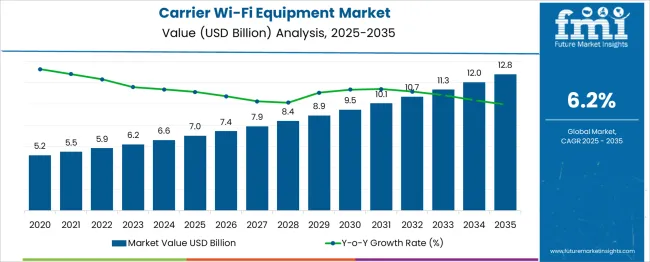

The Carrier Wi-Fi Equipment Market is estimated to be valued at USD 7.0 billion in 2025 and is projected to reach USD 12.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period. Compound absolute growth analysis reveals a steady expansion trajectory with compounding effects becoming more pronounced after 2030. Between 2025 and 2030, the market adds USD 1.9 billion, increasing from 7.0 billion to 8.9 billion, accounting for 32.8% of total growth, driven by growing offload for mobile data traffic, dense small-cell deployments, and integration of Wi-Fi 6 and Wi-Fi 6E for carrier-grade performance. In the subsequent phase (2030–2035), the market contribution accelerates to USD 3.9 billion, representing 67.2% of cumulative growth, as adoption of Wi-Fi 7, convergence of fixed and mobile networks, and enterprise-managed services become mainstream.

Annual incremental additions also scale significantly, rising from USD 0.4 billion per year in early stages to over USD 0.8 billion by 2035, indicating strong back-weighted compounding. The total multiplier effect over the decade is 1.83x, underscoring consistent reinvestment potential. Vendors leveraging cloud-managed platforms, AI-based network optimization, and carrier-grade security will capitalize on these expanding opportunities as operators transition toward high-capacity, low-latency connectivity ecosystems.

| Metric | Value |

|---|---|

| Carrier Wi-Fi Equipment Market Estimated Value in (2025 E) | USD 7.0 billion |

| Carrier Wi-Fi Equipment Market Forecast Value in (2035 F) | USD 12.8 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The carrier Wi-Fi equipment market holds a strategic yet specialized position across its broader network infrastructure segments. In the carrier-grade networking equipment market, its share is about 10–12%, as routers, switches, and optical transport dominate investment. Within the fixed wireless access and broadband infrastructure market, carrier Wi-Fi accounts for 8–10%, driven by operator-led deployments for residential and enterprise broadband offload. In the telecom operator managed services market, it represents 6–8%, reflecting its inclusion alongside managed fiber, mobile backhaul, and IoT connectivity services.

For the Wi-Fi infrastructure and enterprise-grade equipment market, the share rises to 15–18%, as carrier Wi-Fi delivers high-capacity connectivity for stadiums, airports, and public hotspots. In the 5G and edge convergence infrastructure market, its contribution is 4–5%, since Wi-Fi is primarily a complementary access technology supporting indoor coverage and edge computing applications.

Although these shares appear moderate compared to core telecom infrastructure, demand for carrier Wi-Fi is accelerating due to rising mobile data consumption, traffic offloading needs, and monetization opportunities through Wi-Fi roaming and analytics. Adoption of Wi-Fi 6/6E and upcoming Wi-Fi 7 standards, coupled with integration into Open RAN and MEC platforms, positions carrier Wi-Fi as a critical enabler for seamless connectivity, enhanced quality of service, and low-latency enterprise solutions worldwide.

The carrier Wi-Fi equipment market is progressing steadily as operators and enterprises increasingly deploy high-performance wireless solutions to meet escalating data demand. Rising smartphone penetration, bandwidth-intensive applications, and the proliferation of IoT devices are driving the adoption of advanced Wi-Fi infrastructure.

Network operators are prioritizing carrier-grade solutions to enhance coverage, reduce congestion, and deliver seamless connectivity experiences in high-density environments. The market is also benefiting from ongoing innovations in standards and integration with cellular networks, enabling a more reliable and cost-effective complement to mobile broadband.

Future growth is expected to be supported by the expansion of smart cities, enterprise digital transformation initiatives, and heightened requirements for secure and managed wireless networks. Enhanced capacity, improved energy efficiency, and a focus on total cost of ownership are paving the way for broader deployments across diverse verticals.

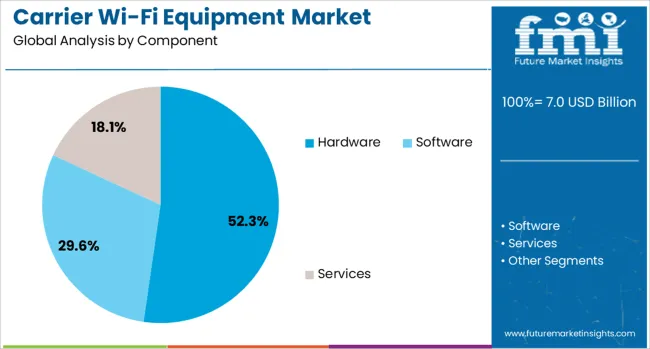

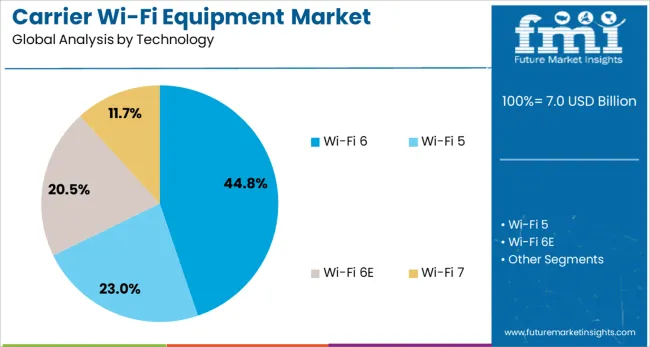

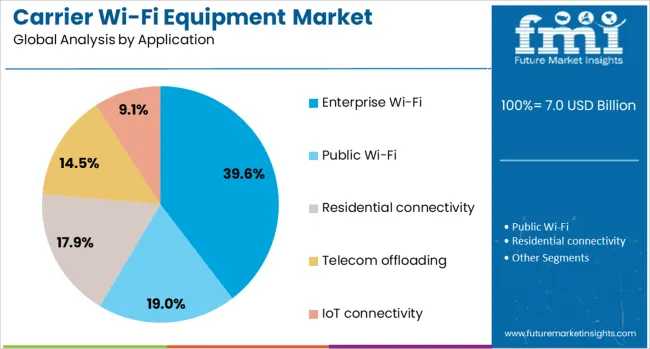

The carrier wi-fi equipment market is segmented by component, technology, application, end use, and geographic regions. The carrier Wi-Fi equipment market is divided into Hardware, Software, and Services. In terms of technology, the carrier Wi-Fi equipment market is classified into Wi-Fi 6, Wi-Fi 5, Wi-Fi 6E, and Wi-Fi 7. Based on the application of the carrier wi-fi equipment market is segmented into Enterprise Wi-Fi, Public Wi-Fi, Residential connectivity, Telecom offloading, and IoT connectivity. By end use of the carrier wi-fi equipment market is segmented into Telecom operators & ISPs, Enterprises, Government & public sector, and Healthcare & education. Regionally, the carrier wi-fi equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by component, the hardware segment is projected to hold 52.30% of the total market revenue in 2025, emerging as the leading segment. This dominance is attributed to the critical role of access points, controllers, and gateways in establishing the foundational infrastructure required for carrier-grade Wi-Fi networks.

Continuous enhancements in hardware performance, including higher throughput, better heat dissipation, and compact designs, have reinforced its indispensability. Operators have been prioritizing investments in scalable and modular hardware to support rapid deployment and maintenance efficiency, which has strengthened its share.

The reliability and longevity of physical equipment, combined with advancements that accommodate the latest standards and security protocols, have sustained the hardware segment’s prominence in enabling robust, high-capacity networks.

In terms of technology, Wi-Fi 6 is expected to account for 44.8% of the market revenue in 2025, positioning it as the top technology segment. This leadership has been driven by its ability to deliver higher data rates, lower latency, and improved performance in dense user environments compared to previous generations.

Network providers have increasingly adopted Wi-Fi 6 to meet the surge in connected devices and the growing demand for real-time applications, which require stable and efficient connections. The technology’s enhanced spectral efficiency and support for advanced features such as OFDMA and MU-MIMO have further accelerated its deployment.

Wi-Fi 6 has been favored for its alignment with emerging use cases like smart campuses, industrial automation, and public venues where consistent performance is critical, cementing its leading share in the market.

When segmented by application, enterprise Wi-Fi is projected to capture 39.6% of the market revenue in 2025, maintaining its position as the leading application segment. This prominence has been fueled by the accelerating digital transformation initiatives across industries, which demand secure, high-performance wireless networks to support cloud applications, remote work, and IoT integration.

Enterprises have increasingly relied on carrier-grade Wi-Fi to enable seamless connectivity for employees, customers, and devices while maintaining network security and manageability. The ability of enterprise Wi-Fi to deliver consistent coverage, support mobility, and handle high-density environments has reinforced its adoption in corporate offices, manufacturing facilities, and educational institutions.

Additionally, the scalability and cost-effectiveness of carrier Wi-Fi solutions have made them the preferred choice for enterprises seeking reliable and future-ready wireless infrastructure.

Carrier Wi‑Fi equipment includes access points, controllers, gateways, and software systems deployed by telecom operators and network providers to deliver wireless internet services in homes, public venues, and enterprise environments. These systems enable managed high‑density coverage and seamless user authentication across indoor and outdoor zones. Demand is driven by rising data consumption on mobile devices, public Wi‑Fi access expectations, and the need for offload from cellular networks. Suppliers offering scalable hardware, centralized network management, and secure authentication protocols have been well placed. Equipment capable of seamless roaming, high throughput, and simplified deployment continues to guide procurement decisions among operators and venue integrators.

Growth in carrier Wi‑Fi equipment deployment has been supported by a strong increase in mobile data usage and reliance on high‑speed connectivity in public and commercial settings. Operator networks have adopted managed Wi‑Fi to relieve cellular network congestion and maintain service quality. Provision of Wi‑Fi hotspots at transportation hubs, retail outlets, and hospitality locations has raised user expectations for free or premium access. Demand for equipment that supports concurrent device connections, high throughput, and secure authentication has reinforced adoption. Unified management systems facilitating centralized control of network access, usage policies, and performance metrics have further driven investment. Regulatory mandates requiring public connectivity in urban centres and transport nodes have also supported uptake of carrier-grade Wi‑Fi systems.

Expansion of carrier Wi‑Fi equipment has been constrained by the need to integrate with existing cellular core networks, authentication systems, and billing platforms. Compatibility issues between Wi‑Fi controllers and mobile network edge systems have increased technical complexity. Security and privacy regulations governing user data and authentication flow have necessitated strict compliance procedures. High‑performance hardware compatible with WPA3, captive portal systems, and seamless roaming functionality is expensive. Metrics on quality‑of‑service, throughput, and latency require extensive monitoring and testing to maintain operator SLAs. Deployment in public spaces demands robust hardware resistant to theft and vandalism, which drives up design and installation costs. Coordination across internal teams and venue owners has sometimes slowed roll‑out plans for new zones.

Opportunities exist in expanding Wi‑Fi deployment into venues such as mass transit, stadiums, airports, hotels, and campuses where managed internet access is expected. Partnerships with venue operators and system integrators allow turnkey installation and maintenance service offerings. Monetization models leveraging tiered access, loyalty integration, and advertising support recurring revenue potential. Bundled solutions combining Wi‑Fi hardware with analytics platforms for customer footfall, dwell time, and network usage are being adopted. Emerging demand for captive portal personalization and branded connectivity experiences enables tailored offerings. Extensions into IoT network support for venue sensors, digital signage and location tracking further expand use cases. Lease‑based equipment financing models lower the entry barrier for operators and accelerate zone roll‑out.

Adoption of cloud‑based Wi‑Fi management platforms has increased, enabling centralized control of dispersed access point deployments and performance monitoring. Modular hardware deployment supports hot‑swap and incremental scaling in high‑density scenarios. Use of mesh networking and dynamic channel allocation has improved coverage and capacity in large venues. Integration of advanced roaming protocols such as Passpoint ensures a seamless user experience across network zones. Tracking of network usage via analytics dashboards supports service-level monitoring and usage‑based billing. Equipment support for blended access using private LTE or small cell integration is growing. Software‑defined networking features that allow policy updates and firmware upgrades remotely have guided supplier development road maps.

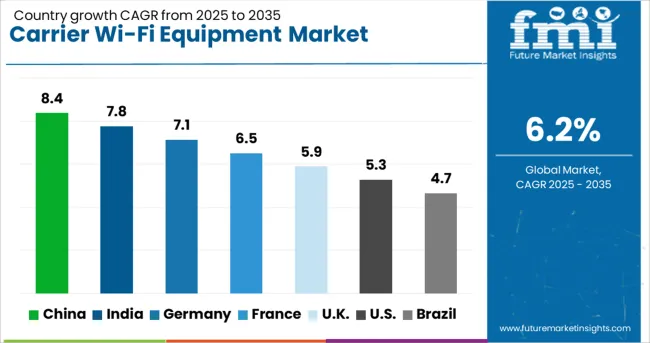

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

| USA | 5.3% |

| Brazil | 4.7% |

The carrier Wi-Fi equipment market is projected to grow at a CAGR of 6.2% between 2025 and 2035, supported by increasing demand for high-speed connectivity, offloading mobile data traffic, and adoption of advanced network infrastructure. China leads at 8.4% CAGR, driven by the integration of Wi-Fi 6 and extensive telecom deployments. India follows at 7.8%, with growth linked to rising broadband penetration and network densification in urban regions. Among OECD countries, Germany posts 7.1%, focusing on next-generation Wi-Fi deployment for public networks and enterprises. France records 6.5%, supported by connectivity upgrades in hospitality and transportation sectors, while the United Kingdom grows at 5.9%, emphasizing large-scale deployments in commercial spaces and educational institutions. The report covers over 40 countries, with detailed insights for five profiled below.

China is projected to grow at an 8.4% CAGR, driven by the rapid adoption of Wi-Fi 6 technology and the expansion of public Wi-Fi infrastructure. Telecom operators are deploying carrier-grade Wi-Fi solutions to manage surging data traffic in densely populated regions. Integration of Wi-Fi in transport hubs, shopping centers, and stadiums is strengthening network capacity for high user volumes. Domestic manufacturers are increasing production of access points, controllers, and backhaul equipment to meet rising deployment needs. Partnerships between telecom providers and enterprises are creating new revenue streams through managed Wi-Fi services and high-speed connectivity solutions across smart urban projects.

India is expected to achieve a 7.8% CAGR, supported by the growing demand for cost-effective connectivity solutions in urban and rural areas. Telecom operators are investing in large-scale Wi-Fi deployments to complement mobile broadband and enhance network coverage. Carrier-grade Wi-Fi hotspots are increasingly being integrated with fiber backhaul to improve reliability and speed. Growth in digital services and rising video streaming consumption are contributing to higher demand for Wi-Fi-enabled networks in educational institutions, retail spaces, and transport corridors. Equipment providers are focusing on developing energy-efficient hardware solutions to meet increasing deployment across metro cities and regional hubs.

Germany is forecasted to post a 7.1% CAGR, driven by adoption of next-generation Wi-Fi solutions in enterprise and public networks. Telecom operators are integrating Wi-Fi networks with cellular systems to manage heavy data loads in commercial zones. Investments in smart transportation projects and large-scale events are increasing demand for carrier-grade access points and controllers. Enterprise adoption of managed Wi-Fi services is accelerating as organizations seek improved connectivity for remote and hybrid work environments. Manufacturers are introducing high-capacity equipment compatible with advanced standards to support faster, low-latency wireless communication.

France is projected to grow at a 6.5% CAGR, supported by strong adoption of Wi-Fi in hospitality, retail, and transportation sectors. Public Wi-Fi solutions are being deployed in railway stations, airports, and stadiums to manage increased passenger data requirements. Telecom operators are investing in robust backhaul systems to ensure reliable connectivity across national networks. Wi-Fi integration in smart infrastructure projects is boosting demand for high-performance routers, access points, and controllers. Partnerships between telecom providers and technology vendors are focusing on modular solutions that simplify scalability for commercial and municipal deployments.

The United Kingdom is expected to grow at a 5.9% CAGR, driven by Wi-Fi deployment across educational institutions, healthcare facilities, and commercial complexes. Telecom providers are implementing advanced network management platforms for better load balancing and traffic optimization. Demand for carrier Wi-Fi is increasing as enterprises seek reliable connectivity to support remote work and cloud-based applications. Deployment in stadiums, convention centers, and transportation corridors is expanding to accommodate high user density during events. Strategic collaborations between telecom firms and service integrators are shaping cost-efficient solutions for urban and regional connectivity projects.

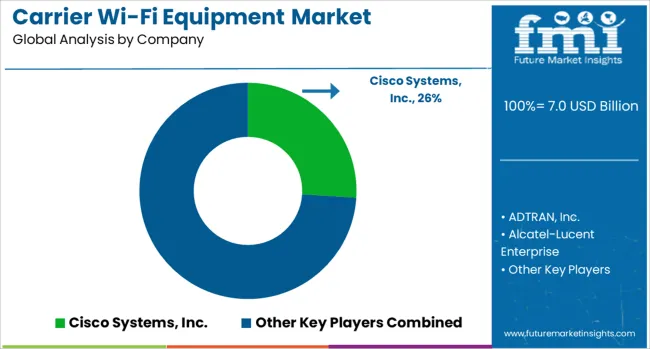

The carrier Wi-Fi equipment market is highly competitive, featuring major global networking and telecom solution providers such as Cisco Systems, Inc., ADTRAN, Inc., Alcatel-Lucent Enterprise, Ruckus Networks, Ericsson AB, Extreme Networks, Aruba Networks, Huawei Technologies Co., Ltd., Juniper Networks, Inc., and Nokia Corporation. Cisco leads the market with its comprehensive Wi-Fi portfolio integrated with cloud-based management, security features, and advanced analytics for large-scale deployments.

Huawei and Nokia focus on carrier-grade Wi-Fi solutions integrated with 5G and fixed broadband networks to enhance mobile offload capabilities and quality of service. Ericsson emphasizes seamless integration of Wi-Fi with cellular networks using its managed services model, while Juniper and Extreme Networks deliver robust solutions with a strong emphasis on SDN (Software-Defined Networking) and AI-driven network automation. Aruba Networks differentiates through enterprise-grade security and IoT support, catering to telecom operators expanding into enterprise services, whereas Ruckus Networks focuses on smart Wi-Fi solutions with adaptive antenna technology to deliver consistent performance in dense environments.

ADTRAN and Alcatel-Lucent Enterprise address niche segments with cost-effective Wi-Fi platforms optimized for regional carriers. Market competition is shaped by rapid 5G rollouts, increased demand for mobile data offloading, and growing adoption of cloud-based network orchestration. Differentiation strategies include support for Passpoint/Hotspot 2.0, advanced QoS management, and AI-enabled predictive analytics for traffic optimization.

Future growth will be driven by convergence of Wi-Fi 6 and 6E technologies, integration with private 5G networks, and development of open Wi-Fi architectures to reduce vendor lock-in. Companies investing in automation, cybersecurity, and edge intelligence will maintain competitive advantage as operators prioritize low-latency, high-capacity connectivity solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.0 Billion |

| Component | Hardware, Software, and Services |

| Technology | Wi-Fi 6, Wi-Fi 5, Wi-Fi 6E, and Wi-Fi 7 |

| Application | Enterprise Wi-Fi, Public Wi-Fi, Residential connectivity, Telecom offloading, and IoT connectivity |

| End Use | Telecom operators & ISPs, Enterprises, Government & public sector, and Healthcare & education |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cisco Systems, Inc., ADTRAN, Inc., Alcatel-Lucent Enterprise, Ruckus Networks, Ericsson AB, Extreme Networks, Aruba Networks, Huawei Technologies Co., Ltd., Juniper Networks, Inc., and Nokia Corporation |

| Additional Attributes | Dollar sales by product type (Wi-Fi access points, controllers, network management software) and application (mobile offload, public hotspots, enterprise connectivity), with demand fueled by rising data consumption and the need for cost-effective capacity expansion. Regional trends indicate strong deployment in North America and Asia-Pacific for carrier offload and smart city infrastructure, while Europe focuses on Wi-Fi/5G integration for enterprise and public services. Innovation trends include AI-powered traffic management, Wi-Fi 6E adoption, cloud-based orchestration, and enhanced security protocols to meet the growing complexity of heterogeneous network environments. |

The global carrier wi-fi equipment market is estimated to be valued at USD 7.0 billion in 2025.

The market size for the carrier wi-fi equipment market is projected to reach USD 12.8 billion by 2035.

The carrier wi-fi equipment market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in carrier wi-fi equipment market are hardware, _access points (aps), _wireless controllers, _gateways & routers, _antennas & cables, software, _network management & monitoring, _security solutions, _traffic management, _analytics platforms, services, _installation & deployment, _maintenance & support and _managed services.

In terms of technology, wi-fi 6 segment to command 44.8% share in the carrier wi-fi equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carrier Screening Market Size and Share Forecast Outlook 2025 to 2035

Carrier Infrastructure in Telecom Applications Market - Forecast 2025 to 2035

Cup Carriers Market Size, Share & Trends 2025 to 2035

Pet Carriers Market Analysis - Trends, Growth & Forecast 2025 to 2035

Market Share Breakdown of Cup Carrier Packaging Suppliers

Multicarrier Parcel Management Solutions Software Market Size and Share Forecast Outlook 2025 to 2035

Bird Carriers Market Size and Share Forecast Outlook 2025 to 2035

Baby Carriers Market

Drink Carrier Poly Bags Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in Drink Carrier Poly Bags

Cable Carrier Market

Bottle Carrier Market Trends – Growth & Forecast 2024-2034

Flavour Carriers Market Trends – Growth & Industry Forecast 2025-2035

Beverage Carrier Market Size and Share Forecast Outlook 2025 to 2035

Multi-pack Carriers Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Multi-Pack Carriers Suppliers

Solid Phase Carrier Resin for Peptide Drug Synthesis Market Size and Share Forecast Outlook 2025 to 2035

Wine Bottle Carrier Market Trends & Forecast 2024-2034

Baby & Toddler Carriers & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Wine Carrier Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA