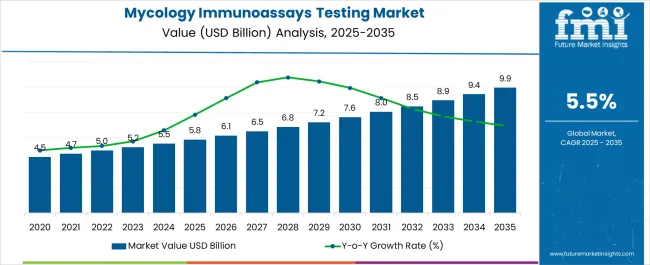

The Mycology Immunoassays Testing Market is estimated to be valued at USD 5.8 billion in 2025 and is projected to reach USD 9.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Mycology Immunoassays Testing Market Estimated Value in (2025 E) | USD 5.8 billion |

| Mycology Immunoassays Testing Market Forecast Value in (2035 F) | USD 9.9 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The Mycology Immunoassays Testing market is witnessing steady growth, driven by the rising prevalence of fungal infections and the increasing demand for rapid and accurate diagnostic solutions. Immunoassays, particularly those based on advanced technologies, provide high sensitivity and specificity, enabling early detection and improved patient outcomes. The market is being supported by advancements in diagnostic platforms, automation, and multiplex testing capabilities that enhance efficiency and reduce turnaround times.

Hospitals, clinical laboratories, and research institutions are increasingly adopting immunoassays to manage patient care, monitor treatment efficacy, and conduct epidemiological studies. Regulatory emphasis on diagnostic accuracy and compliance with laboratory standards further drives adoption. Integration with electronic health records and laboratory information systems enables streamlined workflow and better data management.

Growing awareness among healthcare professionals regarding fungal disease burden, coupled with increasing investment in diagnostic infrastructure, is shaping market growth As demand for precise, rapid, and scalable testing solutions continues to rise, the Mycology Immunoassays Testing market is positioned for sustained expansion over the coming decade.

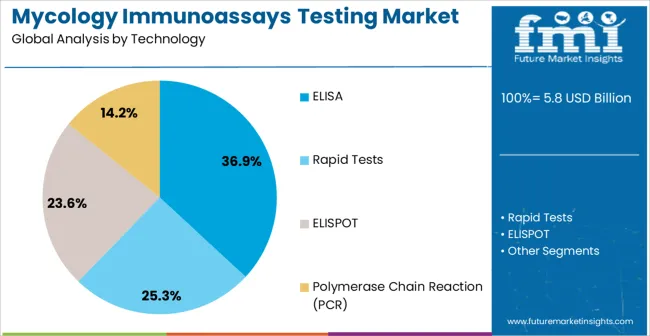

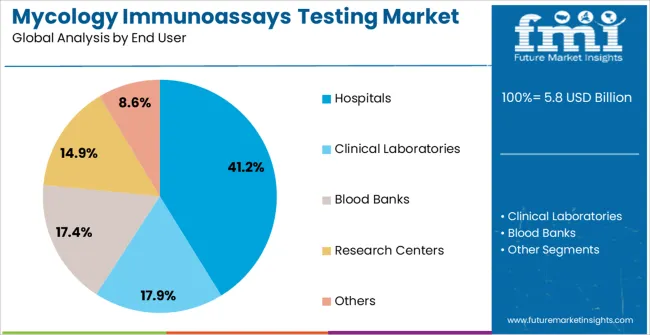

The mycology immunoassays testing market is segmented by technology, end user, and geographic regions. By technology, mycology immunoassays testing market is divided into ELISA, Rapid Tests, ELISPOT, and Polymerase Chain Reaction (PCR). In terms of end user, mycology immunoassays testing market is classified into Hospitals, Clinical Laboratories, Blood Banks, Research Centers, and Others. Regionally, the mycology immunoassays testing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ELISA technology segment is projected to hold 36.9% of the market revenue in 2025, establishing it as the leading technology type. Growth in this segment is being driven by ELISA’s ability to provide high accuracy, reproducibility, and quantitative analysis for a wide range of fungal pathogens. The technology allows for automated, high-throughput testing, which reduces manual errors and improves laboratory efficiency.

ELISA assays are versatile and compatible with multiple sample types, including serum, plasma, and tissue, enabling broad application across clinical diagnostics. Hospitals and laboratories favor ELISA due to its reliability, established protocols, and cost-effectiveness compared with alternative methods.

Ongoing technological enhancements, such as improved antibodies, detection systems, and software integration, are further strengthening adoption As the demand for rapid, sensitive, and scalable testing solutions increases in response to rising fungal infections, ELISA technology is expected to maintain its leadership, supported by continuous innovation and the ability to meet evolving clinical requirements.

The hospitals end-user segment is anticipated to account for 41.2% of the market revenue in 2025, making it the leading end-user category. Growth is being driven by the increasing need for accurate fungal diagnostics to manage patient care, particularly in immunocompromised populations. Hospitals leverage immunoassays for early detection, treatment monitoring, and outbreak management, enabling timely clinical decision-making and improving patient outcomes.

Integration of testing platforms with hospital information systems allows efficient data handling, reporting, and clinical workflow optimization. The segment is also supported by increasing investments in diagnostic infrastructure, laboratory automation, and training of healthcare personnel. Hospitals are prioritizing adoption of rapid and reliable immunoassays to reduce hospitalization duration and associated costs.

Rising awareness of fungal infections, regulatory requirements, and the growing burden of complex infections are further reinforcing the preference for advanced immunoassay solutions As healthcare systems continue to focus on quality patient care and operational efficiency, hospitals are expected to remain the largest end-user segment, driving sustained market growth.

The frequency of invasive fungal infections has dramatically increased in the recent years and has high mortality and morbidity. Accurate and early diagnosis is very important for the appropriate antifungal therapy. Conventional techniques like microbiology, radiological and histological remain the basis of diagnosis but have limited impact on clinical decision making.

There is always a need to characterize fungi accurately and quickly, which can be done by mycology immunoassays test. The fungi are parasitic and saprophytic eukaryotic organisms. The diagnostic methods for fungal infections are direct examination, radiology, and fungal culture and non-culture methods.

Diabetic patients are more susceptible to infectious diseases such as Cryptococcus, mucocutaneous candidosis and dematiaceous fungal infection. Rapid and accurate diagnosis of these life threatening fungal diseases is of clinical importance. Mycology is concerned with the study of the fungi. Histopathology, microscopy and use of fungal-specific stains plays an important role in the diagnosis of infections.

Fungi cause disease in man by virtue of their allergenicity, toxigenicity or pathogenicity. Mycology immunoassays are used to detect products or host responses to infection.

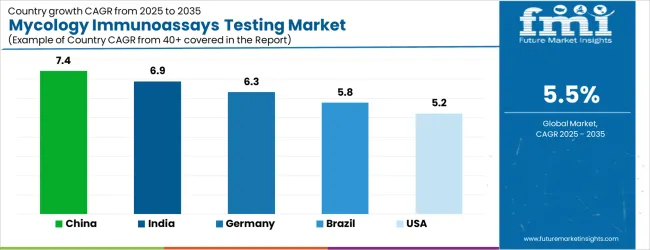

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| Brazil | 5.8% |

| USA | 5.2% |

| UK | 4.7% |

| Japan | 4.1% |

The Mycology Immunoassays Testing Market is expected to register a CAGR of 5.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.4%, followed by India at 6.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.1%, yet still underscores a broadly positive trajectory for the global Mycology Immunoassays Testing Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.3%. The USA Mycology Immunoassays Testing Market is estimated to be valued at USD 2.2 billion in 2025 and is anticipated to reach a valuation of USD 2.2 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 302.9 million and USD 163.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.8 Billion |

| Technology | ELISA, Rapid Tests, ELISPOT, and Polymerase Chain Reaction (PCR) |

| End User | Hospitals, Clinical Laboratories, Blood Banks, Research Centers, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

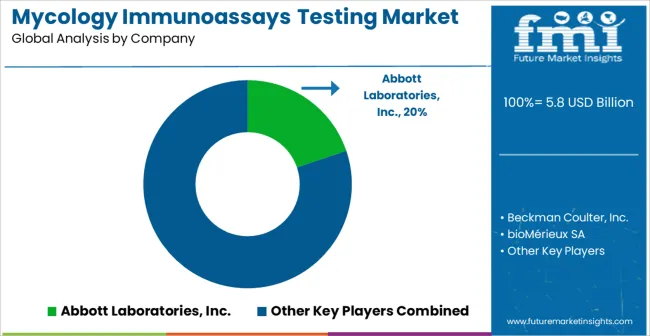

| Key Companies Profiled | Abbott Laboratories, Inc., Beckman Coulter, Inc., bioMérieux SA, MiraVista Diagnostics, F. Hoffmann-La Roche Ltd., Siemens AG, Ortho-Clinical Diagnostics, Inc., and ELITech Group |

The global mycology immunoassays testing market is estimated to be valued at USD 5.8 billion in 2025.

The market size for the mycology immunoassays testing market is projected to reach USD 9.9 billion by 2035.

The mycology immunoassays testing market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in mycology immunoassays testing market are elisa, rapid tests, elispot and polymerase chain reaction (pcr).

In terms of end user, hospitals segment to command 41.2% share in the mycology immunoassays testing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HSV Testing Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HPV Testing and Pap Test Market Size and Share Forecast Outlook 2025 to 2035

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Self-Testing Market Analysis - Size, Share, and Forecast 2025 to 2035

Food Testing Services Market Size, Growth, and Forecast for 2025–2035

Bend Testing Machine Market Growth - Trends & Forecast 2025 to 2035

An Analysis of the Leak testing Machine Market by Detectors and Sensors Hardware Type through 2035

Soil Testing Market Growth - Trends & Forecast 2025 to 2035

Examining Food Testing Services Market Share & Industry Outlook

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA