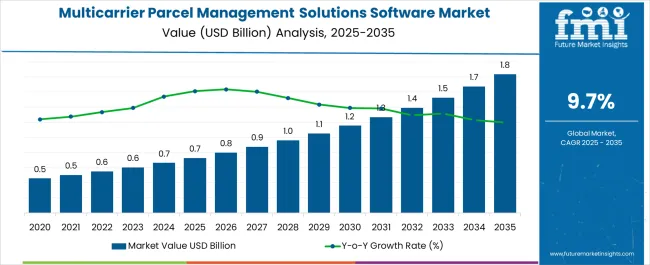

The Multicarrier Parcel Management Solutions Software Market is estimated to be valued at USD 0.7 billion in 2025 and is projected to reach USD 1.8 billion by 2035, registering a compound annual growth rate (CAGR) of 9.7% over the forecast period.

| Metric | Value |

|---|---|

| Multicarrier Parcel Management Solutions Software Market Estimated Value in (2025 E) | USD 0.7 billion |

| Multicarrier Parcel Management Solutions Software Market Forecast Value in (2035 F) | USD 1.8 billion |

| Forecast CAGR (2025 to 2035) | 9.7% |

The multicarrier parcel management solutions software market is advancing steadily, supported by the rapid growth of e-commerce, rising shipment volumes, and the need for enterprises to optimize last-mile delivery efficiency. Industry updates and logistics publications have highlighted that businesses are increasingly relying on advanced parcel management platforms to automate carrier selection, reduce shipping costs, and improve customer delivery experiences.

Cloud-based deployment models and API integrations have enhanced scalability, enabling companies to manage complex multi-carrier networks with real-time visibility. Additionally, supply chain disruptions and fluctuating freight costs have increased the demand for software solutions that provide analytics-driven decision-making and flexible carrier strategies.

Large-scale investments from logistics technology providers, combined with partnerships between software vendors and global carriers, are further strengthening the market landscape. Looking forward, expansion of omnichannel retail, integration of AI-driven route optimization, and sustainability-driven shipping practices are expected to fuel growth. Segmental demand will continue to be driven by cloud-based deployments for their flexibility and cost advantages, as well as large enterprises seeking robust solutions to handle global logistics networks.

The cloud-based segment is projected to account for 64.5% of the multicarrier parcel management solutions software market revenue in 2025, maintaining its lead due to its scalability, cost-efficiency, and ease of integration. Growth in this segment has been reinforced by enterprises shifting from on-premises systems to cloud platforms to achieve faster implementation timelines and lower upfront investments.

Cloud-based solutions have provided real-time access to shipping data, enabling logistics teams to make quicker, more informed decisions. Industry reports have highlighted the growing importance of API-driven integrations, which allow businesses to seamlessly connect cloud-based platforms with e-commerce, ERP, and warehouse management systems.

Additionally, the ability to support remote operations and global access has made cloud deployments especially valuable in the context of distributed workforces and global shipping operations. As companies prioritize flexibility and agility in their supply chains, the cloud-based segment is expected to remain the dominant deployment model, supported by ongoing advancements in cybersecurity and data compliance frameworks.

The large enterprises segment is projected to contribute 58.9% of the multicarrier parcel management solutions software market revenue in 2025, securing its position as the leading organizational segment. This growth has been attributed to the complex logistics operations and high shipment volumes handled by large enterprises, which necessitate advanced parcel management systems.

Annual reports from logistics-intensive industries have emphasized the importance of these solutions in reducing transportation costs, improving delivery speed, and ensuring compliance with cross-border shipping regulations. Large enterprises have been able to leverage sophisticated features such as AI-driven carrier optimization, predictive analytics, and automated labeling to streamline their global supply chains.

The scale of their operations also allows for significant returns on investment from software adoption, further incentivizing deployment. Furthermore, partnerships between major enterprises and logistics software providers have led to customized solutions that address industry-specific needs. As global trade volumes and e-commerce activities continue to rise, the large enterprises segment is expected to sustain its leadership by driving innovation and adoption in parcel management technology.

The market is rushing to implement digital technologies as a way to streamline operations, create smarter ships and fleets, and better prepare for future challenges.

As consumer demand for multicarrier parcel management solutions software grows, global supply chains are growing and becoming more complex. The increased demand for products, ingredients, and raw materials directly impacts the environment.

Market players must implement new ways to streamline their supply chain and optimize productivity in today's highly competitive market.

End users can easily organize inventory data digitally, monitor and manage to track information, and create electronic invoices using multicarrier parcel management solutions software that incorporates cutting-edge technologies like AI, Big Data, and Analytics.

Multicarrier parcel management solutions software companies can save time and money by reducing the time spent shipping, receiving, tracking, and compiling order data.

Furthermore, more stringent environmental requirements continue to shape the transportation sector as transporters strive to maintain service levels while lowering costs and ensuring operational sustainability. This positively influences the multicarrier parcel management solutions software adoption trends.

As several countries have extended trade protection and changed policies regarding shipping, rising trade tensions between nations is one of the major factors limiting the market growth.

This has had an impact on the market for multicarrier parcel management solutions software digital transformation. Furthermore, rising trade tensions are stifling global trade and activity, which is stifling the market for multicarrier parcel management solutions software and opportunities.

Furthermore, the risks of trade tensions escalating and a broader reversal of globalization have clearly increased, affecting global consumption and employment. This is expected to have an impact on investment around the world, obstructing the resilience of global trade momentum. As a result, an increase in country-to-country conflict of interest could have a negative impact on the multicarrier parcel management solutions software market.

Companies in the multicarrier parcel management solutions software market have prioritized simplifying all aspects of multicarrier parcel management solutions software through enterprise-level tools.

On the same lines, startups are gaining traction, as their robust transportation management system aids in the multicarrier parcel management solutions software of same-day shipping and other business processes.

As a result, platforms that provide a single login for all logistics management, including inbound and outbound freight across parcel, ocean, and international air, are becoming increasingly popular, influencing the multicarrier parcel management solutions software market outlook.

Companies in the multicarrier parcel management solutions software market are creating platforms that allow users to connect with all shipping carriers and print labels with a single click. They offer solutions for managing pricing and stock levels across all sales channels from a single platform, an emerging market trend.

Stakeholders in the market are developing platforms that make bulk ordering, return form printing, and invoice printing a breeze which is an emerging trend in multicarrier parcel management solutions software market.

Due to rapid urbanization, increased online business, and rising adoption of multicarrier parcel management solutions software and new technologies such as robotics, artificial intelligence, machine learning, Internet of Things, Blockchain, and drones, the multicarrier parcel management solutions software has a presence in all regions including North America, Europe, and the Asia Pacific.

The adoption of multicarrier parcel management solutions software increases its efficiency in delivering parcels and goods.

This factor aided multicarrier parcel management solutions software expansion in all regions. The multicarrier parcel management solutions software market growth is fueled by increased spending capacity and online business.

The United States’ multicarrier parcel management solutions software market is expected to grow with a CAGR of 17.9% over the forecast period. The explosive growth of E-commerce companies in the United States is the main driving force behind the market expansion.

Major E-commerce companies, such as Amazon and Flipkart in India and Alibaba in China, use multicarrier parcel management solutions software to manage their global supply chains.

North America is anticipated to have the second-largest multicarrier parcel management solutions software market share due to its early adoption of it.

New research report on multicarrier parcel management solutions software market shows that the legacy players in the market are concentrating on delivering solutions that meet specific needs, such as the installation of various technologies and the update and extension of current systems that is likely to boost the market for multicarrier parcel management solutions software along with the adoption trends.

Centiro, ConnectShip, Inc., MetaPack, ProShip, Inc., and Pitney Bowes Inc. dominate the multicarrier parcel management solutions software market.

Recent Development in the Multicarrier Parcel Management Solutions Software Market:

Key Players

The global multicarrier parcel management solutions software market is estimated to be valued at USD 0.7 billion in 2025.

The market size for the multicarrier parcel management solutions software market is projected to reach USD 1.8 billion by 2035.

The multicarrier parcel management solutions software market is expected to grow at a 9.7% CAGR between 2025 and 2035.

The key product types in multicarrier parcel management solutions software market are cloud based and on-premise.

In terms of organization size, large enterprises segment to command 58.9% share in the multicarrier parcel management solutions software market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Exam Management Software Market

Quote Management Software Market Size and Share Forecast Outlook 2025 to 2035

Trade Management Software Market Size and Share Forecast Outlook (2025 to 2035)

Space Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Event Management Software Market Analysis - Size, Share, and Forecast 2025 to 2035

Grant Management Software Market - Trends, Size & Forecast 2025 to 2035

Video Management Software Market

Server Management Software Market Size and Share Forecast Outlook 2025 to 2035

Skills Management Software Market Size and Share Forecast Outlook 2025 to 2035

Change Management Software Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Church Management Software Market Size and Share Forecast Outlook 2025 to 2035

Cattle Management Software Market Size and Share Forecast Outlook 2025 to 2035

Output Management Software Market Insights – Growth & Forecast through 2035

Travel Management Software Market

Talent Management Software Market Report – Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA