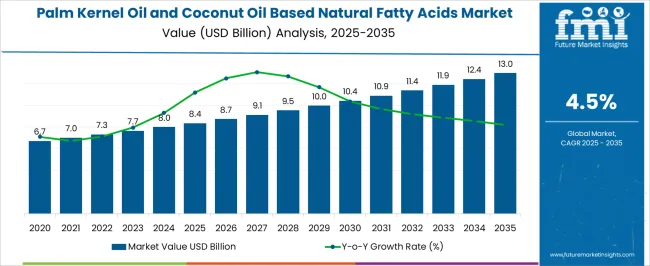

The palm kernel oil and coconut oil based natural fatty acids market is estimated to be valued at USD 8.4 billion in 2025 and is projected to reach USD 13.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. Growth is driven by increasing utilization of natural fatty acids in personal care, cosmetics, soaps, detergents, and industrial applications, where emollient, surfactant, and emulsifying properties are critical. Rising consumer preference for plant-based, biodegradable, and mild formulations is enhancing adoption in shampoos, body washes, and skin creams, while industrial users leverage fatty acids in chemical intermediates, lubricants, and coatings.

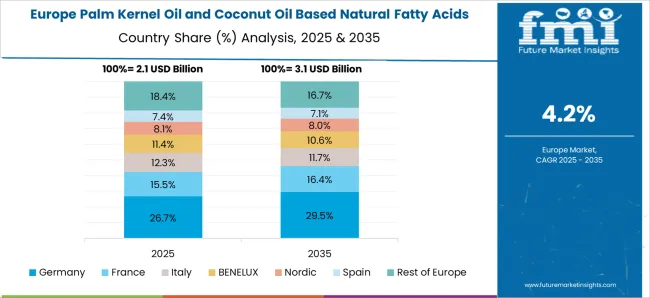

Dollar sales and share analyses indicate that personal care and cosmetic applications account for the largest portion of revenue, followed by industrial and soap-based products. Regional expansion is led by Asia-Pacific, particularly Indonesia and India, due to large-scale production and growing consumption, while Europe and North America emphasize high-purity, specialty formulations for premium products. Manufacturers are focusing on refining techniques, fractionation, and product diversification to capture market share, while partnerships with distributors and online platforms ensure broad market reach. The market demonstrates steady momentum supported by evolving consumer preferences, regulatory compliance, and multi-industry adoption.

| Metric | Value |

|---|---|

| Palm Kernel Oil and Coconut Oil Based Natural Fatty Acids Market Estimated Value in (2025 E) | USD 8.4 billion |

| Palm Kernel Oil and Coconut Oil Based Natural Fatty Acids Market Forecast Value in (2035 F) | USD 13.0 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The palm kernel oil and coconut oil based natural fatty acids market is shaped by interconnected parent markets, each contributing distinctly to overall demand and growth. The personal care and cosmetics market holds the largest share at 35%, as natural fatty acids are widely used in shampoos, soaps, skin creams, and lotions for their emollient, surfactant, and moisturizing properties, meeting rising consumer preference for plant-based and mild formulations. The soap and detergent market contributes 25%, with manufacturers leveraging fatty acids as key ingredients to enhance cleansing, lathering, and fragrance retention in bars, liquids, and specialty detergents. The industrial chemicals and lubricants market accounts for 20%, where fatty acids serve as intermediates in the production of esters, coatings, lubricants, and chemical additives, supporting functional and performance requirements across multiple applications.

The food and nutraceutical market holds 10%, driven by usage of fatty acids as emulsifiers, flavor enhancers, and functional ingredients in processed foods and dietary supplements. Finally, the pharmaceutical and specialty chemicals market represents 10%, utilizing fatty acids in formulations for capsules, ointments, and therapeutic applications. Collectively, personal care, soap/detergent, and industrial segments account for 80% of overall demand, highlighting that everyday hygiene, industrial processing, and cosmetic applications remain the primary growth drivers, while food and pharmaceutical applications contribute to incremental market expansion globally.

The palm kernel oil and coconut oil based natural fatty acids market is growing steadily, supported by their extensive use in personal care, household, and industrial applications. Industry publications and trade reports have emphasized the increasing shift towards biodegradable and renewable raw materials in surfactant and oleochemical production, which has significantly boosted demand for these natural fatty acids.

The market is further benefiting from rising consumer awareness regarding sustainable sourcing and the environmental benefits of plant-based ingredients. Technological advancements in fractionation and hydrogenation processes have improved yield efficiency and quality consistency, strengthening their competitiveness against synthetic alternatives.

Additionally, evolving regulatory frameworks favoring eco-friendly formulations have encouraged manufacturers in the detergents, cosmetics, and food sectors to increase reliance on these oils. Emerging economies are witnessing a rise in consumption due to expanding middle-class populations and growing demand for premium household and personal care products. Going forward, sustained industrial demand, supported by strong supply chain networks in key producing countries, is expected to keep market growth on an upward trajectory.

The palm kernel oil and coconut oil based natural fatty acids market is segmented by end-user, and geographic regions. By end-user, palm kernel oil and coconut oil based natural fatty acids market is divided into detergents, personal care, plastics, rubber, and others. Regionally, the palm kernel oil and coconut oil based natural fatty acids industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The detergents segment is projected to account for 41.6% of the palm kernel oil and coconut oil based natural fatty acids market revenue in 2025, holding the largest share among end-users. This dominance is driven by the segment’s reliance on fatty acids as primary raw materials for manufacturing soaps, liquid detergents, and other cleaning agents.

These natural fatty acids offer excellent surfactant properties, biodegradability, and mildness to skin, making them highly desirable for both household and industrial cleaning formulations. Industry data has indicated a rising demand for phosphate-free and environmentally safe detergents, a trend that has directly supported increased use of plant-derived fatty acids.

Moreover, the detergents segment has benefited from steady consumption patterns in both developed and emerging markets, where hygiene awareness and cleaning product penetration are on the rise. Strategic collaborations between fatty acid producers and detergent manufacturers have also streamlined supply and product innovation. As consumer preference continues to favor sustainable cleaning solutions, the detergents segment is expected to retain its leading position in the market.

The market is primarily driven by personal care, soap/detergent, and industrial applications. Emerging food, nutraceutical, and pharmaceutical uses provide additional growth opportunities globally.

The palm kernel oil and coconut oil based natural fatty acids market is witnessing strong growth due to increased incorporation in personal care and cosmetic products. Shampoos, conditioners, soaps, body washes, and skincare formulations utilize these fatty acids for their moisturizing, emulsifying, and foaming properties. Consumers increasingly prefer plant-derived ingredients that are gentle on the skin and hair, enhancing daily personal care routines. Brand differentiation through product purity, scent, and multifunctionality further drives adoption. Retail expansion, e-commerce channels, and promotional campaigns support broader market penetration, particularly among millennials and Gen Z consumers. Dollar sales and share indicate that personal care products dominate revenue streams, emphasizing both household usage and premium cosmetic applications.

The soap and detergent segment significantly contributes to the market, with fatty acids valued for improving cleansing efficiency, lathering, and fragrance retention. Bar soaps, liquid detergents, and specialty cleaning products rely on fatty acids to deliver high-quality performance while meeting consumer expectations for mildness and effectiveness. Industrial and commercial cleaning also employs concentrated formulations of fatty acids for scalable applications. Dollar sales and share analysis reveal that soap and detergent products account for nearly a quarter of overall market revenue. Manufacturers are increasingly offering cost-efficient, concentrated, and multi-purpose solutions. Distribution through modern trade, retail chains, and online platforms ensures widespread availability, while marketing campaigns highlight product efficacy and skin safety to drive adoption in households and institutional settings.

Industrial users represent a critical segment for natural fatty acids, utilizing them as intermediates in lubricants, coatings, surfactants, and chemical additives. Functional properties such as emulsification, wetting, and solubility are essential for performance in industrial processes. Dollar sales and share show that industrial and specialty applications account for around 20% of total market value. Manufacturers focus on high-purity, customizable fatty acids to meet diverse sector requirements. Adoption is supported by partnerships with chemical formulators and industrial clients seeking performance consistency. Regulatory compliance and adherence to environmental standards further strengthen market trust. Increasing use in textile, polymer, and metalworking applications contributes to incremental demand across global industrial sectors.

Food, nutraceuticals, and pharmaceutical segments are emerging as important markets for palm kernel and coconut oil fatty acids. These applications leverage emulsifying, stabilizing, and flavor-enhancing properties in processed foods, dietary supplements, and medicinal formulations. Dollar sales and share analysis indicate this segment contributes approximately 20% of overall market revenue, with growing awareness of functional foods and plant-based dietary ingredients. Manufacturers emphasize high-quality, food-grade, and specialty fatty acids to meet safety and efficacy standards. Adoption is driven by product labeling, clean-label trends, and the increasing demand for natural additives in health-focused products. Collaborative efforts with nutraceutical and pharmaceutical companies ensure customized solutions and sustained market penetration.

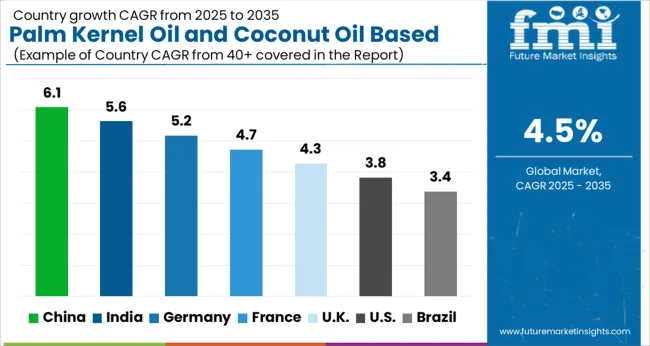

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| U.K. | 4.3% |

| U.S. | 3.8% |

| Brazil | 3.4% |

The global palm kernel oil and coconut oil based natural fatty acids market is projected to grow at a CAGR of 4.5% from 2025 to 2035. China leads at 6.1%, followed by India at 5.6%, Germany at 5.2%, the U.K. at 4.3%, and the U.S. at 3.8%. Growth is fueled by rising demand for plant-based fatty acids in personal care, cosmetics, soaps, detergents, and industrial applications. Asia, particularly China and India, exhibits rapid expansion due to large-scale palm and coconut oil production, cost-effective manufacturing, and growing domestic consumption. Europe emphasizes high-purity formulations, specialty products, and regulatory compliance, while North America focuses on clean-label, multifunctional fatty acids for cosmetics, personal care, and industrial intermediates. Increasing adoption in emerging applications, such as nutraceuticals and pharmaceuticals, further supports market expansion. The analysis includes over 40+ countries, with the leading markets shown below.

The palm kernel oil and coconut oil based natural fatty acids market in China is projected to grow at a CAGR of 6.1% from 2025 to 2035, driven by rising demand in personal care, cosmetics, soap, detergent, and industrial applications. Increasing consumer preference for plant-based, mild, and multifunctional ingredients supports adoption in shampoos, skin creams, and body washes. Industrial users leverage fatty acids as intermediates in lubricants, coatings, and chemical additives. Domestic production, particularly from palm and coconut oils, ensures cost-effectiveness and supply reliability. Retail and e-commerce channels expand market accessibility, while collaborations with international manufacturers enhance product quality, purity, and formulation diversity. Nutraceutical and pharmaceutical applications further strengthen growth opportunities.

The market in India is expected to expand at a CAGR of 5.6% from 2025 to 2035, supported by increasing use in personal care, soaps, detergents, and industrial applications. Rising consumer awareness about plant-derived, eco-friendly ingredients drives adoption in skincare, haircare, and hygiene products. Industrial manufacturers utilize fatty acids in lubricants, chemical additives, and surfactants for textile and polymer applications. Domestic palm and coconut oil production ensures stable raw material supply, enabling cost-effective manufacturing. E-commerce platforms, modern retail, and distribution networks increase product accessibility, while collaborations with global suppliers enhance product quality and diversification. Emerging demand in nutraceuticals and pharmaceuticals contributes to incremental revenue.

The market in Germany is projected to grow at a CAGR of 5.2% from 2025 to 2035, with strong demand from cosmetics, personal care, and industrial sectors. Consumers prioritize natural, mild, and multifunctional ingredients in soaps, shampoos, and skincare formulations. Industrial applications in chemical intermediates, coatings, and lubricants further drive adoption. High-purity fatty acids, regulatory compliance, and eco-certifications are critical for market acceptance. Dollar sales and share indicate significant revenue from premium personal care products. Manufacturers focus on product differentiation, technical support, and collaborations with local distributors to ensure broad market reach. Growth in nutraceuticals and pharmaceutical uses provides additional opportunities for expansion.

The U.K. market is expected to grow at a CAGR of 4.3% from 2025 to 2035, driven by rising adoption in personal care, hygiene, and industrial segments. Consumers prefer plant-derived, multifunctional ingredients in skincare, haircare, and body care products. Industrial users employ fatty acids in lubricants, surfactants, coatings, and chemical intermediates. Dollar sales and share show notable revenue from soap and detergent formulations. Manufacturers are focusing on compliance with EU regulations, eco-certifications, and high-quality production standards. Retail expansion, e-commerce channels, and collaborations with global suppliers improve accessibility. Emerging applications in food, nutraceuticals, and pharmaceuticals contribute incremental growth across multiple end-use sectors.

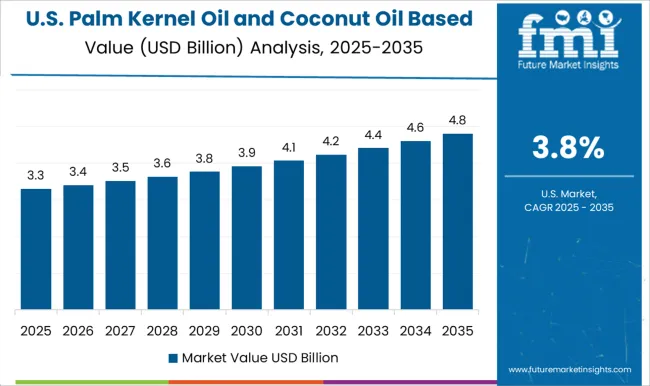

The market in the U.S. is projected to grow at a CAGR of 3.8% from 2025 to 2035, led by adoption in personal care, cosmetics, soap, and detergent segments. Consumer preference for plant-based, multifunctional, and mild ingredients supports usage in shampoos, body washes, and skincare products. Industrial users leverage fatty acids as intermediates in coatings, lubricants, and specialty chemicals. Dollar sales and share indicate personal care and industrial segments dominate revenue streams. Manufacturers emphasize high-purity, food-grade, and specialty formulations. E-commerce, retail chains, and distributor partnerships increase market reach, while emerging applications in nutraceuticals and pharmaceuticals provide additional growth avenues across North America.

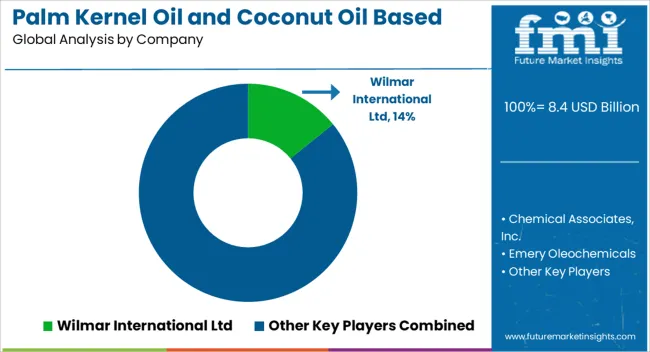

Competition in the palm kernel oil and coconut oil based natural fatty acids market is defined by product purity, versatility, and application range. Wilmar International Ltd leads with large-scale production, integrated supply chains, and a diverse portfolio spanning personal care, soaps, detergents, and industrial intermediates. Chemical Associates, Inc. and Emery Oleochemicals compete with specialty fatty acids tailored for cosmetics, pharmaceuticals, and lubricants, emphasizing high-purity grades and formulation support. Kao Corporation and OLEON N.V. differentiate through sustainable sourcing practices, refined product quality, and multifunctional formulations suited for skincare, haircare, and industrial applications. VVF L.L.C. and United Coconut Chemicals, Inc. focus on region-specific markets, offering cost-effective solutions for personal care, detergents, and chemical intermediates.

Emerging and regional players such as Procter & Gamble, Pacific Oleochemicals Sdn Bhd, Vantage Specialty Chemicals, Inc., Kuala Lumpur Kepong Berhad, Twin Rivers Technologies, Inc., Musim Mas Holdings, Philippine International Development, Inc., and Timur Oleochemicals Malaysia compete through niche product offerings, including high-purity lauric acid, surfactants, and cosmetic-grade fatty acids. Strategies focus on product diversification, reliability of supply, and formulation expertise. Sustainability, regulatory compliance, and certifications for personal care and industrial use are highlighted as differentiators. Collaborations with cosmetic, pharmaceutical, and detergent manufacturers enhance market penetration and product adoption. Product brochure content is detailed and informative. Specifications cover fatty acid type, purity, chain length, saponification value, iodine value, and application suitability for personal care, soap, detergent, lubricant, or pharmaceutical use.

Packaging options, storage instructions, and handling guidelines are clearly stated. Applications in shampoos, creams, soaps, lubricants, surfactants, and industrial intermediates are showcased to demonstrate versatility. Multi-purpose utility, compatibility with cosmetic or industrial formulations, and supplier support services are emphasized, reflecting a market oriented toward quality, consistency, and broad end-use adoption across global and regional markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.4 Billion |

| End-User | Detergents, Personal care, Plastics, Rubber, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Wilmar International Ltd, Chemical Associates, Inc., Emery Oleochemicals, Kao Corporation, OLEON N.V., VVF L.L.C., United Coconut Chemicals, Inc., Procter & Gamble, Pacific Oleochemicals Sdn Bhd, Vantage Specialty Chemicals, Inc., Kuala Lumpur Kepong Berhad, Twin Rivers Technologies, Inc., Musim Mas Holdings, Philippine International Dev., Inc., and Timur Oleochemicals Malaysia |

| Additional Attributes | Dollar sales, share, CAGR, leading countries, end-use industries (personal care, detergents, industrial), raw material availability, pricing trends, regulatory landscape, emerging applications, and competitive strategies. |

The global palm kernel oil and coconut oil based natural fatty acids market is estimated to be valued at USD 8.4 billion in 2025.

The market size for the palm kernel oil and coconut oil based natural fatty acids market is projected to reach USD 13.0 billion by 2035.

The palm kernel oil and coconut oil based natural fatty acids market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in palm kernel oil and coconut oil based natural fatty acids market are detergents, personal care, plastics, rubber and others.

In terms of end-user, the detergent segment is set to command 41.6% share in the palm kernel oil and coconut oil based natural fatty acids market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Palmitic Acid Market Size and Share Forecast Outlook 2025 to 2035

Palm Mid-Fraction Market Size, Growth, and Forecast for 2025 to 2035

Palm Oil Market - Size, Share, and Forecast 2025 to 2035

Palm Oil-Free Skincare Market Insights – Trends & Growth 2024-2034

Saw Palmetto Market Analysis by Powder, Whole and others Forms Through 2035

Date Palm Market Size and Share Forecast Outlook 2025 to 2035

Cetyl Palmitate Market Analysis Size Share and Forecast Outlook 2025 to 2035

Ascorbyl Palmitate Market Analysis - Size, Share, and Forecast 2025 to 2035

Ethylhexyl Palmitate Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Palm Oil Market Size and Share Forecast Outlook 2025 to 2035

Hydrogenated Palm Oil Market

Elaeis Guineensis (Palm) Fruit Extract Market Size and Share Forecast Outlook 2025 to 2035

Tissue Cultured Date Palm Market Trends – Growth & Industry Forecast 2024 to 2034

Fruit Kernel Products Market

Elaeis Guineensis Kernel Oil Market Analysis by Application, Sales Channel and Region Through 2035

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Amino Acids Market Growth - Trends & Forecast 2025 to 2035

Amino Acids Premixes Market

Threonine Acids Market Analysis by Food Dietary Supplements, Animal Feed, Pharmaceuticals, and Others Through 2035

Food Amino Acids Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA