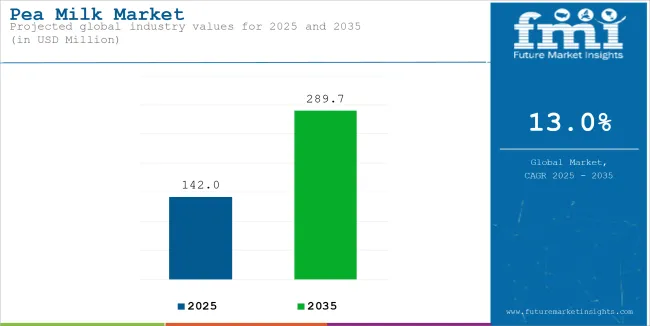

The global pea milk market is estimated to be valued at USD 142 million in 2025 and is anticipated to grow at a CAGR of 13.0% during the forecast period, reaching USD 289.7 million by 2035.

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 142 million |

| Market Size (2035) | USD 289.7 million |

| CAGR (2025-2035) | 13% |

This growth is primarily driven by the increasing demand for plant-based dairy alternatives, as consumers shift towards vegan, lactose-free, and dairy-free products. Pea milk, made from yellow peas, offers a nutritious alternative, high in protein and calcium, making it a popular choice for health-conscious consumers.

The rising popularity of plant-based diets, the growing awareness of the environmental impact of dairy farming, and concerns over lactose intolerance are key factors contributing to market expansion.

Pea milk’s rich protein content, coupled with its versatility in cooking and beverages, has led to its adoption in both foodservice and retail sectors.

Additionally, its sustainability benefits, such as a lower carbon footprint compared to traditional dairy milk, are resonating with eco-conscious consumers.

The global pea milk market is estimated to be valued at USD 142 million in 2025. It occupies about 8-10% of the plant-based beverage market, alongside almond, soy, and oat milks, driven by pea protein’s clean-label and allergen-friendly advantages. In the dairy alternatives market, pea milk contributes around 5-7%, as consumers seek lactose-free and sustainable options.

Within the non-dairy protein beverage segment, it holds a 10-12% share, thanks to its high protein content and neutral flavor profile. In the functional food and beverage ingredients market, pea milk ingredients account for 2-3%, used in fortified shakes and health drinks. Across the broader food and beverage ingredients market, pea protein from pea milk represents approximately 0.1-0.2%, reflecting its emerging but impactful role in modern food formulations.

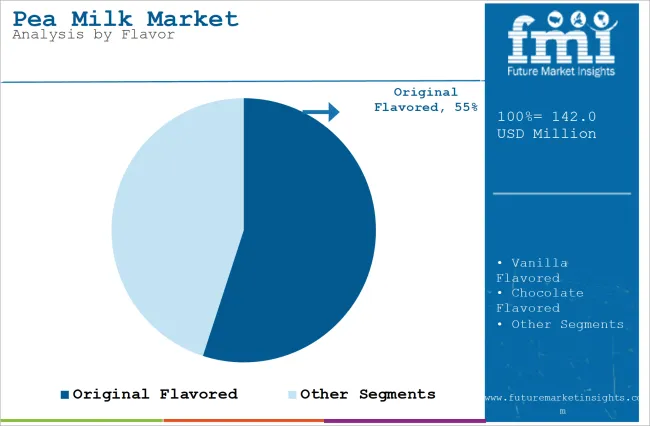

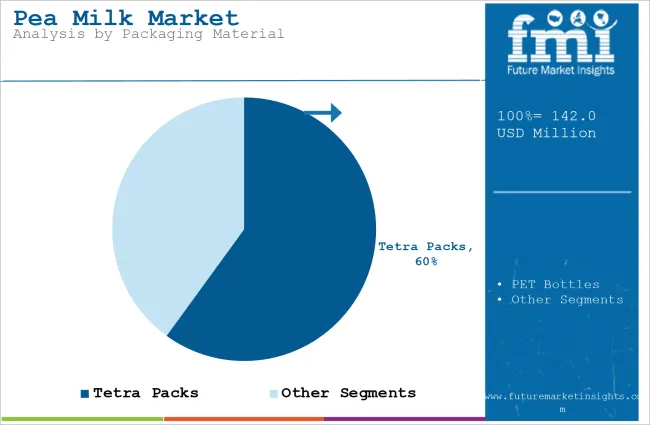

The pea milk market is forecasted to grow at a CAGR of 13% between 2025 and 2035, driven by increasing demand for plant-based, allergen-free dairy alternatives. India is expected to be the fastest-growing market with a CAGR of 22.2%, supported by rising health awareness. Original flavored pea milk will dominate the global market, accounting for 55% of sales in 2025, while tetra packs will remain the preferred packaging format with a 60% share. The U.S. will maintain a strong presence due to supportive nutrition regulations, and China’s growth will be propelled by rapid urbanization. Ripple Foods leads with a 15% share.

Adam Lowry, Founder of Ripple Foods, emphasized that, “The rise in demand for plant-based beverages, particularly pea milk, reflects the shift in consumer preferences toward healthier, sustainable alternatives. We’re committed to expanding our product offerings to meet this growing demand.” This highlights the significant role of pea milk in the evolving plant-based beverage market.

With increasing consumer demand for sustainable, plant-based options, the pea milk market is set to experience robust growth through 2035.

The pea milk market is growing due to rising demand for healthy dairy alternatives. In 2025, original flavor will lead with 55% share, tetra packs with 60%, and brick-and-mortar stores will dominate distribution with 65%, while individual consumers remain the key end users across all segments.

The original flavor of pea milk is projected to capture a dominant 55% market share by 2025.

| Attributes | Details |

|---|---|

| Top Flavor | Original Flavored |

| Market Share in 2025 | 55% |

Tetra packs are set to lead the pea milk packaging segment, expected to hold a 60% market share by 2025.

| Attributes | Details |

|---|---|

| Top Packaging Material | Tetra Packs |

| Market Share in 2025 | 60% |

HoReCa (Hotels, Restaurants, and Cafés) are set to lead the pea end user segment, expected to hold a 45% market share by 2025.

The sales channels for pea milk include both traditional brick-and-mortar stores and online retail channels. In 2025, brick-and-mortar stores are expected to hold 65% of the market share due to the convenience and tactile experience they offer.

Move Toward Vegan and Plant-based Diets to Increase Product Adoption

The demand for plant-based milk alternatives, such as pea milk, is owing to the increasing number of consumers who have embraced vegan and plant-based diets, very much driven by concerns for animal options within these diets. These consumers are increasingly being aware of the benefits of plant-based diets and demanding innovative products that suit their fast-paced lifestyles.

High Production Cost May Hamper Uptake

The major factor limiting market growth is the prohibitive cost of pea milk. The cost of processing peas into a milk-like product, which includes processes such as formulation, fortification, and extraction may add to the overall price of the product.

This factor may make it out-of-reach for the middle-class customer base. Moreover, the unique texture and taste of pea milk may not appeal to everyone, which hinders its mass adoption.

Development of Functional and Flavored Variants

With growing consumer preferences, the market has been witnessing rising functional and flavored offerings of pea milk. Functional variants high in added minerals, probiotics, vitamins, and protein are witnessing popularity among health-conscious consumers.

At the same time, brands are offering a variety of flavors, such as chocolate, vanilla, and coffee among others, making pea milk increasingly appealing to youth and families alike. This trend is in the direction of personalization and catering to diverse tastes and nutritional demands.

India is poised to grow at a CAGR of 22.2% from 2025 to 2035. The increasing availability of plant-based milk alternatives in India is helping fuel growth in the pea milk segment. Pea milk is often marketed by international and local brands, which appeals to the rising number of individuals. Moreover, the growing existence of online retail platforms allows wider distribution, facilitating access to urban populations.

China is poised to grow at a CAGR of 19.3% from 2025 to 2035. The main factors for the growth of plant-based products in the country are rapid urbanization and increasing disposable incomes. Since the population in urban regions is increasing in China, so is the demand for innovative, convenient food options.

Urban consumers have better access to plant-based products including pea milk, and rising incomes have encouraged them to opt for healthier, premium food choices. The transition toward a more health-conscious diet is seen as supporting the growth in China’s market.

The high demand for plant-based foods in Canada is expanding the market. The country has a strong agricultural sector, supporting the production of plant-based ingredients, including peas. Companies such as Ripple Foods in Canada are leading the innovation of pea milk, making high-quality products. This, along with growing innovations by leading manufacturers is contributing to market growth.

The government encourages health and nutrition programs that support the increasing demand for plant-based diets. As people become more aware of health problems such as lactose intolerance, obesity, and heart disease, the USDA dietary guidelines recommend plant-based alternatives to dairy products. This has increased the number of government-sponsored nutrition programs, which may include plant-based for schools, public health initiatives, and other institutions.

The USA Food and Drug Administration also regulates the labeling of plant-based products, which ensures that consumers receive accurate and transparent information, further supporting the credibility and growth of the market.

The increasing prevalence of obesity in the UK is driving the adoption of pea milk as more individuals look for healthier alternatives. With obesity now being one of the country’s major public health issues, consumers have turned to plant-based products that can provide a much healthier nutritional profile compared to dairy. Pea milk is lower in saturated fat and often vitamins and minerals are added to it.

Leading Player: Ripple Foods 15%

Leading players in the pea milk market, such as Ripple Foods, Sproud, and Bolthouse Farms, are shaping the industry with product innovations and strong funding.

Ripple Foods, for instance, has raised significant capital to expand its protein-enriched offerings. Sproud is targeting North America with green, low-carbon pea milk, supported by USD 6.6 million in funding.

Bolthouse Farms, owned by Campbell Soup Company, entered the plant-based market with its Protein Milk line. Emerging players like Devon Garden Foods and Qwrkee Foods Ltd. focus on niche markets by offering higher protein content and nutrient-enriched variants. The market remains fragmented with high entry barriers due to production costs, consumer acceptance, and regulatory requirements, while consolidation among key players continues.

Recent Pea Milk Industry News

In terms of flavor, the market is segmented into original flavored, vanilla flavored, chocolate flavored, and barista flavored.

In terms of packaging material, the market is segmented into tetra packs and PET bottles.

In terms of end-user, the market is segmented into individual consumers, HoReCa, and gyms & cafés.

In terms of sales channel, the market is segmented into brick & mortar stores and online retail channel.

In terms of region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The market is predicted to reach a size of USD 142.0 million in 2025.

The market size is poised to reach USD 289.7 million by 2035.

The prominent companies in the market include Sproud, VLY Foods, Nestle SA, and Mighty Pea.

The original-flavored product is leading in the pea milk market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Peanut Milk Market Analysis - Size, Share & Forecast 2025 to 2035

Chickpea Milk Market Analysis by Category, Flavor and End Use Through 2025 to 2035

Pea Grits Market Size and Share Forecast Outlook 2025 to 2035

Pearl Liquid Market Size and Share Forecast Outlook 2025 to 2035

Pearl Eye Drops Market Size and Share Forecast Outlook 2025 to 2035

Peak Shaving Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Pea Flakes Market Size and Share Forecast Outlook 2025 to 2035

Peanut Butter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pea Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pea Fiber Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Peak Shaving Diesel Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Pea Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pearlescent Pigment Market Growth - Trends & Forecast 2025 to 2035

Peanut Butter Keto Snacks Market Analysis - Trends & Growth 2025 to 2035

Pea Starch Concentrate Market Trends - Growth & Industry Forecast 2025 to 2035

Pea Protein Ingredients Market Insights - Plant-Based Nutrition Growth 2025 to 2035

Market Share Breakdown of Pea Flakes Manufacturers

Peanut Flour Market

Spear Phishing Market Size and Share Forecast Outlook 2025 to 2035

Spear Phishing Solutions Market Insights – Trends & Forecast through 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA