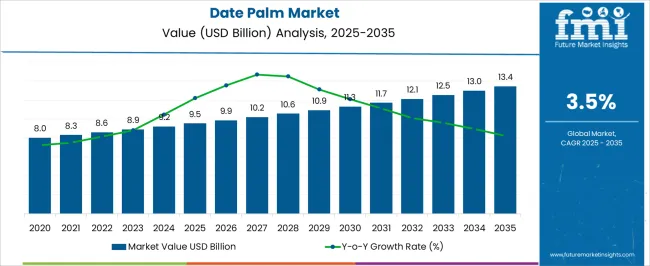

The date palm market is estimated to be valued at USD 9.5 billion in 2025 and is projected to reach USD 13.4 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

Momentum is expected to be anchored by retail multipacks, pitted and chopped formats, date paste for bakery fillings, and date syrup as a natural sweetener. Seasonal peaks linked to Ramadan and festive gifting are reinforced by year round snacking, energy bar recipes, and ready dessert kits. Premium varieties such as Medjool, Deglet Noor, Ajwa, and Zahidi are favored where size grade counts and texture consistency are demanded by modern trade. Post harvest handling, grading, and clean packaging are treated as essential to control moisture and extend shelf life. Compliance with HACCP, ISO 22000, Halal, and Kosher norms is prioritized to unlock wider export lanes. From 2030 to 2035, value is expected to advance from USD 11.3 billion to USD 13.4 billion, implying a second block addition of USD 2.1 billion and preserving a 3.5 percent CAGR over 2025 to 2035.

Later period gains are projected to come from value added ingredients such as date sugar, clarified syrup, and paste concentrates that feed into confectionery, infant snacks, breakfast cereals, and dairy mix ins. Foodservice demand is supported by stable supply programs for hotels and quick service restaurants that require consistent Brix, moisture targets, and uniform sizing. Origin diversification across Saudi Arabia, UAE, Iran, Egypt, Tunisia, Algeria, Israel, and the United States is viewed as risk mitigation for buyers. Procurement criteria are expected to emphasize residue compliance, traceability, defect thresholds, and packaging that protects against clumping. With e commerce and distributor networks deepening last mile reach, repeat purchase cycles are likely to remain resilient and price mix should trend favorable.

| Metric | Value |

|---|---|

| Date Palm Market Estimated Value in (2025 E) | USD 9.5 billion |

| Date Palm Market Forecast Value in (2035 F) | USD 13.4 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

Within the global dates and stone fruits market, the date palm segment captures approximately 30 %, reflecting the prominence of dates among fruits of similar type. In the broader tropical and subtropical fruit market, its share is around 10 %, showing that while important, dates remain one of many fruits grown in warmer climates. Considering the agriculture and horticulture sector, the date palm market accounts for about 3 %, highlighting its niche status within the expansive global agricultural industry.

In the natural sweeteners and health snack market, the share of date palm products is roughly 15%, due to their positioning as healthier alternatives to refined sugars and processed snacks. Finally, within the functional foods and nutraceuticals market, date-based ingredients hold around 5 %, reflecting their growing use in health-oriented products such as energy bars, supplements, and functional food preparations. These figures illustrate that while date palms are modest within the vast agriculture sector, they achieve more substantial presence in targeted markets where their natural sweetness and nutritional profile offer distinct advantages.

The market is experiencing significant growth, supported by increasing global demand for nutrient-rich and naturally sweet fruit products. Rising consumer preference for healthy snacks, along with the expanding popularity of plant-based diets, has been instrumental in driving market expansion. The market is also benefiting from strong export opportunities, particularly from regions with established cultivation practices.

Advances in post-harvest processing, packaging, and supply chain infrastructure have further enhanced product availability across both developed and emerging markets. Moreover, the rising awareness of the health benefits of dates, including their high fiber, antioxidant, and mineral content, is encouraging year-round consumption.

Government initiatives to promote sustainable agriculture and investments in modern irrigation techniques have supported higher yields and better quality produce Looking forward, the market is expected to remain buoyant, driven by innovation in product forms, expanding distribution through e-commerce channels, and increased application in functional foods, confectionery, and bakery products.

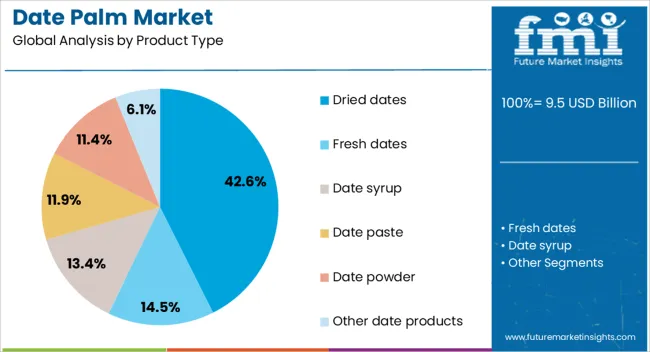

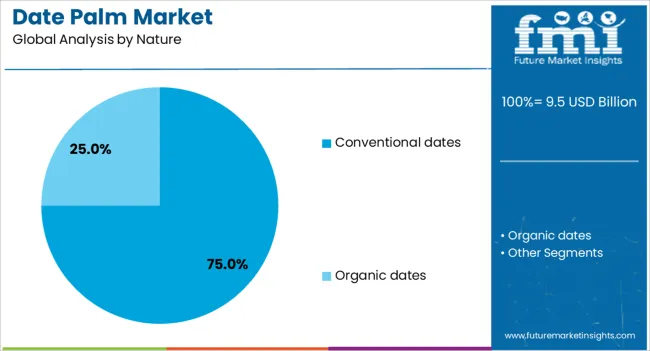

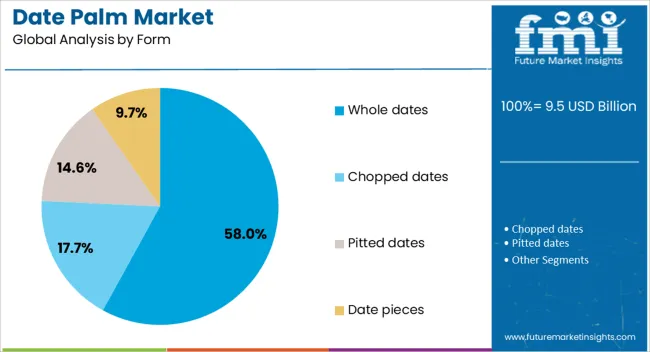

The date palm market is segmented by product type, nature, form, application, distribution, and geographic regions. By product type, date palm market is divided into dried dates, fresh dates, date syrup, date paste, date powder, and other date products. In terms of nature, date palm market is classified into conventional dates and organic dates. Based on form, date palm market is segmented into whole dates, chopped dates, pitted dates, and date pieces. By application, date palm market is segmented into food and beverage applications, dietary supplements and nutraceuticals, pharmaceutical applications, cosmetics and personal care, animal feed, and industrial applications. By distribution, date palm market is segmented into supermarket/hypermarket, convenience stores, online retail, specialty stores, and others. Regionally, the date palm industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The dried dates segment is projected to hold 42.60% of the market revenue share in 2025, making it the leading product type. This leadership is supported by the segment’s extended shelf life and ease of storage, which have enabled consistent supply across global markets. Dried dates have gained preference among consumers seeking convenient and nutrient-dense snack options that do not require refrigeration.

The segment has benefited from advancements in drying technologies that preserve flavor, texture, and nutritional value while meeting international quality standards. Demand has also been reinforced by the segment’s versatility in culinary applications, including confectionery, bakery, and packaged snacks.

As awareness of natural sweeteners grows, dried dates are increasingly replacing refined sugar in various products, enhancing their appeal Furthermore, the high export potential of dried dates from leading producing countries has strengthened the segment’s commercial viability, ensuring its continued prominence within the overall Date Palm market.

The conventional dates segment is anticipated to account for 75% of the market revenue share in 2025, positioning it as the dominant nature category. This leadership is driven by the widespread cultivation of conventional date varieties, which allows for cost-efficient production and competitive pricing in global markets. Farmers and producers have maintained conventional farming practices that ensure high yields and consistent quality, making the segment accessible to a broad consumer base.

Conventional dates are widely preferred in regions with high consumption rates due to their affordability and familiarity among consumers. Their strong presence in wholesale and retail supply chains has further reinforced their market dominance.

Additionally, the segment benefits from established trade relationships, bulk export volumes, and long-standing brand recognition in major importing countries These factors collectively ensure that conventional dates maintain a leading position, with stable demand across both domestic and international markets.

The whole dates segment is expected to capture 58% of the market revenue share in 2025, making it the leading form category. The growth of this segment is supported by consumer preference for minimally processed products that retain their natural taste and nutritional value. Whole dates have been favored in both fresh and packaged formats, serving as a versatile ingredient in traditional dishes and modern health-oriented snacks.

Their appeal has been amplified by the increasing demand for clean-label products, with consumers seeking foods free from additives and artificial processing. The segment has also gained traction due to its suitability for gifting and festive consumption in many cultures, further boosting seasonal demand.

Export opportunities have been strong for whole dates, particularly in premium quality grades, supported by advanced sorting, grading, and packaging techniques As global health-conscious trends continue to rise, whole dates are expected to retain their dominance within the Date Palm market.

The date palm market is expanding as global demand for natural sweeteners and nutrient-rich foods grows across households and food industries. Opportunities are increasing in processed formats and international exports, while trends emphasize diversification into innovative products and byproduct utilization. Challenges remain in cultivation efficiency, climate resilience, and competitive pricing among major producers. In my opinion, long-term success will favor producers who invest in modern farming, advanced processing, and value-added product innovation, allowing them to capture higher margins and strengthen their share in global date palm trade.

Demand for date palm produce has been growing as consumers seek natural sweeteners and nutrient-dense food sources. Dates are rich in fiber, vitamins, and minerals, making them highly valued in both traditional diets and modern health-conscious lifestyles. Their versatility across bakery, confectionery, beverages, and snacks has strengthened consumption globally. With increasing interest in clean-label ingredients, dates are replacing refined sugar in several processed food categories. In my opinion, demand will continue to expand as both households and industries adopt date palm products as healthier alternatives to artificial sweeteners.

Opportunities have become evident in processed forms of dates, including syrups, pastes, and powders, which are increasingly utilized in global food manufacturing. Export markets are presenting lucrative prospects for Middle Eastern and North African producers, where large-scale cultivation dominates. Growth is also visible in nutraceutical and energy snack sectors, where date-based ingredients are gaining recognition. I believe producers who invest in modern processing facilities and export-grade quality certifications will unlock significant opportunities, as international buyers prefer standardized, packaged, and value-added date palm products for diverse consumption needs.

Trends are shaping the date palm market toward product diversification and efficient use of byproducts. Alongside traditional dried and fresh dates, innovative products such as date chocolates, date-flavored beverages, and functional bars are expanding consumer reach. Byproducts like date seeds are being repurposed for animal feed, cosmetics, and bio-based materials, highlighting their wider economic potential. In my opinion, such trends underscore a transition from commodity-based trade to value-driven industries, where innovation in packaging, branding, and secondary applications will determine market leadership and create differentiation for producers globally.

Challenges persist in date palm cultivation, including vulnerability to pests, diseases, and water-intensive farming practices. Fluctuations in climate conditions affect yields and quality, posing risks to consistent supply. Competition among exporting nations such as Saudi Arabia, Egypt, and Iran adds pricing pressure in international markets. Smaller growers struggle with access to modern farming techniques and quality certifications, limiting their competitiveness. In my assessment, addressing these challenges requires stronger investment in research, advanced irrigation methods, and cooperative marketing models that enhance both productivity and global positioning of date palm growers.

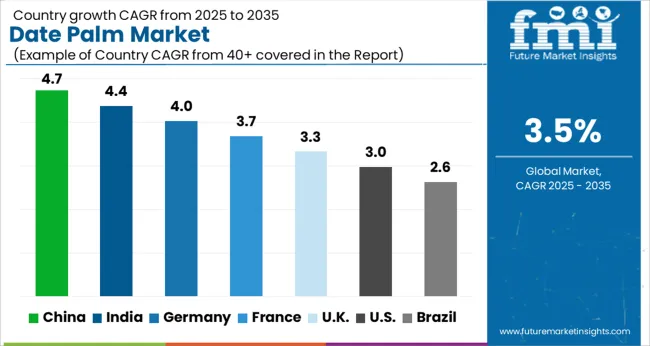

| Country | CAGR |

|---|---|

| China | 4.7% |

| India | 4.4% |

| Germany | 4.0% |

| France | 3.7% |

| UK | 3.3% |

| USA | 3.0% |

| Brazil | 2.6% |

The global date palm market is projected to grow at a CAGR of 3.5% from 2025 to 2035. China leads with a growth rate of 4.7%, followed by India at 4.4%, and France at 3.7%. The United Kingdom records a growth rate of 3.3%, while the United States shows the slowest growth at 3%. Growth is driven by rising demand for dates in food processing, health-based diets, and confectionery applications. Emerging economies such as China and India see higher growth due to expanding consumer bases and dietary diversification, while developed markets like the USA and the UK focus on premium imports, value-added products, and healthier alternatives.

The date palm market in China is projected to grow at a CAGR of 4.7%. Rising consumer awareness of dates as a natural source of nutrition, along with growing demand in bakery, confectionery, and beverage segments, is fueling adoption. Imports of dates are increasing as consumer interest in exotic and health-oriented foods rises. The country’s e-commerce growth and modern retail channels further enhance availability and accessibility. China’s strong shift toward healthy snacking and functional foods ensures a steady increase in demand for both whole dates and processed date-based ingredients.

The date palm market in India is expected to grow at a CAGR of 4.4%. Rising consumption of dates as both a household staple and a festive product is fueling demand. India’s large vegetarian population increasingly relies on dates as a source of natural sweetness and nutrition. Imports from Middle Eastern countries continue to dominate the supply chain, while value-added products like date syrups and energy bars are gaining popularity. Expanding retail networks and e-commerce platforms are improving consumer access, while changing lifestyles and rising disposable incomes support higher consumption of premium date varieties.

The date palm market in France is projected to grow at a CAGR of 3.7%. France has a strong demand for dates due to its Mediterranean dietary culture, with imports primarily coming from North African countries. The rising consumer shift toward healthier sweeteners has led to an increase in the use of dates in baked goods, snacks, and gourmet foods. Organic and fair-trade dates are gaining popularity among health-conscious consumers. The emphasis on high-quality imports and the expanding presence of ethnic foods in supermarkets are also contributing to the market’s growth.

The date palm market in the UK is projected to grow at a CAGR of 3.3%. Growing health awareness and the rising trend of plant-based diets are encouraging higher consumption of dates as a natural sweetener. Imports from the Middle East and North Africa continue to dominate, with increased demand for Medjool and Deglet Noor varieties. Value-added products such as date-based spreads, syrups, and snack bars are becoming more popular among younger consumers. The market is further supported by expanding online retail platforms and consumer preference for nutritious, convenient snack options.

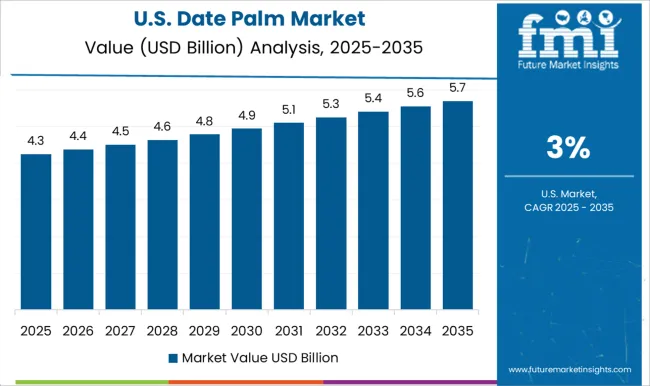

The date palm market in the USA is projected to grow at a CAGR of 3%. While growth is slower compared to emerging economies, steady demand persists due to increasing interest in natural sweeteners and plant-based diets. Domestic cultivation, particularly in California, provides a strong base for supply, but imports of premium varieties continue to rise. The growing use of dates in energy bars, smoothies, and baked products reflects shifting consumer preference toward healthier snacks. Innovation in packaging and product forms, along with rising demand for organic options, ensures steady market growth in the USA

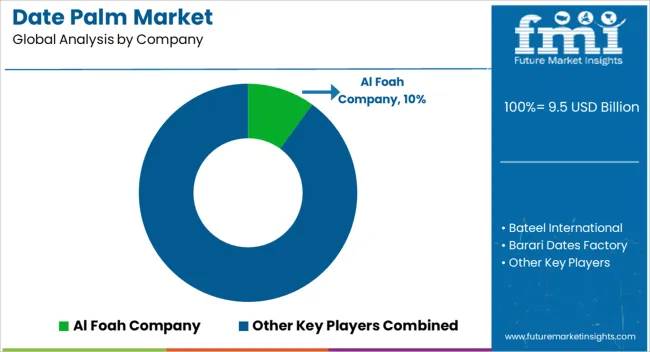

Competition in the date palm market has been shaped by established growers, cooperatives, and processors that emphasize branding, export strength, and diversified product lines. Al Foah Company has been positioned as a leading name from the UAE, where extensive cultivation networks and strong export channels have been cultivated to dominate bulk supply as well as packaged formats. Bateel International has been steering competition toward premium and luxury segments, offering gourmet date products and value-added assortments that command higher price points in both domestic and international markets. Barari Dates Factory has been recognized for its industrial-scale processing facilities, where standardization and bulk packaging for wholesale and retail buyers have been emphasized.

Datepac LLC and Bard Valley Natural Delights have been shaping the North American landscape, where cooperative models and brand-driven marketing have elevated the perception of Medjool dates in health-focused categories. Hadiklaim Date Growers Cooperative has been reinforcing Israel’s footprint with coordinated grower strategies, ensuring reliable export volumes supported by modern packing technologies. Emirates Dates Factory and Al Barakah Dates Factory L.L.C have been solidifying the UAE’s role as a global hub, offering a balance of traditional varieties and processed date products suited for retail, institutional, and private-label contracts. Strategies among these firms have been influenced by their ability to balance heritage with modern consumer expectations.

Al Foah and Emirates Dates Factory have been noted for their export-oriented strategies, building credibility through certifications and consistent supply chains. Bateel International has been carving an identity through luxury gifting and retail experiences, setting itself apart with a lifestyle positioning that many competitors have struggled to match. Barari and Al Barakah have been catering to industrial buyers and mass retailers, providing economies of scale that create competitive leverage. Hadiklaim has been asserting strength through cooperative organization, ensuring that small and medium growers can compete effectively in the export market. Datepac and Bard Valley have been reinforcing the importance of branding in North America, with Medjool dates promoted as superfoods appealing to wellness-driven consumers. Collectively, the competitive field has been defined by the balance of premium marketing, mass-market reliability, and regional leadership, where brand identity and product quality have been treated as decisive factors for long-term success.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.5 Billion |

| Product Type | Dried dates, Fresh dates, Date syrup, Date paste, Date powder, and Other date products |

| Nature | Conventional dates and Organic dates |

| Form | Whole dates, Chopped dates, Pitted dates, and Date pieces |

| Application | Food and beverage applications, Dietary supplements and nutraceuticals, Pharmaceutical applications, Cosmetics and personal care, Animal feed, and Industrial applications |

| Distribution | Supermarket/Hypermarket, Convenience stores, Online retail, Specialty stores, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Al Foah Company, Bateel International, Barari Dates Factory, Datepac LLC, Bard Valley Natural Delights, Hadiklaim Date Growers Cooperative, Emirates Dates Factory, and Al Barakah Dates Factory L.L.C |

| Additional Attributes | Dollar sales by product type (whole dates vs processed products), Dollar sales by form (dried, fresh, syrup, paste), Trends in natural sweetener use and healthy snacking, Use in bakery, confectionery, and beverage formulations, Growth in premium and organic date varieties, Regional production and consumption patterns in Middle East, North Africa, and Asia-Pacific. |

The global date palm market is estimated to be valued at USD 9.5 billion in 2025.

The market size for the date palm market is projected to reach USD 13.4 billion by 2035.

The date palm market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in date palm market are dried dates, fresh dates, date syrup, date paste, date powder and other date products.

In terms of nature, conventional dates segment to command 75.0% share in the date palm market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tissue Cultured Date Palm Market Trends – Growth & Industry Forecast 2024 to 2034

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Competitive Overview of Date Product Market Share

Pre-validated Packaging Market

Sodium Molybdate Market - Growth & Demand 2025 to 2035

Ammonium Metavanadate Market Size and Share Forecast Outlook 2025 to 2035

Over-The-Air Software Update Market Growth – Trends & Forecast 2024-2034

Automotive Over-The-Air (OTA) Updates Market Size and Share Forecast Outlook 2025 to 2035

Palm Kernel Oil and Coconut Oil Based Natural Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Palmitic Acid Market Size and Share Forecast Outlook 2025 to 2035

Palm Oil Market - Size, Share, and Forecast 2025 to 2035

Palm Mid-Fraction Market Size, Growth, and Forecast for 2025 to 2035

Palm Oil-Free Skincare Market Insights – Trends & Growth 2024-2034

Saw Palmetto Market Analysis by Powder, Whole and others Forms Through 2035

Cetyl Palmitate Market Analysis Size Share and Forecast Outlook 2025 to 2035

Ascorbyl Palmitate Market Analysis - Size, Share, and Forecast 2025 to 2035

Ethylhexyl Palmitate Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Palm Oil Market Size and Share Forecast Outlook 2025 to 2035

Hydrogenated Palm Oil Market

Elaeis Guineensis (Palm) Fruit Extract Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA