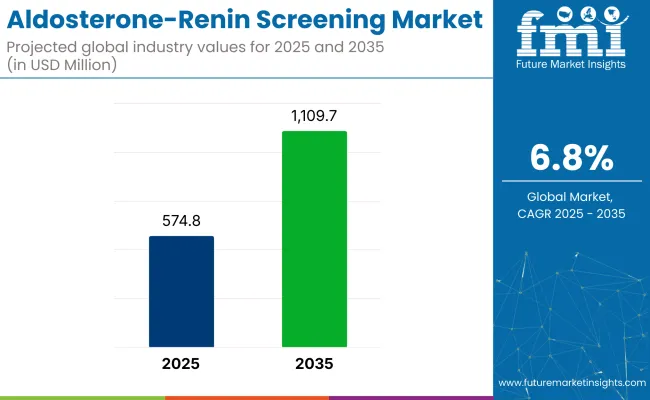

The aldosterone-renin screening market is forecasted to grow from USD 574.8 million in 2025 to USD 1,109.7 million by 2035, at a CAGR of 6.8% during the forecast period.

This growth is being driven by the increasing demand for accurate diagnostic tools to detect primary aldosteronism (PA), a condition characterized by excessive aldosterone production. Clinical laboratories and healthcare facilities are expected to see growing demand for reliable screening solutions as the need for early detection of PA and related conditions rises globally.

In a Roche article titled “Improving Diagnosis of Primary Aldosteronism with Mass Spectrometry” (April 2025), a senior Roche laboratory leader stated, “The aldosterone-to-renin ratio (ARR) is the recommended biochemical screening tool. Development and improvement in the performance of aldosterone and renin determinations have permitted more reliable screening and diagnosis of PA.

Therefore, labs are turning to liquid chromatography-tandem mass spectrometry (LCMS/MS) in first-line testing. This technology has the potential to improve diagnostic accuracy for PA.” This reflects how mass spectrometry is being used to enhance the diagnostic accuracy of PA, which in turn is shaping market growth.

With growing regulatory pressures to improve the accuracy and reliability of diagnostic tools, increasing investments in liquid chromatography-tandem mass spectrometry (LC-MS/MS) and advanced immunoassay kits are expected to drive market expansion. Automation is also being integrated into laboratory workflows, increasing efficiency and accuracy. As diagnostic accuracy improves, the demand for aldosterone-renin screening is expected to continue rising through 2035, with Asia (particularly China) being recognized as a key growth region.

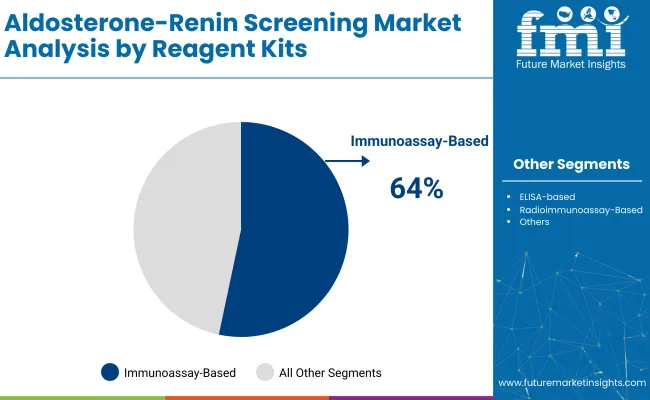

The market is segmented by reagent kits, indication, sample type, end-user, and region. Reagent kits include immunoassay-based kits, ELISA-based kits, radioimmunoassay-based kits, aldosterone-to-renin ratio (ARR) panels, and LC-MS/MS-based assays. In terms of indication, the market covers primary aldosteronism (PA), resistant hypertension, secondary hypertension, adrenal adenoma, and others.

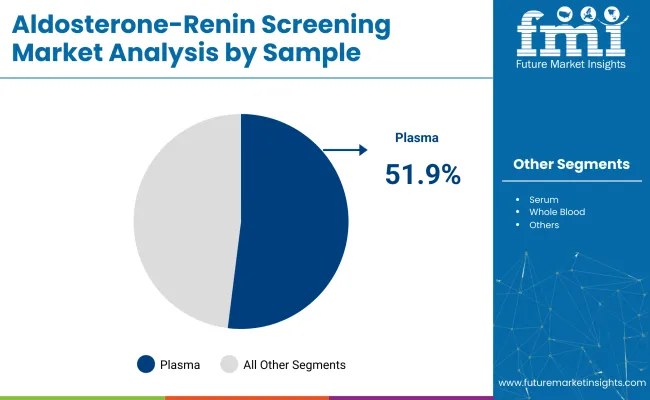

The sample segment includes plasma, serum, whole blood, urine, and other samples. End-users of the market are hospitals, pathology laboratories, endocrinology clinics, cardiology clinics, and diagnostic kit manufacturers/CROs. Geographically, the market spans North America, Western Europe, East Asia, and South Asia.

Immunoassay-based kits are projected to capture 64% of the aldosterone-renin screening market in 2025. These kits are preferred for their high sensitivity, ease of use, and accuracy in diagnosing primary aldosteronism and other endocrine disorders.

Plasma samples are projected to account for 51.9% of the aldosterone-renin screening market sample segment by 2025. Plasma is considered the preferred sample type for analyzing aldosterone and renin levels due to its stability, ease of collection, and the ability to obtain reliable results.

Primary aldosteronism (PA) is expected to capture 32% of the aldosterone-renin screening market share in 2025. PA is a key indication in the aldosterone-renin screening market due to its association with hypertension, electrolyte imbalances, and cardiovascular diseases.

Diagnostic kit manufacturers and contract research organizations (CROs) are expected to capture 35% of the aldosterone-renin screening market share by 2025. This segment is driven by the increasing demand for high-quality diagnostic kits and research-driven solutions for adrenal gland disorders.

The aldosterone-renin screening market is being driven by increased recognition of primary aldosteronism and advancements in diagnostics. However, challenges such as diagnostic variability and equipment requirements are limiting widespread adoption.

Increasing recognition of primary aldosteronism as a significant cause of secondary hypertension is driving market growth

The recognition of primary aldosteronism as a prevalent cause of secondary hypertension is being significantly boosted. This condition is associated with increased risks of cardiovascular diseases, stroke, and kidney failure. As a result, aldosterone-renin screening is being prioritized for early detection, with the aldosterone-renin ratio (ARR) test considered the most reliable method.

Clinical guidelines are being updated to emphasize the importance of ARR testing, leading to higher screening rates. Physician awareness is also being enhanced, which is contributing to the growth of the aldosterone-renin screening market.

Variability in diagnostic protocols and the need for specialized equipment are limiting market growth

Despite the growing demand, challenges related to variability in diagnostic protocols and the need for specialized equipment are being faced by the aldosterone-renin screening market. Factors such as patient preparation and timing of blood collection are being identified as variables that influence test results, leading to inconsistencies.

The necessity for specialized equipment and trained personnel to perform the tests is limiting accessibility, particularly in resource-constrained environments. These barriers are restricting the widespread adoption of aldosterone-renin screening and may hinder market growth.

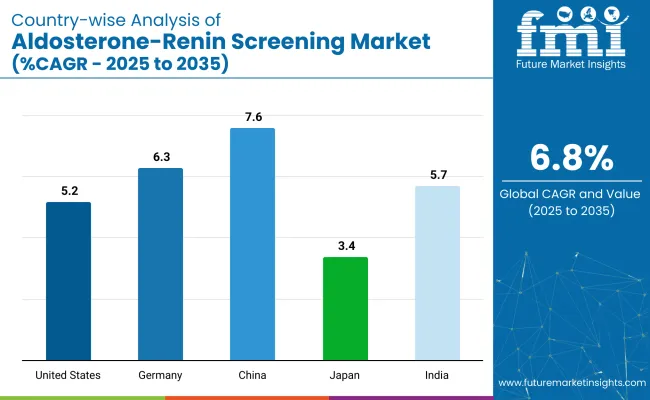

The aldosterone-renin screening market is expected to experience steady growth through 2035. Growth is driven by advancements in diagnostic technologies and increasing awareness of diseases related to aldosterone and renin imbalances. Rapid market expansion is being observed in China and India, while technological innovations and healthcare advancements are being focused on in developed markets such as the U.S. and Germany.

| Countries | Estimated CAGR (%) |

|---|---|

| United States | 5.2% |

| Germany | 6.3% |

| China | 7.6% |

| Japan | 3.4% |

| India | 5.7% |

The United States aldosterone-renin screening market is expected to grow at a CAGR of 5.2% through 2035. The demand for aldosterone-renin screening solutions is being driven by advancements in diagnostic testing and increased awareness of aldosterone-renin imbalances.

The Germany aldosterone-renin screening market is projected to grow at a CAGR of 6.3% through 2035. The market is being supported by the increasing demand for accurate diagnostic solutions and the growing focus on personalized medicine.

China’s aldosterone-renin screening market is expected to grow at a CAGR of 7.6% through 2035. Expansion is being driven by rapid industrialization, increasing healthcare awareness, and government initiatives to improve diagnostic capabilities.

Japan’s aldosterone-renin screening market is projected to grow at a CAGR of 3.4% through 2035. The market is being supported by Japan’s advanced healthcare system, which emphasizes drug safety and diagnostic precision.

Aldosterone-renin screening market in India is expected to grow at a CAGR of 5.7% through 2035. Growth is being driven by increasing health awareness, government initiatives promoting medical infrastructure, and rising incidences of hypertension and endocrine disorders.

Domestic and international companies like Abbott and Roche are focusing on introducing affordable and effective screening solutions. The government’s push for improving healthcare access and boosting the pharmaceutical industry’s global competitiveness is further driving market growth. The rising demand for pharmaceutical exports is also accelerating the adoption of effective aldosterone-renin screening solutions in India.

The aldosterone-renin screening market is characterized by a diverse range of suppliers. Key players like Quest Diagnostics, Labcorp, and ARUP Laboratories dominate the market due to their extensive product portfolios, technological advancements, and strong global presence in the laboratory testing sector.

Comprehensive testing services for primary aldosteronism, including aldosterone and renin assays, are offered by these companies, and automated solutions for determining the aldosterone-to-renin ratio (ARR) are provided. Tier 2 players, such as Diasorin and Mindray, focus on innovative solutions, while Tier 3 players target regional markets with cost-effective and niche product offerings.

Recent Aldosterone-Renin Screening Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 574.8 million |

| Projected Market Size (2035) | USD 1,109.7 million |

| CAGR (2025 to 2035) | 6.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and Number of Tests/Units for volume |

| Reagent Kits Analyzed (Segment 1) | Immunoassay-based kits; ELISA-based kits; Radioimmunoassay-based kits; Aldosterone-to-renin ratio (ARR) panels; LC-MS/MS-based assays |

| Indications Covered (Segment 2) | Primary aldosteronism (PA); Resistant hypertension; Secondary hypertension; Adrenal adenoma; Others |

| Sample Types Covered (Segment 3) | Plasma; Serum; Whole blood; Urine; Others |

| End-User Segments Covered (Segment 4) | Hospitals; Pathology laboratories; Endocrinology clinics; Cardiology clinics; Diagnostic kit manufacturers/CROs |

| Regions Covered | North America, Western Europe, East Asia, South Asia |

| Countries Covered | North America: United States; Canada Western Europe: United Kingdom; Germany; France; Italy; Spain East Asia: China; Japan; South Korea South Asia: India; Pakistan; Bangladesh |

| Key Players Influencing the Market | Thermo Fisher Scientific Inc.; Enzo Biochem Inc.; Wuhan Fine Biotech Co., Ltd.; EagleBio; ALPCO; Bio- Techne; Immunodiagnostic Systems; Revvity; Gold Standard Diagnostics |

| Additional Attributes | Dollar sales by reagent kit type (immunoassay, ELISA, ARR panels, LC-MS/MS); Market growth in primary aldosteronism vs resistant hypertension; Regional adoption rates of screening tests; Advances in diagnostic technology and automation |

The market is segmented into immunoassay-based kits, ELISA-based kits, radioimmunoassay-based kits, aldosterone-to-renin ratio (ARR) panels, and LC–MS/MS-based assays.

The market covers primary aldosteronism (PA), resistant hypertension, secondary hypertension, adrenal adenoma, and others.

The market includes plasma, serum, whole blood, urine, and others.

The market is categorized into hospitals, pathology laboratories, endocrinology clinics, cardiology clinics, and diagnostic kit manufacturers/CROs.

The market spans North America, Western Europe, East Asia, and South Asia.

It is expected to be valued at USD 574.8 million in 2025.

It is projected to grow at a CAGR of 6.8% from 2025 to 2035.

Immunoassay-based reagent kits will lead with a 64% share in 2025.

Plasma samples are expected to hold a 51.9% share in 2025.

Asia, particularly China, is expected to be the key growth region.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA