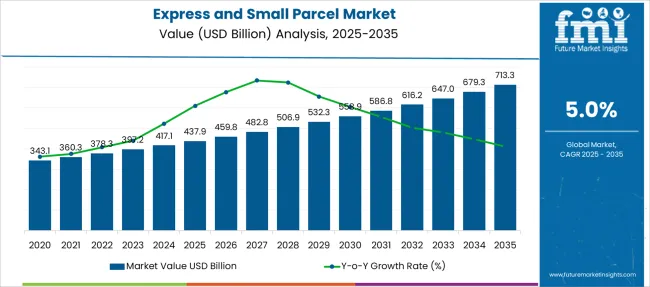

The Express and Small Parcel Market is estimated to be valued at USD 437.9 billion in 2025 and is projected to reach USD 713.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Express and Small Parcel Market Estimated Value in (2025 E) | USD 437.9 billion |

| Express and Small Parcel Market Forecast Value in (2035 F) | USD 713.3 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The express and small parcel market is expanding rapidly as the global economy shifts toward on-demand fulfillment and real-time logistics visibility. Increasing urbanization, last-mile delivery demand, and B2C e-commerce expansion are significantly influencing service innovation and infrastructure deployment. Logistics providers are investing in digital route optimization, AI-driven fleet tracking, and automated sortation systems to enhance delivery speed and accuracy.

Strategic partnerships between courier firms and tech platforms are enabling more integrated and customer-centric experiences. Moreover, governments and private sectors are prioritizing urban freight mobility, sustainable delivery practices, and electrification of vehicle fleets to meet regulatory and environmental standards.

The evolution of omnichannel retail and cross-border e-commerce is expected to further reshape distribution models, opening opportunities in micro-fulfillment centers, parcel lockers, and multi-modal transport strategies. As real-time service guarantees become a competitive differentiator, the market is poised for continued investment and expansion.

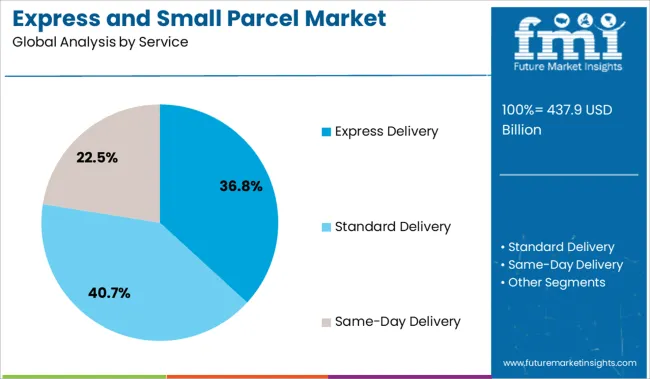

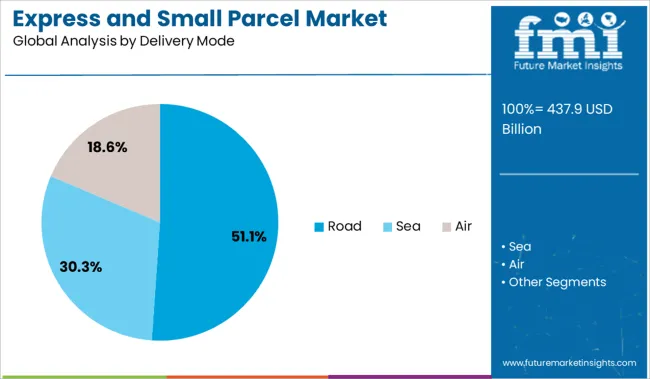

The market is segmented by Service, Delivery Mode, and End-Use and region. By Service, the market is divided into Express Delivery, Air, Road, Sea, Standard Delivery, Air, Road, Sea, Same-Day Delivery, Air, Road, and Sea. In terms of Delivery Mode, the market is classified into Road, Sea, and Air.

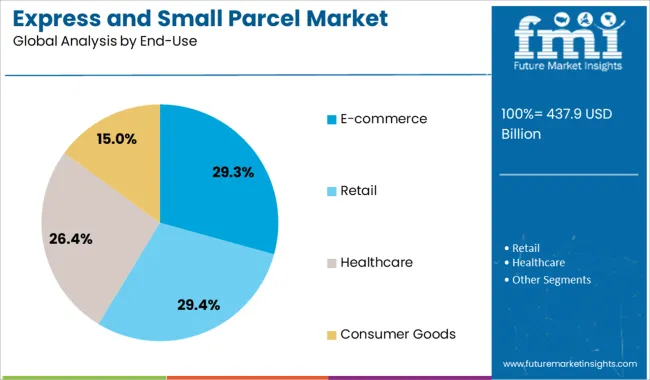

Based on End-Use, the market is segmented into E-commerce, Retail, Healthcare, and Consumer Goods. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Express delivery services are projected to contribute 36.8% of total revenue in 2025 within the service category, making them the leading segment. This leadership is attributed to rising consumer demand for fast and reliable shipping solutions across both domestic and international markets.

The expansion of time-sensitive shipments, coupled with service-level differentiation strategies by leading logistics providers, has enhanced the value proposition of express services. Innovations such as predictive delivery windows, real-time tracking, and AI-enabled route optimization are further boosting efficiency and reliability.

Enterprises are increasingly relying on express networks for high-priority shipments, particularly in healthcare, electronics, and fashion. The growth of premium e-commerce offerings and business-critical supply chains has reinforced express delivery as the preferred service tier among end users, sustaining its dominant share in the segment.

Road transport is forecast to account for 51.1% of total market revenue in 2025 within the delivery mode segment, positioning it as the primary channel for parcel movement. This dominance is driven by the versatility, scalability, and relative cost-effectiveness of road logistics in both urban and intercity networks.

With expanding road infrastructure and the proliferation of decentralized fulfillment hubs, road delivery has become integral to enabling flexible and timely last-mile operations. Advancements in fleet telematics, EV integration, and real-time dispatch coordination are optimizing delivery performance while reducing carbon emissions.

Additionally, regulatory support for commercial vehicle electrification and congestion pricing schemes are influencing operators to enhance road-based delivery models. Road transport continues to offer the highest level of geographic coverage and operational control, ensuring its position as the backbone of the express and small parcel ecosystem.

The e-commerce segment is expected to represent 29.3% of market revenue by 2025 within the end-use category, leading all other verticals in parcel volume demand. This dominance is being driven by a surge in online retail, mobile commerce penetration, and rapid digital adoption across global consumer markets.

E-commerce sellers are prioritizing delivery speed, transparency, and flexible service levels, pushing logistics providers to implement scalable fulfillment and same-day delivery capabilities. Personalization in checkout and delivery experiences, coupled with innovations like click-and-collect and locker networks, are enhancing last-mile efficiency.

Seasonal spikes, return logistics, and cross-border transactions are adding further complexity and demand for responsive parcel solutions. As e-commerce continues to redefine customer expectations, logistics networks are being restructured to support higher volumes, dynamic routing, and reverse logistics, making this segment the central growth engine of the express and small parcel market.

The express and small parcel market is expanding due to increasing demand for e-commerce, faster delivery times, and international trade. However, challenges such as rising operational costs, regulatory compliance, and competition from alternative delivery models are limiting growth.

The express and small parcel market is growing rapidly, driven by the booming e-commerce industry. As more consumers shop online, the need for fast and efficient delivery services has skyrocketed. Express parcel services, which offer quicker delivery times and reliable tracking, are in high demand, particularly in regions with a strong e-commerce presence. The growth of online retail, combined with consumer expectations for faster delivery times, is significantly fueling the growth of the express and small parcel delivery market.

Despite strong growth prospects, the express and small parcel market faces challenges stemming from rising operational costs and intense competition. Logistics providers are facing increased costs related to fuel, infrastructure, and labor, which can limit their ability to offer competitive pricing while maintaining profit margins. Additionally, competition from alternative delivery models, such as drone deliveries and locker-based systems, is pushing traditional carriers to innovate or risk losing market share. These factors contribute to pricing pressures and operational complexities for companies within the market.

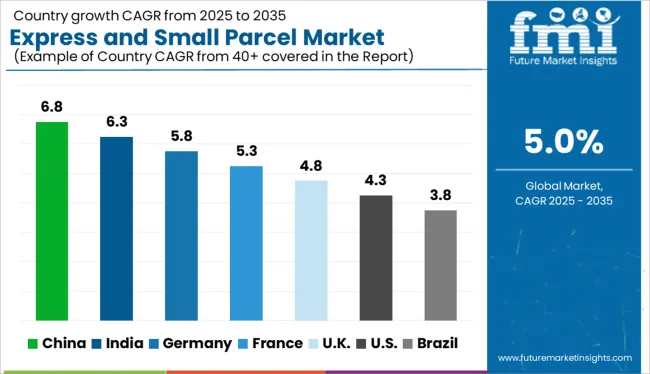

| Country | CAGR |

|---|---|

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

Global express and small parcel market demand is projected to rise at a 5% CAGR from 2025 to 2035. Of the five profiled markets out of 40 covered, China leads at 6.8%, followed by India at 6.3%, and Germany at 5.8%, while the United Kingdom records 4.8% and the United States posts 4.3%. These rates translate to a growth premium of +36% for China, +26% for India, and +16% for Germany versus the baseline, while the United Kingdom and the United States show slower growth. Divergence reflects local catalysts: increasing demand for express and small parcel delivery services in China and India, driven by e-commerce growth, while more mature markets like the United States and the United Kingdom experience slower growth due to market saturation and established logistics infrastructure.

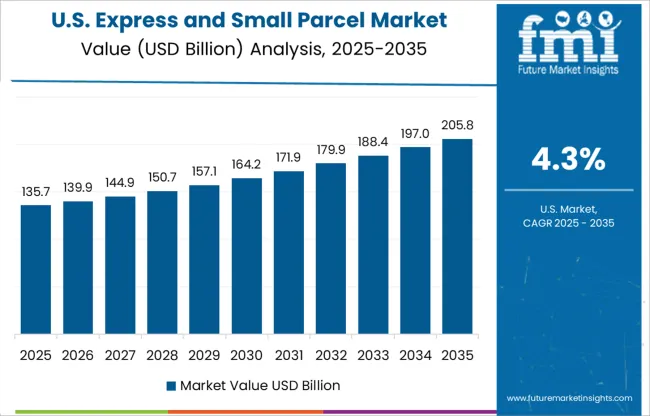

The express and small parcel market in the United States is forecast to grow at a CAGR of 4.3% through 2035. This moderate pace is attributed to a mature e-commerce landscape where next-day and same-day deliveries are already normalized. However, rising cross-border fulfillment and increased direct-to-consumer shipments from mid-sized enterprises are fueling incremental growth. Regional hubs are optimizing parcel handling with AI-based routing and micro-fulfillment centers. Logistics providers are consolidating last-mile delivery fleets with dynamic route modeling, maintaining operational cost control amidst growing volume expectations.

The express and small parcel market in the United Kingdom is projected to grow at a CAGR of 4.8% between 2025 and 2035. Demand is supported by the resurgence of local manufacturing and a return to UK-based distribution after Brexit. Retailers are leveraging integrated parcel locker networks and third-party drop services to mitigate delivery delays. Same-day shipping demand is growing in pharmacy, electronics, and specialty food segments. Tight labor markets and regulatory caps on delivery hours are pressuring firms to digitize fleet logistics and enhance courier productivity.

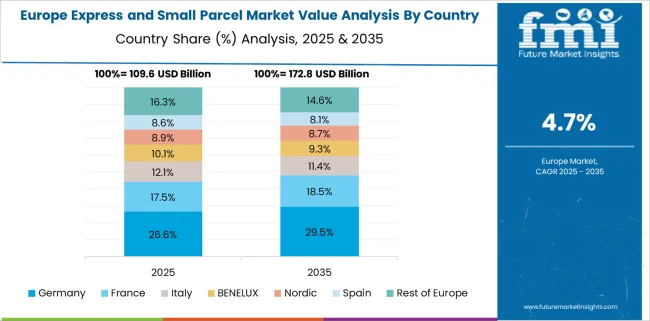

Germany’s express and small parcel market is anticipated to expand at a CAGR of 5.8% during the forecast period. The sector benefits from industrial re-shoring and intra-European trade which continues to rely on time-definite parcel shipments. Deutsche Post, DPD, and Hermes are upgrading infrastructure to manage greater parcel densities in both rural and urban zones. E-commerce giants are establishing cross-dock nodes near borders to expedite outbound parcels to Central and Eastern Europe. Despite environmental policy pressure, consumer demand for fast delivery remains intact, especially in B2B segments.

India’s express and small parcel market is expected to grow at a CAGR of 6.3% from 2025 to 2035. Rising digital transactions and tier-2 city adoption of e-commerce are reshaping logistics demand. Domestic firms like Delhivery, Ecom Express, and Shadowfax are scaling up automated sort centers and building out same-day coverage in high-density zones. Government-backed postal digitization efforts are also revitalizing last-mile delivery models. Customizable delivery windows and COD-enabled parcel routes are being deployed to improve service stickiness among value-conscious buyers.

China continues to lead the segment with a projected CAGR of 6.8% through 2035. Driven by integrated e-commerce ecosystems and vast inter-provincial demand, small parcel volumes are accelerating. Platforms like JD Logistics and Cainiao are reducing fulfillment windows using AI-synced inventory placement and autonomous vehicle trials. Cross-border commerce via Belt and Road logistics lanes is supporting parcel traffic to Southeast Asia, Eastern Europe, and Africa. Policy support for trade zones and bonded warehouses is reinforcing outbound parcel volume.

In the express and small parcel market, competitiveness is driven by delivery speed, cross-border network density, and e-commerce fulfillment integration. FedEx leads globally with its expansive air-ground hybrid model and proprietary last-mile infrastructure spanning over 220 countries. UPS and DHL Express follow closely, targeting premium B2B and retail logistics through sector-specific offerings like healthcare, fashion, and perishables. USPS dominates in USA domestic volume via low-cost routing and government-backed services. In Asia, SF Express and J&T Express are gaining ground with mobile-first logistics and cash-on-delivery tie-ups. Regulatory compliance on customs declarations, delivery tracking standards, and CO₂-linked service classification has intensified across USA, EU, and ASEAN corridors.

In 2025, rising operational costs, contract instability, and fluctuating delivery capacity challenge parcel carriers. These pressures are accelerating demand for third-party logistics, automated route optimization, and strategic network redesign to maintain service efficiency and meet e-commerce fulfillment expectations.

| Item | Value |

|---|---|

| Quantitative Units | USD 437.9 Billion |

| Service | Express Delivery, Air, Road, Sea, Standard Delivery, Air, Road, Sea, Same-Day Delivery, Air, Road, and Sea |

| Delivery Mode | Road, Sea, and Air |

| End-Use | E-commerce, Retail, Healthcare, and Consumer Goods |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | NYULangoneHospitals, ApolloHospitals, TrinityHealth, MassachusettsGeneralHospital, UCSFHealth, ClevelandClinic, Cedars-Sinai, Mayoclinic, PhenixHealth, and FremantleFamilyDoctors |

| Additional Attributes | Dollar sales concentrated in e-commerce fulfillment and same-day delivery services, share led by last-mile electric vans and micro-hub networks, demand driven by AI optimized route planning and autonomous delivery robots, retrofitting visible in traditional postal fleets being upgraded with telematics and parcel lockers, ergonomic considerations essential in handheld scanners and deep-insert parcel pouches, and momentum shifting toward carbon-neutral electric vehicles and compact drones over diesel trucks for enhanced efficiency and sustainability. |

The global express and small parcel market is estimated to be valued at USD 437.9 billion in 2025.

The market size for the express and small parcel market is projected to reach USD 713.3 billion by 2035.

The express and small parcel market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in express and small parcel market are express delivery, air, road, sea, standard delivery, air, road, sea, same-day delivery, air, road and sea.

In terms of delivery mode, road segment to command 51.1% share in the express and small parcel market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Protein Expression Market Size and Share Forecast Outlook 2025 to 2035

Protein Expression Technology Analysis by Product Type by Indication and by End User through 2035

Difficult-to-Express Proteins Market Insights – Growth & Forecast 2024-2034

Transient Protein Expression Market

Mammalian Transient Protein Expression Market Forecast and Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA