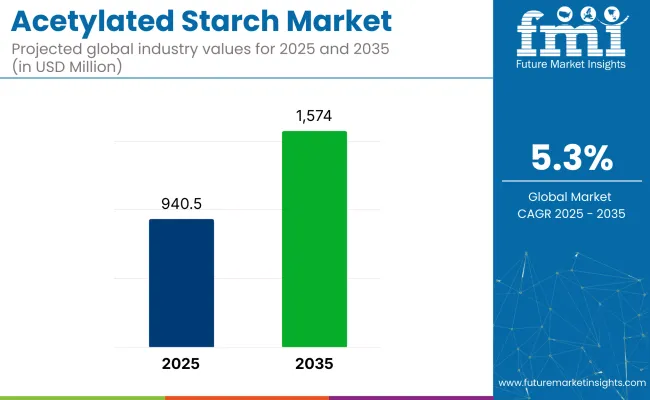

The acetylated starch market is set to be valued at USD 940.5 million in 2025. Demand is projected to grow at a valuation of USD 1,574 million by 2035 at a CAGR of 5.3%. The industry is set to grow steadily, driven by its increasing use in pharmaceuticals, food and beverage, and dietary supplements.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 940.5 million |

| Projected Market Size in 2035 | USD 1,574 million |

| CAGR (2025 to 2035) | 5.3% |

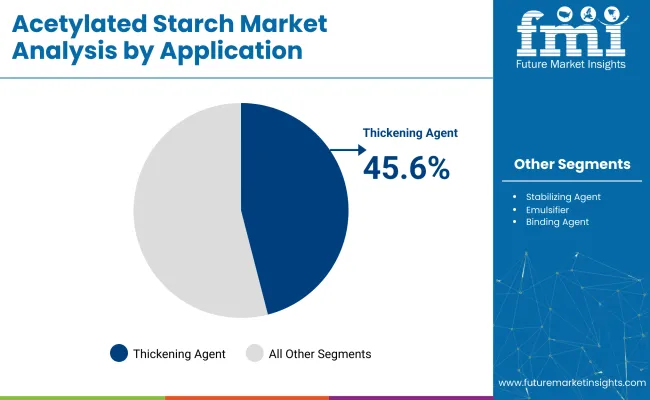

As a thickening agent, acetylated starch plays a critical role in improving texture and consistency in food products. The growing demand for natural, plant-based alternatives has accelerated its adoption.

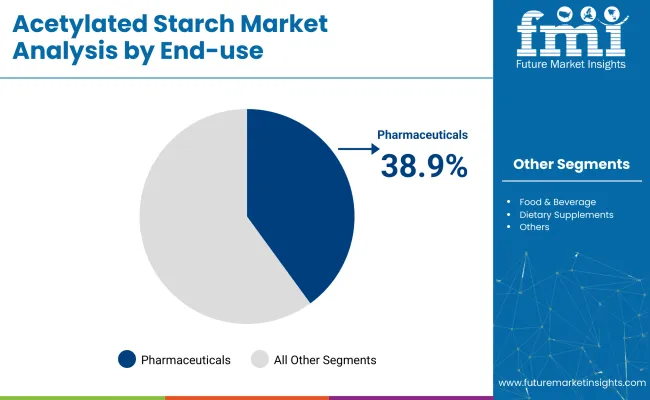

Acetylated starch is also used in binding, emulsifying, and stabilizing products, which further boosts its demand in functional food and pharmaceutical applications. The industry is expected to expand significantly in regions like India, China, and the USA as industries prioritize better food quality and pharmaceutical formulations.

The industry holds a niche but significant share within its parent markets. In the starch market, acetylated starch accounts for approximately 5-7%, as it is a modified form of starch with specialized applications. Within the food and beverage additives market, its share is around 2-3%, primarily used as a thickener, stabilizer, and emulsifier in processed foods.

In the biodegradable polymers market, acetylated starch contributes approximately 1-2%, as it plays a role in developing eco-friendly plastics. In the pharmaceutical excipients market, its share is about 1%, used mainly in tablets and drug formulations as a binder. In the cosmetics and personal care market, acetylated starch represents around 3-5%, added for its texturizing and stabilizing properties in creams, powders, and lotions.

The market is segmented by application into thickening agent, stabilizing agent, emulsifier, binding agent, and gelling agent. It is segmented by end-use into pharmaceuticals, food and beverages, dietary supplements, textile, paper, and other industries. Industry analysis has been carried out in North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic countries, Russia & Belarus, and Middle East & Africa.

The thickening agent segment is expected to hold 45.6% of the acetylated starch market share in 2025. Its dominance is attributed to the wide use of acetylated starch in improving texture and maintaining consistency in processed foods. Applications in soups, sauces, gravies, and dairy-based items contribute to its high usage.

The rising consumption of ready-to-eat and packaged meals has further driven the need for stable thickening solutions across food manufacturing. The food industry’s focus on shelf-life stability and mouthfeel has reinforced the segment’s strong position.

The pharmaceutical sector is expected to account for 38.9% of the acetylated starch market in 2025. Its use in tablet and capsule manufacturing stems from its reliable binding and stabilizing properties. Acetylated starch enhances both the physical structure and release performance of pharmaceutical products, making it an essential excipient.

The growing demand for health supplements and over-the-counter medications-especially in BRICS and ASEAN nations-is contributing to its wider adoption. As global healthcare needs expand, acetylated starch will remain critical in formulation development and production efficiency.

Acetylated starch demand is rising due to its use in plant-based foods and pharma-friendly formulations like pediatric syrups. Brands like Nestlé and Cipla have adopted it for stability and texture. However, price and supply volatility from weather-affected crops like corn and tapioca remains a key production challenge.

Increasing Demand for Functional Food Ingredients and Processed Foods

Acetylated starch is gaining popularity for its ability to function as a thickening agent, stabilizer, and emulsifier, catering to the consumer desire for convenience, long-lasting food products. Processed food consumption continues to rise, particularly in emerging markets like India and China, where evolving consumer preferences are creating demand for more convenient food options. With a growing shift toward health-conscious diets, acetylated starch is being integrated into a broader array of products, accelerating market expansion.

Supply Chain Constraints and High Production Costs

The sourcing of essential raw materials such as corn and cassava is vulnerable to climate change and other environmental factors, contributing to price instability and supply chain interruptions. The intricate processes involved in acetylating starch further increase production costs.

These challenges may hinder the scalability of the industry, particularly in price-sensitive regions. Manufacturers must address these challenges to ensure steady and sustainable market growth in the face of rising production complexities and fluctuating raw material prices.

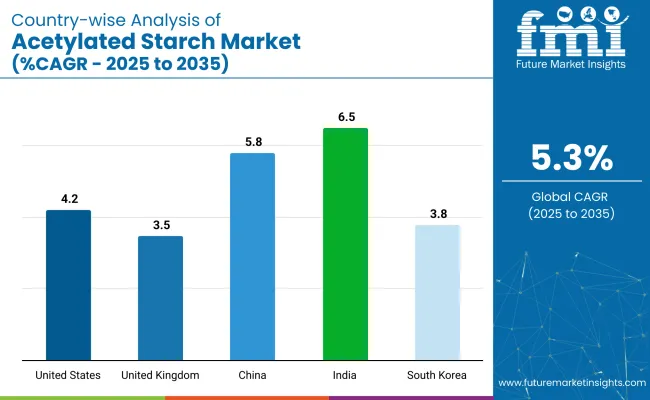

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.2% |

| United Kingdom | 3.5% |

| China | 5.8% |

| India | 6.5% |

| South Korea | 3.8% |

The acetylated starch market is set to grow at a global CAGR of 5.3% through 2035, with BRICS and ASEAN economies shaping the future landscape. India, at 6.5%, leads global growth, backed by expanding use in processed foods, tablet manufacturing, and starch derivatives.

China, at 5.8%, also shows strong growth, with demand driven by food, paper, and biodegradable packaging sectors. Among OECD countries, Japan (4.9%) stands out for its use of acetylated starch in clean-label and plant-based applications, alongside growth in bioplastics.

Germany (4.5%) benefits from a robust industrial base, with widespread use across food and technical formulations. The USA market (4.2%) remains steady, driven by long-established demand in food and pharma. The fastest-growing opportunities now lie in BRICS and ASEAN countries, where industrialization, evolving diets, and localized production are reshaping the supply and demand dynamics of acetylated starch.

The United States acetylated starch market is expected to grow at a CAGR of 4.2% from 2025 to 2035. As part of the OECD group, the country continues to show steady growth, supported by its advanced food processing infrastructure and a large consumer base.

Acetylated starch is widely used as a stabilizer and thickening agent in processed foods, ready-to-drink beverages, and sauces. The pharmaceutical sector also contributes to demand through its use in tablet coatings and powdered formulations. The shift toward health-conscious eating and the rising preference for clean-label ingredients have further enhanced demand across retail and institutional channels.

The United Kingdom is expected to grow at a CAGR of 3.5% in the industry. The demand for natural and functional ingredients in food products is increasing as consumers prioritize health-conscious diets and convenient food options.

Acetylated starch is being widely used in the food and beverage sector, especially in sauces, dairy products, and baked goods, to enhance texture and consistency. The UK ’s stringent food regulations and high demand for clean label ingredients further support the market's expansion.

China is expected to grow at a CAGR of 5.8% in the industry. With a rising middle class and increasing demand for processed foods, China is one of the fastest-growing markets for acetylated starch. Consumers are shifting towards convenience foods and health-focused ingredients, driving the demand for functional food additives like acetylated starch. The food and beverage, pharmaceutical, and dietary supplement industries are all expected to contribute to growth in the Chinese market.

India is projected to grow at the fastest rate in the industry, with a CAGR of 6.5%. The rise in the increasing demand for processed foods and dietary supplements is driving the market. India’s growing urban population and adoption of westernized eating habits are contributing to the demand for convenience foods that rely on functional ingredients like acetylated starch. The increasing awareness about the benefits of natural and organic products is likely to further propel market growth in India.

South Korea is projected to grow at a CAGR of 3.8% in the industry. The increasing demand for processed foods and dietary supplements, coupled with a strong interest in health-conscious eating, is driving market expansion.

Acetylated starch is widely used as a stabilizer and emulsifier in the food industry, especially in beverages, baked goods, and dairy products. South Korea’s well-developed food processing industry and the growing demand for clean label ingredients further support the market growth.

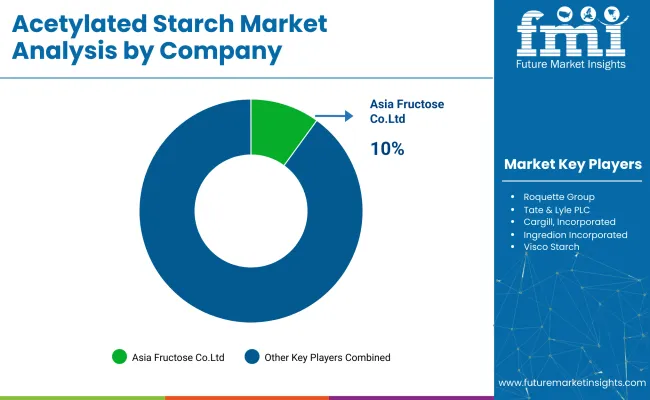

The global industry features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as Asia Fructose Co., Ltd., Banpong Tapioca Flour Industrial Co., Ltd., and V Delta Co., Ltd. lead the market with extensive product portfolios, strong R&D capabilities, and robust distribution networks across food, beverage, pharmaceutical, and industrial sectors.

Key players including Visco Starch, Chai Prasit Products Co., Ltd., and Roquette Group offer specialized formulations tailored to specific applications and regional markets. Emerging players, such as Tate & Lyle PLC, Cargill, Incorporated, and Ingredion Incorporated, focus on innovative extraction technologies and cost-effective solutions, expanding their presence in the global market.

| Report Attributes | Details |

|---|---|

| Estimated Market Size (2025E) | USD 940.5 million |

| Projected Market Value (2035F) | USD 1,574 million |

| Value-based CAGR (2025-2035) | 5.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and thousand tons for volume |

| Application Segmentation | Thickening Agent, Stabilizing Agent, Emulsifier, Binding Agent, Gelling Agent |

| End-use Segmentation | Pharmaceuticals, Food and Beverage, Dietary Supplements, Pharmaceuticals, Textile, Paper, Others |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players Influencing the Market | Banpong Tapioca Flour Industrial Co Ltd, V Delta Co., Ltd., Visco Starch, Asia Fructose Co., Ltd., Chai Prasit Products Co., Ltd., Roquette Group, Tate & Lyle PLC, Cargill, Incorporated, Ingredion Incorporated, Archer Daniels Midland Company (ADM) |

| Additional Attributes | Dollar sales by application type, end-use, and region, increasing demand for acetylated starch in food and pharmaceuticals, growing use in emulsifiers and stabilizers, rising adoption in textile and paper industries, regional trends in starch sourcing and production. |

The market is segmented into Thickening Agent, Stabilizing Agent, Emulsifier, Binding Agent, and Gelling Agent.

The market is segmented into Pharmaceuticals, Food and Beverages, Dietary Supplements, Textile, Paper, and Other Industries.

Industry analysis has been carried out in North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, and Middle East & Africa.

The global market size is estimated to be USD 940.5 million in 2025 and USD 1,574 million by 2035.

The expected CAGR is 5.3% from 2025 to 2035.

The Thickening Agent application segment holds the largest market share at 45.6% in 2025.

Asia Fructose Co., Ltd. is the leading company in the market, holding a 10% market share.

The projected CAGR for India is 6.5% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acetylated Distarch Phosphate Market

Starch-based Texturizing Agents Market Size and Share Forecast Outlook 2025 to 2035

Starch-based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Starch-derived Fiber Market Size and Share Forecast Outlook 2025 to 2035

Starch-Based Bioplastics Packaging Market Insights - Growth & Forecast 2025 to 2035

Starch Derivatives Market by Product Type, Source, End Use and Region through 2035

Starches/Glucose Market

Starch Glucose Syrup Market

Starch Recovery Systems Market Outlook – Growth, Demand & Forecast 2023-2033

Distarch Phosphate Market Size and Share Forecast Outlook 2025 to 2035

UK Starch Derivatives Market Report – Size, Share & Innovations 2025-2035

Cornstarch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Monostarch Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Pea Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA Starch Derivatives Market Analysis – Demand, Trends & Outlook 2025-2035

Pea Starch Concentrate Market Trends - Growth & Industry Forecast 2025 to 2035

Food Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wheat Starch Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Starch Derivatives Market Trends – Growth, Demand & Forecast 2025-2035

Native Starch Market Analysis - Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA