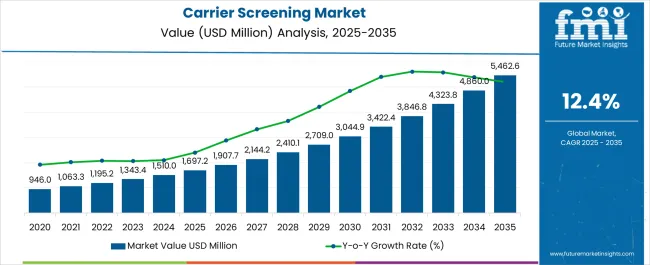

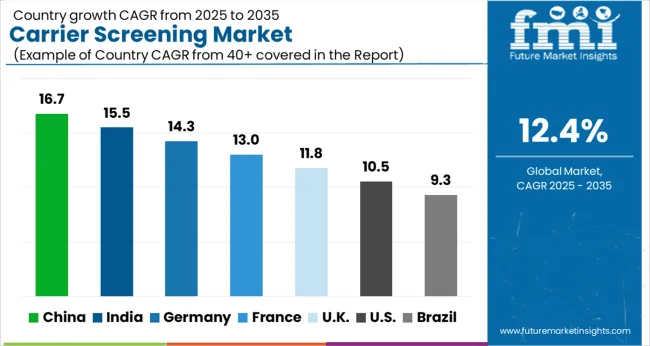

The carrier screening market is estimated to be valued at USD 1697.2 million in 2025 and is projected to reach USD 5462.6 million by 2035, registering a compound annual growth rate (CAGR) of 12.4% over the forecast period.

Healthcare providers evaluate carrier screening panels based on disease coverage breadth, analytical accuracy, and turnaround time requirements when establishing genetic testing protocols for preconception counseling, prenatal care, and reproductive medicine programs. Test selection involves analyzing detection rates, false positive frequencies, and ethnic population coverage while considering insurance coverage policies, patient counseling requirements, and laboratory certification standards necessary for clinical implementation. Procurement decisions balance testing costs against diagnostic value metrics including risk assessment accuracy, patient satisfaction outcomes, and clinical decision-making support that influence reproductive healthcare service delivery.

Laboratory operations require specialized sequencing platforms, bioinformatics infrastructure, and quality management systems that ensure consistent analytical performance across high-throughput genetic testing workflows. Production coordination involves managing sample processing schedules, reagent inventory, and instrument maintenance while maintaining CLIA certification, CAP accreditation, and laboratory quality standards. Quality assurance procedures address analytical validation, proficiency testing, and result interpretation protocols that ensure accurate carrier status determination while supporting genetic counselor consultation and patient reporting requirements.

Cross-functional coordination involves molecular biologists, genetic counselors, and clinical laboratory directors collaborating to optimize testing workflows that balance analytical throughput with result accuracy while maintaining regulatory compliance and patient confidentiality protection. Result interpretation involves variant classification, population frequency analysis, and clinical significance assessment while addressing ethnic diversity considerations and rare variant detection that influence carrier risk assessment accuracy. Reporting systems incorporate standardized terminology, risk communication guidelines, and genetic counselor consultation recommendations that support patient understanding and clinical decision-making processes.

Clinical integration involves coordination between obstetrics practices, reproductive endocrinology clinics, and genetic counseling services to establish comprehensive screening programs that address patient education, consent procedures, and result discussion protocols. Genetic counselor training programs address carrier screening interpretation, risk communication techniques, and reproductive option counseling that support patient decision-making while maintaining professional practice standards. Electronic health record integration encompasses result reporting, clinical decision support, and family history documentation that facilitate screening program implementation and follow-up care coordination.

Partnership development involves collaboration between laboratory service providers, healthcare systems, and genetic counseling organizations to establish comprehensive carrier screening programs that address diverse patient populations and clinical practice requirements. Contract negotiations include testing volume commitments, result turnaround guarantees, and genetic counselor consultation services that support healthcare provider implementation while ensuring patient care quality. Strategic alliances encompass technology platform providers, bioinformatics companies, and population health organizations to deliver integrated screening solutions that optimize testing accessibility and clinical utility.

| Metric | Value |

|---|---|

| Carrier Screening Market Estimated Value in (2025 E) | USD 1697.2 million |

| Carrier Screening Market Forecast Value in (2035 F) | USD 5462.6 million |

| Forecast CAGR (2025 to 2035) | 12.4% |

The carrier screening market is expanding steadily due to growing awareness of genetic disorders, rising demand for early diagnosis, and advancements in genomics technologies. Increasing adoption of preventive healthcare practices and the availability of cost effective genetic testing are reinforcing the role of carrier screening in family planning decisions.

Regulatory support for genetic counseling and integration of advanced sequencing platforms into clinical workflows are also strengthening adoption. Improved accessibility of testing services across both developed and emerging regions is accelerating uptake.

The outlook for the market remains positive as healthcare providers and patients alike prioritize early risk identification and precision driven healthcare, creating opportunities for innovative testing platforms and service delivery models.

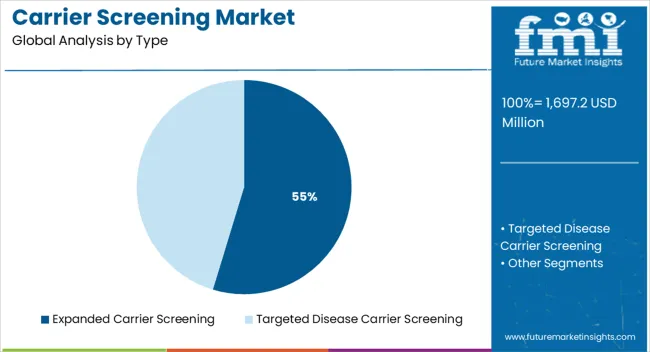

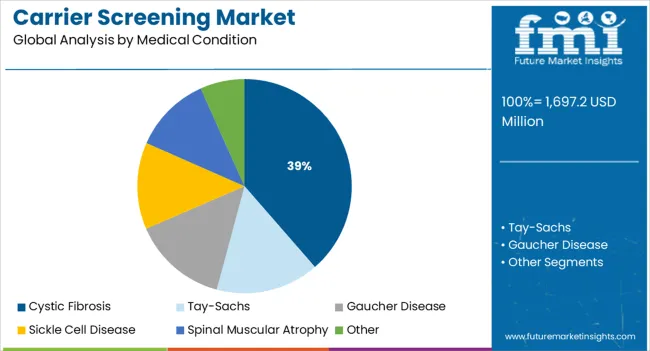

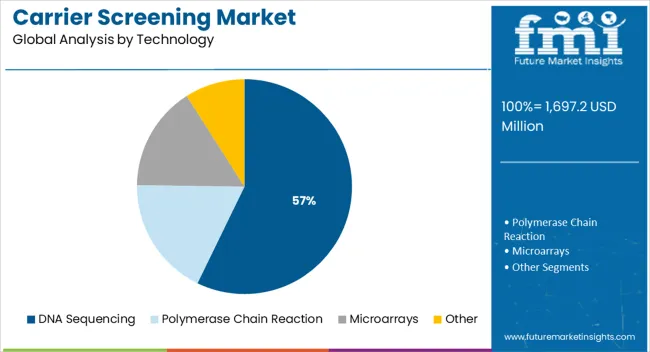

The market is segmented by Type, Medical Condition, Technology, and End User and region. By Type, the market is divided into Expanded Carrier Screening and Targeted Disease Carrier Screening. In terms of Medical Condition, the market is classified into Cystic Fibrosis, Tay-Sachs, Gaucher Disease, Sickle Cell Disease, Spinal Muscular Atrophy, and Other. Based on Technology, the market is segmented into DNA Sequencing, Polymerase Chain Reaction, Microarrays, and Other. By End User, the market is divided into Hospitals, Laboratories, Physician Offices & Clinics, and Other. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The expanded carrier screening segment is projected to account for 54.70% of market revenue by 2025 within the type category, establishing it as the leading segment. Its dominance is supported by its ability to detect a wide range of genetic conditions across diverse populations, providing a more comprehensive risk assessment compared to targeted panels.

The rising awareness of rare genetic diseases and the availability of broad based screening panels have driven its adoption among both healthcare providers and patients.

As personalized medicine continues to advance, expanded carrier screening has gained traction as an essential tool in preventive reproductive healthcare, reinforcing its position as the most preferred type segment.

The cystic fibrosis segment is expected to hold 38.60% of market revenue by 2025 within the medical condition category, making it the leading condition tested in carrier screening. This dominance is attributed to the high prevalence of cystic fibrosis across various regions, the significant health burden it poses, and the availability of well established screening protocols.

Strong advocacy from healthcare organizations and regulatory recommendations for cystic fibrosis testing as part of routine reproductive planning have also supported widespread adoption.

The combination of clinical importance, regulatory guidance, and patient demand continues to reinforce cystic fibrosis as the largest contributor within the medical condition segment.

The DNA sequencing segment is expected to capture 57.20% of total market revenue by 2025 under the technology category, positioning it as the leading technology. This is driven by its superior accuracy, scalability, and capacity to analyze multiple genes simultaneously.

Falling sequencing costs and improvements in throughput have further expanded its adoption in clinical carrier screening. DNA sequencing enables more comprehensive detection of mutations compared to older technologies, which has strengthened its role in genetic testing strategies.

With continuous innovations in sequencing platforms and integration into clinical settings, this technology is expected to remain the cornerstone of carrier screening, ensuring its dominance in the technology segment.

A disease has a higher chance of being effectively treated or cured the earlier it is discovered. It might also be easy to cope with the sickness if it is treated at an early stage.

People can make important decisions about their support and health needs, as well as regarding legal and financial issues, in the early stages of a disease, which helps them plan. Disorders that are inherited include Tay-Sachs disease, sickle cell anemia, and cystic fibrosis.

For a couple with a genetic problem, carrier testing for these disorders can give information about the likelihood of producing a child. Pre-symptomatic/predictive testing refers to risk identification before the onset of symptoms. Many genetic diseases can be identified early on during pregnancy.

The carrier screening market is expanding as a result of consumer desire for reliable and secure carrier tests. The integration of carrier tests into routine clinical treatment benefits the industry commercially.

Particularly in affluent countries like England, France, the United States, Italy, Japan, and Germany, the average age of first-time mothers has been rising. The primary drivers of maternal age advancement are a stable financial situation, rising literacy rates, and social variables. This results in surging carrier screening market adoption trends.

Maternal age increases are directly correlated with the probability of catastrophic chromosomal abnormalities. The average maternal age is increasing, which is predicted to raise the incidence of chromosomal abnormalities and increase the demand for carrier screening.

The carrier screening market on a global scale was estimated in 2020 to be worth USD 946 billion and is anticipated to expand at a CAGR of 11.7% from 2020 to 2024. In 2024, the market was estimated to be worth another USD 946 billion. The market's estimated value in 2020 was USD 1.13 billion.

The carrier screening industry is expected to increase at a faster rate than average during the forecast period, due to reasons such as the growing emphasis on early illness identification and prevention, rising customized medicine acceptance, and rising use of regular testing for genetic abnormalities.

Due to the region's growing prevalence of neurological, hematological, and pulmonary problems, as well as the consequent increase in the demand for testing, North America held a sizable market share in 2024.

The population's ethical concerns about carrier screening and the strict laws governing the clearance of carrier screening tests are impeding carrier screening market expansion. The lack of consistency among laboratories, the administration of pre- and post-test follow-up, and provider misconceptions are further implementation challenges that are projected to impede market expansion.

The price of carrier testing is probably going to limit market expansion. Since there is no requirement to take the test, insurance firms are free to set the terms and conditions following their policies. As a result, out-of-pocket costs may increase by an additional USD 100 to USD 1,000.

| Attributes | Details |

|---|---|

| Expanded Carrier Screening - CAGR | 12.9% |

With a 12.9% CAGR between 2025 and 2035, the expanded carrier screening (ECS) market is predicted to grow at a significant rate and generate the most revenue. The ECS is a new type of carrier screening that screens for a wide range of genetic illnesses, regardless of ethnic background. To increase their carrier screening market share, companies in the industry are engaging in strategic efforts, such as product development.

The company's enhanced test gives customers the option to ask for single- or multi-gene repeat expansion assessments. Consequently, it is anticipated that the informative test is poised to increase the test's utilization and help with individualized medical management.

The demand for carrier screening is likely to increase as people become more aware of genetic illnesses.

Multiple test types are supported by the program, including carrier screening, NIPT, and hereditary cancer. The main tests in carrier screening include a panel for SMA/CF, a screening for fragile X, a panel for Ashkenazi Jews, and a comprehensive panel based on guidelines.

Over 1,300 genetic diseases with recessive inheritance harm babies. The American College of Obstetricians and Gynecologists advises making carrier screening mandatory for all expectant mothers. According to estimates, carrier screening should pay particular attention to Cystic Fibrosis (CF).

When both parents carry the gene for cystic fibrosis, there is a 25% risk that the child is also going to have the condition, while there is a 50% chance that the infant is poised to only be a carrier. Similarly, one of the common recessive illnesses is Spinal Muscular Atrophy (SMA). A non-functional copy of SMN1 was inherited from parents in around 98% of afflicted instances.

This results in the escalation of carrier screening market trends.

| Attributes | Details |

|---|---|

| DNA Sequencing Segment Share | 39.9% |

With a market share of 39.9%, the DNA sequencing market category ruled the overall carrier screening market.

The carrier screening tests are performed at several prenatal diagnostics clinics that use sequencing technologies.

Chromosome micro-array and next-generation sequencing technologies are two examples of how technology is advancing quickly in the market.

The full-exon gene sequencing method based on NGS can find high carriers, according to the National Tay-Sachs and Allied Diseases Association. In terms of Tay-Sachs carrier screening, genotyping is thought to be less sensitive than NGS technology.

| Attributes | Details |

|---|---|

| Laboratory Segment Share | 47.1% |

With 47.1% carrier screening market share throughout the forecast period, the laboratory segment dominated the global market. Market participants are developing investment proposals as a result of the rising demand for genetic testing.

Considered to be the principal suppliers of sequencing solutions to the labs are Oxford Nanopore, Illumina, and ThermoFisher. To incorporate carrier screening services, the end-users are engaging in vertical acquisitions and mergers.

The rising use of carrier screening services in-house by end users is predicted to significantly affect the market's estimated value.

| Attributes | Details |

|---|---|

| Market Share | 40.19% |

With a share of 40.19% between 2035 and 2035, the North American carrier screening market is anticipated to have a commanding position in the industry. Since this area has a sophisticated and effective healthcare system.

The presence of several important firms in the North American region provides a competitive edge for market expansion. The industry is predicted to grow because there is a significantly higher awareness of chromosomal problems and how to prevent them in the area.

Hematological and neurological problems are more prevalent in North America, which reinforces the need for screening testing.

Due to the improved infrastructure of healthcare facilities, thoughtfully crafted reimbursement policies, and improving growth of economic elements, Asia Pacific is predicted to experience a large increase in the carrier screening market. The market is poised to grow as non-profit groups in the area take more initiatives.

Future growth is anticipated to be rapid in the Asia Pacific. The market is being driven by key competitors' growing investments, particularly in China and India. It is believed that the growing senior population and increased awareness of genetic illnesses are poised to fuel the market.

The carrier screening market is growing due to the increasing demand for genetic testing to identify individuals who carry genetic mutations that could be passed on to their children, particularly in prenatal and reproductive health. Leading players in this market include Abbott Laboratories, F. Hoffmann-La Roche AG, Danaher Corporation, Illumina Inc., Thermo Fisher Scientific Inc., Eurofins Scientific SE, Fulgent Genetics Inc., OPKO Health Inc., Quest Diagnostics Incorporated, Invitae Corporation, and Luminex Corporation, each offering advanced diagnostic solutions for carrier screening.

Abbott Laboratories and Roche AG provide innovative genetic testing platforms, offering high-throughput screening for a wide range of inherited conditions. Danaher Corporation and Illumina Inc. lead with next-generation sequencing technologies, enabling comprehensive and accurate carrier screening for genetic disorders. Thermo Fisher Scientific and Eurofins Scientific focus on genetic analysis tools and services to support healthcare providers in delivering personalized care. Fulgent Genetics and OPKO Health provide targeted carrier screening tests for specific genetic conditions, while Quest Diagnostics and Invitae Corporation offer wide-ranging testing panels for inherited diseases. Luminex Corporation specializes in molecular diagnostics, with a focus on multiplex testing technologies.

| Items | Values |

|---|---|

| Quantitative units (2025) | USD 1,697.2 million |

| Type | Expanded carrier screening; targeted disease carrier screening |

| Medical Condition | Cystic fibrosis; Tay-Sachs; Gaucher disease; sickle cell disease; spinal muscular atrophy; other |

| Technology | DNA sequencing; polymerase chain reaction; microarrays; other |

| End-user | Hospitals; laboratories; physician offices & clinics; other |

| Regional coverage | North America; Latin America; Western Europe; Eastern Europe; Balkan & Baltic; Russia & Belarus; Central Asia; East Asia; South Asia & Pacific; Middle East & Africa |

| Key Countries Covered | United States; Canada; Germany; United Kingdom; France; China; India; Japan; South Korea; Brazil; Mexico; GCC; South Africa |

| Top Companies Profiled |

Abbott Laboratories, F. Hoffmann-La Roche AG, Danaher Corporation, Illumina Inc., Thermo Fisher Scientific Inc., Eurofins Scientific SE, Fulgent Genetics Inc., OPKO Health Inc., Quest Diagnostics Incorporated, Invitae Corporation, Luminex Corporation |

| Additional Attributes | Dollar sales by type, medical condition, technology, end user, and region; expanding NGS penetration; growth in lab-based and at-home screening; emphasis on counseling, regulatory compliance, data governance, and test affordability |

The global carrier screening market is estimated to be valued at USD 1,697.2 million in 2025.

The market size for the carrier screening market is projected to reach USD 5,462.6 million by 2035.

The carrier screening market is expected to grow at a 12.4% CAGR between 2025 and 2035.

The key product types in carrier screening market are expanded carrier screening and targeted disease carrier screening.

In terms of medical condition, cystic fibrosis segment to command 38.6% share in the carrier screening market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carrier Wi-Fi Equipment Market Size and Share Forecast Outlook 2025 to 2035

Carrier Infrastructure in Telecom Applications Market - Forecast 2025 to 2035

Cup Carriers Market Size, Share & Trends 2025 to 2035

Pet Carriers Market Analysis - Trends, Growth & Forecast 2025 to 2035

Market Share Breakdown of Cup Carrier Packaging Suppliers

Multicarrier Parcel Management Solutions Software Market Size and Share Forecast Outlook 2025 to 2035

Bird Carriers Market Size and Share Forecast Outlook 2025 to 2035

Baby Carriers Market

Drink Carrier Poly Bags Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in Drink Carrier Poly Bags

Cable Carrier Market

Bottle Carrier Market Trends – Growth & Forecast 2024-2034

Flavour Carriers Market Trends – Growth & Industry Forecast 2025-2035

Beverage Carrier Market Size and Share Forecast Outlook 2025 to 2035

Multi-pack Carriers Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Multi-Pack Carriers Suppliers

Solid Phase Carrier Resin for Peptide Drug Synthesis Market Size and Share Forecast Outlook 2025 to 2035

Wine Bottle Carrier Market Trends & Forecast 2024-2034

Baby & Toddler Carriers & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Wine Carrier Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA