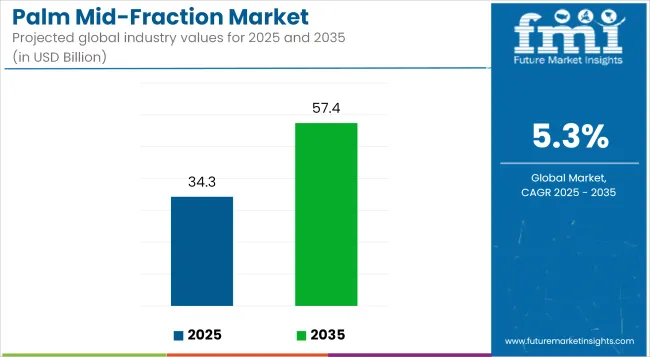

With increasing adoption in bakery and confectionery fat applications and rising demand in global food manufacturing, the Palm Mid-Fraction market is anticipated to rise from USD 34.25 billion in 2025 to USD 57.40 billion by 2035, advancing at a CAGR of 5.3%.

The market has evolved as a key fat ingredient in structured lipids and specialty applications, especially due to its desirable melting properties and compatibility with cocoa butter equivalents (CBEs). The industry’s trajectory from 2020 to 2024, marked by a CAGR of 4.2%, laid the groundwork for broader integration into processed foods and dairy fat alternatives.

The market’s expansion is being supported by multiple shifts in ingredient formulation trends. Increased demand for cocoa butter alternatives in confectionery and stability-improving fats in bakery sectors has intensified usage of palm mid-fractions. Food processors are actively reformulating products to enhance melt-in-mouth characteristics while maintaining supply-chain stability.

However, regulatory scrutiny on palm oil sustainability and traceability has created friction. Stakeholders are addressing this through RSPO certification adoption and palm traceability frameworks. Innovations in enzymatic interesterification and fractionation technologies are being deployed to improve functional customization, while global processors continue capacity expansions and diversify sourcing across Malaysia and Indonesia. Nonetheless, volatility in palm oil pricing and environmental pressure on deforestation remain persistent constraints.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 34.25 Billion |

| Projected Global Industry Value (2035F) | USD 57.40 Billion |

| Value-based CAGR (2025 to 2035) | 5.3% |

By 2035, demand for palm mid-fractions is expected to become more niche but functionally critical. As consumer preferences shift towards clean-label and sustainable fats, manufacturers are anticipated to increase their reliance on highly specific palm-based fractions that offer enhanced crystallization, neutral taste, and oxidation stability.

The bakery and specialty fat industry will remain central to this demand. Meanwhile, global trade alignment and certification requirements will continue shaping sourcing patterns. Despite moderate CAGR growth, value contribution per unit is projected to rise, driven by product innovation and diversification across emulsified products, fillings, and whipping creams. Palm mid-fractions are expected to sustain their role as a high-performance ingredient in global processed food systems.

Market Share: 6.8% (2025, estimated global share within palm mid-fraction applications)

While traditionally overlooked, infant nutrition is emerging as a high-value segment within the palm mid-fraction (PMF) landscape, driven by its role in structured lipid development. PMFs, specifically with high 1,3-dioleoyl-2-palmitoyl-glycerol (OPO) content, are increasingly used to mimic human milk fat composition in infant formula.

This application has gained traction among formulators seeking to optimize fat digestibility and calcium absorption in newborns. Notably, Bunge Loders Croklaan and IOI Loders Croklaan have expanded their OPO-rich PMF portfolios for Asian and European infant formula markets, capitalizing on this structural functionality.

EU regulations under EFSA mandate specific fat composition requirements for infant formula, pushing processors toward fractionated fats with consistent melting points and purity. This technical demand is enabling the growth of proprietary structured lipids derived from palm mid-fractions, especially in high-end formulations. For example, FrieslandCampina and AAK have invested in enzymatic processing to increase yield efficiency of OPO-based ingredients under GMP-certified systems.

As sustainability scrutiny tightens, RSPO-certified PMFs are being prioritized for infant-grade production. By 2035, this segment is projected to capture higher margins despite volume constraints, reflecting a shift towards premium, science-backed lipid design in early nutrition.

Market Share: 4.3% (2025, estimated global share within palm mid-fraction applications)

The cosmetics industry is integrating palm mid-fraction (PMF) derivatives as structured emollients in skincare and haircare formulations, leveraging their oxidative stability, smooth sensory finish, and low melting points. Unlike crude palm oil derivatives, PMFs deliver precise crystallization behavior critical in creams, body butters, and balms, where textural consistency is a premium attribute. Global personal care ingredient players, such as KLK OLEO and BASF Care Creations, have incorporated PMF-based esters to enhance product stability under varying climatic conditions.

Regulatory acceptance of palm-based emollients under ISO 16128 natural origin indices has improved their appeal for natural and organic beauty products. Palm mid-fraction esters like isopropyl palmitate and glyceryl stearate, derived from fractionated PMF streams, are increasingly listed on clean-label ingredient decks. Their compatibility with active ingredient carriers and preservation systems further supports usage in high-SPF sunscreens and anti-aging creams.

Sourcing dynamics are being influenced by RSPO-MB and segregated supply chain models, especially for brands active in European and Japanese markets. This segment is expected to witness gradual CAGR acceleration through 2035, driven by demand for non-comedogenic, biodegradable emollients aligned with the growing “plant-based skincare” trend.

Increase in Demand for Bakery Products is Driving the Palm Mid-Fraction Market

Because palm mid-fraction can prolong and preserve a products shelf life it is becoming more and more popular in the global market. Additionally, it serves as a base coat in the process of creating Cocoa Butter Equivalents (CBE). Compared to hydrogenated soft oils palm mid-fraction is thought to be a healthier option for baking and confections. Because of its health benefits palm mid-fraction is becoming more and more well-liked as fitness trends and health consciousness rise.

Throughout the evaluation period it is anticipated to fuel demand for palm mid-fraction. The demand for baked goods and ready-to-eat food items is always rising due to their growing popularity. Palm mid-fraction also meets all of the needs of bakers including extending the products shelf life satisfying the growing dietary-healthy trends and delivering a pleasing taste and texture.

Demand for Cosmetic Products Drives the Market Growth

Natural and organic personal care products are becoming more and more popular as people become more conscious of the possible negative effects of synthetic ingredients. Palm mid-fraction is used to make soaps lotions and creams which contributes to the markets expansion.

Pharmaceutical Industry Adds to the Market Growth

Globally the pharmaceutical industry is expanding significantly. Because of its stability solubility and compatibility with active pharmaceutical ingredients palm mid-fraction is a desirable ingredient for topical formulations and drug delivery systems.

Advancements in Technology in the Processes of Fraction is Driving the Market

Growth in the market has been aided by continuous improvements in fractionation techniques such as supercritical fluid extraction and dry fractionation which have raised the productivity and quality of palm mid-fraction production.

Tier 1 companies includes industry leaders acquiring a 20% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base. They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size companies having a presence in some regions and highly influencing the local commerce and has a market share of 30%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies includes mostly of small-scale businesses serving niche economies and operating at the local presence having a market share of 50%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope. As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

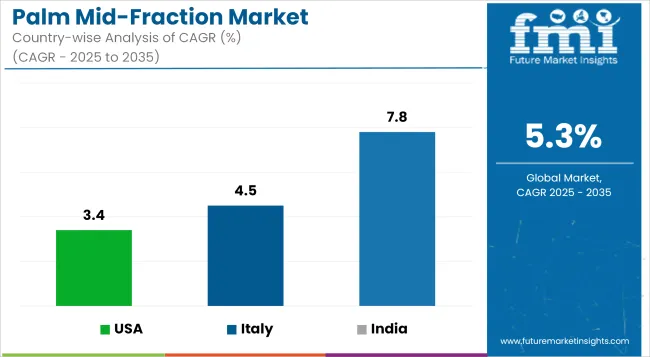

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, Italy and India come under the exhibit of high consumption, recording CAGRs of 3.4%, 4.5% and 7.8%, respectively, through 2035.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 3.4% |

| Italy | 4.5% |

| India | 7.8% |

As palm mid-fraction sales in the United States continue to rise North America is expected to hold the second-place ranking followed by Asia Pacific. S. With consumers adopting busier lifestyles and having more disposable income there is a growing demand for bakery and on-the-go products which is expected to support the regional market. It is also expected that the market will be driven by the growing trend of giving confectionery products like cookies chocolates and baked goods.

Its anticipated that leading brands increased emphasis on developing creative and captivating consumer-attracting strategies will boost sales of confectionery products due to impulsive buying. A significant contributing factor to the growing demand for palm mid-fraction for the production of ready-to-eat foods is the proliferation of convenience stores and hypermarkets/supermarkets throughout the United States.

During the 2025 to 2035 forecast period the palm mid-fraction market in Asia Pacific is anticipated to grow at a notable rate. The largest nation for processing palm mid-fraction is thought to be India. The nation is the location of a developing market where palm mid-fraction is processed before being exported worldwide.

Demand for specialty fats and oils in the food industry is driving the Italian palm mid-fraction market. Because of its special melting properties palm mid-fraction is used in chocolate and confections. The market is also growing as a result of the growing confectionery industry and consumer demand for goods with better mouthfeel and texture.

A large number of domestic and foreign competitors compete fiercely in the palm mid-fraction market. To obtain a competitive edge major market participant prioritize sustainable practices strategic alliances and product innovation. Important businesses in the industry are working to guarantee certification clearance for sustainability and quality.

By grade industry has been categorized into Hard Palm Mid-fraction and Soft Palm Mid-fraction

By end-use industry has been categorized into Food Industry, Bakery, Confectionery, Edible Oils & Fats, Detergents & Surfactants, Cosmetics & Personal Care and Others

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa and Asia

The market is expected to grow at a CAGR of 5.3% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 57.40 Billion.

Food and beverage industry are driving up demand for the market.

North America is expected to dominate the global consumption.

Some of the key players in manufacturing include Mewah Group, Felda Iffco Sdn Bhd, Intercontinental Specialty Fats Sdn. Bhd. & Pavlos N. Pettas S.A.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Palm Kernel Oil and Coconut Oil Based Natural Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Palmitic Acid Market Size and Share Forecast Outlook 2025 to 2035

Palm Oil Market - Size, Share, and Forecast 2025 to 2035

Palm Oil-Free Skincare Market Insights – Trends & Growth 2024-2034

Saw Palmetto Market Analysis by Powder, Whole and others Forms Through 2035

Date Palm Market Size and Share Forecast Outlook 2025 to 2035

Cetyl Palmitate Market Analysis Size Share and Forecast Outlook 2025 to 2035

Ascorbyl Palmitate Market Analysis - Size, Share, and Forecast 2025 to 2035

Ethylhexyl Palmitate Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Palm Oil Market Size and Share Forecast Outlook 2025 to 2035

Hydrogenated Palm Oil Market

Elaeis Guineensis (Palm) Fruit Extract Market Size and Share Forecast Outlook 2025 to 2035

Tissue Cultured Date Palm Market Trends – Growth & Industry Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA