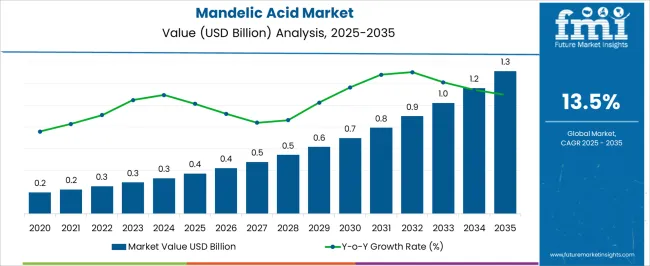

The Mandelic Acid Market is estimated to be valued at USD 0.4 billion in 2025 and is projected to reach USD 1.3 billion by 2035, registering a compound annual growth rate (CAGR) of 13.5% over the forecast period. The YoY analysis highlights early consolidation between 2025 and 2027, where growth moves modestly from USD 0.4 to 0.5 billion, indicating gradual adoption. Momentum picks up from 2028 onward, with consistent increases of USD 0.1 billion per year, pushing the market beyond USD 0.8 billion by 2031.

Between 2030 and 2033, YoY growth accelerates, supported by strong demand in pharmaceuticals, cosmetics, and specialty chemicals, where mandelic acid’s antimicrobial and exfoliating properties gain wider applications. The market surpasses USD 1.0 billion by 2033, signaling entry into a mature growth phase. By 2034–2035, growth continues but at a slightly moderating pace, with increments of about USD 0.1 billion annually, indicating that expansion is stabilizing as the market edges toward saturation.

| Metric | Value |

|---|---|

| Mandelic Acid Market Estimated Value in (2025 E) | USD 0.4 billion |

| Mandelic Acid Market Forecast Value in (2035 F) | USD 1.3 billion |

| Forecast CAGR (2025 to 2035) | 13.5% |

The mandelic acid market is progressing steadily, driven by its versatile applications in pharmaceuticals and personal care industries. Growing consumer awareness about gentle yet effective skincare ingredients has increased demand for mandelic acid in cosmetic formulations.

The pharmaceutical sector has particularly embraced mandelic acid for its antibacterial and exfoliating properties, making it suitable for treating skin conditions such as acne and hyperpigmentation. Product innovations focusing on combining mandelic acid with other active ingredients have broadened its utility.

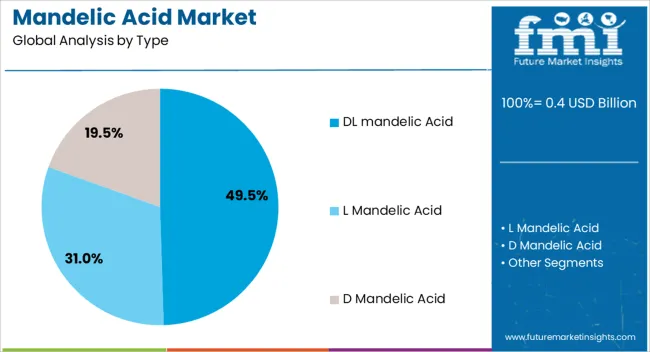

Regulatory encouragement for the use of mild alpha hydroxy acids in medical and cosmetic treatments has further supported market growth. Additionally, the rising prevalence of skin-related disorders and increasing investments in pharmaceutical research have propelled demand. The market is anticipated to expand as manufacturers develop novel formulations targeting both therapeutic and aesthetic applications. Segment growth is expected to be led by DL mandelic acid as the preferred type and the pharmaceutical industry as the dominant application sector.

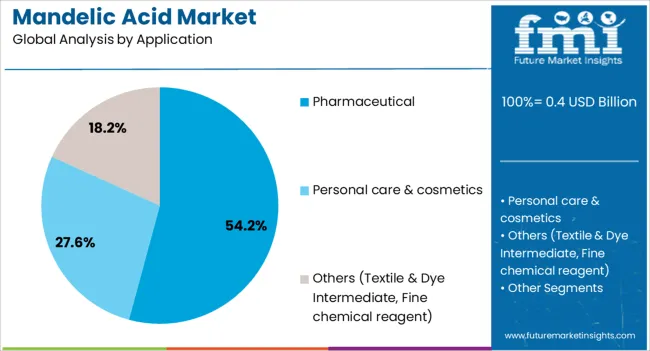

The mandelic acid market is segmented by type, application, and geographic regions. By type, the mandelic acid market is divided into DL mandelic Acid, L Mandelic Acid, and D Mandelic Acid. In terms of application, the mandelic acid market is classified into Pharmaceutical, Personal care & cosmetics, and Others (Textile & Dye Intermediate, Fine chemical reagent). Regionally, the mandelic acid industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The DL mandelic acid segment is projected to hold 49.5% of the mandelic acid market revenue in 2025, maintaining its position as the leading type. This segment’s prominence is due to the balanced chemical properties of DL mandelic acid, which provide effective exfoliation and antimicrobial effects without causing excessive skin irritation.

Its stability and solubility have made it a preferred choice in both pharmaceutical and cosmetic formulations. Manufacturers and formulators have favored DL mandelic acid for its ability to deliver consistent results in skin treatment products.

The segment has benefited from expanding applications in acne treatment, anti-aging products, and pigmentation correction. As the demand for multifunctional skincare ingredients grows, DL mandelic acid is expected to sustain its leading role in the market.

The pharmaceutical segment is anticipated to account for 54.2% of the mandelic acid market revenue in 2025, positioning it as the largest application category. This growth has been driven by mandelic acid’s effectiveness in dermatological treatments and its inclusion in prescription and over-the-counter formulations.

Pharmaceutical companies have leveraged mandelic acid’s antibacterial and exfoliating properties to develop therapies for acne, skin infections, and other dermatological conditions. Increasing skin health awareness and rising dermatology patient visits have supported wider adoption of medical treatments.

Additionally, mandelic acid’s favorable safety profile compared to other alpha hydroxy acids has encouraged its use in sensitive patient populations. As research expands into new therapeutic areas, the pharmaceutical segment is expected to remain the primary driver of market growth.

Mandelic acid is advancing across cosmetics, pharmaceuticals, chemicals, and consumer health applications. Its versatility, mild effectiveness, and multi-industry relevance continue to elevate its global demand profile.

Mandelic acid has secured a strong foothold in cosmetic formulations, driven by its gentler exfoliating properties compared to other alpha hydroxy acids. It is highly valued in products designed for sensitive and acne-prone skin, offering benefits such as reducing hyperpigmentation, evening out tone, and addressing fine lines. Skincare brands are increasingly incorporating mandelic acid into serums, toners, and chemical peels to meet consumer demand for effective yet mild actives. Its antibacterial nature further enhances its relevance in acne treatments, making it a preferred choice among dermatologists. The market for cosmetic-grade mandelic acid continues to expand as personal care manufacturers position it as a premium active ingredient.

Pharmaceutical adoption of mandelic acid is accelerating, supported by its utility in antibacterial formulations and drug intermediates. It is used in oral and topical treatments where antibacterial properties are required, particularly in urinary tract infections and dermatological applications. Drug manufacturers also employ mandelic acid as a chiral building block in complex synthesis, which broadens its value in medicinal chemistry. Its pharmacological compatibility with sensitive formulations ensures acceptance in a wide range of therapeutic areas. This growing pharmaceutical interest has reinforced its position beyond cosmetics, creating a dual market pull. Research institutions and pharmaceutical firms are investing in enhancing applications that extend its clinical significance.

Mandelic acid is also gaining traction in the chemical intermediates segment, particularly in specialty synthesis, fragrance compounds, and fine chemicals. Its unique molecular properties allow it to act as a precursor in producing higher-value derivatives with industrial and commercial relevance. Perfume manufacturers employ mandelic acid for aroma compounds, while fine chemical producers rely on it for synthesis processes requiring precision and stability. Its compatibility with multiple end-use industries broadens its functional relevance, encouraging companies to pursue product diversification. The steady demand for high-purity intermediates in both consumer and industrial markets strengthens the long-term opportunity landscape for mandelic acid suppliers globally.

Increasing consumer awareness of ingredient safety and skin health has significantly boosted mandelic acid demand. Unlike harsher acids, its larger molecular size ensures slower penetration, reducing irritation while delivering reliable results. This makes it an appealing option for sensitive users seeking gentler skincare alternatives. Rising preference for clinically tested, multi-functional actives has pushed formulators to highlight mandelic acid in new launches. Its dual benefits in both cosmetic and pharmaceutical products position it as an ingredient that bridges personal care with therapeutic relevance. Health-conscious consumers are favoring products backed by dermatological validation, and mandelic acid fits this expectation, reinforcing its market expansion across sectors.

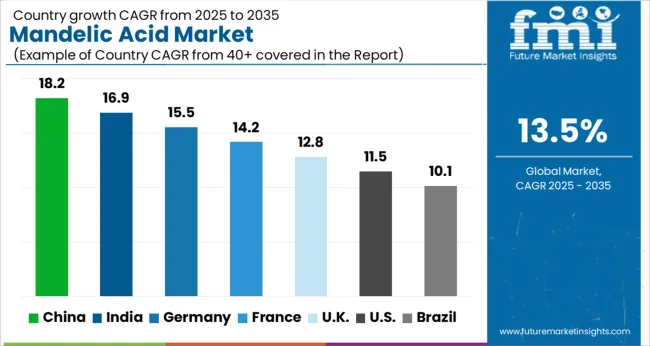

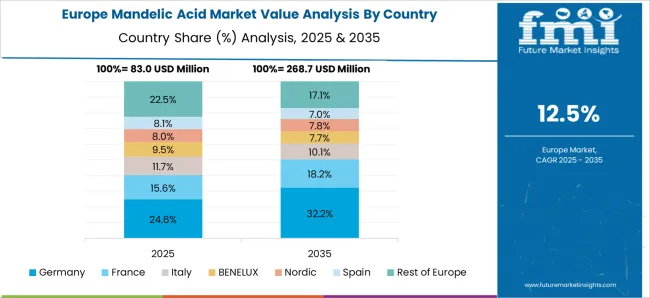

The mandelic acid market is projected to grow globally at a CAGR of 13.5% from 2025 to 2035, supported by rising adoption in cosmetics, pharmaceuticals, and fine chemical industries. China leads with a CAGR of 18.2%, driven by large-scale skincare manufacturing, domestic pharmaceutical integration, and growing demand for premium exfoliating actives. India follows at 16.9%, supported by its expanding personal care sector, strong pharmaceutical production base, and rising consumer preference for clinically proven skincare formulations.

France records 14.2% growth, underpinned by high demand for cosmetic-grade mandelic acid in anti-aging and sensitive skin formulations. The United Kingdom grows at 12.8%, with expansion tied to increasing dermatology-based product launches and incorporation of AHAs in premium skincare brands.

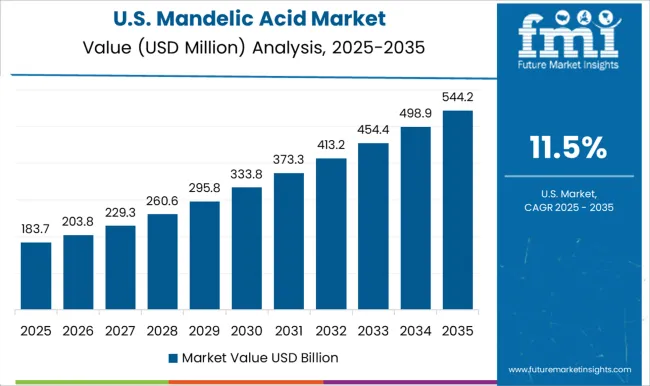

The United States achieves 11.5%, reflecting a mature but steadily growing market focused on pharmaceutical-grade applications, acne treatment formulations, and specialty chemical use. This outlook highlights Asia’s role in driving global mandelic acid adoption, Europe’s strength in high-quality cosmetic and healthcare formulations, and the USA maintaining steady reliance on pharmaceutical and dermatology-based applications.

China is projected to grow at a CAGR of 18.2% during 2025-2035, well above the 13.5% global baseline. During 2020-2024, the CAGR is estimated at 15.9%, supported by early traction in cosmetic actives, expanding dermocosmetic brands, and wider availability of pharmaceutical-grade inputs. The later uplift has been driven by scaled production of high-purity mandelic acid, broader adoption in acne control and pigmentation lines, and stronger penetration into cosmeceutical peels used by clinics. Pharmaceutical intermediates for antibacterial formulations added steady pull, while fine-chemical usage in aroma compounds created incremental volume. Distribution through domestic e-commerce and clinic channels improved sell-through, and contract manufacturing agreements increased export readiness. In this view, China is expected to remain the volume anchor and price setter.

India is forecast to expand at a CAGR of 16.9% during 2025-2035, outpacing the global 13.5% marker. The 2020-2024 CAGR is assessed at 14.4%, underpinned by growing adoption of AHAs in mass and masstige skincare, pharmacist-led recommendations for acne regimens, and wider dermatologist engagement. The higher trajectory in the next phase is explained by capacity additions in specialty chemicals, private-label skin treatments for pharmacy chains, and stronger use of mandelic acid as a chiral intermediate in select APIs. Tier-2 and tier-3 city consumers increasingly seek mild yet proven actives, which raises sustained reorder rates. Education campaigns around irritation control have favored mandelic over harsher acids, helping premium lines gain share.

France records a CAGR of 14.2% for 2025-2035, modestly above the global 13.5% baseline. The 2020-2024 CAGR is gauged at 12.2%, supported by early integration of mandelic acid in sensitive-skin peels and serums. The step-up has been enabled by cosmeceutical brands promoting multi-acid systems where mandelic provides tolerance and tone correction, coupled with growth in clinic back-bar products. Niche fragrance synthesis contributed incremental demand for high-purity grades. Regulatory clarity on labeling and irritation thresholds improved consumer trust, while prestige retailers expanded assortments with dermatologist-endorsed offerings. In effect, France has been positioned as the formulation quality benchmark, where efficacy and tolerance are prioritized in product design.

The CAGR for the United Kingdom is projected at 12.8% during 2025-2035 compared with a global 13.5% baseline. The 2020-2024 CAGR is estimated at 10.8%, as adoption centered on chemist-led brands, cautious clinic usage, and limited domestic synthesis. The later improvement has been credited to stronger listings in national drugstore chains, greater use of mandelic acid in blemish regimens for tolerant application, and clinic-grade peels extending into aesthetic boutiques. Clear differentiation versus glycolic solutions improved repeat rates among sensitive-skin users. Distinctly stated, the earlier period progressed at 10.8% due to conservative clinical uptake and fragmented distribution; the forward period reaches 12.8% as retail planograms broaden, clinic protocols standardize, and online education raises acceptance.

The United States posts a CAGR of 11.5% for 2025-2035, below the global 13.5% average yet on a firmer path than earlier years. The 2020-2024 CAGR is placed at 9.8%, with demand anchored in dermatologist-recommended acne care, prestige serums, and limited use as pharmaceutical intermediates. Momentum improves in the next phase through broader retail education on irritation control, increased adoption in physician-dispensed peels, and integration within multi-step routines that pair mandelic with niacinamide and azelaic acid. Contract manufacturers strengthen supply security for indie brands, widening label counts. Replacement of harsher acids in sensitive-skin ranges sustains repeat purchases and stabilizes pricing in premium formats.

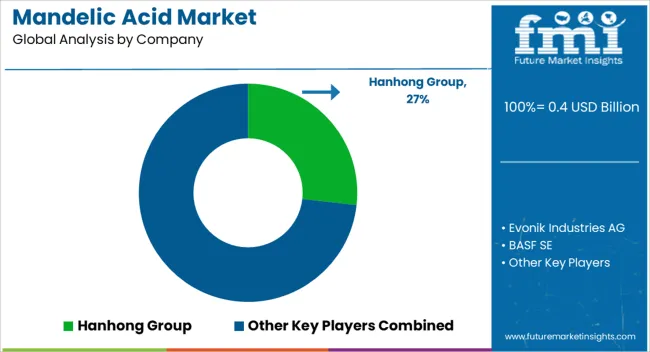

The mandelic acid market is highly competitive, with a blend of global chemical manufacturers and specialized life sciences companies focusing on cosmetic, pharmaceutical, and research-grade applications. Hanhong Group plays a strong role in supplying large-scale mandelic acid intermediates for industrial and pharmaceutical end uses, particularly in Asia.

Evonik Industries AG leverages its specialty chemicals expertise to deliver high-purity cosmetic-grade mandelic acid for skincare formulations and clinical products. BASF SE emphasizes R&D-driven production, offering stable and consistent mandelic acid solutions for personal care and fine chemical industries. Sigma Aldrich, a part of Merck KGaA, maintains a strong global footprint by providing high-purity mandelic acid for academic, clinical, and commercial research purposes.

Alfa Aesar, under Thermo Fisher Scientific, offers laboratory-scale mandelic acid products, catering to researchers and specialty developers. Clearsynth specializes in custom synthesis and isotopically labeled compounds, ensuring tailored mandelic acid solutions for pharmaceutical innovation. Biosynth Carbosynth focuses on specialty biochemicals, supplying mandelic acid derivatives for advanced drug discovery and biotechnology applications.

Santa Cruz Biotechnology enhances the competitive field by serving the biomedical research sector with niche mandelic acid offerings targeted at experimental and diagnostic use. Differentiation in this market is shaped by product purity, scalability of production, and alignment with end-use industries ranging from cosmetics to pharmaceuticals.

Competitive strategies focus on expanding cosmetic applications, ensuring compliance with global quality standards, strengthening supply reliability, and supporting R&D collaborations that push mandelic acid into new therapeutic and specialty chemical frontiers..

| Item | Value |

|---|---|

| Quantitative Units | USD 0.4 Billion |

| Type | DL mandelic Acid, L Mandelic Acid, and D Mandelic Acid |

| Application | Pharmaceutical, Personal care & cosmetics, and Others (Textile & Dye Intermediate, Fine chemical reagent) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hanhong Group, Evonik Industries AG, BASF SE, Sigma Aldrich, Alfa Aesar, Clearsynth, Biosynth Carbosynth, and Santa Cruz Biotechnology |

| Additional Attributes | Dollar sales, share, application mix in pharmaceuticals, cosmetics, and industrial uses, regional consumption patterns, price trends, competitive landscape, regulatory approvals, sourcing strategies, and emerging end-use demand shifts. |

The global mandelic acid market is estimated to be valued at USD 0.4 billion in 2025.

The market size for the mandelic acid market is projected to reach USD 1.3 billion by 2035.

The mandelic acid market is expected to grow at a 13.5% CAGR between 2025 and 2035.

The key product types in mandelic acid market are dl mandelic acid, l mandelic acid and d mandelic acid.

In terms of application, pharmaceutical segment to command 54.2% share in the mandelic acid market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Food Acidulants Market Growth - Key Trends, Size & Forecast 2024 to 2034

Folic Acid Market Size and Share Forecast Outlook 2025 to 2035

Oleic Acid Market Size and Share Forecast Outlook 2025 to 2035

Dimer Acid-based (DABa) Polyamide Resin Market Size and Share Forecast Outlook 2025 to 2035

Humic Acid Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA