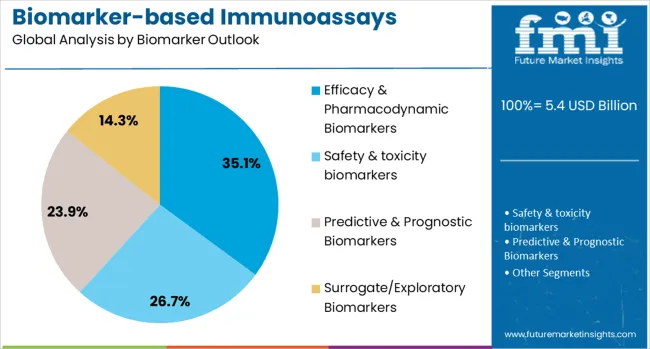

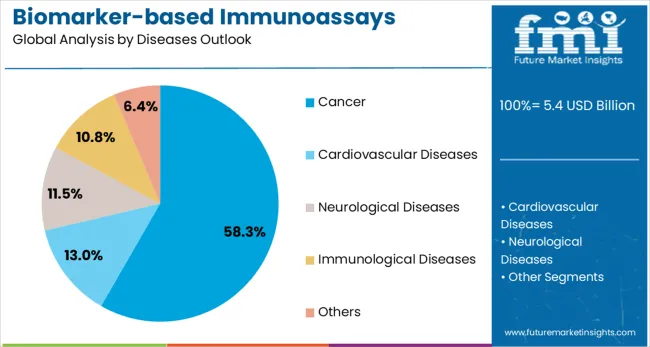

The market is segmented by sample type, product, biomarker type, disease indication, end-use, and region. By sample type, the market is divided into blood, tissue, urine, saliva, and others. Based on product, the market is categorized into reagents & kits, consumables, instruments/analyzers, and services. In terms of biomarker type, the market is segmented into efficacy & pharmacodynamic biomarkers, safety & toxicity biomarkers, predictive & prognostic biomarkers, and surrogate/exploratory biomarkers. By disease indication, the market is classified into cancer, cardiovascular diseases, neurological diseases, immunological diseases, and others. By end-use, the market is divided into hospitals & clinics, diagnostic laboratories, research & academic institutes, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The blood sample segment is projected to account for 60% of the biomarker-based immunoassays market in 2025, reaffirming its position as the dominant sample type. Healthcare providers and clinical laboratories increasingly prefer blood-based biomarker assays for their accessibility, standardized collection procedures, and comprehensive biomarker coverage across multiple disease areas. Blood samples' proven reliability in providing consistent and clinically relevant biomarker measurements directly addresses diagnostic requirements for accurate disease detection and monitoring.

This sample type forms the foundation of most biomarker testing protocols, as it represents the most accessible and clinically validated specimen type for biomarker analysis across diverse healthcare settings and patient populations. Laboratory investments in automated blood processing systems and standardized collection procedures continue to strengthen the adoption of blood-based biomarker assays. With healthcare providers prioritizing diagnostic accuracy and workflow efficiency, blood samples align with both clinical requirements and operational considerations, making them the central component of biomarker-based diagnostic strategies.

Reagents & kits are projected to represent 43% of biomarker immunoassay demand in 2025, underscoring their critical role as essential consumables for routine biomarker testing operations. Clinical laboratories prefer reagent kits for their standardized formulations, quality control components, and ability to deliver consistent assay performance across multiple testing platforms. Positioned as essential supplies for biomarker testing workflows, reagents & kits offer both analytical reliability benefits and operational convenience advantages.

The segment is supported by the continuous development of new biomarker assays and the growing demand for standardized testing protocols that ensure inter-laboratory reproducibility. Reagent manufacturers are investing in kit development that enables broad menu testing and multiplexed biomarker analysis. As biomarker testing becomes more routine and standardized, reagents & kits will continue to dominate the market while supporting reliable and scalable biomarker detection across diverse clinical applications.

The efficacy & pharmacodynamic biomarkers segment is forecasted to contribute 35% of the biomarker immunoassays market in 2025, reflecting the critical importance of biomarkers in drug development and therapeutic monitoring. Pharmaceutical companies and clinical researchers increasingly utilize efficacy biomarkers to assess drug response, monitor treatment effectiveness, and guide dose optimization in clinical trials and patient care. This aligns with precision medicine trends that emphasize biomarker-guided therapy selection and personalized treatment approaches.

The segment benefits from growing pharmaceutical investment in biomarker-driven drug development and increasing regulatory requirements for companion diagnostics in drug approval processes. With established clinical utility in oncology and emerging applications in other therapeutic areas, efficacy biomarkers serve as primary drivers of immunoassay development, making them a critical component of personalized medicine and therapeutic monitoring strategies.

The cancer disease indication segment is forecasted to contribute 58% of the biomarker immunoassays market in 2025, reflecting the predominant role of biomarkers in cancer diagnosis, prognosis, and treatment selection. Oncology healthcare providers increasingly rely on biomarker-based immunoassays for tumor characterization, treatment response monitoring, and identification of patients who may benefit from targeted therapies. This aligns with precision oncology trends that emphasize molecular profiling and biomarker-guided treatment decisions.

The segment benefits from extensive biomarker research in oncology and the established clinical utility of cancer biomarkers, including tumor markers, immune checkpoint proteins, and therapeutic targets. With significant clinical evidence supporting biomarker use in cancer care and growing adoption of companion diagnostics, cancer applications serve as the primary market for biomarker immunoassays, making them a critical foundation for precision oncology and personalized cancer treatment.

The hospitals & clinics end-use segment is forecasted to contribute 38% of the biomarker immunoassays market in 2025, reflecting the primary role of healthcare facilities in providing patient care and diagnostic services. Hospital laboratories and clinic-based testing facilities increasingly integrate biomarker immunoassays into routine patient care workflows while providing comprehensive diagnostic and monitoring services. This aligns with integrated healthcare delivery models that emphasize point-of-care testing and rapid diagnostic capabilities.

The segment benefits from established healthcare infrastructure and growing emphasis on personalized medicine approaches that require biomarker testing at the point of care. With direct patient care responsibilities and clinical decision-making requirements, hospitals & clinics serve as primary users of biomarker immunoassays, making them a critical foundation for clinical adoption and patient care integration.

The market is advancing due to the increasing demand for personalized medicine and the growing need for accurate diagnostic tools for chronic diseases. The market faces challenges such as high biomarker validation costs, complex regulatory requirements for companion diagnostics, and standardization issues across various platforms. Opportunities exist in liquid biopsy technologies, AI-assisted biomarker discovery, and multiplexed testing systems. Trends are driven by advancements in non-invasive diagnostics, AI integration, and innovations in point-of-care immunoassays. Suppliers offering scalable, validated solutions are poised to succeed.

The shift towards personalized medicine is driving demand for biomarker-based immunoassays, as treatments become more tailored to individual biomarkers. This approach is especially prominent in oncology, cardiology, and neurology, where precise biomarker targeting enhances treatment efficacy. The increasing prevalence of chronic diseases, such as cancer and cardiovascular conditions, fuels the need for reliable diagnostic tools that enable early detection and continuous monitoring. Biomarker-based immunoassays are crucial for identifying biomarkers that predict disease progression and therapeutic responses, driving further market growth.

Trends in the biomarker-based immunoassays market are driven by the increasing demand for high-throughput testing platforms that enable the detection of multiple biomarkers simultaneously. This approach reduces testing time and enhances efficiency in disease monitoring and personalized treatments. Point-of-care solutions are becoming increasingly important, enabling rapid diagnostic results and immediate clinical decision-making. Advanced analytics powered by artificial intelligence is improving the precision of biomarker analysis. These innovations are driving the development of more accessible, reliable, and cost-effective immunoassays, contributing to the market's expansion.

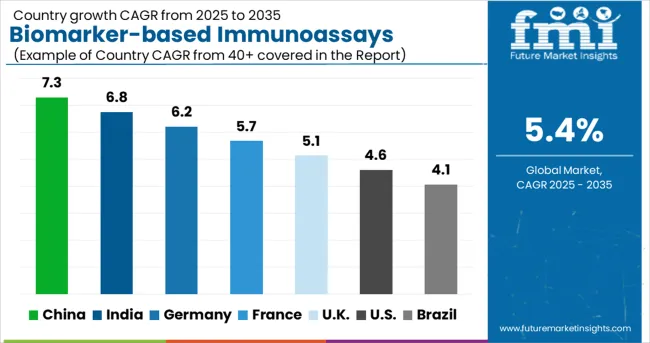

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

The biomarker-based immunoassays market is experiencing solid growth globally, with China leading at a 7.3% CAGR through 2035, driven by expanding healthcare infrastructure, increasing chronic disease prevalence, and growing adoption of precision medicine approaches. India follows closely at 6.8%, supported by rising healthcare access, expanding diagnostic capabilities, and increasing awareness about personalized medicine benefits. Germany shows strong growth at 6.2%, emphasizing precision medicine excellence and advanced biomarker research. France records 5.7%, focusing on molecular diagnostics and healthcare innovation. The UK shows 5.1% growth, prioritizing precision medicine integration and biomarker research.

The report covers an in-depth analysis of 40+ countries with top-performing countries are highlighted below.

China is set to experience a CAGR of 7.3% in the biomarker-based immunoassays market from 2025 to 2035. The country’s rapidly advancing healthcare infrastructure and increasing demand for precision medicine are key factors driving market growth. With an expanding healthcare sector and a rising focus on early disease detection, especially in oncology, China is witnessing a surge in the adoption of immunoassay technologies. The government's emphasis on expanding access to healthcare services and improving disease diagnosis has created significant opportunities for biomarker-based immunoassays in both public and private healthcare settings. Local manufacturers are also innovating and developing cost-effective solutions, further contributing to market expansion. The rise in chronic diseases and the push for personalized medicine are expected to further boost the demand for advanced immunoassay technologies in China.

Demand for biomarker-based immunoassays in India is growing at a CAGR of 6.8% from 2025 to 2035. The country’s growing healthcare sector, rising number of diagnostic laboratories, and increasing prevalence of chronic diseases are fueling market growth. As India continues to urbanize, there is a growing demand for advanced diagnostic tools, with biomarker-based immunoassays being increasingly used for early detection of diseases such as cancer, cardiovascular diseases, and infectious diseases. The expansion of private healthcare and diagnostic chains is further increasing the availability and adoption of these technologies. Moreover, India’s increasing focus on medical research and clinical trials is also driving the demand for immunoassays in both diagnostic and therapeutic applications. Government initiatives to improve healthcare access and affordability are expected to boost the market’s growth trajectory in the coming years.

Germany is expected to grow at a CAGR of 6.2% in the biomarker-based immunoassays market from 2025 to 2035. The country’s well-established healthcare system, strong emphasis on medical research, and advanced diagnostic capabilities make it a leading market for immunoassays. As Germany continues to invest in precision medicine, the demand for biomarker-based tests is growing rapidly. The country’s aging population and high prevalence of chronic diseases, such as cancer, cardiovascular diseases, and diabetes, are further accelerating the adoption of advanced immunoassay technologies. Germany’s robust healthcare infrastructure, combined with a rising focus on personalized medicine and disease prevention, is driving the use of immunoassays in both clinical and research settings. The country’s innovation in diagnostic tools and favorable reimbursement policies are expected to support market expansion.

France is expected to expand at a CAGR of 5.7% from 2025 to 2035 in the biomarker-based immunoassays market. France’s well-developed healthcare infrastructure, coupled with increasing investments in medical research and diagnostic technologies, is driving market growth. As the country focuses on improving disease prevention, early diagnosis, and personalized treatment, biomarker-based immunoassays are becoming essential tools in the healthcare system. The increasing burden of chronic diseases such as cancer, diabetes, and cardiovascular conditions is pushing the demand for advanced immunoassay technologies. France’s regulatory framework, which supports the development and implementation of advanced diagnostic technologies, further strengthens the adoption of immunoassays.

Revenue from biomarker-based immunoassays in the United Kingdom is expanding at a CAGR of 5.1% through 2035, supported by a strong emphasis on precision medicine integration and biomarker research excellence across the NHS and academic research institutions. British healthcare providers value analytical accuracy, clinical utility, and evidence-based testing, positioning biomarker immunoassays as essential tools for personalized medicine and research applications. Growth in precision medicine programs and biomarker research initiatives is increasing the adoption of immunoassay technologies across NHS laboratories, cancer centers, and university research facilities. Rising demand for personalized medicine and companion diagnostics is encouraging healthcare providers to invest in advanced biomarker detection capabilities that support evidence-based treatment decisions and clinical research.

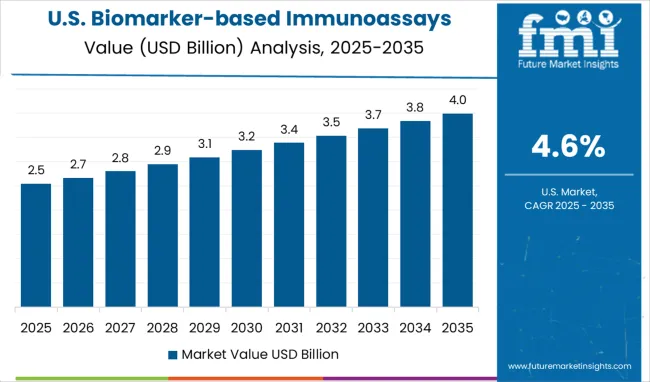

The USA biomarker-based immunoassays market is expected to grow at a CAGR of 4.6% from 2025 to 2035. The USA market is largely driven by advancements in precision medicine, increasing healthcare expenditure, and rising investments in healthcare R&D. Immunoassays are gaining prominence in clinical diagnostics, particularly for cancer detection, genetic testing, and infectious diseases. With the growing demand for personalized treatment and early detection methods, biomarker-based immunoassays are increasingly utilized in clinical and research settings. The USA healthcare system’s continuous push toward improving disease management and prevention further drives market growth. The increasing prevalence of chronic diseases also contributes to the growing demand for these diagnostic tools.

Revenue from biomarker-based immunoassays in Brazil is projected to grow at a CAGR of 4.1% through 2035, supported by expanding healthcare infrastructure, rising awareness about personalized medicine, and increasing adoption of advanced diagnostic technologies in clinical practice. The country's developing biomarker testing capabilities and rising focus on chronic disease management are creating significant opportunities for immunoassay market growth. International diagnostic companies and domestic laboratories are establishing comprehensive capabilities to serve the growing demand for biomarker detection services. Healthcare infrastructure expansion and chronic disease management focus are driving demand among hospitals, diagnostic laboratories, and research institutions across major healthcare regions. Government initiatives supporting healthcare access and medical technology adoption are encouraging the utilization of biomarker testing technologies.

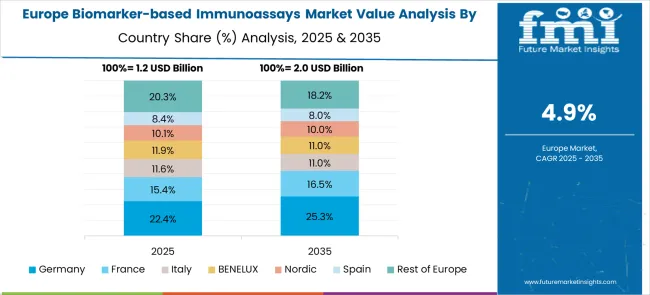

The biomarker-based immunoassays market in Europe demonstrates mature development across major economies, with Germany showing a strong presence through its advanced healthcare system and emphasis on precision medicine and biomarker research, supported by healthcare providers leveraging clinical expertise to implement comprehensive biomarker testing programs that emphasize analytical quality, clinical utility, and integration with personalized treatment approaches across oncology and other specialty areas. France represents a significant market driven by its healthcare excellence and sophisticated understanding of molecular diagnostics and biomarker applications, with healthcare providers focusing on advanced biomarker immunoassay solutions that combine French medical expertise with cutting-edge diagnostic technologies for enhanced disease detection and treatment monitoring in hospital and clinical laboratory settings.

The UK exhibits considerable growth through its emphasis on precision medicine research and National Health Service integration, with strong adoption of biomarker immunoassays across NHS laboratories, cancer centers, and specialized diagnostic services. Germany and France show expanding interest in companion diagnostic applications, particularly in oncology and cardiovascular medicine, requiring personalized treatment selection. BENELUX countries contribute through their focus on healthcare innovation and advanced diagnostic technology adoption. At the same time, Eastern Europe and Nordic regions display growing potential driven by increasing healthcare investment and expanding biomarker testing capabilities.

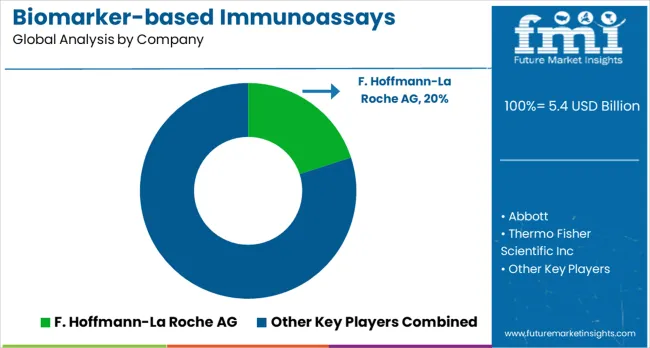

The biomarker-based immunoassays market is defined by competition from large diagnostic firms, specialized testing providers, and emerging precision medicine developers. Companies are heavily investing in assay development, biomarker validation, platform automation, and clinical support to ensure the delivery of accurate and reliable immunoassay solutions. Focus on innovation in multiplexed testing platforms, liquid biopsy applications, and AI-driven biomarker analysis is critical for driving clinical adoption and strengthening market positions.

F. Hoffmann-La Roche AG holds a leading position with a significant market share, offering comprehensive biomarker immunoassay solutions tailored for companion diagnostics and precision medicine. Abbott competes by providing robust, automated immunoassay platforms with extensive biomarker coverage, streamlining diagnostic workflows for a broad range of clinical needs. Thermo Fisher Scientific Inc. emphasizes advanced immunoassay technologies focused on biomarker discovery and validation, while also offering a range of research solutions for clinical applications. Eurofins Scientific specializes in laboratory services, focusing on biomarker testing and providing high-quality testing capabilities to enhance clinical insights.

QIAGEN leverages its expertise in molecular testing, offering solutions for biomarker analysis across multiple applications. Bio-Rad Laboratories Inc. provides immunoassay platforms and quality control solutions that ensure the accuracy of test results. Siemens Healthineers AG delivers automated immunoassay systems and a variety of healthcare technology solutions that improve clinical testing efficiency. Merck KGaA focuses on specialty chemicals and reagents for biomarker detection, supporting researchers in clinical and laboratory settings. PerkinElmer Inc. and Agilent Technologies Inc. offer a wide range of analytical instrumentation and biomarker testing solutions aimed at both research and clinical applications, with a focus on diverse biomarker categories and disease areas.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 5.4 billion |

| Sample Type | Blood, Tissue, Urine, Saliva, Others |

| Product | Reagents & Kits, Consumables, Instruments/Analyzers, Services |

| Biomarker Type | Efficacy & Pharmacodynamic Biomarkers, Safety & toxicity biomarkers, Predictive & Prognostic Biomarkers, Surrogate/Exploratory Biomarkers |

| Disease Indication | Cancer, Cardiovascular Diseases, Neurological Diseases, Immunological Diseases, Others |

| End-use | Hospitals & Clinics, Diagnostic Laboratories, Research & Academic Institutes, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | F. Hoffmann-La Roche AG, Abbott, Thermo Fisher Scientific Inc., Eurofins Scientific, QIAGEN, Bio-Rad Laboratories Inc., Siemens Healthineers AG, Merck KGaA, PerkinElmer Inc., and Agilent Technologies Inc. |

| Additional Attributes | Dollar sales by sample type and disease indication category, regional demand trends, competitive landscape, buyer preferences for blood versus alternative sample types, integration with precision medicine approaches, innovations in liquid biopsy technology, AI-assisted biomarker analysis, and multiplexed testing platform development |

The global biomarker-based immunoassays market is estimated to be valued at USD 5.4 billion in 2025.

The market size for the biomarker-based immunoassays market is projected to reach USD 9.2 billion by 2035.

The biomarker-based immunoassays market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in biomarker-based immunoassays market are blood, tissue, urine and saliva.

In terms of product outlook , reagent & kits segment to command 42.8% share in the biomarker-based immunoassays market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA