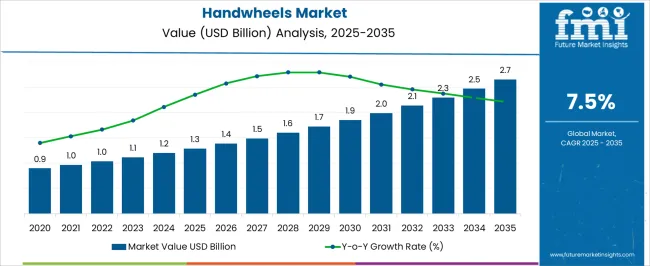

The handwheels market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 2.7 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period. The market exhibits significant regional growth imbalance, driven by varying industrialization rates, manufacturing capacities, and the adoption of automated systems across regions. Asia-Pacific maintains the largest share throughout the forecast period, owing to high industrial output, extensive process industries, and increasing demand for machinery requiring manual control components. The growth in this region is further supported by the rapid expansion of the chemical, energy, and manufacturing sectors, which rely on handwheels for valves, actuators, and precision equipment.

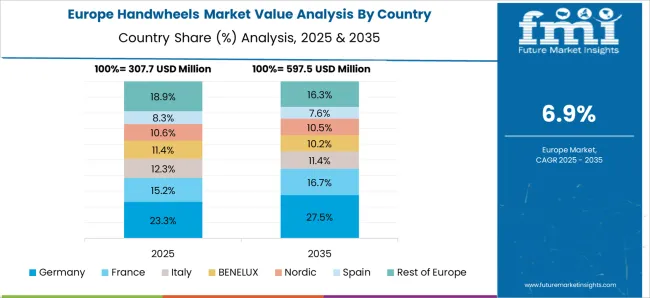

Europe, while mature, contributes a stable portion of the market, driven primarily by stringent quality standards, advanced engineering sectors, and retrofitting of industrial plants with precision control mechanisms. Growth in Europe is moderate, reflecting the region’s established infrastructure and slower expansion of greenfield industrial projects. North America exhibits steady growth with rising adoption in oil and gas, water treatment, and automation-driven industries; however, regulatory standards and market saturation limit explosive expansion.

By 2035, Asia-Pacific’s share continues to dominate, highlighting the regional dependence on industrial growth and process automation, while Europe and North America experience incremental increases in market value. The imbalance indicates that market strategies need to be region-specific, focusing on high-growth opportunities in Asia-Pacific, stable demand in Europe, and technologically driven adoption in North America, ensuring optimized allocation of resources and targeted penetration.

| Metric | Value |

|---|---|

| Handwheels Market Estimated Value in (2025 E) | USD 1.3 billion |

| Handwheels Market Forecast Value in (2035 F) | USD 2.7 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The handwheels market is experiencing stable growth, supported by increasing demand across industrial machinery, mechanical control systems, and precision equipment. The ongoing emphasis on operational ergonomics and manual control in manufacturing and mechanical setups is contributing to the sustained adoption of handwheels.

Industry updates and corporate communications from machinery and component manufacturers highlight that these products continue to play a critical role in environments where manual positioning, clamping, or adjustments are required. Trends in customized machine components are shaping the future outlook, with a focus on worker safety and the integration of advanced grip and material designs that enhance durability and usability.

Additionally, the rising preference for metal and composite-based components, driven by their strength and corrosion resistance, is further strengthening demand. With increasing automation not eliminating the need for mechanical fallback systems, handwheels are expected to remain a relevant component in a variety of applications, reinforcing their importance across both developed and emerging markets.

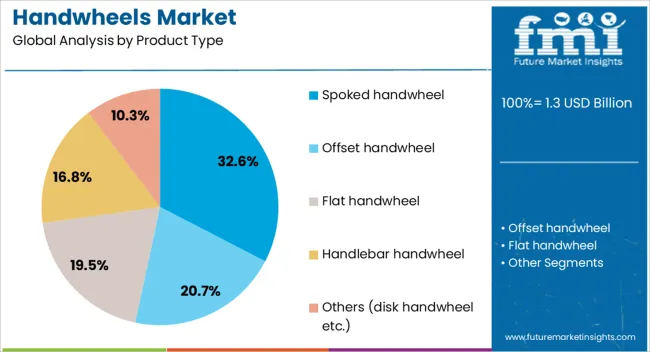

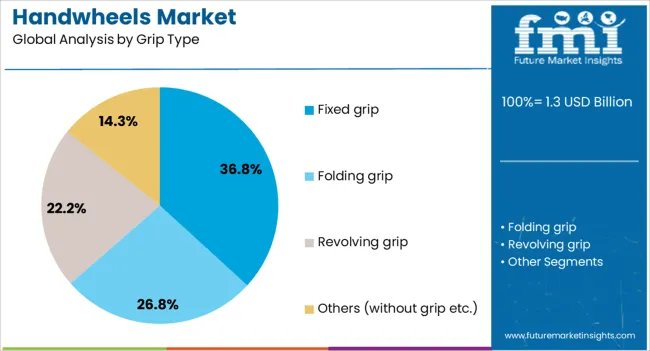

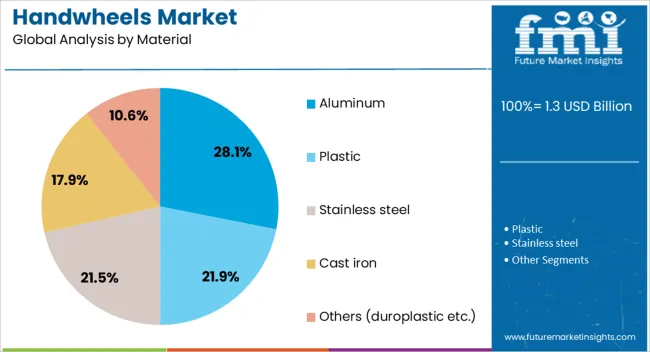

The handwheels market is segmented by product type, grip type, material, type of assembly, end-use industry, distribution channel, and geographic regions. By product type, the handwheels market is divided into Spoked handwheel, Offset handwheel, Flat handwheel, Handlebar handwheel, and Others (disk handwheel, etc.). In terms of grip type, the handwheels market is classified into Fixed grip, Folding grip, Revolving grip, and Others (without grip, etc.). Based on the material, the handwheels market is segmented into Aluminum, Plastic, Stainless steel, Cast iron, and Others (duroplastic, etc.). The handwheels market is segmented by type of assembly into Plain hole, Keyway hole, and Others (square hole, etc.).

By end-use industry, the handwheels market is segmented into the manufacturing industry, Automotive, Oil & gas, Food & beverage, Construction, and Others (pharmaceuticals, etc.). The handwheels market is segmented by distribution channel into Direct sales and Indirect sales. Regionally, the handwheels industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The spoked handwheel segment is projected to account for 32.6% of the Handwheels market revenue share in 2025, making it the leading product type. This dominance is being driven by its functional design, which allows for easy handling, weight reduction, and enhanced operator grip in industrial and mechanical environments. Spoked designs have been widely used in heavy-duty machinery and manual control applications where robustness and precision are essential.

Their structural advantage provides high torque control while reducing fatigue during prolonged usage. The segment's popularity is also supported by its compatibility with various materials and mounting configurations, which adds flexibility for manufacturers and end users.

Its design further supports improved ventilation and debris resistance, particularly in workshop or factory conditions.

The fixed grip segment is expected to hold 36.8% of the Handwheels market revenue share in 2025, establishing it as the dominant grip type. This leadership has been attributed to the segment’s ability to offer stable and controlled manual input, making it a preferred choice in applications where consistent torque and rotation are critical. Fixed grips are known for their durability and low maintenance, which adds value in long-term industrial use.

They provide a secure hold, minimizing slippage and improving safety during repetitive tasks. The segment's growth is further supported by its suitability for equipment that requires fixed positioning or intermittent manual adjustments. Manufacturers have continued to enhance these grips with ergonomic shaping and material refinements to meet evolving user expectations. The rising demand in sectors such as packaging, food processing, and heavy machinery is contributing to the segment’s sustained dominance.

The aluminum segment is projected to contribute 28.1% of the Handwheels market revenue share in 2025, making it the leading material type. This leadership has been supported by aluminum's superior balance of strength, weight, and corrosion resistance, which makes it an optimal choice for varied industrial applications. The material’s machinability and formability have allowed for precise and durable designs, aligning with the performance expectations of modern mechanical systems.

Aluminum-based handwheels have been favored in environments where both strength and lightweight handling are essential, such as in transportation equipment, factory machinery, and process control systems. Additionally, the metal’s resistance to rust and environmental degradation has increased its preference for use in outdoor or high-moisture settings. The segment’s growth has also been bolstered by the material’s recyclability and cost efficiency, which align with sustainability goals in manufacturing.

The market has expanded due to the increasing demand for precision control in industrial machinery, valves, and automated systems. Handwheels are widely used to regulate mechanical operations, adjust equipment settings, and ensure operational safety across manufacturing, chemical, and process industries. Growth has been driven by the adoption of ergonomically designed components, robust materials, and modular designs that enhance usability and durability. Industrial automation, process optimization, and regulatory compliance for operational safety have further strengthened demand for high-quality handwheel solutions globally.

Handwheels have been increasingly integrated into automated and semi-automated industrial systems to enhance operational efficiency and process control. In industries such as manufacturing, chemical processing, and water treatment, precise adjustment of valves, levers, and control mechanisms has been facilitated through ergonomically designed handwheels. Materials such as stainless steel, aluminum, and reinforced polymers have been utilized to provide durability and resistance to harsh operating conditions. Modular designs have allowed customization for various machinery types, enabling smooth integration into complex systems. Ergonomic improvements have reduced operator fatigue while enhancing control accuracy. Additionally, maintenance operations have been simplified through standardized components and easy replacement options. The focus on automation and process optimization has reinforced the role of handwheels as critical mechanical interfaces, driving their widespread adoption across industrial sectors globally.

Advancements in material science and engineering have strengthened handwheel performance and longevity. High-strength metals, corrosion-resistant alloys, and thermoplastic polymers have been employed to enhance resistance against mechanical wear, chemical exposure, and extreme temperatures. Surface treatments such as powder coating, anodization, and anti-slip finishes have improved operator safety and tactile feedback. Lightweight materials have been adopted to reduce inertia while maintaining structural integrity, particularly in large machinery applications. Customization in handwheel geometry and grip design has improved operational efficiency and minimized operator strain. Manufacturers have also focused on modular components that allow easy replacement of handles, rims, or spokes without dismantling machinery. Material innovation has ensured consistent performance under diverse industrial conditions, making handwheels reliable and essential for precision operation in sectors where mechanical accuracy and safety are critical.

The growth of the handwheels market has been influenced by regulatory standards and safety compliance requirements in industrial operations. Occupational safety regulations have mandated ergonomically designed components to reduce operator injury and fatigue, particularly in chemical, energy, and heavy machinery industries. Handwheels are required to comply with quality and strength standards to ensure reliable operation under high torque and extreme environmental conditions. Certifications for industrial machinery often specify the use of standardized and tested handwheels to maintain operational safety. Audits and compliance checks by regulatory authorities have reinforced the adoption of high-quality handwheels. Additionally, industrial operators have implemented preventive maintenance protocols to replace worn components, further driving demand. Regulatory alignment and safety mandates have positioned reliable handwheel solutions as integral components for operational compliance and workplace safety in industrial facilities globally.

The modernization of industrial machinery and the rise of custom equipment solutions have driven handwheel demand globally. Manufacturing, packaging, food processing, and energy sectors have replaced legacy components with high-precision handwheels to enhance control and adaptability. Custom applications have emerged in specialized machinery, allowing tailored dimensions, materials, and torque ratings. Integration with digital monitoring systems has enabled hybrid control where manual adjustments complement automated operations. The focus on reducing operational downtime and improving operator ergonomics has encouraged the adoption of advanced handwheel designs. Suppliers have expanded product portfolios to provide modular, scalable solutions for diverse industries. Consequently, machinery modernization and the need for customized control components have reinforced consistent growth in the handwheel market, ensuring its relevance in evolving industrial ecosystems worldwide.

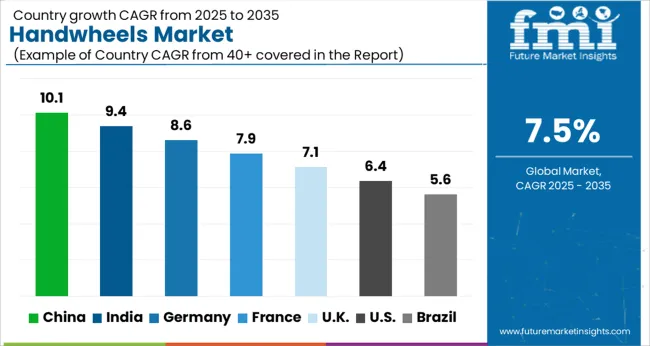

The market is projected to grow at a CAGR of 7.5% between 2025 and 2035, driven by rising demand in industrial machinery, automation systems, and precision control equipment. China leads with a 10.1% CAGR, supported by large-scale manufacturing and adoption in industrial automation. India follows at 9.4%, expanding through growth in machinery production and process industries. Germany, at 8.6%, benefits from advanced engineering and precision manufacturing capabilities. The UK, growing at 7.1%, focuses on specialized applications in manufacturing and engineering sectors. The USA, at 6.4%, experiences steady demand from industrial automation and maintenance markets. This report covers 40+ countries, with the top markets highlighted here for reference.

China is expected to grow at a CAGR of 10.1% in the handwheels market from 2025 to 2035, driven by industrial automation, manufacturing modernization, and increased adoption in machinery control applications. Expansion of precision manufacturing facilities and investments in smart factories is accelerating demand, while collaborations between domestic OEMs and international suppliers are fostering innovation. Rising production of automotive, mechanical, and energy equipment is further supporting sales of handwheels. The integration of ergonomic designs and high-performance materials is enhancing operational efficiency and safety, driving adoption across various industrial segments.

India is projected to expand at a CAGR of 9.4% in the handwheels market during 2025–2035, supported by increasing industrial automation and mechanized equipment adoption. Growth in manufacturing sectors including automotive, metal fabrication, and machinery is stimulating demand. Local producers are collaborating with global manufacturers to enhance product quality and durability. Rising awareness of operational safety and ergonomic designs is driving preference for advanced handwheel solutions. Government incentives promoting industrial modernization are further encouraging adoption across key industrial hubs.

Germany is forecast to grow at a CAGR of 8.6% in the handwheels market between 2025 and 2035, supported by strong manufacturing and mechanical engineering sectors. The market is driven by demand for high-quality, durable, and ergonomically designed handwheels. Expansion of automation in automotive and industrial machinery is further enhancing adoption. Strategic collaborations between local OEMs and technology providers are enabling product innovation. Continuous investment in precision manufacturing and industrial control systems is strengthening sales across mechanical, energy, and transportation equipment sectors.

The United Kingdom is anticipated to grow at a CAGR of 7.1% in the handwheels market from 2025 to 2035, with demand supported by manufacturing modernization and automation initiatives. Key industries including automotive, mechanical engineering, and industrial equipment are driving adoption. Suppliers are focusing on ergonomic designs, durable materials, and customization to meet industry requirements. Government programs supporting industrial efficiency and safety standards are further promoting the uptake of advanced handwheels.

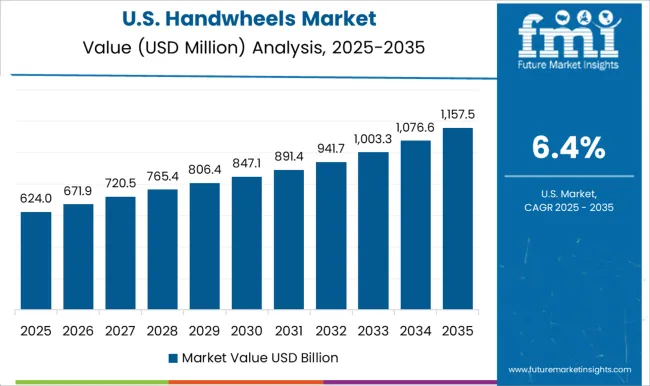

The United States is forecast to expand at a CAGR of 6.4% in the handwheels market between 2025 and 2035, driven by industrial automation, modern machinery, and safety-focused designs. Increasing adoption in automotive, mechanical, and energy equipment is enhancing market growth. Local manufacturers are innovating ergonomic and high-performance handwheels to improve efficiency and user safety. Strategic partnerships with international suppliers are facilitating advanced product deployment. Rising investment in smart factories and industrial control systems is further supporting market expansion.

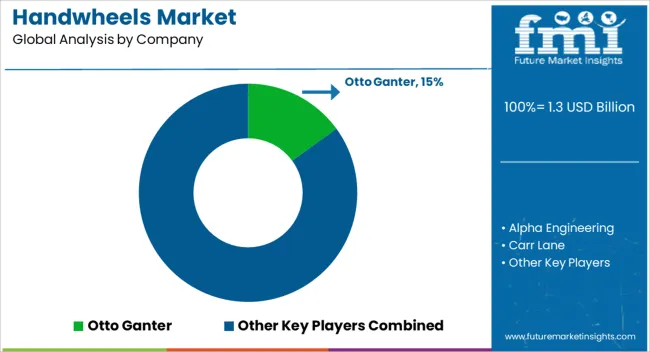

The market is characterized by manufacturers delivering precision mechanical components for industrial, automotive, and machinery applications. Otto Ganter stands out with a wide portfolio of handwheels, knobs, and machine components designed for ergonomic use and long-term reliability. Elesa specializes in engineering handwheels with advanced plastics and metal alloys, offering modular designs suited for various industrial environments. KIPP provides innovative mechanical components, including handwheels, levers, and clamping solutions, focusing on quality and precision engineering. Carr Lane and Jergens cater to high-demand industrial applications, providing durable and standardized handwheels for machine tools and assembly lines.

Alpha Engineering and Igus focus on lightweight, corrosion-resistant materials that improve efficiency in motion control applications. Misumi and Norelem enhance market offerings with customizable handwheel solutions tailored for automated machinery and production equipment. Erwin Halder and Imao Corporation provide ergonomic designs and high-strength materials suitable for heavy-duty industrial operations. Market players continue to focus on product launches, R&D investments, and collaborations with machinery manufacturers to improve functionality and durability. Emerging companies such as OneMonroe and Steel-Smith are expanding their footprint with niche offerings and specialized designs. High precision requirements, adherence to industry standards, and the need for reliable material selection create entry barriers for new entrants, ensuring the dominance of established players in industrial and commercial handwheel applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Product Type | Spoked handwheel, Offset handwheel, Flat handwheel, Handlebar handwheel, and Others (disk handwheel etc.) |

| Grip Type | Fixed grip, Folding grip, Revolving grip, and Others (without grip etc.) |

| Material | Aluminum, Plastic, Stainless steel, Cast iron, and Others (duroplastic etc.) |

| Type of Assembly | Plain hole, Keyway hole, and Others (square hole etc.) |

| End Use Industry | Manufacturing industry, Automotive, Oil & gas, Food & beverage, Construction, and Others (pharmaceuticals etc.) |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Otto Ganter, Alpha Engineering, Carr Lane, Dandong Foundry, Elesa, Erwin Halder, Igus, Imao Corporation, Jergens, KIPP, Misumi, Norelem, OneMonroe, Steel-Smith, and Trumbull Manufacturing |

| Additional Attributes | Dollar sales by handwheel type and end-use industry, demand dynamics across industrial machinery, valves, and automation equipment, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in ergonomic designs, lightweight materials, and precision control features, environmental impact of material sourcing and manufacturing, and emerging use cases in automated production lines, process control systems, and robotics integration. |

The global handwheels market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the handwheels market is projected to reach USD 2.7 billion by 2035.

The handwheels market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in handwheels market are spoked handwheel, offset handwheel, flat handwheel, handlebar handwheel and others (disk handwheel etc.).

In terms of grip type, fixed grip segment to command 36.8% share in the handwheels market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA