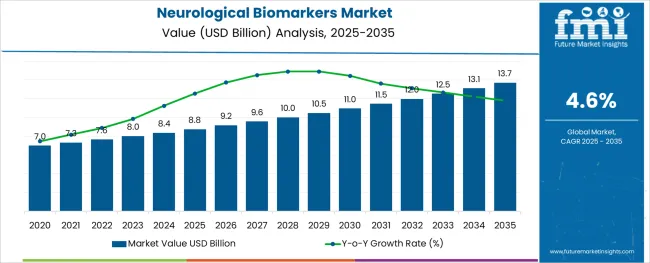

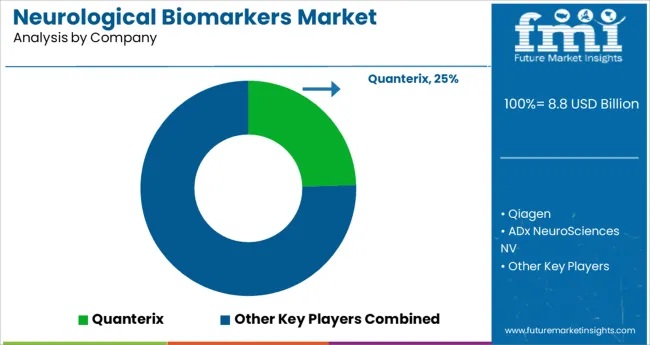

The Neurological Biomarkers Market is estimated to be valued at USD 8.8 billion in 2025 and is projected to reach USD 13.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

The neurological biomarkers market is undergoing significant growth as advancements in molecular diagnostics, neuroimaging techniques, and therapeutic research converge to address the rising burden of neurological disorders. Increasing prevalence of neurodegenerative diseases and the growing emphasis on early detection and precision medicine have positioned biomarkers as critical tools for diagnosis, prognosis, and treatment monitoring.

Technological innovations in imaging and fluid-based biomarker platforms are enabling greater accuracy and reproducibility, driving broader clinical and research adoption. Future growth is expected to be supported by expanding clinical trials targeting novel therapeutics, regulatory initiatives favoring biomarker-based diagnostics, and strategic collaborations between academia and industry.

These dynamics are paving the way for improved patient outcomes and more efficient drug development processes across the neurological disease spectrum.

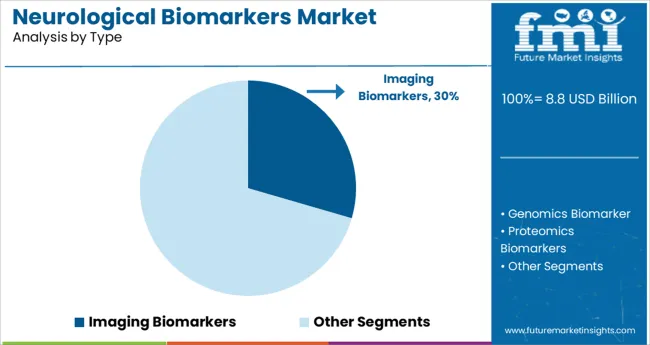

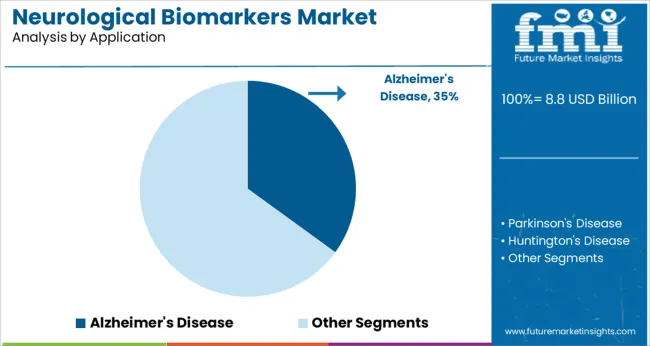

The market is segmented by Type, Application, and End User and region. By Type, the market is divided into Imaging Biomarkers, Genomics Biomarker, Proteomics Biomarkers, Metabolomics Biomarkers, and Others. In terms of Application, the market is classified into Alzheimer's Disease, Parkinson's Disease, Huntington's Disease, Schizophrenia, Depression, Multiple Sclerosis, and Spinal Muscular Atrophy.

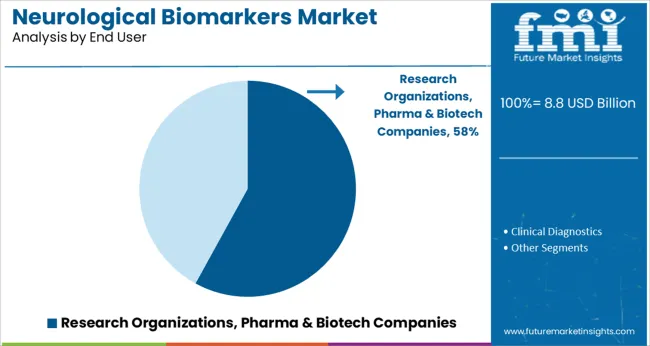

Based on End User, the market is segmented into Research Organizations, Pharma & Biotech Companies and Clinical Diagnostics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, the imaging biomarkers segment is projected to hold 29.5% of the total market revenue in 2025, establishing itself as the leading type segment. This leadership has been driven by the ability of imaging biomarkers to provide real time, noninvasive insights into structural and functional brain changes associated with neurological conditions.

The high resolution and specificity offered by modalities such as MRI, PET, and CT have strengthened their clinical utility in detecting early pathological changes and monitoring disease progression. The integration of advanced imaging protocols with artificial intelligence and machine learning algorithms has further enhanced diagnostic accuracy and interpretability.

This convergence of technology and clinical demand has reinforced the imaging biomarkers segment’s prominence in both research and clinical settings.

In terms of application, the Alzheimer’s disease segment is expected to account for 35.0% of the market revenue in 2025, positioning it as the top application area. This dominance has been shaped by the high prevalence and societal impact of Alzheimer’s disease, which have driven substantial investments in biomarker discovery and validation.

The urgent need for early detection and effective therapeutic interventions has intensified focus on identifying reliable biomarkers that can signal disease onset before the appearance of clinical symptoms. Imaging and fluid biomarkers have been increasingly adopted to improve diagnostic confidence, stratify patients for clinical trials, and monitor treatment response.

Growing awareness among clinicians and patients, combined with continued research funding, has sustained the leadership of this segment within the neurological biomarkers market.

When segmented by end user, research organizations, pharma and biotech companies are projected to capture 58.0% of the market revenue in 2025, emerging as the leading end user group. This leadership has been reinforced by their central role in driving biomarker discovery, validation, and commercialization efforts.

Large scale research initiatives, coupled with the need for robust biomarkers to support drug development pipelines, have motivated these entities to invest heavily in biomarker platforms and infrastructure. Their ability to conduct extensive clinical studies, leverage multidisciplinary expertise, and navigate regulatory pathways efficiently has enabled them to dominate the adoption of neurological biomarkers.

The demand for precise tools to support translational research and regulatory submissions has further cemented their position as the primary drivers of market growth.

The statistics accumulated by Future Market Insights reveal the global forum of neurological biomarkers, which has witnessed an unprecedented surge over the past few years.

The key providers in the market are in conjunction with the increasing demand for neurological biomarkers. There has been a gradual rise from a CAGR of 5.2% registered during the period of 2020 to 2025 and is likely to decrease at an adequate 4.6% in the forecast period.

Complications in the basic understanding of the molecular signatures of biological processes, as well as the neglect of treatment of neurological disorders, may slightly decline the market growth during the forecast period. On the contrary, spreading awareness regarding the benefits of predictive biomarkers may create several market opportunities for key clinicians.

Alzheimer's Disease - By Application Type

By application type, the market is segmented into Alzheimer's disease, Parkinson's disease, Huntington's disease, schizophrenia, depression, multiple sclerosis, and spinal muscular atrophy. It has been studied by the analysts at Future Market Insights that the Alzheimer's disease segment is estimated to hold a major market share of 5.2% through the forecast period.

The vital elements determining the momentum of this segment are:

Pharma & Biotech Companies - By End User Type

By end-user type, the market is segmented into research organizations, pharma & biotech companies, and clinical diagnostics. It has been studied by the analysts at Future Market Insights that the pharma & biotech companies segment is estimated to hold the largest market share through the forecast period.

Recent biomarker breakthroughs, such as biomarker signatures, are making neurological illnesses more curable. As a result, non-invasive diagnostics, faster medication development, and earlier diagnosis are now possible.

In addition, key players are conducting clinical trials and biomarker research and development (R&D) to provide more precise findings for neurological illnesses, which is likely to increase demand for neurological biomarkers throughout the projected period.

The need for verifying and finding biomarkers in big populations is enormous. This strategy is being used in the research process, which increases the likelihood of the neurological biomarkers market growing rapidly in the next years.

Furthermore, neuropathologists are expected to determine the nomination and delineation of suitable treatment regimens as new and fresh neuroscience biomarkers are introduced.

Precision medicine, also known as customized medicine, has been identified as one of the most promising techniques for treating a variety of disorders. The increasing frequency of the brain and other nervous system tumors is one of the primary reasons driving the market growth.

It is becoming more used as a diagnostic technique, assisting in the identification of certain biological markers.

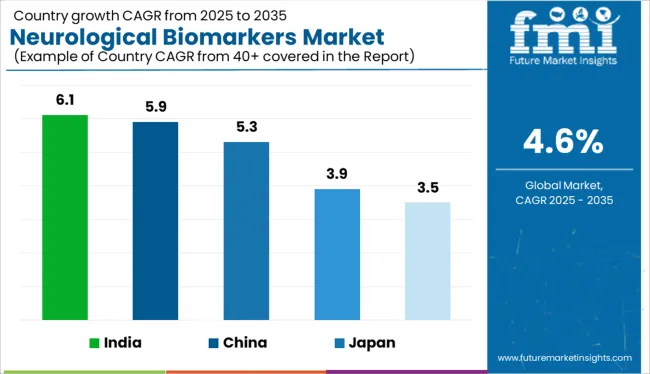

| Country | United States |

|---|---|

| CAGR (2025 to 2035) | 13.7% |

| HCAGR (2020 to 2025) | 4.3% |

| Country | United Kingdom |

|---|---|

| CAGR (2025 to 2035) | 3.5% |

| HCAGR (2020 to 2025) | 4.3% |

| Country | China |

|---|---|

| CAGR (2025 to 2035) | 5.9% |

| HCAGR (2020 to 2025) | 6.3% |

| Country | Japan |

|---|---|

| CAGR (2025 to 2035) | 5.3% |

| HCAGR (2020 to 2025) | 6% |

| Country | India |

|---|---|

| CAGR (2025 to 2035) | 6.1% |

| HCAGR (2020 to 2025) | 7.3% |

| Attributes | Details |

|---|---|

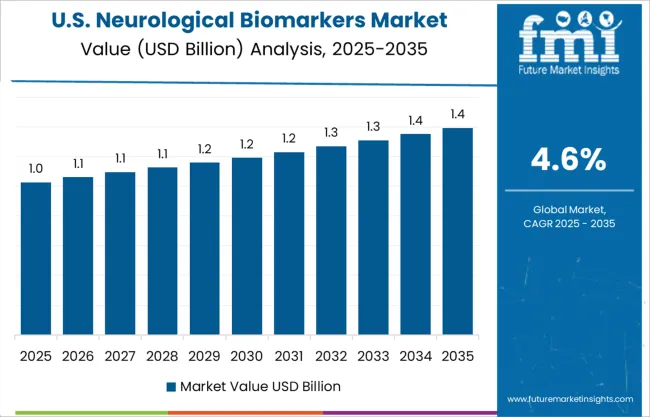

| USA Market Size (2035) | USD 13.7 billion |

| USA Market Absolute Dollar Growth (million/billion) | USD 1.2 billion |

North America is one of the leading neurological biomarkers markets. The USA is the most lucrative market in the region, with a revenue share of 13.7%. The value of the smart home devices market in the USA is estimated to reach a high of USD 13.7 billion by the year 2035.

The dominance of the country is attributed in part to its relatively high illness burden, adoption of biomarkers for diagnostic, therapeutic development, and prognostic reasons, and a boost in research funding.

The global cost of dementia was USD 7 billion in 2020, and it is anticipated to reach USD 2 Trillion by 2035, according to the WHO. Key stakeholders in the United States are delivering an interactive teaching course that includes insights from world-renowned specialists on the clinical utility of standardized CSF testing to enable a fast diagnosis of Alzheimer's disease.

To speed clinical development projects, top scientists and industry-leading laboratories drive the creation of more advanced biomarker strategies, as well as specialized tests and on-target protocol assistance. Furthermore, prominent doctors claim to have extensive neurodegeneration biomarker experience to assist in making decisions.

They have a strategic focus on neurodegeneration, neuroinflammation, traumatic brain injuries (TBI), and multiple sclerosis (M.S.), and they collaborate with a fast-developing network of university researchers, pharmaceutical, and biotech partners to enhance head health research.

Germany is a market with several market opportunities and a favorable revenue share.

Key players in Germany provide research facilities that target all aspects of neurodegenerative illnesses (such as Alzheimer's, Parkinson's, and Amyotrophic lateral sclerosis) in order to create innovative preventive, treatment, and healthcare techniques.

On a national and global scale, they work closely with universities, university hospitals, and other research institutes.

Key players strive to produce so-called functional biomarkers based on neural network activity utilizing artificial intelligence and unique mathematical techniques.

These biomarkers are supposed to disclose whether the network is functioning properly or not, as well as if a certain medicine changes this state, which ultimately assists in the identification of potential drugs.

Moreover, driven by a passion for promoting human health for all, they are establishing a network of discovery, connecting scientists, and exchanging thoughts, ideas, and knowledge in order to advance neuroscience research.

| Attributes | Details |

|---|---|

| Japan Market Size (2035) | USD 643.8 million |

| Japan Market Absolute Dollar Growth (million/billion) | USD 259.5 million |

The Asia Pacific currently holds a notable share of the neurological biomarkers market, with Japan and India as its most lucrative markets.

This is attributed to a growing number of clinical studies being done in developing nations such as India and China, as well as rising illness rates and growing demand for targeted therapies in the central nervous system, which are projected to fuel the biomarkers market.

Japan holds a revenue share of 5.3%, with an approximated valuation of USD 643.8 million by 2035. The country has a strong position in the neuroimaging market, owing to the launch of unique solutions such as PET scanners with motion correction and the development of new IVD tests, which are expected to catalyze the growth of the medical device industry in the country.

Japan is a country with a high number of elderly people. As the geriatric population grows, it is expected that the number of patients suffering from neurodegenerative disorders may grow as well.

As the chance of getting various diseases grows with age, numerous biomarkers that could be used to evaluate diseases are being developed. These biomarkers can detect the presence of diseases as well as track their progression and treatment success.

| Attributes | Details |

|---|---|

| India Market Size (2035) | USD 13.7 million |

| India Market Absolute Dollar Growth (million/billion) | USD 157.9 million |

India is currently the largest neurological biomarkers market and holds a high revenue share of 6.1%, with an approximated valuation of USD 13.7 million by 2035. In India, key players strive to alter the future of healthcare by using ultrasensitive biomarker detection.

A certain market player has a team of empowered researchers that use their ‘Simoa’ precision tools, diverse menu of assay kits, and bespoke assay creation services to bring breakthrough discoveries in illness and therapy to the forefront.

The digital health solutions offered by regional players enable the development of methodologies that provide illness diagnosis far earlier, improved prognoses, and enhanced treatment ways to improve the population's quality of life and lifespan for future generations.

Start-up companies are offering additional therapeutic solutions, as well as advanced technology to provide ample biomarkers in neurological disorders:

The presence of a considerable number of key companies in several regions is contributing to market growth. Ongoing research and development (R&D) activities to develop advanced technologies, as well as new product innovation, further creates numerous opportunities for the neurological biomarkers market share.

Recent Developments:

The global neurological biomarkers market is estimated to be valued at USD 8.8 billion in 2025.

It is projected to reach USD 13.7 billion by 2035.

The market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types are imaging biomarkers, genomics biomarker, proteomics biomarkers, metabolomics biomarkers and others.

alzheimer's disease segment is expected to dominate with a 35.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

EPO Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Rare Neurological Disease Treatment Market Report – Demand, Growth & Industry Outlook 2025-2035

Industry Share Analysis for Rare Neurological Disease Treatment Providers

Vitamin Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Molecular Biomarkers For Cancer Detection Market Size and Share Forecast Outlook 2025 to 2035

Prognostic Biomarkers Market

Predisposition Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Asthma and COPD Biomarkers Market

Diagnostic Exosome Biomarkers Market Trends – Growth & Forecast 2025 to 2035

Cognitive Impairment Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

MRI-based Quantitative Biomarkers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA