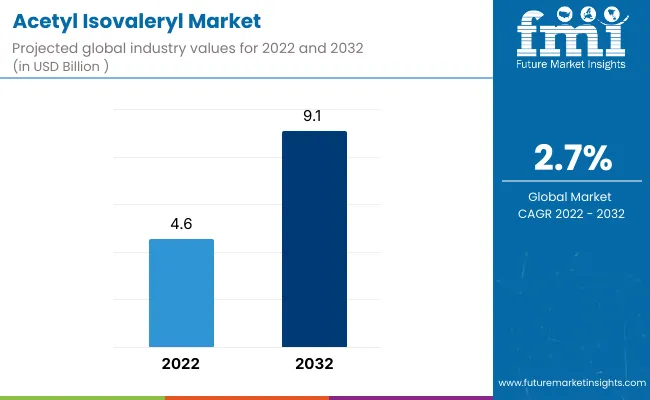

The global acetyl isovaleryl market size is expected to be valued at US$ 9.1 Bn in 2032. Rising demand for acetyl isovaleryl for usage in the production of tablets, such as aspirin and paracetamol is likely to bode well for the market. As per FMI, the global acetyl isovaleryl market is set to reach US$ 4.6 Bn in 2022 and exhibit growth at a CAGR of 2.7% in the forecast period from 2022 to 2032.

| Report Attribute | Details |

| Acetyl Isovaleryl Market Estimated Base Year Value (2021) | US$ 3.8 Bn |

| Acetyl Isovaleryl Market Expected Market Value (2022) | US$ 4.6 Bn |

| Acetyl Isovaleryl Market Anticipated Forecast Value (2032) | US$ 9.1 Bn |

| Acetyl Isovaleryl Market Projected Growth Rate (2022-2032) | 2.7% CAGR |

Acetyl isovaleryl is considered to be a yellow liquid with a cheesy, buttery odor. It can be synthesized by using the bromination technique of mesityl oxide. It is then treated with sulfuric acid. The resulting liquid is utilized as a flavoring ingredient to prepare rum, pineapple, banana, cream, coffee, and cheese flavors.

Acetyl is a moiety in organic chemistry. It is a compound of multiple organic compounds, including acetylsalicylic acid, acetaminophen, neurotransmitter acetylcholine, acetic acid, acetylcysteine, and acetyl-CoA.

Acetyl organic compounds have showcased a high ability to cross the blood-brain barrier. These enable a given drug to reach one’s brain very quickly and surges the effectiveness of a particular dose. These also make the drug’s effects more intense.

Moreover, acetyl can be generated by using numerous methods. The utilization of acetyl chloride or acetic anhydride is one of the most commonly used methods to generate acetyl.

The high demand for paracetamols, aspirins, and pain killers in both developed and developing countries is anticipated to push the acetyl isovaleryl market growth in future years. It is also extensively used in the production of several significant medicines.

The increasing prevalence of common cold caused by various types of viruses is likely to boost the need for over-the-counter cough medicines, including paracetamol to get relief from early symptoms. In emerging countries, it has driven the sales of paracetamol drugs for flu, cold, and cough. It is a major factor that is anticipated to bode well for the global market.

Taking a high dose of paracetamol or aspirin may lead to various side effects, such as insomnia, constipation, agitation, headache, and vomiting. Even at recommended dosages, the potential for liver damage exists. The risk is high in those individuals who drink three or more alcoholic beverages every day.

The availability of multiple brands and their usage in combination with novel ingredients to treat flu and common cold may confuse patients and lead to inadvertent double-ups in terms of dosing. This factor may also hamper the demand for acetyl isovaleryl in the upcoming years.

Asia Pacific is projected to generate the largest acetyl isovaleryl market share in the upcoming years. This growth is attributable to the high demand for pain management drugs and the rising prevalence of flu, as well as headaches in India and China. It is further propelling the consumption of paracetamol and aspirin as these help in the treatment of mild to moderate pain, including toothaches, osteoarthritis, headaches, flu aches, backaches, and menstrual periods.

Paracetamol is also considered to be a highly effective antipyretic that is used for reducing fever. The rising prevalence of numerous indicative conditions and the increasing usage of OTC drugs in remote areas are also expected to propel the Asia Pacific market.

By region, North America is likely to remain in the second position in terms of share in the assessment period. Sales of acetyl isovaleryl in this region are estimated to surge owing to the increasing prevalence of migraine in the U.S. and Canada. The presence of a well-established healthcare infrastructure in these countries is another crucial factor that is likely to augment growth.

According to the Centers for Disease Control and Prevention (CDC), women were nearly twice as likely as men to have had a severe migraine or headache in the last 3 months in 2018 in the U.S. alone. This trend is set to continue throughout the forthcoming years, thereby fostering the North America market.

Some of the reputed companies in the global acetyl isovaleryl market include The Dow Chemical Company, BOC Sciences, TCI America, Parchem Fine and Specialty Chemicals, Durturust Animal Pharmaceutical Ltd., Penta Manufacturing Company, Fengchen Group Co, Ltd., Synerzine, Celanese Corporation, Wholechem, Eastman Chemical Company, Vigon International, Wacker Chemie, and BP among others.

The majority of the leading players in the market are aiming to invest huge sums in research and development activities to introduce innovative products. A few other companies are increasingly focusing on expanding their manufacturing facilities to cater to the high demand from various end-use industries. Meanwhile, some of the small-scale enterprises are joining hands with international companies to co-develop new products.

| Report Attribute | Details |

| Growth Rate | CAGR of 2.7% from 2022 to 2032 |

| Base Year for Estimation | 2021 |

| Historical Data | 2015-2020 |

| Forecast Period | 2022-2032 |

| Quantitative Units | Revenue in US$ Billion, Volume in Kilotons and CAGR from 2022-2032 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered |

|

| Regions Covered |

|

| Key Countries Profiled |

|

| Key Companies Profiled |

|

| Customization | Available Upon Request |

The global acetyl isovaleryl market is set to surpass US$ 9.1 Billion in 2032.

Asia Pacific is set to lead the acetyl isovaleryl market in the forecast period.

The Dow Chemical Company, BOC Sciences, TCI America, Parchem Fine and Specialty Chemicals, and Durturust Animal Pharmaceutical Ltd. are some of the renowned companies in the acetyl isovaleryl market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acetylacetone Market Size and Share Forecast Outlook 2025 to 2035

Acetyl Tributyl Citrate market Size and Share Forecast Outlook 2025 to 2035

Acetylcholine Market Size and Share Forecast Outlook 2025 to 2035

Acetylated Starch Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Acetyls Market Analysis - Size, Share & Forecast 2025 to 2035

Acetyl Serine Market Growth - Trends & Forecast 2025 to 2035

Acetyl Tyrosine Market

Acetylated Distarch Phosphate Market

2-Acetylthiophene Market Growth – Trends & Forecast 2025 to 2035

Triacetylresveratrol Market Size and Share Forecast Outlook 2025 to 2035

Tetraacetylethylenediamine (TAED) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA