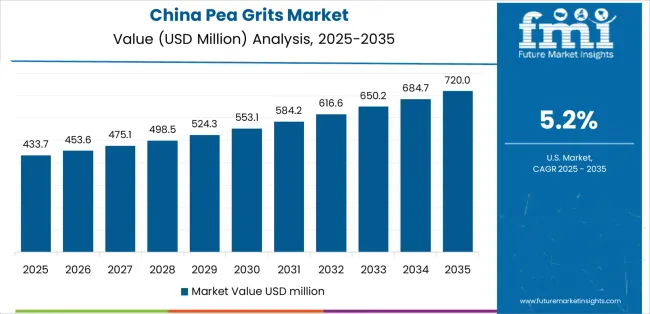

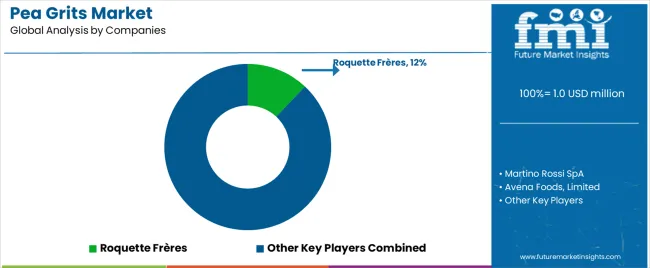

The pea grits market is projected to rise from USD 1.0 million in 2025 to USD 1.7 million by 2035, reflecting an absolute increase of USD 0.7 million during the assessment period. This translates into a CAGR of 5.8%, highlighting a steady growth trajectory supported by evolving dietary preferences, expansion in plant-based ingredients, and the use of pea derivatives in multiple processing industries. The market size, although niche compared with staple commodities, is advancing as pea grits secure applications in functional food formulations, bakery blends, and snack production, driven by their protein density, fiber enrichment, and gluten-free positioning.

On the demand side, food processors are incorporating pea grits into cereals, porridges, extruded snacks, and fortified bakery goods to meet rising consumer interest in alternative protein sources. The clean-label trend has elevated demand for minimally processed ingredients, and pea grits are finding a role as natural texturizers and nutritional enhancers. Their compatibility with both conventional and plant-based recipes makes them attractive to food manufacturers seeking diversification of product portfolios. Pharmaceutical and nutraceutical sectors are also exploring pea grit fractions for use in controlled formulations due to their stability and digestibility, adding further momentum to demand expansion.

Supply-side dynamics are influenced by pulse cultivation patterns and milling infrastructure. Regions with strong pea production bases, such as Europe and North America, dominate the availability of high-quality pea grits. The supply chain remains moderately concentrated, as milling facilities capable of producing consistent grit fractions are fewer compared to flour or protein isolate processors. This concentration creates sensitivity to harvest volatility and trade fluctuations, as variations in pea yields directly affect raw material availability. Efficient processing technology and controlled sourcing from pulse cooperatives are becoming critical to ensuring reliable supply.

Production scalability is another consideration, as pea grit manufacturing requires precision milling to maintain uniform particle size and functional properties. Investments in advanced milling equipment and integrated processing lines are being undertaken by established players to optimize output and maintain cost competitiveness. Smaller producers remain challenged by capital intensity and operational efficiency, which limits broader market participation. Product innovation, such as flavored or fortified pea grits for direct consumer use, represents a growing area of production focus, enabling differentiation and value capture.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | Food processing ingredients | 45% | Protein enrichment, texture applications |

| Poultry and animal feeds | 28% | Cost-effective protein source, digestibility | |

| Foodservice applications | 15% | Restaurant ingredients, institutional food | |

| Household/retail consumption | 8% | Direct consumer cooking, traditional dishes | |

| Other industrial uses | 4% | Pet food, specialized applications | |

| Future (3-5 yrs) | Plant-based food formulations | 40-45% | Meat alternatives, dairy analogs, protein bars |

| Functional food ingredients | 20-25% | Fortification, texture improvement, clean label | |

| Animal nutrition optimization | 18-22% | Sustainable feed protein, aquaculture applications | |

| Foodservice plant-based menus | 10-15% | Restaurant chains, institutional catering | |

| Direct-to-consumer products | 5-10% | Retail packaged goods, e-commerce brands | |

| Pet food premium segment | 3-5% | Natural pet nutrition, allergen alternatives |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1 million |

| Market Forecast (2035) | USD 1.7 million |

| Growth Rate | 5.80% CAGR |

| Leading Product Type | Green Pea Grits |

| Primary End-Use | Food Processing |

The market demonstrates strong fundamentals with green pea grits capturing dominant share through superior nutritional profile and versatile food processing applications. Food processing applications drive primary demand, supported by increasing plant-based product development and clean-label ingredient trends. Geographic expansion remains concentrated in North America and Europe with established pulse processing infrastructure, while Asia Pacific shows accelerating adoption rates driven by protein security initiatives and sustainable agriculture programs.

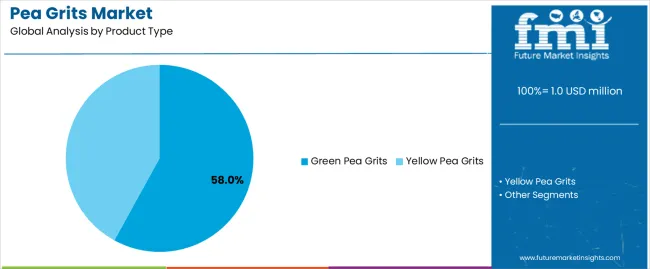

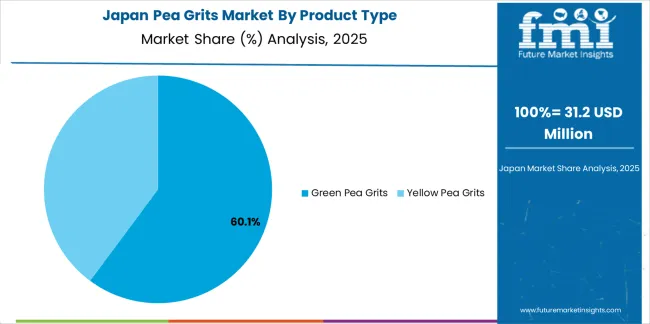

The market segments by product type into green pea grits and yellow pea grits, representing variations in pea variety selection that offer distinct color, flavor, and nutritional characteristics for comprehensive food processing and feed application optimization.

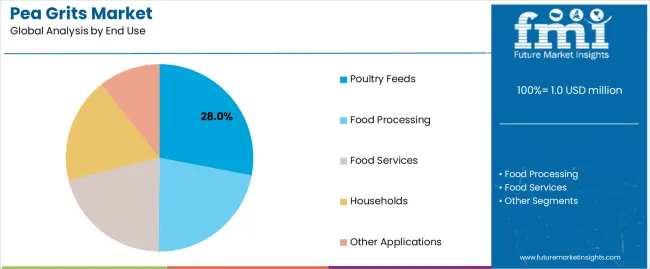

End-use segmentation divides the market into food processing, poultry feeds, foodservices, households, and other applications, reflecting distinct requirements for protein content, particle size specifications, and functional performance across diverse consumption patterns.

Flavor segmentation covers sweet and savory applications, while distribution channels span B2B (business-to-business), B2C (business-to-consumer) including hypermarkets/supermarkets, convenience stores, and specialty retail stores.

Geographic distribution covers Asia Pacific (China, India, Japan), North America (United States, Canada), Europe (Germany, United Kingdom, France), Latin America, and other regions, with North America and Europe leading established markets while Asia Pacific demonstrates explosive growth potential.

The segmentation structure reveals ingredient progression from traditional pulse processing toward specialized food ingredient applications with enhanced functionality and clean-label credentials, while application diversity spans from animal nutrition to sophisticated plant-based food formulations requiring precise protein and texture specifications.

Market Position: Green pea grits command the leading position in the pea grits market with approximately 58% market share through superior nutritional profile, appealing color characteristics, and versatile food processing applications that enable manufacturers to achieve optimal protein enrichment while maintaining clean-label positioning across plant-based products, traditional dishes, and animal feed formulations.

Value Drivers: The segment benefits from food processor preference for vibrant green color that signals freshness and natural ingredients, higher protein content averaging 22-25% compared to yellow varieties, and consumer associations with traditional green pea preparations that enhance product acceptance. Enhanced amino acid profiles and digestibility characteristics make green pea grits ideal for both human consumption and premium animal feed applications.

Competitive Advantages: Green Pea Grits differentiate through proven nutritional superiority including higher lysine content, appealing visual characteristics for food applications, and established supply chains from major pea-producing regions in North America and Europe that ensure consistent quality and availability.

Key market characteristics:

Yellow Pea Grits maintain approximately 42% market position due to competitive pricing advantages, neutral flavor profile, and suitable functionality for animal feed applications and industrial food processing where color considerations prove less critical than cost efficiency and protein content.

Market Intelligence Brief:

Growth Characteristics:

Market Context: Food processing applications dominate the market with strongest growth contribution at 6.8% CAGR, reflecting critical role of pea grits in plant-based product development, protein fortification programs, and clean-label ingredient initiatives across diverse food manufacturing sectors from meat alternatives to baked goods.

Appeal Factors: Food manufacturers prioritize ingredient functionality, nutritional profile, and clean-label credentials that enable plant-based positioning, allergen-free formulations, and sustainable sourcing claims resonating with consumer trends. The segment benefits from substantial investment in plant-based R&D and reformulation initiatives replacing animal-based proteins with pulse ingredients.

Growth Drivers: Plant-based meat alternative market expansion creates derived demand for textured protein ingredients including pea grits. Gluten-free product development drives adoption in bakery and snack applications. Protein fortification trends in breakfast cereals, nutrition bars, and functional foods create sustained ingredient demand.

Application dynamics include:

Poultry Feeds capture approximately 28% end-use share through cost-effective protein supplementation in broiler and layer rations where pea grits provide essential amino acids, energy content, and digestibility characteristics supporting optimal animal performance and feed conversion efficiency.

Market Intelligence Brief:

Foodservices account for approximately 15% end-use share with fastest growth rate at 7.5% CAGR through restaurant chains, institutional catering, and QSR (quick-service restaurants) incorporating plant-based menu items requiring pea grit ingredients for protein content and texture optimization.

Value Drivers:

Household consumption captures approximately 8% market share through direct consumer purchases for traditional cooking applications, ethnic cuisine preparation, and health-conscious meal preparation in home cooking environments.

Other applications including pet food, aquaculture feeds, and industrial uses account for remaining market share through specialized requirements for natural protein ingredients in premium pet nutrition formulations and sustainable aquaculture operations.

Market Position: Sweet flavor applications demonstrate growing market interest in dessert formulations, breakfast products, and confectionery items incorporating pea grits for protein fortification and texture modification while maintaining sweet taste profiles.

Value Drivers: Protein bar manufacturers incorporating pea grits into sweet formulations, breakfast cereal producers adding pulse proteins for nutritional enhancement, and bakery applications developing protein-enriched sweet goods create expanding market opportunities.

Savory applications capture dominant market share through established use patterns in soup bases, savory snacks, meat alternative products, and traditional culinary preparations where pea grits provide protein, texture, and familiar flavor profiles.

Market Context: B2B (Business-to-Business) distribution commands dominant position with approximately 70% channel share through bulk ingredient sales to food processors, feed manufacturers, and industrial customers requiring reliable supply relationships, technical support, and consistent quality specifications.

Business Model Advantages: Direct manufacturer relationships enable customized specifications, long-term supply contracts, and technical collaboration on product development that create stable revenue streams and operational efficiency for pea grit suppliers.

Operational Benefits: Bulk logistics optimization, quality assurance programs, and application development support create value-added differentiation opportunities beyond commodity pricing competition in pulse ingredient markets.

B2C distribution through hypermarkets/supermarkets, convenience stores, and specialty retailers captures approximately 30% channel share with accelerating growth driven by consumer interest in cooking with pulse ingredients, ethnic cuisine preparation, and health-conscious shopping patterns.

Growth Characteristics:

Market Context: Asia Pacific dominates pea grits market growth with fastest CAGR at 7.2% driven by population growth, protein security initiatives, expanding food processing industry, and traditional consumption patterns across China, India, and Southeast Asian nations requiring pulse-based ingredients.

Business Model Advantages: The region provides largest consumption volumes for both traditional food applications and emerging plant-based product development, driving sustained demand while supporting regional pulse cultivation and processing capacity expansion.

Operational Benefits: Asia Pacific markets benefit from agricultural production capabilities in India and China, growing middle-class protein consumption, and government food security programs that create integrated pulse processing value chains and competitive market economics.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Plant-based protein demand (vegan/vegetarian trends, sustainability concerns) | ★★★★★ | Consumer dietary shifts drive plant protein ingredient demand; pea grits positioned as clean-label, sustainable protein source |

| Driver | Food allergy considerations (soy-free, gluten-free alternatives) | ★★★★★ | Allergen avoidance creates market opportunity for pea-based ingredients; hypoallergenic properties enable wide formulation use |

| Driver | Sustainable agriculture & protein diversification | ★★★★☆ | Nitrogen-fixing properties and low water requirements position peas as sustainable crop; agricultural diversification away from soy benefits pulse ingredients |

| Restraint | Flavor challenges & off-taste perceptions | ★★★★☆ | Beany or earthy flavor notes limit application in sensitive formulations; requires masking or flavor optimization for mainstream acceptance |

| Restraint | Price volatility & crop yield variations | ★★★☆☆ | Agricultural commodity pricing fluctuates with weather and harvest; margin pressure during high-price periods affects affordability |

| Restraint | Competition from other pulse proteins (lentils, chickpeas) | ★★★☆☆ | Multiple pulse alternatives compete for food processing adoption; differentiation requires functional advantages or cost positioning |

| Trend | Protein fortification & functional food development | ★★★★★ | Food manufacturers enriching products with plant proteins; pea grits enable protein content claims without allergen concerns |

| Trend | Clean-label movement & minimal processing | ★★★★☆ | Simple ingredient lists favor recognizable pulse ingredients; pea grits align with consumer desire for natural, minimally processed foods |

| Trend | Circular economy & upcycled ingredients | ★★★★☆ | Side-stream utilization in pea processing creates value-added products; sustainability credentials enhance brand positioning |

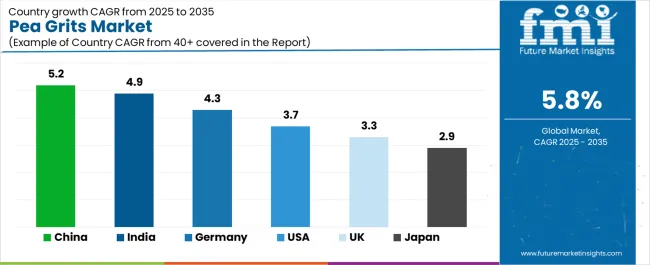

The pea grits market demonstrates varied regional dynamics with Growth Leaders including China (5.2% growth rate) and India (4.9% growth rate), driven by plant-protein snacks, bakery extenders, noodle and batter systems, and starch–protein co-processing near pulse hubs. Steady Performers encompass Germany (4.3% growth rate) and developed regions that benefit from rigorous quality programs, extrusion know-how, and private-label depth. Mature Markets feature the United States (3.7% growth rate), United Kingdom (3.3% growth rate), and Japan (2.9% growth rate), where label clarity, texture control, and reliable supply chains support consistent growth patterns. Regional synthesis shows East Asian markets leading adoption through puffed snacks, instant noodles, and pet nutrition; North America maintains steady expansion anchored in gluten-control bakery and high-protein formats; European markets post moderate growth focused on particle control, flavor management, and audit-ready documentation.

| Region/Country | 2025–2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 5.2% | Local milling near ports; odor-managed lots; fast QC & Chinese COAs | Price pressure; flavor drift in warm routes; import paperwork |

| India | 4.9% | Value SKUs for snacks/noodles; drum-split service; fryer and extruder trials | Monsoon logistics; heat stability; GST complexity |

| Germany | 4.3% | Tight granulation bands; low-OD lots; bakery and meat-alt pilots | Strict specs; long validations; allergen cross-contact control |

| United States | 3.7% | Gluten-management in bakery; pet-nutrition grades; rapid sampling | Grain price swings; freight; taste masking in high loads |

| United Kingdom | 3.3% | Retailer co-dev snacks; cereal and batter extensions; shelf-ready cases | HFSS rules; pack size pressure; consistency audits |

| Japan | 2.9% | Fine-grit precision; clear label cues; small-lot pilots for convenience | Space limits; humid summers; slow rotation risk |

China establishes fastest market growth through large snack corridors, instant noodle plants, and pet-food clusters that seek plant-forward extenders without sacrificing crunch or bowl life. The country’s 5.2% growth rate reflects demand from Shanghai, Guangdong, and Shandong hubs where converters want odor-managed pea grits that run clean on extruders and fryers. Success rests on particle size discipline, moisture control, and peroxide limits that protect taste in light-flavor snacks and clear soups. Bakery teams blend grits into steamed buns and crackers for texture while holding color. Pet lines favor consistent proteins and low ash to stabilize stool scores and palatability. Import partners who localize COAs, maintain buffer stock, and release lots quickly gain share during seasonal launches. E-commerce brands extend reach with family pouches and recipe cards that teach home cooks how to use grits in congee toppings and batters. Millers near ports win on freight and speed, especially when they offer deodorized options for delicate flavor systems.

Strategic Market Indicators:

India shows one of the fastest adoption curves in pea grits, expanding at 4.9% during 2025–2035. Growth centers on namkeen, extruded snacks, instant noodles, and value bakery where pea grits lift protein while keeping bite. Clusters in Delhi NCR, Gujarat, Maharashtra, and Karnataka reach for drum-split services (5–25 kg) and clear SOPs that limit dusting and carryover. Fryer lines ask for particles that drain oil well, reduce breakage, and keep seasonings bright. Noodle plants want blends that hold strand strength yet cook fast for cup formats. Festival spikes require depot playbooks, moisture-proof wraps, and quick QC release to avoid rework during rain weeks. Private brands push small pouches for kirana, while modern trade buyers prefer shelf-ready cases for quick restocks. Training on flavor masking and basic deodorization lifts acceptance in lightly seasoned products. Documentation in bilingual format and GST-clean billing shorten onboarding for distributors and co-packers.

Market Intelligence Brief:

Germany remains the European benchmark for quality-led pea grits adoption, maintaining a 4.3% growth rate from 2025 to 2035. Buyers in Bavaria, NRW, and Baden-Württemberg expect tight granulation, low off-odor, and verified microbiology for bakery, cereal coatings, meat alternatives, and soups. Formulators rely on clean particle distributions to manage hydration and crumb structure, with odor-managed grits supporting mild flavors and long shelf life. Audit depth matters: allergen cross-contact control, metal detection, and batch trace move projects through retailer gates. Pilot plants value vendor support on shear settings, water ratios, and dwell time for both extrusion and hydrated dough systems. Private label teams co-develop crunch inclusions and breaders that keep adhesion in oven cycles. Success rises with evidence that grits hold color, limit sandy mouthfeel, and remain stable in retort or pasteurization. Millers that offer consistent deodorized grades and EU-language documentation secure repeat listings across seasonal runs.

Market Intelligence Brief:

The United States holds a leading position in the pea grits market, maintaining a steady 3.7% growth rate through 2035. Demand spans gluten-management in bakery, high-protein cereals, snack puffs, and pet nutrition where texture and bowl life drive repeat purchase. Brands want rapid sampling, spec-matched alternates, and freight-sensible sourcing to cushion crop swings. Snack makers focus on even expansion and gentle seasoning adhesion, while bakers need granulation that supports crumb without gritty chew. Pet formulators request consistent protein and low ash to stabilize stool scores and palatants. Co-manufacturers prefer lots that run across multiple clients without lengthy clean-downs. Data-led resets reward suppliers who protect velocity on core SKUs while adding two to three flavors per cycle. Regional DCs with safety stock keep promo calendars intact during storm seasons. Clear taste-masking guides help developers hold delicate vanilla or cheese notes at higher inclusion levels.

Market Intelligence Brief:

United Kingdom advances at 3.3%, with retailer programs favoring portion-sized snacks, oven-ready breaders, and cereal inclusions that keep bite without heavy seasoning. Buyers ask for shelf-ready outers, tidy case weights, and consistent granulation that supports quick line changeovers. Bakery teams use grits to lift protein while preserving crumb softness in rolls and wraps. Coating lines seek adhesion that survives oven cycles and air-fryer prep. Convenience and discounter channels want compact packs and clear front-of-pack cues. Wins grow when suppliers run bake and oven tests with retailer labs, share sieve curves, and document odor control steps. UK DC safety stock smooths weekly promos and school-holiday peaks. Clear claim phrasing and predictable micro counts ease audits. Small pilot runs for limited flavors keep novelty flowing while protecting core ranges from cannibalization.

Market Intelligence Brief:

Japan posts 2.9% growth, shaped by refined taste targets, compact packaging, and convenience-led rotations. Converters in Tokyo, Osaka, and Nagoya prefer fine-to-medium grits that hydrate predictably and carry delicate flavors such as shoyu, dashi, yuzu, and mild cheese. Convenience stores require small pouches with perfect seals and low scuff labels, so outer cases must hold shape through dense backrooms. Noodle and tempura lines test blends that improve texture while keeping cook time and oil uptake under control. Documentation in Japanese, clear odor descriptors, and storage guidance for humid summers build trust. Success improves when vendors offer deodorized options, micro sets that prove low off-notes, and pilot support on water ratios and dwell times. Seasonal minis and gift packs benefit from tight lot matching so repeat buyers experience identical bite month to month.

Strategic Market Considerations:

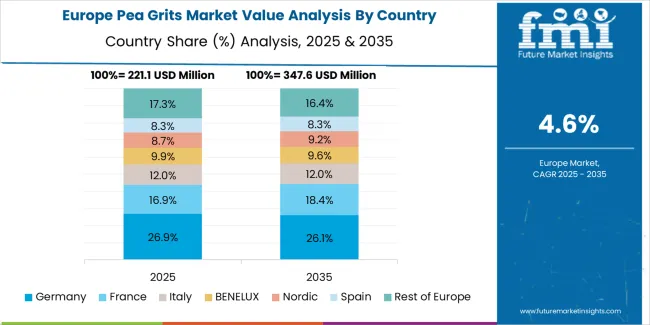

The European pea grits market is projected to grow from USD 1.12 billion in 2025 to USD 1.62 billion by 2035, registering a CAGR of 3.8%. Germany is expected to maintain leadership with a 34% share in 2025 through bakery, cereal, and meat-alt applications anchored by tight specifications and audit depth. The United Kingdom follows with 22%, driven by retailer co-developed snacks, breaders, and cereal inclusions. France holds 17% with soup and snack corridors; Italy accounts for 15% via bakery and breaders; Spain reaches 9%, while the rest of Europe edges from 3% to 3.5% by 2035 as Central and Nordic plants add extrusion and coating capacity.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Integrated pulse processors | Farmer networks, processing capacity, logistics infrastructure | Supply security, cost position, volume capability | Innovation speed; specialty applications |

| Specialty ingredient suppliers | Application expertise, custom specifications, technical service | Differentiation, premium positioning, customer intimacy | Production scale; commodity competition |

| Regional processors | Local market access, cultural understanding, farmer relationships | Geographic proximity, flexibility, relationship focus | Technology gaps; international reach |

| Food ingredient companies | Application development, formulation expertise, market access | Technical service, innovation support, global reach | Pulse sourcing; agricultural expertise |

| Organic pulse suppliers | Organic certification, sustainable sourcing, niche positioning | Premium segments, clean-label credentials, brand loyalty | Volume constraints; price premium limitations |

| Item | Value |

|---|---|

| Quantitative Units | USD 1 million |

| Product Type | Green Pea Grits, Yellow Pea Grits |

| End Use | Food Processing, Poultry Feeds, Food Services, Households, Other Applications |

| Flavor | Sweet, Savory |

| Distribution Channel | B2B, B2C (Hypermarkets/Supermarkets, Convenience Stores, Specialty Retail Stores) |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, United States, Germany, United Kingdom, Japan, Canada, France, Australia, Brazil, Netherlands, Italy, Spain, Belgium, and 20+ additional countries |

| Key Companies Profiled | Martino Rossi SpA, Avena Foods Limited, Best Cooking Pulses Inc., ADM, Ingredion, Roquette Frères, AGT Food and Ingredients, The Scoular Company, Vestkorn Milling, Great Western Grain |

| Additional Attributes | Revenue analysis by product type and end-use categories, regional consumption patterns across Asia Pacific, North America, and Europe, competitive landscape with integrated processors and specialty suppliers, customer preferences for organic certification and functional specifications, distribution channel dynamics across B2B and B2C sectors, innovations in particle size optimization and flavor neutralization, development of application-specific grades with protein content and digestibility optimization capabilities |

The global pea grits market is estimated to be valued at USD 1.0 million in 2025.

The market size for the pea grits market is projected to reach USD 1.7 million by 2035.

The pea grits market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in pea grits market are green pea grits and yellow pea grits.

In terms of end use, poultry feeds segment to command 28.0% share in the pea grits market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Green Pea Grits Market

Pearl Liquid Market Size and Share Forecast Outlook 2025 to 2035

Pearl Eye Drops Market Size and Share Forecast Outlook 2025 to 2035

Peak Shaving Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Pea Flakes Market Size and Share Forecast Outlook 2025 to 2035

Peanut Butter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pea Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pea Fiber Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Peak Shaving Diesel Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Pea Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pea Milk Market Growth - Industry Projections & Market Trends

Pearlescent Pigment Market Growth - Trends & Forecast 2025 to 2035

Peanut Milk Market Analysis - Size, Share & Forecast 2025 to 2035

Peanut Butter Keto Snacks Market Analysis - Trends & Growth 2025 to 2035

Pea Starch Concentrate Market Trends - Growth & Industry Forecast 2025 to 2035

Pea Protein Ingredients Market Insights - Plant-Based Nutrition Growth 2025 to 2035

Market Share Breakdown of Pea Flakes Manufacturers

Peanut Flour Market

Spear Phishing Market Size and Share Forecast Outlook 2025 to 2035

Spear Phishing Solutions Market Insights – Trends & Forecast through 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA