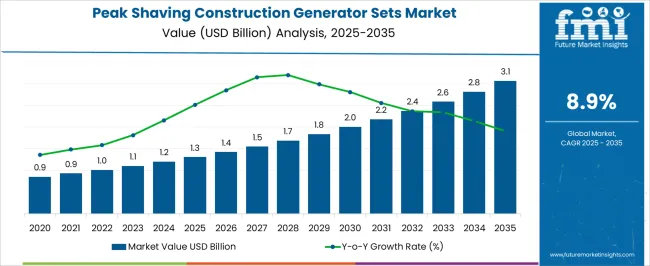

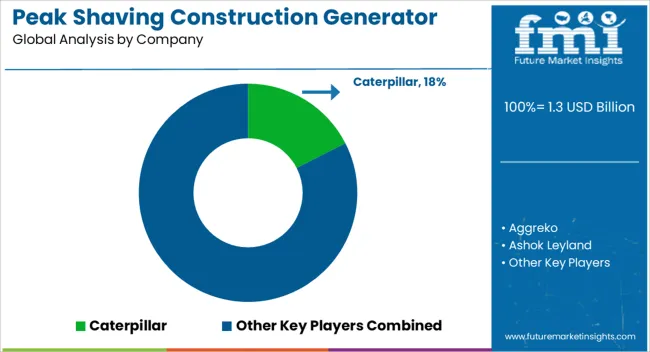

The peak shaving construction generator sets market is estimated at USD 1.3 billion in 2025 and is projected to reach USD 3.1 billion by 2035, registering a CAGR of 8.9% during the forecast period. Growth is driven by the rising need to manage power demand fluctuations at construction sites, particularly where grid stability is limited. Generator sets designed for peak shaving are increasingly being adopted to reduce operational costs, optimize fuel efficiency, and support energy-intensive equipment during peak load periods. Manufacturers are introducing hybrid models with renewable integration and advanced control systems to enhance reliability. Demand is gaining momentum across Asia and the Middle East, while mature markets in North America and Europe are adopting high-capacity units for large-scale infrastructure projects.

| Metric | Value |

|---|---|

| Peak Shaving Construction Generator Sets Market Estimated Value in (2025 E) | USD 1.3 billion |

| Peak Shaving Construction Generator Sets Market Forecast Value in (2035 F) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 8.9% |

Market growth is being supported by the rising pressure on energy cost optimization and grid load balancing during peak demand hours. The integration of generator sets into hybrid energy systems and the growing emphasis on operational continuity at construction sites have further strengthened market dynamics.

Rapid urban development, expansion of public infrastructure, and the growing frequency of grid instabilities have compelled project developers to invest in high-performance generator sets. These systems are now being selected not only for emergency backup but also for strategic power management during peak load periods.

Future opportunities are expected to arise from digital monitoring, emissions control technologies, and modular deployments tailored to large-scale construction applications. As regulatory environments tighten and project timelines shrink, the role of peak shaving generators in ensuring uninterrupted and efficient operations is projected to remain essential.

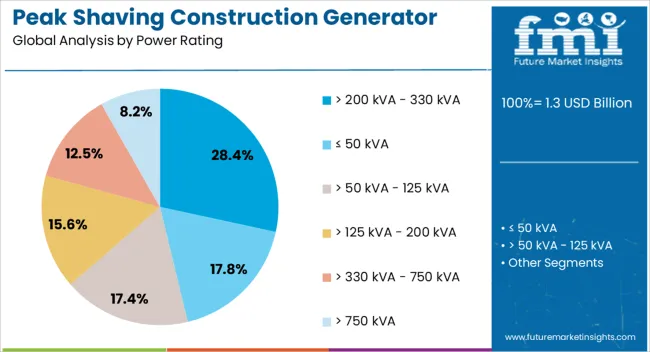

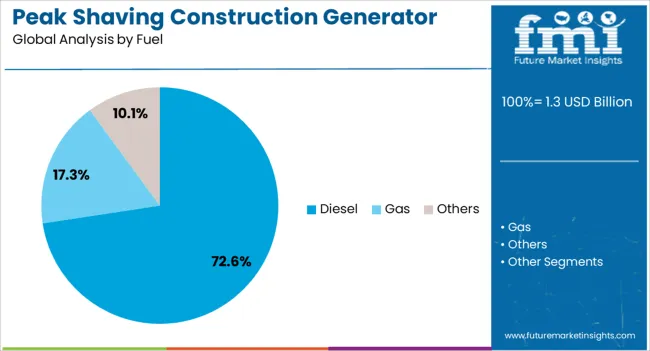

The peak shaving construction generator sets market is segmented by power rating, fuel, and geographic regions. By power rating, the peak shaving construction generator sets market is divided into > 200 kVA - 330 kVA, ≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 330 kVA - 750 kVA, and > 750 kVA. In terms of fuel, the peak shaving construction generator sets market is classified into Diesel, Gas, and Others. Regionally, the peak shaving construction generator sets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The > 200 kVA to 330 kVA power rating segment is expected to hold 28.4% of the Peak Shaving Construction Generator Sets market revenue in 2025, making it the leading power band. This share is being driven by its optimal balance between capacity, portability, and compatibility with high-demand construction applications.

Generator sets in this range are being deployed across mid to large-scale sites that require stable power for cranes, concrete batching plants, heavy machinery, and lighting systems. Their ability to handle substantial loads while maintaining fuel efficiency has made them a preferred choice for contractors seeking dependable peak shaving solutions.

The segment’s growth has also been supported by manufacturers offering scalable models that can be synchronized for load sharing or operated independently as needed. With project developers increasingly seeking flexible and rugged solutions to manage fluctuating energy demands, this power rating is expected to maintain its lead in the coming years.

The diesel segment is projected to account for 72.6% of the Peak Shaving Construction Generator Sets market revenue in 2025, emerging as the dominant fuel type. This dominance is being attributed to the high reliability, wide availability, and proven performance of diesel-powered generator sets in demanding construction environments. Diesel engines are capable of delivering high torque and stable output over extended periods, making them highly suitable for peak shaving applications where energy demand surges are frequent.

The established global supply chain for diesel fuel and availability of service infrastructure have also reinforced adoption across regions. Additionally, diesel generator sets are known for their durability and compatibility with advanced control systems, enabling better load management and real-time monitoring.

Despite the growing interest in alternative fuels, the diesel segment continues to benefit from its cost-effectiveness and lower upfront investment, especially in remote or developing regions where fuel logistics play a critical role. These factors are expected to keep diesel as the primary fuel choice in the foreseeable future.

The peak shaving construction generator sets market is growing due to rising infrastructure projects, cost efficiency, and regulatory demands. These generators are essential in ensuring uninterrupted power during peak demand and meeting environmental and operational goals.

The demand for peak shaving construction generator sets is primarily driven by the ongoing growth in construction activities. With numerous large-scale projects, particularly in developing areas, the need for uninterrupted power supply has become critical. These generators are widely used in construction sites to maintain operations during peak demand or power outages. Construction sites often face power instability, which can cause significant delays and operational inefficiencies. Peak shaving generators, therefore, ensure smooth continuity of work, preventing costly downtimes. The demand is further supported by the increasing trend of temporary power needs across multiple construction phases and the expansion of infrastructure projects globally.

Large-scale infrastructure projects such as road construction, urban development, and commercial buildings contribute significantly to the demand for peak shaving construction generator sets. These projects, often spanning vast areas and with extended timelines, require a continuous, reliable power supply to keep construction equipment and machinery operational. As governments around the world increase infrastructure investments, especially in emerging markets, the need for reliable power generation solutions grows. These construction projects are typically located in areas with unreliable or no access to the electrical grid, further driving the demand for peak shaving generators to handle power surges during construction operations.

Cost-effectiveness plays a significant role in driving the adoption of peak shaving construction generator sets. As construction projects become more cost-sensitive, project managers and contractors look for ways to reduce expenses while maintaining operational efficiency. Peak shaving generators offer a flexible solution, enabling construction companies to lower their overall energy costs by managing power during peak demand times. Their ability to be rented rather than purchased makes them a cost-effective option for temporary power needs. This operational efficiency, combined with their ability to reduce energy costs, makes peak shaving generators an attractive option for construction companies looking to optimize their budgets.

Regulatory compliance and environmental concerns are becoming increasingly important drivers for the peak shaving construction generator sets market. Many regions are implementing stricter regulations on emissions and noise levels for construction equipment. As a result, generator manufacturers are focusing on developing cleaner and quieter units to meet these regulations. Companies are also incorporating advanced filtration and emission-reducing technologies to align with the environmental standards. The need for compliance with environmental regulations is pushing construction companies to adopt peak shaving generators that not only provide reliable power but also minimize their ecological footprint, thus maintaining legal compliance while optimizing performance.

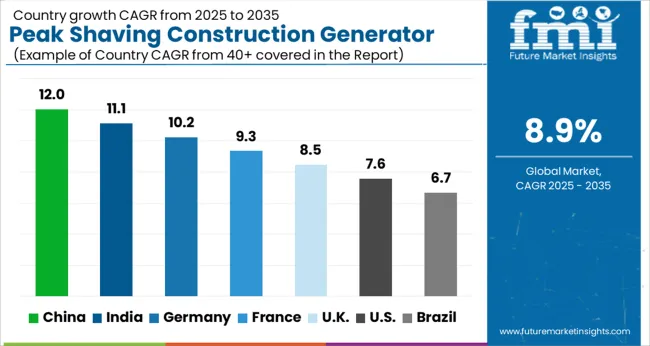

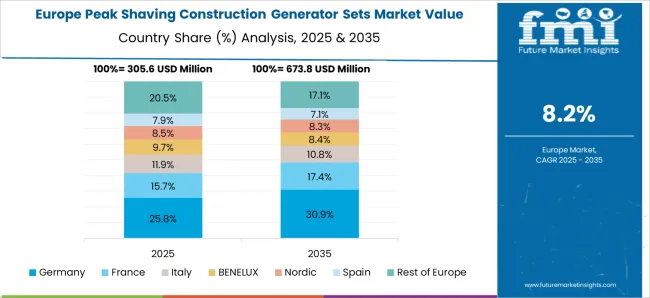

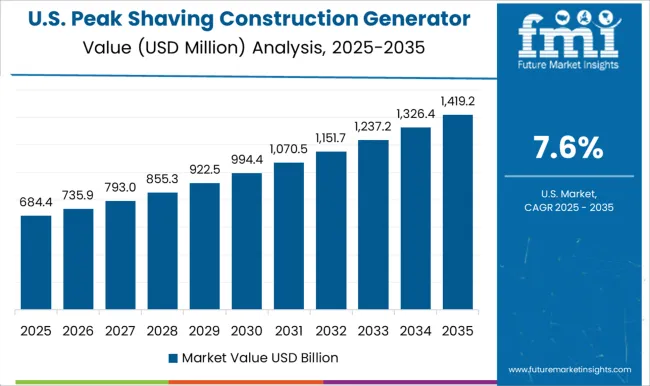

The Peak Shaving Construction Generator Sets market is projected to grow globally at a CAGR of 8.9% from 2025 to 2035, supported by the rising demand for uninterrupted power in construction sites, large-scale infrastructure projects, and remote areas with unreliable grid access. China leads with a CAGR of 12.0%, driven by its rapid urbanization, booming construction industry, and increasing demand for reliable power supply in remote locations. India follows at 11.1%, benefiting from the growing infrastructure development and government investment in construction projects. France records 9.3%, fueled by the demand for flexible power solutions in the construction and energy sectors. The United Kingdom grows at 8.5%, supported by an expanding construction industry and increasing adoption of temporary power solutions. The United States stands at 7.6%, driven by high demand from construction projects and the continued need for backup power during peak demand times in both urban and rural areas. The analysis identifies these countries as key players in shaping global demand for construction generator sets, with their focus on expanding infrastructure, ensuring energy reliability, and optimizing temporary power solutions for large-scale projects.

The UK is projected to achieve a CAGR of 8.5% for 2025–2035, up from an estimated 7.2% during 2020–2024, slightly below the global average of 8.9%. This increase is attributed to the expansion of infrastructure projects and construction activities, which require reliable power sources in remote and urban construction sites. The growth between 2020 and 2024 was influenced by steady demand for temporary power during peak usage times, particularly in urban development projects. However, from 2025 onward, the market is expected to accelerate due to a rise in large-scale infrastructure initiatives, urban regeneration projects, and a greater need for backup power solutions to mitigate power shortages. A growing trend of renting generator sets, along with stricter regulations requiring backup power for construction sites, further supports the increase in market demand.

China is expected to lead the Peak Shaving Construction Generator Sets market with a projected CAGR of 12.0% from 2025 to 2035, compared to 10.5% during 2020–2024. The continued expansion of construction and infrastructure projects in the country is a primary driver for this growth. The higher rate in the coming years is attributed to the increasing reliance on temporary power generation due to rapid urbanization and large-scale development projects, especially in less developed regions where grid infrastructure is limited. The Chinese government’s support for urban infrastructure development and the continuous demand for construction machinery and equipment will further fuel the market. With strong local manufacturing capabilities, China is expected to become a hub for the production and use of peak shaving generators.

India’s Peak Shaving Construction Generator Sets market is projected to grow at a CAGR of 11.1% from 2025 to 2035, compared to 9.6% during 2020–2024. The rise in growth is driven by the rapid expansion of infrastructure projects across the country, along with a burgeoning construction sector that requires temporary power during peak usage times. The previous years saw slower growth due to limited investment in backup power solutions and a lower penetration of rental generator services. However, the demand for peak shaving generators is expected to accelerate with the government’s increasing focus on urban development, smart cities, and industrial expansion. Ongoing development in rural areas will require temporary power solutions to meet construction demands in regions with unreliable power grids.

France is expected to grow at a CAGR of 9.3% from 2025 to 2035, up from 7.5% during 2020–2024. This growth is primarily attributed to ongoing large-scale infrastructure projects, particularly in the renewable energy and transportation sectors, which require uninterrupted power. The slower growth during the earlier period was influenced by the country’s mature infrastructure and limited use of temporary power in some construction sectors. However, with the increasing demand for backup power in construction, especially in remote locations and energy-intensive industries, demand for peak shaving generator sets is set to increase. France’s adoption of environmentally-friendly, fuel-efficient generators will also help sustain long-term market growth.

The USA market for Peak Shaving Construction Generator Sets is projected to achieve a CAGR of 7.6% from 2025 to 2035, compared to 6.1% during 2020–2024. The moderate growth in the past period was driven by a stable demand for temporary power in construction and industrial sectors. The USA market is set to accelerate with the increasing complexity and scale of infrastructure projects, particularly in sectors like energy, transportation, and residential development. The trend toward higher construction productivity and operational efficiency is pushing for more reliable and scalable power solutions. Rental generator services are also expected to expand as companies seek flexible, cost-effective power generation options.

The Peak Shaving Construction Generator Sets market is characterized by a mix of leading global manufacturers and specialized energy solution providers, each focusing on delivering reliable, high-performance power generation for construction sites. Key players include Caterpillar, Aggreko, Atlas Copco, Cummins, and Generac Power Systems, all of whom leverage their extensive manufacturing capabilities and global reach to supply temporary power solutions for construction, industrial, and commercial sectors. Greaves Cotton and Kirloskar provide competitively priced solutions tailored to emerging markets, while Mahindra Powerol focuses on cost-effective, fuel-efficient generators for the construction sector. HIMOINSA, Mitsubishi Heavy Industries, and Rolls-Royce offer specialized high-capacity generators designed to meet the specific power needs of large-scale infrastructure projects.

J C Bamford Excavators and Kohler lead in integrating advanced automation and control systems for more efficient generator operation. These companies differentiate themselves based on power capacity, fuel efficiency, and the ability to meet demanding power needs in remote and urban construction sites. They compete on the basis of product innovation, scalability, service offerings, and ensuring compliance with environmental and regulatory standards. Sterling Generators and Wartsila provide critical power solutions for large-scale construction projects that require uninterrupted power during peak demand. The competitive landscape is also shaped by developments in emission control technologies, customer service capabilities, and the ability to provide flexible rental options for temporary power needs. Strategic objectives include expanding regional production capabilities, focusing on reducing operational costs through improved fuel efficiency, and offering flexible rental services to accommodate growing demand in the construction sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Power Rating | > 200 kVA - 330 kVA, ≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 330 kVA - 750 kVA, and > 750 kVA |

| Fuel | Diesel, Gas, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar, Aggreko, Ashok Leyland, Atlas Copco, Cummins, Generac Power Systems, Greaves Cotton, HIMOINSA, J C Bamford Excavators, Kirloskar, Kohler, Mahindra Powerol, Mitsubishi Heavy Industries, Rolls-Royce, Sterling Generators, and Wartsila |

| Additional Attributes | Dollar sales trends, market share by region, and growth projections in construction, industrial, and commercial sectors. |

The global peak shaving construction generator sets market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the peak shaving construction generator sets market is projected to reach USD 3.1 billion by 2035.

The peak shaving construction generator sets market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in peak shaving construction generator sets market are > 200 kva - 330 kva, ≤ 50 kva, > 50 kva - 125 kva, > 125 kva - 200 kva, > 330 kva - 750 kva and > 750 kva.

In terms of fuel, diesel segment to command 72.6% share in the peak shaving construction generator sets market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Peak Shaving Diesel Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Loudspeaker Market Insights - Size, Share & Industry Growth 2025-2035

Loudspeaker Subwoofer Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Waterproof Speaker Market Analysis - Trends, Growth & Forecast 2025 to 2035

Shaving Pen Market Analysis – Trends, Growth & Forecast 2025-2035

Shaving Care Market Insights – Growth & Forecast 2024-2034

VR Headsets Market Size and Share Forecast Outlook 2025 to 2035

Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Cloud AI Chipsets Market

LNG Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

High Flow Needle Sets Market

Commercial Gas Gensets Market Size and Share Forecast Outlook 2025 to 2035

Onboard Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Smart Connected Assets and Operations Market Trends - Growth & Forecast 2025 to 2035

Commercial Diesel Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA