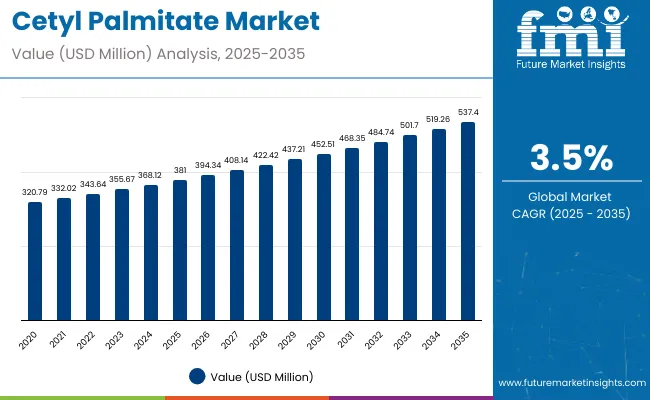

The cetyl palmitate market is estimated to be valued at USD 381.0 million in 2025. It is projected to reach USD 537.4 million by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period. The market is projected to add an absolute dollar opportunity of USD 156.0 million over the forecast period, reflecting a 1.41 times growth at a CAGR of 3.5%.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 381.0 million |

| Projected Value (2035F) | USD 537.4 million |

| CAGR (2025 to 2035) | 3.5% |

The market’s expansion is expected to be driven by rising consumer preference for naturally derived emollients and emulsifiers in cosmetic and personal care products, including creams, lotions, and hair care formulations.

By 2030, the market is projected to reach approximately USD 452.5 million, representing an incremental value of USD 71.5 million over the first half of the decade. Between 2030 and 2035, the market is expected to grow further to USD 537.4 million, adding another USD 84.9 million, indicating a moderately back-loaded growth trend driven by the rising adoption of natural ingredients and innovative product formulations in the personal care and cosmetics industries.

Companies such as Sigma-Aldrich Co. LLC., Fine Organics, Kraft Chemical Company, and Croda International are advancing their competitive positions through investment in research and development for high-purity cetyl palmitate derivatives. Strategic partnerships, eco-friendly sourcing practices, and regulatory compliance are enabling expansion into premium cosmetics, skincare, and hair care formulations, strengthening product portfolios and market presence globally.

The cetyl palmitate market accounts for a modest yet notable share across its parent markets, reflecting its niche yet essential role in various industries. Within the specialty chemicals market, it represents approximately 2.5% of total value, while in the cosmetic ingredients market, it holds around 4.2% due to its widespread use as an emollient. In the personal care ingredients segment, its share is estimated at 3.8%, and about 1.9% in the industrial lubricants market. The pharmaceutical excipients market sees a 2.3% share, while in food additives, it accounts for roughly 1.5%. In the oleochemicals sector, its presence is approximately 3.1%.

The market is witnessing growth due to increased demand for naturally derived, biodegradable emollients in cosmetic and personal care products. Innovations are focused on eco-friendly sourcing from plant oils, improving product stability and texture, and reducing environmental impact. Developments include advanced formulation technologies, enhanced bioavailability, and multifunctional applications in creams, lotions, and hair care. Regulatory approvals for naturally derived ingredients in Europe and North America also support expansion. Current trends highlight clean-label formulations, cruelty-free certifications, and the integration of cetyl palmitate into organic and vegan personal care products, driving global adoption.

The cetyl palmitate market is being driven by rising consumer demand for naturally derived, biodegradable ingredients in cosmetic and personal care products. Its emollient and emulsifying properties make it highly suitable for creams, lotions, and hair care formulations, offering smooth texture, improved skin hydration, and product stability.

Increasing awareness of clean-label and cruelty-free products is further supporting adoption, particularly in premium skincare, organic cosmetics, and personal hygiene categories. Regulatory approvals in regions such as North America and Europe for naturally sourced esters are also fostering market expansion.

As sustainable and eco-friendly personal care trends gain momentum, manufacturers are prioritizing ingredient safety, multifunctionality, and high-performance formulations. With consumer focus on natural and effective skincare solutions, cetyl palmitate is increasingly integrated across cosmetic and personal care applications, ensuring steady growth in both emerging and developed markets globally.

The market is segmented by product type, hair type, application, distribution channel, and region. By product type, the market is divided into shampoos & conditioners, creams & lotions, lipsticks & balms. By hair type, the market is classified into emulsifier, stabilizer, and skin conditioner. By application, the market is bifurcated into cosmetics and personal care, and the pharmaceutical industry. Based on distribution channel, the market is bifurcated into online and offline. Regionally, the market is classified into North America, Europe, Asia-Pacific, Latin America, Japan and the Middle East & Africa.

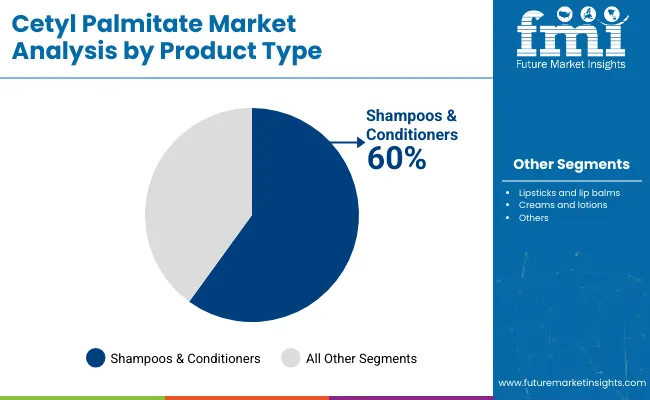

The shampoos & conditioners segment holds a commanding 60% share of the product type category, primarily due to cetyl palmitate’s superior emollient and conditioning properties that enhance hair texture, manageability, and shine. It is widely incorporated into formulations to deliver smoothness and softness, particularly in premium and organic hair care products.

Increasing consumer demand for naturally derived ingredients and multifunctional products is accelerating the adoption of cetyl palmitate in shampoos and conditioners. The ingredient’s ability to improve lather, viscosity, and overall sensory experience makes it a preferred choice for formulators seeking high-performance, eco-friendly hair care solutions.

Companies are investing in R&D to optimize cetyl palmitate concentrations for diverse hair types, including dry, damaged, and color-treated hair, ensuring both efficacy and compliance with regulatory and sustainability standards. This segment is poised to maintain robust growth, supported by rising awareness of hair wellness and clean-label preferences.

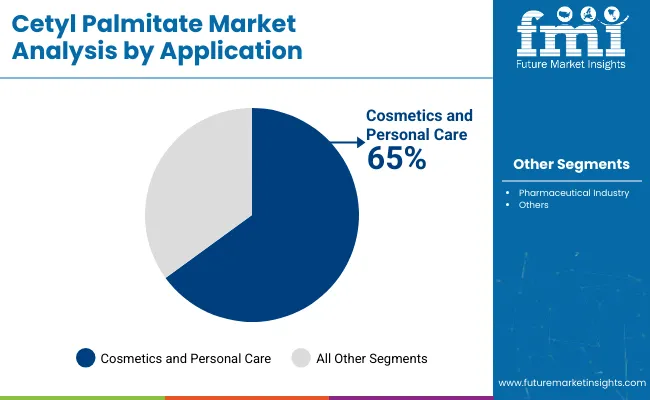

Cosmetics and personal care remain the leading application segment, commanding 65% of the market share, as cetyl palmitate is extensively used in creams, lotions, body butters, and serums. Its emollient, moisturizing, and skin-conditioning properties make it indispensable for formulations that require smooth texture, enhanced spreadability, and skin hydration.

The surge in demand for clean-label, vegan, and cruelty-free cosmetic products has further strengthened cetyl palmitate’s adoption. Its compatibility with other natural ingredients and stability in diverse formulations allows manufacturers to meet consumer expectations for high-quality, sustainable personal care solutions.

Ongoing product innovations, including multifunctional skincare offerings and enhanced bioavailability technologies, are driving investment in this segment. Regulatory approvals for naturally sourced esters in key markets such as North America and Europe also support continued growth, positioning cosmetics and personal care as a core driver for the cetyl palmitate market from 2025 to 2035.

In 2025, global cetyl palmitate demand is projected to reach USD 381.0 million, driven by its broad applications in cosmetics, personal care, and hair care formulations. Its emollient, moisturizing, and stabilizing properties make it a preferred choice in creams, lotions, shampoos, conditioners, and serums. Manufacturers are increasingly shifting toward sustainably sourced cetyl palmitate from palm and coconut oils to meet demand for natural, biodegradable, and eco-friendly ingredients. Innovations targeting skin hydration, hair conditioning, and texture enhancement are reinforcing adoption, while premium product lines integrate cetyl palmitate for smoothness, luster, and long-lasting moisture retention. North America and Europe remain key growth regions, supported by strong quality standards and high consumer spending, driving a steady CAGR of 3.5%.

Sustainability, Multi-functionality, and Premium Formulations Drive Cetyl Palmitate Adoption

Cosmetic and personal care brands are incorporating cetyl palmitate to enhance product performance, stability, and texture while aligning with clean-label, vegan, and cruelty-free trends. Its multifunctional nature allows formulators to replace multiple ingredients with a single, stable emollient, streamlining production and boosting product appeal. In premium skincare, cetyl palmitate delivers superior hydration and a smooth finish, while in hair care it improves conditioning and manageability. Formulations using sustainably sourced cetyl palmitate support eco-conscious branding, increasing adoption among leading global cosmetic houses. Collaborations between ingredient suppliers and beauty brands are producing ready-to-use, high-performance blends that reduce formulation time while maintaining consistent quality across product lines.

High Raw Material Costs, Feedstock Volatility, and Regulatory Compliance Restrict Expansion

Market growth is constrained by the elevated cost of sustainably sourced plant oils and the limited availability of high-purity cetyl palmitate. Price fluctuations in palm and coconut oil feedstocks can raise formulation costs by 10-15%, creating procurement and budget challenges for manufacturers. Regulatory compliance in North America and Europe requires extensive quality testing, extending development cycles by 3-5 weeks. Complex processing and purification requirements increase production overhead, while variability in emollient performance between batches limits scalability for cost-sensitive product ranges. These factors, combined with competition for sustainable raw materials, create entry barriers for smaller producers, tempering expansion despite strong demand for multifunctional cosmetic ingredients.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 3.8% |

| France | 3.6% |

| Germany | 3.4% |

| UK | 3.2% |

| Japan | 2.9% |

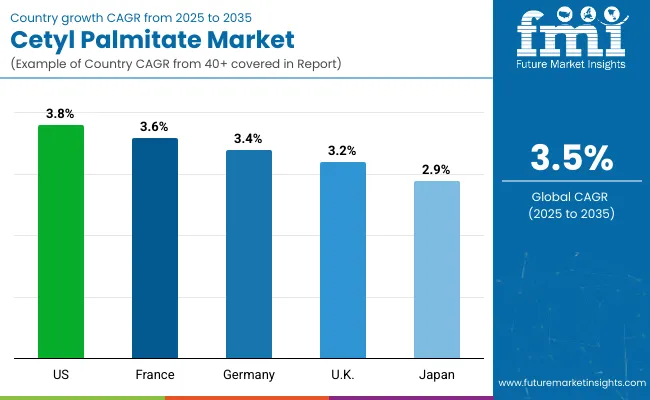

The cetyl palmitate market exhibits varying growth dynamics across leading countries, reflecting differences in regulatory frameworks, consumer preferences, and industry maturity. The USA leads with a CAGR of 3.8%, supported by high disposable income, widespread cosmetic usage, and strong adoption of natural ingredients. France and Germany follow with CAGRs of 3.6% and 3.4%, driven by stringent quality standards and increasing demand for clean-label personal care products. The UK and Japan, with CAGRs of 3.2% and 2.9%, reflect moderate growth influenced by consumer trends toward premium and sustainable formulations. These differences highlight regional opportunities for market penetration and product innovation.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

Revenue from cetyl palmitate in the USA is projected to rise at a CAGR of 3.8% from 2025 to 2035, led by robust demand in cosmetics, personal care, and premium hair care formulations. Increasing consumer preference for natural, biodegradable, and multifunctional ingredients is influencing product adoption, while manufacturers focus on eco-friendly sourcing and innovative formulation development. Major urban centers such as New York, Los Angeles, and Chicago serve as hubs for high-value cosmetic and personal care manufacturing, boosting demand for high-purity cetyl palmitate across diverse product categories.

Key Statistics:

The cetyl palmitate market in France is estimated to strengthen at a CAGR of 3.6% from 2025 to 2035, supported by strong demand for premium cosmetics and skincare products in Paris, Lyon, and Marseille. French consumers prioritize natural, cruelty-free, and multifunctional ingredients, prompting manufacturers to integrate cetyl palmitate into creams, lotions, and serums for improved texture and skin-conditioning benefits. Regulatory compliance with EU cosmetic standards enhances product safety and quality, ensuring sustained market growth. Partnerships between ingredient suppliers and cosmetic brands continue to strengthen France’s position in high-end cosmetic manufacturing.

Key Statistics

The sales of cetyl palmitate in Germany are expected to flourish at a CAGR of 3.4% from 2025 to 2035, fueled by functional and organic cosmetic innovations in Berlin, Hamburg, and Frankfurt. Manufacturers are emphasizing high-quality, naturally derived ingredients to meet the rising demand for clean-label skincare, hair care, and personal care formulations. The country’s cosmetic industry benefits from advanced processing facilities, organic certification trends, and a strong focus on sustainable sourcing, positioning Germany as a leader in natural ester innovation for premium personal care applications.

Key Statistics

Revenue from cetyl palmitate in the UK is projected to expand at a CAGR of 3.2% from 2025 to 2035, slightly below the global average. Consumer interest in sustainable, natural, and multifunctional ingredients is boosting demand in creams, lotions, and hair care formulations. However, limited domestic production capacity and reliance on imports post-Brexit present supply chain challenges. Despite these constraints, premium personal care brands in London, Manchester, and Edinburgh continue to adopt cetyl palmitate for high-quality product development, with investments in sustainable sourcing and eco-certifications driving growth potential.

Key Statistics

The demand for cetyl palmitate in Japan is anticipated to grow at a CAGR of 2.9% from 2025 to 2035, reflecting steady demand for high-quality skincare and premium personal care products. Urban centers such as Tokyo, Osaka, and Kyoto serve as key consumption hubs, with strong consumer preference for multifunctional, naturally derived ingredients that deliver skin-conditioning and anti-aging benefits. Domestic brands are investing in advanced formulation techniques and sustainable sourcing, supported by a cultural emphasis on quality, purity, and innovation in cosmetics.

Key Statistics

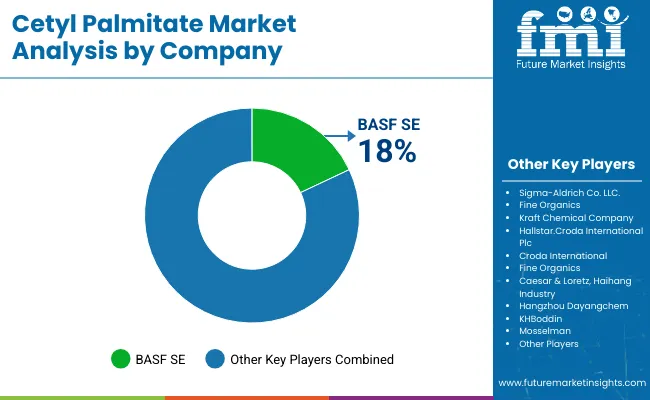

The cetyl palmitate market is moderately consolidated, comprising a combination of global specialty chemical suppliers, ingredient-focused companies, and regional producers offering diverse personal care and cosmetic solutions. Leading players such as Sigma-Aldrich Co. LLC., Croda International Plc, BASF SE, and Fine Organics dominate the market, leveraging extensive R&D capabilities, global distribution networks, and strong relationships with cosmetic and personal care manufacturers. Their competitive advantage lies in high-purity cetyl palmitate production, scalable supply chains, and advanced formulation support for multifunctional products in skin care, hair care, and cosmetic applications.

Companies like Hallstar and Kraft Chemical Company differentiate themselves through product customization, regulatory compliance services, and development of multifunctional cetyl palmitate derivatives that enhance skin hydration, emolliency, and texture. These players focus on integrating eco-friendly sourcing, clean-label certifications, and stable, high-performance formulations to meet stringent consumer and regulatory demands across North America, Europe, and Asia-Pacific markets. Their strategic focus on niche applications such as organic personal care and premium hair care products positions them competitively against larger chemical suppliers.

Regional and mid-sized players such as Evonik Industries, Caesar & Loretz, Hangzhou Dayangchem, and BioCell Technology concentrate on localized production, sustainable sourcing, and specialized product offerings, enabling targeted penetration in emerging markets. Entry barriers remain significant due to high raw material costs, stringent regulatory approvals, and the technological expertise required for stable, multifunctional formulations. Market competitiveness increasingly depends on formulation innovation, purity and consistency of cetyl palmitate, sustainability practices, and strong collaboration with cosmetic and personal care manufacturers to deliver application-ready solutions across diverse product categories.

| Item | Value |

|---|---|

| Quantitative Units | USD 381.0 Million |

| Product Type | Shampoos and Conditioners, Lipsticks and Lip Balms, Creams and Lotions. |

| Hair Type | Emulsifier, Stabilizer, Skin Conditioner |

| Application | Cosmetics and Personal Care, Pharmaceutical Industry |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Latin America, Asia Pacific, Eastern Europe, Western Europe, Japan |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Sigma-Aldrich Co. LLC, Fine Organics, Kraft Chemical Company, Hallstar, Croda International Plc, BASF SE, Caesar & Loretz, Haihang Industry, Hangzhou Dayangchem, KHBoddin, Mosselman, Evonik Industries, Oleon NV, BioCell Technology, Taiwan Njc Corporation, DeWolf Chemical (an Azelis Americas company), Ashland |

| Additional Attributes | Dollar sales by application and purity grade, regional demand trends, competitive landscape, consumer preference shifts toward plant-derived cetyl palmitate, integration of sustainable sourcing and green chemistry practices, innovations in esterification processes, and advancements in product stability for extended shelf life across end-use industries |

The global cetyl palmitate market is estimated to be valued at USD 381.0 million in 2025.

The cetyl palmitate market size is projected to reach USD 537.4 million by 2035.

The cetyl palmitate market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The shampoos & conditioners segment is projected to lead the cetyl palmitate market with 60% market share in 2025.

In terms of application, the cosmetics and personal care segment will command 65% share in the cetyl palmitate market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cetyl Trimethyl Ammonium Chloride Market

Cetyl Esters Market

Acetylacetone Market Size and Share Forecast Outlook 2025 to 2035

Acetyl Tributyl Citrate market Size and Share Forecast Outlook 2025 to 2035

Acetylcholine Market Size and Share Forecast Outlook 2025 to 2035

Acetylated Starch Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Acetyls Market Analysis - Size, Share & Forecast 2025 to 2035

Acetyl Serine Market Growth - Trends & Forecast 2025 to 2035

Acetyl Isovaleryl Market

Acetyl Tyrosine Market

Acetylated Distarch Phosphate Market

2-Acetylthiophene Market Growth – Trends & Forecast 2025 to 2035

Triacetylresveratrol Market Size and Share Forecast Outlook 2025 to 2035

Tetraacetylethylenediamine (TAED) Market Size and Share Forecast Outlook 2025 to 2035

Ascorbyl Palmitate Market Analysis - Size, Share, and Forecast 2025 to 2035

Ethylhexyl Palmitate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA