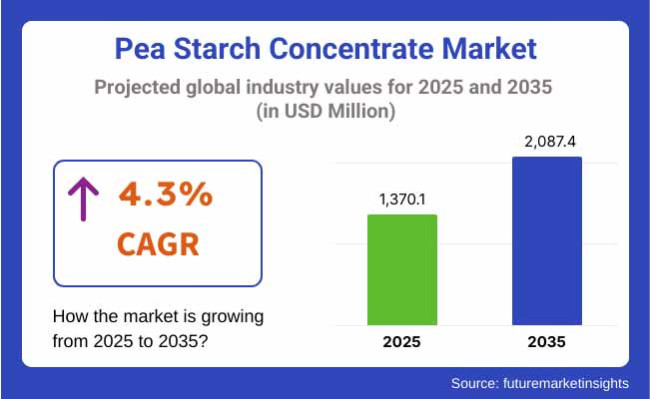

The pea starch concentrate market is expected to rise to USD 1,370.1 million by 2025 and hit USD 2,087.4 million by 2035, with a CAGR of 4.3% during the coming years. There is a rise in plant-based diets, more use of pea stuff in protein bars and dairy-like items, and better extraction and processing tech pushing this growth. Also, growing investment in sustainable and non-GMO food solutions is driving market growth.

The pea starch concentrate market will grow well from 2025 to 2035. This rise is because more people want plant-based ingredients, use them in food and drinks, and like clean-label and gluten-free stuff. Pea starch is used often in cooking, pet food, health items, and other fields. It's valuable because it works well, has good texture properties, and is easy to digest.

North America will lead the pea starch concentrate market. High buyer need for plant-based, allergen-free items drives it. More money goes into green food production. Many food processing firms are based here. The USA and Canada are at the front due to more use of pea ingredients in fake meat, more love for gluten-free baking, and growing need for clean food additives.

The rise of pea starch in health foods, more use in sports supplements, and more non-GMO and organic food boosts demand. Also, government help for green farming and plant-based food innovation speeds up industry growth.

Europe owns a big part of the pea starch concentrate market. Countries like Germany, the UK, France, and the Netherlands are leading in gluten-free food and plant-based options. They get support from rules and look for green ways to source ingredients. The EU wants clear food labels. People now prefer pea-based milk and bread more. There is more money going into healthy starches for weight loss.

Pea starch concentrate is growing in baby food. It’s being used more in foods with extra fiber and prebiotics. Unique ingredients are shaping what food companies do. Europe also aims to cut down on fake food additives and to make food more sustainable. This drives new product ideas and growth in the market.

The Asia-Pacific area is set to grow the most in the pea starch concentrate market. This growth is due to more people caring about health, a higher need for plant-based items, and the pet food market getting bigger. China, Japan, India, and Australia are top users of pea starch in food making, pet food, and fiber-rich goods.

China’s growing health food market, the need for clean-label starch, and more use of pea-based parts in snacks are pushing the market up. In India, more people want vegan food, gluten-free baked goods, and candy. Government support for plant-based farming helps too. Japan and Australia lead in high-end pet food and new high-fiber foods, aiding the market’s growth in this area.

Challenges

High Processing Costs and Competition from Other Plant-Based Starches

A major problem in the pea starch concentrate market is the high cost of getting and making the starch. This makes prices high and hard to scale. There is also strong competition from other plants like corn, potato, and tapioca starch. This adds more problems.

The fluctuations in pea crop yields and constraints in the supply chain impact the accessibility of raw materials and the ability to maintain stable prices. This presents additional challenges for producers.

Opportunities

Functional Food Expansion, Sustainable Packaging, and Prebiotic Applications

The pea starch concentrate market has lots of room to grow, even with the hurdles it faces. More people like foods that help digestion and manage weight, which helps more pea starch foods sell well.

New eco-friendly ideas, like using pea starch for green packing, mean more business chances. People also want more healthy prebiotic fibers from peas, making this market a winner.

High-protein sports snacks with pea starch for those into fitness and plant-based diets are pushing this growth even further. All these trends show the market is set to expand quickly.

From 2020 to 2024, the pea starch concentrate market saw steady growth. The rise was due to higher demand for plant-based ingredients, clean-label foods, and gluten-free options. Pea starch became popular in food processing, pet food, and other uses thanks to its gelling, thickening, and water-binding abilities. More people wanting non-GMO and allergen-free ingredients also helped the market grow. But there were challenges. Supply problems, changing raw material costs, and not enough consumer awareness in new markets slowed growth a bit.

Between 2025 and 2035, the pea starch concentrate market is set to grow. The push for greener options, new products, and more uses in different areas will drive this growth. More refined pea starch that works better will be used in processed food, sports drinks, and eco-friendly wrapping. Also, using smart tech for mixing ingredients and clear tracking with blockchain will build trust and make the industry smoother. As more people want plant-based items, the pea starch market will be key in making clean and functional food for the future.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with food safety and labeling regulations for plant-based ingredients. |

| Technological Advancements | Conventional processing techniques for extracting pea starch concentrates. |

| Industry Applications | Primarily used in food, pet food, and industrial applications. |

| Adoption of Smart Equipment | Limited automation in processing and quality control. |

| Sustainability & Cost Efficiency | Gradual adoption of sustainable sourcing and eco-friendly production methods. |

| Data Analytics & Predictive Modeling | Basic market trend analysis and demand forecasting. |

| Production & Supply Chain Dynamics | Dependence on regional pea production and traditional distribution models. |

| Market Growth Drivers | Demand driven by plant-based food trends, gluten-free diets, and functional ingredient needs. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter sustainability certifications, traceability mandates, and clean-label transparency requirements. |

| Technological Advancements | Advanced enzymatic extraction, AI-driven formulation, and bio-refining for improved purity and functionality. |

| Industry Applications | Expansion into biodegradable packaging, sports nutrition, and pharmaceutical excipients. |

| Adoption of Smart Equipment | Integration of IoT-enabled processing equipment for real-time quality monitoring and efficiency optimization. |

| Sustainability & Cost Efficiency | Full transition to carbon-neutral production, regenerative agriculture, and circular economy-based packaging. |

| Data Analytics & Predictive Modeling | AI-powered predictive analytics for ingredient optimization and supply chain efficiency. |

| Production & Supply Chain Dynamics | Diversification into alternative sourcing, blockchain-based traceability, and localized processing hubs. |

| Market Growth Drivers | Growth fueled by sustainability initiatives, advanced ingredient science, and expanding applications in new industries. |

The pea starch concentrate market in the United States is seeing strong growth. This is due to the rising need for plant-based items in foods. More people want clean-label and gluten-free goods, and the pet food and fish feed markets are expanding. The FDA and USDA set the rules for pea-based food’s standards and labels.

Pea starch is now used more in high-protein snacks and healthy foods. There’s also a bigger need for eco-friendly pet foods. Plus, making pea starch without GMOs and using organic methods is changing the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

The pea starch concentrate market in the UK is growing because more people want plant-based and allergen-free foods. There's more demand for clean-label items, and people use pea starch in meat alternatives and bakery goods. Food rules by the UK Food Standards Agency (FSA) and the British Retail Consortium (BRC) keep it all safe.

Growth in pea starch is seen in gluten-free and keto foods. There's also more need for eco-friendly, plant-based pet food. People are finding new ways to use pea starch in dairy-free foods. Also, there's a rise in money spent on biodegradable packaging with pea starch. This shapes the market too.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.1% |

The pea starch concentrate market in the European Union is growing steady. This is due to strict EU laws on clean-label food, more demand for plant protein, and interest in useful starch for food. The European Food Safety Authority and the European Commission oversee food rules and sustainability plans.

Germany, France, and the Netherlands lead in pea starch use for meat and dairy alternatives. They research modified starch uses and boost pea starch biofilms for packaging. Also, funds for pea starch in drugs and health products help the market to grow.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.3% |

The pea starch concentrate market in Japan is growing fast. More people want plant-based food items. They use pea starch in traditional and processed foods. Many consumers now seek gluten-free and non-GMO options. The Japanese Ministry of Health, Labour, and Welfare (MHLW) and the Japan Food Research Laboratories (JFRL) keep food safe and approve new ingredients.

Japanese businesses invest in pea starch for gluten-free noodles and snacks. They expand into organic and fermented products. They also create coatings with pea starch to keep foods fresh. Also, there is a growing use of pea starch in health supplements and adding it to foods for extra fiber. These trends are shaping the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.4% |

The market for pea starch concentrate in South Korea is seeing growth. This boost comes from higher demand for plant ingredients, more use in sweets and baked goods, and government support for other proteins. The South Korean Ministry of Food and Drug Safety (MFDS) and the Korea Food Research Institute (KFRI) manage food security and ingredient progress.

The use of pea starch in non-dairy goods is rising. There is more need for prebiotic ingredients, and high-performance pea starch for food texture is trending. Also, money going into pea starch-based biodegradable films for green packaging is growing.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

The pea starch concentrate market is growing due to the increasing demand for plant-based foods. This is further compounded by its use in gluten-free and high-fiber foods. People are starting to use pea starch in food, feed, and other areas. Yellow and green pea starches are most popular. They are easy to digest, good for health, and meet clean-label rules.

Yellow pea starch is used a lot in gluten-free bread, dairy-free creams, and meat made from plants. It has lots of amylose, holds water well, and makes foods feel better. This type of starch is liked because it tastes plain, digests easily, and helps keep food stable.

More people are using yellow pea starch because they want plant-based and allergen-free food. People also want foods rich in fiber and clear-label products that are not genetically modified. New tech in finding ingredients, eco-friendly farming, and mixing starch with protein make products more flexible.

But, yellow pea starch has issues like changing costs of raw stuff, tough processing, and competition with other plant starches like corn and tapioca. Still, advances in changing starch with enzymes, using AI to make better textures, and tracking eco-friendly supplies should help the market grow and save money.

Green pea starch is used a lot in food making, healthy pills, and fiber-rich snacks. It adds more nutrients, helps the gut, and fights bad stuff in the body. This type has lots of good starch, helping with digestion and blood sugar.

More people want green pea starch due to the benefits for the gut, the need for plant fiber, and the rise of green pea items in health goods. New ways of studying gut health, better starch extraction, and water-saving farming are making it better for health and easier to make.

But, there are problems like fewer green peas than yellow ones, higher costs, and taste issues in food. New mixes of green pea fiber and starch, better food texture with AI, and special starch fermentation might make it more popular and liked by people.

Individuals desire pea starch concentrates due to their preference for natural options. Organic and regular starches are popular. They are environmentally conscious, adhering to regulations, and prefer using products with transparent labeling.

Organic pea starch is used a lot in organic food, plant-based bars, and baby food. It is very pure, has no chemicals, and meets the organic rules. These food items are for people who care about healthy eating and want ingredients that are organic and not made with GMOs.

More people are using organic pea starch now because they want organic and plant-based foods. They also do not want food with chemicals, and there are more ways to use this starch in baby food. New ways to track these foods with AI, good farming, and eco-friendly methods are making it easier to get and trust these products.

But there are problems too. It costs more to make, there isn't a lot of land for organic farming, and these products can be pricey. Yet, new tech like AI to grow more crops, packaging that breaks down, and mixes with different kinds of organic pea starch might help more people use it and make it cheaper.

Plain pea starch is common in making food, animal feed, and in green industry uses. It is cheap to produce in large amounts and has many uses. This makes it a good choice for many industries needing plant-based stuff.

More people want this starch now. It's used more in foods, pet food, and fish feed. Pea starch is also used in green plastics. AI helps make better pea starch. Cheap starches with enzymes and good farming practices make production better and cut harm to nature.

But, there are problems. Corn and potato starch compete with pea starch. There are rules on non-GMO starch, and pea crop yields can change. New ideas like mixing starch with proteins, AI to make starch feel better, and using less water can help pea starch stay strong in the market.

The pea starch concentrate market is growing fast. People want plant-based stuff, simple food labels, and new starch options. More use of peas in gluten-free and no-allergy foods helps. It's also used more in pet and fish food. Better ways to get starch also drive growth. Companies aim for pure, non-GMO, and organic pea starch. They want it for thickening, binding, and making food texture better. Leading ingredient suppliers, food makers, and starch firms are in the market. They innovate with protein-rich, modified pea starch, and thick formulas.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Roquette Frères | 18-22% |

| Ingredion Incorporated | 14-18% |

| Emsland Group | 12-16% |

| Cosucra Groupe Warcoing | 10-14% |

| AGT Food and Ingredients | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Roquette Frères | Makes pure pea starch for gluten-free baking, snacks, and other uses. |

| Ingredion Incorporated | Works on non-GMO pea starch for simple food and drink recipes. |

| Emsland Group | Creates pea starch that thickens and holds water well for food making. |

| Cosucra Groupe Warcoing | Provides pea starch concentrates optimized for dairy alternatives, pet food, and plant-based meat applications. |

| AGT Food and Ingredients | Focuses on sustainable pea-based ingredients for food, feed, and industrial uses. |

Key Company Insights

Roquette Frères (18-22%)

Roquette leads the pea starch concentrate market, offering high-quality starch solutions with excellent water retention and binding properties.

Ingredion Incorporated (14-18%)

Ingredion specializes in clean-label, allergen-free pea starch formulations, ensuring stability in processed foods and dairy alternatives.

Emsland Group (12-16%)

Emsland focuses on modified pea starch for enhanced viscosity and gelation properties, optimizing use in sauces, bakery, and convenience foods.

Cosucra Groupe Warcoing (10-14%)

Cosucra provides pea starch with high amylose content, ensuring improved texture and consistency in plant-based foods.

AGT Food and Ingredients (6-10%)

AGT develops sustainable, minimally processed pea starch, supporting natural food product formulations.

Other Key Players (30-40% Combined)

Several starch manufacturers, plant-based ingredient suppliers, and food technology companies contribute to advancements in pea starch purity, functionality, and industrial applications. These include:

The overall market size for the pea starch concentrate market was USD 1,370.1 Million in 2025.

The pea starch concentrate market is expected to reach USD 2,087.4 Million in 2035.

Growing demand for plant-based and gluten-free ingredients, increasing use in food and beverage formulations, and rising applications in pet food and industrial sectors will drive market growth.

The USA, Canada, China, Germany, and France are key contributors.

Food-grade pea starch concentrate is expected to dominate due to its high functionality in bakery, confectionery, and processed food applications.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by End-Use, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by End-Use, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by End-Use, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by End-Use, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 38: Asia Pacific Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 40: Asia Pacific Market Volume (MT) Forecast by End-Use, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: MEA Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 46: MEA Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 48: MEA Market Volume (MT) Forecast by End-Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Nature, 2023 to 2033

Figure 23: Global Market Attractiveness by End-Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Nature, 2023 to 2033

Figure 47: North America Market Attractiveness by End-Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End-Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Nature, 2023 to 2033

Figure 95: Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Nature, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 110: Asia Pacific Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 114: Asia Pacific Market Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Nature, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by End-Use, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Nature, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: MEA Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 134: MEA Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 138: MEA Market Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 141: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Nature, 2023 to 2033

Figure 143: MEA Market Attractiveness by End-Use, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pea Grits Market Size and Share Forecast Outlook 2025 to 2035

Pearl Liquid Market Size and Share Forecast Outlook 2025 to 2035

Pearl Eye Drops Market Size and Share Forecast Outlook 2025 to 2035

Peak Shaving Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Pea Flakes Market Size and Share Forecast Outlook 2025 to 2035

Peanut Butter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pea Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pea Fiber Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Peak Shaving Diesel Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Pea Milk Market Growth - Industry Projections & Market Trends

Pearlescent Pigment Market Growth - Trends & Forecast 2025 to 2035

Peanut Milk Market Analysis - Size, Share & Forecast 2025 to 2035

Peanut Butter Keto Snacks Market Analysis - Trends & Growth 2025 to 2035

Pea Protein Ingredients Market Insights - Plant-Based Nutrition Growth 2025 to 2035

Market Share Breakdown of Pea Flakes Manufacturers

Peanut Flour Market

Pea Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Spear Phishing Market Size and Share Forecast Outlook 2025 to 2035

Spear Phishing Solutions Market Insights – Trends & Forecast through 2034

Cellular Repeater Market Analysis – Growth & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA