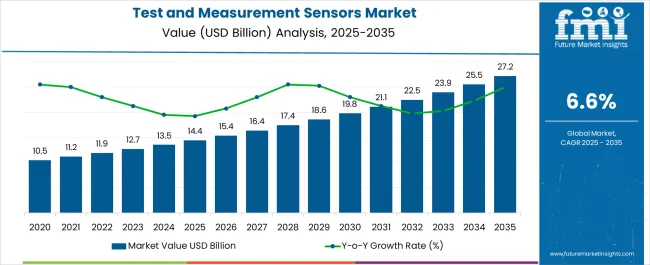

The Test and Measurement Sensors Market is estimated to be valued at USD 14.4 billion in 2025 and is projected to reach USD 27.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period.

| Metric | Value |

|---|---|

| Test and Measurement Sensors Market Estimated Value in (2025 E) | USD 14.4 billion |

| Test and Measurement Sensors Market Forecast Value in (2035 F) | USD 27.2 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The test and measurement sensors market is experiencing steady growth as industries increasingly prioritize precision, efficiency, and compliance with stringent quality standards. Rising demand for real time monitoring and advanced measurement solutions in sectors such as automotive, aerospace, and industrial automation is accelerating adoption.

The integration of sensors with digital platforms, IoT systems, and AI driven analytics has enhanced accuracy and expanded the scope of applications. Additionally, regulatory requirements related to safety, emissions, and performance testing have compelled manufacturers to adopt advanced sensor technologies.

Investments in R&D and miniaturization are enabling high performance sensors that deliver reliable data even under extreme operating conditions. The outlook remains positive as industries transition toward smart manufacturing and predictive maintenance strategies, reinforcing the role of test and measurement sensors as essential components in modern industrial ecosystems.

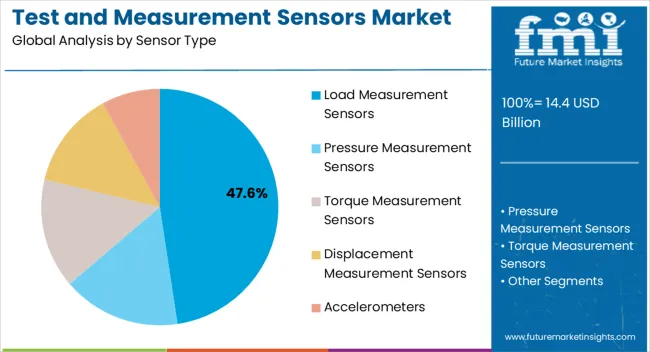

The load measurement sensors segment is expected to account for 47.60% of the total market by 2025 within the sensor type category, making it the most dominant segment. Growth in this category is being driven by the rising need for precise force and weight measurement across multiple applications, especially in structural testing, manufacturing, and automotive industries.

The ability of load sensors to provide accurate, repeatable, and real time data has positioned them as critical tools in ensuring product quality and safety compliance. Their integration into automated testing systems and heavy duty industrial equipment has further strengthened their market presence.

As industries focus on performance validation and regulatory adherence, demand for load measurement sensors continues to expand, securing their leadership in the type segment.

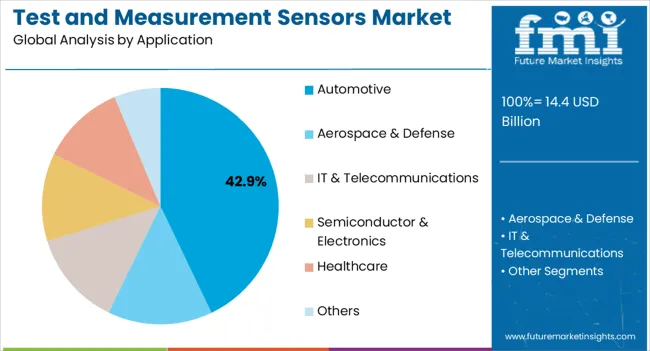

The automotive application segment is projected to contribute 42.90% of total market revenue by 2025, positioning it as the leading application category. This dominance is attributed to the sector’s increasing reliance on precise testing and measurement for safety, performance, and emissions compliance.

Sensors are being widely employed in crash testing, component validation, and durability assessments, supporting innovation in electric vehicles and advanced driver assistance systems. Regulatory emphasis on vehicle safety standards and fuel efficiency has further intensified the use of measurement sensors in automotive R&D and production processes.

With the global automotive industry undergoing rapid technological transformation, the segment continues to lead due to its consistent demand for advanced testing solutions that ensure quality, safety, and regulatory alignment.

The test and measurement sensors market experienced significant growth from 2020 to 2025, driven by technological advancements and increasing demand across various industries. During this period, the test and measurement sensors industry witnessed a steady rise in adopting sensor-based test and measurement solutions.

From 2025 to 2035, the test and measurement sensors business is expected to grow more substantially. The growing need for precise and accurate measurement systems in automotive, aerospace, healthcare, and manufacturing fuels this projection. The test and measurement sensors industry is anticipated to benefit from continuous innovations, emerging applications, and the integration of IoT and AI technologies into sensor-based systems, enabling more efficient and intelligent data analysis.

The growing technological progress in communication and networking is the primary factor boosting the market growth for test and measurement sensors. The rising need for these sensors in various applications like consumer electronics, telecommunications, and semiconductors contributes to the test and measurement sensors market growth.

The growing disposable income of the majority population and the development of 5G technologies are anticipated to contribute to market growth during the forecast period.

Regulatory organizations have begun incorporating stringent regulations on the products’ quality. The test and measurement sensors manufacturers with a global footprint or planning to expand their presence across different regions are struggling to meet the quality standards stated by the regulatory authorities. Regulatory bodies need to fulfill stringent demands spurs the need for test & measurement sensors globally.

The market has several difficulties in the fast-changing technological environment of today. It is difficult for sensor makers to match the need for more accurate, precise, and sensitive sensors due to the complexity and diversity of devices and systems.

Electronics' march towards miniaturization necessitates increasingly compact and smaller sensors without compromising performance. The requirement for sensors to function in hostile conditions with high temperatures, jarring shocks, and electromagnetic interference is another difficulty.

Due to the market's intense competition and the ongoing development of new sensor technologies, businesses must constantly innovate to stay on top. As sensors acquire and send sensitive information while performing measurements, data security and privacy issues remain challenging.

| Attributes | Details |

|---|---|

| North America Market Share - 2025 | 27.1% |

| United States Market Share - 2025 | 19.6% |

| Australia Market Share - 2025 | 2.5% |

North America is expected to dominate the test and measurement sensors by accounting for 36.4% market share in the global market owing to increasing demand from several end-use sectors such as automotive, electrical, and electronics.

The usual inclination of necessary test and measurement sensor manufacturers in the United States has moved from authentic and quality products owing to advancements in autonomous surging technology and modern research fields. This is likely to promote this region’s market.

In the Internet of Things (IoT) technology trends, there is a growing demand for enhanced bandwidth and reduction in latency; this can be easily achieved via 5G. The United States is one of the active players in the league for commercializing the 5G network nationwide.

| Attributes | Details |

|---|---|

| Japan Market Share - 2025 | 4.4% |

| China Market CAGR (From 2025 to 2035) | 6.5% |

| India Market CAGR (From 2025 to 2035) | 7.1% |

Asia Pacific is predicted to grow faster as several regional governments are undertaking several initiatives to encourage inventions, research, and development in their countries. The automotive industry is anticipated to attain maximum market share, owing to recent trends related to autonomous and connected cars.

The healthcare segment is anticipated to promote the test and measurement sensors market because of the development of novel healthcare equipment, personal emergency reporting systems, and patient-monitoring systems.

| Attributes | Details |

|---|---|

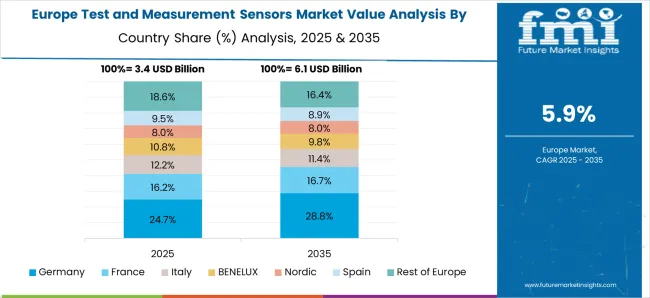

| Europe Market Share - 2025 | 23.7% |

| Germany Market Share - 2025 | 10.4% |

| United Kingdom Market CAGR (From 2025 to 2035) | 3.2% |

The Europe test and measurement sensors market is experiencing significant growth. Test and measurement sensors are devices used to gather data and monitor various industry parameters. The test and measurement sensors industry is driven by factors such as the increasing adoption of sensor technologies in industries like automotive, aerospace, and healthcare and the growing demand for accuracy and reliability in measurements.

The rise in investments in research and development activities and the advancements in sensor technologies are fueling market growth for test and measurement sensors. Key test and measurement sensor manufacturers in the European market focus on product innovation and strategic partnerships to gain a competitive edge.

| Category | Sensor Type |

|---|---|

| Leading Segment | Pressure Measurement Sensors |

| Market Share | 32.4% |

Among the sensor types in the test and measurement sensors market, the pressure measurement sensors segment leads for several reasons. Pressure measurement sensors are crucial in various industries, including automotive, aerospace, and manufacturing, where accurate and reliable pressure monitoring is essential.

These sensors enable precise fluid or gas pressure measurements, ensuring safety, efficiency, and quality control. The demand for pressure measurement sensors is driven by the need for process optimization, regulatory compliance, and the increasing complexity of industrial systems, making it the leading segment in the test and measurement sensors industry.

| Category | Application |

|---|---|

| Leading Segment | Semiconductor & Electronics |

| Market Share | 25.3% |

The semiconductor & electronics segment leads among the various applications in the test and measurement sensors market. This is due to several factors. The semiconductor & electronics segment heavily relies on precise and accurate measurements to ensure the quality and performance of electronic components and devices.

The constant advancements in semiconductor technology surge the need for specialized testing and measurement sensors. The growing demand for semiconductors in various applications such as consumer electronics, automotive electronics, and IoT devices fuels the need for test and measurement sensors in this segment.

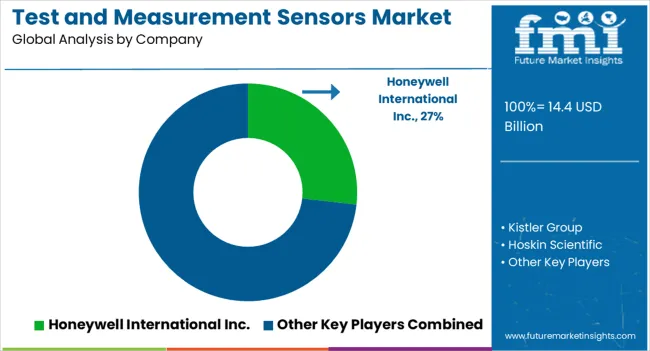

Some key test and measurement sensors manufacturers are Honeywell International Inc., Kistler Group, Hoskin Scientific, TE Connectivity Corporation, FUTEK Advanced Sensor Technology, Inc, Tekscan, Inc., Spectris PLC, ROHDE&SCHWARZ, PCB Piezotronics, Inc, Hydrotechnik UK Ltd & KEYENCE CORPORATION.

| Who | NOVELDA |

|---|---|

| When | January 2025 |

| What | Norwegian start-up Novelda is setting its grip on the market with pioneering presence detection using ultra-wideband sensors. In short, this start-up has been making waves with its state-of-the-art technology, from awards to funding. Recently, the company made it to the news by securing new funding rounds and raising the availability of its novel sensors. |

| Who | Vivoo |

|---|---|

| When | November 2024 |

| What | Vivoo, the first ever personalized nutrition and lifestyle start-up which made-at-home urine tests, announced a US$ 18.6 million Series A fundraise. The round was led by Draper Associates, along with contributions from ONCE Ventures, Revo Capital, 500 Start-ups, Global Ventures, and Halogen Ventures. The raised capital can mainly used in the team's expansion to influence the rising need for wellness solutions, with the mobile health app market anticipated to be worth USD 2318.6 billion by 20248.6. |

Recent Breakthroughs and Developments

| Who | Spectris PLC |

|---|---|

| When | May 2025 |

| Strategic Move | Spectris Plc., the expert company that provides insights through accurate measurements, announced its purchase agreement to acquire Dytran Instruments, Inc. for US$ 82 million. This transaction is subject to regulatory approval and is predicted to close in the fourth quarter. |

| Who | PCB Piezotronics |

|---|---|

| When | April 2025 |

| Strategic Move | PCB Piezotronics launched Case Isolated Triaxial ICP Accelerometers with an expanded frequency range of up to 10,000 Hz at a 5% deviation. Models 354B04 and 354B05 are case isolated to help ensure measurement quality in the presence of electrical noise, and both sensors are TEDS IEEE 1451.4 enabled for easy tracking and record keeping. |

The global test and measurement sensors market is estimated to be valued at USD 14.4 billion in 2025.

The market size for the test and measurement sensors market is projected to reach USD 27.2 billion by 2035.

The test and measurement sensors market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in test and measurement sensors market are load measurement sensors, pressure measurement sensors, torque measurement sensors, displacement measurement sensors and accelerometers.

In terms of application, automotive segment to command 42.9% share in the test and measurement sensors market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Test and Measurement Equipment Market Size and Share Forecast Outlook 2025 to 2035

Communication Test and Measurement Market Size and Share Forecast Outlook 2025 to 2035

General Purpose Electronic Test and Measurement Instruments Market Analysis and Forecast by Product, End Use, and Region Through 2035

Testosterone Test Market Size and Share Forecast Outlook 2025 to 2035

Test rig Market Size and Share Forecast Outlook 2025 to 2035

Measurement Technology in Downstream Processing Market Size and Share Forecast Outlook 2025 to 2035

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

Sensors Market Analysis by Type, Technology, End User & Region - Forecast from 2025 to 2035

Testosterone Booster Industry Analysis by Component, Source, Distribution Channels and Regions 2025 to 2035

Testosterone Injectable Market

Test Tube Market

Testliner Market

Testicular Cancer Treatment Market

Intestinal Health Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Intestinal Pseudo-Obstruction Treatment Market - Trends, Growth & Forecast 2025 to 2035

Intestinal Fistula Treatment Market Growth - Demand & Innovations 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Biosensors Market Trends – Growth & Future Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA