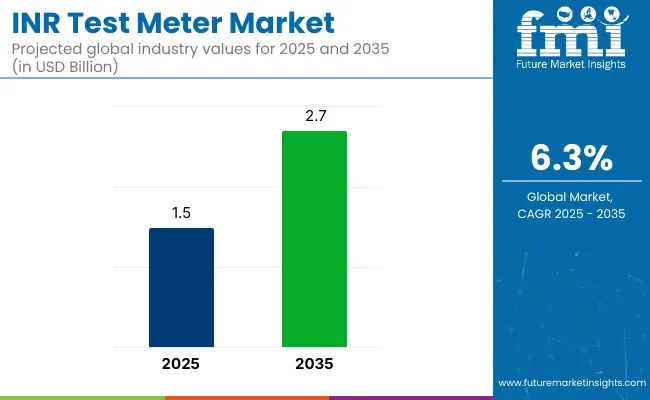

The INR test meter market is valued at USD 1.5 billion in 2025 and is poised to reach USD 2.7 billion by 2035, which shows a CAGR of 6.3% over the forecast period.

The market is experiencing consistent growth due to the increasing prevalence of cardiovascular diseases, deep vein thrombosis, atrial fibrillation, and other conditions requiring long-term anticoagulation therapy. INR (International Normalized Ratio) test meters are critical point-of-care diagnostic devices that allow for real-time monitoring of blood coagulation levels in patients using warfarin or similar anticoagulants. Rising demand for portable, user-friendly monitoring devices is driving adoption across hospitals, clinics, and home healthcare settings.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.5 billion |

| Industry Value (2035F) | USD 2.7 billion |

| CAGR (2025 to 2035) | 6.3% |

Technological advancements in biosensor technology, Bluetooth-enabled devices, and integration with mobile health applications are enhancing the accuracy, convenience, and connectivity of INR test meters. Modern devices offer fast results, easy data sharing with healthcare providers, and simplified self-monitoring processes, making them suitable for chronic disease management and telehealth models. Manufacturers are developing compact and affordable meters with disposable test strips to improve patient compliance and minimize the need for frequent lab visits.

These innovations are particularly beneficial for aging populations and patients in remote or underserved areas. Moreover, the companies are investing heavily in research and development to launch innovative products.

Supportive regulatory frameworks and growing awareness of anticoagulation therapy management are strengthening market growth across both developed and emerging economies. Healthcare systems in North America and Europe have incorporated INR monitoring into standard treatment protocols, while countries in Asia Pacific and Latin America are expanding access to point-of-care testing through public health initiatives.

As the burden of chronic cardiovascular disorders increases globally and remote patient monitoring gains traction, the INR test meter market is expected to expand steadily, driven by patient-centric healthcare delivery, technological integration, and the rising need for personalized and preventive care solutions.

Comparative analysis of fluctuations in compound annual growth rate (CAGR) for the global INR test meter market between 2024 and 2025 on six months basis is shown below. By this examination, major variations in the performance of these markets are brought to light, and also trends of revenue generation are captured hence offering stakeholders useful ideas on how to carry on with the market's growth path in any other given year. January through June covers the first part of the year called half1 (H1), while half2 (H2) represents July to December

The table demonstrates the expected CAGR for the global INR test meter market. In the first half (H1) i.e., from 2024 to 2034, the business is projected to grow at a CAGR of 6.4%, further followed by 6.7% in the second half.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 6.4% |

| H2 (2024 to 2034) | 6.7 |

| H1 (2025 to 2035) | 6.3% |

| H2 (2025 to 2035) | 7.0% |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease to 6.3% in the first half followed by 7.0% in the second. In the first half the market witnessed a decrease of 10 BPS while in the second, the market witnessed an increase of 33 BPS.

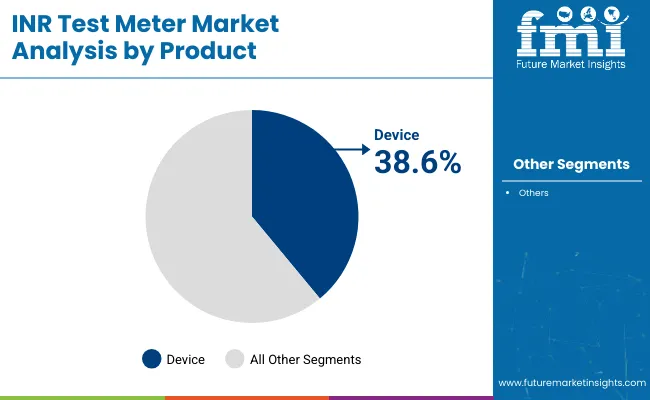

The market is segmented based on product, end user, and region. By product, the market includes device, lancet, and test strips. In terms of end user, the market is categorized into hospitals, specialty clinics, ambulatory surgical centers, and homecare settings. Regionally, the market is classified into North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and the Middle East and Africa.

Devices are projected to dominate the INR test meter market by product type, accounting for 38.6% market share in 2025. This leadership stems from growing patient interest in self-monitoring solutions and a systemic shift toward decentralized, point-of-care diagnostics.

INR testing devices offer a compact, easy-to-use alternative to laboratory testing, empowering patients to monitor their anticoagulation levels at home and take informed actions without frequent hospital visits. The rise in chronic cardiovascular and clotting-related conditions has made INR testing more routine, pushing device adoption into mainstream care.

Self-monitoring tools support personalized treatment plans and reduce hospital load by enabling quicker response times for dosage adjustments. Additionally, pharmacies and outpatient clinics are expanding access to INR test devices, supported by favorable reimbursement policies in several countries.

Key players like Roche, Abbott, and Siemens Healthineers are investing in improving device portability, accuracy, and battery life. Technological advancements in microfluidics and integrated data-tracking also improve ease-of-use, especially for elderly or chronic care patients.

As the healthcare ecosystem gravitates toward remote monitoring and personalized therapy, INR test devices will remain critical in reducing complications and hospital readmissions associated with anticoagulant therapies.

| Product Segment | Market Share (2025) |

|---|---|

| Device | 38.6% |

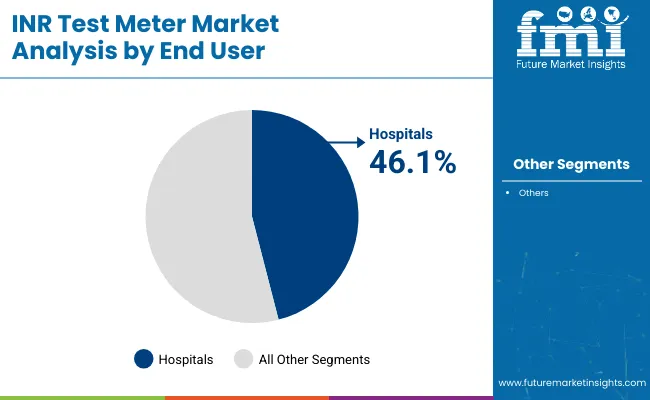

Hospitals are set to dominate the INR test meter market by end user, holding a 46.1% market share in 2025. This leadership is attributed to their central role in the clinical management of patients undergoing anticoagulation therapy, especially those with cardiovascular complications, clotting disorders, or recovering from major surgeries. INR testing in hospital environments is standard practice due to the need for precise and frequent monitoring in both outpatient and inpatient settings.

High-acuity care environments such as emergency departments and intensive care units rely heavily on INR meters to determine the dosage of anticoagulants like warfarin or direct oral anticoagulants (DOACs).

Hospitals are equipped with advanced coagulometers that offer faster results, higher accuracy, and integration with electronic medical records, making them ideal for real-time clinical decision-making. While home-based INR monitoring is growing, hospital facilities remain indispensable for initial diagnosis, therapy planning, and post-operative care.

In many developing nations, limited access to personal INR devices further strengthens hospital dependency. Additionally, well-trained medical staff and the availability of comprehensive diagnostic infrastructure reinforce the reliability of in-hospital INR testing. As the burden of cardiovascular diseases rises and surgical interventions increase, hospitals will continue to lead as the most utilized end-use setting in the INR test meter market.

| End User Segment | Market Share (2025) |

|---|---|

| Hospitals | 46.1% |

Integration of INR Test Meters with Digital Health Ecosystems Anticipates the Growth of the Market

Healthcare is moving toward real-time data sharing and remote patient management, INR test meters are becoming fast integral to be connected with smartphones, electronic health records, and telehealth platforms.

This integration enables automated data collection, remote physician access, and patient health trend analysis. This enable healthcare providers to make timely and informed decisions for therapy adjustments.

More recently, the availability of IoT-enabled medical devices has enhanced the efficacy of INR monitoring by minimizing manual error while ensuring data accuracy. Future wearable health technology may include non-invasive or minimally invasive sensing technologies in test meters for INR that make self-monitoring more accessible.

In order to boost digital health initiatives, governments and governing councils are pushing interoperability standards by investing in remote patient monitoring to support patients on those journeys. With this digital transformation in place, it is not only the betterment of patient outcomes but also the building of new markets for tech-driven INR-testing solutions and ensuring that the market grows organically.

Advancements in Point-of-Care Testing and Digital Health Integration Expect in this Market Growth

The Advanced Point-of-care Testing Technologies contributed significantly to the popularity of INR test meters. They even have gotten more reliable, accurate, and user-friendly. In a traditional laboratory INR testing, it requires so much time because it involves drawing blood and taking samples for analysis in clinical settings delaying the adjustment of treatment. On the contrary, those INR test meters are instantaneous in their results through a small prick of a finger and are able to follow up anticoagulant therapy in real time.

Portable, handheld, and wireless INR-test meters that patients can use for simple self-testing in their homes or outpatient clinics have also been developed. Moreover, digital health technologies also incorporate functionality in INR test meters enabling easy connectivity to smartphones or into cloud-based health platforms.

Today, a large majority of INR meters now offer Bluetooth or Wi-Fi connection, allowing the instantaneous transmission of results by the patient directly to the health care provider. This advancement essentially reduces the frequency and necessity for office visits, at the same time providing remote patient monitoring. This capability to track the trend of INR readings over time and getting automated alerts if they fall out of the normal range is useful in preventing further health risks associated with improper anticoagulation management.

One of the expected outcomes of this increasing need for connected health solutions is to further refine personalized approaches in treatment by incorporating more artificial intelligence and predictive analytics into INR test meters. These changes not only empower patient autonomy but also promote improvement in the efficiency of healthcare because it permits proactive interventions, which may reduce emergency hospital visits. This trend in point-of-care INR testing technology will continue to propel further growth of the market with greater accessibility and better management of anticoagulation worldwide..

Growing Adoption of Home-Based and Telemedicine Solutions can bring New Business Opportunities to the Market Players

INR test meters plays an important role as these tools enable people undergoing anticoagulation therapy to conveniently monitor their blood coagulation at home, minimizing reliance on frequent laboratory tests. Moreover, this has been augmented with the integration of digital health and telemedicine platforms, greatly enhancing the usefulness of INR test meters with consultations and sharing data in real time with your physician.

Because many healthcare providers are encouraging self-monitoring, better optimization in anticoagulation therapy significantly reduces complications through increased patient compliance.

Furthermore, government and state agencies are appreciating the emerging field of home health, prompting policy changes for more home diagnostics and telehealth. Expansion in telemedicine services and the acceptance of connected healthcare ecosystems support the opportunity for INR test meter manufacturers in increasing device functionalities, performing AI-driven analytics, and expanding their market offerings.

The trend of digital health is thus likely to help INR test meter providers to collaborate with healthcare institutions, insurance providers, and remote care platforms in using self-monitoring as a standard practice, hence assuring the continued growth of the market and improving patient outcomes.

High Cost and Limited Reimbursement Policies Hinders the Growth of the Market

The adoption of INR test meters broadly accepted due to its high price and limited reimbursement policies despite the great demand for it, especially by low- and middle-income countries. Self-monitoring devices of INR, though providing great convenience along with improved treatment adherence, are expensive during purchase and for test strips thereafter. Many patients on long-term anticoagulation therapy rely on laboratory-based testing because it is less expensive, especially when covered by public or private health insurance plans.

However, in many regions, reimbursement policies for home INR testing are inconsistent or insufficient, making it financially challenging for patients to afford self-testing devices. Basic needs in a developing economy are the necessity of a healthcare system, not advanced point-of-care diagnostics.

INR test meters, therefore, are less accessible to only the fairly selected population. There are also other insurance companies that partially do not cover INR test meters and have stringent eligibility criteria for reimbursement, making it unappealing to patients' uptake of self-monitoring solutions.

Some advanced countries are putting up home INR monitoring, but both policy changes and cost reductions serve to pave the way for the adoption of this technology. The lack of standardized reimbursement policies is a real constraint to healthcare providers' recommendations for INR self-testing, which patients may not afford.

Cost-effective models, subsidy programs, and reimbursement schemes that create access to the INR test meter will ease this barrier through concerted efforts of governments, insurance providers, and manufacturers.

The global INR test meter industry recorded a CAGR of 4.5% during the historical period between 2020 and 2024. The growth of INR test meter industry was positive as it reached a value of USD 1.4 billion in 2024 from USD 1 in 2020.

Over the last couple of years, many changes have occurred in the INR test meter market due to innovations in the management of anticoagulation and increasing awareness of self-monitoring solutions. Traditionally, INR testing was performed only in clinical laboratories; thus, patients undergoing long-term anticoagulation needed to make frequent visits to facilities.

Such a situation is very time-consuming and does not give much scope for patient independence in treatment management. The deployment of point-of-care INR test meters is counted as a major advancement in anticoagulation management by decentralizing the monitoring and effectively fast-tracking the process as being very convenient level of care.

The INR test meter market is on an upward trend attributable to cardiovascular diseases, the elderly population, and the increasing acceptance of digital health solutions. Wireless connectivity, mobile applications, and telemedicine allow enhanced utility of INR meters in sharing real-time patient data with healthcare providers.

Reimbursement policies are improving generally, especially in the developed markets. This has encouraged adoption among patients. Also, the COVID-19 pandemic heightened interest in enabling remote patient monitoring, reflecting how central INR testing solutions at home would be.

The future market prospects seem highly promising owing to improvements in technology, increased patient awareness, and better healthcare access in developing countries. INR monitoring will be further optimized using personalized medicine and AI-derived analytics. Increased regulatory support and cost-effective solutions will drive higher adoption rates. INR test meters are poised to be significant components of fresh anticoagulation management, promising better patient outcomes and reducing healthcare burden.

Tier 1 companies comprise market leaders with a market revenue of above USD 100 million capturing significant market share of 48.6% in global market. These market leaders are characterized by high production capacity and a wide product portfolio.

These market leaders are distinguished by their extensive expertise in providing their services underpinned by a robust consumer base. Prominent companies within tier 1 include F. Hoffmann-La Roche Ltd, Lepu Medical Technology (Beijing) Co., Ltd. and ACON Laboratories, Inc.

Tier 2 companies include mid-size players with revenue of USD 50 to 100 million having presence in specific regions and highly influencing the local market and holds around 32.7% market share. These are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have access to global reach. Prominent companies in tier 2 include CoaguSense Inc., Abbott and Eurolyser Diagnostica GmbH

Finally, Tier 3 companies, act as a suppliers to the established market players. They are essential for the market as they specialize in specific products and cater to niche markets, adding diversity to the industry.

Overall, while Tier 1 companies are the primary drivers of the market, Tier 2 and 3 companies also make significant contributions, ensuring the INR test meter market remains dynamic and competitive.

The section below covers the industry analysis for the INR test meter market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided. The United States is anticipated to remain at the forefront in North America, with a value share of 90.9% through 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 4.5% |

| Germany | 4.0% |

| Japan | 5.9% |

| China | 6.3% |

| India | 6.8% |

United States INR test meter market is poised to exhibit a CAGR of 4.5% between 2025 and 2035.

The German government and private insurers have increasingly recognized the benefits of self-monitoring for anticoagulation therapy, thus offering comprehensive insurance coverage for both INR test meters and test strips. Besides, Germany is an aging country with a huge percentage suffering from cardiovascular diseases, such as atrial fibrillation and deep vein thrombosis, which is further propelling demand.

Due to the leading medical device manufacturing companies and active research in the field of digital health solutions for AI-driven anticoagulation management systems, the efficiency and accuracy of INR test meters have improved over time.

The German regulatory framework has struck a good balance on quality and precision in medical devices, creating the right environment for innovation in wireless and connected INR test meters. Increased integration of INR monitoring with telemedicine platforms expands patient access to anticoagulation management, convenience, and better clinical outcomes.

While digital health adoption keeps increasing, Germany is still foreseen to be one of the major markets for INR test meters, given the presence of a well-regulated healthcare ecosystem and relentless technological advancement.

India is anticipated to grow at a substantial CAGR of 6.8% throughout the forecast period.

Increasing awareness of cardiovascular diseases, improving access to healthcare, and a burgeoning middle-class population are driving growth in the INR test meter market in India. Traditionally, monitoring of anticoagulation in India had been done mainly in hospitals due to limited availability of point-of-care testing solutions.

The increasing penetration of telemedicine and mHealth platforms has further improved the reach related to anticoagulation monitoring, enabling consultations remotely and tracking INR on smartphone applications. However, the cost remains a challenge, and market growth will be majorly dependent on affordability and insurance penetration.

Therefore, on the front of remedy, local manufacturers and multinationals launch affordable INR test meters and test strips, increasing access in Tier 2 and Tier 3 cities. With rising awareness and healthcare investments, India is positioned to be a very strong market for INR test meters over the next couple of years.

Germany is expected to have a strong foothold when it comes to technology innovation.

The German government and private insurers have increasingly recognized the benefits of self-monitoring for anticoagulation therapy, thus offering comprehensive insurance coverage for both INR test meters and test strips.

Besides, Germany is an aging country with a huge percentage suffering from cardiovascular diseases, such as atrial fibrillation and deep vein thrombosis, which is further propelling demand. Due to the leading medical device manufacturing companies and active research in the field of digital health solutions for AI-driven anticoagulation management systems, the efficiency and accuracy of INR test meters have improved over time.

The German regulatory framework has struck a good balance on quality and precision in medical devices, creating the right environment for innovation in wireless and connected INR test meters. Increased integration of INR monitoring with telemedicine platforms expands patient access to anticoagulation management, convenience, and better clinical outcomes.

While digital health adoption keeps increasing, Germany is still foreseen to be one of the major markets for INR test meters, given the presence of a well-regulated healthcare ecosystem and relentless technological advancement.

The INR test meter market is expected to grow from USD 1.5 billion in 2025 to USD 2.7 billion by 2035, reflecting a steady CAGR of 6.3% during the forecast period.

Devices lead the INR test meter market by product, accounting for a 38.6% market share in 2025, owing to rising demand for self-monitoring tools and point-of-care diagnostics.

Hospitals dominate the end user segment with a 46.1% market share in 2025, driven by their central role in managing cardiovascular conditions and conducting regular anticoagulation monitoring.

Rising prevalence of cardiovascular diseases, growth in home-based monitoring, supportive reimbursement policies, and technological integration such as Bluetooth and mobile health apps are propelling market expansion.

North America and Europe are leading due to advanced healthcare infrastructure, while Asia Pacific and Latin America are witnessing fast growth supported by public health initiatives and remote care access.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Test Strips, 2017 to 2033

Table 6: Global Market Volume (Units) Forecast by Test Strips, 2017 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2017 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 10: North America Market Volume (Units) Forecast by Product, 2017 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Test Strips, 2017 to 2033

Table 12: North America Market Volume (Units) Forecast by Test Strips, 2017 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2017 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Product, 2017 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Test Strips, 2017 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Test Strips, 2017 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2017 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Product, 2017 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Test Strips, 2017 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by Test Strips, 2017 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2017 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Product, 2017 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Test Strips, 2017 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by Test Strips, 2017 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2017 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Product, 2017 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Test Strips, 2017 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Test Strips, 2017 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2017 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Product, 2017 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Test Strips, 2017 to 2033

Table 42: East Asia Market Volume (Units) Forecast by Test Strips, 2017 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2017 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Product, 2017 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Test Strips, 2017 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by Test Strips, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Test Strips, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2017 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 9: Global Market Volume (Units) Analysis by Product, 2017 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Test Strips, 2017 to 2033

Figure 13: Global Market Volume (Units) Analysis by Test Strips, 2017 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Test Strips, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Test Strips, 2023 to 2033

Figure 16: Global Market Attractiveness by Product, 2023 to 2033

Figure 17: Global Market Attractiveness by Test Strips, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Test Strips, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 27: North America Market Volume (Units) Analysis by Product, 2017 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Test Strips, 2017 to 2033

Figure 31: North America Market Volume (Units) Analysis by Test Strips, 2017 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Test Strips, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Test Strips, 2023 to 2033

Figure 34: North America Market Attractiveness by Product, 2023 to 2033

Figure 35: North America Market Attractiveness by Test Strips, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Test Strips, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Product, 2017 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Test Strips, 2017 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Test Strips, 2017 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Test Strips, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Test Strips, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Test Strips, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Test Strips, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Product, 2017 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Test Strips, 2017 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by Test Strips, 2017 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Test Strips, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Test Strips, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Test Strips, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Test Strips, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product, 2017 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Test Strips, 2017 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by Test Strips, 2017 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Test Strips, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Test Strips, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Test Strips, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Test Strips, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Product, 2017 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Test Strips, 2017 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Test Strips, 2017 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Test Strips, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Test Strips, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Test Strips, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Test Strips, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Product, 2017 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Test Strips, 2017 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by Test Strips, 2017 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Test Strips, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Test Strips, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Test Strips, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Test Strips, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Product, 2017 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Test Strips, 2017 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Test Strips, 2017 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Test Strips, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Test Strips, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Test Strips, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Test and Measurement Equipment Market Size and Share Forecast Outlook 2025 to 2035

Testosterone Test Market Size and Share Forecast Outlook 2025 to 2035

Test rig Market Size and Share Forecast Outlook 2025 to 2035

Test and Measurement Sensors Market Size and Share Forecast Outlook 2025 to 2035

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

Testosterone Booster Industry Analysis by Component, Source, Distribution Channels and Regions 2025 to 2035

Testosterone Injectable Market

Test Tube Market

Testliner Market

Testicular Cancer Treatment Market

Intestinal Health Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Intestinal Pseudo-Obstruction Treatment Market - Trends, Growth & Forecast 2025 to 2035

Intestinal Fistula Treatment Market Growth - Demand & Innovations 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

5G Tester Market Growth – Trends & Forecast 2019-2027

RF Tester Market Growth – Trends & Forecast 2019-2027

V2X Test Scenario Editor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA