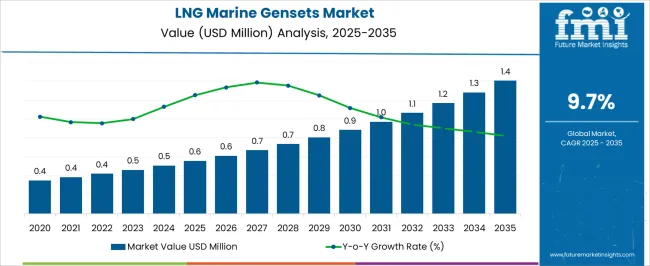

The LNG marine gensets market, estimated at USD 0.6 million in 2025 and forecast to reach USD 1.4 million by 2035 with a CAGR of 9.7%, demonstrates a gradual yet accelerating growth pattern driven by the increasing adoption of liquefied natural gas as a marine fuel. Asia-Pacific is projected to dominate regional growth due to the expansion of commercial shipping activities, government incentives promoting cleaner marine fuels, and the ongoing development of LNG bunkering infrastructure. The region’s emphasis on reducing sulfur oxide and nitrogen oxide emissions aligns with global maritime regulations, supporting the deployment of LNG-powered gensets across both cargo and passenger vessels. Incremental adoption in Asia-Pacific is expected to significantly contribute to market expansion, reflecting a combination of environmental policy enforcement and growing marine logistics demands.

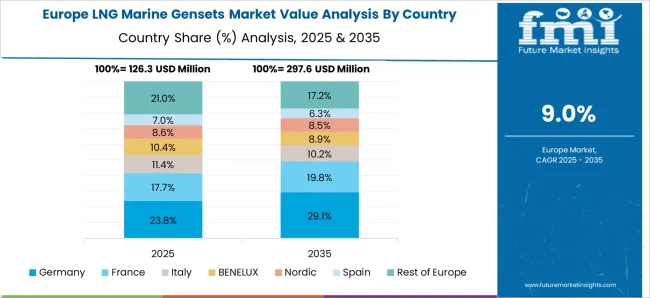

Europe’s growth in the LNG marine gensets market is steady, shaped by stringent environmental regulations and the modernization of shipping fleets in Northern and Western Europe. Investments in LNG bunkering facilities and retrofitting of existing vessels support moderate adoption rates, though the region’s well-established conventional marine fuel infrastructure limits rapid market penetration.

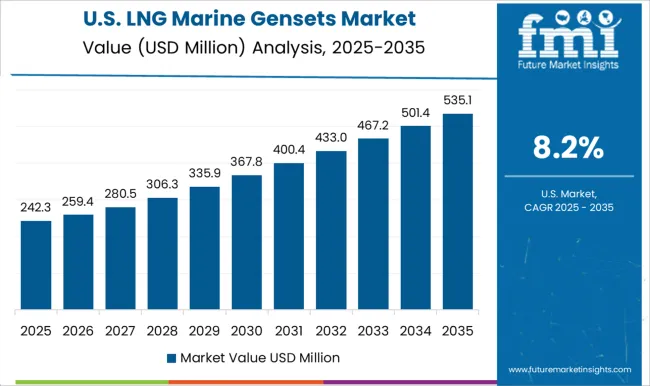

North America exhibits slower growth, constrained by limited LNG bunkering networks and reliance on conventional marine fuels, though regulatory pressures for cleaner emissions are gradually encouraging adoption. The regional growth imbalance is pronounced, with Asia-Pacific as the fastest-growing market, Europe maintaining moderate expansion, and North America demonstrating the slowest uptake despite increasing environmental compliance initiatives.

| Metric | Value |

|---|---|

| LNG Marine Gensets Market Estimated Value in (2025 E) | USD 0.6 million |

| LNG Marine Gensets Market Forecast Value in (2035 F) | USD 1.4 million |

| Forecast CAGR (2025 to 2035) | 9.7% |

The LNG marine gensets market represents a specialized segment within the marine power generation and alternative fuels industry, emphasizing reduced emissions, efficiency, and compliance with maritime regulations. Within the broader marine power systems market, it accounts for about 4.5%, driven by demand from container ships, cruise vessels, and offshore support vessels. In the marine engine and auxiliary power segment, it holds nearly 5.1%, reflecting adoption for onboard power generation and propulsion support. Across the alternative marine fuels market, the segment captures 4.0%, highlighting the shift from conventional marine diesel to liquefied natural gas.

Within the sustainable shipping and decarbonization category, it represents 3.6%, emphasizing alignment with IMO emission standards and environmental regulations. In the shipbuilding and retrofit solutions sector, it secures 3.9%, underlining growing retrofitting and new-build LNG propulsion initiatives. Recent developments in this market have focused on dual-fuel technologies, modular designs, and fuel efficiency. Innovations include LNG gensets integrated with advanced energy management systems to optimize load sharing and reduce fuel consumption.

Key players are collaborating with shipbuilders, marine operators, and energy providers to expand LNG adoption and ensure compliance with global emission standards. Hybrid integration with batteries and shore power connections is gaining traction to enhance operational flexibility. Additionally, safety improvements, cryogenic fuel storage innovations, and predictive maintenance technologies are being deployed. These trends demonstrate how efficiency, compliance, and technology adoption are shaping the LNG marine gensets market.

The LNG marine gensets market is experiencing steady expansion, driven by the maritime industry’s transition toward cleaner propulsion and auxiliary power solutions in response to stricter emission regulations. LNG’s lower sulfur oxide, nitrogen oxide, and particulate matter emissions compared to conventional marine fuels have positioned it as a preferred choice for compliance with International Maritime Organization (IMO) standards. Technological advancements in genset design have improved fuel efficiency, operational reliability, and maintenance intervals, making LNG gensets more viable for both new builds and retrofits.

Shipbuilders and fleet operators are increasingly integrating LNG-based auxiliary power systems to align with decarbonization goals while maintaining operational cost efficiency. Additionally, infrastructure investments in LNG bunkering facilities and growing LNG availability in major ports are supporting wider adoption.

Market growth is expected to be led by demand in merchant fleets, continued enhancements in compression ignition technology, and increasing uptake in lower power rating segments for small to medium-sized vessels requiring flexible and environmentally compliant power solutions.

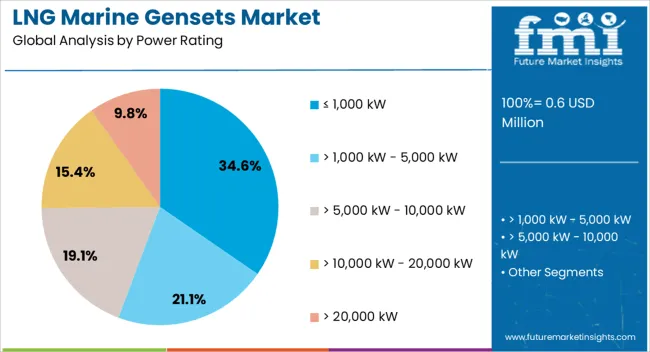

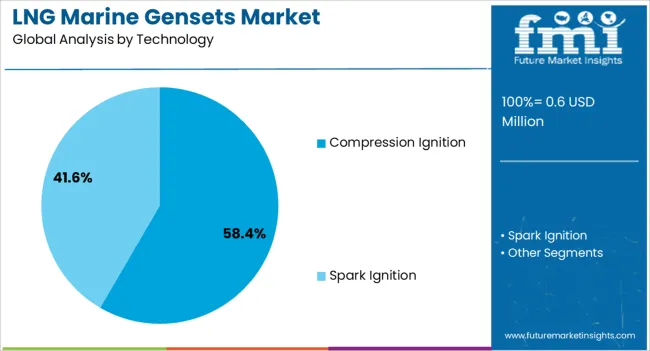

The LNG marine gensets market is segmented by power rating, technology, application, and geographic regions. By power rating, the LNG marine gensets market is divided into ≤ 1,000 kW, > 1,000 kW - 5,000 kW, > 5,000 kW - 10,000 kW, > 10,000 kW - 20,000 kW, and > 20,000 kW. In terms of technology, the LNG marine gensets market is classified into Compression Ignition and Spark Ignition.

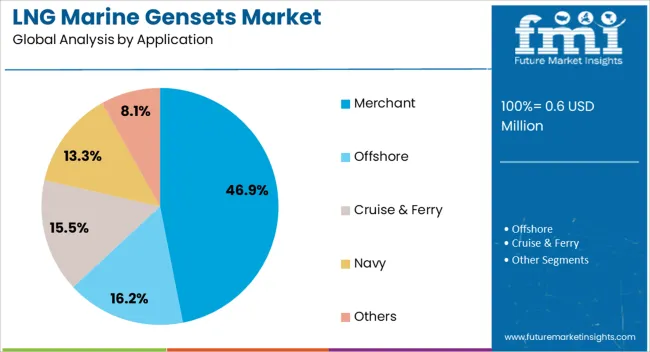

Based on application, the LNG marine gensets market is segmented into Merchant, Offshore, Cruise & Ferry, Navy, and Others. Regionally, the LNG marine gensets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ≤ 1,000 kW segment is projected to account for 34.6% of the LNG marine gensets market revenue in 2025, reflecting its suitability for smaller vessels and auxiliary power applications. Growth in this segment has been supported by rising demand for efficient, low-emission power solutions in tugboats, ferries, offshore support vessels, and coastal ships.

These vessels typically operate on shorter routes or in emission-controlled areas, making compact LNG gensets an attractive choice for meeting environmental regulations without overhauling propulsion systems. The segment also benefits from lower capital investment requirements, easier integration into existing vessel designs, and flexibility in load management.

Additionally, advancements in modular genset systems have improved scalability, enabling operators to add capacity as operational needs evolve. With small to medium-sized vessel activity increasing in both commercial and passenger segments, demand for ≤ 1,000 kW LNG gensets is expected to remain robust.

The compression ignition segment is projected to hold 58.4% of the LNG marine gensets market revenue in 2025, maintaining its leadership due to its proven efficiency and operational reliability in marine environments. Compression ignition engines adapted for LNG fuel have delivered high thermal efficiency, extended service life, and consistent performance under varying load conditions.

Ship operators have favored this technology for its compatibility with dual-fuel configurations, allowing flexibility to switch between LNG and conventional fuels depending on availability and cost. Additionally, technological improvements in fuel injection, combustion control, and emission reduction systems have enhanced the performance of LNG-powered compression ignition gensets while meeting stringent IMO Tier III requirements.

The segment’s dominance is further supported by the extensive global service network and established maintenance expertise for compression ignition systems, which reduces operational risk for fleet operators.

The merchant segment is projected to capture 46.9% of the LNG marine gensets market revenue in 2025, leading adoption due to the sector’s high operational hours and focus on fuel cost optimization. Merchant vessels such as container ships, bulk carriers, and tankers have increasingly adopted LNG gensets for auxiliary power to comply with emission control area regulations while reducing operating costs over the vessel’s lifecycle.

The segment’s growth is supported by the expansion of LNG bunkering infrastructure in major global shipping hubs, enabling more consistent fuel availability. Furthermore, rising global trade volumes and fleet modernization programs have created opportunities for retrofitting older merchant vessels with LNG-based auxiliary power systems.

Fleet operators have also recognized the potential for LNG gensets to future-proof their vessels against tightening environmental standards, ensuring long-term compliance and operational efficiency. With the merchant sector under continuous pressure to decarbonize while maintaining profitability, LNG gensets are expected to remain a key investment area.

The market has expanded as the shipping industry increasingly seeks cleaner and more efficient propulsion and auxiliary power solutions. Liquefied natural gas (LNG) is being adopted as an alternative marine fuel to reduce sulfur oxide, nitrogen oxide, and carbon emissions from vessels. LNG-powered generator sets provide reliable onboard energy for propulsion, auxiliary systems, and hotel loads, making them essential for container ships, cruise liners, and offshore support vessels. Growing environmental regulations, including IMO emission standards, have accelerated adoption of LNG gensets in new shipbuilding projects and retrofits.

The shipping industry has been a primary driver for LNG marine gensets as vessel operators seek to comply with strict emission regulations and reduce fuel costs. Container ships, tankers, cruise ships, and offshore service vessels increasingly integrate LNG gensets for propulsion and auxiliary power needs. LNG adoption reduces sulfur oxide and particulate emissions while maintaining high operational efficiency. Fleet owners are motivated by long-term savings from lower fuel consumption and the ability to access emission-controlled ports. Retrofit projects for existing vessels further expand the market. Shipping companies are forming partnerships with engine manufacturers and fuel suppliers to ensure consistent LNG availability. The focus on sustainable operations, combined with regulatory pressure from international maritime organizations, continues to support strong market growth.

Technological innovation in LNG marine gensets has improved fuel efficiency, operational safety, and engine reliability. Modern gensets incorporate dual-fuel systems, high-pressure fuel injection, and advanced control software to optimize performance across varying load conditions. LNG storage solutions, including cryogenic tanks and insulated piping, ensure safe fuel handling onboard. Safety systems with gas detection, emergency shutdown, and leak prevention protocols reduce operational risks. Integration with energy management systems allows optimal distribution of power between propulsion and auxiliary loads. Engine manufacturers are investing in research to enhance thermal efficiency and reduce maintenance intervals. These technological developments make LNG gensets competitive with conventional diesel engines while meeting stringent environmental standards, boosting confidence among shipowners and operators.

International and regional environmental regulations have been critical in driving LNG marine genset adoption. The International Maritime Organization (IMO) sulfur cap, ballast water management standards, and nitrogen oxide limits have compelled shipowners to seek low-emission propulsion solutions. LNG gensets offer a reliable method to meet these compliance requirements, reducing greenhouse gas emissions and particulate matter. Regions such as Europe, North America, and parts of Asia enforce stricter port entry standards, encouraging retrofits and new-build LNG-powered vessels. In addition, governmental incentives, subsidies, and funding programs for cleaner shipping fuels further promote LNG adoption. Regulatory enforcement continues to shape investment decisions, ensuring that LNG marine gensets remain a strategic solution for sustainable maritime operations worldwide.

Despite advantages, LNG marine gensets face challenges related to infrastructure, cost, and operational complexity. Limited LNG bunkering stations in certain regions constrain vessel deployment and logistics planning. High capital expenditure for LNG gensets and cryogenic fuel storage increases upfront costs, creating barriers for smaller operators. Crew training, fuel handling safety, and specialized maintenance requirements add operational complexity. Inconsistent global fuel pricing and supply can affect adoption, while retrofitting older vessels presents technical challenges. Nevertheless, increasing investment in LNG infrastructure, growing awareness of long-term operational benefits, and ongoing technological improvements are gradually mitigating these obstacles.

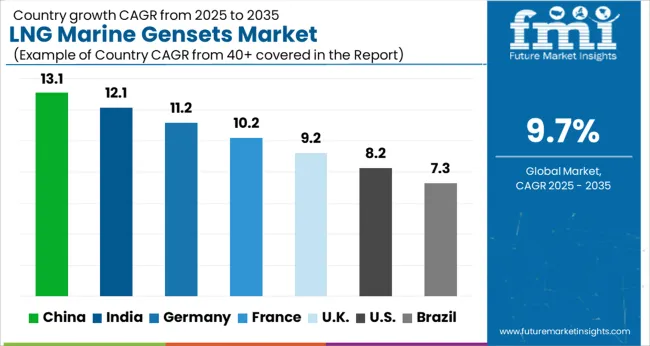

| Country | CAGR |

|---|---|

| China | 13.1% |

| India | 12.1% |

| Germany | 11.2% |

| France | 10.2% |

| UK | 9.2% |

| USA | 8.2% |

| Brazil | 7.3% |

China led the market with a forecast growth of 13.1%, driven by rising adoption in commercial shipping and port operations. India followed at 12.1%, supported by modernization of maritime fleets and increasing LNG infrastructure. Germany recorded 11.2%, reflecting investments in environmentally compliant marine propulsion systems. The United Kingdom achieved 9.2%, driven by expansion in offshore and coastal LNG-powered vessels. The United States posted 8.2%, where gradual integration of LNG gensets in commercial and naval fleets sustained market activity. Together, these countries highlight the key regions advancing marine LNG genset adoption and technology integration. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to grow at a CAGR of 13.1%, driven by rapid adoption of liquefied natural gas as a cleaner fuel alternative in the shipping and port sectors. Increasing environmental regulations and stricter emission standards are accelerating the replacement of conventional diesel-powered generators with LNG-based solutions. The expansion of China’s maritime trade routes and shipbuilding activities is supporting demand for energy-efficient and low-emission marine power systems. Furthermore, investments in retrofitting existing vessels and developing LNG bunkering infrastructure are providing significant growth opportunities. Technological advancements in marine genset efficiency, safety, and reliability are also contributing to market expansion.

India is expected to grow at a CAGR of 12.1%, fueled by increased maritime trade, expansion of ports, and emphasis on emission reduction strategies. LNG-powered generators are being adopted for both new ships and retrofitting older vessels to comply with environmental norms. Government initiatives to promote alternative fuels in shipping and logistics are strengthening market growth. Investment in LNG bunkering infrastructure, along with growing awareness of the environmental and operational advantages of LNG gensets, is driving market expansion. Additionally, the shipbuilding and offshore energy sectors are increasingly incorporating LNG-based power solutions, providing opportunities for technology adoption and system optimization.

Germany is anticipated to grow at a CAGR of 11.2%, supported by strict European Union environmental regulations targeting maritime emissions. Adoption of LNG-powered generators is increasing across commercial shipping fleets, offshore support vessels, and ferries to ensure compliance with emission limits. Technological innovations in generator performance, fuel efficiency, and safety are contributing to wider acceptance. Ports and logistics hubs are investing in LNG refueling infrastructure, facilitating operational flexibility and reducing carbon footprints. Demand is further reinforced by the expansion of offshore renewable energy projects, which require reliable and low-emission gensets for marine vessels supporting project deployment and maintenance.

The United Kingdom’s market is projected to expand at a CAGR of 9.2%, with growth driven by adoption in commercial shipping, offshore wind operations, and port logistics. Regulatory incentives aimed at reducing maritime pollution are encouraging operators to invest in LNG-powered generators. The expansion of port infrastructure and LNG bunkering facilities enhances accessibility for LNG-fueled vessels. Technological developments in marine gensets, including improved efficiency, durability, and emission reduction capabilities, are increasing market acceptance. The government and private sectors are actively supporting the transition toward low-emission marine power systems, ensuring alignment with national and international sustainability targets.

The United States is expected to grow at a CAGR of 8.2%, driven by increased demand for cleaner energy solutions in shipping, logistics, and offshore industries. Regulatory requirements and environmental policies are encouraging vessel operators to transition from diesel to LNG-powered generators. Investments in port infrastructure, including LNG bunkering stations, are facilitating the adoption of low-emission solutions. Technological advancements in genset reliability, operational efficiency, and safety are further contributing to market expansion. The growing interest in LNG-powered vessels in offshore energy and commercial shipping operations is creating new opportunities for manufacturers and service providers in the USA maritime sector.

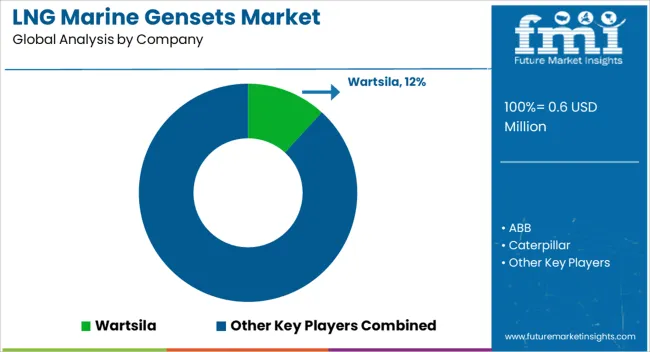

The market is shaped by major global manufacturers and energy solution providers offering high-performance, low-emission power generation systems for marine applications. Wartsila has established itself as a leader with advanced dual-fuel and LNG-powered gensets that support cleaner shipping operations while ensuring reliability in demanding maritime environments. ABB provides integrated electrical propulsion systems combined with sophisticated power management solutions, enabling optimized fuel consumption and reduced emissions across large vessels. Caterpillar and Cummins deliver a wide range of marine gensets renowned for durability, operational efficiency, and compliance with international emission regulations.

Fischer Panda focuses on compact and efficient LNG gensets suitable for auxiliary power in smaller vessels and specialized applications. HD Hyundai Heavy Industries & Engines Machinery, MAN Energy Solutions, and Mitsubishi Heavy Industries bring extensive expertise in large-scale marine propulsion, offering solutions that balance performance, efficiency, and environmental sustainability. Other players such as Kirloskar, Nidec Corporation, Rehlko, Rolls-Royce, Scania, Volvo Penta, and YANMAR provide modular genset systems, hybrid configurations, and auxiliary power solutions tailored to diverse commercial shipping, cruise, and offshore operations. These companies are advancing the adoption of LNG-based marine power, addressing the global push for cleaner, sustainable, and efficient maritime transportation.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.6 Million |

| Power Rating | ≤ 1,000 kW, > 1,000 kW - 5,000 kW, > 5,000 kW - 10,000 kW, > 10,000 kW - 20,000 kW, and > 20,000 kW |

| Technology | Compression Ignition and Spark Ignition |

| Application | Merchant, Offshore, Cruise & Ferry, Navy, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Wartsila, ABB, Caterpillar, Chevron, Cummins, Fischer Panda, HD Hyundai Heavy Industries & Engines Machinery, Kirloskar, MAN Energy Solutions, Mitsubishi Heavy Industries, Nidec Corporation, Rehlko, Rolls-Royce, Scania, Volvo Penta, and YANMAR |

| Additional Attributes | Dollar sales by genset type and power rating, demand dynamics across cargo ships, passenger vessels, and offshore platforms, regional trends in LNG adoption for marine propulsion, innovation in fuel efficiency, emissions reduction, and dual-fuel capability, environmental impact of reduced sulfur and greenhouse gas emissions, and emerging use cases in hybrid propulsion, auxiliary power, and sustainable maritime operations. |

The global LNG marine gensets market is estimated to be valued at USD 0.6 million in 2025.

The market size for the LNG marine gensets market is projected to reach USD 1.4 million by 2035.

The LNG marine gensets market is expected to grow at a 9.7% CAGR between 2025 and 2035.

The key product types in LNG marine gensets market are ≤ 1,000 kw, > 1,000 kw - 5,000 kw, > 5,000 kw - 10,000 kw, > 10,000 kw - 20,000 kw and > 20,000 kw.

In terms of technology, compression ignition segment to command 58.4% share in the LNG marine gensets market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

LNG Liquefaction Equipment Market Size and Share Forecast Outlook 2025 to 2035

LNG Tank Containers Market Size and Share Forecast Outlook 2025 to 2035

LNG Bunkering Market Size and Share Forecast Outlook 2025 to 2035

LNG Terminal Market Size and Share Forecast Outlook 2025 to 2035

LNG Virtual Pipeline Market Size and Share Forecast Outlook 2025 to 2035

LNG Storage Tank Market Growth - Trends & Forecast 2025 to 2035

Floating LNG Power Vessel Market Growth – Trends & Forecast 2024-2034

Marine Toxin Market Size and Share Forecast and Outlook 2025 to 2035

Marine Thermal Fluid Heaters Market Size and Share Forecast Outlook 2025 to 2035

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Marine Power Battery System Market Size and Share Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA