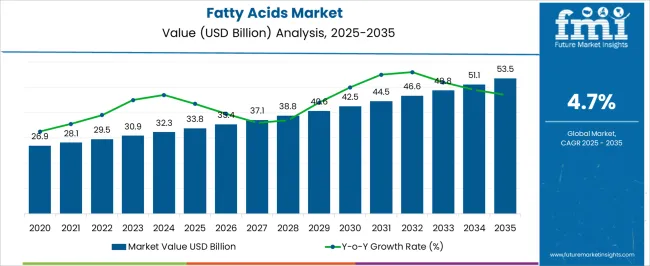

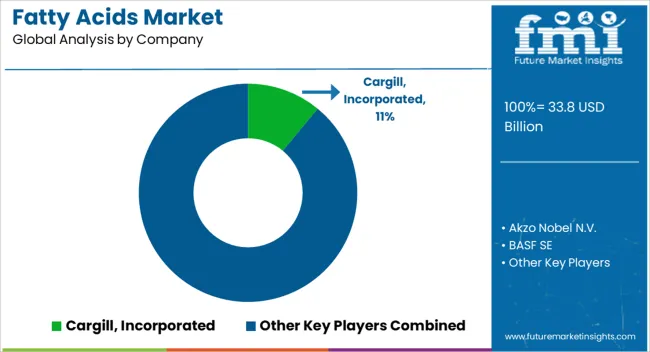

The fatty acids market is estimated to be valued at USD 33.8 billion in 2025 and is projected to reach USD 53.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

Absolute dollar opportunity over 2025–2035 totals USD 19.7 billion. The first half contributes USD 8.7 billion as value advances to USD 42.5 billion by 2030, while the second half contributes USD 11.0 billion to 2035. That distribution assigns 44.2 percent of the pool to 2025–2030 and 55.8 percent to 2030–2035, a late period premium of USD 2.3 billion, or about 26 percent. Average annual additions step up from USD 1.74 billion in 2025–2030 to USD 2.20 billion in 2030–2035. Yearly increments also accelerate across the path, rising from USD 1.6 billion in 2026 to USD 2.4 billion in 2035, which signals growing absolute gains on a larger base.

Milestone checks indicate about one quarter of the total opportunity captured by 2028, and roughly two thirds by 2032, supporting front loaded base building followed by heavier value capture later. Volume expansion is assessed as the primary engine, anchored in detergents, home and personal care, food emulsifiers, and industrial intermediates. Price contribution appears selective, tied to purity grades, ester derivatives, and certification requirements. Sensitivities include palm kernel and coconut feedstock volatility, policy shifts on additives and labeling, and logistics tightness. In my view, the opportunity stack looks resilient, with late period mix upgrades and steady reorder cycles lifting absolute gains even under variable input costs.

| Metric | Value |

|---|---|

| Fatty Acids Market Estimated Value in (2025 E) | USD 33.8 billion |

| Fatty Acids Market Forecast Value in (2035 F) | USD 53.5 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The fatty acids market is anchored by five parent ecosystems that collectively shape specifications, purity grades, and downstream formulations. The oleochemicals market contributes about 28 to 32%, where fatty acids serve as core feedstocks for surfactants, esters, amides, and glycerol derivatives across home and industrial applications. The soaps and detergents market adds roughly 18 to 22%, with lauric, palmitic, stearic, and oleic profiles selected to tune hardness, foaming, and total fatty matter targets in soap noodles, laundry bars, and liquid cleaners. The personal care and cosmetics ingredients market accounts for 12 to 15%, as fatty acids and their esters are applied as emollients, emulsifiers, and rheology aids in skin care, hair care, and color formulations.

The food and beverage additives market provides around 10 to 12%, supplying inputs for mono and diglycerides, release agents, and edible coatings that require food grade compliance and sensory neutrality. The industrial lubricants and greases market represents 8 to 10%, where fatty acids are esterified into synthetic base stocks and metalworking fluids valued for lubricity, hydrolytic stability, and corrosion control. Across these parents, demand is influenced by supply of palm, coconut, and tallow streams, by fractionation capacity, and by consistency in iodine value and acid number. Adoption is favored where clean handling, reliable sourcing, and performance repeatability are required across regulated and performance driven applications.

The market is experiencing steady expansion, driven by rising demand across food, nutraceutical, personal care, and industrial applications. Growing awareness of the health benefits associated with specific fatty acids, particularly in cardiovascular and cognitive health, has influenced product innovation and market adoption. Technological advancements in extraction and refining processes have improved product purity, enabling applications in high-value sectors such as pharmaceuticals and functional foods.

Additionally, sustainability trends are promoting the use of plant-based and renewable feedstocks, enhancing the market's appeal in environmentally conscious industries. The global shift toward healthier diets, coupled with increased use of fatty acids in cosmetics and industrial lubricants, is creating diverse growth avenues.

Regulatory support for the use of specific fatty acids in food and healthcare, along with the expansion of manufacturing capacity in emerging economies, is reinforcing the market’s long-term potential As consumer preferences evolve toward high-quality, sustainable, and functional ingredients, the Fatty Acids market is positioned for continued growth.

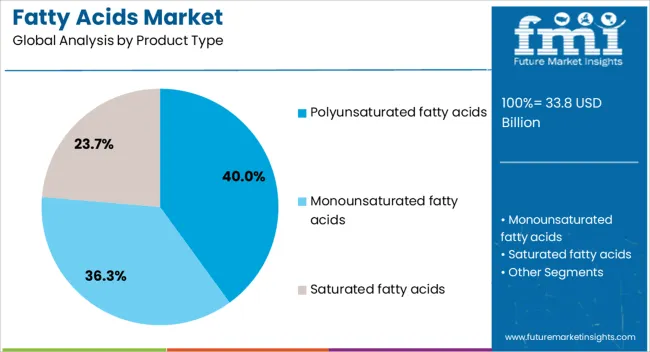

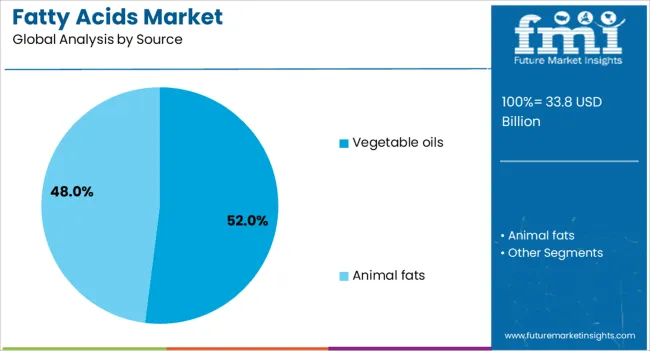

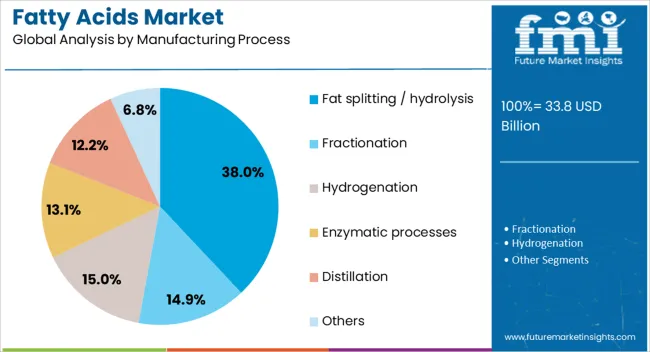

The fatty acids market is segmented by product type, source, manufacturing process, application, end use, and geographic regions. By product type, fatty acids market is divided into polyunsaturated fatty acids, monounsaturated fatty acids, saturated fatty acids, and specialty fatty acids. In terms of source, fatty acids market is classified into vegetable oils, animal fats, marine oils, and microbial sources. Based on manufacturing process, fatty acids market is segmented into fat splitting / hydrolysis, fractionation, hydrogenation, enzymatic processes, distillation, and others. By application, fatty acids market is segmented into food & beverages, personal care & cosmetics, industrial applications, pharmaceuticals, biofuels & energy, animal feed, and others. By end use, fatty acids market is segmented into food & beverage industry, cosmetics & personal care industry, pharmaceutical industry, chemical industry, automotive industry, energy & power industry, agriculture industry, and others. Regionally, the fatty acids industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyunsaturated fatty acids product type segment is projected to hold 40% of the fatty acids market revenue share in 2025, making it the leading product type. Growth in this segment has been influenced by increasing consumer awareness of the health benefits associated with omega-3 and omega-6 fatty acids. These compounds have been linked to improved cardiovascular, brain, and metabolic health, driving demand in the dietary supplements, functional foods, and fortified beverages sectors. Manufacturers have leveraged advancements in refining and stabilization techniques to enhance the shelf life and bioavailability of polyunsaturated fatty acids, increasing their suitability for diverse applications. Rising prevalence of lifestyle-related disorders has further supported the adoption of these fatty acids in preventive healthcare strategies. The segment has also benefited from strong demand in personal care formulations, where they are valued for their skin barrier repair and anti-inflammatory properties This combination of health-driven consumer demand and technical improvements has cemented the segment’s leadership in the overall market.

The vegetable oils source segment is expected to account for 52% of the market revenue share in 2025, making it the dominant source. This leadership position has been reinforced by the abundant availability, cost-effectiveness, and renewable nature of vegetable oil feedstocks. Oils such as palm, soybean, sunflower, and canola are widely used due to their consistent quality and established supply chains. The segment’s growth has also been supported by increasing demand for plant-based ingredients in food, cosmetics, and industrial applications, aligning with sustainability and clean-label trends. Refining advancements have enabled the extraction of high-purity fatty acids from vegetable oils, meeting stringent quality standards for pharmaceuticals and nutraceuticals. Furthermore, geopolitical and environmental considerations have encouraged diversification toward sustainable sourcing and certified oil production. This ensures a stable supply while addressing consumer concerns about ethical and environmental impact The segment’s cost competitiveness and compatibility with multiple end-use sectors have been instrumental in maintaining its market dominance.

The fat splitting or hydrolysis manufacturing process segment is projected to secure 38% of the market revenue share in 2025, positioning it as the leading process. The segment’s prominence has been attributed to its ability to produce high-purity fatty acids efficiently, using water-based hydrolytic reactions under controlled temperature and pressure. This process is widely adopted due to its adaptability to various feedstocks, including vegetable oils and animal fats, enabling flexibility in raw material sourcing. It offers environmental advantages over solvent-based extraction methods, aligning with global trends toward greener and more sustainable manufacturing practices. Additionally, hydrolysis allows for the separation of fatty acids with minimal degradation, preserving functional properties that are critical for applications in food, cosmetics, and pharmaceuticals. Ongoing technological advancements in continuous hydrolysis systems have improved process efficiency and reduced operational costs, further strengthening its competitive position The combination of quality, versatility, and environmental benefits has solidified this process as the preferred manufacturing method in the fatty acids industry.

Fatty acids remain foundational inputs for food, feed, personal care, cleaners, lubricants, coatings, and polymers. Demand is underpinned by dependable functionality in emulsification, texture, mildness, and process stability. Cost volatility, regulatory compliance, oxidation control, and trade policy risks continue to pressure planning and margins. Attractive upside exists in high purity cuts, branched grades, MCT rich systems, specialty esters, amides, and dimer based chemistries. Buyers prefer suppliers offering technical documentation, pilot support, tolling options, and inventory programs. Regionalization of base capacity and emphasis on specialty portfolios indicate a market that rewards reliability, precision, and application depth.

Demand for fatty acids has been strengthened by broad usage across food emulsifiers, bakery shortenings, confectionery coatings, and flavor carriers, where functional roles in structure, mouthfeel, and shelf stability are critical. Animal nutrition relies on tailored blends that support energy density and pellet quality. Personal care, detergents, and household cleaners depend on fatty acid derivatives for surfactancy, foaming, and mildness, while technical markets employ them in lubricants, metalworking fluids, adhesives, and rubber additives. Lauric, oleic, palmitic, and stearic streams are being selected based on iodine value, cut distribution, and oxidation profile to match application targets. Brand owners are requesting consistent color, odor, and peroxide values to protect finished product quality. As downstream categories focus on formulation reliability and label friendly ingredients, fatty acids are being treated as foundational building blocks that enable performance with manageable cost, wide availability, and proven processing behavior across diverse manufacturing environments.

Feedstock price swings tied to weather, oilseed harvest variability, biofuel policy interactions, and freight rates introduce budgeting uncertainty across contracts. Processing assets for splitting, distillation, and hydrogenation require high uptime and tight quality control, so unplanned outages create sudden spot demand and premiums. Food and pharma grades must meet strict specifications for contaminants, allergens, and residual catalysts, increasing compliance workload and batch release times. Oxidative stability and off notes can arise during storage, forcing higher antioxidant dosing or faster rotation and raising working capital. Trade policy shifts on edible oils, quotas, and export duties complicate sourcing for lauric and C16 C18 cuts. Smaller buyers struggle to secure dedicated lots or long tenor supply agreements, while larger buyers face exposure to basis changes across regions. Together these pressures compress margins, lengthen lead times, and make dual sourcing plus tolling partnerships a near prerequisite for dependable continuity.

Clear upside exists in high purity cuts, isostearic and branched grades, and distilled tall oil fatty acids for premium coatings, adhesives, and lubricants. Personal care favors low odor, light color, narrow cut distributions for emollients, esters, and amides that improve sensorial feel and spreadability. Food and clinical nutrition segments are turning toward structured lipids, MCT rich systems, and tailored triglyceride profiles where flow and oxidation behavior are tightly controlled. Metalworking and polymer processing benefit from calcium zinc stearates and specialty amides that enhance release, slip, and stabilization. Waterborne coatings, printing inks, and alkyd resins are adopting optimized monomers derived from oleic and dimer acids with improved drying and hardness development. Contract manufacturers offering formulation support, pilot lots, and documentation sets for global registrations are being preferred. Suppliers that pair specialty portfolios with application labs and credible technical service are likely to convert more high value pipelines.

Food rules restricting trans fat exposure and tightening contaminant thresholds are favoring well controlled hydrogenation and cleaner catalyst regimes. Traceability expectations are rising, with buyers requesting provenance, processing route disclosure, and documented change control to protect label claims. Formulators are moving to low color, low peroxide benchmarks, nitrogen blanketing, and improved packaging to manage rancidity and aroma drift. Regionalization is evident as Asia Pacific scales base oleochemicals, while North America and Europe focus on specialty cuts, value added esters, and amides with higher documentation needs. Long term offtake contracts, tolling arrangements, and vendor managed inventory are being used to stabilize supply. Digital telemetry on tank farms and automated sampling are improving batch predictability. Mergers, site debottlenecking, and selective backward integration into splitting and fractionation are being pursued to protect feedstock access and shorten response times for custom specifications in time sensitive end markets.

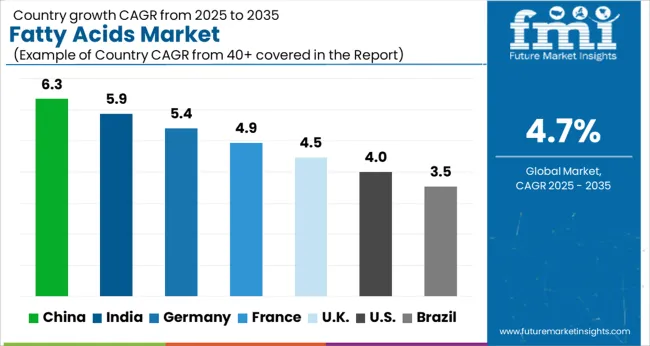

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

The fatty acids market is expected to expand at a global CAGR of 4.7% between 2025 and 2035. China leads with 6.3%, followed by India at 5.9% and Germany at 5.4%, while the UK records 4.5% and the USA trails at 4.0%. China secures the highest growth premium of +1.6%, driven by food, cosmetics, and pharmaceutical applications. India posts +1.2% above baseline, benefiting from strong soap, detergent, and export markets. Germany shows steady growth supported by specialty chemical and nutraceutical demand. The UK and USA reflect moderate yet reliable expansion across premium skincare, supplements, and industrial uses. The analysis includes over 40+ countries, with the leading markets detailed below.

The fatty acids market in China is forecast to expand at a CAGR of 6.3% between 2025 and 2035.The demand is fueled by the country’s strong food processing, cosmetics, and personal care industries, where fatty acids serve as emulsifiers, stabilizers, and surfactants. Pharmaceutical adoption is also rising, particularly for specialty fatty acids used in formulations for cardiovascular and metabolic health. China benefits from large-scale domestic production of oleic, stearic, and palmitic acids, supported by access to raw materials. . Industrial applications, such as lubricants, paints, and coatings, also account for a growing share of consumption. Manufacturers are focusing on improving refining techniques to meet higher quality specifications and expanding into customized solutions for premium skincare and clinical nutrition markets.

The fatty acids market in India is projected to grow at a CAGR of 5.9% from 2025 to 2035, supported by its thriving soap, detergent, and cosmetics sectors. The country is among the largest global consumers of fatty acids, as they are key raw materials in personal hygiene and cleaning products. Palm oil derivatives, particularly stearic and oleic acids, form the backbone of domestic production, though raw material price fluctuations remain a challenge for processors. Nutritional supplements and pharmaceutical industries are also increasing usage of medium- and long-chain fatty acids for health and therapeutic purposes. Rising disposable incomes and awareness of grooming are propelling adoption in skincare and haircare categories. Export opportunities are strengthening, with Indian manufacturers supplying fatty acids to Asia-Pacific and Middle Eastern markets. Industrial applications in plastics, rubber, and lubricants add further demand.

The fatty acids market in Germany is expected to advance at a CAGR of 5.4% through 2035, with demand concentrated in cosmetics, pharmaceuticals, and specialty chemicals. German consumers’ preference for high-quality skincare and grooming products ensures steady demand for oleic, stearic, and lauric acids. Specialty fatty acids are widely used in nutraceuticals and pharmaceutical formulations, particularly in cardiovascular and digestive health applications. The industrial sector also contributes, with fatty acids applied in surfactants, lubricants, coatings, and polymer additives. Germany’s advanced R&D ecosystem fosters innovation in high-purity grades and novel formulations, supporting growth in both consumer and industrial markets. Domestic producers emphasize quality and high-performance standards, while imports cover exotic and niche fatty acid varieties not produced locally.

The UK fatty acids market is forecasted to grow at a CAGR of 4.5% between 2025 and 2035. The personal care sector, particularly premium skincare and haircare products, is a key driver of demand. Food processing companies are also increasingly incorporating fatty acids as additives, emulsifiers, and stabilizers. Pharmaceuticals and dietary supplements create niche demand for specialty fatty acids, especially omega-3 and medium-chain varieties. However, import reliance remains high, with most raw materials sourced from Asia. Rising consumer preference for functional and natural ingredients in cosmetics and healthcare products is fostering market stability. Industrial uses, such as lubricants and coatings, are present but secondary compared to consumer-facing applications.

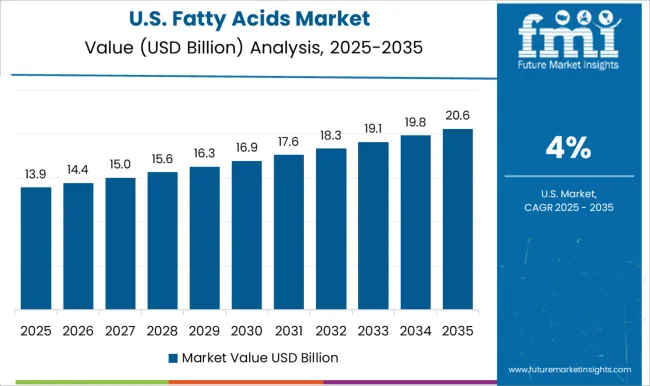

The USA fatty acids market is projected to expand at a CAGR of 4.0%, the slowest among profiled regions, yet remains highly significant in value terms. The country’s demand is anchored in cosmetics, dietary supplements, and industrial applications. Specialty fatty acids such as omega-3 and conjugated linoleic acids are widely used in nutraceuticals for cardiovascular and weight management support. Cosmetics and personal care industries continue to consume significant volumes of fatty acids, driven by consumer demand for advanced skincare and grooming products. Industrial demand spans paints, coatings, plastics, and lubricants. Local producers focus heavily on premium segments, supplying high-value fatty acids with stringent quality requirements. Imports from Asia meet volume-driven commodity demand.

Competition in fatty acids has been shaped by feedstock control, fractionation depth, and application support. Scale has been leveraged by Cargill and Wilmar through integrated crushing, refining, and downstream conversion, enabling consistent oleic, palmitic, stearic, and lauric grades for home care, food, and industrial fluids. BASF and Eastman have competed with differentiated oxo and specialty acids, including pelargonic and 2-ethylhexanoic grades for coatings, lubricants, and plasticizers. Croda has targeted high purity and narrow cuts for personal care and pharma, where color, odor, and trace metals are tightly specified. Emery Oleochemicals and Oleon have focused on versatile oleochemical chains, offering distilled and fractionated C8–C22 acids plus esters for adhesives, lubricants, and surfactants. Choice is driven by consistency, documentation, and lead time. Price follows feedstock and cut tightness.

Strategy has emphasized secure sourcing, regional finishing, and spec led selling. Multi plant networks have been used to shorten transit and hedge crop variability. OEM and brand-owner approvals are pursued to lock in repeat volumes. Portfolio breadth has been used to upsell into esters, amides, metallic soaps, and surfactants where switching costs increase. Technical centers have been tasked with reformulation help, low color processing, and low odor profiles for premium segments. Contract terms often include index linked pricing and minimum offtake. Product brochure content is explicit. Distilled and hydrogenated fatty acids listed by chain length and iodine value. Isostearic and dimer acids positioned for coatings, sealants, and high temperature lubricants. 12-hydroxystearic acid presented for lithium soap greases and cosmetics. Glycerol and pentaerythritol esters highlighted for metalworking and food contact lubricants. Data sheets specify acid value, color, titer, moisture, peroxide value, and trace metals. Forms offered in bulk, IBC, drums, flakes, or pastilles. Regulatory notes cover food grade, cosmetic grade, and industrial grade variants with batch traceability and CoA on request.

| Item | Value |

|---|---|

| Quantitative Units | USD 33.8 Billion |

| Product Type | Polyunsaturated fatty acids, Monounsaturated fatty acids, Saturated fatty acids, and Specialty fatty acids |

| Source | Vegetable oils, Animal fats, Marine oils, and Microbial sources |

| Manufacturing Process | Fat splitting / hydrolysis, Fractionation, Hydrogenation, Enzymatic processes, Distillation, and Others |

| Application | Food & beverages, Personal care & cosmetics, Industrial applications, Pharmaceuticals, Biofuels & energy, Animal feed, and Others |

| End Use | Food & beverage industry, Cosmetics & personal care industry, Pharmaceutical industry, Chemical industry, Automotive industry, Energy & power industry, Agriculture industry, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cargill, Incorporated, BASF SE, Croda International Plc, Emery Oleochemicals Group, Oleon N.V., Wilmar International, Eastman Chemical Company |

| Additional Attributes | Dollar sales by product type and grade split across saturated versus unsaturated cuts, key chain lengths such as C8 C10, lauric C12, palmitic C16, stearic C18, oleic, and linoleic, and by form such as distilled versus fractionated. Dollar sales by end use cover personal care, home care, food and nutraceuticals, lubricants and metalworking, paints and coatings, rubber and adhesives. Demand dynamics have been driven by surfactant and soap base needs, food emulsifier usage, plastic and rubber additives, and stable pharma excipient uptake, with pricing shaped by palm, coconut, and tall oil inputs. Regional trends indicate strong Asia Pacific volume anchored to tropical oils, Europe favoring specialty and pharma grades, and North America leaning on tall oil fatty acids and steady home and personal care replenishment. |

The global fatty acids market is estimated to be valued at USD 33.8 billion in 2025.

The market size for the fatty acids market is projected to reach USD 53.5 billion by 2035.

The fatty acids market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in fatty acids market are polyunsaturated fatty acids, omega-3 fatty acids, and others.

In terms of source, vegetable oils segment to command 52.0% share in the fatty acids market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tallow Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Coconut Fatty Acids Market

Essential Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Polyunsaturated Fatty Acids Market Trends 2025 to 2035

Bio-Inspired Omega Fatty Acids Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Polyglycerol Esters Of Fatty Acids Market

Palm Kernel Oil and Coconut Oil Based Natural Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Lactic Acid Esters Of Mono And Diglycerides Of Fatty Acids Market

Mixed Acetic and Tartaric Acid Esters of Mono and Diglycerides of Fatty Acids Market

Fatty Methyl Ester Sulfonate Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acid Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fatty Amine Market Analysis by Product Type, End Use, and Region Forecast Through 2035

Fatty Liver Treatment Market - Trends & Forecast 2025 to 2035

Fatty Esters Market Growth - Trends & Forecast 2025 to 2035

Tall Oil Fatty Acid Market Size and Share Forecast Outlook 2025 to 2035

Fractionated Fatty Acid Market Size, Growth, and Forecast for 2025 to 2035

Naturally Derived Fatty Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Propane-1,2-Diol Esters of Fatty Acid Market Analysis by Toppings, Processed Meat, Confectionery, Soft and Fizzy Drinks and others Through 2035

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Amino Acids Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA