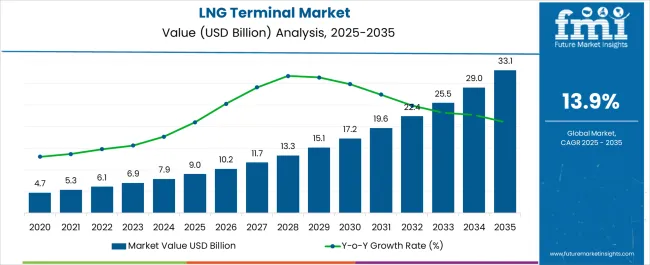

The LNG Terminal Market is estimated to be valued at USD 9.0 billion in 2025 and is projected to reach USD 33.1 billion by 2035, registering a compound annual growth rate (CAGR) of 13.9% over the forecast period. A Year-on-Year (YoY) growth analysis reveals a consistent upward trend in the market value, with notable acceleration over the forecast period. Between 2025 and 2026, the market grows by USD 1.2 billion, from USD 9.0 billion to USD 10.2 billion, reflecting an early-stage YoY growth rate of 13.3%.

This rapid initial growth is driven by increasing global demand for natural gas, along with expansion in infrastructure for LNG production and distribution. From 2026 to 2030, the market continues to experience strong growth, increasing by USD 6.3 billion, moving from USD 10.2 billion to USD 16.7 billion, with an average YoY growth rate of 19.1%.

This surge is fueled by rising investments in LNG infrastructure, particularly in the Asia-Pacific and Europe, and the shift towards cleaner energy sources. Between 2030 and 2035, the market experiences more moderate growth, increasing by USD 7.7 billion, with a YoY growth rate of 9.2%.

This deceleration suggests the market is approaching a phase of stabilization, as LNG terminals become more widespread and the industry matures. The overall YoY analysis indicates a strong acceleration in the earlier years, followed by steady growth as the market matures.

| Metric | Value |

|---|---|

| LNG Terminal Market Estimated Value in (2025 E) | USD 9.0 billion |

| LNG Terminal Market Forecast Value in (2035 F) | USD 33.1 billion |

| Forecast CAGR (2025 to 2035) | 13.9% |

The LNG terminal market is experiencing robust expansion, driven by the global push for cleaner energy alternatives, diversification of energy supply chains, and the need for flexible import/export infrastructure. As countries phase down coal and pivot toward gas as a transition fuel, LNG terminals have become strategic assets for energy security.

Increased investment in terminal automation, cryogenic handling systems, and regasification technologies is enabling higher throughput and efficiency. Additionally, the rising frequency of geopolitical disruptions is prompting governments and private operators to build resilient onshore infrastructures.

Sustainability concerns and emission controls are also accelerating the development of terminals with integrated carbon capture and energy-efficient systems. With LNG demand projected to rise steadily, particularly in Asia-Pacific and Europe, the market is expected to witness sustained terminal development over the next decade.

The LNG terminal market is segmented by terminal and geographic regions. The LNG terminal market is divided into Onshore and Floating. Regionally, the LNG terminal industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

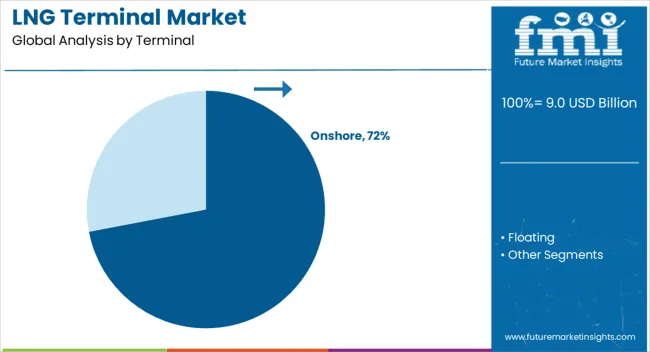

Onshore terminals are projected to account for 72.00% of the total LNG terminal market share by 2025, making it the dominant segment. This leadership is attributed to the maturity, scalability, and cost-efficiency of onshore terminal infrastructure, especially in high-demand regions.

Onshore terminals offer greater storage capacity, better integration with national grid systems, and long-term operational stability compared to floating terminals. Their ability to house large regasification units and liquefaction trains makes them highly suitable for baseload and peak shaving applications.

Additionally, onshore sites benefit from enhanced safety systems, established construction protocols, and lower maintenance costs over the lifecycle. As global energy trade intensifies and supply diversification remains a priority, investment in onshore LNG terminals is expected to remain the backbone of the LNG infrastructure network.

LNG terminals are essential in the liquefaction, storage, and regasification of natural gas, enabling the transportation and distribution of LNG globally. These facilities play a key role in supporting the growth of natural gas as a cleaner energy alternative to coal and oil. The increasing demand for LNG in power generation, transportation, and industrial applications is driving the market. Suppliers are focusing on providing cost-effective, modular, and scalable solutions to meet varying demands. The rise of floating LNG terminals, particularly in offshore locations or regions with limited land availability, is becoming an important trend.

The LNG terminal market is expanding rapidly, driven by the increasing need for energy diversification and security. Countries worldwide are turning to LNG as a cleaner alternative to traditional energy sources like coal and oil, which is boosting the demand for LNG terminals. The rise in natural gas consumption in power generation, transportation, and industrial processes is creating the need for reliable LNG infrastructure. As global energy demands grow, nations are investing heavily in LNG terminals to ensure stable energy supplies. The political and economic instability in traditional energy-producing regions has pushed governments to build LNG infrastructure domestically, securing energy independence and mitigating supply chain risks. The increasing reliance on LNG, especially in developing countries, underscores the importance of expanding terminal infrastructure to meet these growing energy demands and ensure stable supply chains in the long term.

LNG terminal development faces significant challenges due to the high capital investment required for infrastructure and regulatory hurdles. Building and operating LNG terminals demands substantial upfront costs, including for storage tanks, regasification plants, and liquefaction facilities. Additionally, maintaining these terminals requires ongoing investments for operational efficiency and safety. The regulatory approval process for LNG terminals is often complex and time-consuming, with strict environmental and safety standards that can delay project timelines. In some regions, obtaining permits and ensuring compliance with local and international regulations can further increase costs and complicate the process. Supply chain disruptions, particularly for specialized equipment and materials, also add to the complexity of terminal development. These challenges create financial risks and slow down the growth of LNG infrastructure, especially in regions with fewer resources or less-developed energy sectors.

The LNG terminal market offers significant growth opportunities, particularly through the rise of floating LNG (FLNG) terminals. FLNG terminals provide a flexible, cost-effective solution for offshore fields and remote locations, where traditional land-based infrastructure may not be viable. These floating solutions allow for faster deployment and are ideal for smaller-scale projects, particularly in emerging regions with high natural gas potential. Technological advancements in liquefaction and regasification processes also present opportunities for improving energy efficiency and reducing operational costs. As the global demand for LNG continues to rise, there is a growing need for infrastructure to support clean energy adoption, especially in developing economies. Expanding LNG infrastructure in these regions provides an opportunity for manufacturers and operators to increase their market share.

The LNG terminal market is experiencing key trends that align with the growing shift toward cleaner energy solutions. One notable trend is the integration of renewable energy sources, such as solar and wind, with LNG infrastructure. This combination allows for a cleaner, more diversified energy mix and reduces the environmental footprint of LNG operations. Another important trend is the growing adoption of modular LNG terminals, which offer flexibility and cost-effectiveness, particularly in smaller markets or remote regions. Modular designs allow for easier scalability and faster deployment, reducing project timelines. The demand for smaller, decentralized LNG terminals is also increasing as industries seek more localized solutions. As global energy markets continue to evolve, LNG terminals are increasingly designed to support more efficient energy distribution, ensuring flexibility and resilience in both developed and emerging markets.

| Country | CAGR |

|---|---|

| China | 18.8% |

| India | 17.4% |

| Germany | 16.0% |

| France | 14.6% |

| UK | 13.2% |

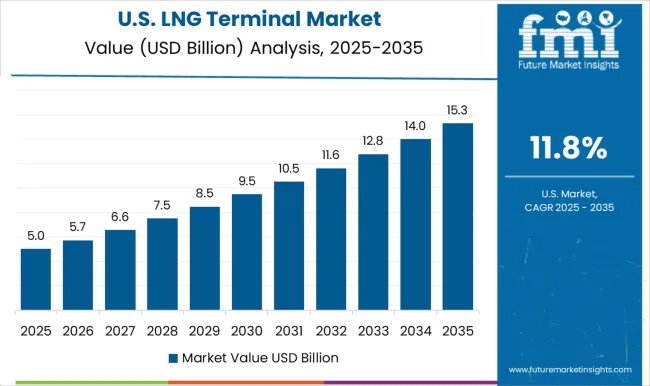

| USA | 11.8% |

| Brazil | 10.4% |

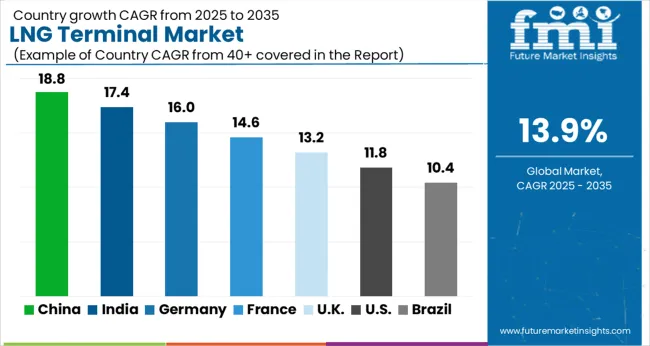

The LNG terminal market is projected to grow at a CAGR of 13.9% from 2025 to 2035. Among the top five profiled markets, China leads at 18.8%, followed by India at 17.4%, Germany at 16.0%, the United Kingdom records 13.2%, and the United States stands at 11.8%. These rates translate to a growth premium of +35% for China, +26% for India, and +16% for Germany compared to the global baseline, while the UK and USA show slower growth. The divergence reflects national differences in energy infrastructure investments, with BRICS economies like China and India experiencing robust growth driven by industrial expansion and demand for cleaner energy. Meanwhile, OECD countries such as the USA and UK show steady progress as they focus on diversification, infrastructure upgrades, and increasing natural gas consumption. The analysis spans over 40+ countries, with the top countries shown below.

China is expected to grow at a CAGR of 18.8% through 2035, supported by its growing energy needs and increasing investments in LNG infrastructure. The country’s expanding demand for natural gas, both for industrial use and residential consumption, is driving the development of new LNG terminals. China’s focus on transitioning to cleaner energy sources and reducing carbon emissions is accelerating the adoption of LNG, making it a preferred alternative to coal. The government's policies and investments in LNG infrastructure are crucial to meeting the rising demand, as the country continues to scale up its natural gas imports.

India is projected to grow at a CAGR of 17.4% through 2035, driven by increasing energy demand and a focus on diversifying the country’s energy sources. The growth in natural gas consumption, particularly in industrial sectors, has increased the demand for LNG terminals. India is investing heavily in expanding its LNG infrastructure to meet the growing needs of its manufacturing, transportation, and power sectors. Furthermore, the government’s initiatives to enhance energy security and reduce dependency on coal further support the adoption of LNG. As the country seeks cleaner energy alternatives, LNG terminals are playing a critical role in supporting India's energy transition.

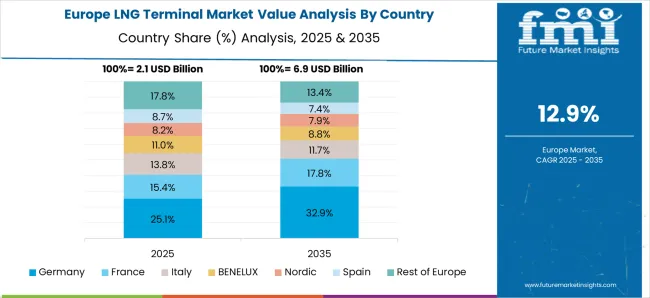

Germany is projected to grow at a CAGR of 16.0% through 2035, with increasing investments in LNG infrastructure to meet rising natural gas demand. The country’s emphasis on energy security and diversification, particularly amid growing geopolitical tensions, is driving demand for LNG terminals. Germany’s energy transition is accelerating its shift towards natural gas as a cleaner alternative to coal. As part of its energy strategy, Germany continues to invest in LNG infrastructure, not only for domestic consumption but also for its role as a key energy hub in Europe. These factors are expected to continue to drive market growth.

The United Kingdom is expected to grow at a CAGR of 13.2% through 2035, with steady demand for LNG driven by the country's push for cleaner energy alternatives and diversification of its energy sources. The UK is investing in LNG terminals to enhance energy security and reduce its reliance on traditional energy imports. The increasing adoption of LNG in the transportation and industrial sectors is contributing to market growth. As the country transitions toward renewable energy and cleaner fuels, LNG continues to play a significant role in its energy strategy, further boosting the need for LNG terminals across the nation.

The United States is projected to grow at a CAGR of 11.8% through 2035, with the demand for LNG terminals driven by the growing domestic natural gas market and the country’s role as a global LNG exporter. The USA continues to expand its LNG export capabilities, supported by the increased production of shale gas. As global demand for LNG rises, the USA is positioned as a key player in the global energy market, with several new terminals being developed to meet this demand. The country’s focus on clean energy and reducing carbon emissions supports the adoption of LNG as a more sustainable energy alternative.

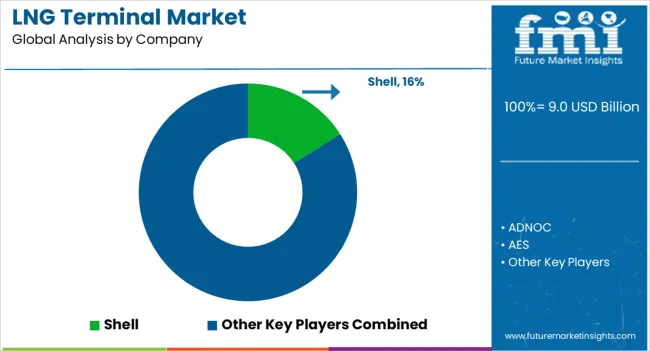

The LNG terminal market is driven by major oil and gas corporations, engineering firms, and utilities offering infrastructure for the liquefaction, storage, and regasification of natural gas. Shell and ExxonMobil are leaders in the market, with extensive global portfolios of LNG terminals supporting both upstream production and downstream distribution, focusing on meeting the growing demand for cleaner energy solutions.

BP and Chevron maintain strong positions through integrated LNG supply chains, owning and operating key liquefaction and regasification facilities in North America, Europe, and Asia. ADNOC and CNPC leverage their significant domestic and international LNG production capacities, with a focus on expanding their terminal infrastructure in the Middle East and Asia-Pacific regions.

Engie and Eni provide a mix of upstream and downstream LNG services, including terminal operations, long-term contracts, and terminal development, supporting growth in Europe and emerging markets. Gazprom and Petronas offer expertise in both LNG production and terminal operations, supporting their positions in Eastern Europe and Southeast Asia, respectively.

Equinor, Pertamina, and KNPC focus on both domestic and international LNG infrastructure to supply power and industrial sectors in their respective regions. AES and Engas also support smaller-scale LNG terminal projects, focusing on niche markets with an emphasis on flexible and modular systems.

Competitive differentiation relies on terminal capacity, efficiency, operational reliability, and integration with global LNG supply chains. Barriers to entry include high capital expenditure for construction, regulatory compliance with environmental standards, and long-term contractual agreements with utility companies. Strategic priorities include expanding terminal capacity to support the increasing demand for LNG, advancing floating LNG (FLNG) technologies, and improving storage and regasification technologies for greater flexibility in terminal operations.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.0 Billion |

| Terminal | Onshore and Floating |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Shell, ADNOC, AES, BP, Chevron, CNPC, Engas, Engie, Eni, Equinor, ExxonMobil, Gazprom, KNPC, Pertamina, and Petronas |

| Additional Attributes | Dollar sales by terminal type (import, export, floating LNG terminals) and end-use segments (utilities, industrial, transportation). Demand dynamics are driven by the global transition to cleaner fuels, the increasing consumption of LNG in power generation, and the expanding transportation market, particularly in maritime shipping and heavy-duty vehicles. Regional trends indicate North America, the Middle East, and Asia-Pacific as leading markets for LNG terminal development, driven by increasing natural gas consumption and LNG trade. Innovation trends include advancements in floating LNG technology for remote or offshore sites, modular and scalable terminal designs, and improved storage solutions for higher capacity and efficiency. Environmental considerations focus on reducing the carbon footprint of LNG operations, implementing environmentally friendly cooling systems, and optimizing terminal logistics for minimal environmental impact. |

The global LNG terminal market is estimated to be valued at USD 9.0 billion in 2025.

The market size for the LNG terminal market is projected to reach USD 33.1 billion by 2035.

The LNG terminal market is expected to grow at a 13.9% CAGR between 2025 and 2035.

The key product types in LNG terminal market are onshore and floating.

In terms of , segment to command 0.0% share in the LNG terminal market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

LNG Intermediate Fluid Vaporizer (IFV) Market Size and Share Forecast Outlook 2025 to 2035

LNG Open Rack Vaporizer (ORV) Market Size and Share Forecast Outlook 2025 to 2035

LNG Liquefaction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Terminal Brushing & Greasing Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

LNG Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

LNG Tank Containers Market Size and Share Forecast Outlook 2025 to 2035

LNG Bunkering Market Size and Share Forecast Outlook 2025 to 2035

Terminal Sterilization Services Market Size and Share Forecast Outlook 2025 to 2035

LNG Virtual Pipeline Market Size and Share Forecast Outlook 2025 to 2035

LNG Storage Tank Market Growth - Trends & Forecast 2025 to 2035

Terminal Management System Market Size, Share, and Forecast 2025 to 2035

Terminal Sterilization Market - Demand & Forecast 2025 to 2035

Terminal Automation Market Growth - Trends, Analysis & Forecast by Offerings, End-User and Region through 2035

LEO Terminal Market Size and Share Forecast Outlook 2025 to 2035

POS Terminal Market Insights – Growth & Trends 2024-2034

Bulk Terminal Market Forecast and Outlook 2025 to 2035

SatCom Terminal Market Analysis - Growth, Demand & Forecast 2025 to 2035

Mini POS Terminals Market Size and Share Forecast Outlook 2025 to 2035

Floating LNG Power Vessel Market Growth – Trends & Forecast 2024-2034

Oil & Gas Terminal Automation Market Growth – Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA